Market Overview

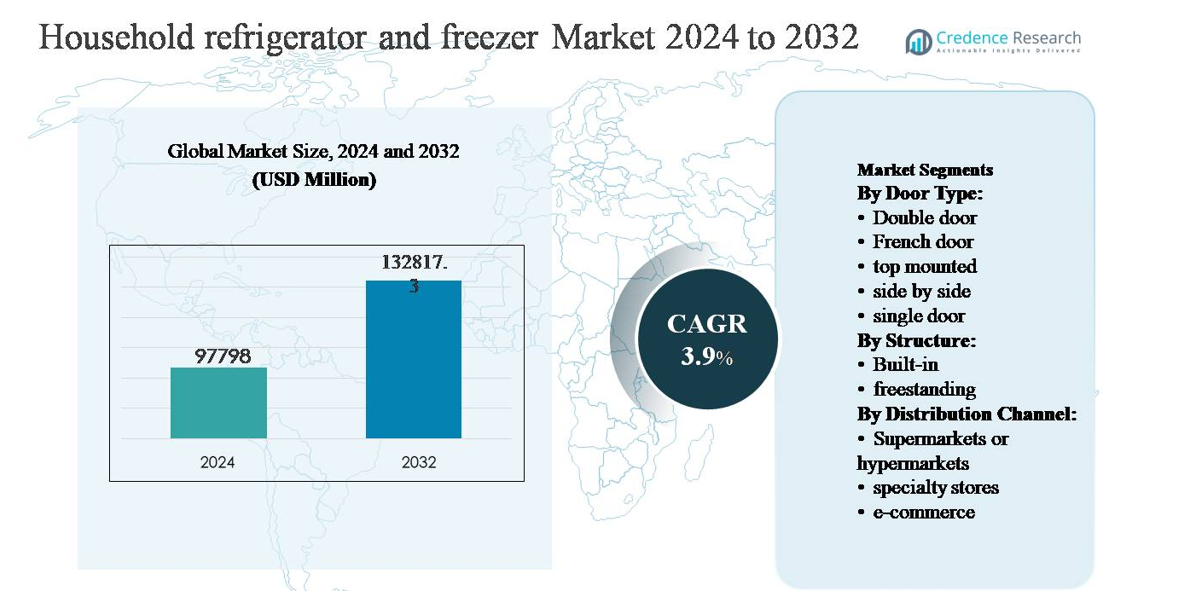

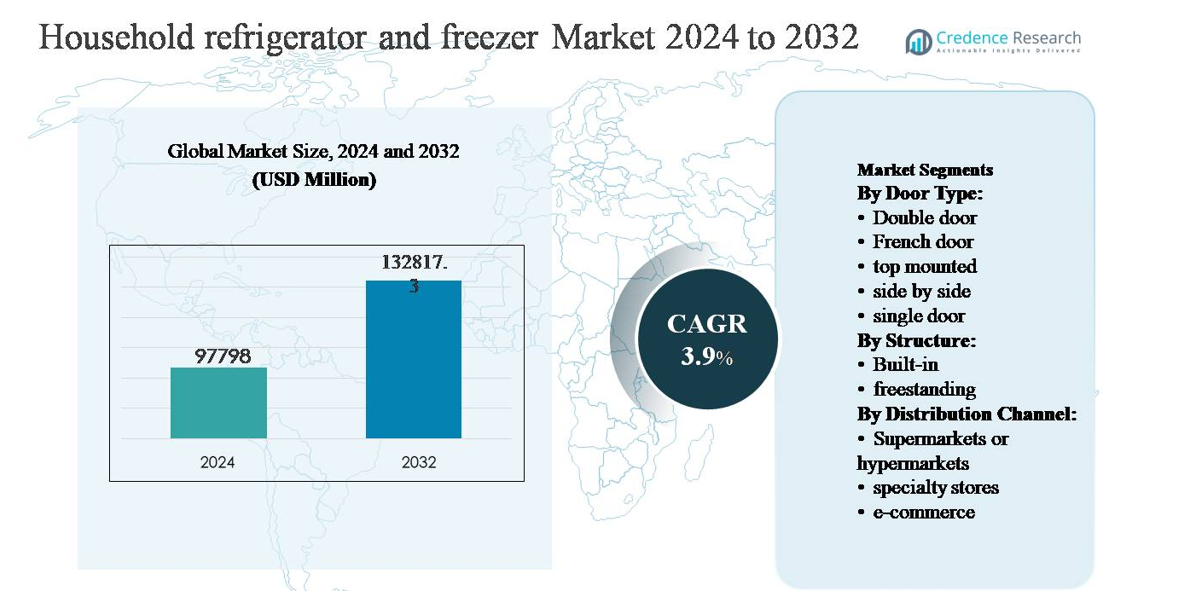

The household refrigerator and freezer market was valued at USD 97,798 million in 2024 and is projected to reach USD 132,817.3 million by 2032, expanding at a compound annual growth rate (CAGR) of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Household Refrigerator and Freezer Market Size 2024 |

USD 97,798 million |

| Household Refrigerator and Freezer Market, CAGR |

3.9% |

| Household Refrigerator and Freezer Market Size 2032 |

USD 132,817.3 million |

The household refrigerator and freezer market is led by a group of globally established manufacturers that compete through technology leadership, scale, and strong brand equity. Key players such as Samsung, Whirlpool Corporation, LG Electronics, AB Electrolux, Robert Bosch GmbH, Liebherr Group, Godrej Industries Ltd., Philips Electronics, Dacor, Inc., and Dover Corporation focus on energy-efficient designs, smart connectivity, and diversified capacity offerings to address varied consumer needs. These companies leverage extensive distribution networks, localized manufacturing, and continuous product innovation to maintain competitiveness. Asia Pacific is the leading region, accounting for approximately 38% of the global market, driven by rapid urbanization, rising household formation, and strong demand from China and India. North America and Europe follow, supported by replacement demand and premium appliance adoption.

Market Insights

- The household refrigerator and freezer market was valued at USD 97,798 million in 2024 and is projected to reach USD 132,817.3 million by 2032, growing at a CAGR of 3.9% during the forecast period, supported by steady replacement demand and expanding household penetration across emerging economies.

- Market growth is primarily driven by rising urbanization, increasing household formation, and growing preference for energy-efficient and frost-free appliances, with double-door refrigerators holding the dominant door-type share at ~36% due to their balance of capacity, price, and efficiency.

- Key market trends include premiumization toward French door and side-by-side models, rapid adoption of inverter compressors, and strong growth of e-commerce channels, while freestanding units dominate the structure segment with ~82% share owing to installation flexibility and affordability.

