Market Overview

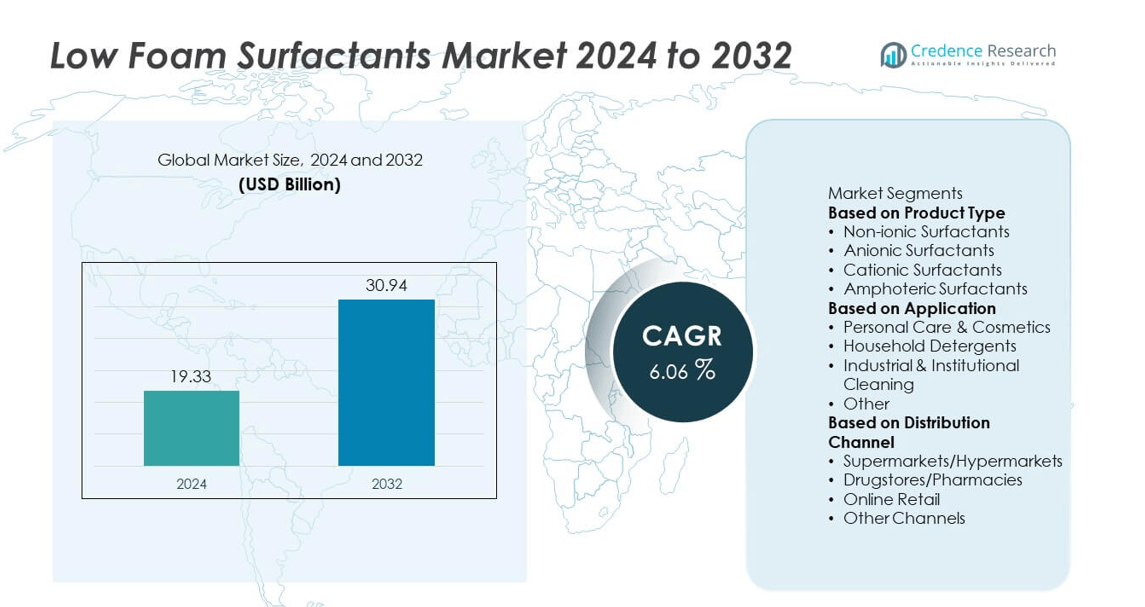

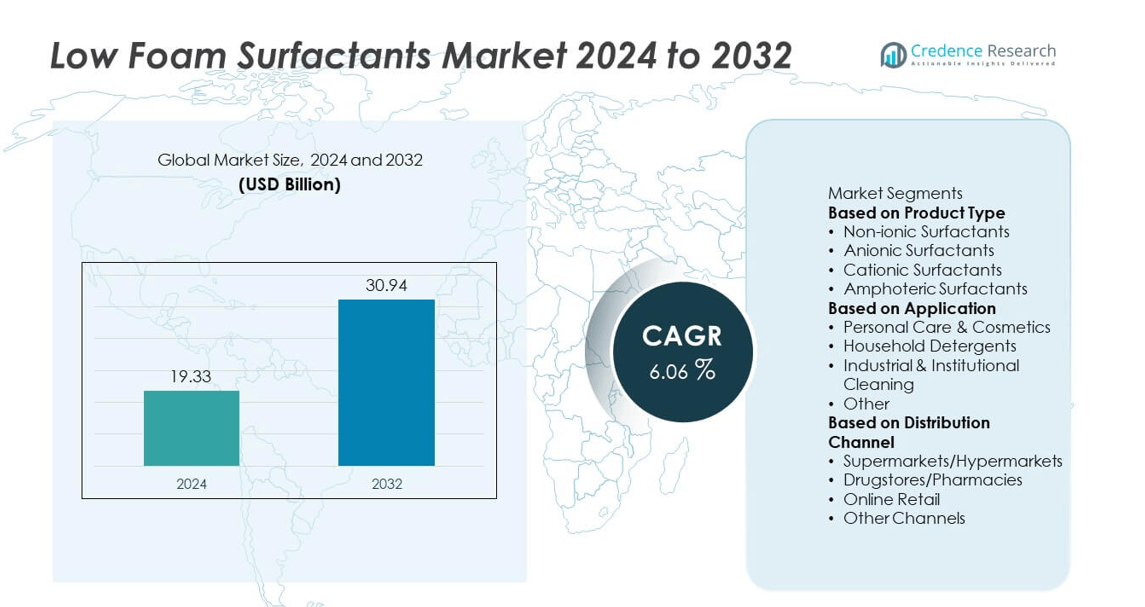

Low Foam Surfactants Market size was valued at USD 19.33 billion in 2024 and is anticipated to reach USD 30.94 billion by 2032, at a CAGR of 6.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Foam Surfactants Market Size 2024 |

USD 19.33 billion |

| Low Foam Surfactants Market, CAGR |

6.06% |

| Low Foam Surfactants Market Size 2032 |

USD 30.94 billion |

The Low Foam Surfactants Market grows with rising demand from industries that require efficient cleaning, wetting, and emulsification without excessive foam formation. Strong adoption in food processing, textile, pulp and paper, and industrial cleaning applications drives steady growth.

The Low Foam Surfactants Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads adoption with advanced industrial cleaning, healthcare, and food processing applications supported by strong R&D activities. Europe emphasizes sustainability and green chemistry, driving demand for bio-based low foam surfactants in household care, textiles, and industrial sectors. Asia-Pacific emerges as the fastest-growing region, fueled by rising industrialization, growing personal care consumption, and expanding manufacturing bases in China and India. Latin America and the Middle East & Africa show steady progress with increasing demand for cost-effective and efficient cleaning products in agriculture and industrial operations. Key players shaping this market include BASF SE, Croda International Plc, Dow, Huntsman International LLC, and Galaxy Surfactants Ltd. These companies focus on sustainable sourcing, technological innovation, and strategic partnerships to strengthen global presence and capture growth opportunities across diverse applications.

Market Insights

- The Low Foam Surfactants Market was valued at USD 19.33 billion in 2024 and is projected to reach USD 30.94 billion by 2032, growing at a CAGR of 6.06%.

- Rising demand from industries such as food processing, pulp and paper, textiles, and industrial cleaning drives growth, supported by the need for efficient formulations with low foam generation.

