Market Overview

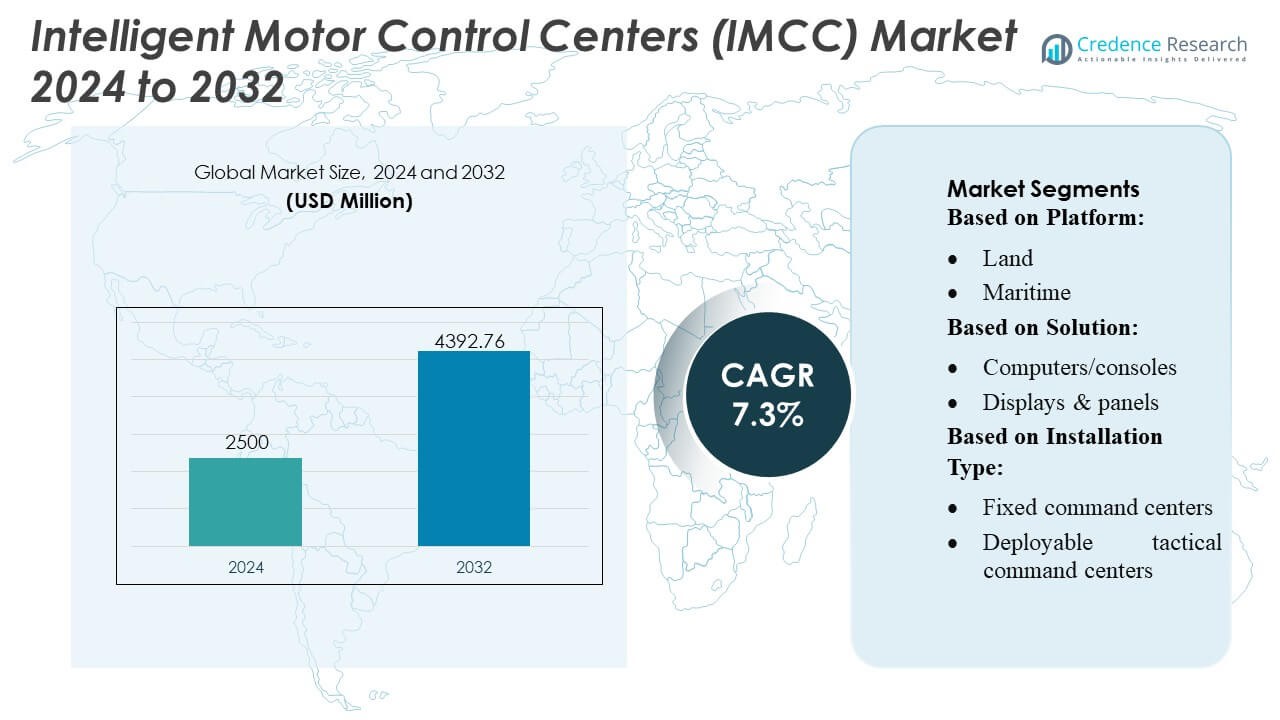

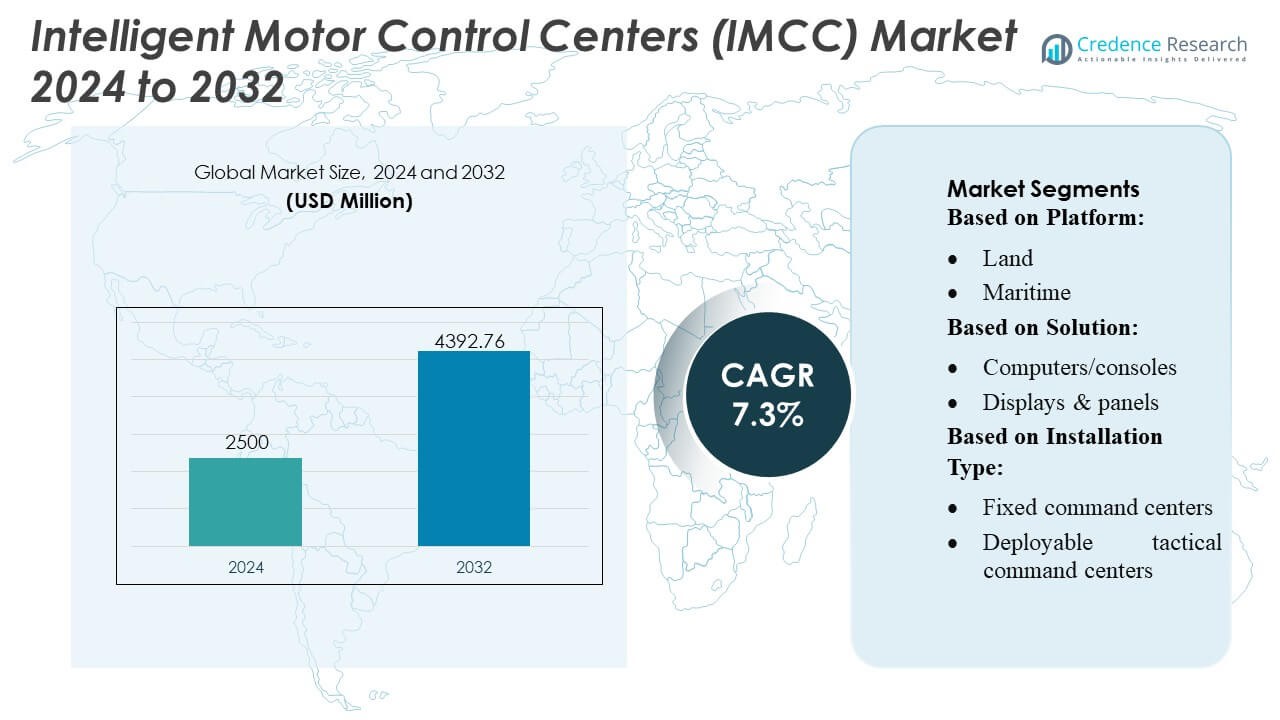

Intelligent Motor Control Centers (IMCC) Market size was valued USD 2500 million in 2024 and is anticipated to reach USD 4392.76 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Motor Control Centers (IMCC) Market Size 2024 |

USD 2500 Million |

| Intelligent Motor Control Centers (IMCC) Market, CAGR |

7.3% |

| Intelligent Motor Control Centers (IMCC) Market Size 2032 |

USD 4392.76 Million |

The Intelligent Motor Control Centers (IMCC) Market is shaped by a mix of global automation manufacturers, electrical infrastructure specialists, and regional engineering firms that compete through advancements in digital diagnostics, predictive maintenance, arc-resistant designs, and energy-efficient motor management solutions. Vendors focus on integrating IIoT connectivity, intelligent relays, and scalable modular architectures to meet rising industrial automation demands across process-intensive sectors. Asia-Pacific leads the global IMCC market with an exact 33–35% share, driven by rapid industrial expansion, strong investments in manufacturing and power infrastructure, and accelerated adoption of smart factory technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Intelligent Motor Control Centers (IMCC) Market was valued at USD 2500 million in 2024 and is projected to reach USD 4392.76 million by 2032, registering a CAGR of 7.3% during the forecast period.

- Demand rises as industries adopt intelligent relays, IIoT integration, and predictive maintenance tools, driving strong market growth across process industries seeking higher energy efficiency and reduced downtime.

- Key trends include expanding use of digital diagnostics, arc-resistant designs, and modular IMCC architectures that support scalable automation upgrades in both greenfield and brownfield facilities.

- Competitive intensity increases as global automation vendors and regional engineering firms innovate in smart monitoring, advanced protection systems, and lifecycle service offerings despite cost constraints and integration challenges.

- Asia-Pacific leads with a 33–35% regional share, supported by rapid industrialization, while microscopes or intelligent modules (depending on segmentation) hold the dominant segment share due to their extensive use in high-load industrial motor applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Platform

The Intelligent Motor Control Centers (IMCC) Market is led by the land-based platform, accounting for the largest market share of over 45% due to extensive deployment across manufacturing plants, oil & gas facilities, metal processing units, and power generation sites. Its dominance stems from rising automation adoption, high energy-efficiency requirements, and modernization of legacy motor-control infrastructure. Maritime, airborne, and space platforms expand gradually as naval fleets, aerospace programs, and satellite manufacturing facilities integrate advanced motor-control architectures to enhance operational reliability, reduce downtime, and support predictive maintenance in mission-critical environments.

- For instance, Daikin Industries, Ltd. has developed a fluoro‑polymer‑based fuel‑line hose material that supports continuous operation at temperatures down to −40 °C and withstands 100 000 cycles of flexing while maintaining less than 0.1 g/day fuel permeation.

By Solution

Hardware represents the dominant solution segment with nearly 50% share, driven by widespread demand for intelligent overload relays, smart circuit breakers, motor protection devices, and high-performance networking components supporting Industry 4.0 architectures. Growth accelerates as industrial operators transition toward digitalized assets requiring real-time diagnostics and secure data transmission across motors, drives, and plant-wide automation systems. Software and services segments gain momentum as plants adopt advanced analytics, digital monitoring dashboards, remote asset-management tools, system integration, and lifecycle support packages that enhance uptime, reduce maintenance costs, and optimize motor-control workflows.

- For instance, Mitsubishi Electric E22C30300 Indoor Fan Motor, matches the provided specifications. It operates at approximately 30 W power (listed as 28 watts or 30 watts depending on the retailer). It has a 5/16″ shaft diameter.

By Installation Type

Fixed command centers dominate the installation landscape with over 40% market share, supported by large industrial complexes, refineries, power plants, and chemical facilities that rely heavily on permanently installed IMCCs for centralized motor control and uninterrupted process automation. Their leadership is reinforced by the need for robust safety systems, scalable control architectures, and high-capacity motor management capabilities. Deployable tactical units, vehicle-mounted systems, and mobile command units witness rising adoption across utilities, mining, and field-operations where rapid deployment, flexibility, and remote operation of motor-intensive equipment are essential for improving reliability and reducing operational delays.

Key Growth Drivers

1. Rising Adoption of Industrial Automation and Smart Manufacturing

The IMCC market expands as manufacturing plants accelerate automation to improve operational efficiency, asset reliability, and energy optimization. Smart factories increasingly deploy IMCCs to integrate real-time diagnostics, predictive maintenance algorithms, and automated fault isolation, reducing downtime and enhancing equipment protection. Growing adoption across sectors such as oil & gas, power generation, water treatment, and chemicals boosts demand for intelligent motor control solutions. The shift toward Industry 4.0, with interconnected motor systems and digital control architectures, further strengthens IMCC deployment across both new installations and modernization projects.

- For instance, Bosch’s EC motor for electric cooling fans supports a power range of 500 W to 850 W, offers a service life exceeding 8,000 h and retains high efficiency in harsh ambient conditions.

2. Growing Focus on Energy Efficiency and Load Optimization

Industries prioritize energy-efficient motor operations due to rising electricity costs and stringent energy-management regulations. IMCCs enable continuous monitoring of load parameters, power quality, thermal stress, and consumption patterns, allowing users to optimize motor performance and reduce wastage. Their ability to integrate variable frequency drives, intelligent relays, and analytics platforms improves process efficiency and ensures compliance with energy-efficiency standards. As sustainability commitments accelerate globally, demand increases for advanced motor control centers capable of optimizing plant-level energy usage and supporting decarbonization initiatives in high-load industrial environments.

- For instance, Lochinvar CENTRUS™ Residential Hydronic Heat Pump (Model RAH040) are confirmed by official product literature. Delivers up to 41,000 Btu/hr (approximately 12.0 kW). Delivers up to 34,800 Btu/hr (approximately 10.2 kW).

3. Increased Demand for Predictive Maintenance and Condition Monitoring

Manufacturers invest in IMCCs to strengthen predictive maintenance and reduce unplanned downtime caused by motor failures. IMCCs deliver actionable insights through embedded sensors, communication modules, and analytics software that track vibration, temperature, insulation health, and torque variations. These systems help maintenance teams detect anomalies before they escalate, extending equipment life and minimizing repair costs. The rapid shift from reactive to predictive maintenance strategies across industrial sectors, supported by growing IIoT adoption, drives IMCC penetration as organizations seek reliable, data-driven motor control solutions.

Key Trends & Opportunities

1. Integration of IIoT, Cloud Platforms, and Edge Computing

The market benefits from rapid integration of IIoT-enabled modules, cloud analytics, and edge intelligence into MCC architectures. Intelligent controllers collect high-resolution motor data, which can be analyzed in real time to enhance decision-making and enable remote diagnostics. Vendors increasingly offer edge-based processing to reduce latency in mission-critical applications such as mining, metals, and large-scale manufacturing. This creates opportunities for advanced digital twin modeling, remote condition-based control, and fleet-level performance benchmarking across large industrial networks.

- For instance, Daikin’s FIT heat pump model DH6VS features a It features a variable-speed swing compressor and inverter technology. It offers rated performance of up to 19.0 SEER2, up to 12 EER2, and up to 8.8 HSPF2. These performance ratings apply to units with capacities ranging from 1.5 to 5 tons.

