Market Overview

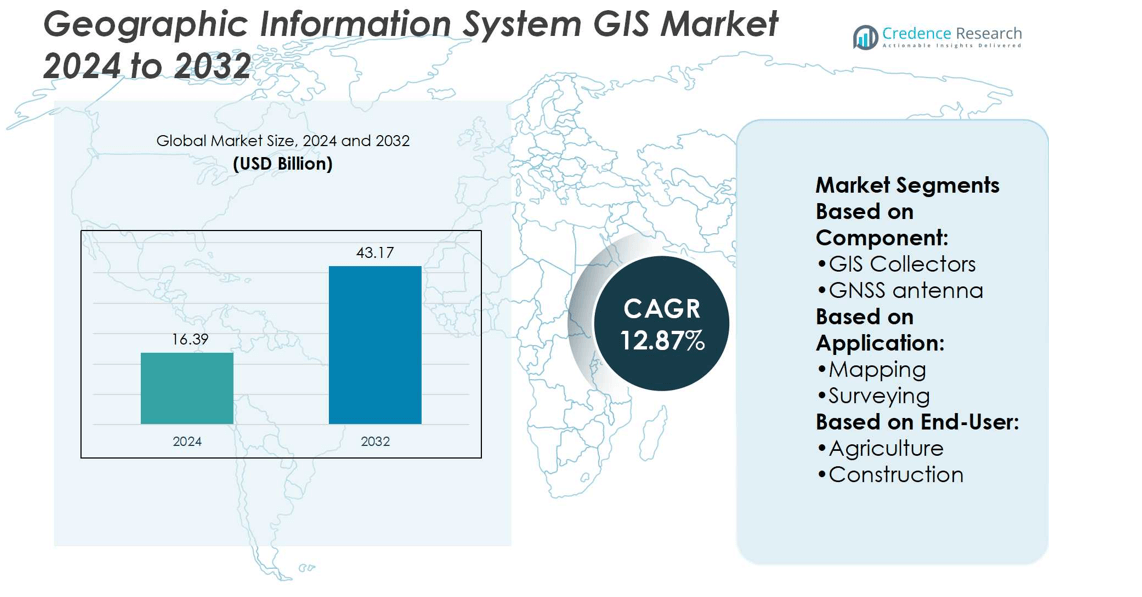

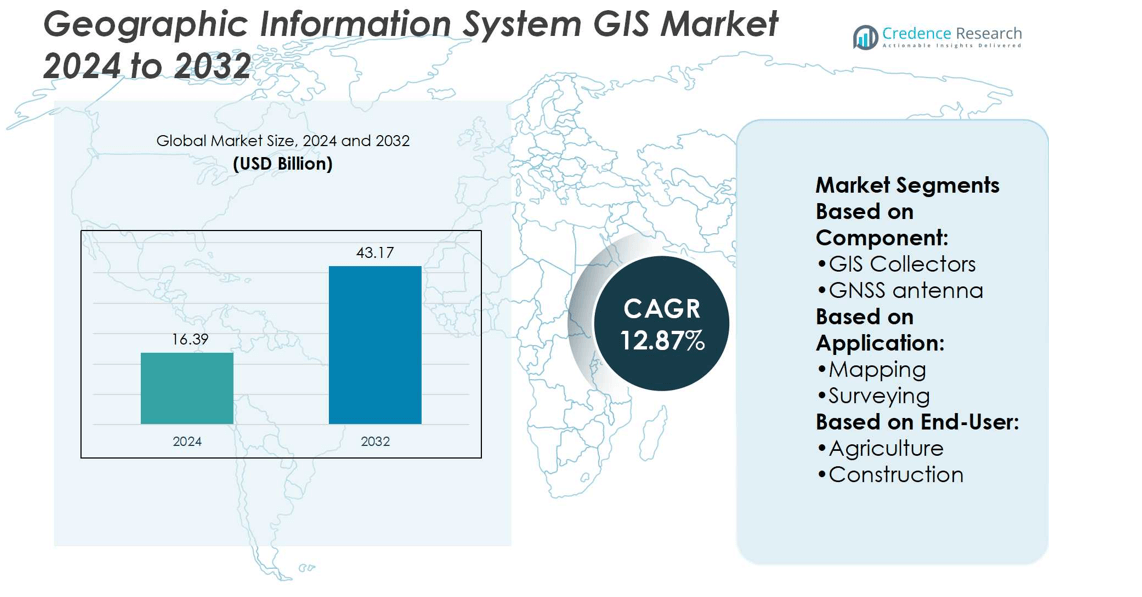

Geographic Information System GIS Market size was valued at USD 16.39 billion in 2024 and is anticipated to reach USD 43.17 billion by 2032, at a CAGR of 12.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geographic Information System (GIS) Market Size 2024 |

