Market Overview:

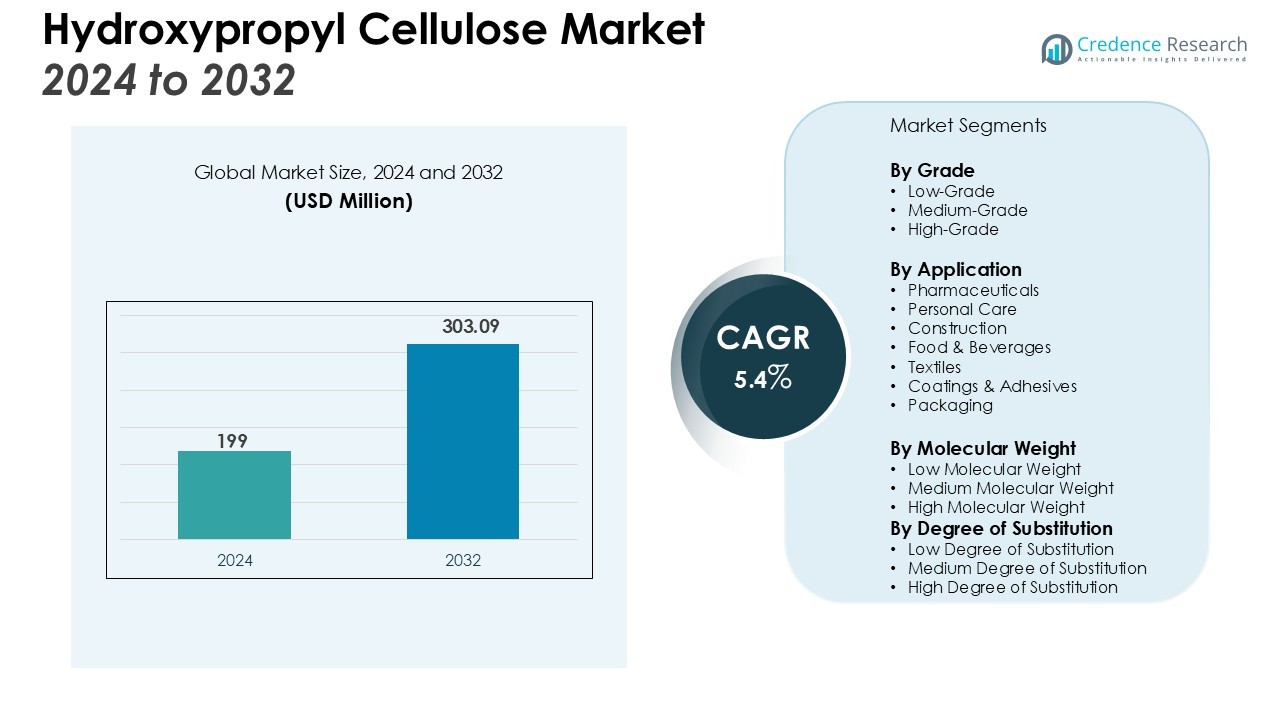

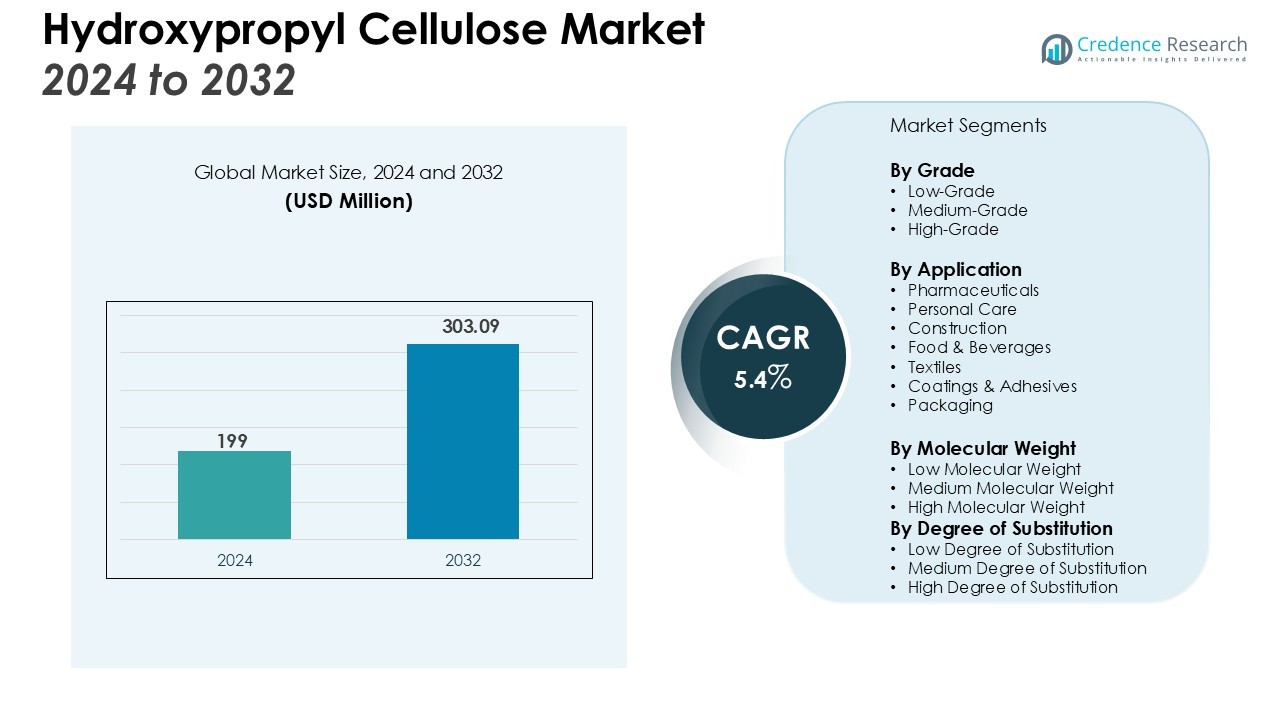

The Hydroxypropyl Cellulose Market size was valued at USD 199 million in 2024 and is anticipated to reach USD 303.09 million by 2032, at a CAGR of 5.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydroxypropyl Cellulose Market Size 2024 |

USD 199 Million |

| Hydroxypropyl Cellulose Market, CAGR |

5.4% |

| Hydroxypropyl Cellulose Market Size 2032 |

USD 303.09 Million |

Key drivers fueling the market include the rising demand for functional polymers in pharmaceuticals and personal care, driven by increasing health awareness and consumer preference for high-quality products. The versatility of HPC, particularly in applications like water retention in construction materials and as a binder in tablet formulations, makes it a vital additive in various industries. Additionally, the growing emphasis on sustainable and eco-friendly products further accelerates HPC’s adoption, especially in biodegradable formulations and packaging. Furthermore, innovations in HPC technology, such as enhanced water solubility and improved processability, are expanding its range of applications.

Geographically, Asia-Pacific holds the largest market share, with China and India leading in both production and consumption due to their large pharmaceutical and cosmetic industries. North America and Europe follow, driven by stringent regulatory standards and high demand for HPC in drug delivery systems. The market in these regions is expected to witness steady growth, supported by advancements in HPC technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Hydroxypropyl Cellulose (HPC) market size was valued at USD 199 million in 2024 and is expected to reach USD 303.09 million by 2032, driven by increasing demand across multiple industries.

