Market Overview

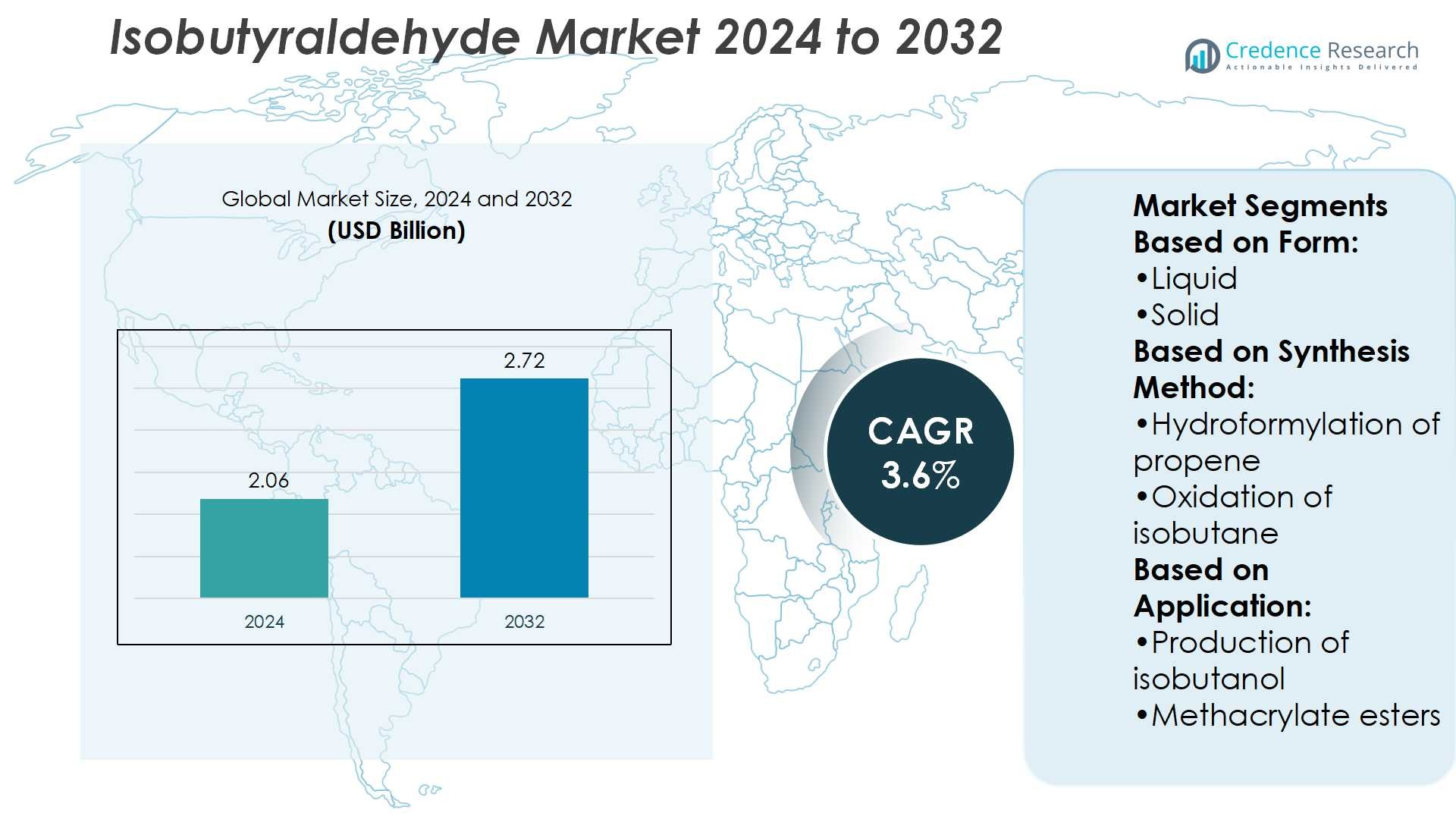

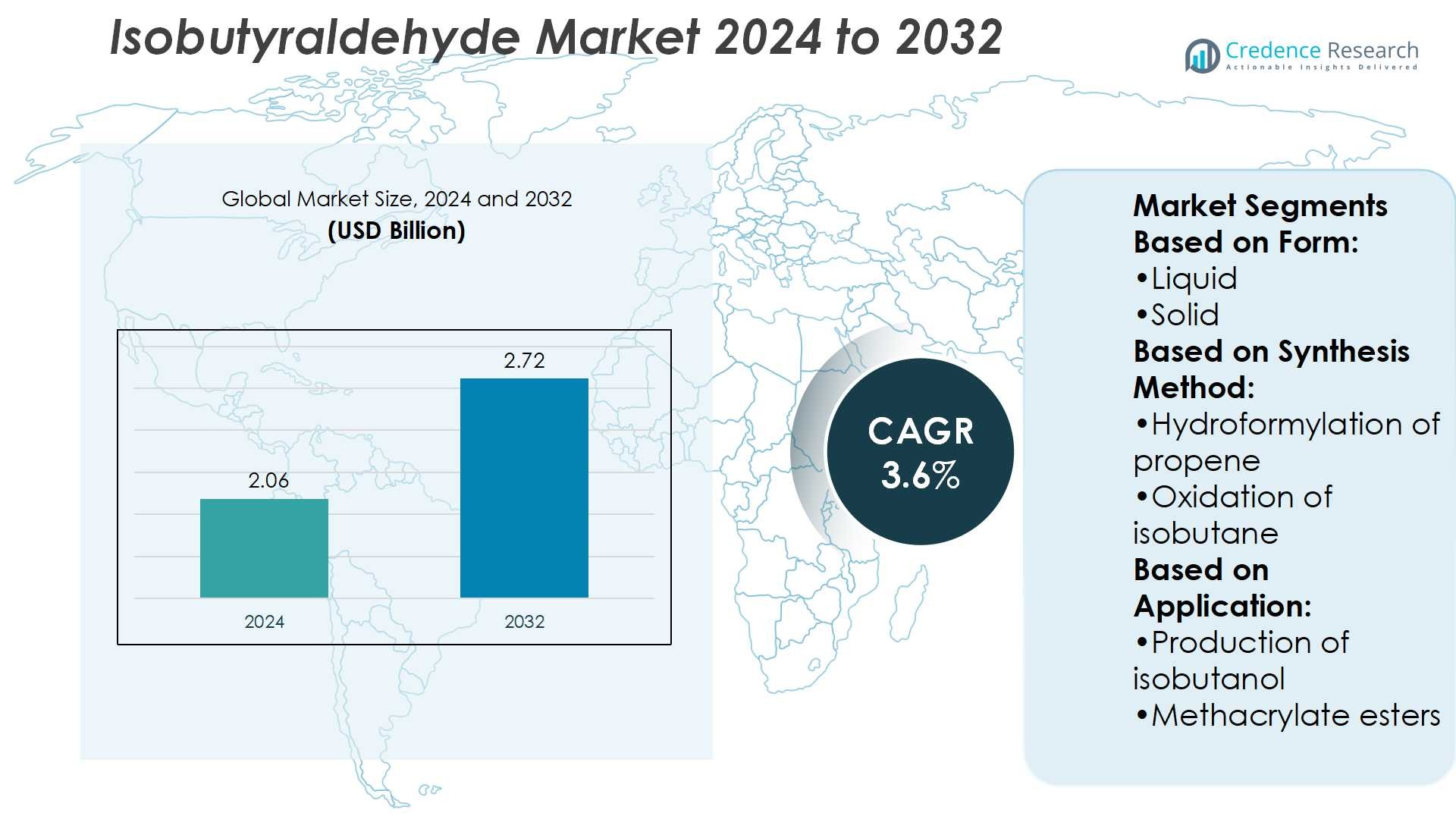

Isobutyraldehyde Market size was valued at USD 2.06 billion in 2024 and is anticipated to reach USD 2.72 billion by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isobutyraldehyde Market Size 2024 |

USD 2.06 Billion |

| Isobutyraldehyde Market, CAGR |

3.6% |

| Isobutyraldehyde Market Size 2032 |

USD 2.72 Billion |

The Isobutyraldehyde Market grows through strong demand from pharmaceuticals, agrochemicals, coatings, and specialty chemicals, where it serves as a critical intermediate. Rising healthcare spending and expanding agricultural needs drive consistent consumption across regions. Trends highlight a clear shift toward sustainable production methods, with companies investing in bio-based feedstocks and advanced catalysts to reduce environmental impact. Increasing use in high-performance coatings, resins, and vitamins reinforces its industrial relevance. Rapid industrialization in Asia-Pacific strengthens supply and capacity expansion, while regulatory compliance in North America and Europe fosters innovation. Together, these drivers and trends position the market for sustained global growth.

