Market Overview

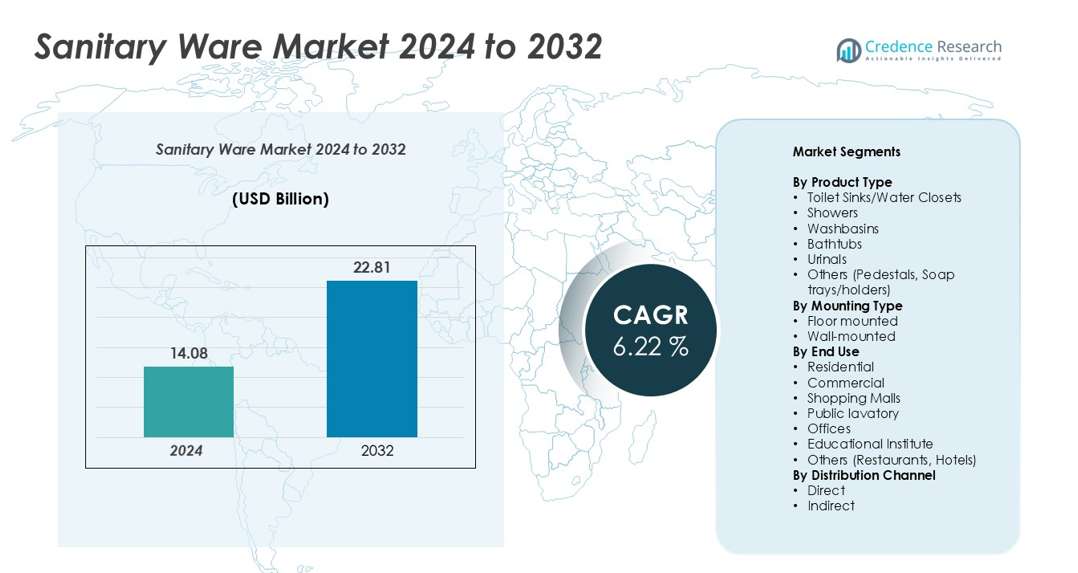

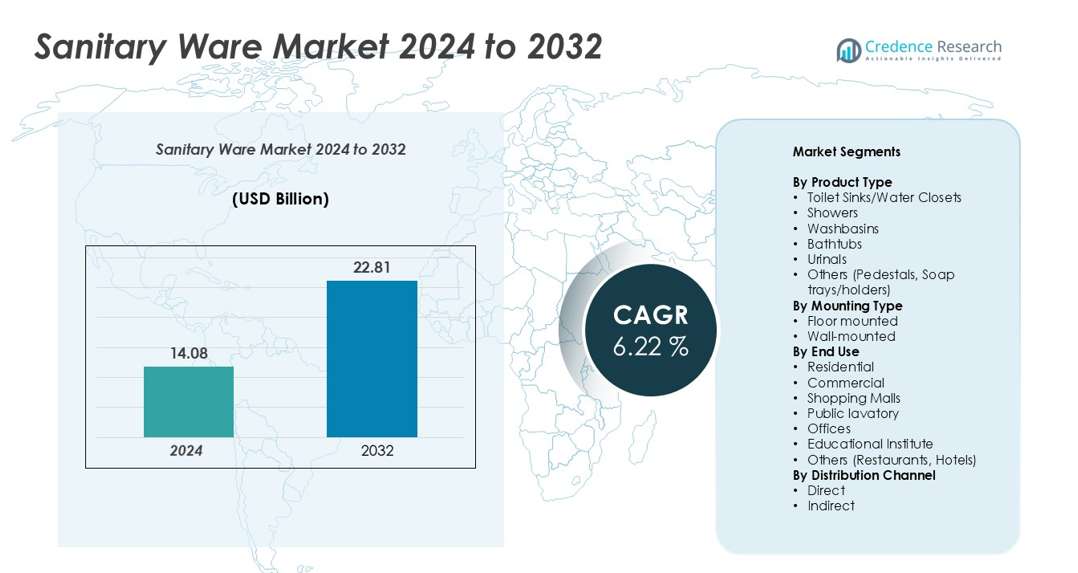

The Sanitary Ware Market size was valued at USD 14.08 billion in 2024 and is anticipated to reach USD 22.81 billion by 2032, at a CAGR of 6.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sanitary Ware Market Size 2024 |

USD 14.08 billion |

| Sanitary Ware Market, CAGR |

6.22% |

| Sanitary Ware Market Size 2032 |

USD 22.81 billion |

The sanitary ware market is shaped by key players such as Hindware, Geberit, CERA, Kohler, Astral Bathware, Johnson International, Jaquar Group, Artize, Duravit, Fuao, Neycer, and Eczacibasi Group. These companies lead through continuous product innovation, sustainable design, and strategic market expansion. Asia-Pacific dominates the market with a 32% share, driven by rapid urbanization and strong infrastructure development. North America follows with 28%, supported by renovation trends and smart product adoption, while Europe holds 25%, emphasizing water-efficient solutions. Regional competition pushes manufacturers to focus on advanced technology, eco-friendly materials, and strong distribution networks to secure long-term growth.

