Market Overview

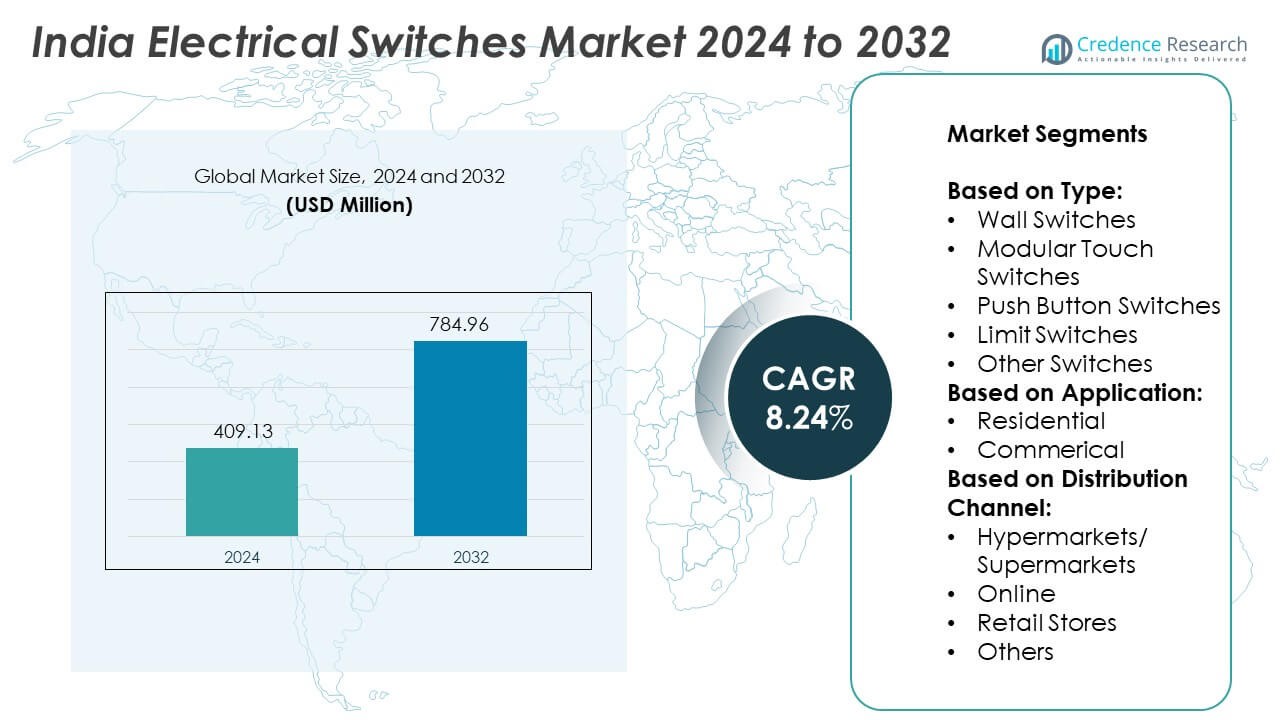

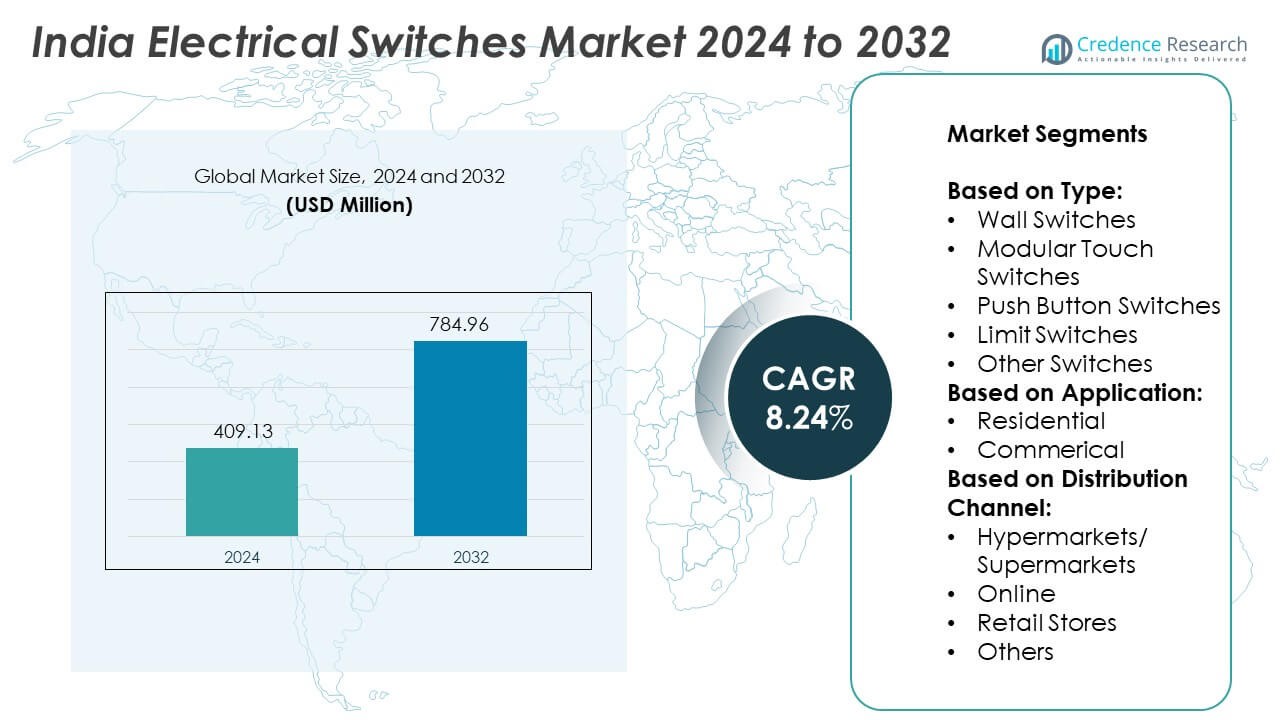

The India Electrical Switches market was valued at USD 409.13 million in 2024 and is expected to reach USD 784.96 million by 2032, growing at a CAGR of 8.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Electrical Switches Market Size 2024 |

USD 409.13 Million |

| India Electrical Switches Market, CAGR |

8.24% |

| India Electrical Switches Market Size 2032 |

USD 784.96 Million |

The India Electrical Switches market grows on increasing demand for smart, energy-efficient, and modular switch solutions across residential and commercial sectors. It benefits from rapid urbanization, infrastructure development, and rising disposable income that drive adoption of advanced home automation and IoT-enabled switches. Consumers prefer aesthetically appealing, durable, and multi-functional products, supporting growth in premium and designer switches. Market players focus on technological innovation, integration with smart home systems, and compliance with energy-saving standards to meet evolving needs. Trends include smart and touch-sensitive switches, modular designs, and digital distribution channels enhancing accessibility and convenience.

The India Electrical Switches market shows strong regional growth across North, South, West, East, and Central India, driven by urbanization, residential projects, and commercial infrastructure development. North and South India lead adoption due to metropolitan expansion and smart home integration, while emerging cities in West and East India present new opportunities for market penetration. Key players driving the market include Havells India Ltd., Schneider Electric India Pvt. Ltd., Legrand India, and GM Modular Pvt. Ltd., focusing on technological