- The competitive landscape is marked by intense rivalry among global brands focusing on smart features, design differentiation, and localized manufacturing, while price sensitivity and regulatory compliance continue to restrain margin expansion in mass-market segments.

- Regionally, Asia Pacific leads with ~38% market share, driven by China and India, followed by North America (~24%) and Europe (~22%), while Latin America (~9%) and Middle East & Africa (~7%) show steady growth supported by urban development and electrification.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Door Type:

The household refrigerator and freezer market by door type is led by double-door refrigerators, which account for approximately 36% of global market share. Their dominance is driven by an optimal balance between storage capacity, affordability, and energy efficiency, making them suitable for middle-income households and urban apartments. Double-door models also benefit from widespread availability across brands and compatibility with inverter compressors and frost-free technology. French door and side-by-side units continue to gain traction in premium segments, while single-door and top-mounted refrigerators remain relevant in price-sensitive and space-constrained markets.

- For instance, Whirlpool’s French door models offer up to 570 liters of storage capacity with adaptive cooling sensors, while single-door and top-mounted units continue to serve space-constrained homes through compact designs below 200 liters.

By Structure:

By structure, freestanding refrigerators and freezers dominate the market with around 82% share, supported by lower upfront costs, ease of installation, and broad model availability across capacity ranges. Freestanding units appeal strongly to both emerging and developed markets, as they offer flexibility for renters and homeowners alike. Continuous product innovation such as energy-efficient compressors, smart connectivity, and modular shelving further strengthens adoption. Built-in refrigerators, while growing steadily, remain concentrated in premium residential projects due to higher costs, customization requirements, and dependence on modular kitchen infrastructure.

