Market Overview

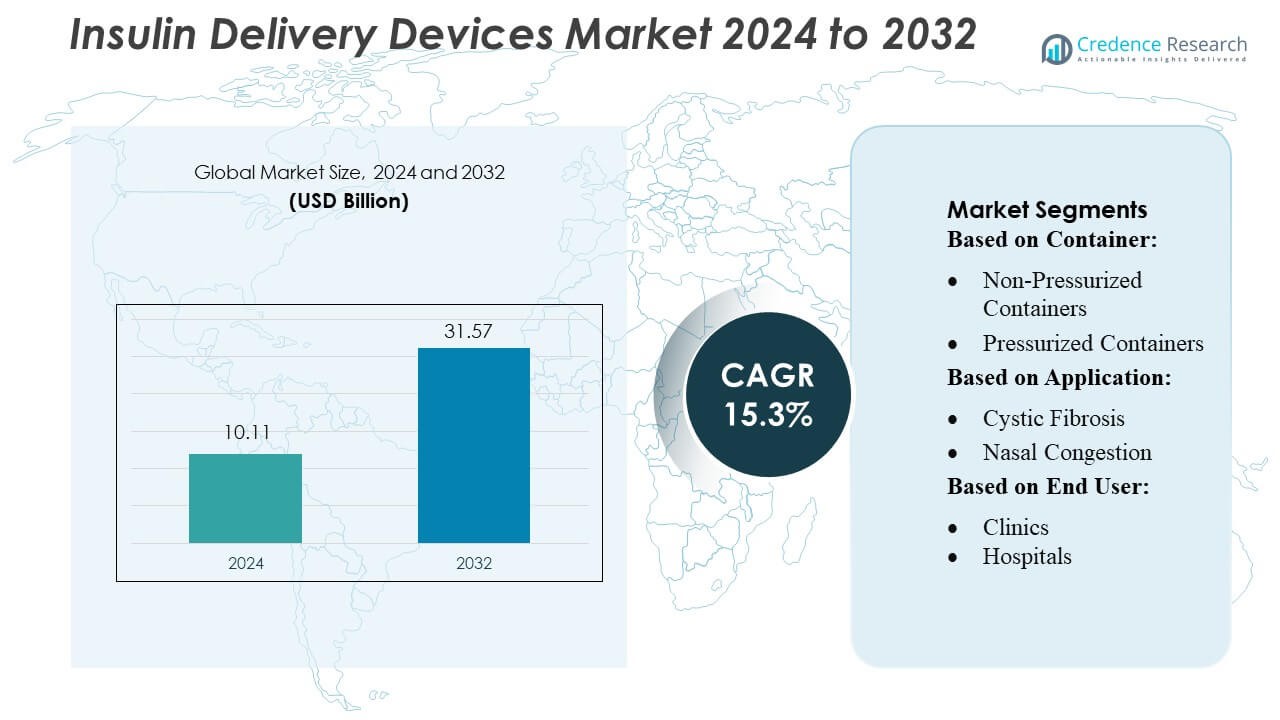

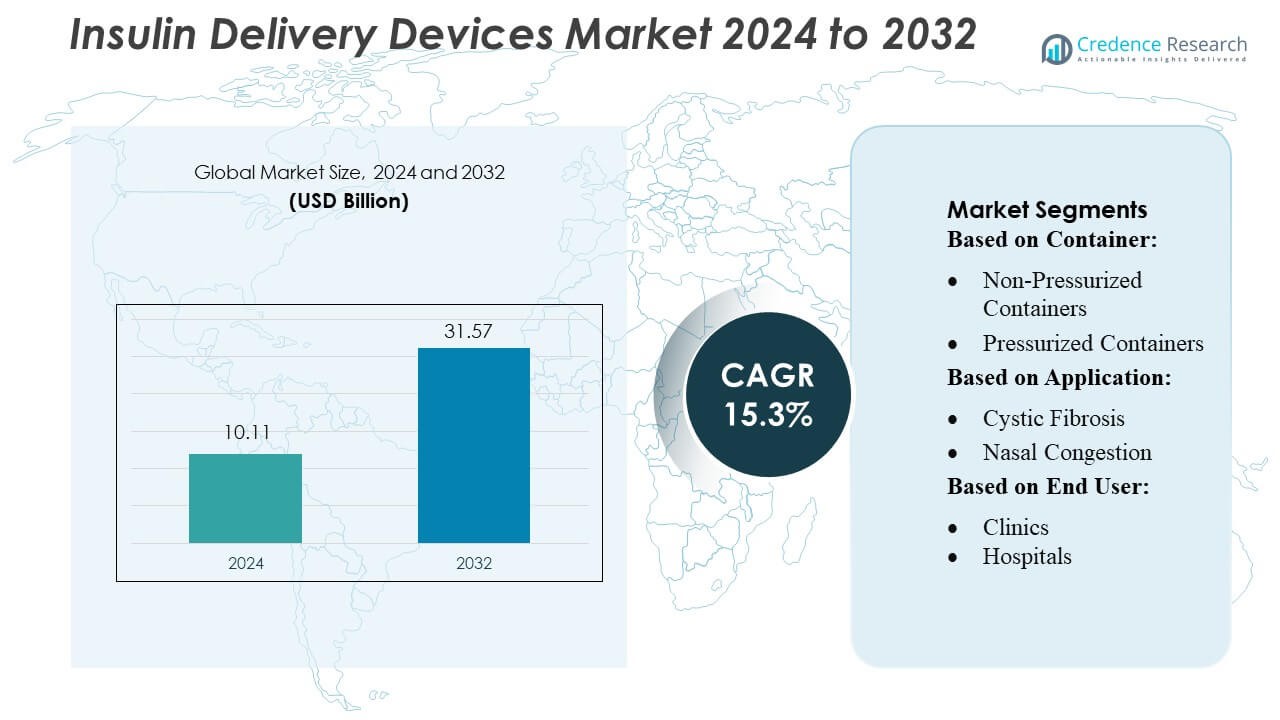

Insulin Delivery Devices Market size was valued USD 10.11 billion in 2024 and is anticipated to reach USD 31.57 billion by 2032, at a CAGR of 15.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insulin Delivery Devices Market Size 2024 |

USD 10.11 Billion |

| Insulin Delivery Devices Market, CAGR |

15.3% |

| Insulin Delivery Devices Market Size 2032 |

USD 31.57 Billion |

The insulin delivery devices market is shaped by strong competition among leading global manufacturers that continue to expand portfolios in smart insulin pens, advanced pumps, and wearable delivery systems. Major companies maintain their advantage through sustained R&D investments, digital health integration, and patient-centric device innovations that improve dosing accuracy and therapy adherence. North America remains the leading region, accounting for approximately 38–40% of the global market share, driven by high diabetes prevalence, strong reimbursement structures, and the rapid adoption of automated and connected insulin delivery technologies across both clinical and home-care settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The insulin delivery devices market was valued at USD 10.11 billion in 2024 and is projected to reach USD 31.57 billion by 2032, registering a strong CAGR of 15.3% during the forecast period.

- Rising diabetes prevalence, increasing adoption of smart insulin pens, and rapid shift toward automated and minimally invasive insulin pumps collectively drive strong market expansion across all major end-user groups.

