Market Overview

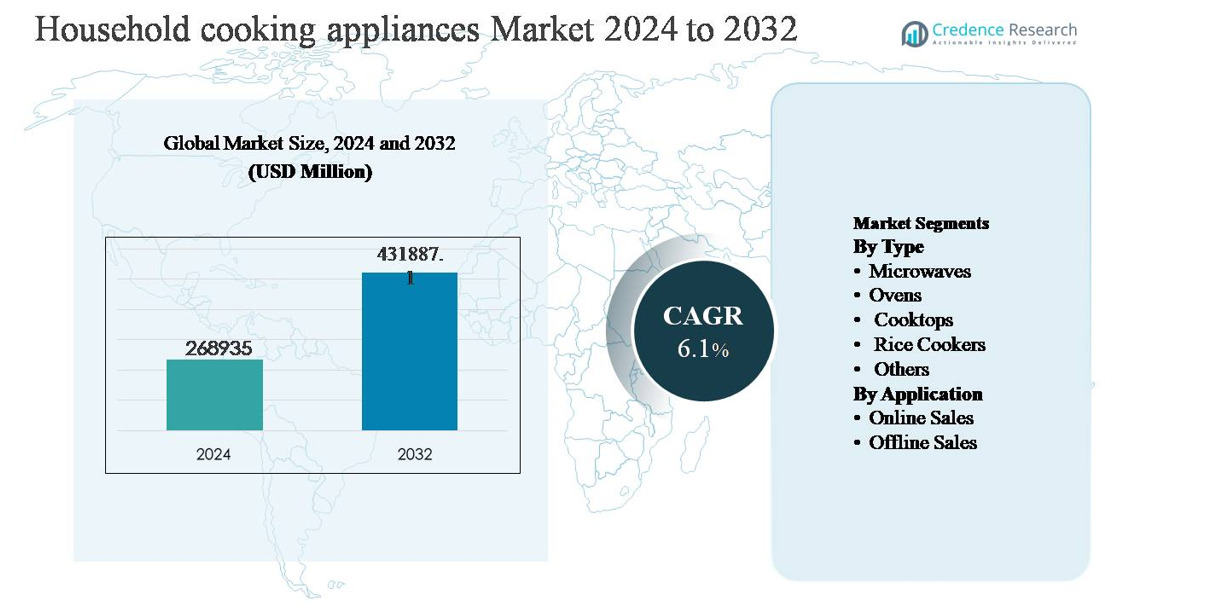

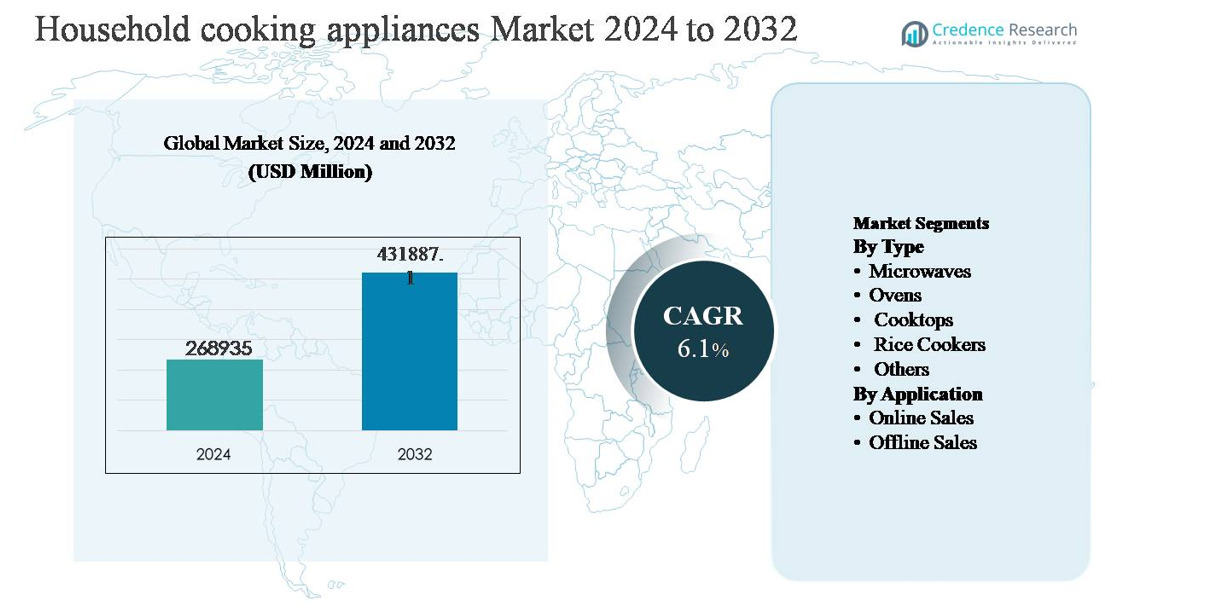

The household cooking appliances market was valued at USD 268,935 million in 2024 and is projected to reach USD 431,887.1 million by 2032, growing at a compound annual growth rate (CAGR) of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Household Cooking Appliances Market Size 2024 |

USD 268,935 million |

| Household Cooking Appliances Market, CAGR |

6.1% |

| Household Cooking Appliances Market Size 2032 |

USD 431,887.1 million |

The household cooking appliances market is led by globally established players including Samsung, LG, Whirlpool, Robert Bosch, AB Electrolux, Haier (GE Appliances), Miele Group, Philips, Hitachi, and Morphy Richards, all of which compete through broad product portfolios, technological innovation, and strong global distribution networks. These companies emphasize energy-efficient designs, smart connectivity, and premium kitchen solutions to strengthen brand positioning and capture higher-value demand. Asia Pacific is the leading region, accounting for approximately 38% of the global market, driven by rapid urbanization, large residential construction activity, and high penetration of essential cooking appliances in China, India, and Southeast Asia. Strong manufacturing bases and price-competitive offerings further reinforce the region’s dominance.

Market Insights

- The household cooking appliances market was valued at USD 268,935 million in 2024 and is projected to reach USD 431,887.1 million by 2032, expanding at a CAGR of 6.1% during the forecast period.

- Market growth is primarily driven by rapid urbanization, rising residential construction, and increasing consumer preference for modern, energy-efficient cooking solutions, particularly induction cooktops and multifunctional appliances in urban households.

- Key trends include growing adoption of smart and connected appliances, rising demand for compact and multifunctional products, and accelerating penetration of online sales channels alongside traditional offline retail.