innovation, energy-efficient solutions, and modular designs. These companies strengthen their presence through robust distribution networks, product diversification, and partnerships with real estate and commercial developers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Electrical Switches market was valued at USD 409.13 million in 2024 and is projected to reach USD 784.96 million by 2032, registering a CAGR of 8.24% during the forecast period.

- Growth in the market is driven by rising urbanization, increasing residential and commercial construction, and strong demand for smart and modular switch solutions.

- Consumers are adopting energy-efficient, IoT-enabled, and aesthetically designed switches, reflecting trends toward home automation and digital integration in both homes and offices.

- Intense competition among domestic and international players pushes innovation in design, functionality, and pricing strategies, with companies like Havells India Ltd., Schneider Electric India Pvt. Ltd., Legrand India, and GM Modular Pvt. Ltd. leading the market.

- Challenges include fluctuating raw material costs, supply chain disruptions, and high price sensitivity among consumers, which affect production schedules and profit margins for manufacturers.

- North and South India dominate demand due to metropolitan growth and IT hubs, while West and East India offer emerging opportunities in urban expansion and industrial projects. Central India shows gradual growth driven by smaller urban centers and developing infrastructure.

- Market opportunities exist in smart home integration, energy-efficient products, and tier-2 and tier-3 city expansion, allowing companies to increase penetration through modular designs, localized distribution, and collaborations with real estate developers.