USD 16.39 billion |

| Geographic Information System (GIS) Market , CAGR |

12.87% |

| Geographic Information System (GIS) Market Size 2032 |

USD 43.17 billion |

The Geographic Information System GIS Market grows through strong drivers and evolving trends that shape its adoption. Rising demand for urban planning, infrastructure development, and environmental monitoring accelerates implementation across public and private sectors. Governments and enterprises use GIS for resource optimization, disaster management, and transportation planning, strengthening its role in sustainable development. At the same time, trends highlight growing adoption of cloud-based GIS platforms, integration with AI and machine learning, and advances in 3D mapping technologies. Expanding use in smart city projects, precision agriculture, and location-based services ensures steady growth and broader applications across global industries.

The Geographic Information System GIS Market shows strong regional presence, with North America leading due to early adoption and government investments, followed by Europe with smart city and environmental initiatives. Asia Pacific emerges as the fastest-growing region driven by urbanization and infrastructure projects, while Latin America and the Middle East & Africa display steady adoption in agriculture, mining, and energy sectors. Key players include Trimble Inc., Hexagon AB, Autodesk Inc., Bentley Systems, Incorporated, SuperMap Software Co., Ltd., and Environmental Systems Research Institute, Inc.

Market Insights

- The Geographic Information System GIS Market was valued at USD 16.39 billion in 2024 and is projected to reach USD 43.17 billion by 2032, growing at a CAGR of 12.87%.

- Rising demand for urban planning, infrastructure development, and environmental monitoring drives adoption across public and private sectors.

- Cloud-based platforms, AI integration, and 3D mapping technologies emerge as key trends shaping market growth.

- Competitive players focus on innovation and partnerships, with leaders such as Trimble Inc., Hexagon AB, Autodesk Inc., and Environmental Systems Research Institute, Inc. driving advancements.

- High implementation costs, technical complexity, and data privacy issues act as restraints limiting adoption in cost-sensitive markets.

- North America leads with early adoption and government investment, while Europe shows strong adoption in smart city and environmental projects.

- Asia Pacific records the fastest growth through rapid urbanization and infrastructure projects, while Latin America and Middle East & Africa expand steadily in agriculture, mining, and energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Use in Urban Planning and Infrastructure Development

Urbanization and infrastructure projects drive strong demand for Geographic Information System GIS Market solutions. Governments and municipalities adopt GIS to manage land use, zoning, and city planning with greater precision. It supports transportation network design, utility management, and disaster preparedness, enabling efficient allocation of resources. Real-time geospatial data provides insights for traffic flow, public safety, and smart city programs. The integration of GIS into infrastructure planning improves long-term sustainability and operational efficiency. Investments in resilient urban systems push adoption across both developed and emerging economies.

- For instance, the City of Ann Arbor uses Trimble Cityworks to manage 60,000 street trees: trimming 4,829 trees last year, exceeding their target of 4,212, and planting over a thousand new trees.

Growing Applications in Environmental Monitoring and Resource Management

The need to monitor environmental changes and natural resources is a significant driver of the market. Organizations use GIS to track deforestation, water resources, soil quality, and biodiversity loss. It aids in climate modeling, disaster risk assessment, and renewable energy site selection. Governments employ GIS for compliance with environmental regulations and conservation initiatives. Rising focus on sustainability pushes industries to rely on geospatial data for resource optimization. The Geographic Information System GIS Market benefits from policies encouraging cleaner energy and sustainable land management. Its ability to provide spatial intelligence supports both regulatory and corporate goals.

- For instance, SuperMap’s Cultivated Land Resources Supervision system processes 1,200 satellite images per year, automatically identifying over 50,000 hectares of non-grain planting areas.

Rising Adoption in Defense, Security, and Disaster Response

Defense and homeland security sectors adopt GIS to enhance surveillance, logistics, and operational planning. It enables accurate mapping of terrain, critical infrastructure, and potential threat zones. Emergency management agencies rely on GIS for flood prediction, wildfire tracking, and evacuation planning. The technology’s role in crisis response enhances its value for both public and private organizations. Increasing geopolitical tensions and natural disaster frequency highlight the need for advanced geospatial tools. Integration with drones, satellites, and remote sensors expands GIS applications in defense operations. These factors create consistent demand across global security frameworks.