- The market is projected to grow at a CAGR of 5.4% between 2024 and 2032, fueled by innovations in HPC technology and its expanding range of applications.

- Rising demand for functional polymers in pharmaceuticals and personal care is a major driver, particularly in drug delivery systems and cosmetics formulations.

- HPC’s role as a binder in tablet formulations and a thickening agent in personal care products increases its adoption across key industries.

- The market benefits from the growing emphasis on sustainable and eco-friendly products, with HPC being biodegradable and derived from renewable sources.

- Asia-Pacific leads the market with a 40% share, driven by high demand from China and India’s pharmaceutical and personal care industries.

- North America and Europe follow with strong growth, supported by stringent regulatory standards and consistent demand for HPC in drug delivery and personal care applications.

Market Drivers:

Rising Demand for Functional Polymers in Pharmaceuticals

The growing demand for functional polymers in pharmaceuticals significantly drives the Hydroxypropyl Cellulose (HPC) market. HPC is widely used in controlled drug delivery systems, improving the stability and release profiles of active ingredients. Its role as a binder and disintegrant in tablet formulations enhances the efficacy of pharmaceutical products, aligning with the increasing consumer preference for high-quality and effective medications. The continuous expansion of the pharmaceutical industry, particularly in emerging markets, further boosts the demand for HPC.

