Market Overview

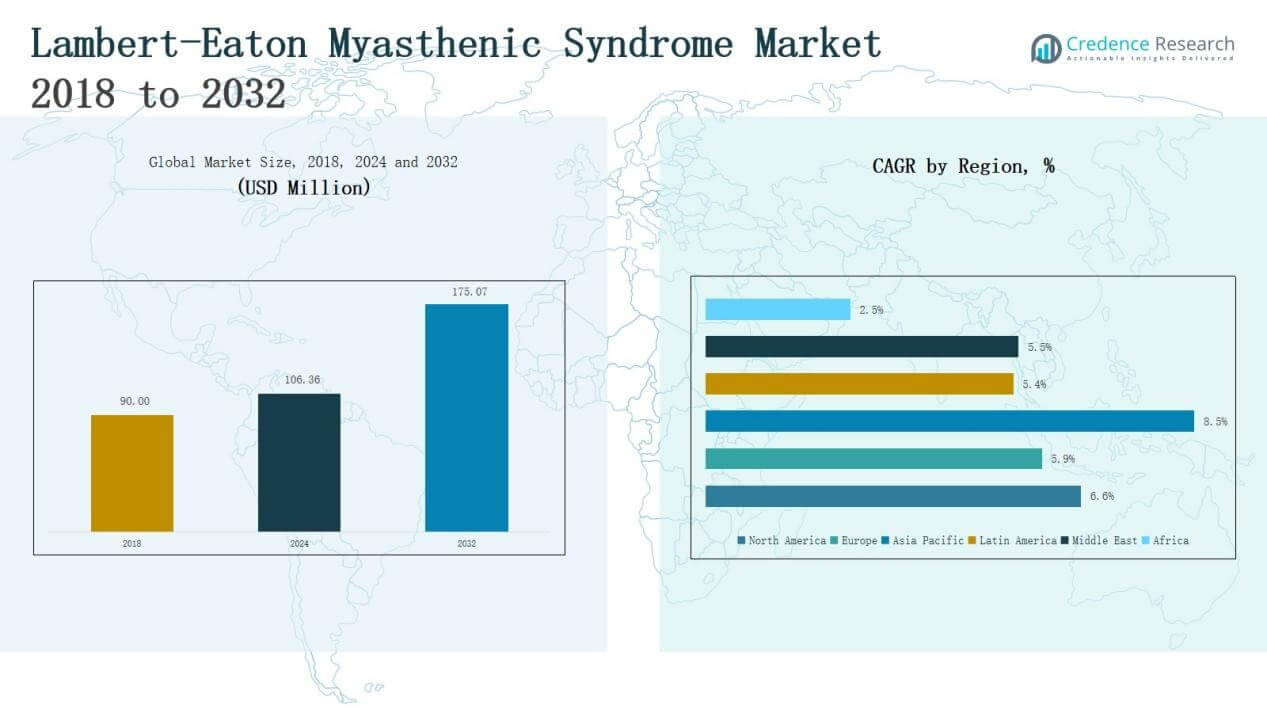

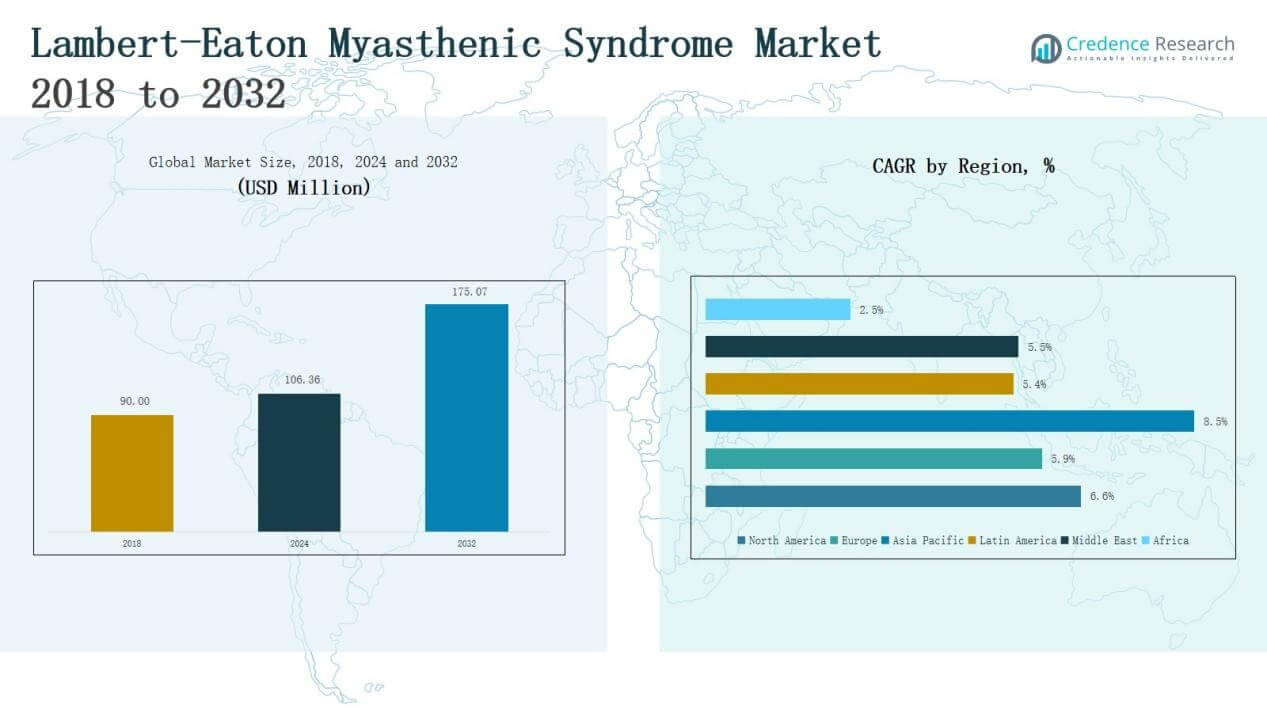

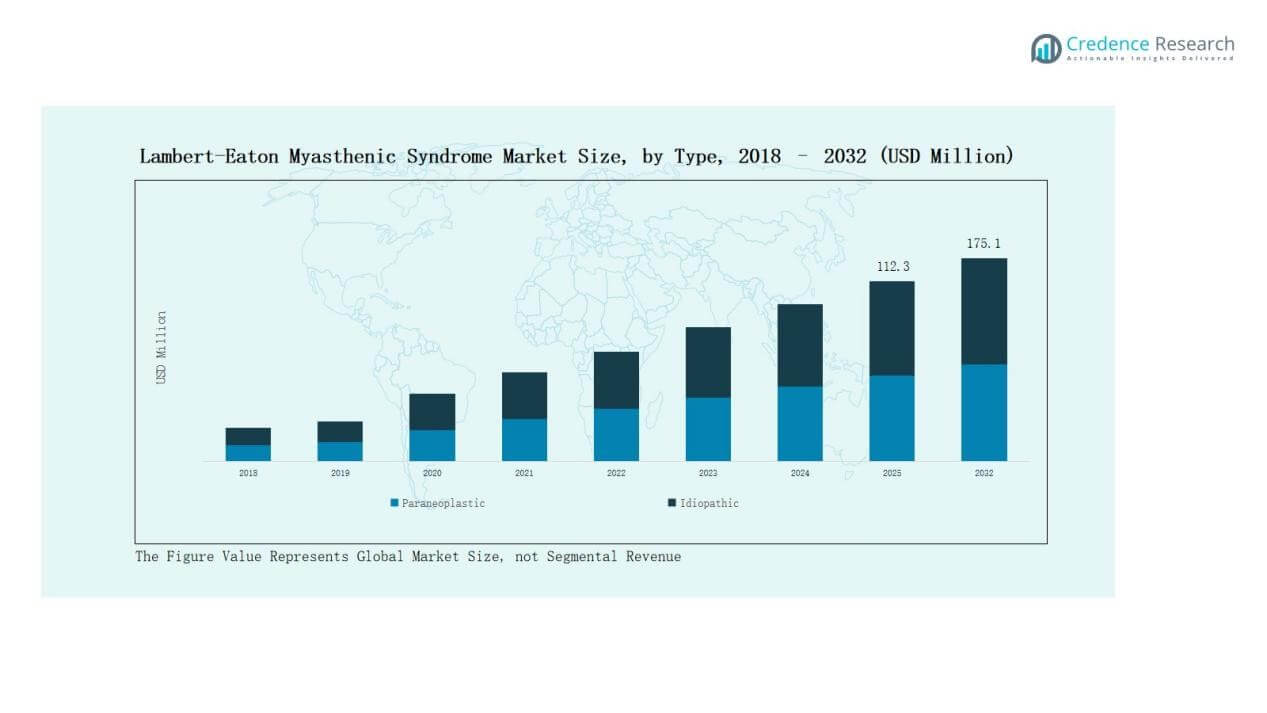

The Lambert-Eaton Myasthenic Syndrome (LEMS) Market size was valued at USD 90.00 million in 2018, reaching USD 106.36 million in 2024, and is anticipated to reach USD 175.07 million by 2032, at a CAGR of 6.56% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lambert-Eaton Myasthenic Syndrome (LEMS) Market Size 2024 |

USD 106.36 Million |

| Lambert-Eaton Myasthenic Syndrome (LEMS) Market, CAGR |

6.56% |

| Lambert-Eaton Myasthenic Syndrome (LEMS) Market Size 2032 |

USD 175.07 Million |

The Lambert-Eaton Myasthenic Syndrome (LEMS) market is shaped by the presence of leading pharmaceutical and biopharmaceutical companies, including Catalyst Pharmaceuticals, Grifols, Alexion Pharmaceuticals, argenx SE, Immunovant, Ra Pharmaceuticals, Bausch Health Companies, Jacobus Pharmaceutical, Takeda Pharmaceutical, and Prestige Biopharma Limited. These players focus on advancing therapies such as cholinesterase inhibitors, potassium channel blockers, and antibody-based treatments, supported by clinical trials and orphan drug designations. Strategic collaborations, acquisitions, and strong research pipelines further enhance their competitive positioning. North America emerged as the leading region in 2024, commanding 44.7% of the global market share, driven by robust healthcare infrastructure, favorable reimbursement policies, and early diagnosis capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Lambert-Eaton Myasthenic Syndrome Market grew from USD 90.00 million in 2018 to USD 106.36 million in 2024 and is projected at USD 175.07 million by 2032.

- North America led with 44.7% share in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, strong pharmaceutical presence, and higher awareness ensuring timely diagnosis and treatment adoption.

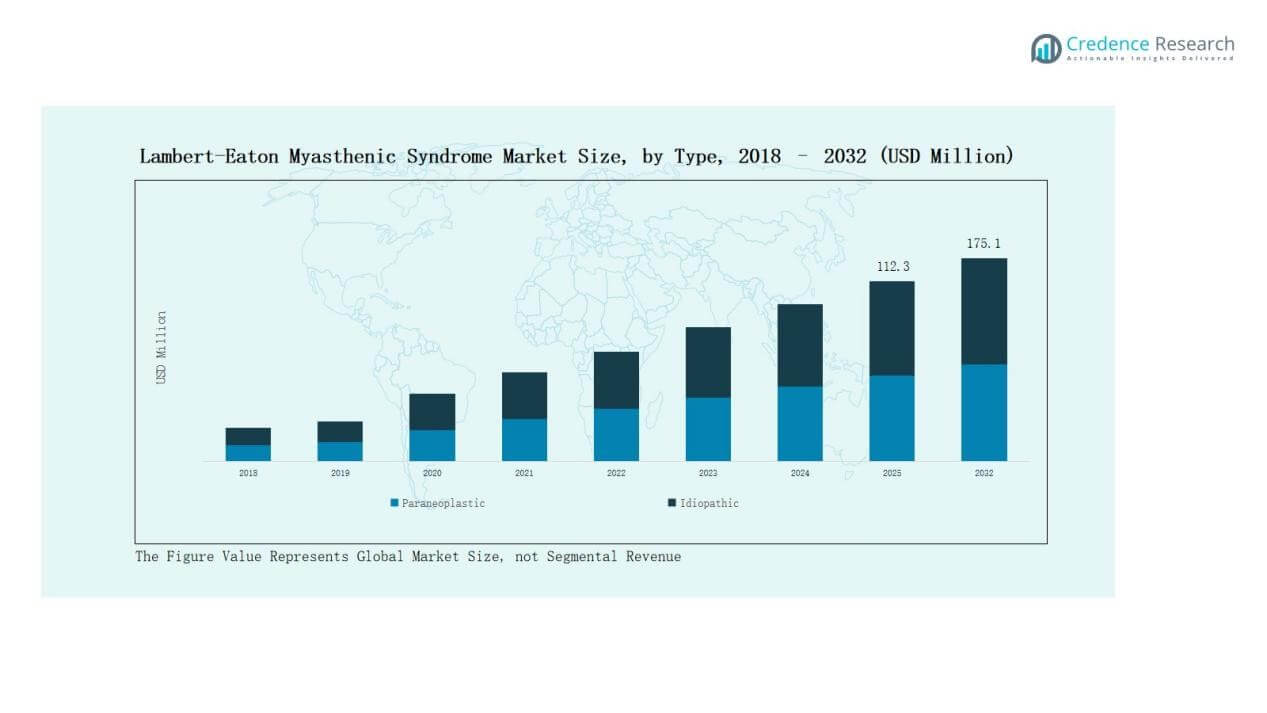

- By type, the paraneoplastic segment dominated with 62% share in 2024, driven by its strong link to small cell lung cancer, while idiopathic cases accounted for 38% due to better diagnostic capabilities.

- By treatment type, medication held the largest share at 47% in 2024, followed by immune therapy at 32%, plasmapheresis at 14%, and others at 7%, supported by drug approvals and wider accessibility.

- Hospitals accounted for the largest end-user share at 54% in 2024, reflecting strong diagnostic infrastructure and insurance-backed care, while specialty clinics held 27%, homecare 11%, and others 8%.

Market Segment Insights

Market Segment Insights

By Type

The paraneoplastic segment held the dominant share of 62% in 2024, driven by its strong association with small cell lung cancer cases. Higher prevalence in cancer patients makes early diagnosis and treatment more frequent compared to idiopathic cases. The idiopathic segment accounted for the remaining 38% share, supported by rising awareness and improved diagnostic capabilities. Growing cancer screening programs and oncology-driven management remain the key driver for the paraneoplastic segment’s lead.

By Treatment Type

Medication accounted for the largest share at 47% in 2024, supported by the wide use of cholinesterase inhibitors and potassium channel blockers. Immune therapy followed with a 32% share, fueled by rising adoption of intravenous immunoglobulin and immunosuppressants. Plasmapheresis captured 14%, while others held 7%, reflecting use in severe or refractory cases. Increasing drug approvals, affordability, and accessibility ensure medication continues as the leading treatment approach.

For instance, UCB received U.S. FDA approval for Rystiggo (rozanolixizumab-noli) for the treatment of generalized myasthenia gravis in adults, strengthening the use of antibody-targeted therapy.

