Market Overview:

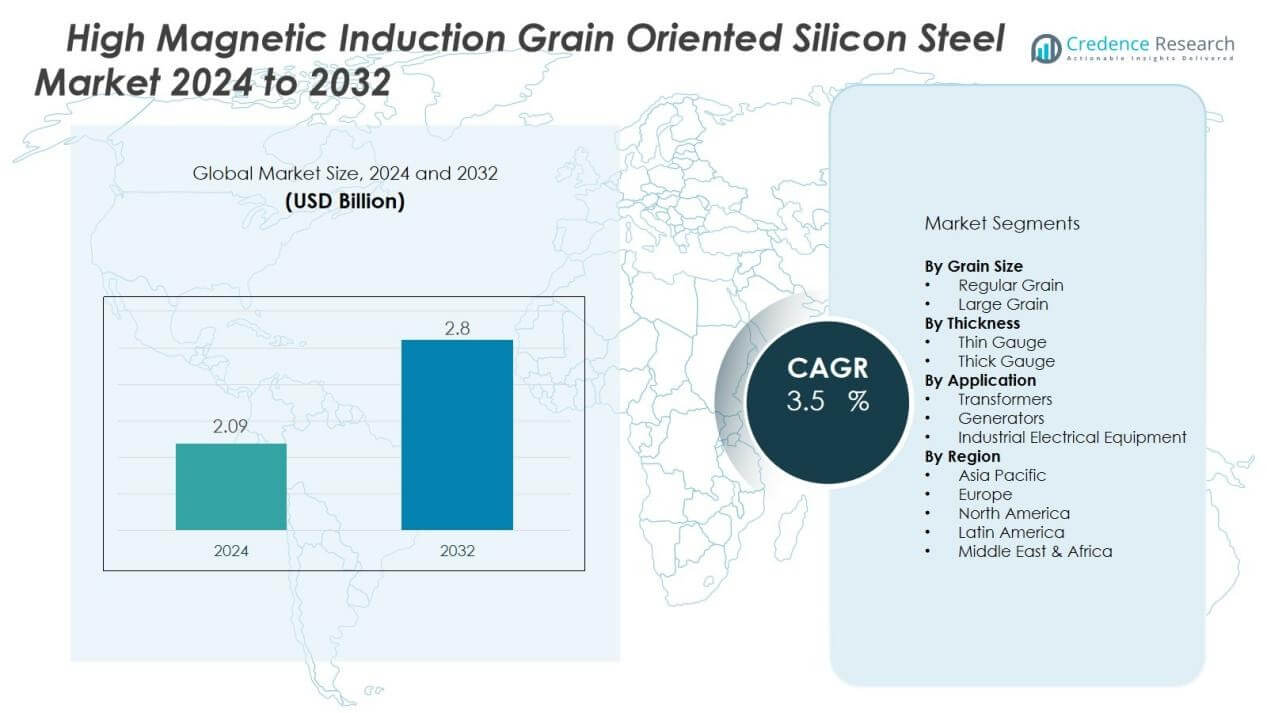

The high magnetic induction grain oriented silicon steel market size was valued at USD 2.09 billion in 2024 and is anticipated to reach USD 2.8 billion by 2032, at a CAGR of 3.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Magnetic Induction Grain Oriented Silicon Steel Market Size 2024 |

USD 2.09 Billion |

| High Magnetic Induction Grain Oriented Silicon Steel Market, CAGR |

3.5 % |

| High Magnetic Induction Grain Oriented Silicon Steel Market Size 2032 |

USD 2.8 Billion |

Key drivers include the increasing need for energy conservation and the global transition toward renewable power generation. Growing electricity demand, expansion of transmission and distribution networks, and modernization of aging grid infrastructure further accelerate adoption. In addition, government regulations promoting low-loss, eco-friendly electrical equipment strengthen market penetration. The integration of advanced steel processing technologies also enhances product performance, reducing operational costs for end users and boosting overall demand.

Regionally, Asia Pacific holds the largest market share, supported by rapid industrialization, large-scale transformer production, and high energy consumption in China, India, and Southeast Asia. North America and Europe follow, with growth fueled by grid modernization initiatives and renewable integration. Latin America and the Middle East & Africa present emerging opportunities, backed by infrastructure development and expanding electricity access, though growth remains at a moderate pace compared to leading regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The high magnetic induction grain oriented silicon steel market was valued at USD 2.09 billion in 2024 and is projected to reach USD 2.8 billion by 2032, growing at a CAGR of 3.5%.