- For instance, Liebherr Group produces fully integrated built-in units with installation depths of 550-560 mm and BioFresh compartments that maintain temperatures close to 0 °C, catering to high-end modular kitchen projects requiring precise customization.

By Distribution Channel:

In terms of distribution, specialty stores lead with approximately 44% market share, driven by personalized sales assistance, product demonstrations, financing options, and after-sales service support. Consumers prefer specialty retailers for high-value appliances where brand comparison and technical guidance influence purchase decisions. Supermarkets and hypermarkets maintain steady demand for entry-level models through promotional pricing, while e-commerce is the fastest-growing channel. Online platforms benefit from expanding digital penetration, doorstep delivery, easy comparisons, and growing consumer confidence in purchasing large appliances through digital retail ecosystems.

Key Growth Drivers

Rising Urbanization and Household Formation

Rapid urbanization and sustained growth in household formation continue to drive demand for household refrigerators and freezers worldwide. Expanding urban populations, particularly in Asia Pacific, the Middle East, and parts of Latin America, are increasing the number of nuclear families and rental households that require essential cooling appliances. Urban lifestyles also favor compact, frost-free, and multi-door refrigerators that optimize space while offering higher storage efficiency. Additionally, rising disposable incomes in emerging economies enable consumers to upgrade from basic single-door models to double-door and side-by-side units. Government-led housing projects and steady residential construction further support first-time purchases, reinforcing refrigerators and freezers as indispensable household appliances with stable replacement demand.

- “For instance, Samsung manufactures various refrigerators, some with a width of approximately 555-600 mm and capacities around 236-256 liters, that fit common kitchen standards and offer full frost-free functionality.”

Growing Demand for Energy-Efficient and Smart Appliances

Increasing awareness of energy consumption and stricter efficiency regulations are accelerating adoption of energy-efficient refrigerators and freezers. Consumers increasingly prefer inverter-based compressors, high star-rated appliances, and eco-friendly refrigerants to reduce electricity costs and environmental impact. Manufacturers respond by launching models with lower power consumption, adaptive cooling, and smart sensors that optimize performance based on usage patterns. The integration of IoT-enabled features such as temperature control via mobile apps, diagnostics, and maintenance alerts further enhances product appeal. These advancements not only support regulatory compliance but also position energy-efficient refrigerators as long-term cost-saving investments, strengthening purchase intent across both developed and emerging markets.

- For instance, AB Electrolux has introduced refrigerators using Cooling 360° technology, which circulates cold air through multiple air channels to reduce temperature fluctuations and improve cooling uniformity, while employing R600a refrigerant with a global warming potential below 5.

Expansion of Organized Retail and Appliance Financing

The expansion of organized retail formats and improved access to consumer financing significantly contribute to market growth. Specialty appliance stores, large-format retailers, and omnichannel platforms enhance product visibility and consumer education, enabling informed purchasing decisions. Attractive financing schemes, including zero-interest EMIs, buy-now-pay-later options, and exchange offers, lower affordability barriers for mid- and premium-segment refrigerators. In emerging economies, retailer-led promotions and seasonal discounting play a crucial role in stimulating volume sales. These factors collectively accelerate penetration of higher-capacity and feature-rich refrigerators and freezers, supporting steady revenue growth across manufacturers and distribution partners.

Key Trends & Opportunities

Premiumization and Multi-Door Refrigerator Adoption

A clear trend toward premiumization is reshaping the household refrigerator and freezer market, particularly in urban and high-income consumer segments. Demand is rising for French door, side-by-side, and four-door refrigerators that offer larger capacity, improved organization, and advanced cooling technologies. Features such as convertible compartments, metal cooling, and humidity-controlled crisper zones enhance food preservation and convenience. Premium models also emphasize aesthetics, with sleek finishes and built-in designs aligning with modern kitchen interiors. This shift creates strong opportunities for manufacturers to increase average selling prices, expand margins, and differentiate through design-led innovation and feature bundling.

- For instance, LG Electronics integrates Linear Cooling™ technology, maintaining temperature fluctuation within ±0.5 °C, and offers premium French-door models with storage capacities exceeding 600 liters.

