Market Overview:

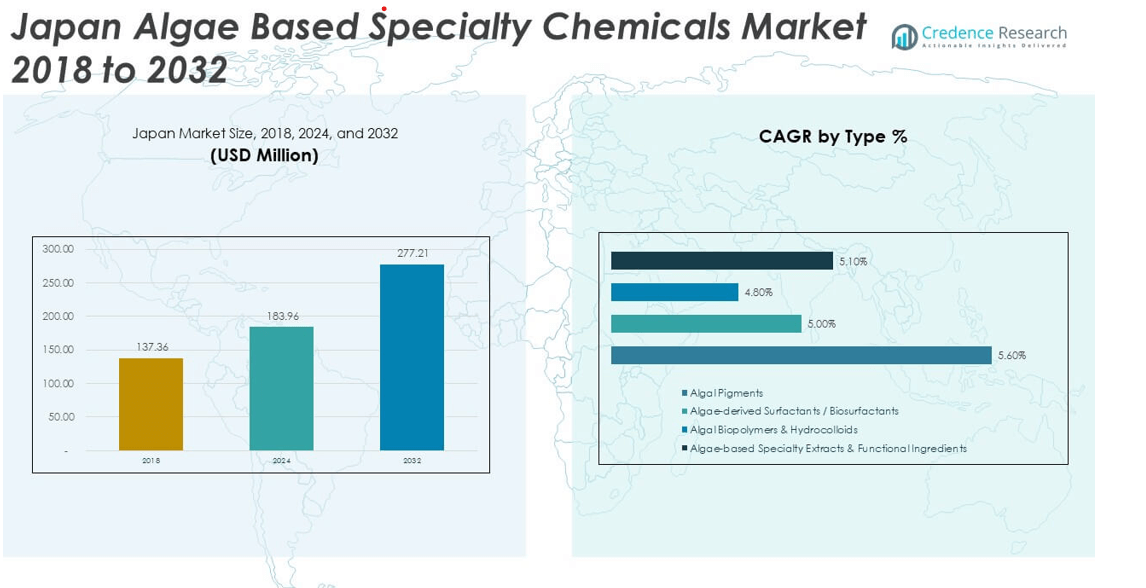

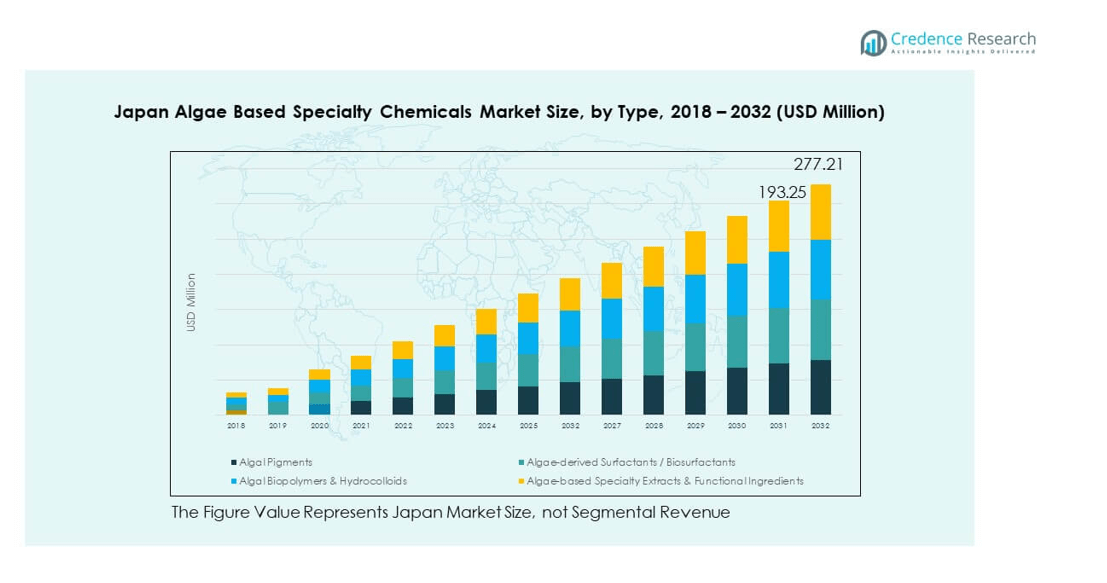

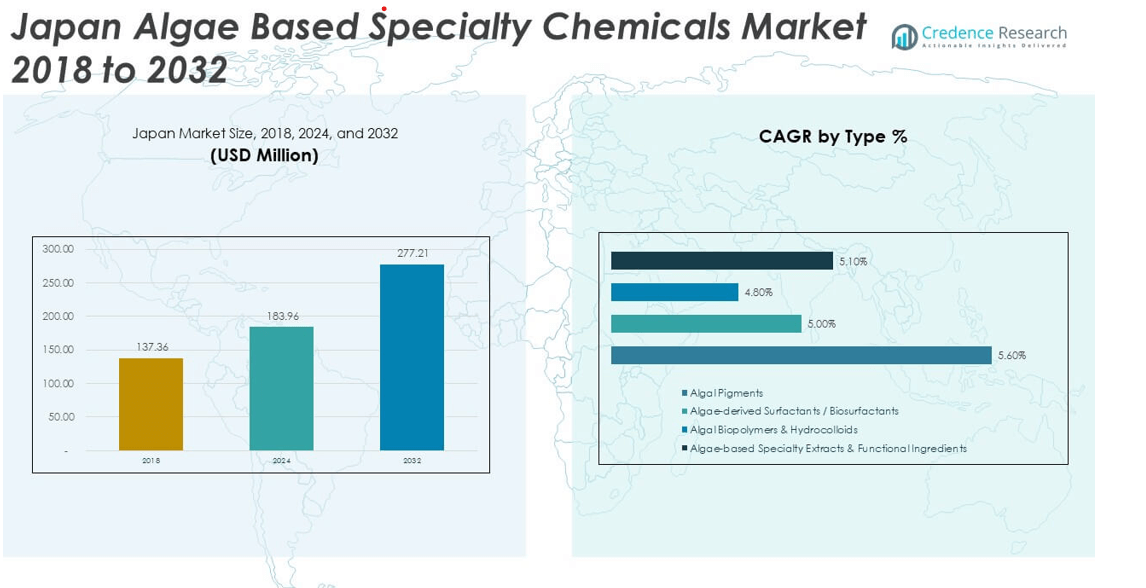

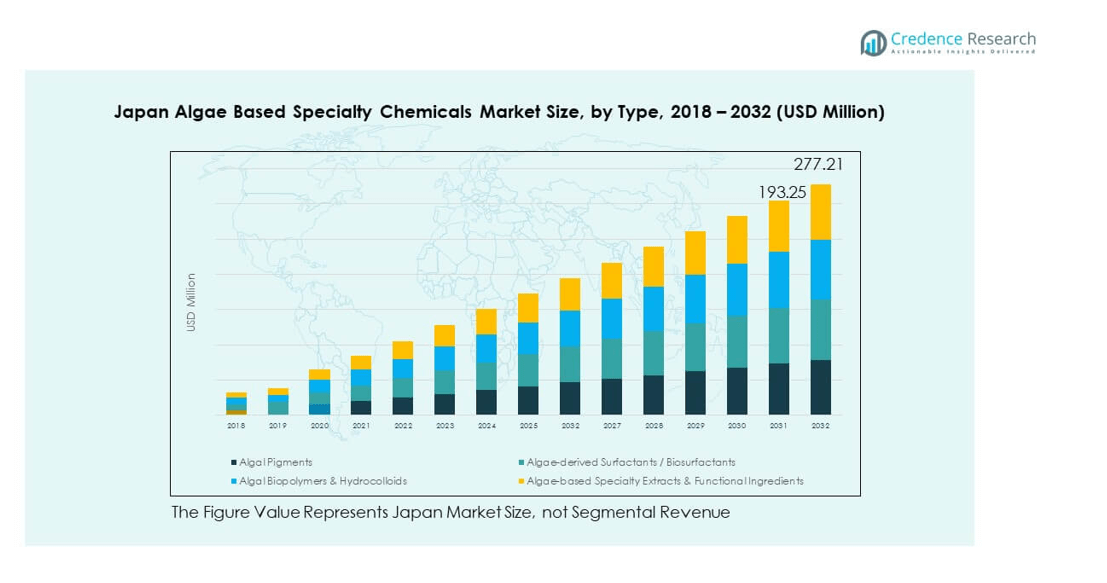

The Japan Algae Based Specialty Chemicals Market size was valued at USD 137.36 million in 2018 to USD 183.96 million in 2024 and is anticipated to reach USD 277.21 million by 2032, at a CAGR of 5.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Algae Based Specialty Chemicals Market Size 2024 |

USD 183.96 million |

| Japan Algae Based Specialty Chemicals Market, CAGR |

5.22% |

| Japan Algae Based Specialty Chemicals Market Size 2032 |

USD 277.21 million |

Growth in the Japan algae-based specialty chemicals market is driven by the rising demand for sustainable and natural alternatives across multiple industries. Companies are adopting algae-derived ingredients in pharmaceuticals, nutraceuticals, and cosmetics to meet consumer preferences for bio-based products. Functional benefits such as antioxidants, pigments, and bioactive compounds enhance product value and encourage wider usage. Strong regulatory support and advancements in algae cultivation technologies further strengthen the market’s trajectory. It reflects a shift toward greener, performance-oriented solutions across consumer and industrial applications.