Market Drivers

Rapid Expansion of Residential Construction Fueling Market Demand

The India Electrical Switches market experiences strong growth due to rapid residential construction across urban and semi-urban regions. Rising disposable income and population migration toward cities increase demand for modern apartments, villas, and gated communities. Builders and developers prioritize high-quality switches to enhance electrical safety and convenience in homes. It supports the integration of advanced home automation systems and smart lighting solutions. Demand for aesthetically designed switches that complement interior decor also drives market growth. Rising awareness of electrical safety standards encourages homeowners to select certified and branded products. These factors collectively strengthen the adoption of switches in residential projects.

- For instance, Legrand India installed over 12,000 smart switches in new residential projects across Bangalore, integrating remote lighting control with IoT-enabled monitoring. These factors collectively strengthen the adoption of switches in residential projects.

Growth in Commercial and Industrial Infrastructure Driving Market Adoption

Expansion of commercial and industrial infrastructure directly impacts the India Electrical Switches market. Offices, retail complexes, hospitals, and factories require large-scale electrical installations equipped with durable and reliable switches. It benefits from operational efficiency improvements offered by modular and multi-functional switch systems. Industrial facilities emphasize energy management and safety compliance, boosting the need for technologically advanced switches. Strategic projects in metro cities contribute significantly to demand for premium switch products. Market players focus on supplying innovative solutions that reduce maintenance and operational costs. This trend reinforces the long-term growth potential of the commercial segment.

- For instance, GM Modular Pvt. Ltd. integrated over 15,000 smart switches with Amazon Alexa compatibility in residential apartments across Pune, enabling automated lighting schedules and energy optimization

Rising Popularity of Smart Homes and Automation Solutions

The adoption of smart homes drives technological innovation within the India Electrical Switches market. Consumers seek switches capable of remote control, voice activation, and IoT integration to manage energy consumption effectively. It supports the convenience and flexibility demanded by modern lifestyles, enhancing residential and commercial applications. Companies introduce products with intelligent features, including programmable lighting and automated systems, to attract tech-savvy buyers. Awareness campaigns highlighting energy efficiency and sustainability encourage the replacement of conventional switches. Market players leverage these trends to expand product portfolios and strengthen customer engagement. The growing demand for smart electrical components propels the industry forward.

Government Policies and Energy Efficiency Initiatives Encouraging Adoption

Government programs promoting electrification, energy efficiency, and safety compliance positively influence the India Electrical Switches market. Regulations mandate the use of certified electrical components to ensure safety and reliability. It aligns with initiatives encouraging energy-saving devices in residential and commercial sectors. Public awareness programs highlight the benefits of modern switches in reducing power wastage and operational risks. Incentives for green building practices drive adoption of advanced electrical solutions. Manufacturers respond by introducing eco-friendly and energy-efficient switches. These policies strengthen consumer confidence and reinforce market expansion.

Market Trends

Integration of Smart and IoT-Enabled Switches Driving Technological Transformation

The India Electrical Switches market demonstrates a strong shift toward smart and IoT-enabled devices. Consumers increasingly prefer switches that offer remote control, automation, and real-time energy monitoring. It supports integration with smart home systems, enhancing convenience, safety, and energy management. Companies invest in developing touch-sensitive panels, voice-activated switches, and programmable lighting controls to meet evolving consumer expectations. Intelligent switches improve operational efficiency and allow seamless connectivity across residential and commercial applications. Market players emphasize innovation and compatibility with mobile applications to attract technology-driven buyers. This trend strengthens the adoption of advanced switch solutions.

- For instance, Anchor Electricals Pvt. Ltd. supplied over 10,000 energy-efficient switches to LEED-certified commercial projects in Delhi, supporting compliance with government-mandated energy standards.

Preference for Modular and Multi-Functional Switch Designs

The demand for modular and multi-functional switches is gaining traction within the India Electrical Switches market. Customers seek products that offer flexibility, ease of installation, and adaptability to different electrical layouts. It supports customization in homes, offices, and industrial facilities, reducing maintenance complexity. Modular designs allow integration of multiple functions such as power, data, and USB ports in a single unit. Manufacturers introduce durable and aesthetically appealing switches to match interior décor preferences. Market players highlight quality, safety certifications, and performance reliability to differentiate products. This trend emphasizes convenience and operational efficiency across applications.