- The competitive landscape is moderately fragmented, with global players such as Samsung, LG, Whirlpool, Bosch, and Electrolux competing through product innovation, premiumization, smart features, and strong after-sales service networks, while regional players focus on affordability.

- Asia Pacific leads the market with approximately 38% share, followed by North America (24%) and Europe (21%); by segment, cooktops dominate by type, while offline sales remain the leading distribution channel due to in-store trust and service support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The household cooking appliances market by type is led by cooktops, which account for the largest market share due to their essential role in daily cooking and widespread adoption across both developed and emerging economies. Gas and induction cooktops dominate demand, supported by rising urbanization, growth in residential construction, and consumer preference for energy-efficient and space-saving solutions. Microwaves and ovens follow, driven by convenience cooking trends and increased consumption of ready-to-eat meals. Rice cookers maintain strong penetration in Asia-Pacific, while other appliances benefit from premiumization and smart kitchen innovations.

- For instance, Bosch (BSH Hausgeräte) offers induction cooktops with 17 power levels and a PowerBoost function delivering up to 3,700 W on a single zone, enabling rapid heating and precise control.

By Application:

By application, offline sales remain the dominant sub-segment, holding a majority market share as consumers prefer in-store evaluation of large cooking appliances, brand trust, and access to installation and after-sales services. Specialty appliance stores, multi-brand retailers, and hypermarkets continue to drive volume sales, especially in emerging markets. However, online sales are growing rapidly, supported by expanding e-commerce platforms, competitive pricing, wider product assortment, and digital promotions. Increasing internet penetration, improved logistics, and flexible financing options are accelerating online adoption, particularly among younger, urban consumers.

