Market Overview:

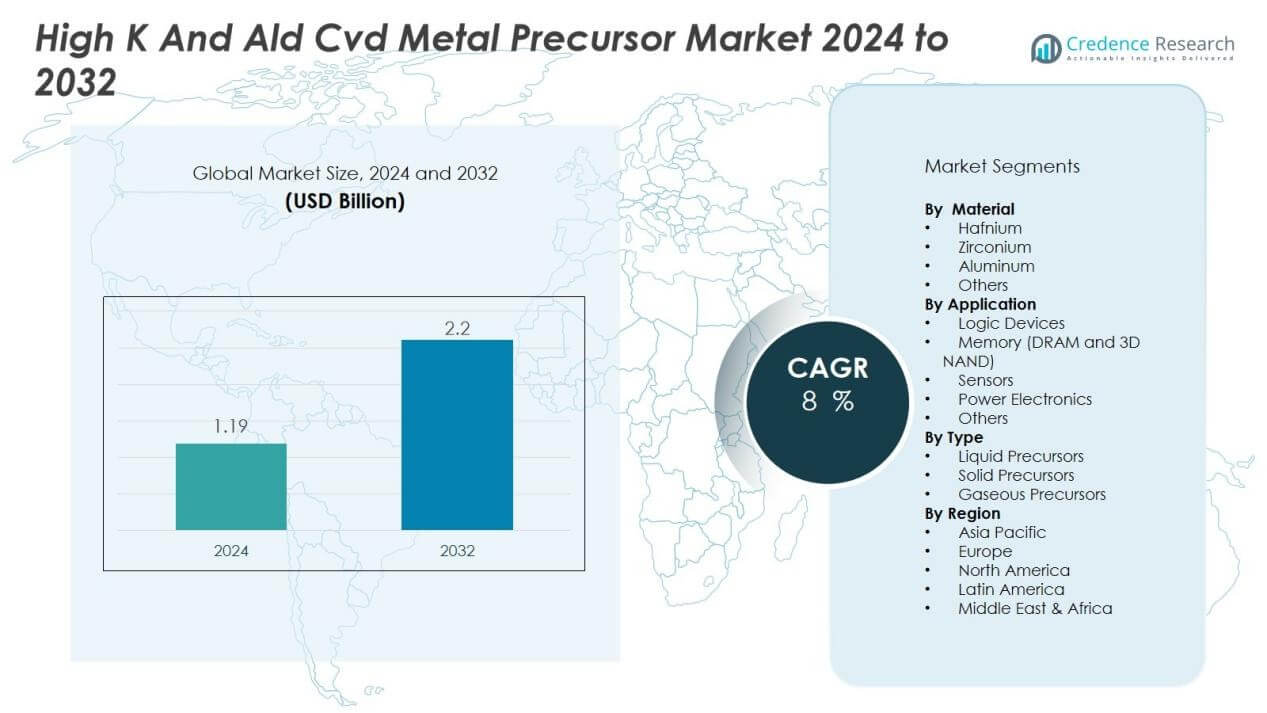

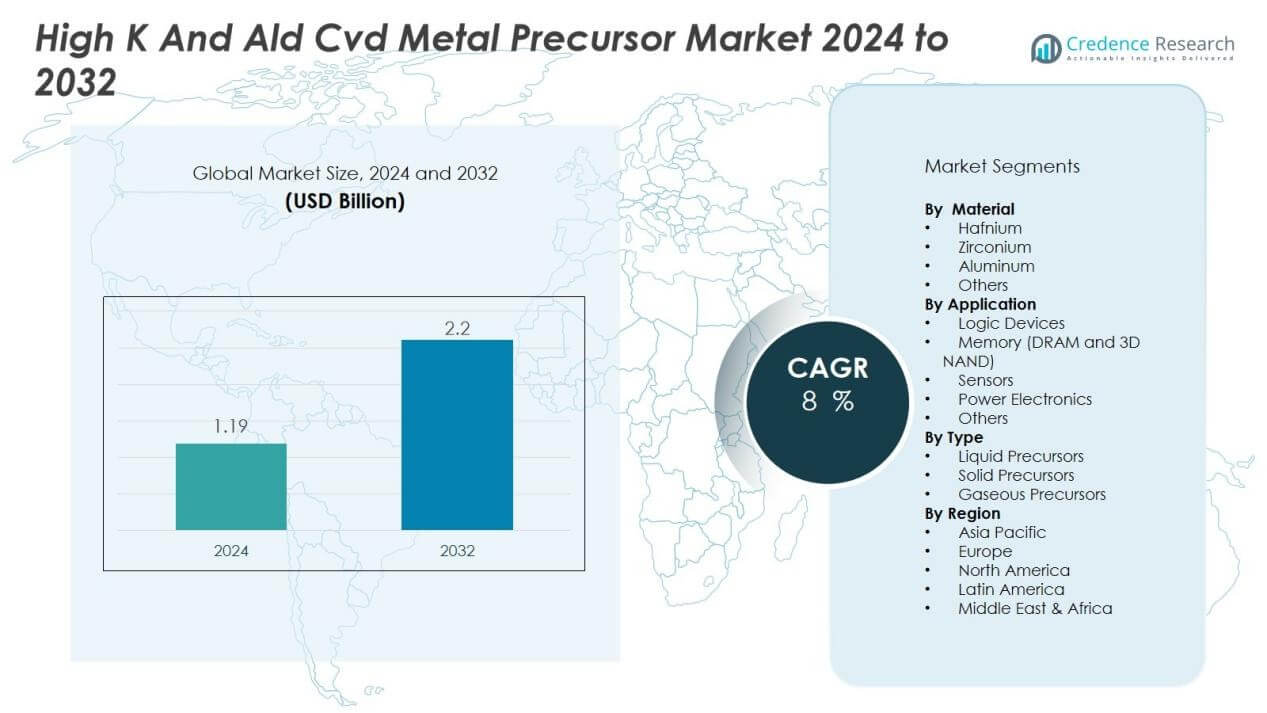

The high k and ald cvd metal precursor market size was valued at USD 1.19 billion in 2024 and is anticipated to reach USD 2.2 billion by 2032, at a CAGR of 8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High-k and CVD ALD Metal Precursors Market Size 2024 |

USD 1.19 Billion |

| High-k and CVD ALD Metal Precursors Market, CAGR |

8% |

| High-k and CVD ALD Metal Precursors Market Size 2032 |

USD 2.2 Billion |

Key drivers include the rising demand for high dielectric constant materials to improve transistor scaling and device reliability. ALD and CVD processes provide precise film deposition critical for next-generation semiconductor manufacturing. The market also benefits from strong R&D investments in advanced materials, growing usage in 3D NAND and DRAM, and the expansion of foundry and integrated device manufacturer (IDM) capacities worldwide. Environmental compliance and efficiency in deposition technologies further enhance adoption.

Regionally, Asia-Pacific dominates the High-k and ALD/CVD Metal Precursor Market, driven by strong semiconductor production in China, Taiwan, South Korea, and Japan. North America follows, supported by the presence of leading technology companies and government-backed semiconductor initiatives. Europe maintains a steady share with robust R&D in microelectronics and collaborative projects. Emerging economies in Southeast Asia and India are expected to see the fastest growth as they expand fabrication capabilities and attract semiconductor investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The high k and ALD CVD metal precursor market was valued at USD 1.19 billion in 2024 and is projected to reach USD 2.2 billion by 2032, growing at a CAGR of 8%.

- Rising demand for high dielectric constant materials to improve transistor scaling and device reliability continues to drive adoption across semiconductor manufacturing.

- The market benefits strongly from expanding use in 3D NAND and DRAM, where accurate material layering supports high-density storage and cloud computing growth.

- Global foundries and IDMs are expanding fabrication capacities, boosting precursor consumption across multiple technology nodes and strengthening supply chain reliance.

- Technological innovation in deposition chemistry and focus on environmentally compliant precursors enhance growth by aligning with strict regulations and sustainability goals.