- For instance, Ashland provides its Klucel™ HPC G grade, which has an average molecular weight of 370,000, making it highly effective as a binder in tablet formulations.

Growth of Personal Care and Cosmetics Industry

The expanding personal care and cosmetics industry plays a crucial role in the growth of the Hydroxypropyl Cellulose market. HPC acts as a thickening agent, emulsifier, and stabilizer in various cosmetic formulations, including lotions, creams, and hair care products. As consumer demand for premium and multifunctional personal care products increases, HPC’s versatility in these applications provides significant value. Its ability to improve product texture and performance enhances the appeal of formulations, contributing to its increased adoption across the industry.

- For instance, the Klucel™ M grade of HPC can achieve a viscosity of up to 6,500 centipoise (cP), which helps create rich, desirable textures in cosmetic creams and lotions.

Sustainability and Demand for Eco-friendly Products

The shift towards sustainability and eco-friendly solutions also drives the market for Hydroxypropyl Cellulose. Increasing awareness of environmental issues has led to a growing preference for biodegradable and non-toxic ingredients in personal care, pharmaceutical, and construction products. HPC, being biodegradable and derived from renewable sources, aligns well with these trends, further boosting its demand in sustainable product formulations. It contributes to the development of eco-friendly packaging and sustainable building materials, making it a key ingredient in green chemistry innovations.

Technological Advancements and Product Innovations

Technological advancements and innovations in Hydroxypropyl Cellulose applications fuel its market growth. Recent improvements in the material’s water solubility, processability, and performance properties have expanded its range of uses. In the construction industry, for instance, HPC’s ability to retain water enhances the quality of cement-based products. Innovations continue to open new opportunities for HPC in industries such as food processing, coatings, and textiles, positioning it as a versatile and valuable polymer across various sectors.

Market Trends:

Technological Advancements in Hydroxypropyl Cellulose Applications

One of the most notable trends in the Hydroxypropyl Cellulose (HPC) market is the continuous development of advanced technologies that enhance its performance across various applications. Innovations in water solubility and processability have expanded HPC’s use in industries such as pharmaceuticals, personal care, and construction. In pharmaceutical formulations, HPC’s enhanced properties improve drug release profiles and stability. In personal care products, advancements in HPC technology have led to the creation of formulations with better texture, spreadability, and performance. These technological improvements position HPC as a vital ingredient in new, high-performance products, fueling its market growth across multiple sectors.

- For instance, Ashland developed Klucel xtend HPC, a controlled-release matrix former capable of matching the drug release profile of other formulations using just 1 part of the polymer for every 2 parts previously required, enabling a reduction in tablet size.

Growing Demand for Eco-friendly and Biodegradable Products

The increasing focus on sustainability and eco-friendly solutions is another key trend influencing the Hydroxypropyl Cellulose market. With rising consumer awareness about environmental issues, industries are shifting towards biodegradable and non-toxic ingredients. HPC’s natural origins and biodegradability make it a favorable choice for manufacturers seeking to meet environmental standards. This trend is particularly evident in the personal care and construction industries, where eco-friendly formulations and sustainable building materials are in high demand. As more companies adopt green practices, the demand for HPC in eco-conscious product lines continues to rise, further boosting its adoption across various applications.

- For instance, in March 2025, Shin-Etsu Chemical Co., Ltd. announced a significant investment of 10 billion yen to enhance its pharmaceutical cellulose business.

Market Challenges Analysis:

Raw Material Sourcing and Supply Chain Disruptions

One of the significant challenges facing the Hydroxypropyl Cellulose (HPC) market is the volatility in the sourcing of raw materials. The primary raw material, cellulose, is derived from plant sources, making it susceptible to supply chain disruptions due to factors such as climate change and fluctuating agricultural yields. These disruptions can lead to price volatility and supply shortages, affecting the overall production cost of HPC. Manufacturers in the HPC market need to secure stable and sustainable sources of cellulose to mitigate these risks. Supply chain inefficiencies can also delay product availability, impacting market growth.

