| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Safety Eyewear Market Size 2024 |

USD 86.37 million |

| India Safety Eyewear Market, CAGR |

8.56% |

| India Safety Eyewear Market Size 2032 |

USD 166.61 million |

Market Overview

The India Safety Eyewear market size was valued at USD 86.37 million in 2024 and is anticipated to reach USD 166.61 million by 2032, at a CAGR of 8.56% during the forecast period (2024-2032).

Strict government mandates under the Factories Act and Mines Act drive demand for certified protective eyewear across manufacturing, construction, mining and oil & gas industries. Rising industrial output fueled by the “Make in India” initiative and large-scale infrastructure investments compels companies to upgrade personal protective equipment, boosting adoption of advanced lenses with anti-fog, scratch-resistant and UV-protective coatings. Growing safety awareness among employers and workers accelerates procurement of ergonomic, lightweight frames that ensure comfort during extended use in India’s diverse climatic conditions. Technological advances such as integrated heads-up displays, sensor-enabled hazard alerts and sustainable, reusable materials shape product innovation and differentiate offerings. Expansion of digital sales channels, virtual fitting tools and B2B e-procurement platforms streamlines sourcing and enables small and medium enterprises to access quality-certified eyewear efficiently. Collaboration between global safety eyewear manufacturers and local distributors fosters knowledge transfer, supports regulatory compliance and enhances market penetration, setting the stage for sustained growth through 2032.

The India Safety Eyewear Market exhibits varied regional dynamics, with industrialised states such as Maharashtra and Tamil Nadu propelling strong demand through automotive and electronics clusters, while heavy-duty manufacturing hubs in West Bengal and Haryana require robust protective lenses. It sees rapid digital adoption in metropolitan centres like Bangalore and Delhi, where e-commerce platforms and B2B portals streamline procurement. Emerging industrial corridors in Odisha and Gujarat fuel growth in mining and petrochemical sectors, prompting buyers to favor ergonomic, impact-resistant designs tailored to local needs. Key players such as Titan Eye Plus, Stylrite Opticals and Chandan Optical Industries compete alongside multinational brands Lenskart, Honeywell International and 3M, each that offer differentiated product portfolios which cover prescription and non-prescription ranges. Partnerships between these manufacturers and regional distributors reinforce compliance with safety standards and expand reach. Collaborative training initiatives and local assembly facilities further enhance accessibility in tier-II and tier-III markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Safety Eyewear market size was valued at USD 86.37 million in 2024 and is anticipated to reach USD 166.61 million by 2032, at a CAGR of 8.56%.

- The Global Safety Eyewear Market was valued at USD 4,244.64 million in 2024 and is projected to reach USD 6,806.27 million by 2032, growing at a CAGR of 6.08% during the forecast period.

- Stringent safety mandates under the Factories Act and Mines Act require certified protective eyewear across manufacturing, construction, mining and oil & gas industries, prompting large-scale procurement cycles by major players and driving steady revenue growth for suppliers nationwide.

- Integration of heads-up displays, sensor-driven hazard alerts and cloud-based analytics elevates product differentiation in premium segments, while local manufacturers collaborate with global tech firms to deploy scalable solutions that enhance real-time worker safety and streamline compliance reporting.

- Adoption of biodegradable polymers and recycled plastics in frame production aligns with environmental guidelines and customer demand for green solutions, prompting investments in cradle-to-cradle design frameworks, lifecycle assessments and circular-economy partnerships across the supply chain.

- Titan Eye Plus, Stylrite Opticals and Chandan Optical Industries compete with multinational brands Lenskart, Honeywell and 3M on R&D collaborations, targeted distribution networks and value-added services, leveraging regional assembly units and after-sales support to secure long-term contracts with large industrial clients.

- Premium pricing for advanced eyewear solutions limits affordability among small and medium enterprises with fixed PPE budgets, while widespread counterfeits in unregulated channels erode brand trust and create safety compliance gaps that undermine overall market credibility.