- Market trends highlight a strong shift toward eco-friendly, bio-based surfactants, with innovations focusing on improved biodegradability, process efficiency, and compatibility with sustainable industrial practices.

- Competitive landscape features BASF SE, Croda International Plc, Dow, Huntsman International LLC, and Galaxy Surfactants Ltd, all investing in R&D, sustainable sourcing, and strategic partnerships to expand product portfolios.

- Market restraints include high raw material costs, supply chain volatility, and performance limitations of some bio-based surfactants in heavy industrial applications, which restrict adoption in cost-sensitive sectors.

- Regional growth patterns show North America leading adoption with strong industrial and healthcare applications, Europe emphasizing green chemistry and regulatory compliance, and Asia-Pacific emerging as the fastest-growing region due to industrial expansion and rising consumer demand.

- Long-term opportunities lie in expanding use of low foam surfactants in healthcare, agriculture, and personal care, with Latin America and the Middle East & Africa gradually increasing adoption through local production initiatives and strategic collaborations with global suppliers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand in Industrial Cleaning and Detergent Applications

The Low Foam Surfactants Market grows with strong demand from industrial cleaning, institutional cleaning, and household detergents. Low foam surfactants provide effective cleaning without excess suds, improving efficiency in automated and large-scale cleaning systems. Food processing, healthcare, and hospitality sectors rely on these solutions to meet strict hygiene standards. Their compatibility with high-efficiency washing machines supports adoption in residential applications. Manufacturers highlight performance benefits such as easy rinsing and reduced water consumption. It reinforces the position of low foam surfactants in cleaning formulations globally.