Integration with Digital Transformation and Emerging Technologies

Digital transformation initiatives across industries amplify GIS adoption. Integration with IoT, AI, and cloud platforms strengthens its analytical capabilities. Businesses use GIS to enhance location-based services, logistics, and supply chain efficiency. Energy and telecom companies apply GIS to optimize asset management and network expansion. Advances in 3D mapping and real-time visualization improve decision-making across sectors. It plays a vital role in predictive modeling, improving accuracy in forecasting demand and risks. The increasing need for data-driven strategies cements GIS as a key enabler of digital ecosystems.

Market Trends

Increasing Adoption of Cloud-Based GIS Platforms

Cloud deployment is a major trend shaping the Geographic Information System GIS Market. Organizations prefer cloud-based platforms for scalability, cost efficiency, and remote access. It enables faster data sharing among stakeholders, improving collaboration in large projects. Governments and enterprises integrate cloud GIS to manage real-time geospatial information. The shift supports mobile workforce needs and strengthens decision-making through instant updates. Continuous upgrades from providers expand service offerings and security features, driving wider adoption.

- For instance, Autodesk Construction Cloud was used by Charles Perry Partners (CPPI) to manage over 380 projects, enabling more than 4,600 active users and about 2,000 partner companies collaborating via Autodesk Build.

Advancements in 3D Mapping and Visualization Technologies

3D mapping tools are gaining traction across industries for better spatial understanding. Construction, mining, and urban planning sectors rely on advanced visualization for precision modeling. It enhances infrastructure planning by providing realistic simulations of terrain and structures. Real estate developers and architects adopt 3D GIS for project presentations and design validation. The Geographic Information System GIS Market benefits from software innovations enabling interactive visualization. Integration with VR and AR technologies further expands use cases in training and simulations.

- For instance, Hexagon’s SHINE-enabled 3D laser the scanner features an ultra-wide scan line of 600 mm at mid-range, which is optimized for digitizing large parts and surfaces faster. This capability is a key advantage for applications involving large-scale inspection.

Rising Role of GIS in Smart City and Infrastructure Projects

Smart city initiatives worldwide drive strong demand for GIS-based solutions. Governments utilize GIS to manage traffic, utilities, and waste management systems. It plays a central role in integrating IoT devices for real-time urban monitoring. Transportation authorities deploy GIS to design efficient routes and reduce congestion. The trend highlights the importance of geospatial intelligence in sustainable urban growth. Expanding smart infrastructure projects secure the market’s long-term momentum across multiple regions.

Growing Integration of GIS with AI and Machine Learning

The combination of GIS with AI and machine learning improves predictive analytics. It enhances pattern recognition in environmental monitoring, disaster forecasting, and resource management. Businesses adopt integrated solutions to analyze consumer behavior and optimize logistics. The Geographic Information System GIS Market benefits from AI-driven automation that reduces manual effort. Machine learning algorithms strengthen accuracy in large-scale data interpretation. These advancements position GIS as a cornerstone technology in digital transformation strategies.

Market Challenges Analysis

High Implementation Costs and Technical Complexity

The Geographic Information System GIS Market faces challenges due to high implementation and maintenance costs. Organizations often struggle with the significant investment required for hardware, software, and skilled personnel. It demands continuous upgrades to ensure compatibility with evolving technologies, creating budget pressures. Smaller enterprises and public agencies face adoption barriers because of limited financial resources. Complex system integration with legacy infrastructure further slows deployment. Lack of trained professionals adds to the difficulty, forcing organizations to rely on external vendors for advanced support. These challenges hinder widespread adoption in cost-sensitive markets.

Data Privacy, Security, and Interoperability Issues

Handling sensitive geospatial data raises critical concerns for businesses and governments. The risk of data breaches and unauthorized access remains a key restraint. It requires stringent cybersecurity frameworks and regulatory compliance, which increase operational costs. Interoperability between different GIS platforms often creates inefficiencies, reducing the full potential of data sharing. Limited standardization across software and hardware platforms complicates cross-border projects. The Geographic Information System GIS Market also faces obstacles from inconsistent data quality, which undermines decision-making accuracy. These issues restrict seamless integration and pose long-term challenges to market expansion.

