Market Overview

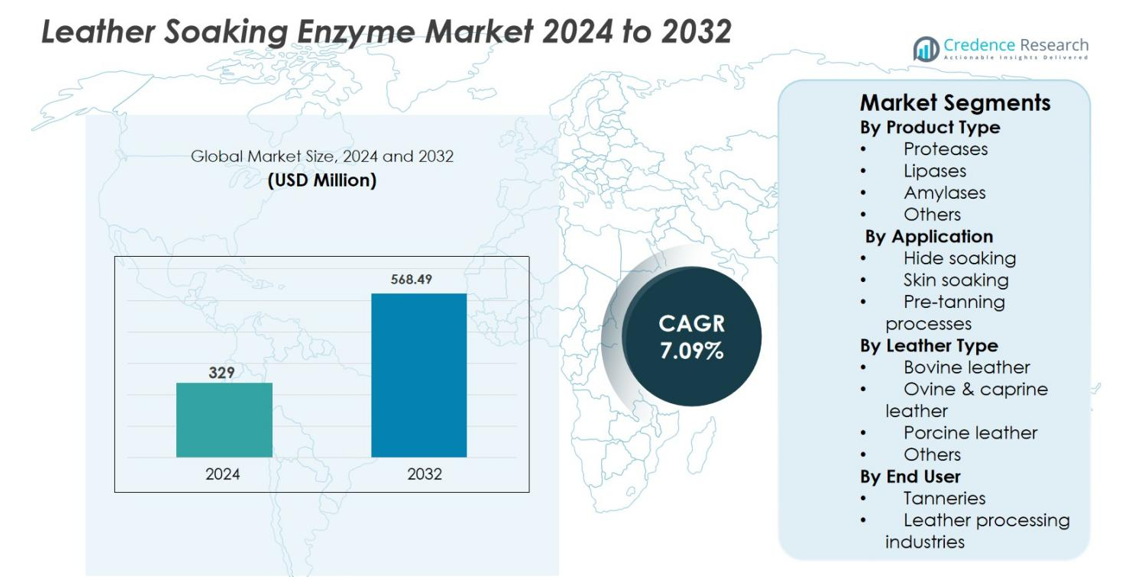

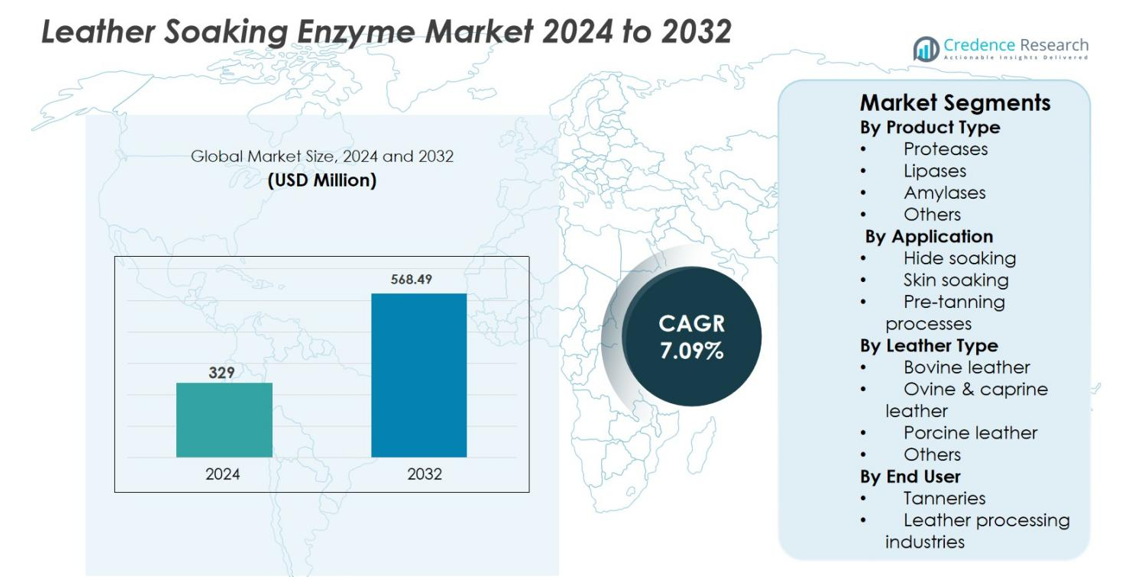

The Leather Soaking Enzyme market size was valued at USD 329 million in 2024 and is anticipated to reach USD 568.49 million by 2032, growing at a CAGR of 7.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Leather Soaking Enzyme Market Size 2024 |