By End-user

Hospitals dominated the market with a 54% share in 2024, due to advanced diagnostic facilities, availability of multidisciplinary care, and preference for acute management in hospital settings. Specialty clinics followed with 27% share, supported by their role in long-term neurological care and patient monitoring. Homecare contributed 11%, growing with the availability of supportive therapies, while others held 8%. The hospital segment’s leadership is driven by higher patient inflow and insurance support for advanced care.

For instance, Apollo Hospitals in India introduced an AI-driven stroke management program across its network, demonstrating why hospitals remain the preferred setting for advanced neurological interventions.

Key Growth Drivers

Key Growth Drivers

Rising Prevalence of Cancer-Associated Cases

Paraneoplastic Lambert-Eaton Myasthenic Syndrome is strongly linked to small cell lung cancer, driving consistent demand for treatment solutions. The rising global cancer burden and early oncology-based detection programs expand the diagnosed patient pool. This creates higher adoption of targeted medications and supportive therapies. Increased healthcare awareness and screening initiatives further reinforce market growth, with hospitals prioritizing integrated care approaches for these patients.

Advancements in Immunotherapies and Medications

Innovations in immunotherapies, intravenous immunoglobulins, and potassium channel blockers are reshaping treatment outcomes. Expanding clinical research on targeted therapies boosts efficacy and reduces side effects, making treatment more accessible. Companies are investing in drug development pipelines focused on rare neurological disorders, including LEMS. Improved regulatory pathways for orphan drugs also accelerate approvals, ensuring faster patient access. Such advancements strongly position novel medications as a key driver in market expansion.

For instance, the bispecific antibody Lynozyfic was approved for relapsed or refractory multiple myeloma after patients had undergone at least four prior therapies, underscoring progress in tailored therapy options.

Supportive Healthcare Infrastructure and Reimbursement Policies

Expanding neurological care infrastructure, especially in developed markets, ensures early diagnosis and effective treatment. Favorable reimbursement schemes for rare diseases support affordability and widen patient access to high-cost therapies like IVIG and immunosuppressants. Governments and insurers are recognizing the burden of rare autoimmune disorders, leading to structured policy support. This strengthens hospital-based care and enhances specialist clinic roles. Strong healthcare frameworks provide a foundation for sustained growth across global markets.

For instance, the U.S. Centers for Medicare & Medicaid Services expanded coverage for intravenous immunoglobulin (IVIG) home infusions, improving treatment access for patients with primary immunodeficiency diseases.

Key Trends & Opportunities

Growing Focus on Rare Disease Research and Orphan Drug Development

Pharmaceutical companies are investing heavily in orphan drug research, supported by government incentives and tax benefits. LEMS, being a rare autoimmune neuromuscular disorder, benefits directly from these initiatives. Increased collaboration between biotech firms and research institutions accelerates the development of innovative therapies. This trend opens significant opportunities for pipeline expansion and market differentiation.

For instance, BioMarin Pharmaceutical secured orphan drug designation for amifampridine phosphate for LEMS from both the U.S. FDA and the European Medicines Agency, ensuring market exclusivity and facilitating regulatory progress.

Integration of Personalized and Precision Medicine

The shift toward personalized medicine is creating opportunities for tailored LEMS treatment approaches. Genetic profiling, biomarker-driven diagnosis, and individualized drug regimens are gaining traction. These strategies enhance treatment outcomes and reduce relapse rates. Integration of AI and digital platforms in neurology also supports patient monitoring and therapy optimization. This positions precision medicine as a transformative opportunity in managing rare neurological conditions.

For instance, Catalyst Pharmaceuticals’ Firdapse (amifampridine phosphate) was approved by the FDA for treating adults with LEMS, demonstrating that formal, regulated approval pathways can provide standardized outcome tracking and safety profiling, which offers important benefits for therapies, particularly in rare diseases.

Key Challenges

Limited Patient Population and Diagnosis Rates

LEMS remains a rare disorder with a small patient base, which restricts large-scale commercial potential. Many cases remain underdiagnosed due to overlapping symptoms with myasthenia gravis and other neuromuscular conditions. This diagnostic gap hinders timely treatment initiation and reduces overall therapy adoption. Limited availability of specialized neurologists and inconsistent awareness campaigns in emerging markets further exacerbate the issue. As a result, diagnosis delays directly impact treatment efficiency, ultimately slowing the overall market expansion and leaving a significant proportion of patients untreated.

High Treatment Costs and Affordability Barriers

Advanced therapies, including IVIG and immunotherapies, involve substantial treatment costs, creating affordability challenges. Patients in developing markets often lack insurance coverage, limiting access. Despite supportive reimbursement in developed regions, financial burden continues to pose a significant challenge. Expensive lifelong treatment and frequent hospital visits increase the strain on families and healthcare systems. High drug development costs and limited competition among manufacturers also keep prices elevated. These factors together restrict the widespread adoption of novel therapies and create long-term affordability concerns.

Adverse Effects and Therapy Limitations

Available medications and immunotherapies often come with side effects such as muscle pain, infections, and gastrointestinal issues. Plasmapheresis, though effective in severe cases, remains invasive and not widely sustainable. These limitations affect long-term patient adherence and create demand for safer alternatives. Furthermore, patients undergoing repeated IVIG infusions may face risks of bloodborne infections, allergic reactions, and limited efficacy over time. Such safety concerns discourage widespread acceptance. The need for safer, more targeted, and less invasive treatment methods remains a pressing challenge for stakeholders in this market.

Regional Analysis

Regional Analysis

North America

North America dominated the Lambert-Eaton Myasthenic Syndrome market, holding 45.2% share in 2018, which slightly increased to 44.7% in 2024 and is projected at 44.7% by 2032. Market size grew from USD 40.68 million in 2018 to USD 47.61 million in 2024, reaching USD 78.27 million by 2032, at a CAGR of 6.6%. Growth is driven by advanced healthcare infrastructure, favorable reimbursement policies, and strong presence of key pharmaceutical players. High awareness and early diagnosis further strengthen the region’s leadership position.

Europe

Europe ranked second, contributing 28.6% share in 2018, slightly decreasing to 27.6% in 2024 and projected at 26.2% by 2032. Revenue expanded from USD 25.74 million in 2018 to USD 29.33 million in 2024, reaching USD 45.83 million by 2032, at a CAGR of 5.9%. Growth is supported by strong clinical research, advanced neurology centers, and government-backed rare disease programs. However, slower adoption of high-cost therapies compared to North America keeps growth moderate.

Asia Pacific

Asia Pacific is the fastest-growing market, holding 15.2% share in 2018, rising to 16.3% in 2024 and projected at 19% by 2032. The region’s revenue increased from USD 13.73 million in 2018 to USD 17.38 million in 2024, and is expected to reach USD 33.25 million by 2032, at a CAGR of 8.5%. Rising healthcare expenditure, expanding neurological research, and growing awareness in China, Japan, and India drive this momentum. Favorable government initiatives for rare disease management further accelerate adoption.

Latin America

Latin America contributed 5.2% share in 2018, stabilizing at 5.2% in 2024 and expected to slightly decline to 4.7% by 2032. Market revenue increased from USD 4.73 million in 2018 to USD 5.53 million in 2024, reaching USD 8.31 million by 2032, at a CAGR of 5.4%. Growth is fueled by expanding healthcare infrastructure in Brazil and Mexico. However, limited specialist availability and affordability barriers constrain higher adoption of advanced therapies.

Middle East

The Middle East accounted for 4.6% share in 2018, reducing slightly to 4.3% in 2024 and projected at 4% by 2032. Regional revenue rose from USD 4.14 million in 2018 to USD 4.64 million in 2024, expected to reach USD 7.02 million by 2032, at a CAGR of 5.5%. Growing healthcare modernization in GCC countries and increased focus on neurological disorders support growth. Yet, uneven access to advanced treatments across the region restricts broader market penetration.