- For instance, LG Electronics supports e-commerce purchases with doorstep delivery and installation services, and offers digital product comparison tools and app-based service booking; however, the typical installation timeline can vary, with no official guarantee of completion within 48 hours in metro cities.

Key Growth Driver

Rapid Urbanization and Residential Construction Growth

Rapid urbanization and sustained growth in residential construction are primary drivers of the household cooking appliances market. Expanding urban populations are increasing demand for modern housing equipped with efficient, space-optimized kitchens, directly supporting appliance adoption. Government-backed affordable housing programs, particularly in Asia-Pacific, the Middle East, and parts of Latin America, are accelerating first-time purchases of essential cooking appliances such as cooktops, ovens, and microwaves. In parallel, rising nuclear family structures and apartment living favor compact and built-in cooking solutions. Replacement demand also remains strong as aging households upgrade from conventional to technologically advanced appliances, reinforcing consistent volume growth across both mass-market and premium product categories.

- For instance, Electrolux offers built-in ovens with 71-liter cavity volumes and multi-level convection systems, supporting full-size cooking in compact footprints.

Rising Disposable Income and Premiumization of Kitchens

Rising disposable income and improving living standards are driving the premiumization of household kitchens worldwide. Consumers increasingly view cooking appliances as lifestyle products rather than basic utilities, encouraging investment in high-performance and aesthetically advanced solutions. This shift supports demand for induction cooktops, multifunctional ovens, and smart microwaves with enhanced safety and automation features. Growth is particularly strong in emerging economies, where expanding middle-class populations aspire to modern kitchen layouts and branded appliances. Additionally, higher spending capacity enables multi-appliance ownership, increasing average selling prices and overall market value, while manufacturers benefit from margins on premium and smart appliance offerings.

- For instance, Philips Domestic Appliances manufactures induction cooktops rated at 2,100 W with feather-touch or sensor-touch controls and various preset cooking programs (typically 6, 8, or 11 specific menus for dishes like Roti/Dosa, Gravy, Deep Fry, etc.), which are widely available in emerging urban markets like India.

Technological Advancements and Energy Efficiency Regulations

Technological innovation and stricter energy efficiency regulations significantly propel the household cooking appliances market. Manufacturers are integrating features such as precise temperature control, sensor-based cooking, inverter technology, and IoT connectivity to enhance performance and convenience. At the same time, governments are enforcing energy efficiency standards and emissions regulations, encouraging the adoption of induction cooktops and electric appliances over traditional gas-based systems. These advancements reduce energy consumption and improve cooking safety, aligning with sustainability goals. Continuous product innovation not only drives replacement cycles but also differentiates brands in a competitive landscape, supporting long-term market expansion.

Key Trend & Opportunity

Smart and Connected Kitchen Appliances

Smart and connected cooking appliances represent a major growth opportunity, driven by increasing adoption of smart home ecosystems. Consumers are increasingly seeking appliances that offer app-based controls, voice assistant compatibility, remote monitoring, and automated cooking programs. These features enhance convenience, precision, and time efficiency, particularly for working professionals and urban households. Manufacturers are leveraging connectivity to offer personalized cooking experiences, predictive maintenance alerts, and software updates, strengthening customer engagement and brand loyalty. As internet penetration and smart device usage expand globally, smart cooking appliances are expected to transition from a premium offering to a mainstream requirement.

- For instance, Haier (GE Appliances) offers Advantium speed ovens combining halogen, convection, and microwave heating with total power output exceeding 2,400 W.

Growth of E-Commerce and Omnichannel Retailing

The expansion of e-commerce and omnichannel retail strategies is transforming the distribution landscape for household cooking appliances. Online platforms provide consumers with extensive product information, price comparisons, customer reviews, and doorstep delivery, improving purchase confidence. Manufacturers and retailers are investing in direct-to-consumer channels, digital marketing, and virtual product demonstrations to enhance reach and reduce dependency on intermediaries. Integration of online and offline channels, such as click-and-collect and in-store pickup, further improves customer experience. This trend presents strong opportunities for market penetration in semi-urban and rural regions with limited physical retail infrastructure.