The Isobutyraldehyde Market shows strong geographical presence, with Asia-Pacific holding the largest share due to rapid industrial growth, followed by North America and Europe with advanced manufacturing and strict regulatory frameworks. Latin America and the Middle East & Africa present emerging opportunities through rising agricultural and healthcare demand. Key players such as BASF SE, Dow Chemical Company, Eastman Chemical Company, Celanese Corporation, Perstorp Holding AB, Mitsubishi Chemical Corporation, LCY Chemical Corp, Evonik Industries AG, LyondellBasell Industries Holdings B.V, and INEOS AG drive competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Isobutyraldehyde Market was valued at USD 2.06 billion in 2024 and will reach USD 2.72 billion by 2032, growing at a CAGR of 3.6%.

- Strong demand arises from pharmaceuticals, agrochemicals, coatings, and specialty chemicals where it acts as a critical intermediate.

- Market trends highlight adoption of sustainable production with bio-based feedstocks and advanced catalysts reducing environmental impact.

- Competition remains intense with companies focusing on efficiency, high-purity products, and global supply chain stability.

- Regulatory pressures and raw material price volatility act as restraints, increasing compliance costs for producers.

- Asia-Pacific leads with the largest share supported by rapid industrial growth, while North America and Europe emphasize innovation under strict frameworks.

- Key players including BASF SE, Dow Chemical Company, Eastman Chemical Company, Celanese Corporation, Perstorp Holding AB, Mitsubishi Chemical Corporation, LCY Chemical Corp, Evonik Industries AG, LyondellBasell Industries Holdings B.V, and INEOS AG drive market competitiveness.

Market Drivers

Rising Demand from Agrochemicals and Specialty Chemicals

The Isobutyraldehyde Market benefits from strong growth in agrochemicals where it serves as a key intermediate for herbicides and pesticides. Expanding global agricultural output and rising demand for higher crop yields drive its consumption. The product’s role in synthesizing specialized compounds supports market relevance in crop protection. Manufacturers prioritize consistent quality and efficiency to meet increasing regulatory compliance in agriculture. Demand stability from the agricultural sector ensures long-term growth potential. It also opens opportunities for innovation in sustainable agrochemical formulations.

- For instance, LCY resumed polypropylene production on Line 4 at its Ta-sheh City site, restoring an annual capacity of 260,000 tons after a three-week maintenance shutdown.

Expanding Applications in Plasticizers and Coatings

The Isobutyraldehyde Market experiences growth through its extensive use in producing plasticizers and coatings. Plasticizers are vital in flexible PVC applications used in construction, automotive, and packaging. Rising construction activities and infrastructure projects increase reliance on these products. The coatings industry benefits from its role in producing resins with improved durability. Growing demand for advanced coating materials in automotive and industrial sectors supports market expansion. It aligns with trends in high-performance materials for durability and environmental compliance.

- For instance, Perstorp Project Valerox boosts plasticizer production capacity.Project Valero, Perstorp largest investment, will lift plasticizer output at its Stenungsund site to 150,000 metric tonnes per year.

Rising Use in Pharmaceutical and Healthcare Industries

The Isobutyraldehyde Market finds strong opportunities in pharmaceutical manufacturing where it acts as an essential intermediate. It supports synthesis of vitamins, active pharmaceutical ingredients, and fine chemicals. Growth in global healthcare expenditure and increasing drug development activities stimulate demand. Pharmaceutical companies focus on intermediates with high consistency, which strengthens its application scope. The market gains additional momentum from biopharmaceutical innovations and growing investments in healthcare research. It continues to strengthen its role as a reliable input for medical advancements.

Strong Growth in Asia-Pacific and Industrial Expansion

The Isobutyraldehyde Market benefits significantly from rapid industrialization in Asia-Pacific, supported by China and India. Expanding chemical manufacturing clusters and lower production costs increase regional competitiveness. Strong demand from end-use industries such as automotive, construction, and pharmaceuticals further drives growth. Government support for manufacturing expansion and export-oriented policies strengthen production capacity. Companies invest in advanced facilities to ensure supply reliability and meet rising global demand. It reinforces the region’s position as a key growth driver for the global market.

Market Trends

Increasing Adoption of Green Chemistry and Sustainable Production

The Isobutyraldehyde Market reflects a clear shift toward sustainable and eco-friendly production methods. Companies invest in bio-based feedstocks to reduce carbon emissions and comply with strict environmental rules. It aligns with global trends favoring lower environmental impact in chemical manufacturing. Green chemistry practices gain traction across regions with rising demand for responsible sourcing. Producers seek energy-efficient technologies to improve yield and reduce waste. This focus strengthens long-term competitiveness while supporting regulatory compliance and customer trust.