- Southern industrial hubs in Tamil Nadu and Karnataka drive leading demand for ergonomic, impact-resistant eyewear, Northern and Western manufacturing clusters ensure consistent procurement in heavy-industry sectors and Eastern states present emerging potential supported by targeted awareness programs and distributor network expansion.

Report Scope

This report segments the India Safety Eyewear Market as follows:

Market Drivers

Stringent Regulatory Framework Fuels Market Growth

The Indian government enforces strict safety regulations under the Factories Act and Mines Act to protect workers from eye hazards. These mandates require use of certified protective eyewear across manufacturing, construction, mining and oil & gas sectors. The India Safety Eyewear Market responds to compliance demands through rigorous certification processes and product testing protocols. It ensures manufacturers maintain high standards for impact resistance, UV protection and scratch resistance. Regulatory bodies conduct frequent audits that compel companies to upgrade equipment inventories. Regulatory authorities collaborate with industry bodies to update safety standards regularly. This continuous oversight creates predictable procurement cycles and stable revenue streams for market participants.

- For instance, the Ministry of Health and Family Welfare has reported an increase in workplace safety initiatives, reinforcing the need for certified protective eyewear.

Rapid Industrial Expansion Drives Equipment Upgrades

Rapid expansion in India’s manufacturing and infrastructure sectors increases demand for personal protective equipment. Major initiatives like Make in India and infrastructure modernization programs create large-scale construction and engineering projects. The India Safety Eyewear Market benefits from procurement budgets that allocate funds for protective gear upgrades. It addresses the need for lightweight, ergonomic frames that reduce worker fatigue during long work shifts. Corporations prioritize supplier selection based on product performance, durability and compliance with international standards. Frequent capital investments in new facilities drive regular replacement and volume purchases. Strong industrial growth sustains market momentum through the forecast period.

- For instance, India’s rapid urbanization and evolving lifestyle patterns are significantly driving the eyewear market, with increased exposure to digital screens and industrial hazards.

Technological Advances Enhance Product Performance

Emerging technologies elevate quality standards and user experience in protective eyewear. Advanced lens coatings provide improved anti-fog, scratch-resistant and UV-blocking properties. The India Safety Eyewear Market integrates smart features such as heads-up displays and sensor-enabled alerts for real-time hazard warnings. It supports collaboration between global technology firms and local manufacturers to introduce cutting-edge designs. Growth in research and development investments leads to novel materials that offer durability and comfort. Continuous product testing validates performance under diverse environmental conditions. Industry players leverage innovation to differentiate their offerings and capture premium market segments.

Diversified Distribution Channels Expand Market Reach

Expansion of digital and traditional sales channels improves product availability across urban and rural regions. E-commerce platforms offer virtual fitting tools and fast delivery options that attract new customer segments. The India Safety Eyewear Market collaborates with distributors, retailers and online marketplaces to ensure seamless supply chain operations. It benefits small and medium enterprises that lack direct access to global manufacturers. Training programs for distributors enhance product knowledge and compliance awareness at the point of sale. Enhanced channel strategies support consistent revenue growth and customer loyalty. Broader reach through multi-channel distribution fortifies market position.

Market Trends

Integration of Smart Technologies for Real-Time Hazard Monitoring

The India Safety Eyewear Market embraces integration of smart technologies that deliver real-time hazard alerts and data-driven safety metrics. Manufacturers partner with tech firms to embed sensors and heads-up displays into protective glasses. It enables workers to receive instant notifications about environmental risks and compliance breaches. Companies adopt cloud-based platforms to aggregate usage data and optimize safety protocols. Industry leaders invest in hardware and software interoperability to ensure seamless system updates. Regulatory bodies monitor performance benchmarks and adapt guidelines to support innovative solutions. These collaborative efforts push safety standards higher and differentiate premium product offerings.

- For instance, eyewear brands in India are increasingly focusing on sustainable materials, incorporating biodegradable polymers and recycled plastics into their designs.

