Market Overview

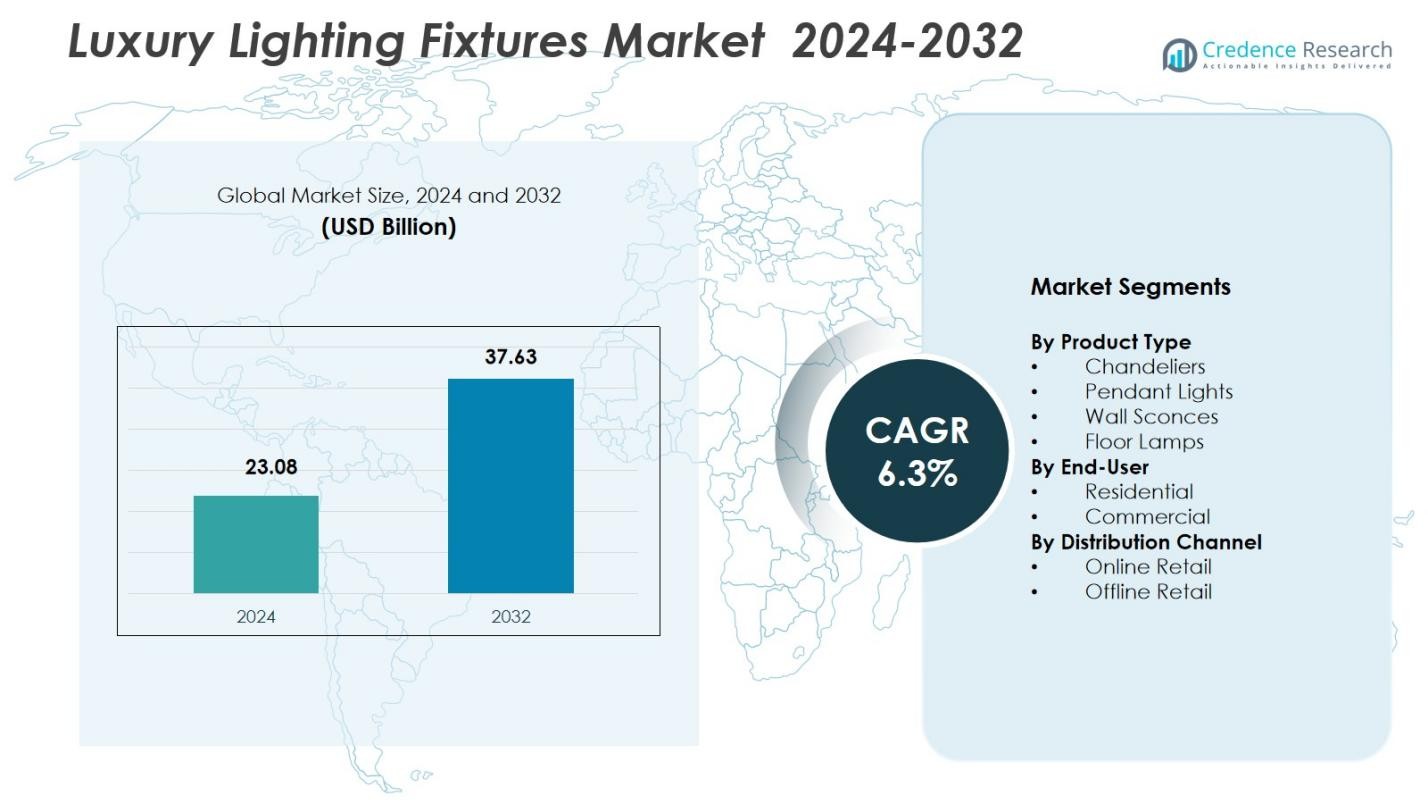

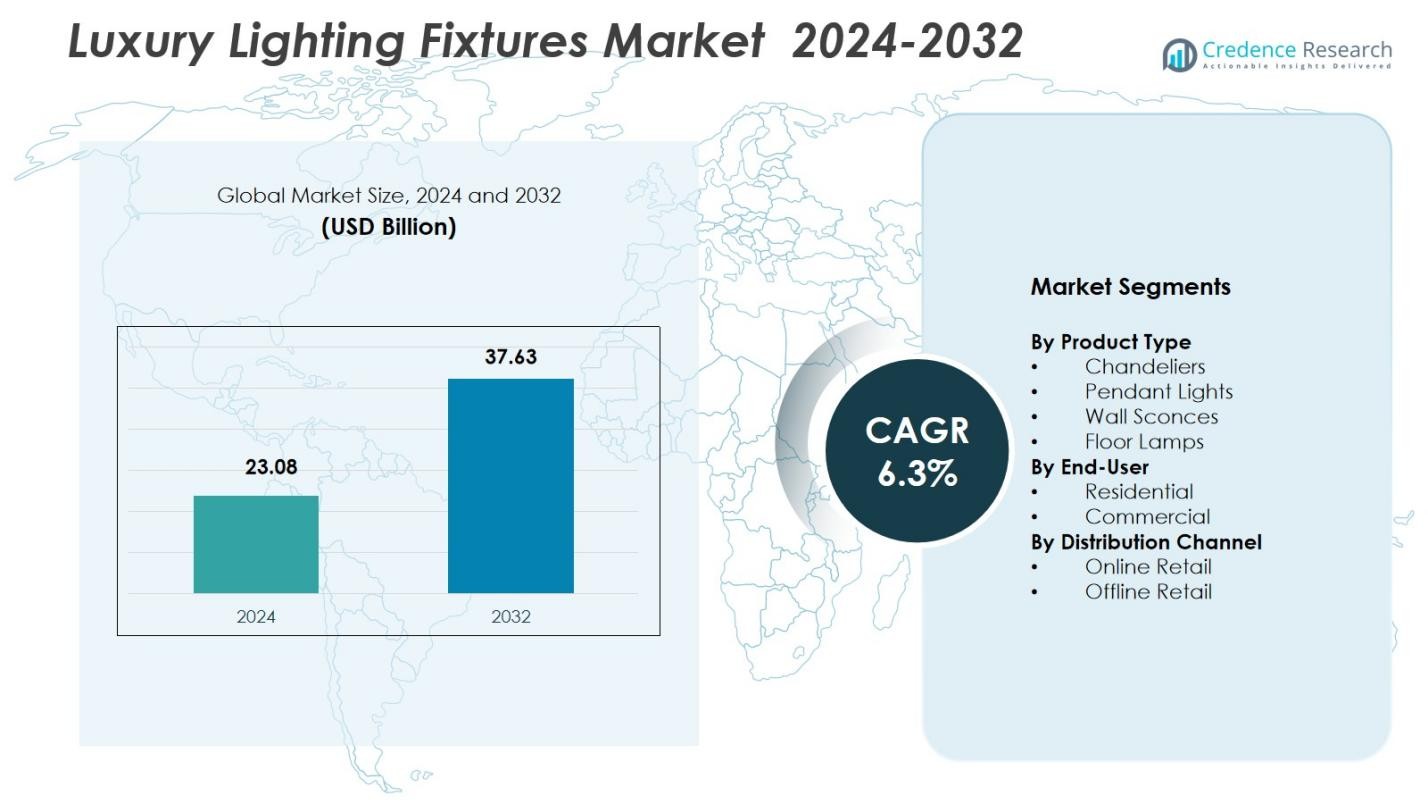

Luxury Lighting Fixtures Market size was valued at USD 23.08 Billion in 2024 and is anticipated to reach USD 37.63 Billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Lighting Fixtures Market Size 2024 |

USD 23.08 Billion |

| Luxury Lighting Fixtures Market, CAGR |

6.3% |

| Luxury Lighting Fixtures Market Size 2032 |

USD 37.63 Billion |

Luxury Lighting Fixtures Market features prominent players such as Tech Lighting, Hudson Valley Lighting Group, Schonbek, Visual Comfort & Co., Currey & Company, Meyda Lighting, Urban Electric Lighting, Hinkley Lighting, Trinity Lighting, and Hubbarton Forge, all of which strengthen industry growth through premium product portfolios, artisanal craftsmanship, and continuous design innovation. These brands actively expand their presence across luxury residential, hospitality, and commercial décor segments through high-end chandeliers, pendant lights, and bespoke lighting solutions. Regionally, North America leads the market with a 34.2% share, supported by strong spending on upscale interior décor, while Europe follows with 29.6%, driven by deep-rooted design excellence and robust luxury hospitality investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Luxury Lighting Fixtures Market reached USD 23.08 Billion in 2024 and will grow at a CAGR of 6.3% through 2032.

- Strong demand for upscale home décor and premium lighting designs drives market expansion, supported by rising adoption of chandeliers, which held a 38.4% share in 2024.

- Key trends include growing interest in artisan-crafted, customizable lighting and increased integration of smart, energy-efficient technologies across residential and commercial spaces.

- Leading players focus on design innovation, sustainable materials, and expanded retail presence, strengthening market presence across high-end décor and luxury hospitality segments.

- Regionally, North America led with a 34.2% share in 2024, followed by Europe at 29.6%, while the residential segment dominated end-use demand with a 56.7% market share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Luxury Lighting Fixtures Market is dominated by chandeliers, which captured 38.4% share in 2024 due to their strong presence in premium residential interiors, luxury hotels, and high-end commercial spaces. Demand is fueled by rising investments in upscale décor, growing preference for statement lighting pieces, and the availability of handcrafted, artisan, and customizable chandelier designs. Pendant lights and wall sconces are also expanding steadily as consumers shift toward layered and aesthetic illumination. Floor lamps continue to support niche demand, especially in designer home décor and boutique hospitality projects, reinforcing product premiumization trends.

- For instance, the “Artemide Tolomeo” floor lamp remains a classic choice in high-end interior projects, prized for its blend of elegant design and functional lighting.

By End-User

The residential segment held the largest 56.7% share in 2024, making it the dominant end-user category in the Luxury Lighting Fixtures Market. Growth is driven by rising consumer spending on luxury home décor, increasing urban premium housing projects, and heightened interest in interior aesthetics fueled by social media and home-improvement culture. Luxury apartments, villas, and smart homes increasingly integrate signature lighting pieces, boosting category adoption. The commercial segment covering hotels, restaurants, retail spaces, and corporate offices continues to grow as hospitality and retail developers prioritize visual branding and experiential lighting environments.

- For instance, Legrand’s smart lighting systems have been increasingly installed in upscale residences across Europe, driven by homeowners’ demand for both aesthetics and tech-enabled convenience.

By Distribution Channel

Offline retail led the Luxury Lighting Fixtures Market with a 64.1% share in 2024, driven by the strong preference for in-store product evaluation, personalized consultation, and the premium brand experience provided by specialty lighting boutiques and showrooms. High-value luxury purchases continue to rely on physical inspection, craftsmanship assessment, and designer-led recommendations, reinforcing offline dominance. Meanwhile, online retail is rapidly gaining traction due to expanding luxury e-commerce platforms, virtual showroom technologies, and increasing consumer comfort with digital purchases of premium décor products, supported by improved logistics and easy customization options.

Key Growth Drivers

Rising Demand for Premium Home Décor

Growing consumer inclination toward upscale interior aesthetics remains a major driver for the Luxury Lighting Fixtures Market. Higher disposable incomes, rapid urbanization, and expansion of luxury residential projects fuel purchases of high-end chandeliers, pendant lights, and designer fixtures. Homeowners increasingly view luxury lighting as a core design element that enhances ambiance and property value, driving consistent market expansion. Social media inspiration, home renovation culture, and the rise of boutique interior designers further accelerate premium lighting adoption across modern households and luxury living spaces.

- For instance, Acuity Brands’ Lithonia Lighting CPHB fixtures with nLight controls were installed at the Lexington Sporting Club. These enhanced the venue’s illumination for sports events, supporting a dynamic luxury atmosphere.

Expansion of Hospitality and Commercial Infrastructure

Significant investments in luxury hotels, fine-dining restaurants, boutiques, and corporate offices contribute strongly to market growth. Hospitality developers prioritize visually impactful lighting designs to enhance guest experience, strengthen brand identity, and elevate architectural aesthetics. Premium lighting solutions are increasingly incorporated into lobbies, suites, event venues, and retail environments, generating substantial demand. Global tourism recovery, new hotel pipelines, and refurbishment of existing properties continue to drive large-scale procurement of designer fixtures, ensuring sustained growth across commercial applications.

- For instance, Hotel Le Dix in Paris integrated motion-sensor LED lighting systems that adapt to guest movements and natural light levels across rooms and public spaces.

Technological Advancements and Smart Lighting Integration

The integration of LED technology, IoT-enabled controls, and intelligent lighting systems enhances the functionality and appeal of luxury lighting products. Smart chandeliers, dynamic dimming systems, energy-efficient decorative fixtures, and customizable lighting scenes attract tech-forward consumers seeking both luxury aesthetics and operational convenience. Manufacturers focus on blending artistry with advanced lighting technologies, enabling enhanced energy savings, remote control, and automation through smartphones or voice-assisted platforms. This merging of luxury design with smart features significantly boosts market penetration and differentiation.

Key Trends & Opportunities

Growing Popularity of Custom and Artisan Lighting

Customized, handcrafted, and artisan-made lighting fixtures are becoming highly sought after as consumers look for unique, personalized décor elements. Luxury buyers increasingly prefer bespoke chandeliers, sculptural pendants, and limited-edition decorative lights that reflect craftsmanship and exclusivity. Designers collaborate with artisans, glassmakers, and metalworkers to create distinctive pieces that elevate interior design value. This trend opens strong opportunities for luxury brands to expand bespoke offerings, cater to niche premium clients, and strengthen positioning in high-end residential and hospitality segments.

- For instance, Lladró’s high-end lighting from its Valencia workshop includes handcrafted porcelain chandeliers and table lamps, created using age-old techniques by sculptors in collaboration with designers like Bodo Sperlein.

Sustainable and Energy-Efficient Luxury Lighting Designs

Sustainability is emerging as a major trend as consumers and commercial buyers seek eco-friendly yet luxurious lighting solutions. Manufacturers focus on materials such as recycled glass, responsibly sourced metals, and energy-efficient LED modules to meet green building standards. Luxury hotels and commercial spaces increasingly prefer sustainable decorative lighting to align with ESG goals and certification programs such as LEED. This shift creates new opportunities for brands to innovate environmentally responsible designs without compromising craftsmanship, visual appeal, or performance.

- For instance, Rove Hotels outfits all its properties with LED lighting, which consumes 75% less energy than traditional bulbs, supporting broader energy-efficient practices across the group.

Key Challenges

High Product Costs Limiting Adoption in Price-Sensitive Markets

The premium pricing of luxury lighting fixtures—driven by high-quality materials, artisanal craftsmanship, and advanced technology—restricts wider adoption in cost-sensitive regions. Consumers in emerging markets often prioritize affordability, making it challenging for luxury brands to achieve large-scale penetration. Additionally, installation costs and the need for professional designers or architects further increase the total investment. This high price barrier limits volume expansion and compels manufacturers to explore tiered pricing, localized manufacturing, and targeted marketing strategies.

Supply Chain Constraints and Material Cost Volatility

The Luxury Lighting Fixtures Market faces challenges from fluctuating costs of metals, crystal components, high-grade glass, and specialty materials essential for premium designs. Global supply chain disruptions, logistics delays, and dependency on skilled artisan labor further intensify production constraints. These issues impact lead times, increase operational expenses, and reduce manufacturers’ ability to scale production efficiently. Brands must strengthen supplier networks, invest in local sourcing, and adopt flexible inventory management strategies to mitigate these challenges and maintain consistent product availability.

Regional Analysis

North America

North America dominated the Luxury Lighting Fixtures Market with a 34.2% share in 2024, supported by strong consumer spending on upscale home décor, extensive luxury residential construction, and a mature hospitality sector. High adoption of smart lighting solutions and strong presence of premium lighting brands further drive market expansion. The U.S. leads the region due to heightened demand for designer chandeliers, bespoke fixtures, and energy-efficient luxury lighting in high-income households and boutique commercial spaces. Renovation activities, architectural upgrades, and increasing preference for aesthetic illumination continue to strengthen growth across residential and commercial applications.

Europe

Europe held a 29.6% share in 2024, positioning it as a critical market driven by its deep-rooted design heritage, strong presence of luxury lighting manufacturers, and high investment in premium architectural décor. Countries such as Germany, Italy, France, and the U.K. lead demand due to robust hospitality projects, heritage restorations, and luxury retail expansions. European consumers prioritize artistic craftsmanship, sustainability, and premium interior aesthetics, boosting sales of chandeliers, pendant lights, and handcrafted designer fixtures. The region’s growing inclination toward energy-efficient luxury lighting and eco-friendly materials further supports sustained market growth.