- For instance,” Hitachi offers online information about its induction cooktops and high-end microwave ovens, which feature comprehensive digital user manuals and inverter technology. Certain advanced inverter-powered microwave models deliver high-power cooking performance with a maximum microwave output of 1,000 W and a grill output of up to 1,300 W for rapid and varied cooking methods.”

Demand for Compact and Multifunctional Appliances

Growing demand for compact and multifunctional cooking appliances is creating new opportunities, particularly in urban markets with limited kitchen space. Consumers prefer appliances that combine multiple cooking functions, such as convection microwave ovens and multi-cookers, to optimize space and utility. This trend aligns with rising apartment living, rental housing, and minimalist kitchen designs. Manufacturers are responding with modular, built-in, and portable solutions tailored to smaller households and urban lifestyles. Multifunctionality also supports cost efficiency for consumers, making these products attractive across both mid-range and premium segments.

Key Challenge

High Price Sensitivity in Emerging Markets

High price sensitivity remains a significant challenge in the household cooking appliances market, particularly in emerging economies. A large portion of consumers prioritizes affordability over advanced features, limiting adoption of premium and smart appliances. Fluctuations in raw material prices, logistics costs, and import duties further pressure product pricing and margins. Manufacturers must balance cost optimization with quality and regulatory compliance, which can constrain innovation and profitability. Intense competition from local and unorganized players offering low-cost alternatives exacerbates pricing pressure, making market expansion challenging without localized manufacturing and value-engineered product strategies.

Supply Chain Disruptions and Regulatory Compliance

Supply chain disruptions and evolving regulatory requirements pose ongoing challenges for market participants. Dependence on global component suppliers exposes manufacturers to risks related to geopolitical tensions, trade restrictions, and transportation delays. Additionally, compliance with varying safety, energy efficiency, and environmental regulations across regions increases operational complexity and costs. Frequent updates to standards require continuous product redesign and certification, extending time-to-market. These factors collectively impact production planning, inventory management, and profitability, compelling companies to invest in supply chain diversification, regional manufacturing, and regulatory expertise to maintain competitiveness.

Regional Analysis

Asia Pacific

Asia Pacific dominates the household cooking appliances market, accounting for approximately 38% of global revenue. Strong population growth, rapid urbanization, and expanding middle-class households drive sustained demand for essential and advanced cooking appliances. Countries such as China, India, and Southeast Asian nations exhibit high penetration of cooktops, rice cookers, and microwaves due to changing dietary habits and rising disposable income. Growth is further supported by large-scale residential construction, electrification initiatives, and increasing adoption of energy-efficient and induction-based appliances. Local manufacturing presence and competitive pricing also contribute to the region’s leadership position.

North America

North America holds around 24% of the household cooking appliances market, driven by high appliance replacement rates and strong demand for premium and smart kitchen solutions. Consumers in the U.S. and Canada prioritize technologically advanced ovens, induction cooktops, and multifunctional appliances that offer convenience and energy efficiency. Smart home integration and sustainability-focused purchasing decisions further support market growth. The region benefits from high consumer spending power, established retail infrastructure, and strong brand presence. Regulatory emphasis on energy efficiency and safety standards also accelerates adoption of advanced electric and connected cooking appliances.

Europe

Europe accounts for approximately 21% of the global household cooking appliances market, supported by demand for energy-efficient and environmentally compliant products. Countries such as Germany, the U.K., France, and Italy lead regional consumption, driven by replacement demand and kitchen modernization trends. Induction cooktops and built-in ovens are widely adopted due to stringent EU energy regulations and sustainability awareness. Compact and multifunctional appliances gain traction in urban households with limited living space. Strong emphasis on design, quality, and durability, combined with a mature retail landscape, sustains steady market growth across Western and Northern Europe.