2. Expansion of Modular, Scalable, and Arc-Resistant Designs

A key trend is the shift toward modular IMCC configurations that allow faster customization, simplified installation, and reduced maintenance downtime. Demand grows for arc-resistant and compartmentalized designs offering enhanced operator safety and compliance with global electrical safety standards. Industries with hazardous environments—oil & gas, petrochemicals, and mining—create strong opportunities for advanced safety-rated IMCCs capable of withstanding electrical faults. This trend accelerates adoption among brownfield facilities seeking to upgrade legacy MCCs with safer, compact, and scalable intelligent units.

- For instance, Bosch Home Comfort has introduced new inverter-driven mini-split and ducted heat pump systems that utilize the low-GWP refrigerant R-454B (which has a Global Warming Potential (GWP) of 470).

3. Growing Adoption in Renewable Energy and Utility Modernization

Increasing investment in renewable energy infrastructure—solar farms, wind plants, and battery energy storage systems—creates new opportunities for intelligent motor control centers. Their ability to manage distributed electrical loads, ensure fault-tolerant operation, and support high automation levels benefits utilities modernizing transmission and distribution networks. IMCCs enhance reliability in auxiliary systems such as cooling motors, trackers, pumps, and power-handling equipment. As countries expand grid modernization programs, demand strengthens for intelligent motor controls that ensure grid stability and improved energy management.

Key Challenges

1. High Initial Investment and Complex Integration Requirements

IMCC deployment requires substantial upfront investment due to the cost of intelligent relays, communication modules, and advanced monitoring systems. Integration with legacy control infrastructure adds complexity, often demanding specialized engineering capabilities and plant-wide system upgrades. Small and medium enterprises may face budget constraints or lack the technical expertise to adopt advanced IMCC architectures. These factors slow adoption rates, especially in cost-sensitive markets or facilities operating older electrical systems with limited digital compatibility.

2. Cybersecurity Risks Associated with Connected Motor Systems

Increasing connectivity of IMCCs to plant networks, cloud platforms, and remote monitoring systems introduces cybersecurity vulnerabilities. Unauthorized access to motor control networks can cause operational disruptions, equipment damage, or safety hazards. Many industries lack robust cybersecurity frameworks to secure sensor data, communication protocols, and control logic. Ensuring secure integration of IIoT devices, deploying encrypted communication, and maintaining multi-layered network protection becomes essential. These cybersecurity concerns remain a critical barrier for organizations planning to deploy highly connected IMCC solutions.

Regional Analysis

North America

North America holds the largest share of around 32–34% in the global IMCC market, supported by strong adoption of industrial automation, large-scale modernization of electrical infrastructure, and high penetration of IIoT-enabled motor control systems. The U.S. leads regional demand due to extensive investments in oil & gas, water treatment, mining, and advanced manufacturing facilities requiring intelligent, fault-tolerant MCCs. Strict energy-efficiency regulations and strong emphasis on predictive maintenance further drive IMCC deployment. The presence of major automation vendors and widespread digitalization initiatives strengthens North America’s leadership position in next-generation motor control technologies.

Europe

Europe accounts for approximately 26–28% of the IMCC market, driven by rapid industrial modernization across Germany, France, Italy, and the U.K. The region benefits from stringent safety standards, strong focus on energy efficiency, and rising adoption of smart electrical distribution systems. IMCC demand accelerates in industries such as automotive, chemicals, food & beverage, and power utilities seeking to improve operational reliability through advanced condition monitoring and digital diagnostics. Europe’s decarbonization agenda and transition toward automated, energy-efficient plants continue to expand opportunities for intelligent motor control systems, especially in high-load industrial environments.

Asia-Pacific

Asia-Pacific captures the highest growth momentum and holds around 33–35% of the global market, driven by industrial expansion across China, India, Japan, and Southeast Asia. The region experiences strong demand for IMCCs due to rapid development in manufacturing, oil & gas, steel, cement, and power generation sectors. Government-led digital transformation programs and heavy investments in utilities, renewable energy, and smart factories strengthen adoption. Cost-sensitive industries increasingly deploy IMCCs to reduce downtime, enhance safety, and manage rising energy consumption. The availability of low-cost manufacturing and expanding automation ecosystems accelerates IMCC penetration across new and retrofitted facilities.