USD 329 million |

| Leather Soaking Enzyme Market, CAGR |

7.09% |

| Leather Soaking Enzyme Market Size 2032 |

USD 568.49 million |

Leather Soaking Enzyme market is led by established enzyme manufacturers such as Novozymes A/S, BASF SE, CHR. Hansen Holding A/S, AB Enzymes GmbH, Rossari Biotech Ltd., Advanced Enzyme Technologies Ltd., and Amano Enzyme Inc., which compete through product innovation, sustainability-focused formulations, and strong technical support for tanneries. These companies emphasize high-performance protease- and lipase-based solutions to improve soaking efficiency, reduce environmental impact, and enhance leather quality. Regionally, Asia Pacific dominates the Leather Soaking Enzyme market with an exact 38.9% market share, supported by large-scale leather manufacturing in China, India, and Southeast Asia. Europe follows, driven by strict environmental regulations and premium leather production, while North America maintains steady demand from automotive and furniture upholstery segments.

Market Insights

- Leather Soaking Enzyme market was valued at USD 329 million in 2024 and is projected to reach USD 568.49 million by 2032, growing at a CAGR of 7.09% during the forecast.

- Increasing demand for eco-friendly and low-pollution leather processing acts as a key market driver, with proteases leading the product type segment by holding about 46.8% share due to their efficiency in impurity removal and fiber opening.

- Market trends highlight a shift toward low-water and energy-efficient soaking processes, alongside growing adoption of advanced enzyme formulations that improve soaking consistency and reduce processing time across tanneries.

- Competitive dynamics are shaped by global and regional players focusing on product innovation, sustainability, and technical support, while cost sensitivity among small tanneries remains a notable market restraint.

- Asia Pacific dominates the market with a 38.9% share, followed by Europe at 27.6% and North America at 21.4%, supported by large-scale leather production, strict environmental regulations, and expanding export-oriented leather industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The By Product Type segment in the Leather Soaking Enzyme market is led by proteases, which accounted for 46.8% market share in 2024. Proteases dominate due to their high efficiency in removing non-collagenous proteins, enhancing fiber opening, and improving water absorption during soaking. Their ability to shorten processing time while improving leather softness and uniformity drives widespread adoption across tanneries. Lipases follow, supported by rising demand for effective fat and grease removal, while amylases are used selectively for starch removal. Increasing emphasis on eco-friendly and enzyme-optimized soaking processes continues to strengthen protease demand.

- For instance, Wilton Bioscience’s Leathozyme-PROAL protease is formulated to rehydrate hides by breaking down connective proteins and removing flesh and fat without damaging collagen, leading to more uniform leather quality in soaking stages.

By Application

Within the By Application segment, hide soaking emerged as the dominant sub-segment, holding 52.3% market share in 2024. This dominance is driven by large-scale processing of bovine hides and the critical role of soaking in restoring moisture and removing curing salts efficiently. Enzyme-assisted hide soaking improves fiber relaxation, reduces chemical consumption, and enhances downstream processing efficiency. Skin soaking follows, supported by growing processing of lighter skins, while pre-tanning processes gain traction for improving leather consistency. Regulatory pressure to reduce water usage and effluent load further accelerates enzyme adoption in soaking applications.

- For instance, Novozymes has documented that enzyme-based hide soaking enables faster salt removal and improved rehydration, allowing tanneries to reduce surfactant use while maintaining consistent hide opening in bovine leather processing.

By Leather Type

The By Leather Type segment is primarily driven by bovine leather, which accounted for 58.6% of the market share in 2024. High availability of bovine hides, extensive use in footwear, automotive upholstery, and furniture manufacturing supports this dominance. Leather soaking enzymes enable uniform hydration and effective impurity removal in thick bovine hides, improving yield and quality. Ovine and caprine leather represents a growing sub-segment due to rising fashion and garment demand, while porcine leather maintains niche usage. Expanding global leather goods production continues to reinforce bovine leather’s leadership.

Key Growth Drivers

Rising Demand for Eco-Friendly Leather Processing

Rising environmental concerns and increasingly stringent regulations on wastewater discharge are strongly driving the Leather Soaking Enzyme market. Conventional soaking chemicals generate high biological and chemical oxygen demand, creating compliance challenges for tanneries. Enzyme-based soaking solutions significantly reduce pollutant load, water usage, and energy consumption while improving process efficiency. Governments and environmental agencies, particularly in Europe and parts of Asia, mandate cleaner production practices, encouraging tanneries to adopt enzymatic alternatives. In parallel, global footwear, automotive, and luxury goods brands are enforcing sustainability standards across their supply chains, pressuring leather processors to shift toward eco-friendly technologies. Leather soaking enzymes support these requirements by enabling effective impurity removal at lower temperatures and shorter processing times. This combination of regulatory pressure, brand-driven sustainability commitments, and operational benefits positions enzyme-based soaking as a preferred solution, making environmental compliance a powerful and sustained growth driver for the market.

- For instance, BASF highlights that enzymatic soaking technologies allow tanneries to operate at lower temperatures and reduced water volumes, contributing to energy savings and improved alignment with EU environmental compliance frameworks.

Expansion of the Global Leather Goods Industry

The steady expansion of the global leather goods industry is a key driver of growth in the Leather Soaking Enzyme market. Rising demand for footwear, handbags, furniture upholstery, and automotive interiors continues to increase leather production volumes worldwide. Large-scale tanneries require consistent, high-quality processing solutions to meet growing output requirements, making enzyme-assisted soaking essential. Leather soaking enzymes improve fiber opening, hydration uniformity, and yield, which directly enhances downstream tanning and finishing performance. Asia Pacific, led by China, India, and Southeast Asia, has emerged as a major leather manufacturing hub, further accelerating enzyme consumption. Export-oriented leather production in these regions prioritizes quality consistency and efficiency, both of which are supported by enzyme-based processes. As manufacturers seek to balance higher throughput with reduced processing defects and waste, soaking enzymes play a critical role, reinforcing their importance as demand for leather goods continues to rise globally.

- For instance, LANXESS documents that enzyme-based soaking solutions support export-focused tanneries in Asia by enhancing process efficiency and minimizing defects, helping meet strict quality standards from global leather goods brands.

Technological Advancements in Enzyme Formulations

Continuous technological advancements in enzyme formulation and biotechnology are significantly driving adoption in the Leather Soaking Enzyme market. Modern enzyme products offer improved stability, higher activity, and broader operating ranges across pH and temperature conditions. These advancements allow tanneries to customize soaking processes for different hide and skin types, improving consistency and reducing processing variability. Enhanced enzyme selectivity ensures effective removal of non-collagenous proteins and fats without damaging collagen fibers, resulting in better leather softness and strength. Innovations also support shorter soaking cycles and lower water requirements, directly improving operational efficiency. As enzyme suppliers invest in research and development, they introduce application-specific formulations tailored to bovine, ovine, caprine, and porcine leather. This technological progress increases confidence among tanneries and accelerates integration of enzymes into standardized workflows, positioning advanced soaking enzymes as a core component of modern leather processing.

Key Trends & Opportunities

Shift Toward Low-Water and Energy-Efficient Soaking

A major trend shaping the Leather Soaking Enzyme market is the shift toward low-water and energy-efficient soaking processes. Water scarcity, rising utility costs, and stricter discharge regulations are pushing tanneries to optimize resource usage. Enzyme-based soaking enables effective hydration and impurity removal at lower temperatures and with reduced water volumes compared to conventional methods. This trend creates strong opportunities for enzyme manufacturers to develop high-performance formulations compatible with water recycling systems and shorter soaking cycles. Tanneries adopting closed-loop and sustainable processing models increasingly rely on enzymes to maintain leather quality under constrained operating conditions. As energy efficiency becomes a strategic priority, enzyme-assisted soaking supports cost savings while meeting environmental targets.