- Challenges include high material costs, complex production processes, and strict compliance requirements that increase operational pressures for manufacturers.

- Asia-Pacific led with 55% share in 2024, followed by North America at 22% and Europe at 15%, reflecting strong semiconductor ecosystems across these regions.

Market Drivers:

Rising Demand for Advanced Semiconductor Devices Driving Adoption:

The high k and ALD CVD metal precursor market benefits from the rapid growth of semiconductor devices. Increasing use of smartphones, high-performance computing, and IoT products creates demand for precise deposition processes. High-k materials enhance transistor scaling while maintaining performance and reliability. It supports advanced chip manufacturing that requires thin, uniform films.

- For instance, Samsung has developed a 512 GB DDR5 memory module using high-k metal gate (HKMG) technology that significantly reduces power consumption while maintaining high performance in AI and supercomputing applications.

Growing Importance of 3D NAND and DRAM in Memory Applications:

The market gains momentum from rising demand for high-density memory solutions. 3D NAND and DRAM technologies depend on ALD and CVD processes for accurate material layering. High-k precursors enable improved device efficiency and extended memory lifespans. It plays a critical role in meeting global data storage and cloud computing growth.

- For instance, in 2022, Micron delivered the world’s first 232-layer 3D NAND flash memory, significantly boosting storage density and performance to enable smaller devices with expanded storage capacity.

Expansion of Foundry and IDM Capacities Boosting Material Demand:

Global foundries and IDMs are expanding their fabrication facilities to meet rising chip needs. This expansion fuels higher consumption of ALD/CVD metal precursors across multiple nodes. The high k and ALD CVD metal precursor market benefits from consistent investments in new fabs and process upgrades. It strengthens its position in global semiconductor supply chains.

Technological Advancements and Environmental Compliance Enhancing Growth:

Continuous innovation in deposition chemistry drives adoption across advanced nodes. Manufacturers focus on creating environmentally compliant and efficient precursors to meet strict regulations. The market benefits from reduced waste generation, better step coverage, and precise atomic-level control. It ensures reliable device performance while aligning with sustainability goals in the semiconductor industry.

Market Trends:

Integration of High-k Materials with Advanced Node Technologies:

The high k and ALD CVD metal precursor market is witnessing strong momentum from advanced node integration. Leading semiconductor manufacturers are adopting high-k materials to enhance gate performance and reduce leakage. ALD and CVD processes provide precise control required for miniaturized and complex architectures. Increasing demand for logic and memory chips drives wider usage of these materials. It supports 5G, AI, and high-performance computing devices that rely on smaller transistors with better energy efficiency. Growing investment in extreme ultraviolet (EUV) lithography further accelerates adoption across multiple fabrication stages.

- For Instance, ASML, the sole supplier of EUV lithography machines, had already delivered its 100th EUV system by early 2020 and shipped 44 EUV systems in 2024 to support sub-5nm node production essential for advanced chip manufacturing

Shift Toward Sustainable and Customized Precursor Solutions:

Sustainability and customization are becoming key focus areas in the market. Manufacturers are developing low-toxicity and environmentally compliant precursors to meet regulatory expectations. Tailored precursor solutions for specific semiconductor devices are gaining traction, ensuring better compatibility with new materials and architectures. It drives collaboration between precursor suppliers and chipmakers to optimize deposition processes. Expanding research in eco-friendly chemistries reduces process waste while maintaining atomic-level precision. This trend strengthens the market’s role in balancing performance, efficiency, and environmental responsibility in global semiconductor production.

- For instance, Intel has committed to powering its global operations with 100% renewable energy by 2030, directly supporting the development of sustainable semiconductor precursors with reduced environmental impacts.

Market Challenges Analysis:

High Material Costs and Complex Manufacturing Processes:

The high k and ALD CVD metal precursor market faces challenges due to high production costs. Developing advanced precursors requires specialized synthesis, strict purity standards, and complex handling. These factors raise overall expenses and limit adoption among smaller semiconductor manufacturers. It struggles with balancing cost efficiency while meeting performance and reliability demands. Continuous price pressure in the semiconductor supply chain further increases difficulty for suppliers. This challenge may hinder wider market penetration across emerging economies.