Expansion of Digital and Omni-Channel Distribution Networks

Digital platforms enable B2B buyers and end users to purchase certified protective eyewear through online portals. The India Safety Eyewear Market leverages virtual fitting tools and interactive product demos to enhance user confidence. It develops seamless integration between e-commerce, distributor networks and direct sales teams. Retailers optimize inventory management with data analytics to ensure product availability in remote locations. Training modules deployed through online channels empower sales staff with detailed product knowledge. Partnerships between local distributors and global manufacturers streamline logistics and compliance. Enhanced distribution strategies improve market penetration and customer satisfaction.

- For instance, e-commerce platforms are transforming the eyewear market by providing consumers with convenient access to a diverse range of products.

Shift Toward Sustainable and Reusable Protective Eyewear Materials

Innovation in material science drives development of eco-friendly and reusable eyewear components. The India Safety Eyewear Market responds to environmental regulations and consumer demand for green solutions. It features frames produced from biodegradable polymers and recycled plastics. Brands implement cradle-to-cradle design to minimize waste and extend product life cycle. Companies incorporate lifecycle assessments into product development and supply chain management. Industry forums facilitate knowledge sharing on sustainable manufacturing practices. Widespread adoption of eco-conscious designs reinforces corporate social responsibility commitments.

Rising Demand for Customized Ergonomic Designs

Ergonomic features become central to new protective eyewear models to reduce worker fatigue. The India Safety Eyewear Market prioritizes adjustable nose pads, flexible temples and lightweight materials. It collaborates with occupational health experts to tailor designs for specific industry requirements. Custom-fit solutions integrate 3D scanning technology to achieve precise measurements. Manufacturers offer modular components that users can swap based on task demands. Consumer feedback influences iterative product enhancements during pilot programs. These personalized approaches elevate comfort levels and foster stronger brand loyalty.

Market Challenges Analysis

Counterfeit Products and Regulatory Compliance Gaps Undermine Safety Standards

Widespread availability of non-certified eyewear through informal retail channels erodes trust in protective equipment performance. The India Safety Eyewear Market contends with products that lack required impact resistance and UV protection ratings. It struggles with inconsistent enforcement of safety norms at state and local levels. Inadequate training among procurement officers hinders identification of genuine certification labels. Suppliers that skirt import duties undercut legitimate vendors on price, which deepens market fragmentation. Enforcement agencies coordinate poorly with manufacturers to trace counterfeit sources. Persistent compliance gaps expose workers to uncontrolled risks and limit overall market credibility.

- For instance, a recent consumer perception study conducted jointly by ASPA and CRISIL revealed that counterfeiting constitutes a substantial 25-30% of the market in India, affecting industries such as pharmaceuticals, apparel, and consumer durables.

High Cost of Advanced Protective Eyewear Restrains Procurement by SMEs

High-performance safety glasses with anti-fog, UV-resistant and sensor-enabled features command premium prices that fall outside the budget of many small and medium enterprises. The India Safety Eyewear Market records slower adoption rates among cost-sensitive buyers. It faces pressure to lower price points without loss of quality or certification standards. Procurement managers delay equipment upgrades when capital expenditure budgets remain fixed. Limited access to financing options restricts timely replacement of obsolete stock. Frequent price fluctuations in raw materials create uncertainty in vendor negotiations. This dynamic creates imbalanced supply and demand cycles for protective eyewear vendors across industrial segments.

Market Opportunities

Untapped Growth in Tier-II and Tier-III Industrial Hubs

Expansion in tier-II and tier-III industrial hubs offers underpenetrated demand for protective eyewear. India Safety Eyewear Market can capitalize on new infrastructure projects and industrial clusters in these regions. Workers at remote plants often lack access to certified safety equipment. Supply chain partners can introduce mobile distribution models to serve underserved areas. It opens local distributor opportunities to broaden geographic coverage. Manufacturers can collaborate with regional chambers to launch targeted awareness programs. This strategy strengthens supply networks and drives significant volume gains.

Customization and After-Sales Service as Differentiators

Demand for customized fit and prescription safety glasses creates differentiation opportunities. India Safety Eyewear Market can expand tailored offerings to address unique worker requirements. Service providers can set up local lens processing centers near industrial zones. It ensures quick turnaround on prescription orders and reduces worker downtime. Bundled maintenance packages help sustain equipment performance over its lifecycle. Training programs paired with product warranties reinforce brand integrity. This model boosts customer loyalty and supports premium pricing.