- For instance, LYB signed a 15-year deal for 450 GWh/year of offshore wind power in Germany and a 10-year agreement for 79 GWh/year of onshore wind power in Italy, boosting renewable electricity for green operations.

Rising Demand for High-Performance Coatings and Resins

The Isobutyraldehyde Market shows strong momentum in coatings and resins due to industrial growth. Expanding applications in automotive, construction, and packaging drive continuous demand for high-performance resins. It supports the production of coatings with improved resistance, durability, and surface finish. Increasing interest in advanced materials that meet both performance and sustainability standards boosts market relevance. Companies explore tailored formulations for industrial and specialty applications. This trend positions isobutyraldehyde-based intermediates as vital to next-generation coatings technology.

- For instance, Celanese began CCU operations that capture 180,000 metric tonnes of CO₂ emissions per year. The project generates 130,000 metric tonnes of low-carbon methanol annually, usable in coatings and resin chemistries.

Growing Role in Pharmaceuticals and Nutraceuticals

The Isobutyraldehyde Market trends highlight expanding pharmaceutical and nutraceutical applications. It plays a central role in the production of vitamins, intermediates, and active compounds. Rising healthcare spending and innovation in life sciences reinforce the need for consistent intermediates. Pharmaceutical companies prioritize reliable supply chains, strengthening its position in global drug manufacturing. Nutraceutical growth further broadens application scope, fueled by demand for wellness products. This dynamic supports sustained demand across both advanced and emerging markets.

Expansion in Asia-Pacific and Strategic Capacity Investments

The Isobutyraldehyde Market benefits from rapid expansion in Asia-Pacific, supported by large-scale industrial growth. Regional manufacturers increase capacity to meet rising demand in chemicals, coatings, and pharmaceuticals. It gains from cost-efficient production hubs and export-focused policies in China and India. Global players invest in joint ventures and technology transfer to secure market presence. Expanding supply networks ensure stability for downstream industries and enhance competitiveness. This trend consolidates Asia-Pacific’s role as a cornerstone of future market expansion.

Market Challenges Analysis

Regulatory Pressures and Environmental Concerns Limiting Growth

The Isobutyraldehyde Market faces growing challenges from stringent environmental and safety regulations. Governments enforce strict limits on emissions, waste disposal, and handling of hazardous chemicals. It creates compliance costs for producers who must invest in advanced safety systems and cleaner production technologies. Companies unable to meet evolving standards risk restricted operations or loss of market access. Rising pressure from environmental groups and global sustainability initiatives further intensifies the challenge. The complexity of regulatory frameworks across regions adds uncertainty for long-term planning and investment.

Volatility in Raw Material Supply and Rising Production Costs

The Isobutyraldehyde Market encounters persistent issues linked to raw material volatility and price fluctuations. Dependence on petrochemical feedstocks exposes producers to crude oil market instability. It leads to cost uncertainty and impacts margins across supply chains. Manufacturers face difficulties in passing higher costs to downstream industries that demand stable pricing. Competition from alternative intermediates also limits flexibility in price adjustments. Rising energy costs and transportation expenses add another layer of pressure. These factors combine to create operational risks that restrict profitability and expansion opportunities.

Market Opportunities

Expanding Opportunities in Pharmaceuticals, Nutraceuticals, and Fine Chemicals

The Isobutyraldehyde Market offers strong opportunities through rising demand in pharmaceuticals, nutraceuticals, and fine chemicals. It serves as a vital intermediate in the production of vitamins, drug compounds, and specialty molecules. Growing healthcare investment and lifestyle-driven consumption of wellness products expand its role in these sectors. The increasing focus on preventive healthcare and dietary supplements further strengthens demand. Producers that ensure high-purity grades and reliable supply chains gain a competitive edge. This trend creates long-term growth potential in advanced and emerging economies.

Growth Potential in Coatings, Resins, and Sustainable Materials

The Isobutyraldehyde Market shows expanding opportunities in coatings, resins, and sustainable material innovation. It enables the development of advanced resins for industrial, automotive, and construction applications that demand higher durability. Rising adoption of eco-friendly and high-performance coatings creates significant prospects for market participants. Producers investing in research to design sustainable intermediates gain broader acceptance across industries. Strategic partnerships and capacity expansions further enhance the ability to meet global demand. These opportunities position isobutyraldehyde as a cornerstone in next-generation material development.

