Market overview

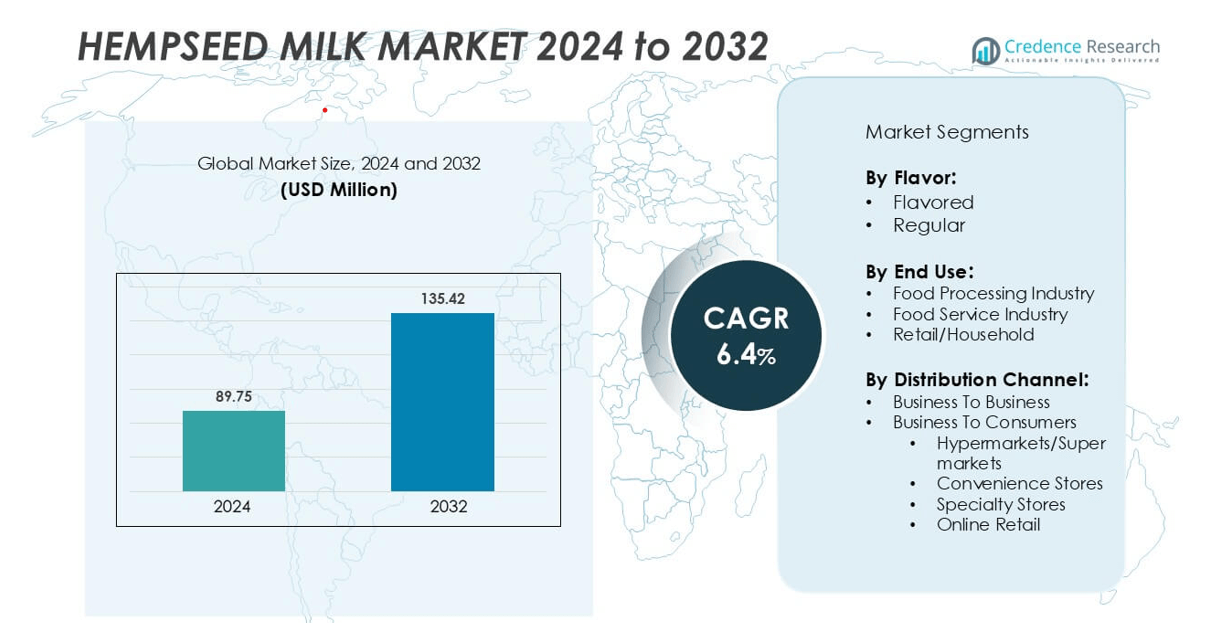

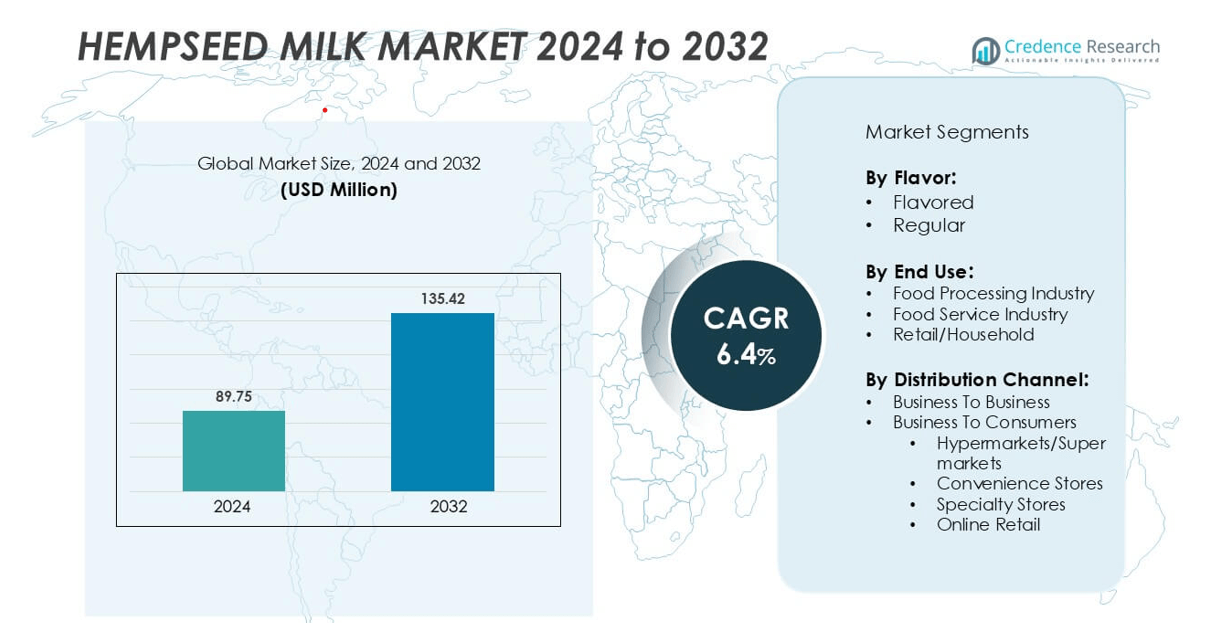

Hempseed milk market size was valued USD 89.75 million in 2024 and is anticipated to reach USD 135.42 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hempseed Milk Market Size 2024 |

USD 89.75 million |

| Hempseed Milk Market, CAGR |

6.4% |

| Hempseed Milk Market Size 2032 |

USD 135.42 million |

The hempseed milk market features key players including SunOpta, Pacific Foods, California Natural Products, Living Harvest Foods, Hudson River Foods, Good Mylk Co., Braham & Murray Good Hemp, Z-COMPANY, EcoMil, and Golden Hemp Company LLC. These companies compete through product innovation, flavored and fortified offerings, and strategic distribution across retail, foodservice, and e-commerce channels. North America emerges as the leading region, accounting for approximately 35% of the global market, driven by high consumer awareness of plant-based diets, growing lactose intolerance, and strong retail infrastructure. Market leaders leverage hypermarkets, specialty stores, and online platforms to capture diverse consumer segments, while sustainability initiatives and health-focused branding further strengthen their market positioning. Collectively, these strategies enable top players to maintain competitive advantage and drive steady regional and global growth.

Market Insights

- The global hempseed milk market is valued at USD 89.75 Million in 2024 and is projected to grow at a CAGR of 6.4% during 2024–2032.

- Growth is driven by rising consumer awareness of plant-based diets, increasing lactose intolerance, and demand for functional and fortified beverages.

- Key trends include expansion of flavored and fortified variants, rising online retail adoption, and increasing focus on sustainable and eco-friendly packaging.

- Competitive analysis shows market players such as SunOpta, Pacific Foods, Living Harvest Foods, and EcoMil focusing on product innovation, multi-channel distribution, and strategic partnerships to strengthen their market position.

