Market Overview

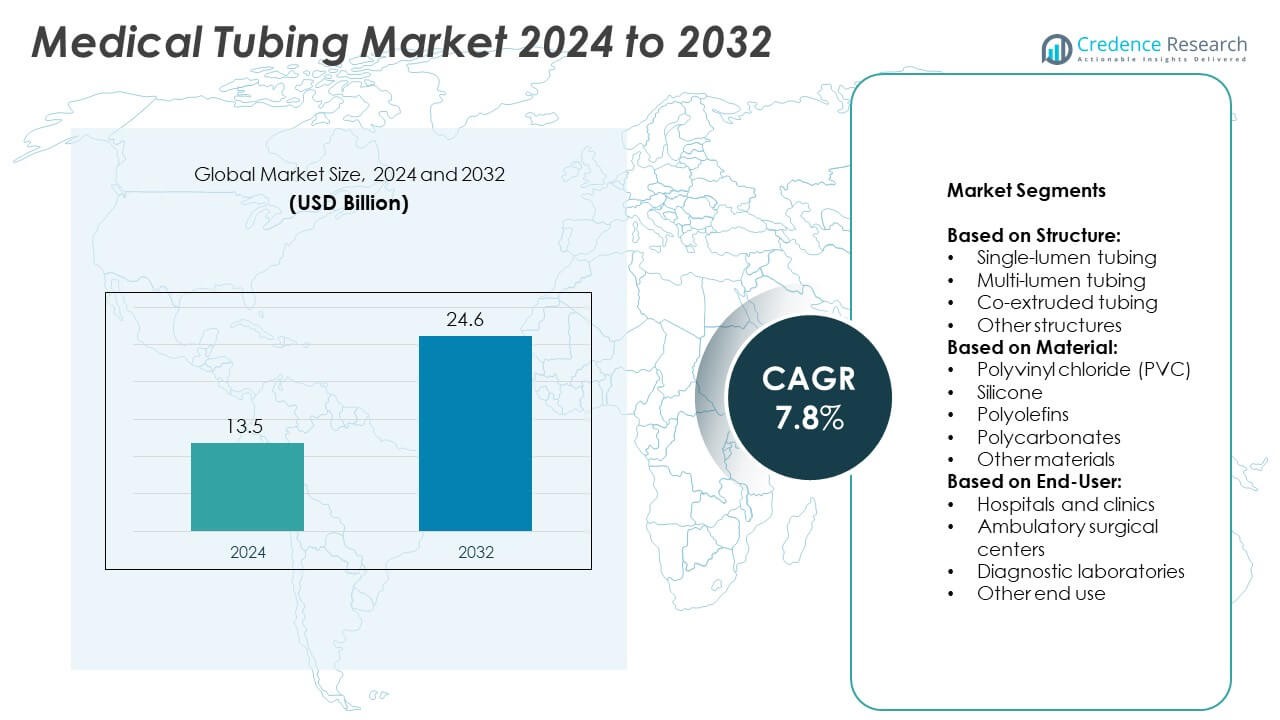

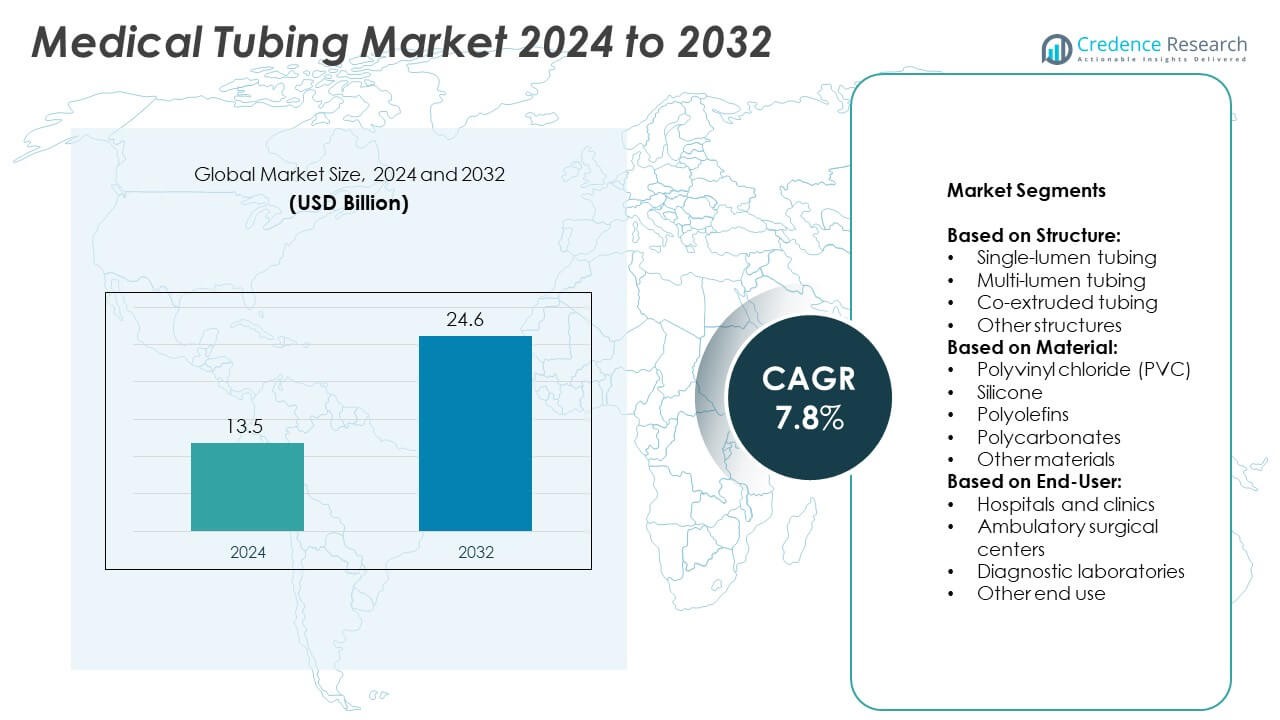

Medical Tubing Market size was valued at USD 13.5 billion in 2024 and is anticipated to reach USD 24.6 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Tubing Market Size 2024 |

USD 13.5 Billion |

| Medical Tubing Market, CAGR |

7.8% |

| Medical Tubing Market Size 2032 |

USD 24.6 Billion |

The Medical Tubing market grows due to rising chronic diseases, aging populations, and demand for minimally invasive procedures. Hospitals and homecare settings require tubing for fluid transfer, respiratory support, and diagnostic systems. Trends include adoption of smart tubing with sensors, use of biocompatible materials, and miniaturized designs for portable devices. Manufacturers focus on sustainable polymers and customization for specific medical applications. Continuous innovation in extrusion technologies supports precision tubing for advanced surgical and diagnostic tools across global healthcare systems.

North America leads the Medical Tubing market due to strong healthcare infrastructure and high device adoption. Europe follows with rising demand for advanced tubing in diagnostics and surgical procedures. Asia Pacific shows rapid growth driven by expanding healthcare access and manufacturing capabilities. Latin America and the Middle East & Africa witness growing investments in hospital systems and chronic care. Key players operating across these regions include SAINT-GOBAIN, ZEUS, SPECTRUM, and FREUDENBERG, each focusing on specialized solutions and global distribution networks.

Market Insights

- Medical Tubing market was valued at USD 13.5 billion in 2024 and is projected to reach USD 24.6 billion by 2032, growing at a CAGR of 7.8%.

- Rising cases of chronic illness, surgical procedures, and aging populations drive global demand for safe, durable tubing.

- Trends include the integration of smart tubing with sensors, use of sustainable materials, and rising adoption of homecare devices.

- Leading players focus on extrusion technology, biocompatible materials, and rapid prototyping for OEM partnerships.

- Strict regulatory approvals and material certification processes increase product development timelines and cost burden.

- North America dominates due to advanced healthcare systems and high usage of minimally invasive medical devices.