Market Insights

- The sanitary ware market was valued at USD 14.08 billion in 2024 and is projected to reach USD 22.81 billion by 2032, at a CAGR of 6.22%.

- Rising urbanization, growing sanitation awareness, and housing development projects drive strong product demand across residential and commercial spaces.

- Smart and water-efficient sanitary solutions are gaining traction, supported by regulatory focus on sustainability and modern bathroom design trends.

- Key players such as Hindware, Geberit, CERA, and Kohler dominate through innovation, strong distribution networks, and eco-friendly product strategies. High product costs and raw material volatility act as major restraints.

- Asia-Pacific leads with 32%, followed by North America with 28% and Europe with 25%. Toilet sinks and water closets hold the largest product segment share, supported by large-scale residential installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Toilet sinks and water closets dominate the sanitary ware market with the largest share. Their widespread use in both residential and commercial settings drives this segment’s growth. Rapid urbanization and rising sanitation awareness support high demand. Washbasins and showers follow, driven by increased bathroom renovations and modern home designs. Growing construction of hotels, offices, and public spaces further boosts product adoption. Manufacturers focus on water-efficient and easy-to-maintain designs to meet regulatory standards and consumer preferences, enhancing market penetration across multiple end-user sectors.

- For instance, Kohler’s Veil intelligent toilet integrates dual-flush technology with a 0.8 or 1.28 gallons-per-flush system and automated seat control, improving water conservation and hygiene performance.

By Mounting Type

Floor-mounted sanitary ware holds the leading market share due to its ease of installation and lower cost. It is widely used in residential, commercial, and institutional projects, making it the preferred choice in large-scale construction. Wall-mounted units are gaining traction, especially in modern buildings and premium segments, due to their space-saving design and aesthetic appeal. The trend toward minimalist bathroom designs accelerates this shift. Increased investments in smart infrastructure and modern housing are expected to boost both mounting categories in the coming years.

- For instance, The Geberit Duofix concealed frame system supports wall-mounted toilets with an 880-pound (400 kg) load capacity and features an integrated dual-flush concealed cistern, typically offering water-saving flush volumes of 1.6 gallons (6 liters) for solid waste and 0.8 gallons (3 liters) for liquid waste.

By End Use

Residential applications lead the market, supported by rising housing development, urban population growth, and improved sanitation facilities. Commercial spaces such as offices, hotels, and restaurants contribute significantly, driven by the expansion of the hospitality and corporate sectors. Public lavatories and shopping malls are growing segments due to government sanitation programs and infrastructure investments. Educational institutes also present steady demand. Increased real estate activity, along with hygiene and design considerations, drives demand across all end-use categories, strengthening the overall market structure.

Key Growth Drivers

Rapid Urbanization and Infrastructure Development

Rapid urbanization is a major driver of the sanitary ware market. Rising migration to urban areas boosts residential and commercial construction activities, creating strong demand for toilets, washbasins, and showers. Governments are investing in housing projects, smart cities, and sanitation initiatives to support growing populations. Real estate developers are integrating modern bathroom fittings in both affordable and premium housing segments. Infrastructure expansion in hospitality, education, and healthcare also fuels market growth. The increased focus on hygiene, coupled with improving water and sewage infrastructure, further strengthens product penetration in developing economies.

- For instance, Hindware offers a range of water-saving products, including dual-flush systems and other fixtures certified by third-party organizations for water efficiency.

Rising Hygiene Awareness and Lifestyle Upgrades

Growing awareness of personal hygiene drives the adoption of modern sanitary products. Consumers prefer advanced and easy-to-clean products that meet safety and health standards. Lifestyle upgrades in urban and semi-urban regions increase demand for premium and smart bathroom solutions. Rising disposable incomes and changing consumer preferences encourage bathroom renovations and modern fittings. The hospitality sector also invests in high-quality sanitary ware to enhance guest experiences. These factors collectively push manufacturers to develop innovative and durable designs, expanding product offerings and market reach.

- For instance, the Jaquar sensor faucet line features infrared sensing technology. Certain models, such as the Blush Sensor faucet, have a quick response time (less than one second). All faucets in this line are designed to automatically shut off when hands are removed, with an adjustable or preset time limit, which reduces water wastage and improves hygiene.

