Market overview

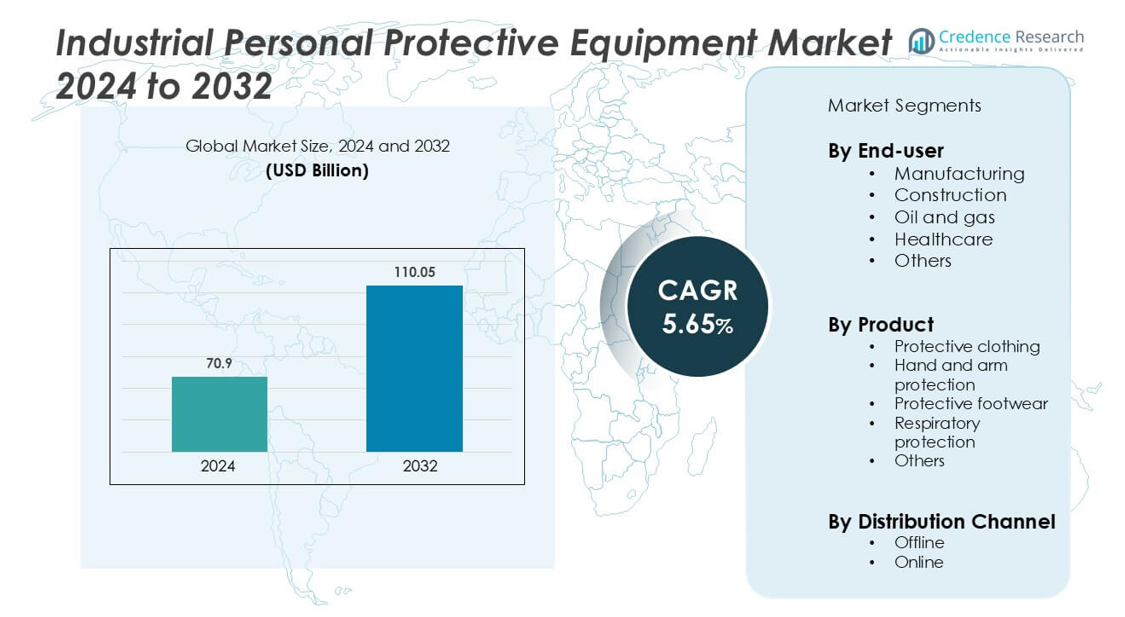

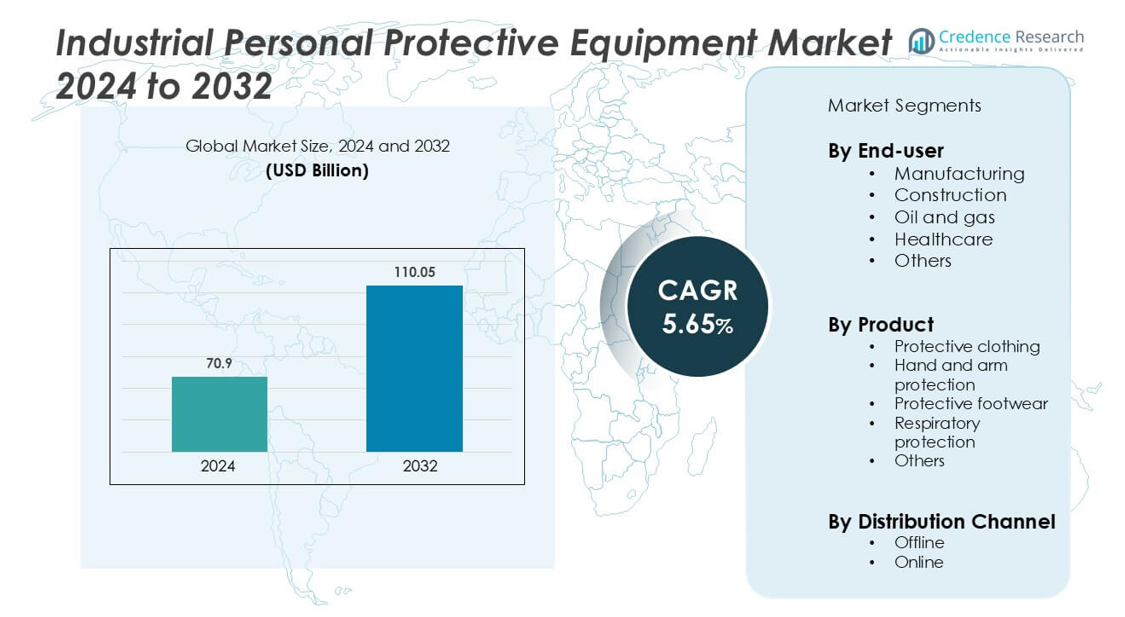

Industrial Personal Protective Equipment Market size was valued USD 70.9 billion in 2024 and is anticipated to reach USD 110.05 billion by 2032, at a CAGR of 5.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Personal Protective Equipment Market Size 2024 |

USD 70.9 billion |

| Industrial Personal Protective Equipment Market, CAGR |

5.65% |

| Industrial Personal Protective Equipment Market Size 2032 |

USD 110.05 billion |

The industrial personal protective equipment (PPE) market is highly competitive, led by prominent players such as DuPont, MSA Safety, Ansell Ltd., Kimberly-Clark Worldwide, Delta Plus Group, Uvex Group, Lakeland Inc., and Mallcom Limited. These companies maintain a strong global presence through advanced product portfolios, continuous innovation, and extensive distribution networks. They focus on developing technologically enhanced and ergonomically designed PPE to meet evolving safety standards across industries. North America dominates the global market, accounting for approximately 30% of total market share, driven by stringent occupational safety regulations, rapid adoption of smart PPE solutions, and high investment in industrial safety compliance.

Market Insights

- The global industrial personal protective equipment (PPE) market is valued at over USD 70.9 billion and is projected to grow at a CAGR of around 5.65% during the forecast period, driven by increasing emphasis on worker safety and regulatory compliance.

- Rising industrialization, infrastructure expansion, and stricter workplace safety mandates across manufacturing and construction sectors are major drivers boosting PPE demand globally.

- Key market trends include the adoption of smart and sustainable PPE solutions, integration of IoT-enabled monitoring devices, and the growing shift toward eco-friendly, recyclable materials.

