Market Overview

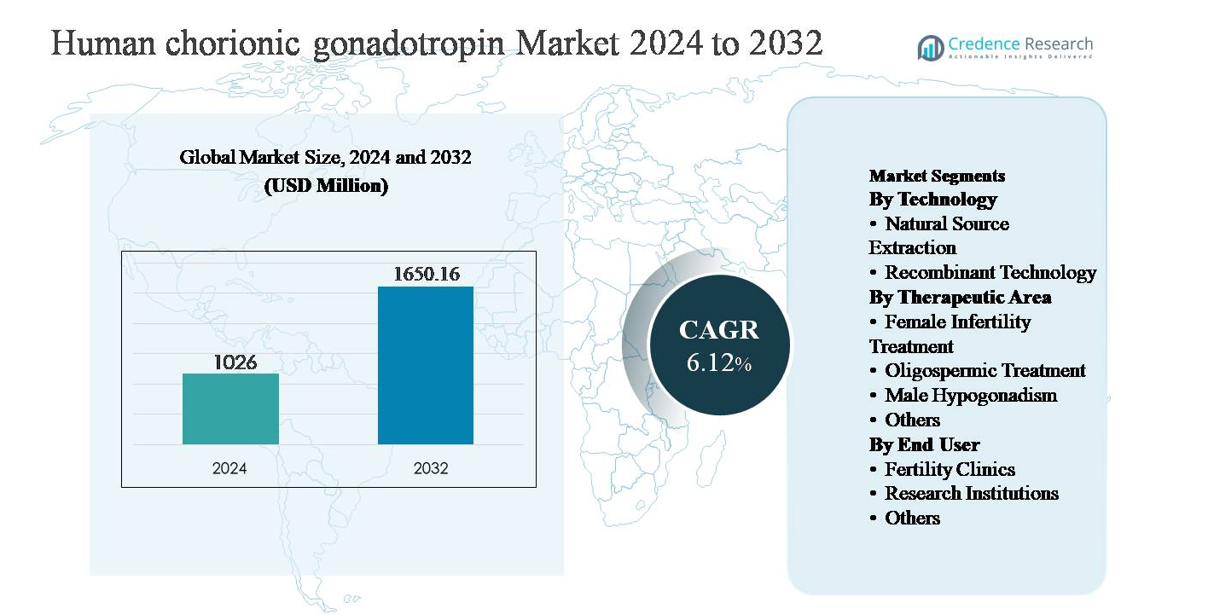

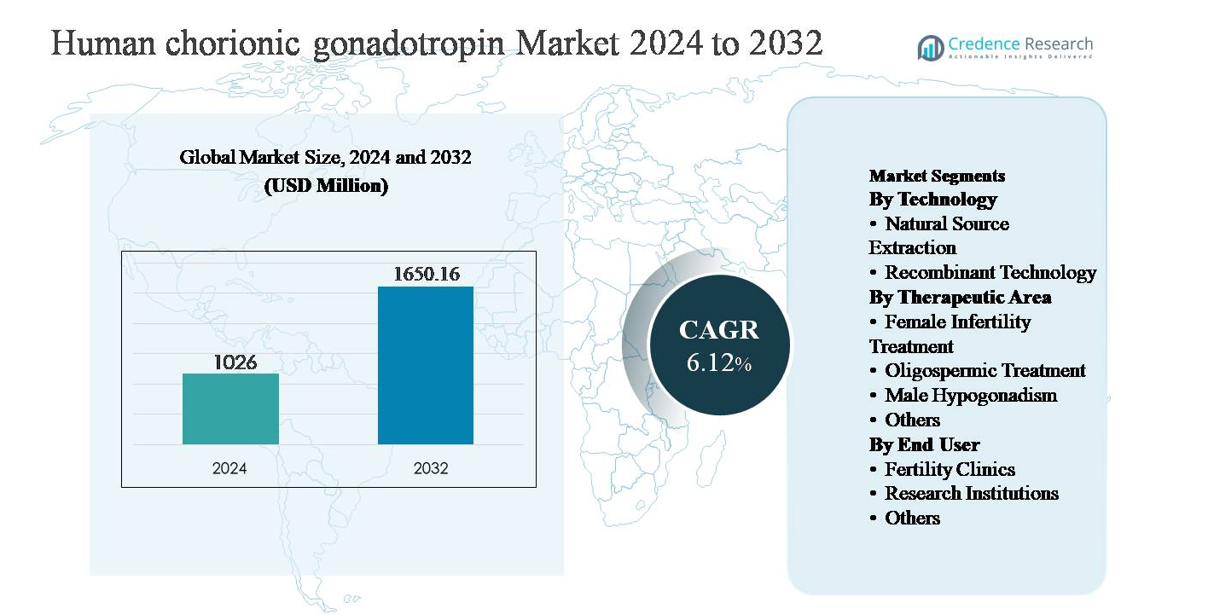

The human chorionic gonadotropin (hCG) market was valued at USD 1,026 million in 2024 and is projected to reach USD 1,650.16 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Human Chorionic Gonadotropin Market Size 2024 |

USD 1,026 million |

| Human Chorionic Gonadotropin Market, CAGR |

6.12% |

| Human Chorionic Gonadotropin Market Size 2032 |

USD 1,650.16 million |

The human chorionic gonadotropin market is led by a group of established pharmaceutical and biologics manufacturers, including Merck & Co., Inc., Ferring Pharmaceuticals Inc., Bristol Myers Squibb Company, Sun Pharmaceutical Industries Ltd, Fresenius Kabi AG, Lupin, Lee BioSolutions Inc., Scripps Laboratories, Sanzyme, and Cigna. These companies compete on manufacturing quality, regulatory compliance, and portfolio strength across recombinant and natural-source hCG formulations. Their presence is strongest in developed healthcare markets, supported by robust fertility treatment infrastructure and advanced endocrinology practices. North America dominates the global market with approximately 38% market share, driven by high assisted reproductive technology adoption, strong clinical awareness, and widespread use of recombinant hormones. Europe follows closely, while Asia-Pacific is emerging as a high-growth region due to expanding fertility services and improving access to hormone therapies.

Market Insights

- The human chorionic gonadotropin market was valued at USD 1,026 million in 2024 and is projected to reach USD 1,650.16 million by 2032, expanding at a CAGR of 6.12% during the forecast period.

- Market growth is primarily driven by the rising prevalence of infertility, increasing utilization of assisted reproductive technologies, and growing clinical adoption of hCG in female infertility, male hypogonadism, and oligospermic treatment, with female infertility representing the dominant therapeutic segment.

- Key market trends include the shift toward recombinant hCG due to higher purity and consistency, personalized fertility treatment protocols, and expanding fertility clinic networks in emerging economies, strengthening demand across clinical settings.