Asia-Pacific

Asia-Pacific accounted for a 23.8% share in 2024, emerging as the fastest-growing region due to rapid urbanization, expanding luxury real estate, and rising disposable incomes in China, India, Japan, and Southeast Asia. Growing investments in high-end hotels, luxury malls, and premium residential complexes fuel strong demand for designer lighting solutions. Increasing adoption of Western-style décor, booming interior design services, and rising consumer inclination toward smart and customizable lighting further accelerate market penetration. Domestic and international brands are expanding retail presence to capture evolving luxury lifestyle trends across the region.

Latin America

Latin America captured a 6.5% share in 2024, driven by increasing refurbishment of high-end hotels, rising upper-middle-class income groups, and growing interest in premium home décor across Brazil, Mexico, and Argentina. The region benefits from expanding luxury residential developments and demand for visually appealing lighting in boutique hospitality and commercial projects. Although price sensitivity affects market depth, the rising availability of branded showrooms and imported designer fixtures boosts adoption. Growth in architectural enhancements and boutique interior design practices continues to support future opportunities in luxury lighting sales.

Middle East & Africa

The Middle East & Africa region accounted for a 5.9% share in 2024, supported by robust luxury infrastructure investments, including premium hotels, mega-malls, palaces, and upscale residential developments. The UAE, Saudi Arabia, and Qatar lead demand with strong adoption of grand chandeliers, custom-made lighting fixtures, and architecturally distinctive designs. High tourism development, large-scale hospitality projects, and luxury retail expansion create sustained opportunities. In Africa, growth remains concentrated in urban centers, with rising demand for premium décor driven by increasing affluence and ongoing commercial infrastructure upgrades.

Market Segmentations:

By Product Type

- Chandeliers

- Pendant Lights

- Wall Sconces

- Floor Lamps

By End-User

By Distribution Channel

- Online Retail

- Offline Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Luxury Lighting Fixtures Market features leading players such as Tech Lighting, Hudson Valley Lighting Group, Schonbek, Visual Comfort & Co., Currey & Company, Meyda Lighting, Urban Electric Lighting, Hinkley Lighting, Trinity Lighting, and Hubbarton Forge. These companies strengthen market presence through extensive product portfolios, premium craftsmanship, and continuous design innovation across chandeliers, pendant lights, sconces, and bespoke lighting solutions. Manufacturers emphasize artisanal quality, custom finishes, and integration of smart lighting technologies to meet evolving consumer preferences. Strategic partnerships with architects, interior designers, and luxury real estate developers further enhance brand visibility. Expansion of exclusive showrooms, investment in digital retail channels, and adoption of sustainable materials also shape competitive strategies. Many brands focus on limited-edition collections and handcrafted products to differentiate offerings in a crowded luxury décor landscape. Overall, competition remains driven by design excellence, brand reputation, and the ability to deliver personalized, high-end lighting experiences.

Key Player Analysis

- Tech Lighting

- Hudson Valley Lighting Group

- Schonbek

- Hubbarton Forge

- Visual Comfort & Co.

- Urban Electric Lighting

- Meyda Lighting

- Currey & Company

- Trinity Lighting

- Hinkley Lighting

Recent Developments

- In July 2025, Hudson Valley Lighting Group acquired Sonneman – A Way of Light, expanding its portfolio into high-performance architectural and LED lighting.

- In 2025, Schonbek introduced a new collection of luxury lighting designs blending nostalgic craftsmanship with contemporary aesthetics.

- In 2024, GE Lighting (a Savant Technologies company) released the “Cync Reveal HD+” full-color smart under-cabinet fixtures and pucks, expanding its smart-lighting offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth as consumers increasingly prioritize premium home décor and luxury interior aesthetics.

- Demand for smart luxury lighting will rise as integration of IoT, automation, and LED efficiency becomes standard in high-end homes.

- Hospitality and luxury commercial projects will continue to drive large-scale procurement of designer lighting solutions.

- Custom-made, artisan-crafted lighting pieces will gain stronger traction among affluent buyers seeking exclusivity.

- Sustainable materials and eco-friendly lighting designs will become essential differentiators for premium brands.

- Online retail channels will expand rapidly, supported by virtual showrooms and digital product visualization tools.

- Global luxury real estate development will fuel demand for statement chandeliers and architectural decorative lighting.

- Brands will invest more in personalization features, modular designs, and bespoke craftsmanship.

- Collaborations between designers, artists, and lighting manufacturers will increase product innovation.

- Market consolidation through acquisitions and partnerships will strengthen portfolios and global distribution networks.

Market Segmentation Analysis:

Market Segmentation Analysis: