Market Overview

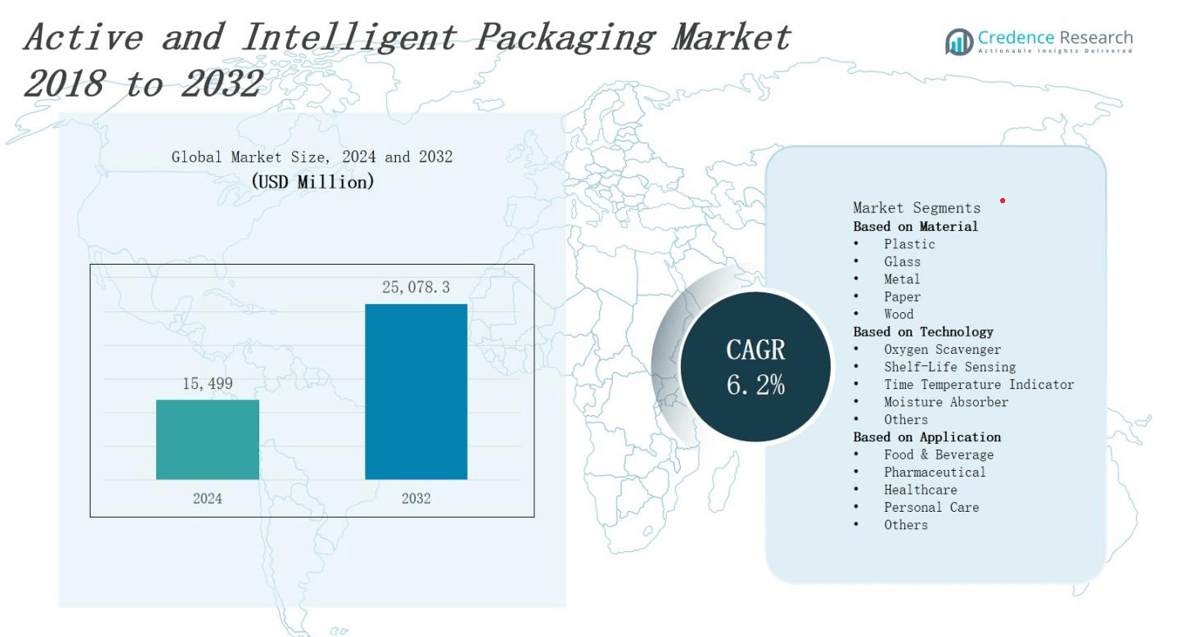

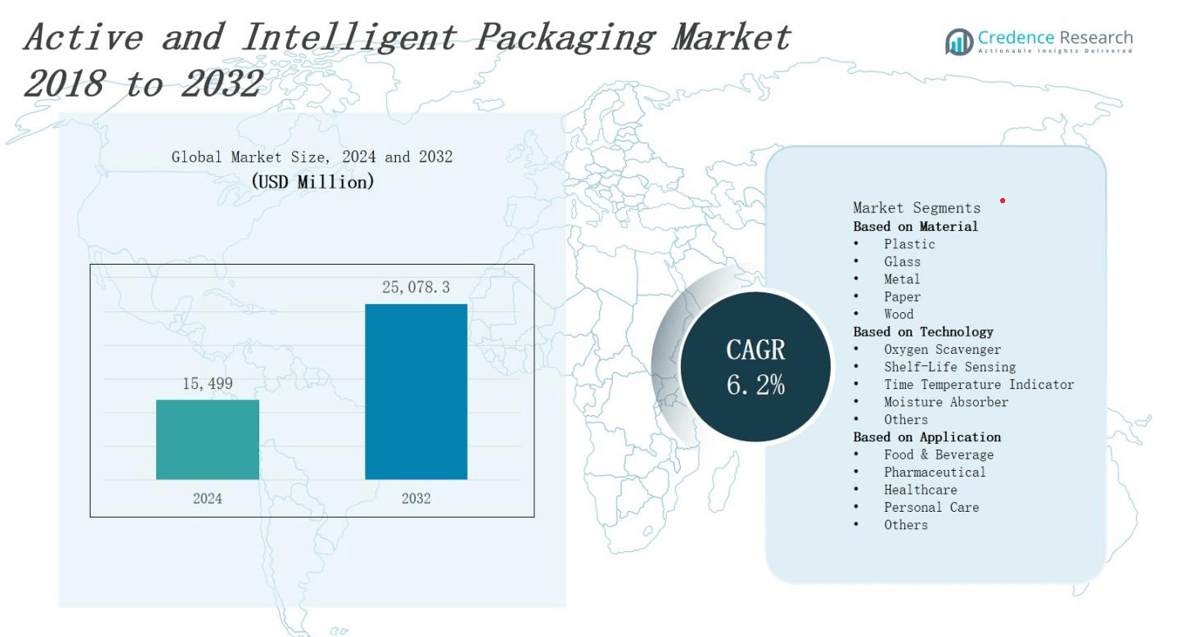

The active and intelligent packaging market is projected to grow from USD 15,499 million in 2024 to USD 25,078.3 million by 2032, expanding at a CAGR of 6.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Active and Intelligent Packaging Market Size 2024 |

USD 15,499 million |

| Active and Intelligent Packaging Market, CAGR |

6.2% |

| Active and Intelligent Packaging Market Size 2032 |

USD 25,078.3 million |

The active and intelligent packaging market grows driven by increasing demand for enhanced product safety, extended shelf life, and improved consumer convenience across food, pharmaceutical, and cosmetic sectors. Rising regulatory requirements for product traceability and anti-counterfeiting solutions propel adoption. Innovations in smart sensors, indicators, and nanotechnology enhance real-time monitoring of product conditions. Growing e-commerce and global supply chains increase the need for packaging that ensures authenticity and quality. Sustainability trends push manufacturers toward eco-friendly materials and recyclable smart packaging. These factors collectively stimulate continuous product development and widespread market expansion worldwide.

The active and intelligent packaging market spans key regions including North America, Europe, Asia Pacific, and the Rest of the World. North America leads with 35% market share, driven by advanced industries and strict regulations. Europe follows with 28%, emphasizing sustainability and innovation. Asia Pacific holds 22%, fueled by rapid urbanization and growing consumer demand. The Rest of the World accounts for 15%, showing emerging growth potential. Key players in this market include Amcor PLC, Crown Holdings Inc, Mitsubishi Gas Chemical Co, Constar International Inc, Ball Corporation, 3M Company, Coveris Holdings SA, Sealed Air Corporation, LCR Hall Crest LLC, and Varcode Ltd.

Market Insights

- The active and intelligent packaging market is projected to grow from USD 15,499 million in 2024 to USD 25,078.3 million by 2032, at a CAGR of 6.2%.

- Increasing demand for enhanced product safety, extended shelf life, and improved consumer convenience drives growth across food, pharmaceutical, and cosmetic sectors.

- Strict regulatory requirements for product traceability and anti-counterfeiting boost adoption of smart packaging technologies like RFID tags, QR codes, and sensors.

