Market Overview

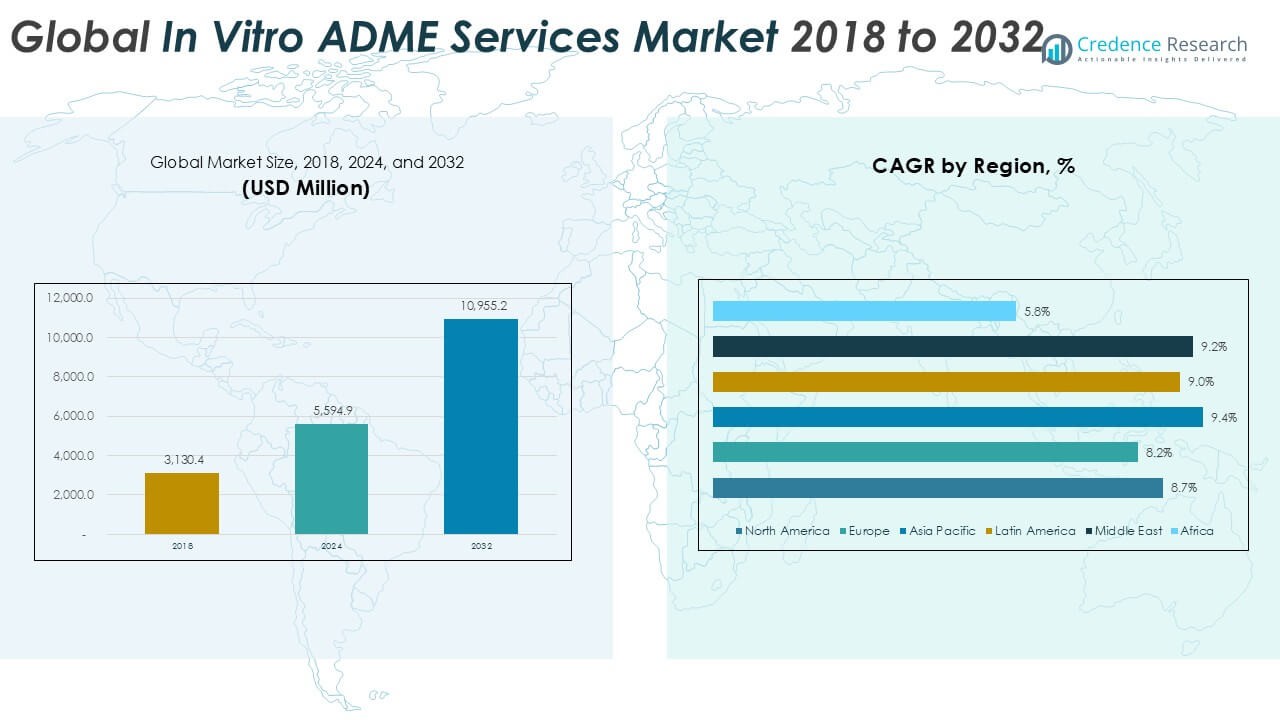

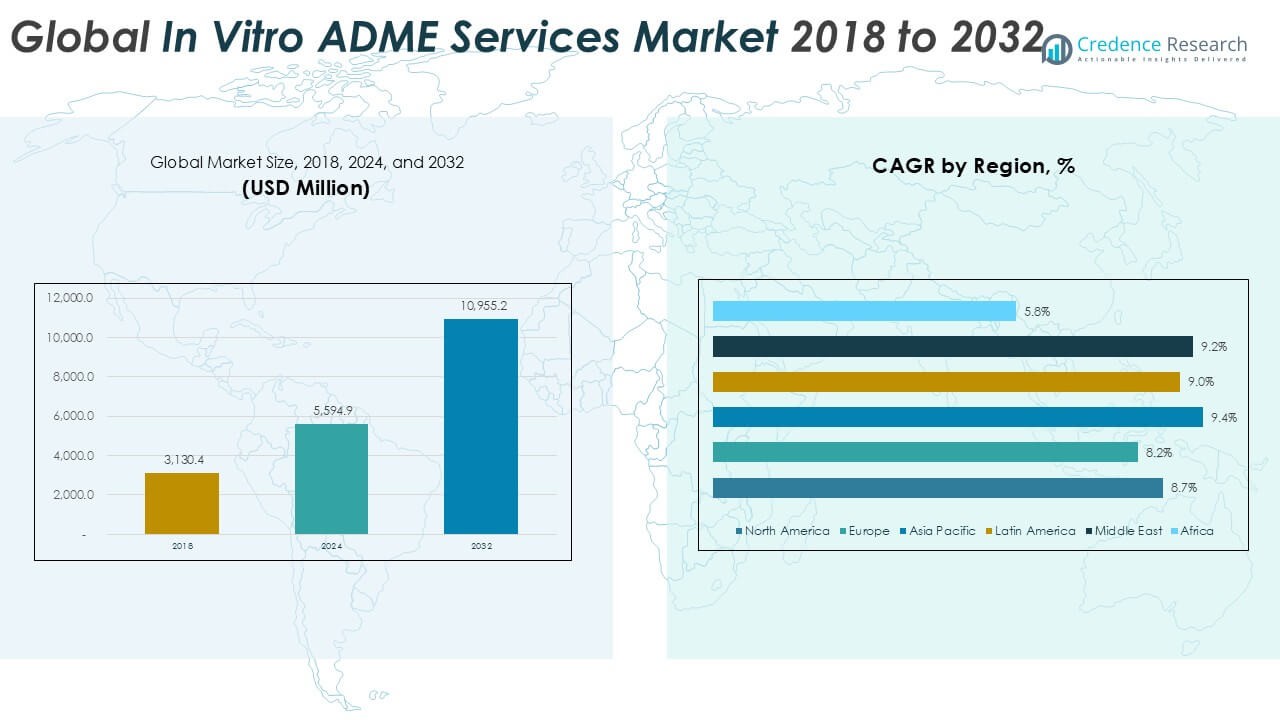

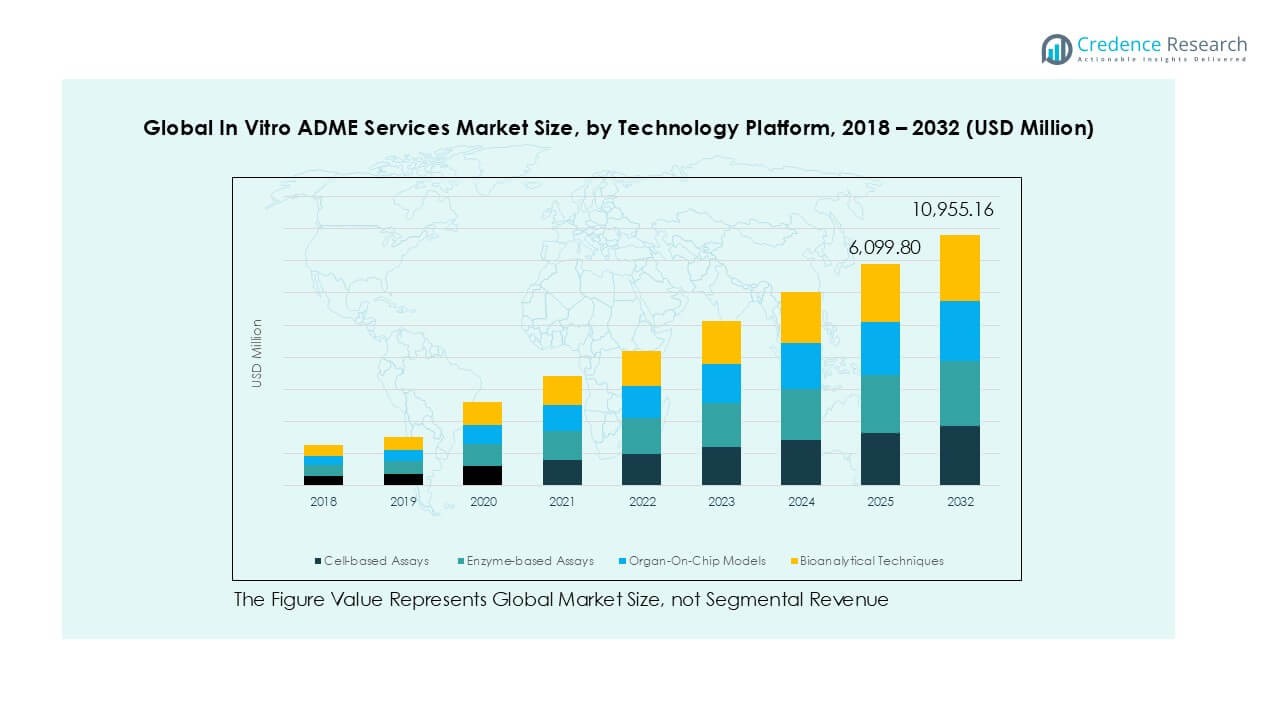

Global In Vitro ADME Services market size was valued at USD 3,130.4 million in 2018, increased to USD 5,594.9 million in 2024, and is anticipated to reach USD 10,955.2 million by 2032, growing at a CAGR of 8.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In Vitro ADME Services Market Size 2024 |

USD 5,594.9 Million |

| In Vitro ADME Services Market, CAGR |

8.72% |

| In Vitro ADME Services Market Size 2032 |

USD 10,955.2 Million |

The global in vitro ADME services market is led by key players including WuXi AppTec, Charles River Laboratories, Pharmaron, IQVIA, Frontage Laboratories, BioDuro, Aurigene Pharmaceutical Services, Sygnature Discovery, CN Bio, and Jubilant Biosys. These companies strengthen their positions through comprehensive service portfolios, advanced bioanalytical platforms, and global client networks. WuXi AppTec and Charles River maintain leadership with extensive infrastructure and integrated R&D services, while Pharmaron and IQVIA expand rapidly through strategic acquisitions and partnerships. Regionally, North America dominates with 33.1% market share in 2024, supported by strong pharmaceutical R&D and CRO presence, followed by Europe with 27.1% and Asia Pacific with 24.5%, the latter showing the fastest growth due to expanding outsourcing and drug development activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global in vitro ADME services market was valued at USD 5,594.9 million in 2024 and is projected to reach USD 10,955.2 million by 2032, growing at a CAGR of 8.72%.

- Rising demand for early-stage drug screening, expanding biologics pipelines, and increased outsourcing to CROs drive market growth, helping reduce R&D costs and improve drug success rates.