Rapid Growth of E-Commerce and Omnichannel Sales

E-commerce is emerging as a high-growth opportunity, driven by increasing digital adoption and improved logistics for large appliances. Online platforms enable consumers to compare specifications, prices, and reviews easily, while offering doorstep delivery, installation services, and flexible return policies. Manufacturers are increasingly adopting omnichannel strategies, integrating online and offline touchpoints to enhance customer engagement. Exclusive online launches, digital promotions, and direct-to-consumer models provide additional revenue channels. As consumer confidence in online appliance purchases strengthens, e-commerce is expected to play a pivotal role in expanding market reach, particularly in tier-II and tier-III cities.

- For instance, Godrej Appliances enables online buyers to select voltage-stabilizer-free refrigerators designed to operate between 130-290 V, reducing installation add-ons.

Key Challenges

High Price Sensitivity and Intense Competition

Price sensitivity remains a key challenge, especially in developing markets where consumers prioritize affordability over advanced features. Intense competition among global and regional manufacturers exerts pressure on pricing and margins, particularly in the mass-market single-door and double-door segments. Frequent promotional discounts, exchange offers, and retailer incentives further compress profitability. Smaller players struggle to sustain margins amid rising input costs, while established brands must continuously balance feature enhancements with cost optimization. This competitive environment makes differentiation difficult and increases reliance on scale, supply chain efficiency, and brand strength to maintain market share.

Supply Chain Volatility and Regulatory Compliance Pressure

Supply chain disruptions and evolving regulatory requirements pose ongoing challenges for refrigerator and freezer manufacturers. Fluctuations in raw material prices, semiconductor shortages, and logistics constraints impact production planning and cost structures. At the same time, tightening energy efficiency standards and environmental regulations particularly related to refrigerants and carbon emissions require continuous investment in R&D and product redesign. Compliance increases operational complexity and time-to-market pressures, especially for manufacturers operating across multiple regions. Smaller firms face difficulties absorbing these costs, while larger players must strategically align innovation investments with regulatory timelines to remain competitive.

Regional Analysis

North America

North America accounts for approximately 24% of the global household refrigerator and freezer market, supported by high appliance penetration and consistent replacement demand. Consumers show strong preference for energy-efficient, large-capacity, and smart refrigerators, particularly French door and side-by-side models. Stringent energy-efficiency standards in the U.S. and Canada continue to drive adoption of inverter compressors and environmentally friendly refrigerants. Premiumization trends, smart home integration, and design-focused kitchen renovations further support value growth. Specialty stores and omnichannel retail dominate distribution, while e-commerce continues to gain traction for replacement purchases.

Europe

Europe represents nearly 22% of the global market, driven by strong regulatory emphasis on sustainability and energy efficiency. Consumers favor compact, built-in, and high-efficiency refrigerators aligned with smaller living spaces and modern kitchen designs. Western European countries such as Germany, France, the U.K., and Italy lead demand, largely supported by replacement cycles rather than first-time purchases. EU energy labeling regulations encourage continuous innovation in low-consumption and recyclable-material appliances. Specialty retailers remain influential, while online sales steadily expand, particularly for mid-range and premium refrigerator models.

Asia Pacific

Asia Pacific dominates the household refrigerator and freezer market with an estimated 38% share, driven by rapid urbanization, population growth, and rising disposable incomes. China and India serve as the primary growth engines, supported by increasing electrification and expanding middle-class households. Demand is strongest for double-door and top-mounted refrigerators that balance affordability, capacity, and energy efficiency. Government housing initiatives and residential construction further stimulate first-time purchases. Additionally, the rapid expansion of organized retail and e-commerce platforms significantly enhances product accessibility across urban and semi-urban markets.

Latin America

Latin America holds approximately 9% of the global household refrigerator and freezer market, supported by improving economic stability and gradual urban expansion. Brazil and Mexico dominate regional demand, driven by replacement sales and growing adoption of frost-free and energy-efficient models. Price sensitivity remains a key factor, favoring single-door and affordable double-door refrigerators in the mass segment. Manufacturers emphasize cost-effective designs and localized production to maintain competitiveness. Expansion of modern retail formats and consumer financing options continues to improve appliance penetration across urban and semi-urban regions.