- The market is highly competitive, with major players such as 3M, DuPont, MSA Safety, Ansell Ltd., and Delta Plus Group focusing on innovation, product diversification, and regional expansion to strengthen their market presence.

- Regionally, North America holds about 30% of the market share, while Asia-Pacific leads in growth, and the manufacturing segment remains the largest end-user category worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By End-user

The manufacturing sector dominates the industrial personal protective equipment (PPE) market, accounting for the largest share due to stringent workplace safety regulations and high adoption of protective gear in assembly lines and heavy machinery operations. Rising automation and the need for worker safety in hazardous environments continue to drive demand. The construction segment follows closely, fueled by rapid urbanization and infrastructure projects. Meanwhile, the oil and gas and healthcare sectors contribute steadily, supported by regulatory compliance and growing awareness of occupational safety standards.

- For instance, the overall number of distinct PPE products offered by 3M is much larger. Across all industries, the 3M India website lists over 2,000 safety-related items.

By Product

Protective clothing represents the dominant product sub-segment, capturing a significant share of the industrial PPE market owing to its essential role in safeguarding workers against chemical, thermal, and mechanical hazards. Demand is further strengthened by regulatory mandates and technological innovations in flame-resistant and high-visibility fabrics. Hand and arm protection, along with protective footwear, also hold considerable market presence, driven by the need for enhanced dexterity and comfort. Growth in respiratory protection is accelerating, particularly in sectors exposed to airborne contaminants and industrial dust.