- For instance, Advanced Enzyme Technologies offers SEBSoak, an enzyme-based soaking formulation designed to improve wettability and swelling in raw hides, contributing to cleaner soaking and better downstream processing performance.

Growth in Emerging Leather Manufacturing Regions

The rapid growth of emerging leather manufacturing regions presents a significant opportunity for the Leather Soaking Enzyme market. Countries in Asia, Latin America, and Africa are expanding leather processing capacities to capture value-added exports. Governments in these regions promote modernization of tanneries and adoption of cleaner technologies to enhance global competitiveness. New facilities increasingly integrate enzyme-based soaking processes from the outset, driving incremental demand. Rising awareness of sustainable leather processing, supported by training programs and technical assistance, further accelerates enzyme adoption. Additionally, international buyers sourcing leather from emerging regions demand compliance with environmental and quality standards, strengthening the case for enzymatic solutions.

- For instance, Advanced Enzyme Technologies supports tanneries in India and Southeast Asia with enzyme-based soaking formulations designed to improve hide hydration and reduce chemical load in modernized beamhouse operations.

Key Challenges

High Cost Sensitivity Among Small Tanneries

High cost sensitivity among small and medium-sized tanneries remains a major challenge for the Leather Soaking Enzyme market. Many small operators prioritize immediate cost reduction over long-term efficiency and environmental benefits, limiting enzyme adoption. Enzyme products often involve higher upfront costs compared to traditional soaking chemicals, creating resistance in highly price-competitive markets. Limited access to technical expertise further complicates adoption, as improper usage can reduce perceived benefits. Smaller tanneries may also lack capital to invest in process optimization required for enzyme-based systems. Overcoming this challenge requires enzyme suppliers to demonstrate clear cost-benefit advantages, including reduced water usage, lower effluent treatment costs, and improved leather yield.

Variability in Raw Hide and Skin Quality

Variability in raw hide and skin quality poses a significant challenge for the Leather Soaking Enzyme market. Differences in animal origin, curing methods, storage conditions, and transportation practices affect soaking performance and enzyme efficiency. Inconsistent raw material quality can lead to uneven hydration and impurity removal, reducing process reliability. This variability may discourage tanneries seeking standardized outputs and predictable production results. Enzyme formulations must be carefully optimized to handle diverse raw material conditions, increasing complexity for suppliers. Additionally, tanneries require technical guidance to adjust enzyme dosage and soaking parameters based on hide characteristics. Without proper optimization, performance inconsistencies can undermine confidence in enzyme-based processes.

Regional Analysis

North America

North America accounted for 21.4% of the Leather Soaking Enzyme market share in 2024, supported by advanced leather processing technologies and strict environmental regulations. Tanneries in the United States and Canada increasingly adopt enzyme-based soaking solutions to comply with wastewater discharge standards and sustainability requirements. Demand is driven by automotive upholstery, furniture, and premium leather goods manufacturing, where consistent quality and process efficiency are critical. The region shows strong adoption of technologically advanced and customized enzyme formulations. In addition, the presence of established enzyme manufacturers and growing emphasis on eco-friendly leather production further support steady market growth across North America.

Europe

Europe held 27.6% market share in 2024, making it a key region in the Leather Soaking Enzyme market. The region’s dominance is driven by stringent environmental regulations, particularly in countries such as Italy, Germany, and Spain, which are major leather processing hubs. European tanneries prioritize enzyme-based soaking to reduce chemical usage, water consumption, and effluent load. Strong demand from luxury footwear, fashion, and automotive interiors further supports enzyme adoption. Continuous innovation, sustainability-focused production, and high regulatory compliance costs encourage widespread use of advanced soaking enzymes.

