Market Overview:

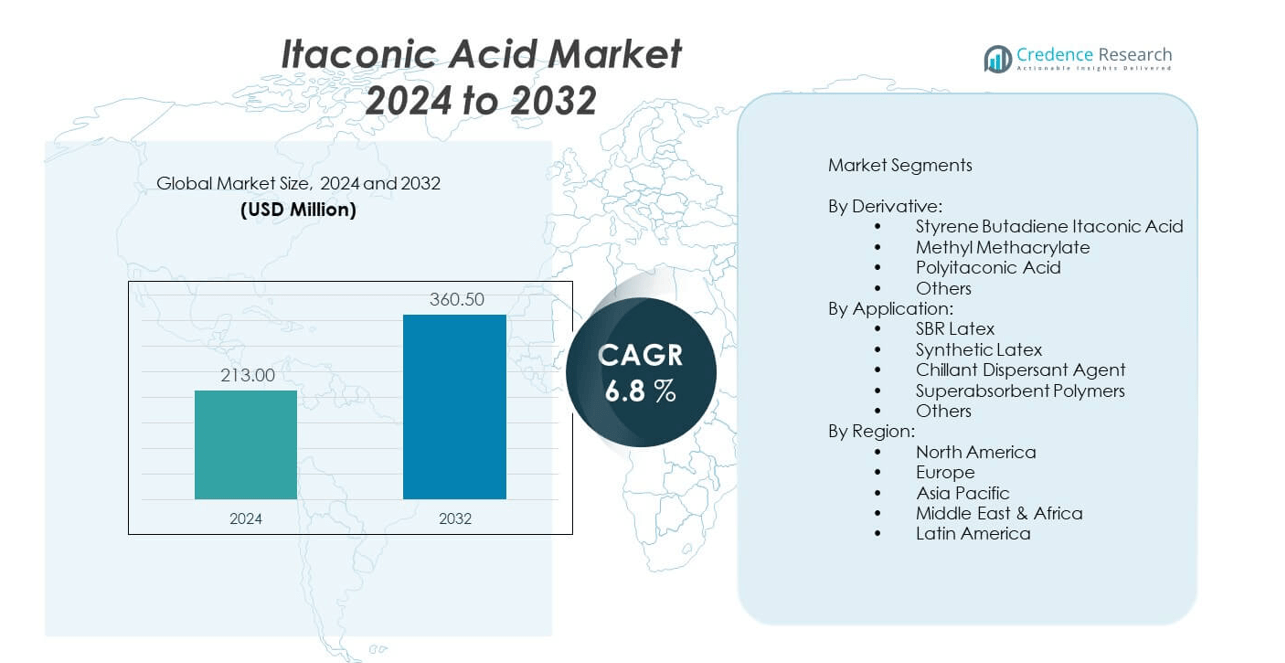

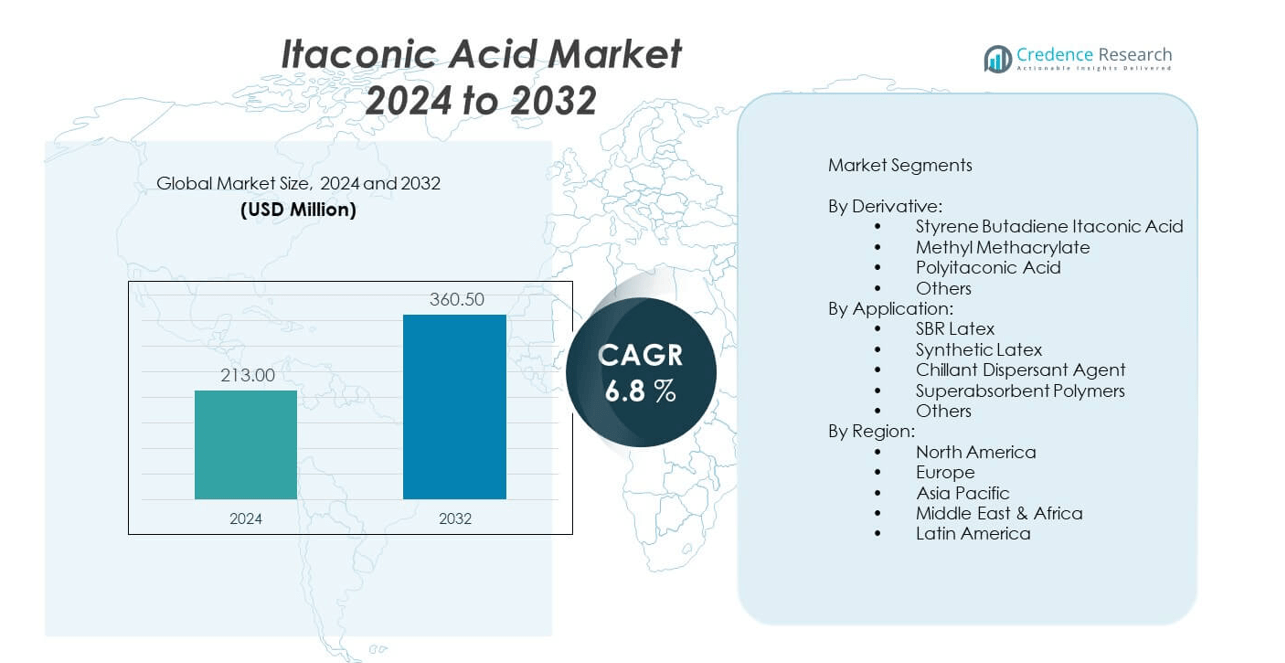

The Itaconic acid market is projected to grow from USD 213 million in 2024 to an estimated USD 360.5 million by 2032, with a compound annual growth rate (CAGR) of 6.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Itaconic acid market Size 2024 |

USD 213 million |

| Itaconic acid market, CAGR |

6.8% |

| Itaconic acid market Size 2032 |

USD 360.5 million |

The growth of the itaconic acid market is fueled by increasing demand for sustainable and bio-based chemicals across multiple industries. Manufacturers use itaconic acid as a platform chemical in biodegradable polymers, detergents, adhesives, and coatings. Rising environmental regulations and consumer preference for green products push industries to adopt itaconic acid as an alternative to petrochemical derivatives. It supports bio-refinery integration and enables downstream production of high-value biochemicals. Expanding applications in synthetic resins and superabsorbent polymers further strengthen its industrial relevance and commercial viability.

North America leads the itaconic acid market due to robust R&D activity, strong bioeconomy infrastructure, and growing demand for sustainable materials in packaging and automotive sectors. Europe follows closely, driven by policy support for renewable chemicals and innovation in green manufacturing. The Asia-Pacific region, led by China and India, is emerging rapidly due to expanding chemical production, rising environmental awareness, and local government initiatives promoting bio-based industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Itaconic acid market is projected to grow from USD 213 million in 2024 to USD 360.5 million by 2032, registering a CAGR of 6.8% during the forecast period.