- Innovations in nanotechnology, smart sensors, and indicators improve real-time monitoring of product conditions, enhancing freshness and authenticity verification.

- Growth in e-commerce and global supply chains increases the need for packaging that protects product quality during shipping and storage.

- Sustainability trends encourage the use of recyclable, biodegradable, and eco-friendly smart packaging materials, aligning with environmental goals.

- North America leads the market with 35% share, followed by Europe at 28%, Asia Pacific at 22%, and the Rest of the World at 15%, driven by industrial advancement, regulatory compliance, and emerging consumer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Enhanced Product Safety and Shelf Life

The active and intelligent packaging market benefits from growing consumer focus on product safety and freshness. It addresses the need to extend shelf life by controlling factors such as oxygen, moisture, and microbial growth. Manufacturers adopt packaging solutions that actively interact with the product to maintain quality during storage and transportation. This demand increases especially in the food and pharmaceutical sectors, where product integrity is critical. The ability to reduce food waste through longer freshness also supports market growth. It encourages companies to innovate packaging technologies that ensure product safety from production to consumption.

- For instance, Tetra Pak’s Direct UHT technology allows beverages like coconut water to be sterilized quickly at high temperatures, extending shelf life to up to 12 months without refrigeration.

Stringent Regulatory Requirements and Traceability

Regulatory bodies worldwide enforce strict guidelines to ensure product safety, authenticity, and traceability. The active and intelligent packaging market supports compliance with these standards through smart packaging technologies like RFID tags, QR codes, and sensors. These features enable real-time monitoring and anti-counterfeiting measures, enhancing supply chain transparency. It helps manufacturers and retailers track product conditions and prevent fraud. Compliance pressures in sectors like pharmaceuticals and food drive the adoption of intelligent packaging solutions, making regulatory requirements a significant growth factor for the market.

Technological Innovations in Smart Packaging Solutions

Technological advances in nanotechnology, biosensors, and wireless communication accelerate growth in the active and intelligent packaging market. These innovations enable packaging to detect spoilage, temperature changes, and contamination effectively. The integration of sensors and indicators provides consumers and supply chain stakeholders with real-time product information. It enhances user experience and trust by delivering freshness status and authenticity verification. Continuous improvements in cost efficiency and functionality expand applications across various industries, driving broader acceptance and commercial success for intelligent packaging.

- For instance, Multisorb Technologies provides active packaging materials such as oxygen absorbers and desiccant labels that extend shelf life and maintain product integrity for pharmaceuticals, food, and dietary supplements.

Growing E-commerce and Sustainability Concerns

The rise of e-commerce intensifies demand for packaging that protects products during extended shipping and storage periods. The active and intelligent packaging market addresses this by offering solutions that maintain product quality throughout complex distribution networks. Sustainability concerns also influence market growth, with manufacturers seeking recyclable, biodegradable, and eco-friendly materials integrated with smart features. It aligns with global efforts to reduce packaging waste and environmental impact. These factors motivate companies to develop innovative packaging that balances performance with sustainability, fueling further market expansion.

Market Trends

Integration of IoT and Advanced Sensor Technologies

The active and intelligent packaging market increasingly incorporates Internet of Things (IoT) and advanced sensor technologies to enhance real-time monitoring. It enables continuous tracking of temperature, humidity, and product freshness throughout the supply chain. These smart features improve transparency and allow timely decision-making to reduce spoilage and waste. Companies focus on developing low-cost, reliable sensors that communicate product status to manufacturers, retailers, and consumers. This trend drives innovation and adoption across food, pharmaceutical, and cosmetics sectors, meeting rising demands for quality assurance.

- For instance, Amcor integrates digital printing with NFC technology in its packaging to provide real-time tracking and authentication of products, enhancing transparency for manufacturers and consumers.

Expansion of Sustainable and Eco-Friendly Packaging Solutions

Sustainability drives innovation in the active and intelligent packaging market, pushing companies toward eco-friendly materials and designs. It integrates biodegradable substrates, recyclable components, and non-toxic additives with intelligent features. Manufacturers develop packaging solutions that reduce environmental impact without compromising functionality. Growing consumer awareness and regulatory pressure encourage adoption of green packaging alternatives. This trend fosters collaboration between material scientists and technology providers to deliver smart packaging that supports circular economy principles and minimizes waste throughout the product lifecycle.

- For instance, Nestlé has partnered with IBM and The Rainforest Alliance to develop blockchain-enabled smart packaging that enhances transparency by allowing consumers to trace the entire product journey, integrating sustainability with intelligent features.

Adoption of Anti-Counterfeiting and Brand Protection Technologies

The active and intelligent packaging market experiences increased adoption of anti-counterfeiting and brand protection technologies due to rising concerns about product fraud. It uses features like holograms, RFID tags, and QR codes to ensure authenticity and protect brand reputation. These technologies help track products and authenticate them at various points in the supply chain. Companies invest in secure packaging solutions to prevent counterfeiting, especially in pharmaceuticals and luxury goods. This trend enhances consumer confidence and supports regulatory compliance globally.

Growth in Personalized and Consumer-Interactive Packaging

Personalization and consumer engagement emerge as key trends in the active and intelligent packaging market. It incorporates interactive elements like NFC tags and augmented reality to deliver customized content and enhance user experience. Brands leverage these technologies to build loyalty and provide product information directly to consumers. The trend aligns with increasing demand for transparency and meaningful interactions in purchasing decisions. Companies prioritize packaging that combines functionality with marketing to differentiate products in competitive markets, driving innovation and market growth.

Market Challenges Analysis

High Costs and Complex Implementation Processes

The active and intelligent packaging market faces challenges due to high production and material costs. Integrating advanced technologies such as sensors, indicators, and communication modules increases overall packaging expenses. It limits adoption, especially among small and medium-sized enterprises with constrained budgets. Complex manufacturing processes and the need for specialized equipment further slow implementation. Companies must invest in research and development to improve cost-efficiency and scalability. Overcoming these financial and operational barriers remains critical for broader market penetration and commercialization.

Regulatory and Standardization Barriers Across Regions

Regulatory complexities and the lack of unified standards create obstacles for the active and intelligent packaging market. It must comply with varying guidelines across countries regarding safety, data privacy, and environmental impact. This fragmented regulatory landscape complicates global distribution and increases time-to-market. Differences in certification requirements and testing protocols also hinder rapid innovation. Industry stakeholders need coordinated efforts to establish harmonized standards. Addressing these regulatory challenges will facilitate smoother adoption and foster international growth opportunities.