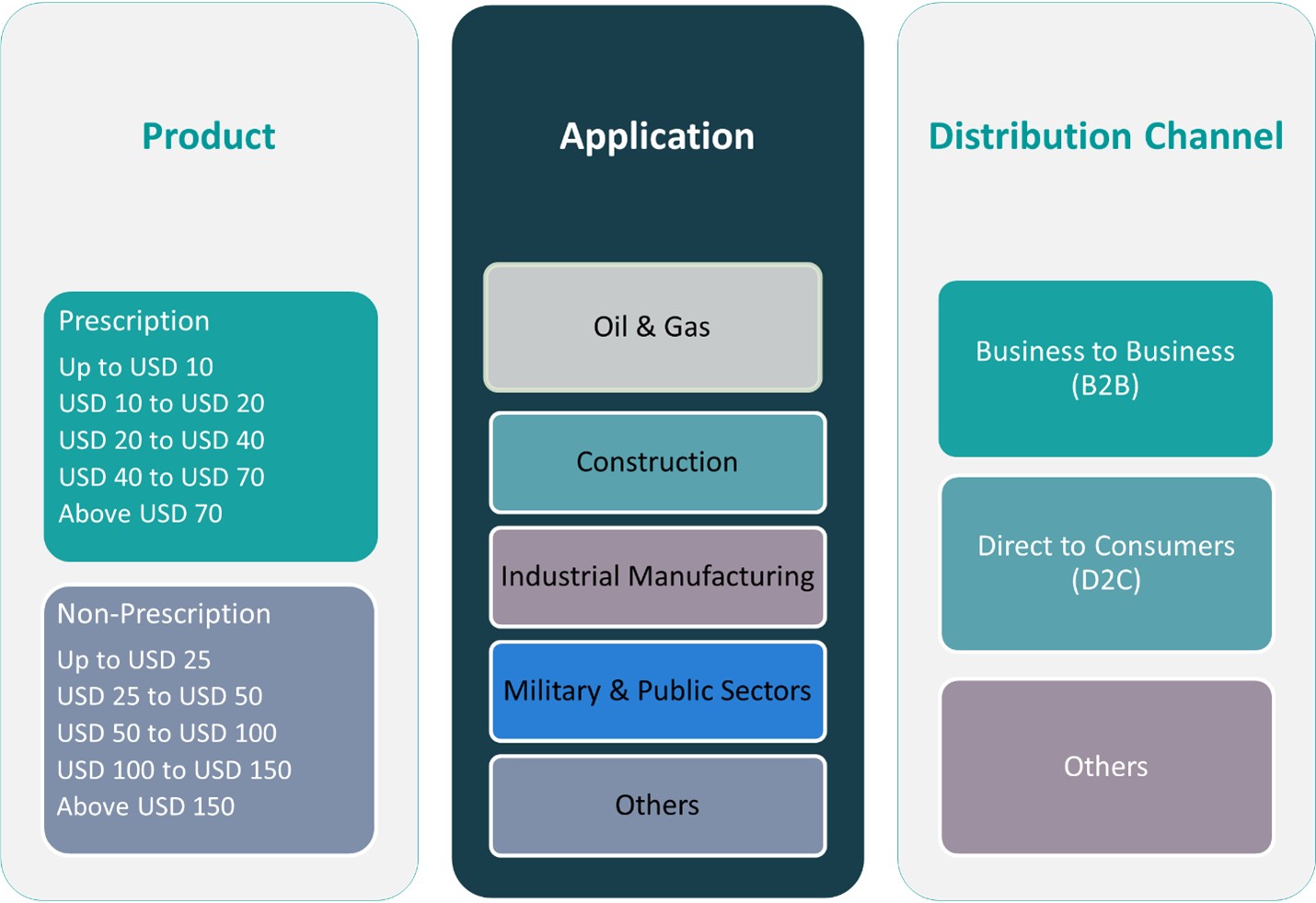

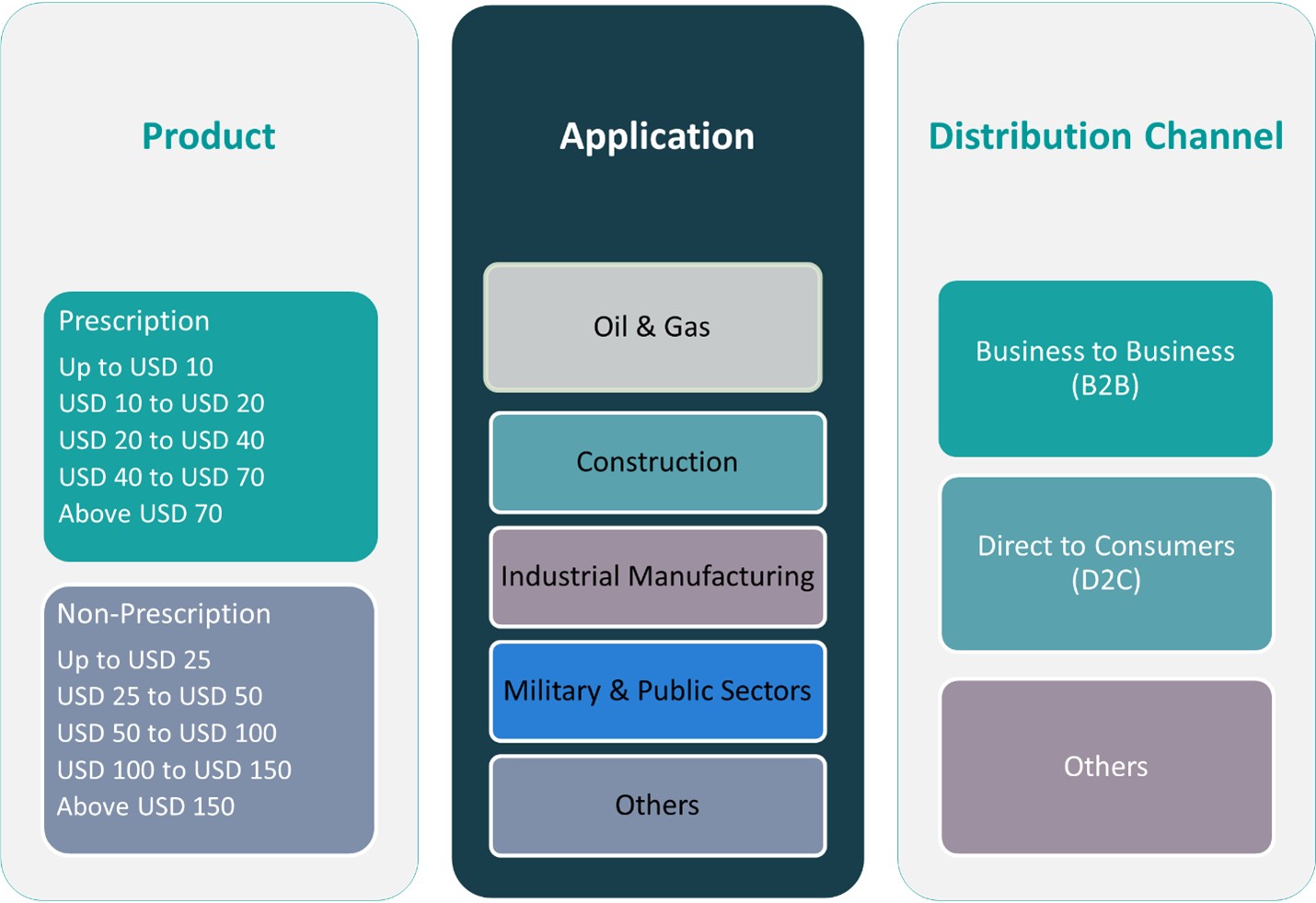

Market Segmentation Analysis:

By Product:

The India Safety Eyewear market divides product offerings into prescription and non-prescription pricing tiers. Prescription eyewear spans price bands from up to USD 10 through above USD 70, while non-prescription options range from up to USD 25 to above USD 150. It ensures buyers meet diverse budget requirements and comply with impact-resistance and UV-protection standards.

