Market Overview

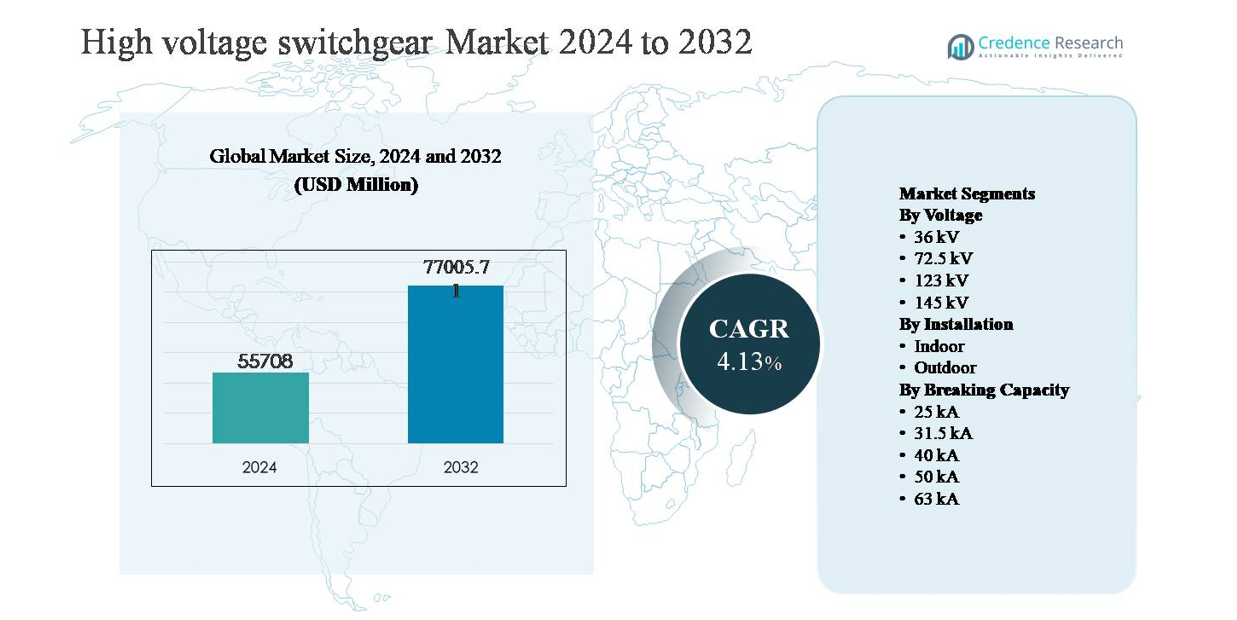

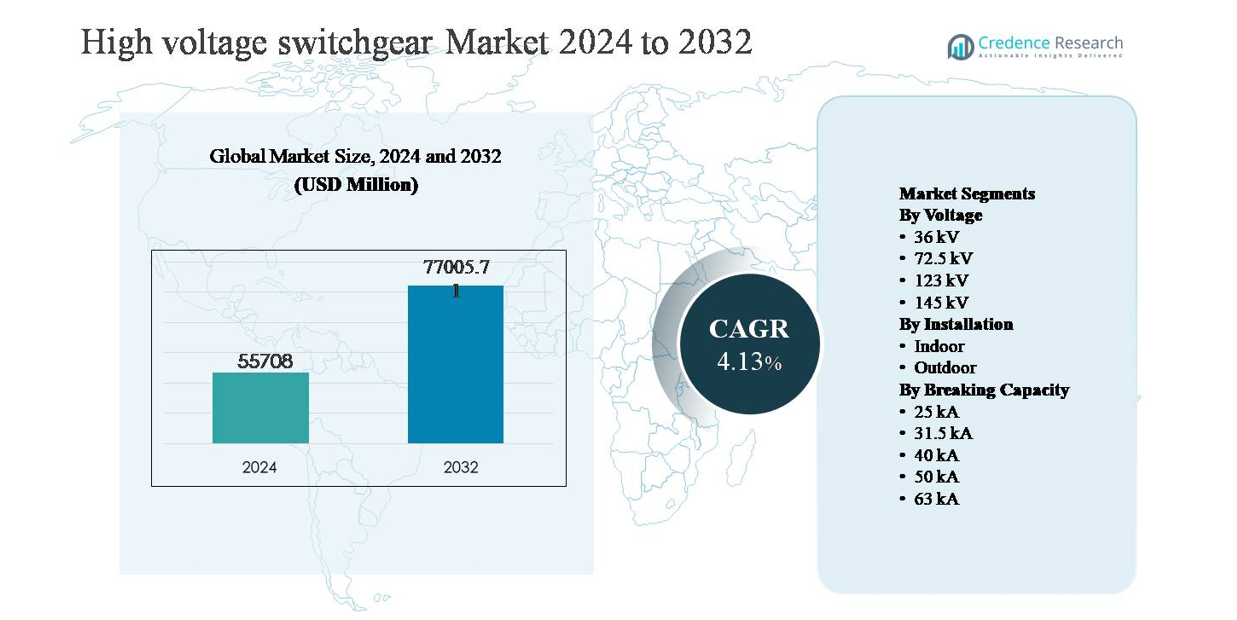

The high-voltage switchgear market was valued at USD 55,708 million in 2024 and is anticipated to reach USD 77,005.71 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Switchgear Market Size 2024 |

USD 55,708 million |

| High Voltage Switchgear Market, CAGR |

4.13% |

| High Voltage Switchgear Market Size 2032 |

USD 77,005.71 million |

The high-voltage switchgear market is led by a group of globally established manufacturers with strong utility and industrial portfolios, including ABB, General Electric, Hitachi, Eaton, HD Hyundai Electric, Fuji Electric, Hyosung Heavy Industries, CG Power and Industrial Solutions, Bharat Heavy Electricals, and E + I Engineering. These companies compete through advanced high-voltage technologies, large-scale manufacturing capabilities, and long-term service offerings aligned with grid modernization and renewable integration needs. Asia Pacific is the leading region, accounting for approximately 38% of the global market share, driven by extensive transmission expansion, rising electricity demand, and large utility investments in China, India, and Southeast Asia. Strong project pipelines and government-backed grid development programs reinforce the region’s leadership position.

Market Insights

- The high-voltage switchgear market was valued at USD 55,708 million in 2024 and is projected to reach USD 77,005.71 million by 2032, growing at a CAGR of 4.13% during the forecast period, supported by sustained investments in transmission and grid infrastructure.

- Market growth is primarily driven by large-scale transmission network expansion, grid modernization, and rising integration of renewable energy, with the 145 kV voltage segment emerging as the dominant sub-segment due to its extensive use in transmission substations and interconnections.

- Key market trends include increasing adoption of digital and smart switchgear, demand for eco-efficient insulation technologies, and growing preference for high breaking capacity ratings, where 31.5 kA holds the largest segment share owing to its balance of performance and cost efficiency.

- The competitive landscape is characterized by global players focusing on technology innovation, localized manufacturing, and long-term service contracts to strengthen utility relationships and address evolving grid requirements.