Regionally, Kanto leads the Japan algae-based specialty chemicals market with strong presence of biotechnology, cosmetics, and nutraceutical industries. Kansai follows with robust contributions from pharmaceutical and food processing companies that integrate algae compounds into innovative products. Chubu shows growing adoption in bioplastics and specialty materials manufacturing. Emerging regions such as Hokkaido and Kyushu expand demand through agriculture, aquaculture, and nutraceutical applications. It demonstrates a balanced mix of mature hubs driving innovation and regional economies adopting algae to meet sustainability goals.

Market Insights

- The Japan Algae Based Specialty Chemicals Market was valued at USD 137.36 million in 2018, reached USD 183.96 million in 2024, and is projected to attain USD 277.21 million by 2032, growing at a CAGR of 5.22%.

- Kanto leads with 36% share due to its concentration of pharmaceutical, nutraceutical, and cosmetics industries, followed by Kansai with 28% driven by food processing and pharma hubs, and Chubu with 22% supported by bioplastics and specialty materials.

- Hokkaido, Tohoku, Kyushu, and other regions collectively hold 14% but are the fastest-growing, supported by agriculture, aquaculture, and government initiatives for rural industrial diversification.

- Algal pigments account for 33% of the segment share, driven by applications in cosmetics, pharmaceuticals, and functional foods.

- Algal biopolymers and hydrocolloids represent 28% of the market, supported by rising demand in food stabilization, packaging, and bioplastic applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Sustainable and Bio-Based Alternatives

The Japan Algae Based Specialty Chemicals Market is supported by the strong push toward sustainable and bio-based solutions. Industries such as cosmetics, food, and pharmaceuticals are moving away from synthetic chemicals to reduce environmental impact. Algae-based products offer biodegradability, renewable sourcing, and improved ecological safety, aligning with global sustainability targets. Regulatory authorities in Japan encourage adoption by tightening restrictions on petroleum-derived inputs. This has created favorable conditions for bio-based formulations to scale across diverse applications. Companies investing in algae-based innovation gain a competitive advantage in product positioning. The ability to offer safe, eco-conscious solutions drives consumer trust and strengthens brand value. It reflects how sustainability is becoming a central driver for long-term growth.