Market Opportunities

Expansion into Emerging Markets and Diverse Industries

The active and intelligent packaging market holds significant opportunities in emerging economies with growing consumer awareness and rising disposable incomes. It can capitalize on expanding food, pharmaceutical, and cosmetic industries seeking advanced packaging solutions. Increasing urbanization and modernization of supply chains in these regions drive demand for product safety and traceability. Companies that tailor products to local requirements and invest in market education will gain competitive advantages. Penetrating diverse sectors such as healthcare, agriculture, and electronics further broadens growth potential and creates new revenue streams.

Advancements in Smart Materials and Digital Technologies

Technological progress in smart materials and digital integration offers vast opportunities for the active and intelligent packaging market. It can leverage innovations like biodegradable sensors, printed electronics, and blockchain for enhanced functionality and sustainability. These developments enable improved real-time monitoring, anti-counterfeiting, and consumer interaction. Collaborations between material scientists, technology firms, and packaging manufacturers accelerate product innovation. Expanding the use of data analytics and connectivity will create smarter, more responsive packaging systems. Exploiting these advancements will strengthen market position and drive future expansion.

Market Segmentation Analysis:

By Material

The active and intelligent packaging market segments by material into plastic, glass, metal, paper, and wood. Plastic dominates due to its versatility, lightweight nature, and cost-effectiveness. It supports integration of sensors and indicators while maintaining durability. Glass and metal provide superior barrier properties, making them suitable for premium and pharmaceutical products. Paper and wood appeal to sustainability-driven markets, offering eco-friendly alternatives that combine with intelligent features. Material choice influences packaging functionality, cost, and environmental impact, guiding manufacturers’ product development strategies.

- For instance, plastic containers in the US use thermochromic ink dots that indicate syrup temperature after microwave heating, enhancing consumer convenience and safety.

By Technology

The active and intelligent packaging market divides by technology into oxygen scavengers, shelf-life sensing, time temperature indicators, moisture absorbers, and others. Oxygen scavengers lead demand by preventing oxidation and preserving product freshness, especially in food and pharmaceuticals. Shelf-life sensing and time temperature indicators provide real-time product condition information, supporting quality assurance and regulatory compliance. Moisture absorbers protect against humidity-related spoilage. Emerging technologies enhance packaging intelligence, enabling precise monitoring and extending application scope across industries.

- For instance, Senoptica’s FDA-approved optical oxygen sensors integrated into modified atmosphere packaging help detect oxygen levels inside food packs, ensuring freshness of bagged salads, sliced meats, cheese, and dairy products by identifying leaks early.

By Application

The active and intelligent packaging market segments into food & beverage, pharmaceutical, healthcare, personal care, and other applications. Food & beverage represents the largest segment due to high demand for freshness, safety, and waste reduction. Pharmaceutical packaging requires strict compliance, driving adoption of traceability and anti-counterfeiting features. Healthcare and personal care sectors seek innovative packaging that enhances user convenience and product integrity. Growing application diversity fuels market expansion, with customized solutions addressing specific industry requirements and consumer expectations.

Segments:

Based on Material

- Plastic

- Glass

- Metal

- Paper

- Wood

Based on Technology

- Oxygen Scavenger

- Shelf-Life Sensing

- Time Temperature Indicator

- Moisture Absorber

- Others

Based on Application

- Food & Beverage

- Pharmaceutical

- Healthcare

- Personal Care

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the active and intelligent packaging market with 35%. It benefits from a strong pharmaceutical industry, advanced food processing sector, and high consumer awareness of product safety and sustainability. Stringent regulatory frameworks drive adoption of smart packaging technologies for traceability and anti-counterfeiting. Well-established supply chains and investments in R&D support continuous innovation. Major companies headquartered in this region accelerate market growth by introducing advanced packaging solutions. Demand from e-commerce and retail sectors further fuels expansion. North America remains a critical region for market development and technology leadership.

Europe

Europe commands 28% of the active and intelligent packaging market. It emphasizes sustainability and regulatory compliance, encouraging widespread use of eco-friendly smart packaging. The region leads in implementing advanced packaging standards for pharmaceuticals and food safety. Growing consumer preference for transparency and interactive packaging drives innovation. Well-developed manufacturing infrastructure supports quick adoption of new technologies. Investments in green materials combined with intelligent features position Europe as a key market for sustainable packaging solutions. Collaborative efforts between governments and industry stakeholders accelerate market progress.