Supply Chain Vulnerabilities and Stringent Regulatory Compliance:

Global supply chain disruptions impact timely delivery of raw materials and precursors. Dependence on limited suppliers creates risks of shortages and price volatility. The high k and ALD CVD metal precursor market also faces strict environmental and safety regulations. It requires heavy investment in compliance measures, which adds to operational costs. Meeting evolving standards across regions complicates expansion strategies for global players. These barriers can slow innovation and limit the speed of scaling new technologies.

Market Opportunities:

Expansion of Next-Generation Semiconductor Applications Creating Growth Potential:

The high k and ALD CVD metal precursor market holds strong opportunities in next-generation applications. Growing adoption of 5G, artificial intelligence, and Internet of Things devices increases demand for advanced semiconductors. High-k materials enable better performance, energy efficiency, and miniaturization for these technologies. It gains further momentum from expanding use in automotive electronics, including electric vehicles and autonomous systems. Rising global data center investments also push demand for high-performance memory chips. This creates a favorable environment for precursor suppliers to scale offerings.

Rising Investments in Emerging Markets and Collaborative Innovation:

Emerging economies in Asia and the Middle East are investing heavily in semiconductor manufacturing. These initiatives open doors for wider precursor adoption across new fabrication facilities. The high k and ALD CVD metal precursor market benefits from collaborations between material suppliers, foundries, and research institutes. It strengthens innovation pipelines and enables the development of customized deposition solutions. Sustainability-focused precursor designs also create opportunities to meet stricter environmental regulations. Growing regional manufacturing hubs provide suppliers with long-term expansion opportunities and diversified revenue streams.

Market Segmentation Analysis:

By Material:

The high k and ALD CVD metal precursor market is segmented by hafnium, zirconium, aluminum, and others. Hafnium-based precursors lead the segment due to their strong dielectric properties and reliability in advanced node fabrication. Zirconium precursors follow closely, offering performance advantages for memory and logic devices. Aluminum and other materials maintain relevance in specialized applications where cost efficiency and compatibility are prioritized. It continues to expand as research explores new chemistries that enhance film quality and scalability.

- For instance, the novel hafnium precursor IHf used in ALD deposition produces HfO2 films with an equivalent oxide thickness of 1.73 nm and achieves an ultra-low leakage current density of 7.02 × 10−8 A/cm² at +0.8 V, demonstrating superior film quality and performance in electronic device fabrication.

By Type:

The market by type includes liquid, solid, and gaseous precursors. Liquid precursors dominate due to ease of handling, stable delivery, and consistent deposition performance. Solid precursors hold a steady share, driven by their effectiveness in specific high-k applications. Gaseous precursors are gaining traction for atomic layer deposition, where uniformity and control are critical. It grows steadily as fabs focus on reliable and scalable precursor supply across varying process requirements.

- For Instance, TANAKA Precious Metals’ TRuST liquid ruthenium precursor achieves vapor pressures 100 times higher than conventional liquid ruthenium precursors at room temperature, demonstrating superior adsorption efficiency and high film deposition speeds.

By Application:

Applications span logic devices, memory (DRAM and 3D NAND), and others such as sensors and power electronics. Memory devices represent the largest share due to rising demand for high-density storage solutions. Logic devices also drive significant adoption with the push for faster, smaller, and energy-efficient processors. Other applications benefit from the versatility of ALD and CVD processes in diverse semiconductor products. It strengthens across all segments as global demand for advanced electronics continues to rise.

Segmentations:

By Material:

- Hafnium

- Zirconium

- Aluminum

- Others

By Type:

- Liquid Precursors

- Solid Precursors

- Gaseous Precursors

By Application:

- Logic Devices

- Memory (DRAM and 3D NAND)

- Sensors

- Power Electronics

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 55% market share in 2024, maintaining its position as the global leader. China, Taiwan, South Korea, and Japan dominate production with advanced foundries and memory fabs. The high k and ALD CVD metal precursor market benefits from continuous investments in fabrication plants and technology upgrades. It gains further support from government-backed initiatives encouraging local semiconductor development. Expanding 5G, consumer electronics, and automotive applications strengthen regional demand. Rapid growth of domestic suppliers also enhances competitiveness in this region.