- For instance, Clariant’s GlucoTain® GEM surfactant is a concentrated sugar-based glucamide with 74% active content and viscosity of 7,000–13,000 mPa·s at 25°C, designed for solid and low-foam cleaning formulations.

Expansion of Applications in Agriculture and Crop Protection

The Low Foam Surfactants Market benefits from increasing use in agriculture and crop protection chemicals. Farmers prefer low foaming solutions for pesticide and herbicide formulations to ensure better spray coverage and penetration. The ability to minimize foaming during mixing improves effectiveness and reduces operational issues in spraying equipment. Growing global demand for food security accelerates adoption of efficient surfactant-based formulations. Low foam surfactants help enhance performance without creating residue that affects crops. It strengthens their role as reliable additives in sustainable agricultural practices.

- For instance, Helena Chemical Company’s Induce® is a nonionic low-foam blend of surfactants, deposition agents, humectants, and defoamers, designed to improve leaf coverage by quickly wetting and spreading sprays. It has a 90% active ingredient content, but not all of that is surfactant; the active ingredients include alkyl aryl polyoxylkane ethers, alkanolamides, dimethyl siloxane, and free fatty acids.

Growth6 in Textile, Paper, and Pulp Processing Industries

The Low Foam Surfactants Market advances through rising use in textile and paper industries where controlled foam is essential. In textile processing, low foam surfactants improve dyeing, finishing, and scouring operations by maintaining uniform quality. Paper and pulp manufacturers adopt them to enhance efficiency in pulping, bleaching, and coating applications. Their ability to minimize foam reduces downtime and improves productivity in continuous industrial processes. Global expansion of textile production and packaging industries creates consistent demand. It secures their position as vital additives in industrial value chains.

Support from Sustainability Goals and Regulatory Compliance

The Low Foam Surfactants Market grows with rising focus on sustainability and stricter regulatory standards. Bio-based and biodegradable surfactants gain traction as industries reduce reliance on traditional synthetic chemicals. Regulations on wastewater treatment and environmental compliance push adoption of eco-friendly formulations. Manufacturers invest in research to produce sustainable solutions with high performance and lower environmental impact. Consumer awareness of green cleaning products also drives market growth in residential applications. It ensures long-term opportunities by aligning low foam surfactants with global sustainability initiatives.

Market Trends

Rising Adoption of Bio-Based and Sustainable Surfactants

The Low Foam Surfactants Market shows a strong trend toward bio-based and environmentally friendly formulations. Industries are shifting from petrochemical-based surfactants to plant-derived and biodegradable alternatives to reduce environmental impact. Regulatory support for sustainable chemicals accelerates this transition. Companies highlight bio-based solutions to align with clean-label and eco-friendly standards. Demand for greener cleaning products in both industrial and household segments strengthens this trend. It reinforces the market’s focus on sustainability and compliance with global environmental goals.

- For instance, Croda’s ECO Brij™ S100 MBAL is a 100% bio-based non-ionic surfactant—produced using bioethanol feedstock—and contains low levels of 1,4‑dioxane (maximum spec of <1 ppm), delivering full renewability without performance compromise.

Growing Use in High-Efficiency and Automated Cleaning Systems

The Low Foam Surfactants Market benefits from rising adoption in high-efficiency cleaning equipment and automated systems. These surfactants deliver effective performance without generating excess foam that disrupts machinery. Sectors such as healthcare, food processing, and hospitality prefer low-foam solutions to ensure compliance with hygiene standards. Their efficiency supports water and energy savings, appealing to industries seeking operational cost reduction. High-efficiency washing machines and industrial dishwashers also rely on these surfactants for reliable performance. It ensures steady integration into advanced cleaning technologies worldwide.

- For instance, Evonik’s REWOQUAT® CQ 200 is a low-foaming nonionic/cationic blend capable of degreasing organic soils at 40 °C while remaining stable across a broad pH range—making it ideal for industrial spray cleaning systems.

Expanding Applications Across Diverse Industrial Processes

The Low Foam Surfactants Market evolves with broader applications across textiles, pulp and paper, and oilfield operations. In textile manufacturing, low foam surfactants enhance dyeing and finishing processes with consistent results. Paper and pulp industries use them to improve bleaching and coating operations while maintaining efficiency. Oilfield operations benefit from low-foam solutions that improve drilling fluid performance and processing efficiency. Growing demand from packaging and specialty chemicals further supports this trend. It highlights their versatility as critical additives in multiple industries.

Innovation in Formulation and Performance Enhancement

The Low Foam Surfactants Market advances through continuous innovation in formulation and performance optimization. Manufacturers develop blends that improve cleaning efficiency while maintaining stability under different conditions. Innovations focus on reducing water consumption, improving rinsability, and ensuring compatibility with automated equipment. Advances in specialty surfactants enable customized solutions for niche applications such as pharmaceuticals and agriculture. Strategic partnerships between chemical companies and end-users accelerate product development pipelines. It ensures ongoing improvements that expand adoption and market competitiveness.

Market Challenges Analysis

High Production Costs and Raw Material Volatility

The Low Foam Surfactants Market faces challenges from high production costs and raw material price fluctuations. Manufacturing bio-based surfactants requires advanced technology and sustainable sourcing, which increases costs compared to synthetic alternatives. Volatility in feedstock prices such as vegetable oils and petrochemical derivatives impacts pricing stability. Smaller manufacturers struggle to remain competitive when cost pressures limit affordability in price-sensitive markets. Fluctuations in global supply chains also create uncertainty in meeting demand consistently. It places pressure on producers to optimize efficiency while maintaining product performance.

Performance Limitations and Compliance Barriers

The Low Foam Surfactants Market encounters hurdles related to performance in specific industrial applications. In processes requiring strong foaming or specialized chemical stability, low-foam surfactants often fail to deliver the same efficiency as conventional options. Industries such as oilfield operations and textiles demand precise formulations, increasing the complexity of product development. Regulatory compliance across multiple regions adds further costs and delays product introduction. Variations in environmental standards across countries create fragmented markets for producers. It underscores the need for continuous innovation to overcome technical gaps and meet global compliance requirements.

Market Opportunities

Rising Demand for Sustainable and Bio-Based Products

The Low Foam Surfactants Market presents strong opportunities through increasing adoption of bio-based and eco-friendly solutions. Growing consumer preference for biodegradable ingredients in detergents, cleaners, and personal care products strengthens this demand. Regulatory frameworks promoting reduced use of petrochemical-based surfactants accelerate the transition to sustainable options. Multinational companies invest in green chemistry and renewable raw materials to capture emerging markets. Premium product lines highlight natural formulations to differentiate in competitive industries. It positions low-foam bio-based surfactants as critical enablers of sustainability-driven growth.

Expansion Across Industrial and High-Performance Applications

The Low Foam Surfactants Market also gains opportunities through industrial applications in sectors such as food processing, textiles, oil and gas, and healthcare. Demand for efficient cleaning, controlled foaming, and stable formulations increases adoption in high-performance environments. Growth in advanced manufacturing and automated cleaning systems further supports usage. Emerging economies provide untapped potential where industrial expansion drives demand for cost-effective surfactant solutions. Strategic collaborations between producers and industrial players enhance innovation pipelines. It creates new revenue streams by extending applications beyond household cleaning to diverse industrial sectors.

Market Segmentation Analysis:

By Product Type

The Low Foam Surfactants Market divides into non-ionic, amphoteric, anionic, and cationic surfactants. Non-ionic surfactants hold the dominant share due to their versatility, mildness, and compatibility with various formulations in detergents, home care, and industrial applications. Amphoteric surfactants gain traction in personal care and healthcare products, where gentle cleaning properties are valued. Anionic surfactants see use in textile and food processing, though their adoption remains more specialized. Cationic surfactants cater to niche sectors, particularly in conditioning and antimicrobial applications. It ensures that diverse product categories address unique industry requirements while supporting innovation in eco-friendly solutions.