- Rising demand for energy efficiency in power equipment drives adoption, with transformers and generators requiring materials that minimize core losses.

- Expansion of renewable energy projects strengthens market growth, as wind and solar power networks rely on efficient transformer cores.

- Modernization of aging electrical networks in developed economies boosts demand for advanced steel that enhances grid stability and reliability.

- Technological advancements in steel processing improve product performance, reduce energy losses, and support evolving industrial standards.

- High production costs and complex manufacturing processes remain challenges, with rising raw material prices adding pressure on profitability.

- Asia Pacific leads with 47% market share in 2024, followed by North America at 26% and Europe at 19%, supported by strong industrial bases and energy transition initiatives.

Market Drivers:

Rising Demand for Energy Efficiency in Power Equipment:

The high magnetic induction grain oriented silicon steel market is driven by the global push for energy efficiency. Transformers, generators, and electrical devices require materials that minimize energy loss and improve performance. High magnetic induction properties reduce core losses and increase efficiency, making the material vital for modern grids. Its adoption aligns with global sustainability targets and regulatory requirements.

- The company’s advanced PowerCore® grades demonstrate superior magnetic properties with core losses as low as 0.70 W/kg at 1.7 Tesla and 50 Hz, significantly outperforming conventional materials and helping transformer manufacturers meet demanding EU Ecodesign Directive requirements.

Expansion of Renewable Energy and Grid Infrastructure:

The rapid growth of renewable power generation fuels demand for efficient transformer cores. Wind and solar projects rely on advanced steel materials to handle fluctuating loads effectively. The high magnetic induction grain oriented silicon steel market benefits from the rising need for reliable, low-loss power transmission. It supports the development of resilient grids capable of integrating renewable sources.

- For instance, advanced grain-oriented silicon steel now achieves magnetic induction values of 1.89T at 800A/m with core losses as low as 0.70 W/kg for domain-refined high induction types.

Modernization of Aging Electrical Networks:

Aging infrastructure across developed economies requires replacement with advanced materials. Governments and utilities invest in upgrading power transmission systems to improve reliability. High magnetic induction silicon steel enables stronger and more efficient networks, reducing operational risks. It plays a crucial role in enhancing stability and ensuring consistent energy supply.

Technological Advancements in Steel Manufacturing:

Advances in steel processing technologies enhance product quality and performance. Improved production methods reduce energy losses and enable uniform magnetic properties. The high magnetic induction grain oriented silicon steel market gains from innovation that meets evolving industrial standards. It helps manufacturers meet efficiency demands while ensuring long-term reliability in electrical applications.

Market Trends:

Growing Adoption in Renewable Power and Smart Grids:

The high magnetic induction grain oriented silicon steel market is witnessing stronger adoption in renewable energy projects and smart grid infrastructure. Wind turbines, solar power systems, and advanced transformers require materials that ensure low energy loss and stable efficiency under variable loads. Governments are investing in cleaner energy networks, and this trend is pushing utilities to integrate high-performance steel for reliable transmission. Smart grid expansion across Asia Pacific, North America, and Europe further strengthens the role of high induction silicon steel. It is becoming essential for creating energy-efficient, environmentally sustainable, and cost-effective networks that can support increasing demand. The material’s performance benefits make it a core component in future-ready energy infrastructure.

- For instance, Siemens Energy received orders to manufacture 700 transformers using thyssenkrupp’s bluemint® powercore® high magnetic induction grain-oriented silicon steel at its Weiz plant in Austria, with each transformer containing approximately 10 tons of this specialized steel material.

Rising Focus on Material Innovation and Sustainability:

Manufacturers are focusing on advanced processing techniques to deliver steel with improved magnetic properties and reduced carbon footprint. The high magnetic induction grain oriented silicon steel market is aligning with sustainability initiatives by promoting recyclable, energy-efficient, and durable products. Companies are investing in research to refine grain orientation methods, enhancing product uniformity and lowering operational costs for users. It is also driving innovations in hybrid transformers that combine efficiency with eco-friendly materials. Global regulations promoting green energy solutions are further accelerating these developments. This trend reflects a strategic shift toward meeting both performance and environmental standards in industrial and power applications.