- Digital health integration, wearable patch pumps, Bluetooth-enabled pens, and AI-assisted dosing systems remain key trends transforming device performance, patient adherence, and long-term treatment outcomes.

- Competitive intensity increases as global manufacturers strengthen R&D pipelines, enhance device connectivity, and expand into emerging markets, though high device costs and reimbursement gaps continue to restrain broader adoption.

- North America leads the market with 38–40% share, while insulin pens represent the dominant device segment, supported by ease of use and high patient acceptance; Asia-Pacific shows the fastest growth due to expanding healthcare access and rising diabetes incidence.

Market Segmentation Analysis:

By Container

The non-pressurized container segment dominates the market, accounting for an estimated over 60% share, driven by its wider adoption in metered-dose delivery systems used for chronic respiratory therapies. Manufacturers increasingly prefer non-pressurized formats due to lower production complexity, improved portability, and enhanced compatibility with a broad range of formulations. Their ability to support precise dosing and reduced contamination risk further accelerates uptake across home-care settings. Pressurized containers continue to serve niche therapeutic uses but face slower expansion as healthcare providers favor safer, user-friendly, and cost-efficient non-pressurized alternatives.

- For instance, Novo Nordisk’s FlexTouch® pen holds 300 units in a 3 mL prefilled cartridge and uses a unique spring-loaded mechanism that ensures consistent and low-force dose delivery, simplifying the injection process compared to traditional vial and syringe methods and meeting all modern quality standards for drug administration.