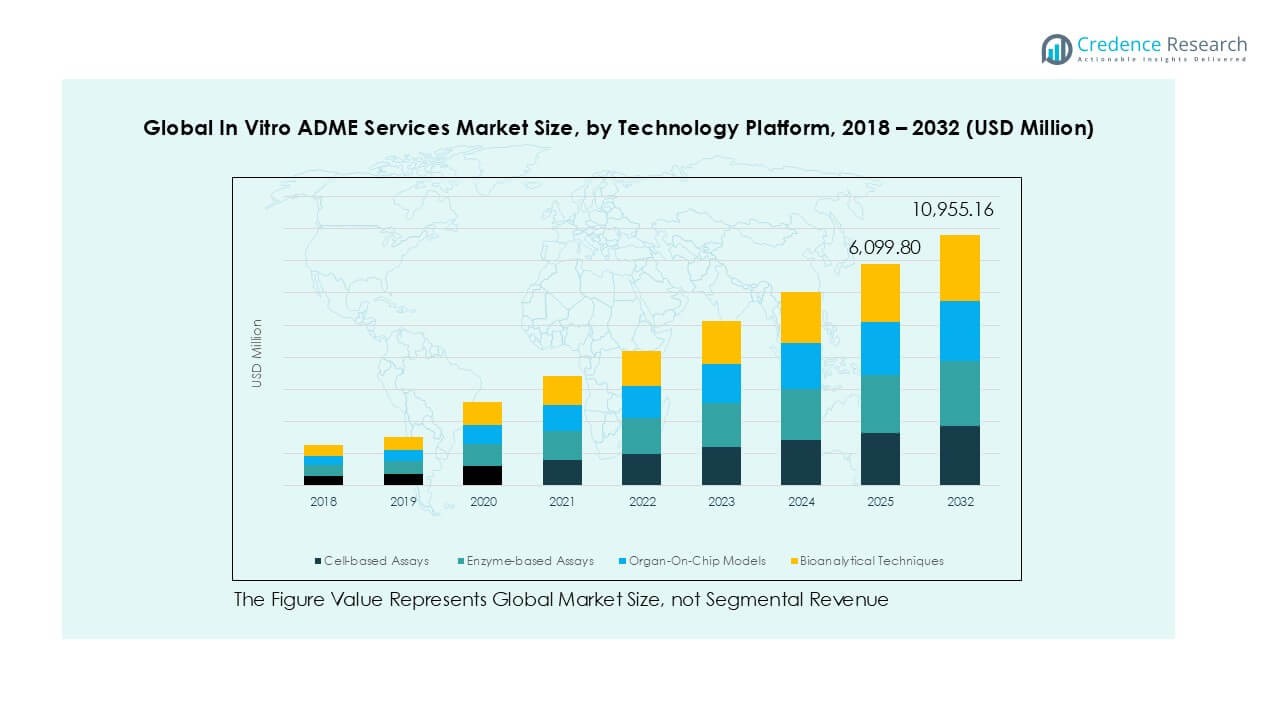

- Key trends include adoption of cell-based assays, which hold the largest segment share, and rapid growth of organ-on-chip models alongside AI-driven predictive analytics for precision medicine applications.

- The competitive landscape features major players such as WuXi AppTec, Charles River Laboratories, Pharmaron, and IQVIA, with firms focusing on partnerships, bioanalytical innovations, and global expansion to strengthen positions.

- Regionally, North America leads with 33.1% share in 2024, followed by Europe at 27.1% and Asia Pacific at 24.5%, with Asia Pacific growing fastest; Latin America, the Middle East, and Africa contribute smaller but expanding shares.

Market Segmentation Analysis:

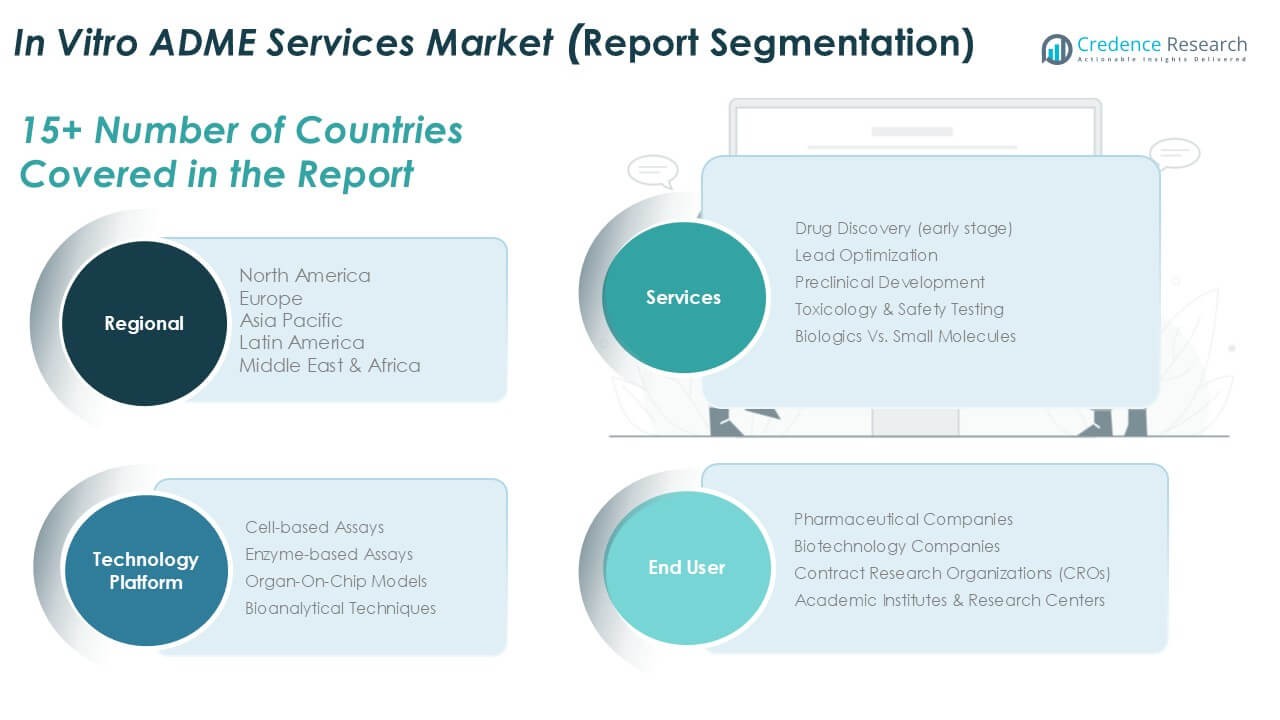

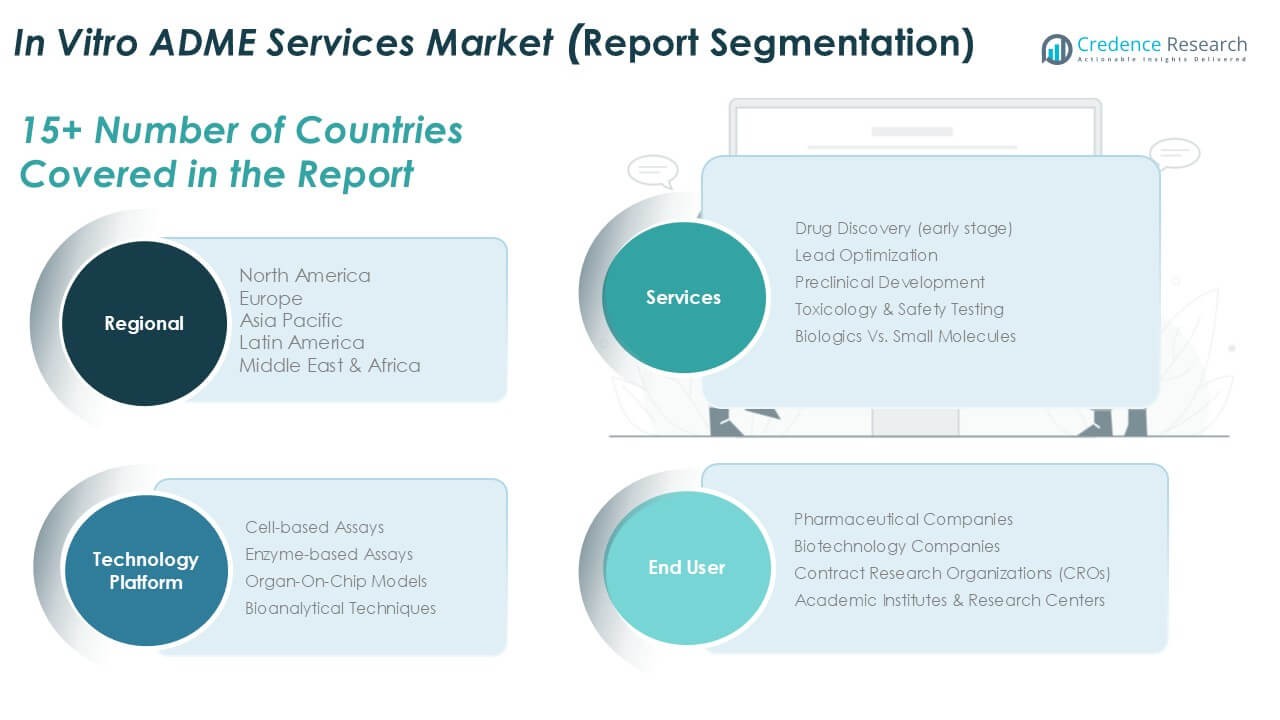

By Services

Drug discovery in the early stage represents the dominant sub-segment, accounting for the largest share of in vitro ADME services in 2024. This segment benefits from the rising demand for early pharmacokinetics screening to reduce late-stage drug failures. Pharmaceutical and biotech firms prioritize early ADME profiling to accelerate candidate selection and lower costs. Lead optimization and preclinical development follow as strong contributors, driven by complex therapeutic pipelines and growing outsourcing to specialized CROs. Toxicology and safety testing also gain momentum, reflecting stricter regulatory requirements for safety assessment.

- For instance, Charles River Laboratories conducted more than 400 early-stage ADME screening programs in 2023, supporting drug discovery partnerships with over 90 biotech and pharmaceutical firms worldwide.