Market Opportunities

Expanding Applications Across Emerging Industries

The Geographic Information System GIS Market presents strong opportunities through its integration into emerging industries. Renewable energy projects leverage GIS for site selection, resource mapping, and infrastructure planning. Healthcare organizations adopt geospatial tools for disease mapping, vaccination tracking, and healthcare access planning. It also supports agriculture through precision farming, soil analysis, and crop yield optimization. Logistics and retail companies utilize GIS to improve delivery efficiency and location-based marketing. Expanding applications across these diverse industries strengthen demand for advanced geospatial intelligence solutions.

Growth Potential in Smart Cities and Infrastructure Development

Smart city initiatives open significant growth avenues for GIS providers. Governments and private developers rely on GIS to design efficient transportation systems, manage utilities, and enhance public safety. It enables real-time integration with IoT devices to improve urban monitoring and service delivery. Infrastructure development in emerging economies creates additional opportunities for GIS-driven planning and asset management. The Geographic Information System GIS Market benefits from rising investment in sustainable cities and resilient infrastructure. Strong partnerships between technology firms and governments accelerate the adoption of advanced GIS solutions worldwide.

Market Segmentation Analysis:

By Component

The Geographic Information System GIS Market is segmented by hardware, which includes GIS collectors, GNSS antennas, total stations, and LiDAR systems. GIS collectors and GNSS antennas support accurate field data gathering, essential for asset management and surveying projects. Total stations remain a preferred tool in construction and infrastructure planning due to their measurement precision. LiDAR adoption grows across forestry, mining, and smart city initiatives because of its ability to deliver high-resolution terrain mapping. It enhances integration between advanced geospatial hardware and software platforms, ensuring efficiency in data collection. Hardware remains a critical foundation driving adoption across industries.

- For instance, Topcon’s GT-1500 robotic total station can measure prism-based distances up to 5,000 meters and non-prism (reflectorless) distances up to 1,000 meters. Depending on the model (GT-1501, GT-1502, or GT-1503), it offers different angle accuracy options, including 1-second, 2-second, or 3-second of arc.

By Application

Mapping holds the largest share, serving urban planning, environmental monitoring, and infrastructure development. Surveying plays a vital role in engineering, land administration, and resource management projects. Location-based services record strong growth, driven by mobile applications, retail analytics, and customer engagement tools. Telematics and navigation strengthen transportation and logistics through efficient routing, safety monitoring, and fleet management. It also supports real-time analytics, creating faster decision-making opportunities for enterprises. The wide set of applications demonstrates the adaptability of GIS solutions across government and commercial use cases.

- For instance, L3Harris provides high-resolution satellite imagery with resolutions from 0.3 to 1 meter, allowing map-based applications to resolve fine ground features. This capability supports diverse applications, including infrastructure mapping, precision agriculture, disaster recovery, and telecommunications, by offering a range of resolutions for detailed analysis and monitoring.

By End User

Agriculture leverages GIS for precision farming, soil analysis, and irrigation management, improving yield and sustainability. Construction companies use GIS for project design, land surveying, and infrastructure asset monitoring to reduce delays and risks. Mining organizations depend on GIS for mineral mapping, environmental monitoring, and operational safety. It helps streamline exploration activities and optimize production strategies in complex terrains. The Geographic Information System GIS Market benefits from this diverse adoption across end users, cementing its role as a key enabler of modern industrial and environmental operations.

Segments:

Based on Component:

- GIS Collectors

- GNSS antenna

Based on Application:

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Geographic Information System GIS Market with 35%. The region benefits from early adoption of geospatial technologies across defense, infrastructure, and environmental applications. Federal and state governments invest heavily in GIS for urban planning, disaster management, and transportation projects. Industries such as agriculture and energy rely on GIS to optimize operations and enhance sustainability. It gains further strength from advanced research institutions and strong collaboration between public agencies and private firms. The presence of key technology providers and continuous innovation secures the region’s leadership position.

Europe

Europe accounts for 27% of the market share, supported by strong regulatory frameworks and investments in digital transformation. Governments in the region implement GIS for smart city development, climate monitoring, and infrastructure modernization. Countries like Germany, France, and the UK actively integrate GIS into transportation, utilities, and renewable energy planning. It also finds applications in precision agriculture and environmental conservation projects. European firms adopt GIS to comply with strict environmental regulations and achieve sustainability goals. Continuous funding from the European Union strengthens regional projects and expands the role of GIS across industries.