- Rising demand for bio-based and sustainable chemicals across polymers, adhesives, and detergents industries drives market expansion.

- Regulatory pressure and consumer preference for eco-friendly products encourage substitution of petrochemical-based inputs with itaconic acid.

- High production costs and limited industrial-scale fermentation capacity restrain wider adoption in cost-sensitive applications.

- North America holds the largest market share, supported by advanced bio-refining capabilities and strong demand from packaging and automotive sectors.

- Europe follows closely with policy-driven support for renewable materials and strong green manufacturing infrastructure.

- Asia-Pacific emerges as the fastest-growing region due to increasing chemical production, environmental awareness, and government initiatives in China and India.

Market Drivers:

Rising Demand for Bio-Based Alternatives in the Chemical Industry:

The global shift toward sustainability has placed bio-based chemicals at the forefront of industrial demand. Itaconic acid, derived from renewable sources, serves as a direct substitute for petroleum-derived acids in multiple applications. Manufacturers across coatings, adhesives, and plastics industries are integrating itaconic acid into their product lines to meet eco-label certifications. Regulatory agencies in North America and Europe promote green chemistry principles, reinforcing adoption. The itaconic acid market benefits from this systemic move toward low-carbon, biodegradable compounds. Companies seek renewable feedstocks to reduce lifecycle emissions and improve environmental compliance. Industry players invest in fermentation technology to scale up production and reduce dependence on fossil inputs. The trend strengthens product positioning across value-added chemical segments.

- For instance, Itaconix Corporation, a leader in bio-based chemical technology, utilizes proprietary fermentation technology to produce poly(itaconic acid) at scale, achieving titers of over 100g/L using Aspergillus terreus, which is considered the industry benchmark for bio-based itaconic acid production

Expanding Use in Superabsorbent Polymers and Specialty Applications:

The rising demand for high-performance superabsorbent polymers in personal care and hygiene products creates new pathways for growth. Itaconic acid is increasingly used in SAP formulations for diapers, adult incontinence products, and feminine hygiene pads. It enhances fluid retention capacity and biodegradability, meeting dual consumer needs for performance and sustainability. Manufacturers use it to replace or supplement acrylic-based monomers, supporting eco-friendly product innovation. The itaconic acid market sees expanding traction in this niche due to rising global hygiene standards. It also finds applications in detergent builders and dispersants, adding to its functional versatility. Its unique reactivity enables development of copolymers and functional additives. The growing preference for biodegradable inputs across consumer goods accelerates integration in end-use sectors.

- For instance, Itaconix’s polyitaconic acid–based superabsorbent polymers are incorporated into hygiene products, where third-party studies report high swelling capacities and improved gel strength compared to traditional acrylic-based SAPs

Growth in the Bioplastics Industry and Circular Economy Initiatives:

The growing bioplastics industry supports long-term demand for itaconic acid across polymer manufacturing. It plays a key role in producing polyitaconic acid and co-polymers with applications in packaging and agricultural films. Governments implement policies encouraging biodegradable alternatives to conventional plastics, expanding commercial viability. Itaconic acid’s compatibility with polylactic acid (PLA) and polyhydroxyalkanoates (PHA) supports innovation in bio-composites. The itaconic acid market aligns with circular economy objectives by enabling recycling-friendly and compostable material development. Brand owners in packaging adopt bio-based additives to meet sustainability goals. Itaconic acid’s role in strengthening material properties without compromising degradability enhances its appeal. Producers explore industrial-scale microbial synthesis to improve production economics and reduce waste. These dynamics reinforce its relevance in next-generation bioplastic formulations.

Supportive Regulatory Environment and Industrial Decarbonization Efforts:

Environmental legislation across major economies continues to favor renewable chemicals in industrial formulations. The itaconic acid market benefits from clean production mandates and restrictions on hazardous substances in adhesives and coatings. It complies with global eco-labels and contributes to reduced VOC emissions, making it suitable for paints, binders, and dispersants. Industries are under pressure to decarbonize their upstream supply chains, prompting reevaluation of input materials. Itaconic acid provides a low-impact option with a favorable environmental profile. Government-backed innovation grants and bio-based product policies support R&D and commercial-scale production. Industry collaborations between chemical producers and bio-refineries enable technology transfer and process optimization. As decarbonization becomes a procurement priority, demand for compliant, renewable intermediates continues to grow.

Market Trends:

Shift Toward Microbial Fermentation for Cost-Effective Production:

Fermentation-based production methods are evolving to improve scalability and cost efficiency in bio-based chemical synthesis. Itaconic acid production increasingly leverages engineered strains of Aspergillus terreus and other fungi to optimize yield and purity. Industrial players focus on reducing feedstock costs and improving fermentation cycle times. Process innovations target continuous production systems and waste minimization. The itaconic acid market benefits from reduced reliance on petrochemicals and agricultural volatility. Manufacturers aim to commercialize fermentation techniques that deliver cost parity with acrylic acid. These advancements support broader adoption in bulk chemical applications. Biotechnology partnerships and pilot-scale trials accelerate transition from lab-scale to industrial output.

- For instance, Komagataella phaffii was engineered by academic and industrial teams to double itaconic acid yields per biomass (+123%) simply by adjusting fermentation temperature from 25°C to 30°C, reaching titers of 13.3g/L after just 40 hours of the methanol-feed phase—a significant reduction in batch cycle time

Emergence of Itaconic Acid in Biomedical and Pharmaceutical Research:

Researchers explore itaconic acid’s potential in drug delivery, biomaterials, and medical coatings due to its biocompatibility and functional group reactivity. It enables synthesis of smart hydrogels, biodegradable carriers, and wound dressing components. Universities and biotech startups investigate derivatives for targeted therapeutic delivery and tissue engineering. The itaconic acid market taps into innovation pipelines that prioritize bio-absorbable and antimicrobial material development. It supports functionalization strategies for controlled release mechanisms. Although still in early-stage commercialization, its presence in biomedical R&D widens its long-term market scope. Collaborations between chemical companies and research institutions facilitate preclinical testing and patent development.

- For instance, researchers at the University of New Hampshire and Itaconix developed and patented poly(itaconic acid) carriers that demonstrate high biocompatibility and the ability to achieve controlled drug release in medical hydrogel matrices, with grafted nanohydrogels showing a swelling capacity that can be tuned above 600g/g and finely controlled pH sensitivity—features advantageous for wound dressing and pharmaceutical applications.

Integration of Itaconic Acid in Water Treatment and Industrial Cleaning Formulations:

The increasing focus on sustainable water treatment solutions opens new application areas for itaconic acid. It functions as a biodegradable chelating agent and dispersant in scale inhibitors and boiler chemicals. It offers a green alternative to phosphates and nitrilotriacetic acid (NTA), aligning with wastewater discharge regulations. The itaconic acid market addresses demand from industrial cleaning and maintenance sectors looking for eco-friendly ingredients. Its compatibility with surfactants and polymers enhances cleaning efficiency and environmental safety. Manufacturers incorporate it into new-generation formulations to meet environmental compliance and operator safety requirements. It reduces metal corrosion and scale formation in water systems, improving system performance and longevity.

Rising Interest in Specialty Coatings and Bio-Based Adhesives:

The coatings and adhesives industries increasingly adopt bio-based monomers to meet zero-VOC and sustainability targets. Itaconic acid supports formulation of binders, dispersants, and reactive diluents with strong adhesion and flexibility. It works well with aqueous and solvent-free systems, helping companies reduce emissions and meet green certification standards. The itaconic acid market benefits from the shift toward renewable raw materials across architectural and industrial coatings. Adhesive manufacturers explore its potential for replacing synthetic acids in pressure-sensitive and structural adhesives. Its multi-functionality enables enhanced durability and substrate compatibility. The trend aligns with client preferences for non-toxic, compliant materials across construction and consumer applications.

Market Challenges Analysis:

High Production Costs and Limited Economies of Scale Restrict Commercial Reach:

Despite its bio-based appeal, the itaconic acid market faces cost barriers due to the complexity of fermentation-based production. Low yield rates, expensive substrates, and high downstream processing costs limit its commercial competitiveness with petrochemical alternatives. Scaling microbial fermentation to industrial levels requires significant capital and technical infrastructure. Producers struggle to match cost-efficiency achieved in synthetic pathways of similar acids. Market expansion slows when clients prioritize pricing over sustainability. Delays in pilot plant optimization and low product availability in some regions further hinder uptake. Investment in advanced fermentation systems and improved strain engineering remains essential. Until production costs align with mainstream demand, large-scale substitution across commodity markets remains limited.

Lack of Standardization and Limited End-User Awareness Across Industries:

The itaconic acid market also faces challenges from low awareness among downstream users, especially in traditional chemical sectors. Many manufacturers remain unfamiliar with its properties, applications, or regulatory status. Absence of global standards or material certifications creates uncertainty around formulation compatibility. Clients hesitate to adopt unfamiliar monomers without proven performance data and lifecycle analysis. The lack of unified technical specifications restricts procurement decisions across sectors such as construction, packaging, and water treatment. Marketing efforts often focus on niche applications, leaving broader commercial segments under-informed. Producers must invest in technical support, application testing, and client education to unlock wider market acceptance.

Market Opportunities:

Rising Focus on Bio-Based Value Chains in Emerging Economies:

Countries in Asia-Pacific, Latin America, and Eastern Europe are promoting bio-based industries to reduce fossil dependency and enhance export competitiveness. The itaconic acid market has strong growth potential in these regions due to increasing investments in green chemistry, infrastructure development, and industrial diversification. Governments provide incentives for bio-refineries and research collaborations. Local chemical manufacturers explore integration of itaconic acid into resin, coating, and polymer segments. Domestic production facilities are expanding to serve regional demand with cost-effective bio-solutions.

Growing Scope in Composite Materials and High-Performance Polymers:

The itaconic acid market holds strong potential in composites used for automotive, aerospace, and construction applications. Its ability to enhance mechanical strength and biodegradability makes it suitable for lightweight, high-strength materials. Manufacturers develop custom formulations combining itaconic acid with PLA, PHA, or cellulose to create performance-optimized bio-composites. These materials help companies meet both durability and environmental compliance targets. The opportunity expands as industries adopt multifunctional materials with green certifications.

Market Segmentation Analysis:

By Derivative

The itaconic acid market is categorized into styrene butadiene itaconic acid, methyl methacrylate, polyitaconic acid, and others. Styrene butadiene itaconic acid holds the leading share due to its strong demand in paper coatings and latex binders, offering improved adhesion and performance. Methyl methacrylate contributes significantly to the market due to its use in adhesives and coatings, especially in automotive and construction sectors. Polyitaconic acid is gaining traction for its biodegradability and role in bio-based polymer development. It enables the creation of environmentally friendly materials and aligns with circular economy goals. The “others” category includes niche derivatives used in customized formulations for specialty applications. Each derivative supports distinct functional requirements across industries, influencing purchasing decisions based on reactivity and performance profile.

- For instance, Polyitaconic acid, commercialized by Itaconix, is utilized in the manufacture of bio-based polymer resins for home and textile care, with products tested to be completely biodegradable in soil within 180 days, aligning with circular economy standards.

By Application

Key application areas of the itaconic acid market include SBR latex, synthetic latex, chillant dispersant agents, superabsorbent polymers, and others. SBR latex leads due to its high utilization in automotive tires, adhesives, and carpet backings. Synthetic latex finds widespread application in paints, coatings, sealants, and construction products where flexibility and strength are essential. Chillant dispersant agents see growing adoption in water treatment and industrial cleaning sectors due to their efficiency and low environmental impact. The superabsorbent polymers segment continues expanding, driven by increased demand for personal hygiene products such as diapers and sanitary pads. The “others” segment includes coatings, bio-based plastics, and emerging materials. The market continues to diversify its application scope to align with performance, sustainability, and regulatory needs.

- For instance Synthetic latex applications, such as paints and sealants, benefit from itaconic acid’s stabilization effect on polymer matrices, as documented by Itaconix technical use-cases showing improved tensile strength and durability over conventional synthetic latex.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Derivative:

- Styrene Butadiene Itaconic Acid

- Methyl Methacrylate

- Polyitaconic Acid

- Others

By Application:

- SBR Latex

- Synthetic Latex

- Chillant Dispersant Agent

- Superabsorbent Polymers

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America accounts for the largest share in the itaconic acid market, contributing approximately 35% of the global revenue in 2024. The region benefits from advanced bio-refining technologies, strong regulatory support for sustainable chemicals, and significant demand from the packaging, coatings, and personal care industries. The United States leads due to robust investment in bio-based R&D and the presence of key players like Itaconix Corporation. Canada supports growth through favorable green chemistry initiatives and growing demand for eco-friendly adhesives and resins. Industrial users across sectors adopt itaconic acid to align with emission targets and green procurement policies. It maintains strong regional demand as corporations prioritize renewable inputs in product formulations.

Europe

Europe holds about 28% of the itaconic acid market, driven by the region’s commitment to the circular economy and sustainable raw material use. Countries like Germany, France, and the Netherlands enforce strict environmental regulations, encouraging adoption of bio-based monomers. The market benefits from strong research infrastructure, policy incentives, and growing consumer preference for biodegradable and non-toxic products. Regional manufacturers integrate itaconic acid into polymers, coatings, and superabsorbent applications to meet compliance and eco-labeling standards. It gains steady traction in the EU due to support from innovation programs and partnerships between chemical producers and bio-refineries. Demand remains consistent across automotive, personal care, and packaging sectors.

Asia Pacific

Asia Pacific represents approximately 25% of the itaconic acid market and is the fastest-growing region. Countries such as China, India, and Japan are investing in bio-based chemical manufacturing to reduce fossil fuel dependence and improve export competitiveness. China leads regional growth with expanding industrial use and local production capabilities. India shows strong demand for green inputs in agriculture, detergents, and hygiene products. The region benefits from lower production costs, growing environmental awareness, and regulatory shifts toward non-toxic raw materials. It supports expansion opportunities as local producers increase capacity and multinational firms establish regional supply chains.

Rest of the World (Latin America and Middle East & Africa)

The remaining 12% of the itaconic acid market comes from Latin America and the Middle East & Africa. These regions are in early stages of adoption but exhibit growing potential due to increasing interest in sustainable agriculture and industrial applications. Brazil and South Africa show emerging demand as part of national bioeconomy efforts. It continues to gain relevance as governments and manufacturers explore renewable alternatives for domestic industries.

Key Player Analysis:

- Itaconix Corporation

- Qingdao Langyatai Group Co., Ltd.

- Alpha Chemika

- Zhejiang Guoguang Biochemistry Co., Ltd.

- Iwata Chemical Co., Ltd.

- Jinan Huaming Biochemistry Co., Ltd.

- Shandong Kaison Biochemical Co., Ltd.

- Chengdu Jinkai Biology Engineering Co., Ltd.

- Ronas Chemicals Ind. Co., Ltd.

- Aekyung Petrochemical Co., Ltd.

- Nanjing Huajin Healthcare Biologicals Co., Ltd.

- Shandong Zhongshun Science & Technology Development Co., Ltd.

- Ultimate Chem India Pvt. Ltd.

- Fuso Chemical Co., Ltd.

- Merck KGaA

- Thermo Fisher Scientific

Competitive Analysis:

The itaconic acid market features a moderately fragmented competitive landscape with a mix of global chemical companies and specialized bio-based manufacturers. Leading players include Itaconix Corporation, Qingdao Langyatai Group, Zhejiang Guoguang Biochemistry, and Merck KGaA. It experiences steady product innovation and process optimization, with a focus on fermentation efficiency and application versatility. Key players invest in capacity expansion, downstream integration, and regional partnerships to enhance market penetration. The market favors companies with strong technical expertise, cost-effective production capabilities, and regulatory certifications. Competition centers around price-performance balance, feedstock flexibility, and alignment with environmental standards. Companies that offer high-purity derivatives and application-specific grades gain competitive advantage in high-growth sectors like hygiene, coatings, and adhesives.

Recent Developments:

- In July 2025, Itaconix Corporationannounced the commercial launch of its BIO*Asterix® line, a new range of plant-based building blocks derived from itaconic acid for use in paints, coatings, and adhesives. This launch expands Itaconix’s product offerings and introduces a patented monomer, providing sustainable alternatives to fossil-based monomers. The company also debuted its first ecommerce platform to market and sell these products, targeting research labs and industry innovators focused on greener polymer solutions.

- In July 2025, Qingdao Langyatai Group Co., Ltd. participated in the 2025 ASEAN-China (Qingdao) Economic and Trade Cooperation Event, showcasing active collaborations and signing initiatives focused on fostering cross-border industrial partnerships. These developments are part of Qingdao’s strategy to deepen ASEAN business ties, particularly in biopharmaceuticals and modern chemical manufacturing.

- In June 2025, Shandong Kaison Biochemical Co., Ltd. benefited from the European Commission’s updated anti-dumping ruling on sodium gluconate. The company secured a reduced anti-dumping duty rate of 5.6%, significantly lower than the typical rate for Chinese exporters, supporting its competitive market position in Europe.

- Notably in July 2025, Iwata Chemical Co., Ltd. completed the acquisition of EXQ in Malaysia, signaling a significant expansion into Southeast Asia’s chemicals market. This move enhances Iwata’s regional supply chain efficiency and strengthens its presence in high-growth Asian markets, in line with its global leadership ambitions in advanced materials and chemicals.

Market Concentration & Characteristics:

The itaconic acid market shows moderate concentration with a few key producers holding significant capacity and distribution reach. It demonstrates high specialization in fermentation-based production methods and requires advanced bioprocessing capabilities. Barriers to entry include technological expertise, cost of production, and regulatory compliance. It favors manufacturers that can balance sustainability with commercial scalability. Market characteristics include increasing application diversification, moderate price sensitivity, and a shift toward region-specific customization. Growth aligns with evolving environmental regulations and demand for bio-based chemical inputs across multiple industries.

Report Coverage:

The research report offers an in-depth analysis based on By Derivative and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for biodegradable polymers will expand application scope across packaging and hygiene sectors.

- Adoption in water treatment and industrial cleaning will grow due to regulatory pressure on phosphates.

- Advancements in fermentation efficiency will reduce production costs and improve scalability.

- Bio-based adhesives and coatings will drive new formulation development.

- Strategic partnerships will support regional expansion and downstream integration.

- Emerging economies will increase consumption through green manufacturing policies.

- Biomedical research will open niche markets in drug delivery and biomaterials.

- Focus on circular economy will promote wider substitution of petrochemical inputs.

- Regulatory incentives will encourage industrial shift toward low-emission raw materials.

- Digitalization of chemical R&D will accelerate innovation in itaconic acid applications.