By Application:

Application analysis shows robust demand in the oil & gas and construction industries, which require high-impact-resistant lenses. Industrial manufacturing drives volume procurement for scratch-resistant and ergonomic frame models. Military and public sectors demand ballistic-rated and multi-hazard eyewear. Mining and utility services sustain specific safety requirements.

By Distribution Channel:

Distribution channels break down into Business to Business (B2B), Direct to Consumer (D2C) and other models such as wholesale partnerships. The India Safety Eyewear market leverages B2B channels for large-volume contracts with infrastructure and manufacturing firms. It capitalizes on D2C portals and e-commerce platforms to serve individual workers and small businesses. Specialized safety retailers and online marketplaces provide additional distribution avenues. Channel diversification reduces lead times and improves geographic coverage. Partnerships with logistics providers ensure timely delivery in urban and remote locations. This multi-channel strategy supports steady revenue growth and deepens market penetration.

Segments:

Based on Product:

- Prescription

- Up to USD 10

- USD 10 to USD 20

- USD 20 to USD 40

- USD 40 to USD 70

- Above USD 70

- Non-Prescription

- Up to USD 25

- USD 25 to USD 50

- USD 50 to USD 100

- USD 100 to USD 150

- Above USD 150

Based on Application:

- Oil & Gas

- Construction

- Industrial Manufacturing

- Military & Public Sectors

- Others

Based on Distribution Channel:

- Business to Business (B2B)

- Direct to Consumers (D2C)

- Others

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern and Western Region

India Safety Eyewear Market shows significant concentration in the Northern region, which accounts for approximately 24% of total share. The states of Uttar Pradesh, Punjab, Haryana and Delhi host extensive manufacturing clusters and construction projects that drive steady demand for certified safety glasses. Western region holds about 26% share, led by Maharashtra and Gujarat’s automotive, chemical and petrochemical plants. It leverages well-established distribution networks and B2B procurement channels in major industrial hubs. Regular infrastructure upgrades in both regions support volume sales. Procurement managers in these areas prioritize compliance with national and international safety standards.

Southern Region

Southern region commands the largest share at nearly 32% in the India Safety Eyewear Market. Tamil Nadu’s automotive clusters, Karnataka’s IT and electronics manufacturing and Andhra Pradesh’s infrastructure projects anchor high-volume purchases of impact-resistant eyewear. It benefits from proactive state-level safety regulations and strong enforcement in industrial zones. Rapid port expansion and export-oriented units generate demand for specialized protective frames. E-commerce platforms enjoy strong adoption in metropolitan centers such as Bangalore and Chennai. Local manufacturers collaborate with distributors to shorten delivery times. This region sets benchmarks for ergonomic design and custom-fit solutions.

Eastern Region

Eastern region comprises roughly 18% of the India Safety Eyewear Market. Industrial hubs in West Bengal and Odisha drive demand for heavy-duty and anti-fog eyewear in steel, mining and power generation sectors. It faces slower adoption in Bihar and Jharkhand due to lower per-capita investment in PPE procurement. Government incentives for regional development and infrastructure schemes create new opportunities. Local distributors expand warehouses to improve reach in remote districts. Training initiatives with safety consultants increase awareness among procurement teams. This region’s growth remains tied to balanced focus on affordability and compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Titan Eye Plus

- Stylrite Opticals

- Chandan Optical Industries

- Lenskart

- Honeywell International, Inc.

- 3M

Competitive Analysis

The India Safety Eyewear Market is shaped by a mix of global manufacturers and domestic optical brands, including Titan Eye Plus, Stylrite Opticals, Chandan Optical Industries, Lenskart, Honeywell International, Inc., and 3M. These companies compete by addressing the growing demand for protective eyewear across industrial, healthcare, and construction sectors. Rising awareness of workplace safety, supported by government initiatives and stricter compliance norms, has created opportunities for both premium and value-based product segments. Local companies focus on affordability, accessibility, and product customization to cater to the diverse needs of industrial workers, healthcare staff, and construction professionals. Their wide distribution networks and established retail presence allow them to serve both urban and semi-urban markets effectively. International manufacturers bring advanced technology and globally certified products to the market, appealing to safety-conscious enterprises in manufacturing hubs and large infrastructure projects. These players emphasize features such as anti-fog lenses, UV protection, and impact resistance, addressing the needs of high-risk work environments. Many companies have partnered with local distributors and industrial suppliers to ensure timely delivery and after-sales support. The market is also witnessing growing investment in e-commerce platforms, enabling broader customer outreach and streamlined product availability. Increasing government regulations on workplace safety and employer responsibility further drive demand for high-quality protective eyewear. The competitive landscape continues to evolve, with both domestic and global participants expanding their portfolios, improving pricing strategies, and enhancing product visibility to secure a larger share of this expanding market.

Recent Developments

- In April 2024, Popticals, a premium eyewear brand, launched the POPZULU Ops Edition, a line of ballistic glasses and safety eyewear. POPZULU is designed for tactical and industrial environments, offering full-scale defense with lenses engineered to shield and a frame that can collapse into a pocket-sized hard-shell case. The POPZULU sunglasses feature an innovative frame design and patented FL2 Micro-Rail System technology for collapsibility. They are crafted using high-quality materials like Hydrophobic Ri-Pel coating, Grilamid TR90 for lightweight and durability, and Impacto lenses from Carl Zeiss Vision that are 5X more resistant to hits and stresses than polycarbonate.

- In April 2024, Innovative Eyewear, Inc. announced filing two new U.S. patent applications related to its new Lucyd Armor smart safety glasses product, which is planned for introduction in mid-2024. The utility patent application covers the product’s functional aspects, while the design patent application covers its ornamental design.

- In March 2024, Protective Industrial Products (PIP), a leader in personal protective equipment, acquired Scope Optics Pty Ltd., a safety eyewear company based in Australia. By incorporating Scope Optics’ safety eyewear into its existing portfolio of eye protection brands, PIP is adding a wider selection of premium designs, advanced lens technologies, and exceptional value to serve its customers better. The acquisition of Scope Optics is another example of PIP’s proven acquisition strategy to strengthen its portfolio of head-to-toe PPE solutions.

Market Concentration & Characteristics

Major domestic and multinational firms account for a significant portion of the India Safety Eyewear Market, with Titan Eye Plus, Honeywell International and 3M collectively capturing over half of total revenue through extensive distribution networks and premium product portfolios. It features a mix of high-volume B2B contracts with infrastructure and manufacturing giants alongside D2C channels that serve individual workers and small enterprises. Price-sensitive segments rely on regional players such as Stylrite Opticals and Chandan Optical Industries, which leverage lower operating costs to offer competitive non-prescription models. Product tiers span from basic impact-resistant frames under USD 25 to advanced smart-glasses above USD 150, catering to diverse budget requirements. Regulatory mandates under the Factories Act and Mines Act sustain steady demand, while multichannel distribution—including e-commerce, safety retailers and direct sales teams—ensures broad geographic coverage. This structure yields moderate concentration at the top and healthy competition across mid- and lower-tier segments.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Safety Eyewear Market is expected to witness steady growth driven by rising awareness of workplace safety.

- Government regulations and compliance mandates will continue to strengthen the demand for certified safety eyewear across industries.

- Manufacturing, construction, and healthcare sectors will remain major contributors to market expansion.

- Domestic production capabilities are likely to improve, reducing dependence on imported products.

- Technological advancements will lead to the development of lightweight, durable, and comfort-focused eyewear.

- Increasing digital penetration will boost online sales channels, making products more accessible in Tier II and Tier III cities.

- Demand for customized and stylish safety eyewear will rise as employers focus on employee comfort and adoption.

- Small and mid-sized enterprises will contribute significantly to demand due to growing safety audits and compliance awareness.

- Training and safety awareness programs by companies and government agencies will encourage regular use of safety eyewear.

- Competitive pricing and expansion of retail networks will support higher market penetration across urban and semi-urban areas.