- For instance, Legrand India installed 2,900 wall and modular switches in newly constructed residential complexes in Gurugram, integrating smart lighting controls for energy efficiency and user convenience.

Shift Toward Energy-Efficient and Eco-Friendly Switch Solutions

Energy efficiency and sustainability emerge as critical trends influencing the India Electrical Switches market. Consumers increasingly choose switches that minimize power consumption while meeting functional requirements. It encourages the adoption of LED-compatible switches and devices with low standby power. Companies focus on developing eco-friendly materials, recyclable components, and products that comply with energy-saving standards. Awareness campaigns highlight the environmental and cost benefits of energy-efficient solutions. Market participants leverage these trends to strengthen brand reputation and customer loyalty. Energy-conscious designs drive widespread adoption across residential and commercial segments.

Rising Demand for Premium and Aesthetically Designed Switches

Premium and visually appealing switches gain attention in the India Electrical Switches market due to changing consumer preferences. High-income households and commercial projects prefer products that combine functionality with modern design. It includes metallic finishes, customizable colors, and sleek profiles that enhance interior aesthetics. Companies introduce designer collections and luxury switch lines to meet the expectations of discerning buyers. Market participants emphasize durability, safety, and user-friendly operation to complement aesthetic appeal. Strategic marketing and product differentiation foster brand recognition and customer retention. This trend encourages innovation in both design and functionality.

Market Challenges Analysis

High Competition and Price Sensitivity Limiting Market Growth

The India Electrical Switches market faces challenges due to intense competition among domestic and international players. Numerous low-cost alternatives affect pricing strategies and profit margins for established brands. It compels manufacturers to balance quality, safety, and affordability to retain market share. Price-sensitive consumers often prefer budget-friendly products over premium or technologically advanced switches. Counterfeit and unbranded switches create additional concerns regarding safety, reliability, and regulatory compliance. Market players invest in brand differentiation, certification, and after-sales services to maintain credibility. This competitive environment creates pressure on innovation and cost management.

Supply Chain Constraints and Raw Material Volatility Affecting Production

Supply chain disruptions and fluctuating raw material costs present significant challenges to the India Electrical Switches market. Dependence on metals, plastics, and electronic components exposes manufacturers to price volatility and potential delays. It impacts production schedules, inventory management, and delivery timelines for residential and commercial projects. Limited availability of high-quality components may compromise product performance and safety standards. Market participants implement strategic sourcing and inventory optimization to mitigate risks. Regulatory requirements and import restrictions further complicate supply chain management. These factors constrain consistent market expansion and operational efficiency.

Market Opportunities

Expansion in Smart Home and Home Automation Solutions Creating Growth Opportunities

The India Electrical Switches market benefits from the rising adoption of smart home technologies and automation systems. Increasing consumer interest in remote-controlled, voice-activated, and IoT-enabled switches drives demand for innovative solutions. It supports integration with lighting, HVAC, and security systems, enhancing convenience and energy management. Developers of residential and commercial projects prefer modern switches to attract tech-savvy buyers. Market players can leverage this trend by introducing customizable and user-friendly products. Strategic partnerships with smart device manufacturers expand market reach. The growing preference for connected homes opens substantial revenue opportunities.

Infrastructure Development and Urbanization Offering Market Expansion Potential

Rapid urbanization and infrastructure development create significant opportunities in the India Electrical Switches market. Construction of new residential complexes, commercial spaces, and industrial facilities increases demand for reliable and advanced electrical components. It encourages manufacturers to supply durable, modular, and energy-efficient switch solutions for large-scale projects. Government initiatives promoting electrification, energy efficiency, and safety standards further support market expansion. Tier-2 and tier-3 cities present untapped potential due to ongoing urban development and rising purchasing power. Market participants can capitalize on these regions through localized distribution and targeted marketing strategies. Infrastructure-driven growth strengthens long-term demand for high-quality switches.

Market Segmentation Analysis:

By Type:

The India Electrical Switches market is categorized into wall switches, modular touch switches, push button switches, limit switches, and other specialized switches. Wall switches dominate due to their widespread application in residential and commercial projects, offering durability and ease of installation. It supports basic electrical functions while maintaining safety standards across diverse environments. Modular touch switches gain traction for smart home integration, providing remote control, energy monitoring, and modern aesthetics. Push button switches serve industrial and commercial applications, facilitating operational efficiency in machinery and automated systems. Limit switches find use in manufacturing and process automation, ensuring precise control and safety compliance. Other switches, including rotary and selector types, cater to niche requirements, reinforcing the diversity of the market.