- For instance, Clariant’s Genapol EP 2454 is a non-ionic, low-foaming surfactant with 100 percent active substance content, widely used in automatic dishwashing and industrial cleaning.

By Application

The Low Foam Surfactants Market demonstrates strong demand across home care, industrial cleaning, food processing, agriculture, personal care, and oilfield chemicals. Home care dominates, driven by widespread use in detergents, automatic dishwashers, and surface cleaners requiring controlled foam levels. Industrial cleaning follows closely, with applications in metal cleaning, electronics, and manufacturing facilities where low foam ensures process efficiency. Food and beverage processing increasingly relies on these surfactants for hygiene, emulsification, and controlled foam stability. Personal care applications expand with demand for mild shampoos, facial cleansers, and cosmetics. It reflects how versatile applications continue to fuel growth across both consumer and industrial environments.

- For instance, Evonik’s Surfynol® 440 is a non‑ionic, non‑foaming dynamic wetting agent used in waterborne pressure-sensitive adhesives. It’s applied at 0.1–2% of formulation weight and has a shelf life of 60 months.

By Distribution Channel

The Low Foam Surfactants Market operates through direct sales and indirect sales channels. Direct sales remain strong among industrial buyers who prefer customized bulk orders and technical support from manufacturers. Indirect sales through distributors, retailers, and e-commerce platforms cater to small-scale businesses and household buyers. Growth in online platforms has expanded accessibility for emerging markets and small enterprises. Partnerships between manufacturers and regional distributors enhance product reach and supply chain efficiency. It highlights the importance of balanced distribution strategies that serve both large-scale industrial users and everyday consumer needs.

Segments:

Based on Product Type

- Non-ionic Surfactants

- Anionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

Based on Application

- Personal Care & Cosmetics

- Household Detergents

- Industrial & Institutional Cleaning

- Other

Based on Distribution Channel

- Supermarkets/Hypermarkets

- Drugstores/Pharmacies

- Online Retail

- Other Channels

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Low Foam Surfactants Market, accounting for 34% in 2024. The region benefits from strong demand in home care, industrial cleaning, and food processing sectors. The United States leads with extensive adoption in automatic dishwashing detergents, laundry care products, and industrial surface cleaners. Canada and Mexico contribute through growing demand in agriculture and food applications where controlled foam is essential. High consumer awareness of sustainable and biodegradable formulations supports further expansion. Investments by leading players in research and product innovation strengthen regional growth. It positions North America as a leader in advancing eco-friendly surfactant technologies.

Europe

Europe represents the second-largest market, with a 30% share in 2024. The region’s growth is driven by stringent regulatory frameworks such as REACH and EU sustainability directives, which encourage the replacement of traditional surfactants with low-foam alternatives. Germany, France, and the United Kingdom are the largest markets, particularly in home care, cosmetics, and industrial cleaning. Expansion of the food and beverage sector further supports steady demand for foam-controlled surfactants. European consumers prioritize green-label and bio-based products, boosting the use of natural non-ionic surfactants. Industrial sectors adopt them to maintain efficiency in automated cleaning processes. It reinforces Europe’s role as a sustainability-focused hub for surfactant innovation.

Asia-Pacific

Asia-Pacific accounts for 25% of the Low Foam Surfactants Market in 2024 and emerges as the fastest-growing region. Rising populations, rapid urbanization, and increasing disposable incomes drive higher demand for detergents, personal care, and food cleaning agents. China and India dominate with large-scale use in household cleaning and agriculture, while Japan and South Korea lead in advanced applications such as electronics and industrial cleaning. Strong local manufacturing capabilities lower costs and expand accessibility across the region. Government initiatives promoting eco-friendly products encourage wider adoption of bio-based surfactants. It positions Asia-Pacific as a long-term growth engine with strong demand across both consumer and industrial markets.

Latin America

Latin America contributes 6% share to the Low Foam Surfactants Market in 2024. Brazil and Mexico are the key contributors, with rising use in food processing, agriculture, and home care industries. Expanding middle-class populations demand affordable and effective cleaning solutions, where low foam surfactants provide performance and safety. Growth in industrial sectors such as textiles and oilfield chemicals further strengthens adoption. Economic constraints limit large-scale penetration, but regional manufacturers focus on cost-effective solutions. It ensures gradual but steady growth across consumer and industrial applications in the region.

Middle East & Africa

The Middle East & Africa holds 5% of the Low Foam Surfactants Market in 2024. Gulf countries such as Saudi Arabia and the UAE drive demand through strong investments in industrial cleaning and oilfield applications. Africa shows rising demand in agriculture and household cleaning, supported by improving urban infrastructure. Limited local production capacity creates reliance on imports from global suppliers. Growing e-commerce and retail networks enhance accessibility of household cleaning products. Governments encourage sustainable formulations to align with environmental goals. It highlights the region as an emerging market with long-term growth potential across both consumer and industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman International LLC

- BASF SE

- Galaxy Surfactants Ltd

- Clariant

- Dow

- Croda International Plc

- Akzo Nobel N.V.

- Helena Chemical Company

- Evonik Industries AG

- Air Products and Chemicals, Inc

Competitive Analysis

Competitive landscape of the Low Foam Surfactants Market is shaped by BASF SE, Dow, Evonik Industries AG, Clariant, Croda International Plc, Huntsman International LLC, Akzo Nobel N.V., Galaxy Surfactants Ltd, Helena Chemical Company, and Air Products and Chemicals, Inc. These companies focus on developing innovative formulations that deliver high efficiency in cleaning, emulsification, and wetting processes while maintaining low foam levels. Strong emphasis is placed on eco-friendly and biodegradable surfactants to align with sustainability regulations and growing customer demand. Leading players expand their portfolios by integrating bio-based raw materials and advancing R&D to enhance product performance across industrial, agricultural, personal care, and healthcare applications. Strategic initiatives such as mergers, acquisitions, and partnerships help strengthen global presence and secure supply chain resilience. Companies also invest in regional production facilities and distribution networks to capture opportunities in emerging economies. Continuous innovation, regulatory compliance, and sustainability-focused strategies remain central to maintaining competitiveness in this growing market.

Recent Developments

- In April 2025, BASF launched new biodegradable, nature-derived ingredients—Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA. These innovations expand BASF’s portfolio of green alternatives, suitable for personal care applications, though not surfactant-specific, reflect its sustainability direction.

- In October 2024, Clariant showcased TexCare Terra polymers that reduce surfactant load while maintaining cleaning performance at lower temperatures—indicative of resource-efficient, low-foam formulations.

- In May 2024, Croda launched NatraFusion SL HA, a mild, low-foam biosurfactant designed for gentle facial cleansing gels, introduced at Suppliers’ Day in 2024.

- In May 2024, Clariant introduced GlucoTain GEM, a concentrated sugar-based glucamide surfactant for solid and waterless personal care formulations, including low-foam options

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low foam surfactants will rise with increasing industrial cleaning applications.

- Sustainable and biodegradable surfactant formulations will gain stronger acceptance across global markets.

- Innovation in bio-based raw materials will improve product performance and reduce environmental impact.

- Food and beverage processing industries will expand adoption for improved hygiene and efficiency.

- Growth in healthcare and pharmaceutical sectors will drive specialized applications of low foam surfactants.

- Asia-Pacific will continue as the fastest-growing region due to strong manufacturing and consumer demand.

- Regulatory frameworks promoting eco-friendly chemicals will support long-term market expansion.

- Strategic collaborations among manufacturers will accelerate innovation and global distribution reach.

- Advanced formulations will target energy and water conservation in industrial processes.

- Increased use in agriculture and textile sectors will strengthen market diversification.