- For instance, Ansell did report selling its 500 millionth pair of HyFlex® gloves. However, this milestone was reached in November 2011, marking the 15th anniversary of the Hy Flex ® brand.

By Distribution Channel

The offline distribution channel remains the dominant segment, accounting for the majority of market share due to established supplier relationships, bulk purchasing preferences, and immediate product availability. Industrial buyers often rely on direct sales and specialized distributors for technical consultation and product assurance. However, the online channel is expanding rapidly, supported by the increasing digitalization of procurement processes, broader product accessibility, and competitive pricing. The convenience of e-commerce platforms and the rise of B2B marketplaces are expected to accelerate this segment’s growth trajectory.

Key Growth Drivers

Stringent Workplace Safety Regulations

The enforcement of strict occupational health and safety standards across industries is a major driver for the industrial personal protective equipment (PPE) market. Regulatory bodies such as OSHA, NIOSH, and the European Agency for Safety and Health at Work mandate the use of PPE to reduce workplace injuries and fatalities. Companies are increasingly investing in advanced protective solutions to ensure compliance and minimize liability risks. Regular audits and safety certifications have further increased product demand. Moreover, the growing emphasis on worker welfare and corporate safety culture has encouraged continuous product upgrades, such as ergonomically designed helmets and flame-resistant clothing, fostering sustained market expansion.

- For instance, 3M developed the SecureFit™ X5000-series safety helmet whose patented Pressure Diffusion Technology reduces forehead pressure by up to 20% compared with prior models.

Rising Industrialization and Infrastructure Development

Rapid industrialization and infrastructure growth, particularly in emerging economies, are significantly boosting the demand for PPE. The expansion of manufacturing, construction, and oil and gas sectors has led to higher employment in hazardous environments, necessitating protective gear. Mega infrastructure projects and industrial corridors in Asia-Pacific and the Middle East are major contributors to market growth. Additionally, the increasing number of small and medium enterprises (SMEs) adopting safety measures to align with international standards has widened product penetration. Continuous investments in industrial development, combined with government initiatives promoting worker safety, further strengthen the market’s growth outlook.

- For instance, DuPont launched its Nomex® Global Portfolio for manufacturing, oil & gas and utilities across Asia-Pacific, emphasising flame-resistant and arc-rated protection with global standards certification and deployment across more than one million garments annually in the region.

Technological Advancements in PPE Design and Materials

Innovation in PPE materials and smart technology integration is transforming the market landscape. Manufacturers are developing lightweight, durable, and breathable materials that enhance comfort without compromising protection. The introduction of smart PPE—featuring sensors for real-time monitoring of worker health and environmental hazards—has significantly improved workplace safety outcomes. Technologies like IoT connectivity and AI-based hazard detection are gaining traction in industries with high exposure risks. Furthermore, advancements in antimicrobial fabrics and sustainable materials align with growing environmental and health awareness, driving replacement demand and product differentiation. These innovations are reshaping user perception, making PPE more functional, efficient, and desirable.

Key Trends and Opportunities

Increasing Adoption of Sustainable and Eco-Friendly PPE

Sustainability has become a central trend in the PPE market, with growing demand for environmentally responsible products. Manufacturers are shifting toward biodegradable, recyclable, and reusable materials to reduce waste and carbon footprints. The adoption of sustainable production practices—such as waterless dyeing and the use of organic fibers—is gaining momentum, particularly in Europe and North America. This shift not only aligns with global ESG commitments but also appeals to eco-conscious end-users. Companies adopting sustainable PPE solutions can strengthen brand image while meeting compliance with evolving environmental regulations. The integration of circular economy principles presents substantial opportunities for innovation and long-term growth.

- For instance, Ansell operates the RightCycle™ Program to recycle eligible, non-hazardous PPE. In October 2025, Ansell reported that the program has successfully diverted approximately 7 million pounds of waste from landfills since 2011, which is approximately 3,175 metric tons. This lifetime figure is very close to the one cited in the claim, which suggests a misunderstanding of the timeframe.