Latin America

Latin America represents about 9% of the household cooking appliances market, with growth driven by improving economic conditions and expanding urban populations. Brazil and Mexico are key contributors, supported by rising residential construction and increasing access to electricity. Demand remains concentrated in mid-range and mass-market appliances, particularly gas cooktops and basic ovens. While price sensitivity remains high, gradual premiumization and increased penetration of modern retail channels support market expansion. Growth in e-commerce and installment-based purchasing options is improving appliance affordability, enabling broader adoption across middle-income households.

Middle East & Africa

The Middle East & Africa region accounts for nearly 8% of the global market, supported by urban expansion, rising household formation, and infrastructure development. Gulf Cooperation Council countries drive demand for premium and built-in cooking appliances, supported by high disposable income and modern housing projects. In Africa, growth is led by basic cooking appliances, driven by electrification initiatives and improving living standards. The market benefits from increasing retail penetration and foreign brand entry, though growth remains moderated by income disparities and reliance on imported appliances in several countries.

Market Segmentations:

By Type

- Microwaves

- Ovens

- Cooktops

- Rice Cookers

- Others

By Application

- Online Sales

- Offline Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The household cooking appliances market features a highly competitive landscape characterized by the presence of global conglomerates, regional manufacturers, and specialized appliance brands competing across price tiers and technologies. Leading players focus on product innovation, energy-efficient designs, and smart appliance integration to strengthen market positioning. Companies increasingly invest in induction technology, multifunctional appliances, and connected features to address evolving consumer preferences. Strategic initiatives such as product launches, geographic expansion, partnerships with real estate developers, and localization of manufacturing remain central to competitive differentiation. Established brands benefit from strong distribution networks and after-sales service capabilities, while regional players compete through cost-effective offerings and market-specific customization. Intense competition continues to drive price optimization, portfolio diversification, and continuous upgrades in safety, sustainability, and digital functionality, shaping long-term competitive dynamics in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch

- Samsung

- Whirlpool

- Haier (GE Appliances)

- AB Electrolux

- LG

- Miele Group

- Hitachi

- Philips

- Morphy Richards

Recent Developments

- In August 2025, GE Appliances (a Haier company) announced a historic $3 billion investment to expand U.S. manufacturing infrastructure across multiple plants, including those producing ranges, cooktops, and built-in ovens; this expansion will modernize production lines in Georgia and Tennessee to increase output of gas and induction cooking products.

- In February 2025, Whirlpool Corporation showcased its latest kitchen innovations at the Kitchen & Bath Industry Show (KBIS 2025), unveiling a 30-inch Smart Electric Range with Air Cooking Technology and a 5.3 cu. ft. cooking cavity, alongside connected appliances designed to simplify cooking with intuitive controls and WipeClean™ surfaces in suite configurations.

- In January 2025, LG Electronics showcased next-generation smart cooking appliances at CES 2025, highlighting ovens and microwaves integrated with LG ThinQ connectivity. The updated lineup supports AI-assisted cooking recommendations and remote monitoring, while premium induction cooktops demonstrated boost power levels exceeding 3,700 W for rapid heating.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for household cooking appliances will continue to grow steadily, supported by urbanization and rising household formation worldwide.

- Energy-efficient and induction-based cooking appliances will gain wider adoption due to regulatory pressure and sustainability awareness.

- Smart and connected cooking appliances will transition from premium offerings to mainstream products across urban households.

- Manufacturers will increasingly focus on multifunctional and space-saving designs to address smaller kitchen layouts.

- Replacement demand will remain strong as consumers upgrade from conventional to technologically advanced appliances.

- Offline retail will retain importance, while online channels will expand rapidly through omnichannel strategies.

- Product customization and modular kitchen compatibility will become key differentiators for leading brands.

- Emerging markets will drive volume growth due to rising disposable income and electrification initiatives.

- Competitive intensity will increase as regional players expand portfolios and global brands localize production.

- Continuous innovation in safety, automation, and user convenience will shape long-term market evolution.