Regulatory Hurdles and Compliance Costs

Another challenge impacting the Hydroxypropyl Cellulose market is the increasingly stringent regulatory landscape. As industries like pharmaceuticals and personal care become more regulated, manufacturers face rising costs to comply with safety and environmental standards. These regulations often require extensive testing and certification processes, which can increase operational expenses and time-to-market. In addition, the constant evolution of regulatory requirements in various regions adds complexity for companies trying to navigate global markets. Companies in the HPC market must invest in staying ahead of these regulatory changes to ensure continued compliance and avoid costly penalties.

Market Opportunities:

Asia-Pacific: Dominant Market Share

Asia-Pacific holds the largest share in the Hydroxypropyl Cellulose (HPC) market, contributing 40% of global demand. China and India are major drivers, with rapid growth in the pharmaceutical, personal care, and construction industries. The region’s expanding industrial base and increasing urbanization enhance the adoption of HPC in various applications. Local manufacturing and advancements in HPC technology further support the market’s dominance. Moreover, the growing focus on sustainable and eco-friendly products aligns with the rising preference for biodegradable polymers like HPC, cementing the region’s leading position in the market.

North America: Significant Market Presence

North America accounts for 25% of the global Hydroxypropyl Cellulose market share, driven by demand in pharmaceuticals and personal care sectors. The U.S. and Canada are key contributors, with stringent regulatory frameworks that support the use of high-quality ingredients like HPC. The region’s focus on product innovation and regulatory compliance further boosts market demand. HPC’s application in drug delivery systems, cosmetics, and industrial solutions continues to expand, supported by ongoing R&D and technological advancements. North America’s well-established market infrastructure ensures steady growth and continued adoption across diverse industries.

Europe: Key Player in Product Innovation

Europe holds 20% of the global Hydroxypropyl Cellulose market share, with key contributions from Germany, France, and the U.K. The region’s strong focus on product innovation drives demand for HPC, particularly in pharmaceuticals and personal care products. Europe’s stringent environmental regulations foster the use of biodegradable polymers in eco-conscious formulations. HPC’s role in sustainable building materials and packaging also supports its growing presence in the market. As the region continues to prioritize both innovation and sustainability, demand for HPC remains robust, with future growth supported by technological advancements and regulatory standards.

Market Segmentation Analysis:

By Grade

The Hydroxypropyl Cellulose (HPC) market is segmented by grade into low, medium, and high-grade categories. High-grade HPC holds the largest share due to its widespread use in pharmaceuticals and personal care products. It offers superior properties, such as enhanced solubility and viscosity, making it ideal for controlled drug release systems and cosmetic formulations. Medium and low grades are commonly used in applications such as construction and textiles, where specific performance characteristics are not as critical but still benefit from the material’s versatility and cost-effectiveness.

By Application

The applications of Hydroxypropyl Cellulose span several industries, with the pharmaceutical and personal care sectors leading demand. In pharmaceuticals, HPC is a key ingredient in tablet formulations, drug delivery systems, and as a binder or stabilizer. In personal care, it is used in products like lotions, creams, and shampoos for its thickening and emulsifying properties. HPC also plays an essential role in construction, where it is utilized as a water retention agent in cement and other building materials. Its use in eco-friendly packaging and sustainable formulations in various industries is expanding rapidly.

- For instance, Ashland’s Klucel™ HPC is used in personal care formulations where it modifies the properties of the final product, achieving a surface tension of 43 mN/m in an aqueous solution.

By Molecular Weight

The molecular weight of Hydroxypropyl Cellulose influences its functional properties, including solubility and viscosity. Low molecular weight HPC is used in applications requiring faster dissolution, such as in food and pharmaceutical formulations. High molecular weight HPC provides enhanced film-forming and thickening properties, making it ideal for use in construction, adhesives, and coatings. The choice of molecular weight depends on the specific requirements of the end-use application, driving demand for various grades and types in the market.

- For instance, in a study using HPC from Nippon Soda, the polymer was used to create robust controlled-release tablets that achieved a breaking force of 70 N, demonstrating excellent consistency.