Middle East & Africa

The Middle East & Africa region accounts for around 7% of the global market and shows steady long-term growth potential. GCC countries lead regional demand due to higher purchasing power, urban development, and preference for large-capacity refrigerators suitable for extended households. In Africa, growth is driven by rising electrification rates and increasing adoption of entry-level models. Extreme climatic conditions elevate the need for reliable cooling performance. Although affordability constraints persist, improving retail infrastructure and economic development support gradual market expansion.

Market Segmentations:

By Door Type:

- Double door

- French door

- top mounted

- side by side

- single door

By Structure:

By Distribution Channel:

- Supermarkets or hypermarkets

- specialty stores

- e-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the household refrigerator and freezer market is characterized by the presence of globally established appliance manufacturers competing through scale, technology innovation, and extensive distribution networks. Leading players such as Samsung Electronics, LG Electronics, Whirlpool Corporation, Haier Group, Electrolux AB, BSH Hausgeräte, Panasonic Corporation, Siemens AG, Miele & Cie. KG, and General Electric focus on expanding energy-efficient and smart refrigerator portfolios to strengthen market positioning. Product differentiation centers on inverter compressors, smart connectivity, multi-door configurations, and premium design aesthetics. Companies actively invest in R&D to comply with evolving energy regulations and environmental standards while improving cooling performance and durability. Strategic partnerships with retailers, expansion of localized manufacturing, and aggressive promotional strategies further enhance competitiveness. Additionally, firms leverage omnichannel sales models and after-sales service capabilities to retain customers and sustain long-term brand loyalty in both mature and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung

- Whirlpool Corporation

- LG Electronics

- AB Electrolux

- Robert Bosch GmbH

- Liebherr Group

- Godrej Industries Ltd.

- Philips Electronics

- Dacor, Inc.

- Dover Corporation

Recent Developments

- In July 2025, Godrej & Boyce promoted new premium AI-powered appliance technologies. The company showcased AI-driven refrigerators with adaptive energy and cooling profiles tailored for local consumer preferences, reinforcing product intelligence and efficiency across its household lineup.

- In May 2025, Godrej & Boyce launched its AI-powered Eon Velvet side-by-side refrigerators with a 600-litre capacity that automatically adjusts cooling and energy usage based on internal load and door-opening patterns, featuring Eco, Holiday, and Super Freeze modes for optimized performance.

- In December 2024, Samsung Electronics announced the expansion of its refrigerator lineup featuring AI Hybrid Cooling technology, unveiled at CES 2025. This system leverages artificial intelligence to optimize cooling performance by analyzing usage patterns and ambient conditions, enhancing temperature stability and reducing energy waste through dynamic airflow management.

Report Coverage

The research report offers an in-depth analysis based on Door type, Structure, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will continue to rise steadily, supported by ongoing urbanization, household formation, and replacement of aging appliances across both developed and emerging markets.

- Energy-efficient and inverter-based refrigerators will gain wider adoption as consumers seek lower electricity consumption and compliance with tightening efficiency regulations.

- Smart and connected refrigerators will see increased penetration, driven by growing smart home ecosystems and consumer preference for convenience and remote monitoring features.

- Premium and multi-door configurations, including French door and side-by-side models, will expand faster than entry-level segments, particularly in urban households.

- Freestanding refrigerators will remain dominant due to flexibility and affordability, while built-in models will grow in premium residential and modular kitchen projects.

- E-commerce and omnichannel retail will play an increasingly important role in sales, supported by improved logistics, installation services, and financing options.

- Manufacturers will focus on product differentiation through design, capacity optimization, and advanced cooling technologies to strengthen brand positioning.

- Use of environmentally friendly refrigerants and sustainable materials will accelerate in response to regulatory and consumer sustainability expectations.

- Price competition will remain intense in mass-market segments, driving greater emphasis on cost optimization and localized manufacturing.

- Emerging markets will continue to act as key growth engines, supported by rising electrification, expanding retail infrastructure, and improving consumer purchasing power.