Expanding Applications in Pharmaceuticals and Nutraceuticals

Demand for algae-derived specialty chemicals is expanding in the pharmaceutical and nutraceutical industries. Consumers prioritize natural, functional ingredients for health benefits, pushing manufacturers to innovate. Algae-derived compounds contain bioactive properties, antioxidants, and essential nutrients that enhance their commercial appeal. Japan’s strong healthcare sector and aging population accelerate the adoption of algae-based supplements. Pharmaceutical companies invest in research to validate algae’s role in therapeutic formulations. Nutraceutical brands leverage algae for immunity, cardiovascular, and anti-inflammatory support. It supports diversification of product portfolios and fosters greater market penetration. This dynamic highlights the role of algae in bridging wellness and science-driven innovation.

Technological Advancements in Cultivation and Processing

Innovation in algae cultivation and extraction technologies drives cost efficiency and scalability. Improved photobioreactors and open-pond systems enhance yield and stability in large-scale production. Advanced bioprocessing ensures extraction of high-value compounds with minimal waste. These methods help companies maintain consistent quality across applications in cosmetics, agriculture, and food sectors. Japan’s investments in biotechnology research institutions strengthen its position in the global algae sector. The adoption of automation and AI monitoring reduces dependency on manual intervention and improves process precision. It allows producers to scale operations while controlling costs and maintaining quality. These technological breakthroughs make algae-derived solutions more accessible to industries at competitive pricing.

- For example, Euglena Co., Ltd. opened an integrated algae-to-biofuels facility in Yokohama producing renewable diesel and jet fuel, with a capacity of 125 kiloliters (33,000 gallons) per year as of 2023. The facility applies Chevron Lummus Global and ARA bioprocessing technology; the renewable diesel produced already meets Japanese industrial fuel standards and has been adopted in public transportation fleets.

Regulatory and Governmental Support for Bioeconomy Growth

Government policies in Japan favor the development of a bio-based economy. Initiatives promoting carbon reduction, circular economy practices, and renewable resources push companies toward algae solutions. Support for research projects and start-ups working in algae biotechnology builds a strong innovation ecosystem. Subsidies and grants lower the entry barriers for new ventures in the sector. Academic-industry collaborations foster knowledge transfer and rapid commercialization of algae products. The government also encourages the development of sustainable supply chains, ensuring consistent raw material availability. It positions Japan as a leader in algae-based specialty chemical development in the Asia-Pacific. The combined effect of regulations and incentives sustains long-term demand for algae-based innovations.

- For instance, in 2023, Japan’s Green Innovation Fund (GI Fund) under NEDO selected CHITOSE Group for a USD 400 million project running through 2030 to scale algae production to 100 hectares. The initiative involves 34 companies and five Japanese universities, aiming to build a sustainable bio-based industry.

Market Trends

Integration of Algae-Based Chemicals in Cosmetics and Personal Care

The Japan Algae Based Specialty Chemicals Market is witnessing strong demand from the cosmetics and personal care industry. Rising consumer interest in clean-label skincare pushes formulators to include natural algae extracts. Algae-derived ingredients deliver anti-aging, hydrating, and antioxidant properties highly valued by Japanese consumers. The demand for multifunctional cosmetic solutions drives greater usage of algae components in premium ranges. Beauty brands are marketing algae-based ingredients as high-performance alternatives to synthetic chemicals. This shift aligns with the Japanese tradition of valuing natural health and beauty. It highlights how lifestyle preferences shape industrial innovation in cosmetics. Growth is reinforced by the global clean beauty movement influencing local demand.

Rising Role of Algae in Agriculture and Crop Enhancement

Agriculture is embracing algae-based inputs for sustainable crop enhancement. Algae extracts improve soil fertility, promote seed germination, and boost crop resilience to stress. Farmers in Japan are adopting algae-based biofertilizers to meet demand for chemical-free produce. This reflects a growing trend toward environmentally conscious farming practices. Algae-based solutions reduce dependency on synthetic fertilizers that contribute to soil degradation. It positions algae as a crucial enabler of food security and sustainable farming. The government’s emphasis on reducing agricultural chemical usage further supports the transition. This agricultural shift creates long-term demand for specialty algae chemicals in rural economies.