- The competitive landscape features established pharmaceutical players focusing on product quality, regulatory compliance, and geographic expansion, with recombinant technology holding the dominant technology segment share over natural source extraction.

- Regionally, North America leads with ~38% market share, followed by Europe at ~29% and Asia-Pacific at ~23%, while Latin America and Middle East & Africa collectively account for the remaining share, supported by gradual healthcare infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology:

The technology segment of the human chorionic gonadotropin market is led by recombinant technology, which accounts for the dominant market share due to its high purity, batch-to-batch consistency, and reduced risk of biological contaminants compared to urine-derived products. Recombinant hCG is increasingly preferred in assisted reproductive procedures because it enables precise dosing and predictable clinical outcomes. Strong regulatory acceptance in developed markets, expanding use in controlled ovarian stimulation protocols, and growing investments by biopharmaceutical companies in recombinant hormone manufacturing are key drivers reinforcing the dominance of this sub-segment over natural source extraction.

- For instance, Merck’s recombinant hCG product Ovidrel® (choriogonadotropin alfa) is produced in Chinese hamster ovary (CHO) cells and supplied as a single-use prefilled syringe containing 250 micrograms of choriogonadotropin alfa in 0.5 mL solution, corresponding to a bioactivity of approximately 6,500 IU, with batch release controlled through validated in vitro and in vivo potency assays.

By Therapeutic Area:

Within therapeutic applications, female infertility treatment represents the dominant sub-segment, holding the largest market share due to the widespread use of hCG in ovulation induction and luteal phase support during assisted reproductive technologies. Rising infertility prevalence, delayed childbearing trends, and increasing adoption of in vitro fertilization and intracytoplasmic sperm injection procedures continue to support demand. hCG’s critical role in triggering final follicular maturation makes it indispensable in fertility protocols. Oligospermic treatment and male hypogonadism contribute steadily, supported by expanding awareness of male reproductive health and endocrine therapies.