Government Sanitation Initiatives and Regulatory Support

Government programs promoting sanitation and hygiene play a vital role in boosting market growth. Initiatives such as public toilet construction, housing schemes, and subsidies encourage product adoption in both urban and rural areas. Regulatory bodies mandate water-efficient and sustainable sanitary ware, pushing companies to upgrade their technologies. Green building standards further increase demand for eco-friendly solutions. These measures enhance accessibility and affordability, especially in developing economies. As governments continue to prioritize sanitation infrastructure, manufacturers benefit from increased procurement and long-term contracts.

Key Trends & Opportunities

Adoption of Smart and Water-Efficient Products

The shift toward smart sanitary solutions is reshaping the market. Products with touchless operation, sensor-based flushing, and water-saving technologies are gaining traction in both residential and commercial spaces. Consumers prefer efficient systems that align with sustainability goals. Manufacturers are introducing IoT-enabled features to enhance convenience and hygiene. This trend opens opportunities in premium housing, healthcare, and hospitality sectors. Increasing water scarcity also supports demand for eco-friendly products, pushing companies to invest in innovation and smart design to remain competitive.

- For instance, Certain models within TOTO’s fully integrated Washlet+ toilet systems, such as the high-end G400, combine an automated sensor-based flush with a Dual-Max flushing system that offers a 0.9-gallon low-flush option. These models also include remote-controlled bidet functionality, which, along with the efficient flushing technology, reduces water usage while improving personal hygiene.

Expansion of the Hospitality and Commercial Real Estate Sector

The rapid growth of hotels, shopping malls, offices, and restaurants is a major opportunity for sanitary ware manufacturers. Modern commercial spaces demand stylish and functional fittings that meet hygiene standards and aesthetic needs. Hospitality chains are adopting luxury bathroom solutions to attract customers. Developers are prioritizing durable, easy-to-maintain, and water-efficient products to reduce operational costs. This expansion creates new avenues for product diversification, B2B partnerships, and large-scale procurement contracts, especially in high-growth markets across Asia-Pacific and the Middle East.

- For instance, Duravit manufactures water-saving toilets, including models with dual-flush and rimless technologies, for commercial projects like hotels. For example, some of its systems can use as little as 1.2 gallons (4.5 liters) or even less per flush, significantly reducing water consumption for hotels and other large facilities.

Sustainable Manufacturing and Circular Economy

Sustainability has become a key focus in the sanitary ware industry. Companies are adopting low-carbon materials, water-efficient designs, and energy-saving production methods. Recycling initiatives and circular economy practices are gaining importance as regulations tighten. Consumers also prefer eco-friendly solutions, creating opportunities for green-certified products. Manufacturers integrating sustainable practices can differentiate their offerings and capture premium market segments. This trend aligns with global environmental goals, positioning the industry for long-term growth and resilience against resource-related disruptions.

Key Challenges

High Cost of Advanced Products

The increasing cost of smart and premium sanitary ware products poses a challenge to market expansion. Many consumers in developing regions prefer low-cost alternatives, limiting the adoption of advanced technologies. High installation and maintenance costs further restrict penetration in mass housing and rural markets. Commercial buyers may also face budget constraints, slowing large-scale adoption. Manufacturers must balance innovation and affordability to sustain growth. Competitive pricing strategies and scalable production can help overcome this challenge and reach wider customer segments.

Supply Chain Disruptions and Raw Material Volatility

Volatile raw material prices and supply chain disruptions create significant challenges for manufacturers. The industry relies heavily on ceramic, metal, and plastic components, which face fluctuations in cost and availability. Geopolitical tensions, trade barriers, and logistics issues can increase lead times and production costs. These factors affect pricing strategies and profit margins, particularly for small and medium enterprises. Companies must adopt flexible sourcing strategies, localize supply chains, and invest in inventory management to reduce risks and ensure market stability.

Regional Analysis

North America

North America holds a 28% market share in the sanitary ware market, driven by strong residential construction, renovation activities, and smart bathroom adoption. The U.S. dominates the region, supported by a well-developed real estate sector and growing investments in green buildings. Consumer preference for premium and water-efficient products accelerates market penetration. Technological advancements, including touchless and sensor-based fittings, further boost demand in both residential and commercial spaces. Government standards promoting sustainable construction strengthen product adoption. The hospitality and healthcare sectors also contribute significantly to steady regional growth.