- Regionally, Asia Pacific leads with around 38% market share, followed by North America at ~24% and Europe at ~22%, while outdoor installations dominate globally with nearly 60% share, reflecting utility-scale deployment patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

The high-voltage switchgear market by voltage is led by the 145 kV segment, which accounts for an estimated around 35% of total market share. This dominance is driven by its widespread use in transmission substations, cross-border interconnections, and grid expansion projects supporting renewable energy integration. Utilities favor 145 kV systems for their optimal balance between capacity, footprint, and lifecycle cost in high-load networks. The 123 kV segment follows closely, supported by upgrades of aging transmission infrastructure, while 36 kV and 72.5 kV primarily serve sub-transmission and large industrial applications.

- “For instance, Hitachi Energy supplies its PASS M0hybrid switchgear platform rated up to 145 kV, with a typical short-circuit current withstand capability of 40 kA and compact bay widths below 4 m, enabling space-efficient transmission substations in dense grid corridors.”

By Installation

By installation, the outdoor switchgear segment dominates with approximately 60% market share, driven by large-scale utility transmission and distribution projects. Outdoor installations are preferred for high-voltage applications due to easier scalability, higher voltage handling, and suitability for open substations in power generation and grid expansion projects. Rapid investments in renewable energy evacuation infrastructure and cross-country transmission lines further reinforce demand. Indoor switchgear continues to grow steadily, supported by urban substations, metro rail projects, and space-constrained industrial facilities requiring compact and environmentally controlled solutions.

- For instance, Siemens Energy supplies outdoor live-tank circuit breakers in the 3AP series rated up to 420 kV, with interrupting capacities of 63 kA and continuous current ratings reaching 4,000 A, enabling deployment in large transmission substations and interconnection nodes exposed to harsh environmental conditions.