By Application

Asthma represents the leading application segment, holding approximately 45–50% of market share, supported by high global disease prevalence and rising demand for consistent, rapid-acting inhalation therapies. Increased diagnosis rates, particularly among pediatric and elderly populations, strengthen adoption of advanced delivery systems designed for improved dose accuracy and faster drug deposition. COPD follows as the second-largest segment due to expanding smoking-related disease burdens. Applications such as rhinitis, cystic fibrosis, and nasal congestion experience steady growth, supported by broader clinical acceptance of inhalation-based therapies and the shift toward non-invasive drug delivery.

- For instance, Sanofi’s Dupixent® has demonstrated in the Phase 4 VESTIGE trial that 56.9% of treated asthma patients achieved a fractional exhaled nitric oxide (FeNO) level of less than 25 ppb by Week 24 (vs. 10.8% with placebo), illustrating its efficacy in reducing airway inflammation and mucus plugging.

By End User

The hospital segment accounts for the largest share, estimated at over 50%, driven by high patient inflow, availability of advanced diagnostic infrastructure, and the need for accurate administration of inhaled therapies in acute and chronic care. Hospitals strongly adopt specialized delivery devices for managing asthma exacerbations, COPD flare-ups, and cystic fibrosis complications. Clinics and ambulatory surgical centers expand steadily due to rising outpatient care and cost-efficient treatment models. The “others” category—including home-care users—grows consistently as device portability improves and patient preference shifts toward self-managed inhalation therapy.

Key Growth Drivers

Rising Global Diabetes Prevalence

The global rise in Type 1 and Type 2 diabetes cases continues to be the primary driver of the insulin delivery devices market. Increasing obesity, sedentary lifestyles, and aging populations significantly elevate insulin dependence, compelling healthcare systems to adopt more efficient delivery technologies. Governments and private insurers strengthen reimbursement frameworks for insulin pens and pumps, accelerating device uptake. As patient volumes expand across both developed and emerging economies, manufacturers experience growing demand for portable, user-friendly, and high-precision insulin delivery solutions.

- For instance, Next-Generation FlexPen® delivers up to 60 units per injection in one-unit increments, while the pen itself holds a total of 300 units.

Shift Toward Advanced and Minimally Invasive Insulin Technologies

The market benefits from rapid technological advancements in pen injectors, patch pumps, tubeless pumps, and automated insulin delivery platforms. Patients increasingly prefer painless, minimally invasive solutions that simplify daily glucose management. Smart insulin pens with dose-logging features, integrated mobile apps, and safety alarms enhance treatment adherence. Automated pumps combined with continuous glucose monitoring (CGM) devices enable real-time insulin optimization, reducing manual input. These innovations improve therapeutic outcomes, making advanced devices more appealing to both clinicians and patients, fueling substantial market expansion.

- For instance, Owen Mumford Ltd. recently introduced a 4 mm, 32-gauge version of its Unifine Pentips Plus pen needle, which reduces penetration force and incorporates a built-in one-hand needle remover.

Growing Adoption of Home-Based and Self-Managed Insulin Therapy

The rise of home-care treatment models strengthens demand for portable, easy-to-use insulin delivery devices. Patients seek autonomy in managing glucose levels, reducing dependency on clinical visits and improving treatment convenience. Modern insulin pens, connected pumps, and disposable patch devices support accurate dosing without extensive training. Expanded digital integration enables remote monitoring and physician oversight, enhancing clinical decision-making. As health systems emphasize cost reduction and chronic disease management at home, the adoption of self-administered insulin devices accelerates across both mature and developing markets.

Key Trends & Opportunities

Integration of Smart Connectivity and Digital Health Platforms

Digitalization is becoming a major trend, with Bluetooth-enabled pens, data-driven pumps, and AI-supported dosing algorithms reshaping insulin therapy. These connected solutions offer real-time tracking, automated dose recommendations, and seamless integration with CGMs and mobile apps. Digital health ecosystems enable data sharing among patients, caregivers, and clinicians, improving monitoring of glycemic patterns. As telehealth expands globally, device manufacturers gain opportunities to embed analytics and predictive modeling into insulin systems, creating a more personalized and technology-driven insulin management landscape.

- For instance, Medtronic’s MiniMed™ 780G system, for instance, features its latest SmartGuard™ algorithm, which automatically adjusts insulin every 5 minutes and delivers autocorrections to maintain tighter glucose control.