Innovation in Functional Foods and Beverages

The functional food and beverage industry is increasingly adopting algae-based ingredients. Japanese consumers are highly receptive to fortified foods offering health benefits. Algae provides omega-3 fatty acids, proteins, and bioactive compounds ideal for functional formulations. Food manufacturers are introducing fortified snacks, beverages, and supplements featuring algae extracts. It connects wellness demands with consumer interest in natural alternatives. The trend is further reinforced by rising awareness of plant-based diets in Japan. Algae aligns with this shift by offering nutrient-dense, plant-origin solutions with proven efficacy. This focus on functional nutrition drives product innovation and competitive differentiation in the sector.

- For instance, on July 10, 2024, Euglena Co., Ltd. and ORYZAE Co., Ltd. launched “ORYZAE GRANOLA Euglena”, a sugar-free granola using ORYZAE’s rice koji-based sweetener and “Ishigaki Island Euglena” superfood. The product integrates Euglena to enhance nutrition in mainstream foods in Japan.

Adoption of Circular Economy Practices in Algae Processing

Circular economy principles are shaping algae-based specialty chemical production. Companies adopt closed-loop systems to recycle water and optimize energy use in cultivation. Waste biomass is converted into biofuels, fertilizers, or secondary products, reducing overall environmental impact. Japan’s industrial ecosystem encourages resource efficiency and low-carbon technologies. It demonstrates alignment between algae’s sustainability potential and broader environmental goals. Integration of circular processes strengthens the eco-friendly value proposition of algae chemicals. These practices also enhance corporate reputation and compliance with tightening green standards. Businesses that adopt such frameworks strengthen their resilience in competitive markets. This trend positions algae as a key player in future sustainable manufacturing.

- For instance, DIC Corporation, in partnership with Green Science Materials, developed indoor mass cultivation technology for the endangered Suizenji Nori algae, ensuring stable production of the high-value polysaccharide SACRAN™ while supporting biodiversity conservation.

Market Challenges Analysis

High Production Costs and Supply Chain Constraints

The Japan Algae Based Specialty Chemicals Market faces challenges linked to high production costs and raw material limitations. Large-scale cultivation requires advanced infrastructure such as photobioreactors and high-maintenance equipment, driving capital intensity. Operational costs remain elevated compared to synthetic alternatives, making price competition difficult. Supply chains for algae biomass are not fully developed, leading to raw material availability issues. Limited production facilities in Japan increase reliance on imports to meet domestic demand. It creates uncertainty for industries depending on consistent, high-volume algae supply. Addressing these hurdles requires coordinated investment in local algae farming and supply chain improvements. Without cost optimization, scaling algae adoption across industries remains a significant challenge.

Market Awareness and Technical Integration Barriers

Awareness of algae-based specialty chemicals remains relatively limited in some industrial sectors. Traditional industries may resist transitioning from established synthetic inputs due to unfamiliarity with algae benefits. Integration of algae-based compounds requires reformulation, testing, and regulatory approval, which extends adoption timelines. Companies hesitate to allocate budgets for such transitions without clear evidence of cost efficiency. It highlights a gap between technological capability and market readiness. Technical challenges also arise in ensuring product stability, consistency, and performance across applications. Overcoming these barriers requires extensive education, pilot projects, and stronger marketing strategies. Wider adoption depends on bridging knowledge gaps between algae innovators and end-users.

Market Opportunities

Expansion into Emerging Industrial Applications

The Japan Algae Based Specialty Chemicals Market presents opportunities in emerging industrial applications beyond traditional sectors. Algae-derived polymers, surfactants, and specialty coatings show potential for eco-friendly industrial use. Industries such as textiles, packaging, and paints can benefit from algae’s functional and sustainable properties. Japan’s strong manufacturing base creates demand for alternative inputs with low environmental impact. It enables algae products to diversify into industrial material supply chains. Collaborations between industrial companies and biotechnology firms are likely to accelerate adoption. Such opportunities open pathways for algae-based innovation beyond health and wellness.

Strengthening of Export Potential in Asia-Pacific

Export potential across Asia-Pacific represents another major opportunity. Countries such as South Korea, China, and Southeast Asian nations show increasing interest in algae-based products. Japan can position itself as a leader by supplying high-quality algae-derived specialty chemicals. It benefits from strong technological expertise and regulatory compliance standards. Regional trade agreements further simplify cross-border supply of bio-based products. Growing demand for eco-friendly inputs in neighboring economies enhances export potential. This geographic advantage reinforces Japan’s ability to act as a reliable algae exporter. It strengthens long-term growth prospects while diversifying market exposure.

Market Segmentation Analysis

By type, the Japan Algae Based Specialty Chemicals Market demonstrates strong diversification across multiple product categories. Algal pigments dominate demand within the cosmetics, pharmaceutical, and food industries because of their natural color stability and antioxidant properties. Algae-derived surfactants and biosurfactants are gaining traction in personal care and cleaning applications, valued for their biodegradability and eco-friendly profile. Algal biopolymers and hydrocolloids find widespread use in food formulations and bioplastics due to their gelling and stabilizing functions. Algae-based specialty extracts and functional ingredients are expanding rapidly, supported by nutraceutical and functional food demand. It reflects how varied product categories create balanced opportunities for producers and end users.

- For instance, at Milan Design Week 2025, design studio We+ and Algal Bio Co., Ltd. presented the “SO-Colored” project, showcasing microalgae-derived pigment powders mixed with natural resins to create vibrant, sustainable color finishes for potential use in cosmetics and design.

By end user, the market displays dynamic growth across consumer and industrial sectors. Food and beverage along with nutraceutical brands drive consistent adoption of algae ingredients for health-oriented product innovation. Cosmetics and personal care companies integrate algae compounds for premium, natural formulations. Pharmaceutical and diagnostics firms rely on algae pigments and biomarkers to enhance precision applications. Packaging and bioplastics manufacturers explore algae-derived polymers to align with sustainability goals. Agriculture and aquaculture formulators utilize algae extracts to improve crop yields and animal health. Industrial and household cleaning product makers adopt algae-based surfactants to reduce reliance on petrochemicals. It highlights the broad commercial appeal across industries seeking bio-based, high-performance alternatives.

- For instance, in April 2024, DIC Corporation, in partnership with high-profile biotech startup Checkerspot Inc., began pilot-scale commercial testing of its algae oil-based DAILUBE™ KS-519 sulfurized extreme pressure (EP) additives for use in metalworking fluids, greases, and lubricants in automotive and industrial sectors.

Segmentation

By Type

- Algal Pigments

- Algae-Derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-Based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis

Kanto Region

The Kanto region holds the largest share of the Japan Algae Based Specialty Chemicals Market, accounting for 36% of total revenue. Tokyo, Kanagawa, and Chiba are central to demand, driven by their concentration of pharmaceutical, nutraceutical, and cosmetics industries. The presence of advanced research institutions and biotechnology companies fosters consistent innovation in algae-based formulations. Strong consumer demand for premium health products and clean-label cosmetics strengthens regional adoption. It benefits from efficient logistics and well-established industrial infrastructure that support large-scale distribution. The region continues to attract investments from both domestic and global players focused on algae-based innovation. This makes Kanto the hub for technological and commercial expansion within the sector.

Kansai Region

The Kansai region contributes 28% of the Japan Algae Based Specialty Chemicals Market, supported by Osaka, Kyoto, and Hyogo’s strong industrial and manufacturing ecosystem. Pharmaceutical and food processing companies in the area actively incorporate algae-derived compounds into health products and functional foods. Local demand is reinforced by consumer preference for sustainable, plant-based ingredients in everyday products. It is further supported by the presence of universities and research centers driving algae biotechnology applications. Strategic collaborations between companies and academic institutions provide a foundation for product development. Kansai’s role as a logistics gateway also aids exports to Asia-Pacific neighbors. This positions the region as a vital contributor to market expansion.

Chubu and Other Regions

The Chubu region represents 22% of the Japan Algae Based Specialty Chemicals Market, with Nagoya and surrounding areas serving as industrial anchors. Its strengths lie in bioplastics and specialty materials manufacturing where algae-derived polymers are gaining traction. Strong industrial linkages support adoption across packaging and agriculture. Hokkaido, Tohoku, Kyushu, and other regions collectively account for 14% of the market. These areas focus on aquaculture, agriculture, and smaller-scale nutraceutical applications where algae extracts improve productivity and sustainability. It offers growth potential through government-backed initiatives for regional industrial diversification and rural development. Together, these subregions balance the geographic footprint of algae-based specialty chemical adoption across Japan.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CABB Chemicals

- BASF SE

- Fuji Chemical Industry Co., Ltd.

- Cyanotech Corporation

- Earthrise Nutritionals

- Japan Algae Co., Ltd.

- CP Kelco

- Cargill

- DSM

- Other Key Players

Competitive Analysis

The Japan Algae Based Specialty Chemicals Market features a competitive landscape shaped by global corporations and domestic leaders. Multinational players such as BASF SE, DSM, and Cargill focus on scaling algae-derived ingredients for pharmaceutical, nutraceutical, and cosmetic applications. Their established distribution networks and financial strength allow them to invest in advanced cultivation and extraction technologies. Domestic companies, including Japan Algae Co., Ltd. and Fuji Chemical Industry Co., Ltd., leverage local expertise and consumer insights to develop tailored solutions for regional demand. It benefits from a balance between global innovation and local specialization that drives healthy competition. Smaller players and niche firms emphasize high-value segments such as algal pigments, biosurfactants, and biopolymers, targeting markets with sustainable product demand. Strategic partnerships between biotechnology firms and universities are common, accelerating R&D pipelines and product launches. Competitive strategies center on sustainability credentials, supply chain reliability, and the ability to meet strict Japanese regulatory standards. Price competitiveness remains a challenge for newer entrants, pushing many toward specialized or premium market niches. It highlights a dynamic market environment where innovation, compliance, and differentiation determine long-term leadership. Companies with strong technological capacity and regional alignment are well-positioned to expand their market share.

Recent Developments

- In August 2025, Phytolipid Technologies secured ¥220 million in seed funding to set up a microalgae-based oil production facility in Setouchi, Japan. This investment is directed at expanding the supply of sustainable food ingredients produced from Nannochloropsis algae and supporting the country’s shift toward eco-friendly specialty chemicals in the food sector.

- In June 2025, CABB Chemicals announced a strategic partnership with Origin by Ocean to establish a first-of-its-kind algae biorefinery at their Kokkola, Finland site. This facility will utilize patented technology to process invasive brown seaweed, producing high-value ingredients like alginate and fucoidan for use in cosmetics, detergents, and textiles.

- In March 2025, Brevel, an Israeli company focusing on microalgae proteins, attracted a $25 million investment with the goal of accelerating commercialization of microalgae-based protein ingredients for food and beverage applications, including potential partnerships and expansion into the Japanese specialty chemicals sector.

Report Coverage

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Algae Based Specialty Chemicals Market will experience stronger adoption in pharmaceuticals and nutraceuticals driven by bioactive compounds.

- Growth in cosmetics and personal care will continue as algae-derived pigments and extracts gain consumer trust.

- Expansion into functional foods and beverages will provide new revenue streams for manufacturers.

- Agricultural applications will strengthen with algae-based biofertilizers and growth enhancers improving sustainability.

- Industrial and household cleaning products will integrate algae biosurfactants to replace petrochemical inputs.

- Packaging and bioplastics producers will accelerate use of algae biopolymers to meet green regulations.

- Technological improvements in cultivation and extraction will lower costs and increase scalability.

- Regional exports to Asia-Pacific will expand, positioning Japan as a leader in algae-based innovation.

- Strategic collaborations between academia and industry will fuel product development and commercial breakthroughs.

- Strong government support for carbon reduction policies will sustain long-term investment in algae-based chemicals.