Expansion of Digital and E-Commerce Distribution Channels

The rise of digitalization has opened new growth avenues for PPE suppliers. Online distribution channels and B2B e-commerce platforms offer greater product accessibility, price transparency, and convenience for industrial buyers. This shift is particularly evident among small and mid-sized enterprises seeking cost-effective procurement solutions. Digital platforms enable real-time inventory tracking, product customization, and global reach, significantly enhancing supply chain efficiency. Moreover, data analytics and AI-driven recommendations are being leveraged to match products with specific industry needs. As remote work and digital procurement become standard business practices, online sales are expected to play a pivotal role in shaping future market dynamics.

- For instance, 3M launched its Connected Safety system which allows tagging of PPE items via RFID or barcodes, storing equipment history and training records in the cloud for hundreds of thousands of assets.

Key Challenges

Fluctuating Raw Material Prices

Volatile raw material costs remain a major challenge for PPE manufacturers. The production of protective clothing, gloves, and footwear relies heavily on materials such as rubber, leather, plastics, and synthetic fibers, all of which are subject to price instability driven by global supply chain disruptions and crude oil fluctuations. This volatility directly impacts profit margins and product pricing. Additionally, geopolitical tensions and transportation bottlenecks have exacerbated material shortages, delaying production timelines. To mitigate these effects, companies are exploring local sourcing, material substitution, and long-term supplier contracts. However, maintaining consistent quality and affordability remains a persistent challenge for industry players.

Counterfeit and Substandard Products

The growing influx of counterfeit PPE poses a serious threat to market credibility and user safety. Low-quality imitations not only fail to meet regulatory standards but also endanger workers and undermine consumer trust. Online marketplaces, while expanding accessibility, have inadvertently facilitated the distribution of unverified products. This issue is particularly prevalent in price-sensitive markets with weak enforcement mechanisms. To counter this challenge, regulatory agencies and manufacturers are intensifying efforts to implement traceability systems, certification labels, and awareness campaigns. Despite these measures, the proliferation of counterfeit products continues to hinder legitimate market growth and compromise occupational safety outcomes.

Regional Analysis

North America

North America holds a significant share of the global industrial personal protective equipment (PPE) market, accounting for over 30% of total revenue. The region’s dominance stems from strict occupational safety regulations enforced by OSHA and growing awareness of workplace hazards. The United States leads the market with robust demand from manufacturing, oil and gas, and healthcare sectors. High adoption of technologically advanced PPE, including smart wearables and respiratory protection, further strengthens market growth. Additionally, strong supply chain infrastructure and continuous product innovation by key players sustain the region’s leadership position.

Europe

Europe represents a substantial portion of the global industrial PPE market, capturing around 25% of total market share. The region’s growth is driven by stringent European Union safety directives and high emphasis on worker health protection. Countries such as Germany, the U.K., and France are key contributors due to their developed industrial bases and advanced manufacturing sectors. The increasing adoption of sustainable and eco-friendly PPE materials aligns with the region’s environmental regulations. Continuous investments in R&D and the rise of automation across industries further enhance product demand and market competitiveness.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the industrial PPE market, accounting for approximately 28% of global revenue. Rapid industrialization, expanding manufacturing activities, and infrastructure development in countries such as China, India, and Japan drive significant demand. Governments across the region are enforcing stricter workplace safety regulations, further boosting market penetration. The rise of local PPE manufacturers offering cost-effective solutions also enhances accessibility. Additionally, increasing foreign investments in construction and energy sectors are stimulating sustained growth. Technological advancements and expanding e-commerce distribution channels contribute to the region’s accelerating market share.

Latin America

Latin America holds a moderate share of the industrial PPE market, representing nearly 10% of global revenue. Growth is primarily driven by expanding construction, mining, and oil and gas industries, particularly in Brazil and Mexico. Increasing awareness of workplace safety and gradual enforcement of regulatory standards are improving PPE adoption rates. However, price sensitivity and limited access to advanced protective equipment remain challenges. Market players are focusing on strategic partnerships and local production to enhance affordability and distribution. As industrial activities expand, the region is expected to witness steady, long-term market development.