Africa

Africa held the smallest share at 1.1% in 2018, increasing slightly to 1.8% in 2024 but expected to fall back to 1.4% by 2032. Market revenue grew from USD 0.97 million in 2018 to USD 1.87 million in 2024, and is forecast to reach USD 2.39 million by 2032, at a CAGR of 2.5%. Limited infrastructure, low awareness, and affordability challenges remain major barriers. However, South Africa and Egypt show improving adoption with growing access to neurological care facilities.

Market Segmentations:

By Type

- Paraneoplastic

- Idiopathic

By Treatment Type

- Immune Therapy

- Medication

- Plasmapheresis

- Others

By End-user

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Drugs

- Cholinesterase Inhibitor

- Potassium Channel Blockers

- Intravenous Immunoglobulins

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Lambert-Eaton Myasthenic Syndrome market is moderately consolidated, with a mix of established pharmaceutical leaders and emerging biopharma companies competing on innovation and therapeutic effectiveness. Key players such as Catalyst Pharmaceuticals, Grifols, Alexion Pharmaceuticals, argenx SE, and Takeda focus on developing advanced therapies, particularly cholinesterase inhibitors, potassium channel blockers, and immunotherapies, to strengthen their positions. Companies are leveraging orphan drug designations, regulatory incentives, and clinical trial investments to accelerate product approvals and expand patient reach. Strategic partnerships, licensing agreements, and acquisitions remain common, enabling firms to broaden research pipelines and market access. The competitive environment is shaped by a strong emphasis on rare disease drug development, patient advocacy collaborations, and affordability initiatives. While Catalyst Pharmaceuticals maintains significant presence with FDA-approved therapies, newer entrants such as Immunovant and Prestige Biopharma are working to gain share through novel antibody-based treatments. Overall, innovation, pricing strategies, and regulatory support define the industry’s competitive dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Catalyst Pharmaceuticals, Inc.

- Grifols, S.A.

- Alexion Pharmaceuticals, Inc.

- argenx SE

- Immunovant, Inc.

- Ra Pharmaceuticals, Inc.

- Bausch Health Companies Inc.

- Jacobus Pharmaceutical Company, Inc.

- Takeda Pharmaceutical Company Limited

- Prestige Biopharma Limited

Recent Developments

- In February 2025, DyDo Pharma launched Firdapse (amifampridine) 10 mg tablets for LEMS in Japan.

- In May 2024, Catalyst Pharmaceuticals received FDA approval to expand the maximum daily dose of Firdapse for LEMS patients weighing over 45 kg, raising the limit from 80 mg to 100 mg.

- In March 2025, Lupin received tentative U.S. FDA approval for its generic version of Firdapse (amifampridine), pending patent resolution.

Report Coverage

The research report offers an in-depth analysis based on Type, Treatment Type, End-User, Drugs and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising cancer prevalence will continue to increase paraneoplastic LEMS cases globally.

- Advancements in immunotherapies will enhance treatment effectiveness and adoption.

- Expanding orphan drug approvals will accelerate availability of innovative therapies.

- Increasing clinical trials will support pipeline growth and diversified treatment options.

- Hospitals will remain the primary centers for diagnosis and advanced care.

- Specialty clinics will expand their role in long-term disease management.

- Asia Pacific will emerge as the fastest-growing regional market with improved access.

- Patient advocacy initiatives will improve awareness and diagnosis rates in underserved regions.

- Strategic collaborations among pharmaceutical companies will strengthen global market penetration.

- Development of safer and less invasive therapies will drive higher patient adherence.

Market Segment Insights

Market Segment Insights Key Growth Drivers

Key Growth Drivers Regional Analysis

Regional Analysis