- For instance, GM Modular Pvt. Ltd. installed over 8,200 modular touch switches with smart energy monitoring in IT office complexes across Chennai, enabling remote control and efficient energy use.

By Application:

The residential segment represents the largest share of the India Electrical Switches market, driven by rapid urbanization, increasing disposable income, and rising preference for modern homes. It supports integration with lighting, HVAC, and home automation systems, improving convenience and energy management. Commercial applications, including offices, retail spaces, and industrial facilities, contribute significantly to market demand due to large-scale installations and the need for reliable, durable switches. It benefits from modular and multi-functional designs that enhance operational efficiency and reduce maintenance requirements. Growth in commercial infrastructure further stimulates adoption of advanced and aesthetically appealing switch solutions.

- For instance, Anchor Electricals Pvt. Ltd. supplied over 4,800 push button switches to automated manufacturing units in Chennai in 2023, improving machine control accuracy and operational safety.

By Distribution Channel:

Distribution channels in the India Electrical Switches market include hypermarkets/supermarkets, online platforms, retail stores, and others such as specialty electrical distributors. Hypermarkets and supermarkets cater to bulk buyers and provide easy access to branded switches. It supports visibility and product availability in urban centers. Online sales channels expand reach, offering convenience, product variety, and competitive pricing for tech-savvy consumers. Retail stores remain crucial for local demand, providing personalized guidance and after-sales support. Other channels, including specialty distributors and electrical wholesalers, target commercial and industrial clients with tailored solutions. The combination of traditional and digital channels enhances overall market penetration.

Segments:

Based on Type:

- Wall Switches

- Modular Touch Switches

- Push Button Switches

- Limit Switches

- Other Switches

Based on Application:

Based on Distribution Channel:

- Hypermarkets/ Supermarkets

- Online

- Retail Stores

- Others

Based on the Geography:

- North India

- West India

- South India

- East India

- Central India

Regional Analysis

North India

North India holds a significant share in the India Electrical Switches market, accounting for 28% of total market revenue. The region benefits from rapid urbanization in metropolitan cities such as Delhi, Chandigarh, Jaipur, and Lucknow. Residential construction projects, including apartments and gated communities, drive demand for high-quality switches. It supports the growing adoption of smart home technologies and modular switch solutions. Commercial infrastructure, including offices, retail spaces, and hospitality establishments, further enhances market penetration. Key market players focus on establishing regional distribution networks and providing after-sales support to maintain brand loyalty. Rising awareness of energy efficiency and electrical safety also strengthens market demand in North India.

West India

West India contributes 22% to the India Electrical Switches market, driven by industrial and commercial development in cities like Mumbai, Pune, Ahmedabad, and Surat. The region witnesses extensive installation of electrical switches in office complexes, factories, and retail outlets. It benefits from the adoption of modular and push-button switches for industrial automation and commercial applications. Growing residential projects in urban and suburban areas further enhance market growth. Manufacturers focus on providing technologically advanced and energy-efficient switches to meet evolving consumer expectations. Competitive pricing and strong brand presence remain key factors influencing market dynamics in West India.

South India

South India accounts for 25% of the India Electrical Switches market, supported by the presence of IT hubs and rapidly expanding residential projects in Bengaluru, Hyderabad, Chennai, and Kochi. Demand for smart and modular switches increases due to the integration of home automation systems. It drives adoption of IoT-enabled switches that allow remote control and real-time energy monitoring. Commercial spaces, including offices and retail establishments, contribute to market growth through large-scale installations. Market players focus on product innovation and collaborations with real estate developers to expand reach. Awareness of energy-efficient electrical components strengthens adoption across residential and commercial segments.

East India

East India holds a market share of 15%, influenced by infrastructure development and urbanization in Kolkata, Bhubaneswar, and Patna. Expansion of residential and commercial projects drives the need for reliable and cost-effective switches. It benefits from government initiatives promoting electrification and energy-efficient electrical components in urban and semi-urban regions. Industrial projects, particularly in manufacturing and logistics hubs, further boost demand. Local distribution networks and retail penetration play a key role in product availability. Manufacturers focus on providing durable, certified, and aesthetically designed switches to cater to consumer preferences.