Latin America

Latin America represents about 6–8% of the IMCC market, supported by ongoing automation upgrades in mining, metals, oil & gas, and water infrastructure. Countries such as Brazil, Mexico, and Chile drive demand as industries modernize outdated electrical systems to improve productivity and reduce operational risks. Investments in power distribution, petrochemicals, and large mining operations create opportunities for IMCCs equipped with advanced protection and monitoring capabilities. However, economic volatility and limited digital expertise slow adoption in several markets. Despite these constraints, the region continues to transition toward intelligent motor control solutions for long-term industrial efficiency.

Middle East & Africa

The Middle East & Africa region holds a 4–6% market share, driven primarily by strong capital investments in oil & gas, petrochemicals, desalination plants, and large power projects. Gulf nations increasingly deploy IMCCs to enhance operational safety, manage high-load motors, and support predictive maintenance in critical infrastructure. Africa’s industrialization and expansion of mining and utilities also contribute to gradual demand growth. However, slower adoption of advanced automation and limited local manufacturing capacity remain challenges. Despite this, large-scale energy projects and modernization of process industries continue to support steady IMCC market expansion.

Market Segmentations:

By Platform:

By Solution:

- Computers/consoles

- Displays & panels

By Installation Type:

- Fixed command centers

- Deployable tactical command centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Intelligent Motor Control Centers (IMCC) Market features a diverse mix of global and regional participants, including Cape Electrical Supply Integration, GT Engineering, Boerstn Electric Co., Ltd, Eaton, Mitsubishi Electric Corporation, Allis Electric Co., Ltd., Powell Industries, Ingeteam SA, ABB, and EAMFCO. The Intelligent Motor Control Centers (IMCC) Market is highly competitive, driven by continuous innovation in digital motor management, safety-enhanced architectures, and automation-enabled control technologies. Vendors focus on integrating IIoT connectivity, edge analytics, and advanced fault-detection systems to strengthen operational reliability across high-load industrial environments. Product differentiation increasingly centers on arc-resistant designs, modular configurations, and energy-efficient intelligent relays engineered for complex process industries. Companies expand their market presence through strategic collaborations with EPC contractors, automation integrators, and utility operators to support large-scale industrial modernization. Growing interest in predictive maintenance and remote diagnostics encourages suppliers to offer integrated service models, lifecycle support, and cloud-enabled monitoring platforms. As digital transformation accelerates, competitive advantage shifts toward vendors capable of delivering scalable, cyber-secure, and analytics-driven IMCC solutions tailored to both greenfield and brownfield installations.

Key Player Analysis

Recent Developments

- In February 2025, L3Harris Technologies debuted its command-and-control software, AMORPHOUS, which is designed to manage swarms of thousands of unmanned systems across different domains. The software is currently being used under contracts for the U.S. Army and the Defense Innovation Unit.

- In June 2024, Siemens expanded its existing partnership with Electro George, a prominent Egyptian electrical panel manufacturer, to bring state-of-the-art low voltage (LV) power distribution solutions to the Egyptian market.

- In May 2024, Eaton, a US power management company, acquired Exertherm, a UK firm specializing in thermal monitoring solutions. Exertherm’s technology monitors temperature in electrical components like switchgear and transformers, providing early warnings of potential failures.

- In February 2024, Collins Aerospace has recently delivered vehicle-mounted air traffic control systems to the U.S. Air Force for Management of air traffic in the most contested environments. The units are called Air Traffic Navigation, Integration, and Coordination Systems (ATNAVICS). These are complete air traffic control systems and are readily transportable to assist diverse and mobile operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Platform, Solution, Installation Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate as industries adopt higher levels of automation and transition toward fully digital motor control environments.

- Adoption of IIoT-enabled IMCCs will rise as plants demand real-time diagnostics and predictive maintenance capabilities.

- Energy-efficient motor management will become a core priority as facilities target reduced consumption and compliance with tightening efficiency standards.

- Modular and arc-resistant IMCC designs will gain traction due to growing emphasis on operator safety and simplified system upgrades.

- Integration of edge computing and advanced analytics will enhance fault identification and reduce downtime in critical applications.

- Utilities and renewable energy projects will increasingly deploy IMCCs to improve load stability and system reliability.

- Brownfield industrial modernization will create strong demand for retrofit-friendly and scalable IMCC architectures.

- Cybersecure motor control infrastructures will become essential as connectivity and cloud integration expand.

- Service-based models such as remote monitoring and lifecycle maintenance will significantly influence vendor competitiveness.

- Regional manufacturing expansion, especially in emerging markets, will support long-term IMCC adoption across diverse process industries.

Market Segmentation Analysis:

Market Segmentation Analysis: