Market Overview

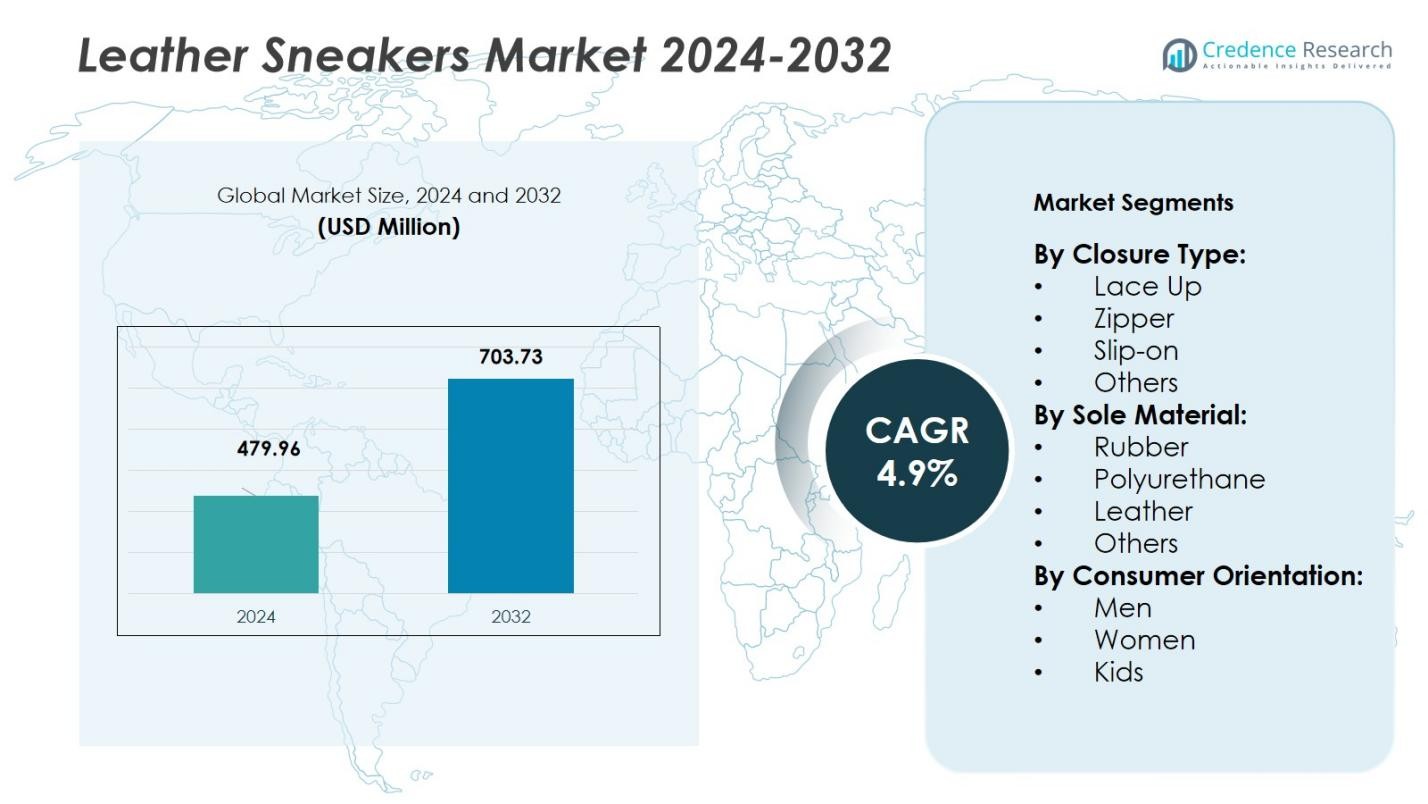

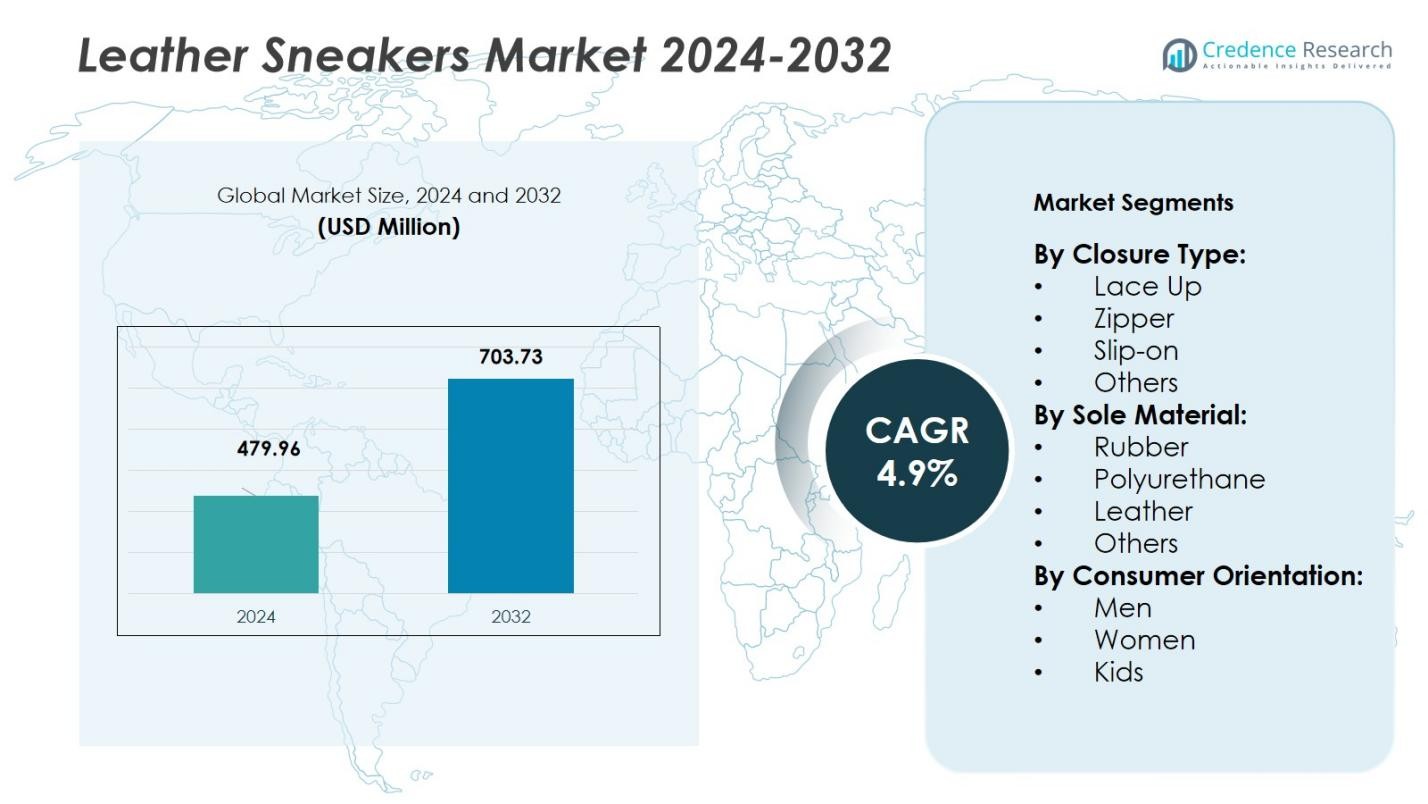

The Leather Sneakers Market size was valued at USD 479.96 million in 2024 and is anticipated to reach USD 703.73 million by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Leather Sneakers Market Size 2024 |

USD 479.96 Million |

| Leather Sneakers Market, CAGR |

4.9% |

| Leather Sneakers Market Size 2032 |

USD 703.73 Million |

The Leather Sneakers Market features key players such as Prada Holding B.V., LVMH, Allen Edmonds, Kering S.A., Bruno Magli,Cole Haan,Genesco Inc. Hermès International S.A., Salvatore Ferragamo S.p.A., and Crockett & Jones, each leveraging brand heritage and premium positioning to capture value in the segment. Regionally, Europe leads with a 32 % share, driven by the region’s legacy in leather craftsmanship and high‑end footwear culture. North America contributes about 25 %, supported by high disposable income and strong direct‑to‑consumer infrastructure, while Asia‑Pacific holds around 30 % and benefits from rising middle‑class demand and urbanisation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Leather Sneakers Market size was valued at USD 479.96 million in 2024 and is anticipated to reach USD 703.73 million by 2032, growing at a CAGR of 4.9% during the forecast period.

- The increasing demand for stylish yet comfortable footwear is driving the growth of leather sneakers, especially among fashion-conscious consumers looking for versatile and durable options.

- Sustainability is a growing trend, with consumers prioritizing eco-friendly materials, including vegan leather and other sustainable alternatives, offering significant growth opportunities.

- Intense market competition, particularly from fast fashion brands and counterfeit products, is challenging premium leather sneaker manufacturers to differentiate through quality and innovation.

- Europe dominates the global market with a 32% share, followed by Asia-Pacific at 30% and North America at 25%, driven by rising disposable income and fashion trends in key regions.

Market Segmentation Analysis:

By Closure Type:

The Leather Sneakers Market is segmented by closure type into Lace Up, Zipper, Slip-on, and Others. Among these, the Lace-Up sub-segment holds the dominant share, accounting for 60% of the market. Lace-Up shoes are favored due to their customizable fit and classic design, appealing to a broad demographic. The increasing demand for comfort and durability in everyday footwear drives this segment’s growth. Additionally, Lace-Up sneakers are often associated with premium leather sneakers, adding to their popularity across various consumer groups, particularly among men and women.

- For instance, Gordon & Bros offers white lace-up sneakers made with 100% genuine leather that combine luxury with durability, targeting the sophisticated consumer seeking both style and comfort.

By Sole Material:

The sole material segment in the Leather Sneakers Market includes Rubber, Polyurethane, Leather, and Others. The Rubber sole sub-segment is the leading category, holding a market share of 45%. Rubber soles are highly preferred for their durability, slip resistance, and comfort, making them ideal for both casual and athletic use. The growing trend for high-performance sneakers, which combine comfort with style, is a key driver for the increased adoption of rubber soles in leather sneakers. This material is favored by both men and women for everyday wear.

- For instance, the HOKA Bondi SR work sneaker combines a water-resistant leather upper with a full-ground-contact rubber outsole engineered with a proprietary slip-resistant compound, targeting service and medical professionals who require high grip on slick floors.

By Consumer Orientation:

The consumer orientation segment of the Leather Sneakers Market is categorized into Men, Women, and Kids. The Men’s segment leads with a significant market share of 55%. Men’s leather sneakers are driven by the demand for versatile and fashionable footwear suitable for both casual and formal occasions. This sub-segment is propelled by fashion trends, with men seeking premium, durable sneakers that combine comfort with aesthetics. Furthermore, rising disposable incomes and a growing inclination toward high-end footwear contribute to the segment’s continued expansion, particularly in North America and Europe.

Key Growth Drivers

Rising Demand for Comfortable and Stylish Footwear

The increasing demand for stylish yet comfortable footwear is one of the primary growth drivers in the Leather Sneakers Market. Consumers are increasingly seeking shoes that combine fashion with functionality, making leather sneakers an ideal choice. As a result, brands are focusing on innovative designs that provide both aesthetic appeal and long-lasting comfort. This trend is further fueled by the growing emphasis on casual and athleisure wear, with leather sneakers becoming a staple in everyday wardrobes for both men and women.

- For instance, Bata India launched a new artisanal collection featuring classic leather derbies and brogues, blending traditional craftsmanship with modern comfort features like Deep Comfort technology, catering to the growing trend of premium, stylish leather footwear.

Expanding Consumer Interest in Premium Footwear

The growing inclination towards premium and luxury footwear is driving the Leather Sneakers Market. Consumers are becoming more willing to invest in high-quality, durable products, with leather sneakers often seen as a long-term investment. High-end brands and designers are capitalizing on this trend by offering leather sneakers with superior craftsmanship, unique designs, and high-end materials. This shift towards premium footwear is especially prominent in developed markets such as North America and Europe, where disposable incomes are rising and consumers are increasingly focused on quality and sustainability.