Segmentations:

By Grade

- Low-Grade

- Medium-Grade

- High-Grade

By Application

- Pharmaceuticals

- Personal Care

- Construction

- Food & Beverages

- Textiles

- Coatings & Adhesives

- Packaging

By Molecular Weight

- Low Molecular Weight

- Medium Molecular Weight

- High Molecular Weight

By Degree of Substitution

- Low Degree of Substitution

- Medium Degree of Substitution

- High Degree of Substitution

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Leading Region

Asia-Pacific commands 40% of the global Hydroxypropyl Cellulose (HPC) market. The region, particularly China and India, drives growth due to expanding pharmaceutical, personal care, and construction industries. Rapid industrialization and urbanization enhance the adoption of HPC, especially in the production of biodegradable and eco-friendly products. The increase in local manufacturing and technological advancements also supports market growth. As demand for sustainable solutions rises, HPC’s role in green formulations is becoming more significant in this region.

North America: Strong Market Position

North America holds a 25% share of the global Hydroxypropyl Cellulose market. The U.S. and Canada are key contributors, with high demand for HPC in pharmaceuticals, personal care, and industrial applications. Regulatory frameworks in the region promote the use of high-quality and safe ingredients like HPC. The ongoing focus on innovation and product development drives consistent market demand. Advancements in drug delivery systems, cosmetics, and other industries ensure that the region remains a key player in the HPC market.

Europe: Focus on Innovation and Sustainability

Europe holds a 20% share in the Hydroxypropyl Cellulose market, led by Germany, France, and the U.K. The region’s emphasis on product innovation, particularly in pharmaceuticals and personal care, fuels the demand for HPC. Strict environmental regulations encourage the use of biodegradable polymers in sustainable products. HPC’s integration into eco-friendly building materials and packaging further boosts its market presence. The ongoing focus on sustainability and technological advancements positions Europe as a growing market for HPC.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Clariant AG

- Nippon Shokubai Co., Ltd.

- Solvay S.A.

- Ashland

- Hercules

- Lonza Group AG

- The Dow Chemical Company

- Mitsubishi Chemical Corporation

- Huntsman International LLC

- AkzoNobel N.V.

- DowDuPont

- ShinEtsu Chemical Co., Ltd.

Competitive Analysis:

The Hydroxypropyl Cellulose (HPC) market is competitive, with major players like Ashland, Dow, Shin-Etsu Chemical, and Nippon Soda leading through their extensive manufacturing capabilities and global reach. These companies focus on expanding their product offerings and increasing their presence in emerging markets. Regional players such as Shandong Head Europe and Hangzhou Showland Technology cater to specific regional needs, offering high-purity grades for specialized applications. The market is witnessing consolidation as larger companies acquire smaller ones to enhance their product portfolios and geographic reach. To maintain a competitive edge, firms are investing in research and development, enhancing regulatory compliance, and prioritizing customer-driven innovations. This environment of intense competition drives continuous advancements in product quality and technological capabilities.

Recent Developments:

- In August 2025, Clariant announced it was advancing its plastics stabilizer technology by expanding production capacity for its Nylostab™ S-EED stabilizer.

- In June 2025, Clariant launched its innovative AddWorks PPA product line, a new generation of PFAS-free polymer processing aids designed for more sustainable polyolefin extrusion.

Report Coverage:

The research report offers an in-depth analysis based on Grade, Application, Molecular Weight, Degree of Substitution and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Hydroxypropyl Cellulose (HPC) will continue to rise as industries focus on sustainable, eco-friendly products.

- Increased adoption of HPC in pharmaceuticals will be driven by its role in controlled drug delivery systems and tablet formulations.

- The personal care sector will expand its use of HPC in various applications, including skin care and hair care products.

- HPC’s versatility in construction materials, particularly as a water retention agent, will foster growth in the building and construction sector.

- The growing trend of green chemistry and biodegradable solutions will further boost HPC adoption in packaging applications.

- Advances in HPC’s technological properties, including solubility and processability, will open new opportunities across multiple industries.

- Emerging markets, particularly in Asia-Pacific, will continue to drive demand as industrialization and urbanization increase.

- Stringent regulatory standards for pharmaceuticals and personal care products will drive the need for high-quality HPC grades.

- HPC’s use in food and beverage applications will increase as demand for functional additives and stabilizers grows.

- Research and development efforts will lead to innovations in HPC products, enhancing their efficiency and broadening their application range.