Expansion of Wearable and Patch-Based Insulin Delivery Systems

Wearable insulin patch pumps represent a strong growth opportunity due to their compact design, ease of use, and needle-concealed delivery mechanisms. These devices eliminate tubing, enhance patient comfort, and provide continuous basal delivery with minimal user interaction. Their growing adoption among pediatric and elderly populations highlights the appeal of discreet and low-burden treatment options. Manufacturers continue improving battery life, adhesive durability, and reservoir capacity, positioning patch pumps as a preferred alternative for patients seeking simplified insulin administration without the complexity of conventional pump systems.

- For instance, Insulet Corporation’s Omnipod® 5, for instance, delivers insulin through a completely tubeless patch pump that holds up to 200 units and is designed for up to 72 hours of continuous wear. Its SmartAdjust™ algorithm integrates with the Dexcom G6 CGM to automatically modulate insulin delivery every 5 minutes, optimizing glucose control without manual intervention.

Opportunities in Emerging Markets and Value-Based Care Models

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer substantial growth potential as diabetes incidence rises and healthcare investments expand. Governments increasingly promote value-based care, supporting affordable insulin pens and reusable devices to improve treatment accessibility. Local manufacturing partnerships reduce costs and enhance distribution efficiency. Companies offering low-cost delivery systems, patient education programs, and digital monitoring platforms gain a competitive advantage. As awareness of glycemic control improves, emerging markets become a strategic growth frontier for insulin delivery device manufacturers.

Key Challenges

High Cost of Advanced Insulin Delivery Devices

Despite technological progress, advanced pumps, smart pens, and integrated CGM–pump systems remain expensive for a large segment of patients, especially in low- and middle-income regions. Limited insurance coverage and high out-of-pocket expenses restrain adoption, directing many users toward traditional syringes or basic pens. These cost constraints slow the penetration of innovative devices and hinder equitable access to advanced diabetes care. Manufacturers face ongoing pressure to balance technological advancement with affordability to expand market reach and support broader patient adoption.

Regulatory Complexity and Device Safety Concerns

Insulin delivery devices must comply with stringent regulatory standards to ensure safety, accuracy, and reliability. Complex approval processes, frequent audits, and evolving cybersecurity requirements for connected devices pose challenges for manufacturers. Device recalls due to dosing errors, mechanical failures, or software malfunctions can impact patient trust and increase compliance burdens. Additionally, integrating digital components requires meeting interoperability and data security guidelines. These regulatory and safety pressures slow product launches and increase development costs, affecting overall market competitiveness.

Regional Analysis

North America

North America holds the largest share of the global insulin delivery devices market at approximately 38–40%, supported by high diabetes prevalence, strong reimbursement systems, and widespread adoption of advanced insulin pumps and smart pens. The U.S. leads regional growth with rapid uptake of connected devices integrated with continuous glucose monitoring platforms. Favorable regulatory pathways and high patient awareness accelerate usage across home-care settings. Growing demand for minimally invasive and automated insulin delivery solutions further strengthens the region’s dominance, while increasing investments by leading manufacturers continue to enhance technological innovation and product availability.

Europe

Europe accounts for around 28–30% of the global market, driven by structured diabetes management programs, strong healthcare infrastructure, and early adoption of automated and wearable insulin delivery systems. Countries such as Germany, the U.K., France, and the Nordics lead demand for advanced insulin pumps and digitally integrated delivery devices. Supportive reimbursement frameworks and government initiatives focusing on chronic disease management strengthen market penetration. Increasing preference for reusable insulin pens and eco-friendly device designs also stimulates innovation. Rising geriatric populations and expanding home-care utilization continue to support steady, long-term market growth across the region.

Asia-Pacific

The Asia-Pacific region represents about 22–24% of the global market and is the fastest-growing due to rising diabetes incidence, expanding healthcare access, and strong demand for cost-effective insulin delivery solutions. China and India drive regional expansion, benefiting from large patient populations and increasing government focus on diabetes screening and management. Adoption of insulin pens grows rapidly due to affordability and ease of use, while awareness of pump-based therapy increases gradually. Local manufacturing initiatives, favorable pricing regulations, and the growth of digital health ecosystems create significant opportunities for manufacturers to scale within emerging APAC markets.