Asia Pacific

Asia Pacific accounts for 22% of the active and intelligent packaging market. Rapid urbanization, increasing disposable income, and expanding food and pharmaceutical sectors fuel demand. The region experiences rising awareness about product safety and quality, encouraging adoption of intelligent packaging. Emerging economies invest in modernizing supply chains and regulatory frameworks. Companies focus on cost-effective packaging solutions tailored for local markets. Asia Pacific offers significant growth opportunities due to its large consumer base and expanding industrial capabilities. Market players actively target this region to capture emerging demand.

Rest of the World

The Rest of the World holds 15% of the active and intelligent packaging market. Growth stems from increasing industrialization and rising consumer awareness in Latin America, the Middle East, and Africa. These regions show growing interest in packaging solutions that enhance product safety and reduce waste. Investments in healthcare and food industries further support demand. Challenges in infrastructure and regulatory harmonization limit rapid adoption but create opportunities for innovative, adaptable technologies. Market participants focus on strategic partnerships and local collaborations to strengthen their presence in these emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Varcode Ltd

- Crown Holdings Inc

- Sealed Air Corporation

- Ball Corporation

- Amcor PLC

- LCR Hall Crest LLC

- Mitsubishi Gas Chemical Co

- 3M Company

- Constar International Inc

- Coveris Holdings SA

Competitive Analysis

The active and intelligent packaging market features intense competition among global and regional players focusing on innovation, product differentiation, and strategic partnerships. Leading companies invest heavily in research and development to introduce advanced packaging technologies, such as sensors, indicators, and RFID tags, that enhance product safety and consumer engagement. It experiences consolidation through mergers and acquisitions to expand product portfolios and geographic reach. Companies emphasize sustainable and eco-friendly packaging solutions to meet growing regulatory and consumer demands. Strong distribution networks and collaborations with food, pharmaceutical, and personal care industries enable market leaders to maintain competitive advantages. Continuous innovation, cost optimization, and responsiveness to changing market needs remain critical for sustaining growth and capturing new opportunities in the evolving active and intelligent packaging market.

Recent Developments

- In June 2025, Amcor launched a sustainable shrink bag for Butterball’s turkey breast packaging, enhancing product freshness and reducing environmental impact.

- In June 2024, Varcode announced a strategic partnership with National Packaging Group (NPG) to develop and distribute smart packaging solutions for temperature-sensitive products.

- In June 2025, Ball Corporation partnered with Açaí Motion to introduce ASI-certified aluminum cans, aligning with sustainability goals and enhancing product traceability.

- In June 2023, Sealed Air launched a new line of smart packaging solutions integrating IoT-enabled sensors for real-time monitoring and data analytics, enhancing product traceability and consumer engagement.

Market Concentration & Characteristics

The active and intelligent packaging market exhibits a moderately concentrated structure, dominated by a few global players who drive innovation and set industry standards. Leading companies focus on technological advancements, product differentiation, and strategic collaborations to maintain competitive advantages. It experiences ongoing consolidation through mergers and acquisitions to expand market reach and enhance product portfolios. The market favors companies that invest heavily in research and development to introduce advanced packaging solutions integrating sensors, indicators, and communication technologies. Customer demand for sustainable and smart packaging further shapes competitive dynamics. Strong distribution networks and partnerships with key end-use sectors, including food, pharmaceutical, and personal care, strengthen market positions. Emerging players face challenges due to high entry barriers, including cost and regulatory compliance. The active and intelligent packaging market rewards innovation, agility, and scalability, encouraging continuous improvement to meet evolving consumer and regulatory expectations.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Technolgoy and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The active and intelligent packaging market will expand due to rising demand for product safety and freshness.

- Technological innovations in sensors and nanomaterials will enhance packaging functionality.

- Regulatory pressure will increase adoption of traceability and anti-counterfeiting solutions.

- Sustainability initiatives will drive development of eco-friendly and recyclable packaging materials.

- E-commerce growth will boost the need for packaging that protects products during transit.

- Integration of IoT and real-time monitoring technologies will become more widespread.

- Manufacturers will focus on cost-effective smart packaging to reach small and medium enterprises.

- Emerging markets will offer significant growth opportunities due to increasing urbanization and disposable incomes.

- Collaboration between packaging companies and technology providers will accelerate innovation.

- Personalized and interactive packaging will gain traction to improve consumer engagement and brand loyalty.