Asia Pacific

Asia Pacific captures 22% of the market share, driven by rapid urbanization and large-scale infrastructure projects. Countries including China, India, and Japan adopt GIS for urban planning, smart city development, and agricultural management. The demand is strong in sectors such as construction, mining, and utilities, where GIS supports efficient planning and resource management. It is further boosted by government-led initiatives for digitalization and technology-driven urban expansion. Rising investment in transportation and logistics infrastructure enhances the market’s presence. The region is positioned as the fastest-growing market due to its expanding industrial base and large population needs.

Latin America

Latin America represents 9% of the Geographic Information System GIS Market share. Governments in Brazil, Mexico, and Argentina adopt GIS for land management, agriculture, and resource exploration. It supports projects in mining, oil and gas, and forestry, sectors that dominate regional economies. Increasing urbanization creates opportunities for GIS applications in transportation and housing development. Public safety and disaster management agencies use GIS for flood monitoring, wildfire control, and emergency planning. Adoption remains steady, but high costs and limited infrastructure restrict wider growth. Partnerships with international firms and technology transfer programs help the region expand its GIS capabilities.

Middle East and Africa

The Middle East and Africa account for 7% of the market share, with growing demand from energy, construction, and defense sectors. Governments in Gulf countries invest in GIS for infrastructure modernization, urban development, and utility management. It is also widely applied in oil exploration, desertification control, and water resource management. African nations adopt GIS for agriculture and land use planning, aiming to increase food security. Security and defense applications create further opportunities for adoption across the region. While market penetration is still developing, rising investments and technology collaborations enhance growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trimble Inc.

- SuperMap Software Co., Ltd.

- Autodesk Inc.

- Hexagon AB

- TOPCON CORPORATION

- L3Harris Technologies, Inc.

- Environmental Systems Research Institute, Inc.

- Pitney Bowes Inc.

- CARTO

- Bentley Systems, Incorporated

Competitive Analysis

The Geographic Information System GIS Market players include Trimble Inc., SuperMap Software Co., Ltd., Autodesk Inc., Hexagon AB, TOPCON CORPORATION, L3Harris Technologies, Inc., Environmental Systems Research Institute, Inc., Pitney Bowes Inc., CARTO, and Bentley Systems, Incorporated. The Geographic Information System GIS Market demonstrates intense competition driven by continuous innovation and expanding applications across industries. Companies compete by advancing cloud-based platforms, precision mapping tools, and real-time analytics solutions. Strong demand from sectors such as construction, agriculture, defense, and smart cities encourages providers to integrate GIS with emerging technologies like AI, IoT, and 3D visualization. Vendors invest heavily in research and development to enhance data accuracy, interoperability, and user accessibility. Strategic partnerships with governments, enterprises, and research institutions strengthen their market presence. Growing emphasis on sustainability and infrastructure modernization further fuels the race to deliver scalable, efficient, and secure geospatial solutions.

Recent Developments

- In September 2024, Bentley Systems acquired Cesium, a leader in 3D geospatial technology, to expand its digital twin capabilities. The acquisition integrates Cesium’s high-precision 3D mapping and visualization tools into Bentley’s portfolio, supporting industries like construction, urban planning, and environmental monitoring with enhanced geospatial modeling and real-time data visualization.

- In July 2024, VertiGIS and Esri formed a multinational partnership to strengthen their collaboration in reselling, co-selling, and co-marketing GIS solutions. The alliance focuses on aligning business and technical strategies, enhancing their global reach, and delivering integrated geospatial tools for various industries, including urban planning, utilities, and infrastructure management.

- In April 2024, GIS Solutions, Inc. provides enterprise GIS technology and services, including cloud-based database design and GIS application development. NV5 Global, Inc. announced the acquisition of the company.

- In April 2024, NV5 Global, Inc. announced the acquisition of GIS Solutions, Inc., which provides enterprise GIS technologies and services such as GIS application development and cloud-based database design.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Installation, Breaking Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Geographic Information System GIS Market will expand with rising adoption in smart city projects.

- Cloud-based GIS platforms will gain momentum due to scalability and cost efficiency.

- Integration of GIS with AI and machine learning will enhance predictive analytics.

- Demand for 3D mapping and visualization tools will increase across construction and urban planning.

- Governments will continue to adopt GIS for infrastructure modernization and environmental monitoring.

- Location-based services will grow further with mobile applications and retail analytics.

- Precision agriculture will strengthen GIS adoption for yield improvement and sustainable farming.

- Defense and security sectors will rely more on GIS for surveillance and strategic planning.

- Developing regions will show accelerated adoption due to rapid urbanization and digital transformation.

- Partnerships between technology providers and public agencies will drive wider GIS implementation.