By Technology Platform

Cell-based assays hold the largest revenue share within the technology platform segment due to their ability to mimic physiological conditions and generate predictive drug behavior data. They are widely adopted for permeability, efflux, and metabolism studies in both small molecules and biologics. Enzyme-based assays continue to grow steadily, supported by demand for metabolic stability and CYP450 inhibition studies. Organ-on-chip models, though emerging, show strong potential with increased investment in microfluidic technologies. Bioanalytical techniques remain crucial, complementing advanced platforms with accurate quantification of drug metabolites and interactions.

- For instance, in 2023, Emulate Inc. provided organ-on-chip systems to numerous pharmaceutical clients, enabling predictive ADME-Tox testing across multiple therapeutic pipelines.

By End User

Pharmaceutical companies dominate the end-user segment, holding the largest market share in 2024. Their leadership is driven by extensive drug pipelines, higher R&D budgets, and reliance on advanced ADME testing to reduce attrition rates. Biotechnology firms follow closely, leveraging ADME services to support niche therapies, biologics, and orphan drugs. Contract Research Organizations (CROs) see increasing demand, benefiting from outsourcing strategies that allow companies to cut operational costs and access specialized expertise. Academic institutes and research centers contribute modestly, with a focus on novel assay development and exploratory drug metabolism studies.

Key Growth Drivers

Rising Demand for Early Drug Screening

The demand for early-stage drug screening remains a major driver of the in vitro ADME services market. Pharmaceutical and biotechnology companies face mounting pressure to reduce attrition rates and R&D costs. Early pharmacokinetic and metabolic profiling using in vitro methods allows researchers to eliminate unsuitable candidates before they reach costly clinical phases. This approach improves success rates while saving time and resources. Increasing adoption of high-throughput ADME assays, coupled with integration of automation and AI-driven analytics, has made early screening more efficient and predictive. Regulatory bodies also encourage robust preclinical assessments, further fueling demand for advanced ADME platforms.

- For instance, Eurofins Scientific performed more than 500,000 in vitro ADME assays in 2023 across its global labs, helping pharmaceutical partners accelerate early screening decisions with high-throughput workflows.

Expansion of Biologics and Targeted Therapies

The global pipeline of biologics and targeted therapies has grown significantly, driving the need for specialized ADME services. Unlike traditional small molecules, biologics require advanced models to evaluate absorption, metabolism, and safety. In vitro platforms such as cell-based assays and organ-on-chip models have become vital for studying biologics in controlled settings. Rising prevalence of chronic and rare diseases boosts the development of monoclonal antibodies, gene therapies, and RNA-based drugs. This surge creates opportunities for service providers to deliver tailored ADME solutions. Companies are investing heavily in customized assays and bioanalytical technologies to address complex therapeutic modalities, expanding their service portfolios.

- For instance, in 2023, WuXi AppTec supported 64 projects for its Advanced Therapies Unit (ATU) through specialized services like ADME and bioanalytical platforms, underscoring rising demand for targeted therapy evaluations. This included support for 1 commercial project, 5 Phase III projects, 9 Phase II projects, and 49 pre-clinical and Phase I projects.

Outsourcing to Contract Research Organizations (CROs)

Growing reliance on CROs is another strong driver in the in vitro ADME services market. Pharmaceutical and biotech firms increasingly outsource ADME testing to reduce operational costs, access specialized expertise, and accelerate drug development timelines. CROs provide end-to-end services including drug discovery, lead optimization, and preclinical safety testing, enabling sponsors to focus on core R&D activities. The expansion of global CRO networks in Asia-Pacific and Eastern Europe offers cost-effective solutions and scalability. Strategic partnerships between CROs and pharma companies are also rising, providing integrated services with advanced bioanalytical capabilities. This trend ensures continuous growth of the outsourced ADME service segment.

Key Trends & Opportunities

Integration of Advanced Technology Platforms

Technological innovation is shaping the in vitro ADME services landscape, with organ-on-chip models and AI-based predictive analytics gaining traction. Organ-on-chip technologies replicate human tissue responses more accurately, reducing the reliance on animal models. AI and machine learning support the analysis of large ADME datasets, improving predictive accuracy for drug interactions and safety outcomes. This integration enhances the reliability of in vitro assays while speeding up decision-making. Service providers adopting these technologies gain a competitive edge by delivering higher-quality insights. The increasing focus on personalized medicine further accelerates adoption, creating opportunities for tailored ADME platforms.

- For instance, in 2023, CN Bio expanded its PhysioMimix organ-on-chip platform and provided systems to pharmaceutical and biotech companies, enabling predictive ADME-Tox studies using liver, lung, and gut models.

Growth of Personalized and Precision Medicine

Personalized medicine continues to reshape drug development, driving demand for more predictive ADME services. As treatments become more patient-specific, understanding drug metabolism and response variability across populations is essential. In vitro assays, including cell-based and bioanalytical platforms, play a critical role in predicting individual drug responses. Pharmaceutical firms are prioritizing pharmacogenomics-linked ADME testing to optimize dosing and minimize adverse effects. This shift aligns with regulatory encouragement for precision-based approaches. The growing pipeline of targeted therapies, particularly in oncology and rare diseases, creates opportunities for service providers to expand specialized ADME testing that supports patient-centric drug development.

Key Challenges

High Cost of Advanced Platforms

One of the key challenges for the in vitro ADME services market is the high cost of advanced technologies. Organ-on-chip models, high-throughput screening platforms, and bioanalytical tools require significant investment in infrastructure and expertise. Smaller biotechnology firms and academic institutes often struggle to afford these technologies, limiting broader adoption. The need for continuous upgrades and validation further increases operational expenses. This cost barrier can slow down innovation and restrict access to advanced ADME testing for early-stage drug developers. Addressing affordability through collaborative partnerships and shared service models remains a pressing industry need.

Regulatory Complexity and Standardization Issues

Regulatory complexity poses another challenge for the global in vitro ADME services market. While regulators encourage early ADME testing, variations in regional guidelines create compliance hurdles. Lack of standardized assay protocols and validation requirements can delay approval processes and increase costs for service providers. Moreover, integrating emerging models like organ-on-chip into regulatory frameworks remains an ongoing issue. Service providers must balance innovation with compliance, ensuring data generated aligns with expectations from agencies such as the FDA and EMA. Without harmonized global standards, achieving widespread adoption and consistency in ADME testing remains difficult.

Regional Analysis

North America

North America dominates the global in vitro ADME services market, accounting for the largest share in 2024 at 33.1%, with revenues rising from USD 1,039.62 million in 2018 to USD 1,850.62 million in 2024. The region is projected to reach USD 3,604.25 million by 2032, growing at a CAGR of 8.7%. Strong pharmaceutical R&D spending, early adoption of advanced bioanalytical technologies, and robust regulatory frameworks drive regional growth. The presence of major CROs and established pharmaceutical companies further strengthens the market. Increasing investment in biologics and precision medicine continues to sustain North America’s leadership position.

Europe

Europe held the second-largest market share in 2024 at 27.1%, with revenues increasing from USD 873.08 million in 2018 to USD 1,515.09 million in 2024. The market is expected to expand to USD 2,848.34 million by 2032, at a CAGR of 8.2%. Growth is supported by strong research infrastructure, strict regulatory requirements for safety evaluation, and demand for advanced drug screening solutions. European pharmaceutical clusters, particularly in Germany, the U.K., and Switzerland, fuel service adoption. Rising emphasis on biologics, biosimilars, and academic–industry collaborations further boosts the market, consolidating Europe as a key hub for in vitro ADME services.

Asia Pacific

Asia Pacific represents the fastest-growing regional market, capturing 24.5% share in 2024, with revenues rising from USD 737.53 million in 2018 to USD 1,371.38 million in 2024. The market is projected to reach USD 2,824.24 million by 2032, registering a CAGR of 9.4%. Rapid expansion of pharmaceutical manufacturing, increasing outsourcing to cost-efficient CROs, and growing government support for life sciences research drive regional momentum. China, India, and Japan are leading contributors, with rising biologics pipelines and demand for advanced assays. Expanding clinical trial activities and investments in precision medicine strengthen Asia Pacific’s position in the global ADME services landscape.

Latin America

Latin America accounted for 8.6% of the global market in 2024, with values increasing from USD 264.52 million in 2018 to USD 479.48 million in 2024. The region is forecasted to reach USD 956.39 million by 2032, growing at a CAGR of 9.0%. Expanding pharmaceutical markets in Brazil and Mexico, rising healthcare investments, and greater adoption of outsourcing services underpin regional growth. CRO penetration is rising, with local and global providers expanding their presence. While infrastructure challenges persist, increasing demand for cost-effective early drug screening and regulatory reforms continue to drive opportunities across the Latin American market.

Middle East

The Middle East captured 4.9% market share in 2024, with revenues climbing from USD 149.63 million in 2018 to USD 275.11 million in 2024. The market is projected to grow to USD 558.71 million by 2032, advancing at a CAGR of 9.2%. Growth is driven by rising R&D investments in Gulf countries, expanding partnerships with global CROs, and government initiatives to diversify economies through life sciences. Increasing prevalence of chronic diseases spurs demand for advanced drug testing solutions. The Middle East market remains small compared to North America and Europe but demonstrates strong potential through innovation-focused healthcare strategies.

Africa

Africa holds the smallest share of the global in vitro ADME services market at 1.8% in 2024, with revenues growing from USD 66.05 million in 2018 to USD 103.19 million in 2024. By 2032, the market is projected to reach USD 163.23 million, reflecting a CAGR of 5.8%, the slowest among all regions. Limited research infrastructure, low pharmaceutical investment, and inadequate regulatory frameworks restrain growth. However, South Africa and a few North African nations are emerging as key contributors due to increasing clinical trials and rising healthcare investments. Gradual improvements in research capacity may unlock opportunities in the long term.

Market Segmentations:

By Services

- Drug Discovery (early stage)

- Lead Optimization

- Preclinical Development

- Toxicology & Safety Testing

- Biologics Vs. Small Molecules

By Technology Platform

- Cell-based Assays

- Enzyme-based Assays

- Organ-On-Chip Models

- Bioanalytical Techniques

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic Institutes & Research Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global in vitro ADME services market is characterized by the presence of established CROs, specialized biotech service providers, and integrated life sciences companies. Leading firms such as WuXi AppTec, Charles River Laboratories, Pharmaron, and IQVIA dominate through broad service portfolios, global infrastructure, and strong client networks. Emerging players including CN Bio, Sygnature Discovery, and Jubilant Biosys strengthen competition with niche expertise in organ-on-chip technologies, cell-based assays, and custom ADME solutions. Strategic partnerships, acquisitions, and investments in advanced bioanalytical platforms are common growth strategies. Financial strength, technological innovation, and regulatory expertise remain key differentiators. The market is also witnessing an increasing number of mid-sized and regional CROs entering the segment, particularly in Asia-Pacific, offering cost-efficient solutions and driving further fragmentation. Overall, competition centers on service differentiation, speed of delivery, and alignment with evolving demands for biologics, precision medicine, and complex drug testing models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- WuXi AppTec

- Frontage Laboratories

- Charles River Laboratories

- BioDuro

- Aurigene Pharmaceutical Services Ltd.

- Pharmaron

- IQVIA

- Sygnature Discovery

- CN Bio

- Jubilant Biosys

- Biolivz

- Other Key Players

Recent Developments

- In January 2025, Eurofins Scientific expanded its ADME testing capabilities by acquiring a state-of-the-art laboratory in Singapore. This strategic move aims to strengthen Eurofins’ presence in Asia-Pacific, catering to the growing demand for advanced drug metabolism and pharmacokinetics studies. The acquisition is part of Eurofins’ broader strategy to enhance its global laboratory network and service offerings.

- In 2024, India’s National Institute of Pharmaceutical Education and Research (NIPER) signed a public-private partnership with a major U.S. biotech company to build ADME testing hubs with AI and bioinformatics tools.

Report Coverage

The research report offers an in-depth analysis based on Services, Technology Platform, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand for early drug screening solutions.

- Cell-based assays will continue to dominate due to higher accuracy and predictive value.

- Organ-on-chip technologies will gain wider adoption as alternatives to animal testing.

- Pharmaceutical companies will remain the largest end-users, supported by extensive R&D pipelines.

- Biotechnology firms will increase usage of specialized ADME services for biologics and gene therapies.

- Contract Research Organizations will capture more share through cost-effective outsourcing models.

- Integration of AI and machine learning will enhance predictive analysis in ADME testing.

- Precision medicine and pharmacogenomics will create new opportunities for customized ADME platforms.

- Asia Pacific will emerge as the fastest-growing regional market, driven by outsourcing and clinical trials.

- Strategic collaborations and acquisitions will remain key growth strategies among leading service providers.