- For instance, JFE Steel Corporation developed a high-grade grain oriented electrical steel (JFE Super Core HM) that achieved core loss values as low as 0.85 W/kg at 1.7 T/50 Hz, contributing significantly to higher transformer efficiency and sustainability metrics.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes:

The high magnetic induction grain oriented silicon steel market faces challenges linked to cost-intensive production and complex processing requirements. Precision in grain orientation and advanced annealing processes demand significant investment in technology and skilled labor. It limits entry for smaller manufacturers and constrains scalability for large-scale adoption. Rising raw material costs, particularly for high-grade silicon, further pressure profitability. These barriers make cost optimization a critical issue for both producers and end users.

Supply Chain Constraints and Regional Dependence:

Global supply chain disruptions pose another major challenge for the high magnetic induction grain oriented silicon steel market. It relies heavily on specific regions for raw materials and advanced manufacturing capacity. Dependence on limited suppliers increases risks during trade restrictions or geopolitical tensions. Transportation delays and price volatility also affect the stability of supply to transformer and power equipment industries. Manufacturers are under pressure to diversify sourcing and establish regional production hubs to reduce vulnerability. Addressing these challenges is vital to maintaining long-term growth.

Market Opportunities:

Expansion of Renewable Energy and Electrification Projects:

The high magnetic induction grain oriented silicon steel market presents strong opportunities with the global shift toward renewable power and electrification. Governments and utilities are investing in wind, solar, and smart grid projects that require efficient transformer cores. It supports low-loss energy transmission, making the material vital for expanding sustainable networks. Rapid urbanization and electrification in Asia Pacific and Africa create further demand for advanced steel solutions. Rising electric vehicle infrastructure also offers growth prospects, as efficient power distribution becomes critical. This expansion strengthens long-term adoption across multiple energy-intensive industries.

Technological Advancements and Green Manufacturing Initiatives:

Ongoing innovation in steel processing opens opportunities to develop higher-performance and eco-friendly products. The high magnetic induction grain oriented silicon steel market benefits from research that enhances magnetic properties while reducing carbon emissions in production. It aligns with global sustainability targets, making the material attractive for regulated markets in Europe and North America. Manufacturers that adopt green technologies gain a competitive advantage in meeting environmental and efficiency standards. Growing customer preference for recyclable and low-emission products further boosts opportunities. These advancements support both commercial growth and compliance with international energy policies.

Market Segmentation Analysis:

By Grain Size:

The high magnetic induction grain oriented silicon steel market is segmented by grain size into regular grain and large grain categories. Large grain products dominate demand because they offer lower core loss and superior magnetic properties. Regular grain steel continues to serve applications requiring cost efficiency and moderate performance levels. It remains relevant in smaller distribution transformers and industrial devices. Large grain products, however, align with global efficiency standards and are favored in modern high-capacity transformers. This segment is expected to expand further with rising demand for energy-efficient solutions.

- For instance, Nippon Steel’s “HiB-Z” large grain-oriented steel achieved a core loss as low as 0.86 W/kg at 1.7 T and 50 Hz. Regular grain steel continues to serve applications requiring cost efficiency and moderate performance levels.

By Thickness:

Segmentation by thickness highlights the importance of material optimization for efficiency. Thin gauges are preferred due to their ability to reduce eddy current losses and improve transformer performance. Thicker gauges continue to find use in cost-sensitive or traditional applications. The high magnetic induction grain oriented silicon steel market benefits from technological advancements that allow manufacturers to produce thinner sheets with consistent quality. It supports the production of compact, lightweight, and efficient electrical equipment. The push toward thinner materials is expected to gain momentum as grid modernization accelerates.

- For instance, POSCO continues to supply high-quality silicon steel with a thickness of 0.35 mm for heavy-duty industrial transformers, supporting reliable performance in regions where infrastructure modernization is gradual and cost concerns are significant.

By Application:

Applications span across transformers, generators, and industrial electrical equipment. Transformers account for the largest share, driven by rising electricity demand and renewable energy integration. Generators also contribute significantly, especially in large-scale power generation projects. The high magnetic induction grain oriented silicon steel market benefits from industrial applications where efficiency and durability are critical. It continues to expand in smart grids, electric vehicle infrastructure, and high-capacity power distribution systems. This segment will remain a growth driver with ongoing electrification initiatives worldwide.