Asia Pacific

Asia Pacific dominated the Leather Soaking Enzyme market with a leading share of 38.9% in 2024. The region benefits from large-scale leather manufacturing in countries such as China, India, Vietnam, and Bangladesh. Rapid expansion of footwear, garment, and export-oriented leather goods industries significantly boosts enzyme consumption. Tanneries increasingly adopt soaking enzymes to improve efficiency, reduce processing time, and meet international environmental standards. Government initiatives promoting cleaner leather production and rising awareness of sustainable processing further accelerate adoption. Cost-effective manufacturing combined with growing export demand positions Asia Pacific as the fastest-growing regional market.

Latin America

Latin America accounted for 7.4% of the market share in 2024, driven by expanding leather processing activities in Brazil, Mexico, and Argentina. The region has a strong presence in bovine leather production, supporting steady demand for soaking enzymes. Increasing exports of leather footwear and upholstery products encourage tanneries to adopt enzyme-based processes to improve quality and meet international compliance requirements. Although adoption is slower compared to developed regions, rising environmental awareness and gradual modernization of tannery infrastructure are supporting market growth. Supplier-led technical support plays a key role in expanding enzyme penetration across the region.

Middle East & Africa

The Middle East & Africa region captured 4.7% of the Leather Soaking Enzyme market share in 2024. Growth is supported by emerging leather processing industries in countries such as Turkey, Egypt, Ethiopia, and South Africa. Increasing investment in value-added leather production and exports drives adoption of enzyme-based soaking solutions. Tanneries in the region are gradually transitioning toward cleaner processing methods to meet global buyer requirements. While infrastructure and technical constraints limit rapid adoption, growing government support and rising demand for sustainable leather products are expected to steadily improve market penetration over the forecast period.

Market Segmentations:

By Product Type

- Proteases

- Lipases

- Amylases

- Others

By Application

- Hide soaking

- Skin soaking

- Pre-tanning processes

By Leather Type

- Bovine leather

- Ovine & caprine leather

- Porcine leather

- Others

By End User

- Tanneries

- Leather processing industries

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Leather Soaking Enzyme market is characterized by the presence of both global enzyme manufacturers and regional specialty suppliers competing on product performance, sustainability, and technical support. Key players such as Novozymes A/S, BASF SE, CHR. Hansen Holding A/S, AB Enzymes GmbH, Rossari Biotech Ltd., Advanced Enzyme Technologies Ltd., Amano Enzyme Inc., Dyadic International, Inc., and Bioprocess Control AB focus on developing high-efficiency enzyme formulations tailored for diverse hide and skin types. Companies emphasize research and development to enhance enzyme stability, selectivity, and compatibility with low-water and energy-efficient soaking processes. Strategic partnerships with tanneries, application-specific customization, and strong after-sales technical services are critical competitive factors. Regional players strengthen their positions through cost-competitive offerings and localized distribution networks. Increasing demand for eco-friendly leather processing continues to intensify competition, driving innovation and differentiation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hansen Holding A/S

- Rossari Biotech Ltd.

- BASF SE

- Novozymes A/S

- Bioprocess Control AB

- AB Enzymes GmbH

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Dyadic International, Inc.

- Enmex S.A.

Recent Developments

- In June 2025, BASF Leather Solutions secured a major contract win with a leading global leather producer to supply enzyme-based tanning solutions designed to lower chemical usage and effluent in leather processing.

- In November 2024, Creative Enzymes launched a new range of innovative enzymatic solutions for sustainable leather processing, including protease, deliming/bating, and lipase enzyme products that reduce reliance on traditional chemicals.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Leather Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of leather soaking enzymes will increase as tanneries prioritize sustainable and low-impact processing methods.

- Stricter environmental regulations will continue to drive replacement of conventional chemicals with enzyme-based solutions.

- Protease-based formulations will remain dominant due to their efficiency and wide applicability across leather types.

- Demand will grow from footwear, automotive upholstery, and furniture leather applications.

- Asia Pacific will retain its leadership due to expanding leather manufacturing and export activities.

- Enzyme formulations will advance to support low-water and low-temperature soaking processes.

- Customized enzyme solutions for different hides and skins will gain wider acceptance.

- Penetration among small and mid-sized tanneries will improve through cost optimization and technical support.

- Strategic partnerships between enzyme suppliers and tanneries will strengthen long-term adoption.

- Increased focus on quality consistency will reinforce enzymes as essential inputs in modern leather processing.