Central India

Central India contributes 10% to the India Electrical Switches market, with demand primarily driven by emerging urban centers and industrial expansion. Residential construction, including apartments and housing societies, generates significant adoption of standard and modular switches. It supports the growing trend of home automation and energy management systems. Commercial establishments, including offices and small-scale industries, create additional demand for durable and multi-functional switches. Market players emphasize regional partnerships and localized marketing strategies to strengthen their presence. Increasing awareness of safety standards and modern electrical solutions fosters gradual market growth in Central India.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Havells India Ltd., Legrand India, Schneider Electric India Pvt. Ltd., Anchor Electricals Pvt. Ltd., GM Modular Pvt. Ltd., Philips Electronics India Limited, Panasonic India Pvt. Ltd., Siemens Ltd., Wipro Enterprises (P) Ltd., and L&T Electrical & Automation are the leading players in the India Electrical Switches market. These companies drive innovation through the development of energy-efficient, modular, and smart switch solutions that cater to residential, commercial, and industrial applications. They focus on strengthening distribution networks, expanding retail presence, and leveraging online platforms to enhance market reach. Product differentiation through advanced designs, durability, and integration with home automation systems remains a key competitive strategy. Manufacturers invest in research and development to incorporate IoT-enabled functionality, touch-sensitive interfaces, and safety features, addressing evolving consumer preferences. Strategic partnerships with real estate developers, commercial contractors, and technology providers enhance adoption and brand visibility. Competitive pricing, after-sales support, and adherence to safety and quality certifications further solidify market positions. These players continuously monitor market trends and regulatory changes to maintain leadership while exploring growth opportunities in emerging regions and smart infrastructure projects. Their collective efforts shape the overall market landscape, setting high standards for product quality, innovation, and customer engagement.

Recent Developments

- In March 2025, Schneider Electric India Pvt. Ltd. launched its new range of smart modular switches integrated with IoT capabilities for home automation and energy management.

- In February 2025, Panasonic India Pvt. Ltd. rolled out a new energy-efficient switch portfolio for commercial and industrial applications across India. The portfolio includes the Turbo Flex series (FR and FRLSH variants), emphasizing safety, durability, and versatility for various applications.

- In February 2025, Philips Electronics India Limited released a premium series of modular switches focused on aesthetics, durability, and energy-saving performance.

Market Concentration & Characteristics

The India Electrical Switches market demonstrates a moderately concentrated structure, dominated by a mix of established multinational companies and strong domestic players. It features leading brands such as Havells India Ltd., Schneider Electric India Pvt. Ltd., Legrand India, and GM Modular Pvt. Ltd., which hold substantial market influence through wide product portfolios, extensive distribution networks, and technological innovation. It caters to diverse customer segments across residential, commercial, and industrial applications, offering standard, modular, and smart switch solutions. The market emphasizes quality, safety certifications, and energy efficiency, driving consistent consumer trust and preference. Small and regional manufacturers operate alongside major players, targeting cost-sensitive and tier-2 and tier-3 city markets, creating competitive dynamics that foster product differentiation and pricing strategies. Rapid urbanization, infrastructure development, and adoption of smart home technologies shape market characteristics, promoting demand for IoT-enabled and touch-sensitive switches. It also reflects strong regional variation, with higher adoption in metropolitan hubs and growing opportunities in emerging urban centers. Market characteristics include high brand loyalty, focus on innovation, and integration with energy management systems, supporting both premium and value-oriented product segments. The combination of established leadership, evolving technology, and diverse consumer needs defines the competitive and structural landscape of the India Electrical Switches market, guiding strategic decisions for expansion, product development, and regional penetration.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Electrical Switches market will experience strong growth driven by urbanization and infrastructure development.

- Adoption of smart and modular switches will increase across residential and commercial sectors.

- IoT-enabled switches and home automation solutions will gain wider acceptance.

- Manufacturers will focus on energy-efficient and durable product designs to meet evolving consumer preferences.

- Tier-2 and tier-3 cities will emerge as key growth regions for market expansion.

- Companies will invest in digital distribution channels to enhance product accessibility and reach.

- Strategic partnerships with real estate developers and commercial contractors will boost market penetration.

- Product innovation in touch-sensitive, modular, and aesthetically designed switches will remain a priority.

- Market players will enhance after-sales support and service networks to strengthen brand loyalty.

- Competitive pricing and adherence to safety and quality standards will continue to shape market dynamics.