- For instance, Zegna’s Triple Stitch collection features sneakers made from SECONDSKIN leather, suede, and deerskin, blending Italian craftsmanship with comfort and style, appealing to consumers who seek both elegance and functionality.

Evolving Fashion Trends

Evolving fashion trends, particularly in the athleisure and casual wear segments, significantly contribute to the growth of the Leather Sneakers Market. As sneakers transition from strictly athletic footwear to a key component of daily fashion, the demand for leather sneakers is on the rise. The versatility of leather sneakers, which can seamlessly transition from casual to semi-formal attire, has gained significant attention among fashion-conscious consumers. Designers and manufacturers are quick to adapt, introducing new styles and color variations to meet the growing demand for trendy and fashionable leather sneakers.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

Sustainability is emerging as a key trend in the Leather Sneakers Market, with an increasing number of consumers prioritizing eco-friendly materials and ethical production practices. Brands are investing in sustainable leather alternatives, such as vegan leather, and promoting transparency in their supply chains. This trend offers substantial growth opportunities for companies that align with the values of environmentally conscious consumers. As awareness of environmental issues rises, brands that focus on eco-friendly production methods are likely to capture a significant market share in the years to come.

- For instance, French brand Veja is known for using upcycled materials and Amazonian wild rubber in its eco-friendly sneaker collections, with transparent sourcing and a carbon footprint assessment shared on its website.

Growth of E-Commerce and Online Retailing

The growth of e-commerce and online retailing presents a major opportunity for the Leather Sneakers Market. With consumers increasingly shopping online, the convenience of purchasing footwear from the comfort of their homes is driving the expansion of the market. Digital platforms allow brands to reach a global audience, and consumers can easily compare products, prices, and customer reviews. As online shopping continues to grow, especially in emerging markets, companies that effectively leverage e-commerce platforms are poised to benefit from increased sales and brand visibility.

- For instance, Nike reported that its “NIKE Direct” (consumer‑facing) revenues reached US$21.5 billion in fiscal 2024, with the e‑commerce/digital component playing a significant strategic role in connecting consumers directly.

Key Challenges

High Cost of Premium Leather

A significant challenge in the Leather Sneakers Market is the high cost of premium leather materials. Leather, especially high-quality and ethically sourced leather, can be expensive, leading to higher production costs. This, in turn, impacts the retail prices of leather sneakers, which may deter budget-conscious consumers. While premium leather is associated with durability and luxury, the cost factor poses a challenge for manufacturers, especially in price-sensitive markets. Companies must balance the use of premium materials with cost-effective production strategies to remain competitive.

Intense Market Competition

The Leather Sneakers Market faces intense competition, with numerous established brands and new entrants vying for market share. As the demand for leather sneakers grows, so does the number of players in the market, making it increasingly difficult for companies to differentiate themselves. Brands must invest heavily in marketing, innovation, and customer loyalty to maintain a competitive edge. Furthermore, the rise of fast fashion and counterfeit products poses a challenge for premium brands, as they must ensure product authenticity and quality to retain consumer trust and market position.

Regional Analysis

North America

The North America region commands a robust share of the global leather sneakers market, at 25 %. The region benefits from high disposable income levels among consumers and a mature athleisure culture that supports frequent sneaker purchases. Premium brands focused on leather footwear have strong brand recognition and retail presence in the U.S. and Canada. Additionally, online retail penetration and direct‑to‑consumer models continue to accelerate sales, while sustainability trends are reinforcing consumer purchase decisions in favour of high‑quality leather sneakers.

Europe

In Europe, the leather sneakers market holds a significant share of 32 %. This dominance stems from the region’s rich heritage in leather craftsmanship, especially in countries such as Italy and France, coupled with the strong presence of luxury footwear brands. European consumers place a high value on design, heritage and artisanal quality, making leather sneakers a staple in both fashion‑driven and casual wardrobes. Growth is fuelled by rising e‑commerce adoption and a growing shift toward premium casual footwear across key continental markets.

Asia Pacific

Asia Pacific is a rapidly growing region in the leather sneakers market, currently holding 30 % share. Growth in China, India and Southeast Asia is being driven by rising middle‑class incomes, rapid urbanisation and increasing exposure to global fashion trends. Younger consumers are embracing sneakers as a lifestyle choice and brands are capitalising on this trend via localised marketing and online channels. The region also offers cost‑efficient manufacturing bases, enabling faster innovation and production of leather sneaker models catering to both regional and export demands.