Market Segmentation Analysis:

By Form

The Isobutyraldehyde Market is segmented into liquid and solid forms, with liquid form holding a dominant share due to its suitability in large-scale industrial processes. It provides ease of handling, better miscibility, and direct use in continuous chemical synthesis. Solid form remains relevant in niche applications requiring stability during storage or transport. Industrial users prefer the liquid segment for pharmaceutical intermediates and agrochemical production, ensuring consistent adoption. Rising demand from chemical and coatings industries further reinforces the importance of liquid isobutyraldehyde. This form continues to serve as the preferred choice in global supply networks.

- For instance, SGO (solid-grade oligomer) continuous polymerization process enables production of acrylic polyols at nearly. The SGO process allows for the production of polyols that are nearly 100% solids.

By Synthesis Method

The market is divided by synthesis method into hydroformylation of propene and oxidation of isobutane. Hydroformylation of propene leads the segment due to its higher efficiency, yield, and widespread adoption in commercial production. It enables consistent quality and supports large-scale manufacturing across regions. Oxidation of isobutane finds limited but specific usage where feedstock availability and cost advantages exist. Producers investing in advanced catalysts for hydroformylation strengthen competitiveness in global markets. It remains the preferred method for ensuring supply stability and meeting rising industrial demand.

- For instance, Hydroformylation of propylene can be carried out continuously at a feed rate of at least 3 metric tonnes per hour, using a propylene stream containing at least 97 mol% propylene and syngas (H₂ + KOto propylene molar ratio greater than 1.93.

By Application

The Isobutyraldehyde Market shows diverse applications across production of isobutanol, methacrylate esters, pharmaceutical intermediates, and pesticides. Production of isobutanol dominates due to its wide use as a solvent, feedstock, and fuel additive. Methacrylate esters represent a fast-growing segment, driven by demand in coatings, adhesives, and plastics. Pharmaceutical intermediates maintain strong relevance with expanding drug synthesis and vitamin production. Pesticides contribute significant demand through rising agricultural activity and the need for crop protection chemicals. Each application supports sustained consumption across industries, reinforcing the market’s role as a core chemical intermediate.

Segments:

Based on Form:

Based on Synthesis Method:

- Hydroformylation of propene

- Oxidation of isobutane

Based on Application:

- Production of isobutanol

- Methacrylate esters

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 24% of the global Isobutyraldehyde Market share, supported by its strong presence in pharmaceuticals, agrochemicals, and specialty chemicals. The region benefits from advanced manufacturing facilities in the United States and Canada, which focus on high-purity intermediates for healthcare and industrial applications. It also witnesses steady demand from the coatings and plastics industries, particularly in automotive and construction sectors. Strict regulatory standards drive producers to adopt cleaner production technologies and sustainable sourcing practices, enhancing product quality and environmental compliance. Investment in research and development ensures the region maintains technological leadership in synthesis methods. The growing emphasis on innovative, bio-based feedstocks further strengthens market relevance. This focus positions North America as a critical hub for innovation and high-value applications.

Europe

Europe holds a 22% share of the Isobutyraldehyde Market, reflecting its reliance on chemical intermediates for coatings, pharmaceuticals, and industrial resins. Germany, France, and the United Kingdom dominate demand through strong automotive, healthcare, and construction industries. The region emphasizes sustainable production, with leading manufacturers investing in energy-efficient hydroformylation processes. Regulatory frameworks under REACH encourage safe chemical use and sustainable development, shaping industry practices. Producers in Europe also benefit from advanced infrastructure and a skilled workforce, enabling efficient scaling of operations. Increasing investment in pharmaceuticals and specialty chemicals further supports market demand. Europe continues to strengthen its competitive position through sustainability-driven innovation and stringent quality standards.

Asia-Pacific

Asia-Pacific commands the largest share, representing 38% of the Isobutyraldehyde Market, fueled by rapid industrialization and expanding end-use industries. China, India, and Japan serve as key growth drivers with extensive chemical manufacturing clusters and cost-efficient production systems. Strong demand for pesticides, coatings, and pharmaceutical intermediates reinforces the region’s leadership. Government support for industrial expansion and export-oriented policies strengthens the region’s competitive advantage. Investments in production capacity ensure stable supply to global markets. The growing middle-class population and rising healthcare spending add further momentum, particularly in pharmaceuticals and nutraceuticals. Asia-Pacific continues to expand its dominance by combining large-scale output with increasing technological capabilities.

Latin America

Latin America contributes 8% of the global Isobutyraldehyde Market share, driven by agricultural demand and expanding pharmaceutical sectors. Brazil and Mexico lead consumption due to their strong agrochemical industries supporting crop protection. The region’s reliance on pesticides creates stable demand for isobutyraldehyde as an intermediate. Growth in healthcare investments and local pharmaceutical production adds another layer of opportunity. Industrial development and infrastructure projects also support demand for coatings and resins. Challenges remain in terms of limited manufacturing capacity and dependence on imports for high-purity intermediates. Despite these barriers, the region shows consistent growth potential supported by its agricultural base.

Middle East & Africa

The Middle East & Africa holds a 6% share of the Isobutyraldehyde Market, shaped by growing industrialization and rising demand in agrochemicals. Countries such as Saudi Arabia, South Africa, and the UAE support expansion through investments in chemical industries and construction. The region focuses on meeting rising agricultural needs with pesticide production driving demand for intermediates. Pharmaceutical and healthcare sectors are emerging but still contribute a smaller share compared to developed regions. Import dependence remains high, though governments promote initiatives to expand local chemical production. Infrastructure development in construction and transportation also supports market growth. With increasing investment in industrial diversification, the region is expected to expand its presence steadily in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LCY Chemical Corp

- Mitsubishi Chemical Corporation

- INEOS AG

- Perstorp Holding AB

- LyondellBasell Industries Holdings B.V

- Celanese Corporation

- Evonik Industries AG

- BASF SE

- Eastman Chemical Company

- Dow Chemical Company

Competitive Analysis

The Isobutyraldehyde Market players include BASF SE, Dow Chemical Company, Eastman Chemical Company, Celanese Corporation, Perstorp Holding AB, Mitsubishi Chemical Corporation, LCY Chemical Corp, Evonik Industries AG, LyondellBasell Industries Holdings B.V, and INEOS AG. The Isobutyraldehyde Market remains highly competitive, with companies focusing on innovation, capacity expansion, and regional presence to secure growth. Market participants invest in advanced synthesis technologies, sustainable production methods, and high-purity grades to address regulatory pressures and meet diverse industry requirements. Strong demand from pharmaceuticals, agrochemicals, coatings, and specialty chemicals encourages continuous investment in research and development. Firms emphasize supply chain optimization and long-term contracts to maintain stability in volatile raw material markets. Expansion strategies often include joint ventures, acquisitions, and regional manufacturing facilities to strengthen global footprints. Competition centers on efficiency, reliability, and the ability to deliver sustainable solutions that align with evolving industry and environmental standards. This dynamic ensures continuous advancement and positions the market for steady growth.

Recent Developments

- In July 2025, BASF aimed to acquire the remaining 49% stake in Alsachimie from DOMO Chemicals, targeting full ownership. This move strengthens its role in the polyamide 6.6 chain and may impact broader intermediate markets like isobutyraldehyde.

- In September 2024, Celanese introduced new electric vehicle (EV) battery material options at the 2024 Battery Show North America. These materials offer superior stiffness, reduced warpage, and improved noise, vibration, and harshness performance, all while maintaining tensile strength.

- In July 2023, Exxon Mobil Corporation announced its acquisition of Denbury Inc., significantly enhancing its carbon capture capabilities. This strategic move positions ExxonMobil as the operator of the largest carbon dioxide (CO2) pipeline network in the United States, bolstering its commitment to sustainability and emissions reduction efforts.

- In March 2023, Global Bioenergies (Evry, France) launched its Isonaturane 16, 2nd cosmetic ingredient. It is a natural version of isododecane, a twelve-carbon molecule attained by assembling 3 naturally sourced isobutene.

Report Coverage

The research report offers an in-depth analysis based on Form, Synthesis Method, Application and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand in pharmaceuticals and nutraceuticals.

- It will gain momentum from sustainable production methods using bio-based feedstocks.

- Strong growth will come from the coatings and resins sector worldwide.

- Demand for pesticides will sustain market relevance in agriculture.

- Asia-Pacific will continue to dominate due to large-scale industrial expansion.

- North America and Europe will focus on high-purity and regulatory-compliant intermediates.

- Companies will invest in advanced catalysts to improve synthesis efficiency.

- Strategic mergers and partnerships will enhance global supply capabilities.

- Healthcare innovation will strengthen the role of isobutyraldehyde in drug development.

- The market will benefit from ongoing research in eco-friendly and high-performance materials.