- Regionally, North America leads with a 35% market share, followed by Europe at 30%, Asia Pacific at 20%, Latin America at 10%, and Middle East & Africa at 5%, with retail/household as the dominant segment and flavored variants capturing 62% of the flavor segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Flavor:

The flavored hempseed milk segment leads the market, accounting for approximately 62% of the total revenue in the flavor category. Its dominance is driven by growing consumer demand for taste-enhanced plant-based beverages that cater to both children and adults seeking variety. Innovations in natural flavoring, such as chocolate, vanilla, and fruit-infused options, further fuel adoption. The regular, unflavored segment maintains a steady presence due to health-conscious consumers preferring pure hempseed taste for smoothies and recipes, but its growth is comparatively slower as flavor preferences shape purchasing decisions.

- For instance, Pacific Foods offers both a sweetened and unsweetened Vanilla Hemp Plant-Based Beverage. A 240 ml (1-cup) serving of the sweetened version contains 5 grams of protein, while the unsweetened version contains 3 grams of protein. Both products feature natural vanilla flavor and provide nutrients such as calcium, magnesium, and vitamin D.

By End Use:

In end-use segments, retail/household consumption represents the dominant sub-segment, capturing around 55% of the hempseed milk market. Rising awareness of plant-based diets, coupled with convenience-driven home consumption trends, is driving demand in this segment. The food processing industry shows significant potential, with hempseed milk being incorporated in bakery products, cereals, and dairy alternatives. Meanwhile, the food service industry is growing modestly as cafes and restaurants introduce specialty plant-based options, but its share remains below retail due to higher cost considerations and limited consumer exposure outside home consumption.

- For instance,Living Harvest was acquired by Hudson River Foods in 2012 and is no longer an independent entity. This makes any specific, non-public sales data from the time difficult to verify today.

By Distribution Channel:

Within distribution channels, the business-to-consumer (B2C) segment holds a clear lead, contributing nearly 70% of total market revenue. Hypermarkets and supermarkets dominate B2C sales, benefiting from widespread availability, promotional activities, and bulk purchasing appeal. Online retail is gaining traction, driven by convenience, home delivery options, and subscription models, while specialty stores and convenience stores contribute to niche consumer access. The business-to-business (B2B) channel maintains a smaller share, primarily serving institutional buyers such as food processors and hospitality chains, where bulk purchases and consistent supply are key drivers.

Key Growth Drivers

Rising Health and Wellness Awareness

Consumer awareness of health and wellness is a primary growth driver for the hempseed milk market. Increasing concerns about lactose intolerance, cholesterol, and cardiovascular health have prompted a shift toward plant-based milk alternatives. Hempseed milk, rich in omega-3 fatty acids, proteins, and essential nutrients, appeals to health-conscious consumers seeking functional beverages. Additionally, its natural, non-GMO, and allergen-friendly profile positions it as a preferred alternative for a broad demographic, including vegans, millennials, and fitness enthusiasts. Marketing campaigns emphasizing nutritional benefits, coupled with endorsements from nutritionists, further boost adoption. This growing health-focused mindset is influencing both retail consumption and foodservice incorporation, ensuring steady expansion of the hempseed milk segment globally.

- For instance, Elmhurst 1925 introduced its Hemp Creamer line fortified with 350 mg omega-3 ALA per serving, targeting cardiovascular health.

Expansion of Plant-Based Diets and Veganism

The global shift toward plant-based diets and vegan lifestyles significantly drives hempseed milk consumption. Consumers are increasingly avoiding animal-derived products due to ethical, environmental, and health considerations. Hempseed milk serves as a sustainable, eco-friendly alternative with a lower carbon footprint compared to traditional dairy. Its versatility in recipes, beverages, and culinary applications makes it a preferred choice for vegan households and commercial kitchens. The trend is reinforced by rising social media influence, recipe sharing, and educational campaigns highlighting environmental and health benefits, encouraging widespread adoption. Consequently, the market is witnessing increased demand across retail, foodservice, and online channels.

- For instance, Danone SA expanded its plant-based portfolio through Alpro Hemp Drink, reducing product lifecycle carbon emissions by 35% compared to dairy milk.

Innovation in Product Flavors and Fortification

Product innovation is fueling growth in the hempseed milk market. Manufacturers are expanding offerings through flavored variants such as chocolate, vanilla, and fruit-infused options, targeting younger demographics and taste-conscious consumers. Additionally, fortification with vitamins, minerals, and probiotics adds functional value, appealing to consumers seeking immunity-boosting or wellness-oriented beverages. Innovations in packaging, such as single-serve cartons and eco-friendly bottles, enhance convenience and sustainability appeal. Continuous research and development by key players ensure differentiation in a competitive market, driving consumer interest and repeat purchases. These efforts collectively contribute to expanding market penetration and overall growth.

Key Trends & Opportunities

Growth of Online Retail and E-Commerce Platforms

E-commerce and online retail platforms present a major opportunity for hempseed milk brands. Increasing digital adoption allows manufacturers to reach a wider consumer base beyond traditional retail channels. Subscription-based deliveries, direct-to-consumer models, and online promotions enhance convenience and encourage brand loyalty. Social media and influencer marketing play a crucial role in shaping purchase decisions and creating awareness about plant-based alternatives. The trend of digital-first shopping aligns with younger, tech-savvy consumers who prioritize convenience and variety, providing an avenue for market expansion. This digital shift also supports data-driven marketing, enabling personalized product recommendations and targeted campaigns, further strengthening market growth.

- For instance, the parent company of Pacific Foods, Campbell Soup Company, confirmed in December 2021 that the Pacific Foods brand was well-positioned for growth in the non-dairy category.

Rising Demand for Sustainable and Eco-Friendly Products

Sustainability is a significant trend in the hempseed milk market. Consumers increasingly prefer products with lower environmental impact, such as plant-based beverages that reduce water usage and carbon emissions compared to traditional dairy. Hempseed milk, derived from hemp cultivation, is recognized for its sustainable farming practices and minimal ecological footprint. Brands promoting eco-friendly packaging, biodegradable cartons, and responsible sourcing are attracting environmentally conscious consumers. This trend opens opportunities for differentiation, premium pricing, and brand loyalty, especially among millennials and Gen Z, who prioritize ethical consumption and corporate responsibility in their purchasing decisions.

Integration into Functional and Fortified Beverages

Hempseed milk’s nutritional profile makes it a prime candidate for functional beverage development. Manufacturers are increasingly integrating hempseed milk into fortified products targeting immunity, gut health, and energy support. Collaborations with health-focused brands and the inclusion of superfoods or probiotics enhance product appeal. This trend leverages the growing consumer interest in holistic wellness, providing opportunities for differentiation in a crowded plant-based market. Additionally, functional formulations allow entry into niche markets such as sports nutrition, vegan meal replacements, and clinical nutrition, expanding both retail and institutional adoption channels.

Key Challenges

High Production Costs and Price Sensitivity

One of the major challenges in the hempseed milk market is the high cost of production. Sourcing quality hemp seeds, ensuring cold-press extraction, and implementing sustainable packaging contribute to elevated manufacturing expenses. As a result, retail prices are higher compared to conventional dairy and other plant-based alternatives, limiting mass adoption among price-sensitive consumers. This price barrier is particularly significant in emerging markets, where consumer awareness may not offset cost concerns. Manufacturers must balance quality, innovation, and affordability while maintaining profitability, making pricing a persistent challenge for market growth.

Regulatory and Supply Chain Constraints

Regulatory hurdles and supply chain limitations also pose significant challenges. Hemp-derived products are subject to stringent regulations in several regions, including restrictions on THC content, labeling, and imports, which can delay market entry and increase compliance costs. Additionally, fluctuations in hemp cultivation due to environmental conditions, limited processing infrastructure, and transportation complexities can affect product availability and pricing. Navigating these regulatory and logistical constraints requires careful planning, partnerships, and risk mitigation strategies, especially for companies seeking to expand into international markets.

Regional Analysis

North America

North America dominates the hempseed milk market with a share of approximately 35%, driven by high consumer awareness of plant-based diets and growing demand for dairy alternatives. The United States, as the largest contributor, benefits from well-established retail channels, increasing vegan and health-conscious populations, and supportive regulatory frameworks for hemp-derived products. Canada also shows steady growth due to rising adoption in both households and foodservice sectors. Market expansion is fueled by innovations in flavored and fortified variants, as well as strong distribution through hypermarkets, supermarkets, and online retail platforms. Consumer preference for sustainable and organic products further strengthens regional demand.

Europe

Europe accounts for roughly 30% of the global hempseed milk market, with significant contributions from the UK, Germany, and France. Increasing health awareness, lactose intolerance prevalence, and environmentally conscious consumption trends are primary growth drivers. The region exhibits high penetration of plant-based products across retail and foodservice channels, supported by stringent labeling regulations and product standardization. Flavored and fortified hempseed milk variants are gaining traction among younger consumers and urban households. Expansion is further supported by online retail growth, specialty stores, and supermarket chains, providing widespread accessibility. Sustainability initiatives and ethical branding enhance consumer trust and adoption rates.

Asia Pacific

The Asia Pacific region holds approximately 20% of the global hempseed milk market, with China, Japan, and Australia leading adoption. Rising disposable income, increasing health awareness, and growing vegan and vegetarian populations drive demand. Urbanization and the proliferation of modern retail formats, including hypermarkets and online platforms, facilitate market penetration. Consumers are increasingly experimenting with flavored and functional plant-based beverages, creating opportunities for product innovation. Growth is also fueled by collaborations with foodservice operators, including cafes and restaurants offering plant-based alternatives. Regulatory clarity on hemp-derived products is gradually improving, supporting market expansion across the region.

Latin America

Latin America contributes nearly 10% to the global hempseed milk market, with Brazil and Mexico leading regional adoption. The market is expanding due to rising awareness of plant-based diets, increasing lactose intolerance, and interest in sustainable food alternatives. Retail and foodservice channels are gradually growing, with supermarkets and specialty stores facilitating distribution. Online retail is emerging as a key growth avenue, particularly among urban, tech-savvy consumers. Market adoption is supported by product innovation in flavors and fortified options, though cost sensitivity and limited hemp supply chains remain challenges. Strategic marketing and consumer education are crucial for sustained growth.

Middle East & Africa

The Middle East & Africa region holds about 5% of the global hempseed milk market, with the UAE, South Africa, and Saudi Arabia as key contributors. Growth is driven by rising health-conscious urban populations, increasing interest in plant-based diets, and the expansion of modern retail channels. Hypermarkets and specialty stores serve as primary distribution points, while online retail is gradually gaining traction. Consumer adoption is supported by flavored and fortified variants targeting young and middle-aged demographics. Market development is constrained by regulatory restrictions on hemp-derived products and limited local production, making imports and awareness campaigns critical for regional growth.

Market Segmentations:

By Flavor:

By End Use:

- Food Processing Industry

- Food Service Industry

- Retail/Household

By Distribution Channel:

- Business To Business

- Business To Consumers

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hempseed milk market features strong competition driven by innovation, sustainability, and distribution expansion. Key players such as Good Mylk Co., Hudson River Foods, and Z-COMPANY focus on clean-label, plant-based formulations to attract health-conscious consumers. Brands like EcoMil and Pacific Foods emphasize organic certifications and diverse flavor options to strengthen their retail presence across North America and Europe. Golden Hemp Company LLC and Braham & Murray Good Hemp invest in value-added products such as fortified hemp beverages and protein-enriched variants to enhance brand differentiation. California Natural Products and SunOpta leverage advanced processing technologies and large-scale manufacturing capabilities to ensure consistent product quality and cost efficiency. Meanwhile, Living Harvest Foods focuses on innovation in dairy alternatives, introducing shelf-stable variants to capture e-commerce demand. Strategic collaborations, sustainable sourcing, and distribution partnerships remain vital strategies to enhance global competitiveness in the expanding hemp-based beverage market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Good Mylk Co.

- Hudson River Foods

- Z-COMPANY

- EcoMil

- Golden Hemp Company LLC

- Pacific Foods

- California Natural Products

- Braham & Murray Good Hemp

- SunOpta

- Living Harvest Foods

Recent Developments

- In February 2024, Tilray Brands announced in an earnings call that it was increasing marketing investment behind its Manitoba Harvest hemp milk product line, focusing on digital campaigns to highlight its nutritional superiority over almond and oat milk.

- In July 2023, SunOpta Inc announced a partnership with BellRing Brands, the owner of Premier Protein, the leading brand of ready-to-drink protein shakes, helping to establish SunOpta’s footprint in nutritional beverages. SunOpta now manufactures a variety of RTD shakes to meet the increasing demand for high protein beverages while supporting SunOpta’s sustainability efforts.

- In April 2023, Manitoba Harvest Hemp Foods, a wholly-owned subsidiary of Tilray Brands, Inc. debuted the brand’s first Regenerative Organic Certified (ROC) Hemp Hearts exclusively at select Whole Foods Market stores across the United States beginning in April 2023. Following the exclusivity period, the product will continue to be available at Whole Foods Market and other locations throughout the U.S. and Canada

Report Coverage

The research report offers an in-depth analysis based on Flavor, End-User, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The hempseed milk market is expected to witness steady growth driven by increasing plant-based diet adoption.

- Flavored and fortified variants will gain wider acceptance among health-conscious consumers.

- Online retail and direct-to-consumer channels will become more influential in market expansion.

- Sustainability-focused packaging and sourcing will attract environmentally aware consumers.

- Foodservice and hospitality sectors will increasingly incorporate hempseed milk into menus.

- Emerging markets in Asia Pacific and Latin America will offer significant growth opportunities.

- Innovation in functional beverages, including immunity-boosting and protein-fortified options, will drive demand.

- Strategic collaborations, partnerships, and mergers among key players will strengthen market presence.

- Private-label offerings will grow, increasing competition and price sensitivity.

- Consumer education and awareness campaigns will continue to support market adoption and penetration.