Latin America

Latin America holds an estimated 8 % share of the global leather sneakers market. Market growth in this region is supported by increasing consumer interest in international brands and expanding retail infrastructure in key countries such as Brazil and Mexico. While economic volatility and import duties pose headwinds, casual footwear trends, rising urban population and growing awareness of premium leather sneakers are providing positive momentum for the region.

Middle East & Africa

The Middle East & Africa region accounts for 5 % of the global leather sneakers market. The region’s growth is underpinned by increasing retail investments in luxury malls, a growing tourism sector and heightened demand for premium status‑driven footwear. Despite economic and infrastructural disparities across the region, affluent consumer segments in Gulf Cooperation Council countries and South Africa are driving uptake of high‑end leather sneaker offerings.

Market Segmentations:

By Closure Type:

- Lace Up

- Zipper

- Slip-on

- Others

By Sole Material:

- Rubber

- Polyurethane

- Leather

- Others

By Consumer Orientation:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The market sees major players such as Prada Holding B.V., LVMH, Allen Edmonds, Kering S.A., Bruno Magli, Cole Haan, Genesco Inc., Hermès International S.A., Salvatore Ferragamo S.p.A. and Crockett & Jones. These companies dominate competition through strong brand heritage, extensive global distribution networks and premium product positioning. They actively invest in new product launches, collaborations and sustainability initiatives to differentiate themselves and capture discerning consumers. The leather‑sneaker segment places high value on material quality, craftsmanship and design exclusivity; hence, leading firms emphasise these attributes to maintain a competitive edge. At the same time, cost pressures (raw‑material and labour), rapid fashion cycles, and growing entry of fast‑fashion or alternative brands intensify rivalry. Companies are therefore shifting towards direct‑to‑consumer channels and digital engagement to protect margin and loyalty, building partnerships with retailers and online platforms to bolster market reach and adapt to evolving consumer behaviours.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hermès International S.A.

- Kering S.A.

- Allen Edmonds

- Salvatore Ferragamo S.p.A.

- Bruno Magli

- Prada Holding B.V.

- Cole Haan

- Crockett & Jones

- LVMH

- Genesco Inc.

Recent Developments

- In January 2025 Toyoda Gosei Co., Ltd. announced a collaboration with ASICS to launch the “SKYHAND OG” sneaker using leather remnants from steering‑wheel manufacturing.

- In October 2025 Jil Sander and PUMA relaunched their “King Avanti” leather sneaker collaboration in premium leather.

- In February 2025 Reebok (under Authentic Brands Group) entered partnerships with Galaxy Universal and Batra Group to accelerate growth in US, Europe and UK markets.

Report Coverage

The research report offers an in-depth analysis based on Clouser Type, Sole Material, Consumer Orientation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly benefit from the premiumisation of footwear, as more consumers shift from basic to higher‑quality leather sneakers.

- Online and omnichannel retail frameworks will drive faster growth, enabling brands to capture consumers beyond traditional store networks.

- Sustainable leather, including vegetable‑tanned, recycled or bio‑based materials, will gain traction and become a significant differentiator.

- Emerging economies across Asia‑Pacific, Latin America and Africa will contribute disproportionately to growth as disposable incomes rise and fashion awareness expands.

- Brands will invest further in direct‑to‑consumer (DTC) models and personalised experiences such as customisation and limited‑edition drops to foster loyalty.

- Inclusivity across gender and age segments will fuel diversification of product portfolios, with more offerings focused on women and kids.

- Innovations in manufacturing and supply chain automation will improve efficiency and agility, enabling faster product launches and reduced lead times.

- Strategic collaborations between fashion/luxury brands and sneaker or street‑wear players will widen appeal and generate hype‑driven demand.

- Cost pressures from raw‑material (leather) and labour markets will force brands to optimise sourcing, manufacturing and pricing strategies.

- Regulatory emphasis on ethical sourcing, environmental transparency and circular economy initiatives will require brands to embed sustainability into their core operations and messaging.