Segmentations:

By Grain Size

- Regular Grain

- Large Grain

By Thickness

By Application

- Transformers

- Generators

- Industrial Electrical Equipment

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia Pacific:

Asia Pacific accounted for 47% market share in 2024, dominating the global landscape. The region benefits from high transformer production, rapid electrification, and expanding renewable energy infrastructure. China, India, Japan, and South Korea drive demand through large-scale grid modernization and industrial projects. The high magnetic induction grain oriented silicon steel market in Asia Pacific is further supported by government policies promoting energy-efficient materials. It continues to grow with rising electricity consumption and investments in smart grid networks. Local manufacturing capacity also strengthens supply stability and competitiveness.

North America:

North America held 26% market share in 2024, driven by modernization of aging electrical infrastructure. The United States and Canada are investing heavily in renewable integration, particularly wind and solar energy projects. The high magnetic induction grain oriented silicon steel market benefits from policies encouraging energy-efficient equipment. It supports advanced transformer manufacturing and ensures reliable electricity distribution. Increasing demand from electric vehicle charging networks adds further opportunities. Regional manufacturers are focusing on innovation to meet strict efficiency and environmental standards.

Europe:

Europe captured 19% market share in 2024, supported by strong emphasis on sustainability and green energy adoption. Germany, France, and the United Kingdom lead in integrating renewable energy into national grids. The high magnetic induction grain oriented silicon steel market benefits from stringent regulations promoting eco-friendly transformer solutions. It is reinforced by investments in smart grid technology and cross-border power networks. European manufacturers are leveraging innovation to improve material performance and align with EU climate goals. This region is projected to sustain steady demand with ongoing electrification initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NLMK Group

- ArcelorMittal

- Nippon Steel Corporation

- Tata Steel

- POSCO

- Shougang Group

- Magnitogorsk Iron and Steel Works

- Baosteel Group

- Wuhan Iron and Steel Group

- HBIS Group

- Ansteel Group

- JFE Steel Corporation

Competitive Analysis:

The high magnetic induction grain oriented silicon steel market is highly competitive, with global and regional players focusing on innovation, efficiency, and sustainability. Key companies include NLMK Group, ArcelorMittal, Nippon Steel Corporation, Tata Steel, POSCO, Shougang Group, and Magnitogorsk Iron and Steel Works. It is shaped by continuous investment in advanced steel processing technologies, ensuring low core loss and high magnetic performance. Leading firms leverage strong research capabilities, integrated supply chains, and strategic partnerships to strengthen their global footprint. Competition also centers on meeting energy efficiency regulations and sustainability standards across major markets. It is driving manufacturers to expand production capacity and develop eco-friendly solutions to capture long-term demand from renewable energy and grid modernization projects.

Recent Developments:

- In April 2025, Nippon Steel Corporation collaborated with TIER IV to automate heavy-duty transporters at its Nagoya plant.

- In June 2025, ArcelorMittal inaugurated a new 20 million tonnes per annum iron ore concentrator in Liberia, part of a $3 billion investment in the country.

- In May 2025, Tata Steel launched “HyperFlange®,” an innovative hot-rolled steel product designed for automotive lightweight construction.

Report Coverage:

The research report offers an in-depth analysis based on Grain Size, Thickness, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high magnetic induction grain oriented silicon steel market will see rising demand from renewable energy projects, particularly wind and solar power networks.

- Growing investments in smart grid infrastructure will strengthen adoption of energy-efficient transformer materials.

- Manufacturers will focus on advanced steel processing technologies to improve efficiency and reduce core losses.

- Sustainability targets will push producers to adopt eco-friendly and recyclable manufacturing practices.

- Rising electrification in emerging economies will expand opportunities for transformer and generator applications.

- The market will benefit from increasing demand for electric vehicle charging infrastructure and reliable power distribution.

- Regional production hubs will gain importance to address supply chain risks and reduce import dependence.

- Government regulations promoting low-loss electrical equipment will drive further material adoption.

- Research collaborations will accelerate product innovation and performance enhancements in the industry.

- Long-term growth will be supported by industrial expansion, urbanization, and global focus on clean energy.