North America:

North America accounted for 22% market share in 2024, supported by robust semiconductor R&D and design activity. Leading players in the region collaborate with global fabs to secure advanced material supply. The high k and ALD CVD metal precursor market benefits from U.S. government policies aimed at reshoring chip production. It thrives on innovation in logic and memory devices required for data centers and AI. The presence of major integrated device manufacturers boosts adoption of specialized precursor solutions. Ongoing strategic partnerships between material suppliers and technology firms ensure steady market expansion.

Europe:

Europe captured 15% market share in 2024, driven by strong research initiatives and collaborative projects. Countries such as Germany, France, and the Netherlands invest in advanced deposition technologies for next-generation chips. The high k and ALD CVD metal precursor market gains from regional emphasis on sustainable and eco-friendly chemistries. It also benefits from partnerships between universities, material developers, and semiconductor equipment manufacturers. Focus on automotive and industrial electronics further drives regional demand. European companies play a vital role in shaping global precursor innovation and regulatory compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aldrich

- NAVITAS

- BASF

- Dow Chemical

- Fujifilm

- Silicon Mobility

- KMG Chemicals

- JSR Corporation

- Honeywell

- Heraeus

- Sumitomo Chemical

- Mitsubishi Gas Chemical

- Tokyo Ohka Kogyo

- Merck Group

Competitive Analysis:

The high k and ALD CVD metal precursor market is highly competitive, shaped by global material suppliers and technology leaders. Key players include Aldrich, NAVITAS, BASF, Dow Chemical, Fujifilm, Silicon Mobility, KMG Chemicals, JSR Corporation, Honeywell, and Heraeus. These companies focus on advanced chemistries, stable precursor delivery, and integration with cutting-edge semiconductor processes. It benefits from their continuous R&D investments aimed at improving deposition quality and scaling to advanced nodes. Partnerships with leading foundries and integrated device manufacturers strengthen market reach and ensure compatibility with evolving fabrication needs. Companies compete through innovation in sustainable solutions, customized formulations, and efficient supply chain management. It remains a dynamic space where competitive strategies center on technological leadership, regulatory compliance, and long-term collaboration with semiconductor manufacturers.

Recent Developments:

- In May 2025, Aldrich Capital Partners completed a $107 million recapitalization and strategic partnership with Persivia, an AI-driven digital health solutions company, to support Persivia’s national expansion and technology growth strategy.

- In May 2025, BASF signed an agreement to acquire DOMO Chemicals’ 49% share in the Alsachimie joint venture, providing BASF full ownership and strengthening its position in polyamide 6.6 precursor production for industries such as automotive and textiles.

- In July 2025, Navitas Semiconductor announced a strategic partnership with Powerchip Semiconductor Manufacturing Corporation to produce advanced 200mm GaN-on-silicon semiconductor technology for applications like AI data centers, electric vehicles, and solar energy.

Report Coverage:

It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high k and ALD CVD metal precursor market will expand with growing semiconductor miniaturization and advanced node scaling.

- It will see rising adoption in memory devices, particularly 3D NAND and DRAM, to meet data storage demand.

- The market will gain traction from increasing integration of high-k materials in logic devices and AI processors.

- It will benefit from strong investments in 5G infrastructure, IoT devices, and high-performance computing applications.

- The market will advance through sustainable precursor solutions designed to reduce environmental impact and process waste.

- It will strengthen with collaborative innovation between precursor suppliers, semiconductor fabs, and research institutions.

- The market will expand in emerging economies such as India and Southeast Asia through new fabrication facilities.

- It will experience steady growth in automotive electronics, supported by electric vehicle and autonomous system adoption.

- The market will see rising customization of precursors tailored for advanced device architectures and new chemistries.

- It will remain competitive as global players focus on scaling production, securing supply chains, and driving cost efficiency.