Middle East & Africa

The Middle East and Africa account for roughly 7% of the global industrial PPE market share, supported by strong demand from oil and gas, construction, and mining sectors. Countries such as Saudi Arabia, the UAE, and South Africa are major contributors due to large-scale industrial projects and increased safety investments. Growing awareness of occupational health standards and workforce protection initiatives by regional governments further stimulate demand. However, limited local manufacturing capacity and reliance on imports constrain growth potential. Despite these challenges, infrastructure expansion and energy diversification projects continue to drive regional market opportunities.

Market Segmentations

By End-user

- Manufacturing

- Construction

- Oil and gas

- Healthcare

- Others

By Product

- Protective clothing

- Hand and arm protection

- Protective footwear

- Respiratory protection

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the industrial personal protective equipment (PPE) market is characterized by the presence of several global and regional players competing through product innovation, technological advancement, and strategic partnerships. Major companies such as DuPont, MSA Safety, Ansell Ltd., and Kimberly-Clark Worldwide dominate the market with extensive product portfolios and strong distribution networks. These players focus on developing advanced, comfortable, and durable protective gear integrated with smart technologies for enhanced safety monitoring. European manufacturers like Delta Plus Group and Uvex Group emphasize ergonomic design and sustainability, while Asian firms such as Mallcom Limited and Supermax Corporation Berhad expand market reach through cost-effective offerings. Strategic mergers, acquisitions, and collaborations are common, enabling companies to diversify product lines and strengthen geographic presence. The growing importance of regulatory compliance and workplace safety standards continues to intensify competition, compelling manufacturers to invest in research, quality assurance, and digital sales channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont (U.S.)

- Ansell Ltd. (Australia)

- Delta Plus Group (France)

- Kimberly-Clark Worldwide, Inc. (U.S.)

- Uvex Group (Germany)

- Mallcom (India) Limited (India)

- Avon Rubber p.l.c. (U.K.)

- Lakeland Inc. (U.S.)

- Alpha ProTech (Canada)

- COFRA S.r.l. (Italy)

Recent Developments

- In May 2024, Supermax Corporation Berhad completed the acquisition of Supermax Healthcare Canada Inc. By this acquisition, Supermax Healthcare Canada Inc. became a fully-owned subsidiary of Supermax. Such development strategies would help the company enhance its product portfolio in the PPE market.

- In February 2024 Ansell Ltd. introduced a new highly textured glove called MICROFLEX Mega Texture 93-256 to the market. This orange-colored disposable nitrile glove provides a reliable grip and long-lasting protection for industrial workers. It is particularly well-suited for automotive shop employees needing a sturdy glove with tear resistance, high visibility, and excellent gripping capabilities.

- In March 2023, Ansell opened its Greenfield Manufacturing Plant in India, investing USD 80 million in the plant. The new facility aims to provide the most innovative and highest-quality surgical gloves to healthcare professionals across the country

Report Coverage

The research report offers an in-depth analysis based on End-User, Product, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The industrial personal protective equipment market will continue expanding due to increasing emphasis on workplace safety across industries.

- Technological innovations such as smart PPE and IoT-enabled monitoring systems will enhance product functionality and adoption.

- Sustainability initiatives will drive the development of eco-friendly and recyclable protective equipment.

- Demand from emerging economies will rise with accelerating industrialization and infrastructure projects.

- Online distribution channels will gain stronger traction as digital procurement becomes mainstream.

- Manufacturers will prioritize ergonomic design and comfort to improve worker compliance and efficiency.

- Strategic collaborations and mergers will increase to expand global reach and diversify product portfolios.

- Automation and robotics in manufacturing will influence PPE design to address new safety challenges.

- Stringent regulatory standards will continue to shape innovation and product certification requirements.

- Continuous R&D investment will remain vital for differentiation and maintaining competitiveness in the global market.