- For instance, Ferring Pharmaceuticals’ Choragon® is supplied in 1,500 IU and 5,000 IU lyophilized vial formats, with product documentation specifying repeated intramuscular dosing schedules for male hypogonadism to support endogenous testosterone synthesis and spermatogenesis under supervised hormonal therapy protocols.

By End User:

The end-user segment is primarily driven by fertility clinics, which account for the dominant market share owing to their central role in diagnosing and treating infertility through hormone-based protocols. The concentration of advanced reproductive technologies, specialized clinicians, and high patient volumes in these settings drives consistent hCG utilization. Growth in medical tourism for fertility treatments, expansion of private IVF centers, and increasing success rates of assisted reproduction further strengthen this segment. Research institutions represent a smaller share, mainly supporting clinical trials and endocrinology studies, while other end users contribute limited demand.

Key Growth Driver

Rising Prevalence of Infertility and Expanding ART Utilization

The increasing global prevalence of infertility is a primary growth driver for the human chorionic gonadotropin market. Lifestyle changes, rising maternal age, obesity, hormonal disorders, and stress-related reproductive dysfunctions have contributed to higher infertility incidence among both men and women. Human chorionic gonadotropin plays a critical role in ovulation induction, luteal phase support, and spermatogenesis stimulation, making it an essential hormone in assisted reproductive technology (ART) protocols. The growing volume of in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and ovulation induction cycles across fertility clinics continues to drive sustained demand. In addition, expanding insurance coverage for infertility treatments in select countries and increased willingness to seek medical intervention are reinforcing the adoption of hormone-based fertility therapies, directly supporting market growth.

- For instance, IBSA Institut Biochimique’s Gonasi® HP is produced using high-purity extraction and chromatographic purification processes and is available in 2,000 IU, 5,000 IU, and 10,000 IU vial configurations, enabling protocol-specific dosing in controlled ovarian stimulation and ovulation induction treatments.

Advancements in Recombinant Hormone Manufacturing

Technological progress in recombinant DNA and biopharmaceutical manufacturing has significantly accelerated growth in the human chorionic gonadotropin market. Recombinant hCG offers superior purity, consistent bioactivity, and reduced contamination risk compared to urine-derived alternatives, making it increasingly preferred in clinical practice. Enhanced manufacturing scalability and improved formulation stability have strengthened supply reliability, particularly in regulated markets. Pharmaceutical companies continue to invest in advanced cell-line development, bioreactor optimization, and quality control systems to meet stringent regulatory requirements. These innovations support broader physician confidence and regulatory approvals, enabling recombinant hCG to penetrate new therapeutic and geographic markets. As healthcare providers prioritize predictable clinical outcomes and patient safety, recombinant technology continues to reinforce long-term market expansion.

- For instance, Ovidrel® is formulated as a ready-to-use liquid injection stored under refrigerated conditions, eliminating the need for reconstitution and reducing dosing variability associated with lyophilized products, while maintaining stability throughout its labeled shelf life as verified through real-time stability studies submitted to regulatory authorities.

Growing Awareness and Treatment of Male Reproductive Disorders

Rising diagnosis and treatment rates of male reproductive health conditions are contributing meaningfully to market growth. Human chorionic gonadotropin is widely used in the management of male hypogonadism and oligospermia, where it stimulates endogenous testosterone production and spermatogenesis. Increasing public awareness, improved diagnostic capabilities, and greater acceptance of hormone therapy for male infertility are driving patient inflow. Urologists and endocrinologists are increasingly incorporating hCG into long-term treatment regimens as an alternative to exogenous testosterone, particularly for men seeking fertility preservation. Expanding clinical evidence supporting its efficacy and safety further supports adoption, strengthening demand across both hospital and specialty clinic settings.

Key Trend & Opportunity

Shift Toward Personalized Fertility Treatment Protocols

Personalized medicine is emerging as a major trend in fertility care, creating new opportunities for human chorionic gonadotropin utilization. Clinicians are increasingly tailoring hormone dosing based on patient age, ovarian reserve, hormonal profiles, and prior treatment response to optimize outcomes and minimize complications such as ovarian hyperstimulation syndrome. hCG’s versatility across multiple fertility protocols positions it well for individualized treatment strategies. Advances in reproductive endocrinology diagnostics and digital fertility monitoring tools further support customized therapy planning. This trend is expected to increase per-cycle hormone utilization and encourage the adoption of high-purity recombinant formulations that offer precise dosing and consistent therapeutic performance.

- For instance, Roche’s Elecsys® AMH Plus assay, widely used in fertility clinics to quantify anti-Müllerian hormone, provides a measuring range of 03 ng/mL, enabling clinicians to stratify patients by ovarian reserve and individualize stimulation and hCG trigger strategies accordingly.

Expansion of Fertility Services in Emerging Markets

Rapid expansion of fertility clinics and reproductive health infrastructure in emerging economies presents a significant growth opportunity for the human chorionic gonadotropin market. Rising disposable incomes, urbanization, and increasing awareness of infertility treatments are driving patient volumes in Asia-Pacific, Latin America, and parts of the Middle East. Governments and private healthcare providers are investing in specialized fertility centers, often supported by international collaborations and medical tourism. As access to ART services improves, demand for essential fertility hormones such as hCG continues to rise. Local manufacturing partnerships and improved cold-chain logistics further support market penetration in these regions.

- For instance, several large fertility hospital networks in India and Southeast Asia have standardized ovulation trigger protocols around recombinant hCG products requiring controlled refrigeration, supported by on-site pharmaceutical refrigerators maintaining 2-8 °C storage conditions and temperature-monitored transport systems.

Key Challenge

Regulatory and Quality Compliance Complexity

Stringent regulatory requirements pose a major challenge for manufacturers in the human chorionic gonadotropin market. Hormonal therapies are subject to rigorous oversight related to manufacturing consistency, biological safety, and clinical efficacy. Compliance with evolving pharmacovigilance standards, biosimilar guidelines, and sterility requirements increases operational complexity and development timelines. For urine-derived hCG, concerns related to donor variability and contamination risk further complicate regulatory approval and market acceptance. These challenges increase production costs and may limit market entry for smaller players, particularly in highly regulated regions, slowing overall competitive expansion.

High Treatment Costs and Limited Reimbursement

The high cost of fertility treatments remains a significant barrier to broader hCG adoption. Hormone therapies represent a substantial portion of overall ART expenses, often paid out-of-pocket in many countries due to limited insurance coverage. Cost sensitivity among patients can restrict treatment cycles or lead to delayed care, particularly in low- and middle-income regions. Additionally, premium-priced recombinant formulations may face adoption resistance despite clinical advantages. Limited reimbursement frameworks and uneven healthcare funding continue to constrain market accessibility, posing a challenge to sustained volume growth despite rising clinical demand.

Regional Analysis

North America:

North America holds the largest share of the human chorionic gonadotropin market, accounting for approximately 38% of global revenue. The region benefits from advanced fertility treatment infrastructure, high adoption of assisted reproductive technologies, and strong awareness of both female and male infertility treatments. The United States leads regional demand due to a high number of fertility clinics, favorable reimbursement policies for select treatments, and widespread use of recombinant hCG formulations. Strong regulatory oversight ensures consistent product quality, while ongoing clinical research and innovation continue to reinforce North America’s dominant position in the global market.

Europe:

Europe represents around 29% of the global human chorionic gonadotropin market, supported by well-established reproductive healthcare systems and increasing infertility prevalence across key countries. Germany, France, Italy, and the United Kingdom are major contributors, driven by rising utilization of IVF and ovulation induction therapies. The region shows strong adoption of recombinant hCG due to strict regulatory standards emphasizing safety and purity. Government-supported fertility programs in several European countries further support treatment access. In addition, growing awareness of male hypogonadism and expanding endocrinology care continue to strengthen regional market performance.