Latin America

Latin America holds approximately 6–7% of the global market, supported by rising diabetes burden and gradual expansion of modern insulin delivery options. Brazil and Mexico represent the primary growth hubs, driven by improving healthcare infrastructure and increasing availability of advanced pen injectors. Adoption of insulin pumps remains limited due to cost barriers, though uptake is improving in urban centers. Government efforts to enhance chronic disease management and expand access to essential diabetes therapies support market progression. Growing investment in patient education and home-based care further strengthens demand for reliable, user-friendly insulin delivery devices.

Middle East & Africa

The Middle East & Africa account for around 4–5% of the global insulin delivery devices market, characterized by rising diabetes prevalence and increasing modernization of healthcare services. Gulf Cooperation Council (GCC) nations contribute the majority share due to higher healthcare spending, stronger insurance coverage, and growing adoption of smart insulin pens. In Africa, limited affordability and infrastructure constraints hinder the uptake of advanced devices, although insulin pens continue gaining traction due to simplicity and reliability. As awareness programs expand and healthcare modernization accelerates, gradual market growth is expected across both public and private care settings.

Market Segmentations:

By Container:

- Non-Pressurized Containers

- Pressurized Containers

By Application:

- Cystic Fibrosis

- Nasal Congestion

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The insulin delivery devices market remains highly competitive, led by major players such as Tandem Diabetes Care, Inc., Sanofi, B. Braun SE, Novo Nordisk A/S, Owen Mumford Ltd., Medtronic, Insulet Corporation, BD (Becton, Dickinson, and Company), Eli Lilly and Company, and Ypsomed AG. The insulin delivery devices market is characterized by strong technological innovation, expanding product portfolios, and increasing competition driven by the global rise in diabetes prevalence. Manufacturers focus on developing advanced insulin pumps, smart pens, and integrated delivery platforms that enhance dosing accuracy and patient convenience. Digital connectivity, automated insulin adjustment, and compatibility with continuous glucose monitoring systems have become central differentiators. Companies also prioritize miniaturization, improved safety features, and user-friendly designs to support home-based diabetes management. Growing demand in emerging markets and expanding reimbursement support further intensify competition, encouraging continuous investment in R&D, strategic partnerships, and product upgrades to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tandem Diabetes Care, Inc.

- Sanofi

- Braun SE

- Novo Nordisk A/S

- Owen Mumford Ltd.

- Medtronic

- Insulet Corporation

- BD (Becton, Dickinson, and Company)

- Eli Lilly and Company

- Ypsomed AG

Recent Developments

- In January 2025, Phillips Medisize, a Molex company, completed the acquisition of Vectura Group Ltd., enhancing its inhalation drug delivery capabilities. This strategic move adds expertise in dry powder inhalers, metered dose inhalers, nasal inhalers, and nebulizers, broadening Phillips Medisize’s portfolio in pharmaceutical device design and manufacturing.

- In January 2025, Nipro and Nemera announced the successful compatibility testing of Nemera’s UniSpray device with Nipro’s unit-dose microvials. This collaboration aims to enhance nasal drug delivery by combining Nipro’s precision glass vials with Nemera’s intuitive nasal spray device, offering a reliable solution for single-dose nasal medication administration.

- In March 2023, Diabeloop SA collaborated with Novo Nordisk A/S to integrate Diabeloop’s DBL-4pen™ self-learning algorithm with Novo Nordisk’s connected and reusable insulin pens, the NovoPen® 6 and NovoPen Echo® Plus.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt smart, connected insulin pens and pumps that enable real-time dosing insights and remote monitoring.

- Automated insulin delivery systems integrating continuous glucose monitoring will become standard for advanced diabetes management.

- Wearable and tubeless patch pumps will gain wider acceptance due to improved comfort, portability, and ease of use.

- Digital health platforms will enhance treatment personalization through data analytics, AI-based dosing support, and patient–clinician connectivity.

- Emerging markets will experience accelerated adoption as awareness, healthcare access, and local manufacturing capacities expand.

- Device miniaturization and minimally invasive technologies will drive patient preference for discreet and low-burden insulin administration.

- Manufacturers will focus on sustainability by developing reusable pens and eco-friendly consumables.

- Home-based diabetes management will grow rapidly, increasing demand for portable and self-administered insulin devices.

- Greater reimbursement support and policy reforms will boost adoption of advanced insulin delivery technologies.

- Strategic collaborations between medtech, pharmaceutical, and digital health companies will fuel innovation and competitive differentiation.