By Breaking Capacity

In terms of breaking capacity, the 31.5 kA segment holds the leading position with about 32% market share, owing to its broad applicability across transmission and high-capacity distribution networks. Utilities widely deploy 31.5 kA switchgear as a standard rating that balances fault-handling capability with cost efficiency. The 40 kA segment is gaining traction in dense urban grids and renewable-heavy networks where higher fault levels are common. Lower ratings such as 25 kA serve legacy systems, while 50 kA and 63 kA cater to ultra-high fault current applications.

Key Growth Driver

Expansion and Modernization of Power Transmission Infrastructure

Large-scale expansion and modernization of power transmission networks remain a primary growth driver for the high-voltage switchgear market. Aging grid infrastructure across developed economies is driving utilities to replace legacy air-insulated systems with advanced, digitally enabled switchgear to improve reliability and fault management. Simultaneously, emerging economies are investing heavily in new transmission corridors to support rising electricity demand from urbanization, industrialization, and electrification programs. High-voltage switchgear plays a critical role in substations, interconnections, and grid reinforcement projects by enabling safe switching, isolation, and protection of high-capacity networks. Government-backed grid strengthening initiatives and cross-border interconnection projects further accelerate adoption, as utilities prioritize equipment that supports higher load capacities, long operational lifespans, and compliance with evolving grid codes.

- “For instance, GE Grid Solutions has delivered gas-insulated switchgear for 420 kV interconnection substations in Europe, with gas compartments designed to be highly resistant to leaks and intended for operating lifetimes exceeding 40 years. The equipment features mechanical endurance ratings above 10,000 operating cycles, enabling reliable operation under frequent switching and high-load conditions mandated by modern interconnected power systems.”

Integration of Renewable Energy and Grid Stability Requirements

The rapid integration of renewable energy sources such as wind and solar is significantly driving demand for high-voltage switchgear. Renewable power plants often operate in remote locations and require long-distance transmission infrastructure, increasing the need for reliable high-voltage substations and switching equipment. High-voltage switchgear supports grid stability by managing variable power flows, isolating faults, and enabling rapid reconnection during disturbances. Utilities increasingly deploy advanced switchgear solutions to accommodate bidirectional power flows and higher short-circuit levels associated with renewable-heavy grids. As countries pursue aggressive decarbonization targets, investments in renewable energy evacuation systems, offshore wind connections, and hybrid substations continue to boost demand for high-voltage switchgear with enhanced performance and reliability.

- For instance, HD Hyundai Electric manufactures high-voltage gas-insulated and air-insulated switchgear rated up to 800 kV, with live-tank circuit breakers designed for continuous currents of 8,000 Aand short-circuit breaking capacities of 50 kA, supporting bulk power transfer from large onshore and offshore renewable hubs to national grids.”

Rising Electrification of Industrial and Urban Infrastructure

Growing electrification across industrial facilities, transportation networks, and urban infrastructure is another key driver for the high-voltage switchgear market. Energy-intensive industries such as metals, chemicals, data centers, and manufacturing require high-capacity electrical systems to ensure uninterrupted operations and safety. Urban expansion, metro rail projects, electric vehicle charging infrastructure, and smart city developments further increase demand for high-voltage substations equipped with advanced switchgear. Utilities and industrial users prioritize switchgear systems that offer compact designs, high fault-handling capabilities, and integration with digital monitoring platforms. This trend supports sustained investment in high-voltage switchgear as electricity consumption patterns shift toward higher loads and more complex distribution architectures.

Key Trend & Opportunity

Adoption of Digital and Smart Switchgear Technologies

Digitalization is transforming the high-voltage switchgear market through the adoption of smart monitoring, protection, and control technologies. Modern switchgear increasingly incorporates sensors, intelligent electronic devices, and communication interfaces that enable real-time condition monitoring and predictive maintenance. These capabilities help utilities reduce unplanned outages, extend equipment lifespan, and optimize asset management strategies. The shift toward digital substations creates opportunities for manufacturers to offer value-added solutions that integrate seamlessly with supervisory control and data acquisition systems. As grid operators pursue automation and data-driven decision-making, demand for digitally enabled high-voltage switchgear is expected to accelerate, creating long-term opportunities beyond traditional hardware sales.

- For instance, Hyosung Heavy Industries supplies extra-high-voltage digital switchgear and circuit breakers equipped with condition monitoring systems that track operating time, contact wear, and mechanical performance, with breaker designs rated for interrupting capacities of 63 kA and mechanical endurance exceeding 10,000 operating cycles, supporting predictive maintenance in digitally managed transmission substations.

Transition Toward Environmentally Sustainable Switchgear Solutions

Environmental sustainability is emerging as a major trend and opportunity in the high-voltage switchgear market. Regulatory pressure to reduce greenhouse gas emissions is driving a gradual shift away from conventional insulating gases toward eco-efficient alternatives. Manufacturers are investing in research and development to commercialize switchgear technologies that lower environmental impact while maintaining high performance and safety standards. Utilities increasingly prefer sustainable solutions to meet environmental compliance requirements and corporate decarbonization goals. This transition opens opportunities for differentiated product offerings, particularly in regions with strict environmental regulations and strong commitments to sustainable power infrastructure development.

- “For instance, CG Power’s medium-voltage vacuum circuit breaker (VCB) platforms are designed for mechanical endurance exceeding 10,000 operating cycles (meeting the IEC M2 classification) and are designed to support service lifetimes beyond 30 years, supporting long-term deployment in utility substations while reducing maintenance interventions and associated environmental impact.”

Growth of Compact and Space-Efficient Substation Designs

The demand for compact and space-efficient substation solutions is increasing, particularly in densely populated urban areas. High land costs and limited space availability are pushing utilities to adopt switchgear systems that reduce footprint without compromising performance. Compact designs enable indoor and underground substations, supporting urban grid expansion and transportation infrastructure projects. This trend creates opportunities for manufacturers to develop modular, factory-assembled switchgear that simplifies installation and reduces project timelines. As cities continue to expand and electrification intensifies, space-efficient high-voltage switchgear solutions are expected to gain stronger traction.

Key Challenge

High Capital Costs and Complex Installation Requirements

High capital investment and complex installation processes present a significant challenge for the high-voltage switchgear market. The cost of equipment, civil works, and associated infrastructure can be substantial, particularly for large-scale transmission projects. Installation often requires specialized engineering expertise, extended commissioning timelines, and strict safety compliance, which can delay project execution. For utilities in cost-sensitive markets, budget constraints may limit the pace of grid upgrades and new substation development. These factors can slow adoption, especially in regions with limited financial resources or where power infrastructure investments compete with other public spending priorities.

Technical Complexity and Maintenance Demands

The increasing technical complexity of high-voltage switchgear systems poses ongoing challenges for utilities and industrial users. Advanced designs with higher fault ratings, digital components, and automation features require skilled personnel for operation and maintenance. Inadequate technical expertise can increase the risk of operational errors, equipment downtime, and safety incidents. Additionally, maintaining consistent performance over long service lifecycles demands rigorous inspection and asset management practices. In regions facing shortages of trained electrical professionals, these challenges can hinder efficient deployment and long-term reliability of high-voltage switchgear installations.

Regional Analysis

North America

North America accounts for approximately 24% of the global high-voltage switchgear market, supported by ongoing grid modernization and replacement of aging transmission infrastructure. Utilities across the United States and Canada are upgrading substations to enhance reliability, integrate renewable energy, and improve resilience against extreme weather events. Strong investments in wind and solar interconnections, data center power infrastructure, and cross-state transmission projects continue to drive demand. The region also benefits from advanced adoption of digital substations and strict safety standards, encouraging utilities to deploy high-performance, automated high-voltage switchgear across transmission and large industrial networks.

Europe

Europe represents around 22% of the global high-voltage switchgear market, driven by aggressive renewable energy integration and cross-border grid interconnections. The region’s transition toward low-carbon power systems requires extensive reinforcement of transmission networks, particularly for offshore wind and inter-regional electricity trade. Utilities across Western and Northern Europe prioritize advanced switchgear solutions to manage variable power flows and ensure grid stability. Additionally, stringent environmental regulations and sustainability targets are accelerating the adoption of eco-efficient switchgear technologies. Grid refurbishment projects in aging networks across Germany, France, and the U.K. further sustain market growth.