Asia-Pacific:

Asia-Pacific accounts for approximately 23% of the global market and is the fastest-growing regional segment for human chorionic gonadotropin. Rapid expansion of fertility clinics, rising infertility rates linked to lifestyle changes, and increasing medical tourism are key growth drivers. Countries such as China, India, Japan, and South Korea are witnessing strong demand due to improving healthcare infrastructure and growing awareness of assisted reproductive technologies. Expanding private fertility centers and improving affordability of hormone therapies are accelerating adoption. Local manufacturing initiatives and regulatory streamlining further support sustained market expansion across the region.

Latin America:

Latin America holds about 6% of the global human chorionic gonadotropin market, supported by gradual improvements in reproductive healthcare access and growing awareness of infertility treatments. Brazil, Mexico, and Argentina lead regional demand, driven by the expansion of private fertility clinics and rising acceptance of hormone-based therapies. While access remains uneven across countries, increasing urbanization and medical tourism are supporting market growth. Adoption is currently stronger for natural source extraction products due to cost considerations, though recombinant formulations are gradually gaining traction in higher-income urban centers.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 4% of the global market, reflecting its emerging stage of development. Growth is primarily driven by rising infertility awareness, increasing healthcare investments, and expanding fertility clinics in countries such as the UAE, Saudi Arabia, and South Africa. Cultural acceptance of assisted reproduction is improving, particularly in urban centers, supporting higher treatment uptake. However, limited reimbursement, uneven access to advanced fertility services, and cost sensitivity constrain broader adoption. Despite these challenges, ongoing healthcare infrastructure development is expected to support gradual market growth.

Market Segmentations:

By Technology

- Natural Source Extraction

- Recombinant Technology

By Therapeutic Area

- Female Infertility Treatment

- Oligospermic Treatment

- Male Hypogonadism

- Others

By End User

- Fertility Clinics

- Research Institutions

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the human chorionic gonadotropin market is characterized by the presence of established pharmaceutical manufacturers with strong capabilities in hormone production, biologics manufacturing, and reproductive health therapeutics. Leading companies compete primarily on product purity, regulatory compliance, formulation reliability, and geographic reach. Recombinant hCG producers maintain a competitive advantage due to consistent quality and strong physician preference in assisted reproductive protocols, while urine-derived manufacturers focus on cost competitiveness and broader accessibility. Market participants actively invest in manufacturing upgrades, quality assurance systems, and regulatory approvals to strengthen global presence. Strategic partnerships with fertility clinics, distributors, and healthcare providers support market penetration, particularly in emerging regions. In addition, ongoing clinical research and lifecycle management strategies, including improved delivery formats and dosing convenience, are enabling companies to differentiate their portfolios and sustain competitive positioning in a moderately consolidated market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Merck’s fertility franchise, including Ovidrel®, was included in a U.S. public-private agreement to expand direct-to-consumer access to IVF therapies through the TrumpRx.gov platform, planned to go live January 2026, enabling wider prescription access via expanded pharmacy networks.

- In June 2025, Merck Healthcare Pty Ltd. announced anticipated intermittent supply constraints for its recombinant hCG product Ovidrel® (choriogonadotropin alfa) expected from July 1, 2024 through September 30, 2027, with implementation of a stock allocation process to manage distribution while maintaining quality and safety.

- In April 2025,Ferring announced that the U.S. FDA approved a second manufacturing facility for Adstiladrin® (nadofaragene firadenovec-vncg), though not an hCG product itself this indicates expanded GMP infrastructure that supports its broader reproductive medicine portfolio.

Report Coverage

The research report offers an in-depth analysis based on Technology, Therapeutic area, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for human chorionic gonadotropin will continue to rise as infertility prevalence increases across both female and male populations.

- Assisted reproductive technologies will remain the primary application area, sustaining consistent clinical utilization of hCG.

- Recombinant hCG will gain wider adoption due to its purity, safety profile, and predictable therapeutic performance.

- Fertility clinics will remain the dominant end users as global access to reproductive healthcare expands.

- Personalized fertility treatment protocols will drive more precise and protocol-specific use of hCG.

- Emerging economies will contribute significantly to future growth as fertility services and awareness improve.

- Advances in biopharmaceutical manufacturing will enhance product quality and supply reliability.

- Regulatory emphasis on safety and consistency will favor established manufacturers with strong compliance capabilities.

- Increasing focus on male reproductive health will support expanded therapeutic applications of hCG.

- Strategic partnerships and geographic expansion will shape long-term competitive positioning in the market.