Europe

Europe accounts for a 25% market share, supported by high urbanization levels, strict water conservation regulations, and strong environmental awareness. Countries such as Germany, the UK, and France lead in product adoption, emphasizing eco-friendly and durable solutions. Renovation projects and modernization of older infrastructure drive demand for advanced sanitary ware. The region shows a clear preference for wall-mounted and space-saving designs. Government incentives for energy-efficient buildings support the shift toward sustainable bathroom solutions. The hospitality and tourism industries also play a key role in sustaining market growth.

Asia-Pacific

Asia-Pacific leads the global market with a 32% share, fueled by rapid urbanization, expanding residential construction, and government sanitation initiatives. China and India are major contributors due to large-scale housing projects and rising middle-class incomes. Affordable housing demand and improved sanitation infrastructure in rural areas support strong product penetration. Increasing investments in commercial infrastructure, including malls and hotels, further enhance regional growth. Rising adoption of smart and water-saving sanitary solutions positions Asia-Pacific as the fastest-growing region. Manufacturers are also expanding local production capacity to meet surging demand.

Middle East & Africa

The Middle East & Africa region captures a 9% market share, driven by infrastructure expansion, tourism growth, and urban development projects. The UAE and Saudi Arabia are key contributors, with investments in luxury hotels, commercial complexes, and housing developments. Modern design preferences and increasing use of premium sanitary ware support market expansion. Government efforts to enhance sanitation infrastructure in developing areas boost basic product demand. The growing hospitality industry, particularly in Gulf countries, creates opportunities for high-end and smart sanitary fittings, driving steady regional growth.

Latin America

Latin America holds a 6% market share, supported by moderate urbanization and gradual improvements in sanitation infrastructure. Brazil and Mexico lead the region, driven by government housing programs and increasing residential construction. Rising consumer spending on home improvement and bathroom renovation supports product demand. Economic recovery and foreign investments in commercial infrastructure also contribute to growth. The market is shifting from basic sanitary fittings toward more durable and water-efficient products. Expanding tourism infrastructure and modern retail spaces further strengthen market potential across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Toilet Sinks/Water Closets

- Showers

- Washbasins

- Bathtubs

- Urinals

- Others (Pedestals, Soap trays/holders)

By Mounting Type

- Floor mounted

- Wall-mounted

By End Use

- Residential

- Commercial

- Shopping Malls

- Public lavatory

- Offices

- Educational Institute

- Others (Restaurants, Hotels)

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The sanitary ware market is highly competitive, with both global and regional players focusing on innovation, design, and sustainability to strengthen their market position. Key companies include Hindware, Geberit, CERA, Kohler, Astral Bathware, Johnson International, Jaquar Group, Artize, Duravit, Fuao, Neycer, and Eczacibasi Group. These companies emphasize product diversification, advanced water-saving technologies, and smart sanitary solutions to meet evolving consumer demands. Strategic initiatives such as mergers, acquisitions, and collaborations help expand their global footprint. Many players are investing in eco-friendly manufacturing and digital technologies to align with environmental standards. Strong distribution networks, brand positioning, and after-sales services further enhance competitiveness. Continuous R&D efforts and premium product offerings support their leadership in both residential and commercial segments.

Key Player Analysis

- Hindware

- Geberit

- CERA

- Kohler

- Astral Bathware

- Johnson International

- Jaquar Group

- Artize

- Duravit

- Fuao

- Neycer

- Eczacibasi Group

Recent Developments

- In September 2025, Spain partnered with Kazakhstan to build a sanitaryware plant in Kyzylorda with 500,000-unit annual capacity, targeting domestic and Central Asian markets with installation systems and ancillary components.

- In March 2025, TOTO debuted WASHLET S5 with 38% lower energy use via tankless heating and introduced ultra-thin LINEARCERAM vessel lavatories, advancing design and sustainability in North America.

- In October 2024, Hansgrohe Group commissioned the world’s first electrohydraulic shredding facility for galvanized plastic parts, recovering 98% of chrome-plated waste and processing 100,000 kg annually.

- In January 2024, Kohler acquired KLAFS, folding premium sauna solutions into its wellness portfolio and reinforcing leadership in holistic bathroom experiences through German engineering integration.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mounting Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and touchless sanitary solutions will continue to rise across all sectors.

- Water-efficient products will gain wider adoption due to stricter environmental regulations.

- Urbanization and infrastructure expansion will drive steady residential and commercial installations.

- Premium and designer sanitary ware will see strong growth in hospitality and retail sectors.

- Manufacturers will invest more in eco-friendly and recyclable materials.

- Digital technologies will enhance production efficiency and product customization.

- Strategic partnerships and mergers will increase global market reach.

- Asia-Pacific will remain the leading region with sustained construction activity.

- Product innovation will focus on durability, hygiene, and user convenience.

- Competitive pricing strategies will expand accessibility in emerging economies.