Asia Pacific

Asia Pacific dominates the high-voltage switchgear market with approximately 38% market share, reflecting rapid power infrastructure expansion across China, India, and Southeast Asia. Rising electricity demand from urbanization, industrial growth, and electrification initiatives is driving large-scale investments in transmission and distribution networks. Governments across the region are prioritizing grid expansion to support renewable energy deployment and rural electrification programs. High-capacity substations, long-distance transmission lines, and new industrial zones significantly boost demand. The region’s strong pipeline of utility-scale projects and manufacturing expansion positions Asia Pacific as the leading growth engine globally.

Latin America

Latin America holds about 8% of the global high-voltage switchgear market, supported by gradual expansion of transmission infrastructure and renewable energy integration. Countries such as Brazil, Chile, and Mexico continue to invest in grid reinforcement to connect hydropower, wind, and solar projects to national networks. Aging transmission assets and increasing electricity demand from mining and industrial sectors also contribute to market growth. However, investment cycles remain influenced by regulatory frameworks and public funding availability. Despite these challenges, long-term power sector reforms and renewable targets sustain steady demand for high-voltage switchgear solutions.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of the global high-voltage switchgear market, driven by power generation expansion and grid development initiatives. Gulf countries are investing heavily in transmission networks to support urban growth, industrial diversification, and large-scale renewable energy projects. In Africa, electrification programs and cross-country transmission projects are gradually increasing demand. Utilities prioritize robust, high-capacity switchgear to operate under harsh environmental conditions. While infrastructure investment varies by country, long-term energy diversification strategies and population growth continue to create opportunities across the region.

Market Segmentations:

By Voltage

- 36 kV

- 72.5 kV

- 123 kV

- 145 kV

By Installation

By Breaking Capacity

- 25 kA

- 31.5 kA

- 40 kA

- 50 kA

- 63 kA

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the high-voltage switchgear market is characterized by the presence of established global electrical equipment manufacturers and strong regional players competing on technology, reliability, and lifecycle performance. Leading companies focus on expanding their high-voltage portfolios through continuous innovation, particularly in digital monitoring, automation, and environmentally efficient insulation technologies. Strategic investments in manufacturing capacity and localized production enable suppliers to meet large utility tenders and regional grid standards. Companies also emphasize long-term service agreements, predictive maintenance, and retrofit solutions to strengthen customer relationships and recurring revenue streams. Partnerships with utilities, EPC contractors, and renewable energy developers remain central to securing large-scale transmission projects. Competitive differentiation increasingly centers on system integration capabilities, operational safety, compliance with evolving regulations, and the ability to deliver scalable solutions for renewable-heavy and high-load transmission networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Electric

- Hitachi

- ABB

- Eaton

- HD Hyundai Electric

- Fuji Electric

- Hyosung Heavy Industries

- CG Power and Industrial Solutions

- Bharat Heavy Electricals

- E + I Engineering

Recent Developments

- In October 2025, Hitachi Energy introduced the PASS M00-Wind dual-breaker switchgear, engineered specifically for high-power offshore wind applications, enabling scalable deployment of next-generation turbines and supporting high-capacity renewable evacuation infrastructure.

- In July 2025, ABB announced it would supply its next-generation SF₆-free gas-insulated switchgear (SafeRing and SafePlus Air technologies) to E.ON in Germany. This deployment marks a shift toward lower-environmental-impact insulating technologies for utility grids.

- In February 2024, GE Vernova’s Grid Solutions business secured substantial orders from Power Grid Corporation of India (PGCIL) for the supply of 765 kV shunt reactors to support transmission projects that reinforce grid stability and facilitate renewable integration, strengthening grid infrastructure in key regional corridors.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Installation, Breaking capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Grid modernization programs will continue to drive replacement of aging high-voltage switchgear across transmission networks.

- Renewable energy integration will increase demand for high-voltage switchgear with higher fault-handling and grid-stabilization capabilities.

- Utilities will accelerate adoption of digital and smart switchgear to enable predictive maintenance and real-time monitoring.

- Demand for eco-efficient and low-emission insulation technologies will rise in response to tightening environmental regulations.

- Outdoor high-voltage switchgear installations will remain dominant due to large-scale utility transmission projects.

- Compact and modular switchgear designs will gain traction in urban and space-constrained substations.

- Higher breaking capacity ratings will see increased adoption as grid fault levels continue to rise.

- Localization of manufacturing will expand to support regional grid standards and reduce supply chain risks.

- Long-term service contracts and retrofit solutions will grow in importance for revenue stability.

- Emerging economies will remain key growth engines due to sustained investments in power infrastructure expansion.