- Asia Pacific grows rapidly with strong demand from public healthcare expansions and cost-effective local production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Advanced Healthcare Infrastructure and Chronic Disease Management

The growing focus on chronic disease management continues to boost demand for precise, safe, and durable medical tubing. Hospitals and healthcare providers require advanced devices to support long-term therapies such as dialysis, drug infusion, and catheterization. Increasing investments in ICU setups and surgical infrastructure further fuel adoption of high-performance tubing. The Medical Tubing market benefits from rising hospitalization rates and a growing elderly population. Aging individuals often require long-term medical interventions involving catheters, feeding tubes, and IV lines. This growing need for consistent and safe fluid transfer systems supports strong market expansion.

- For instance, Fresenius Medical Care produces and sells dialyzers and other disposable products that are essential components of dialysis treatment. In 2021, the company sold approximately 158 million dialyzers globally. These products include specialized biocompatible tubing systems designed for long-term renal therapies.

Increasing Preference for Minimally Invasive and Home-Based Procedures

Minimally invasive treatments are gaining widespread acceptance due to reduced patient trauma and faster recovery. These procedures often require precision tubing in devices like endoscopes, stents, and laparoscopic instruments. Home healthcare is also expanding, with patients opting for remote drug delivery, oxygen therapy, and fluid management systems. The Medical Tubing market sees growing usage in portable and wearable medical devices. These innovations require flexible and biocompatible tubing solutions that maintain performance outside clinical settings. Home-based care offers comfort and cost savings, driving consistent demand across global markets.

- For instance, BD is a major manufacturer of medical devices, including a wide range of infusion sets and catheters used in healthcare settings, including home-based and minimally invasive care. Its products incorporate features like advanced polymer tubing designed to enhance patient safety and delivery efficiency. The company has made significant investments to boost manufacturing capacity, including an investment of over $2 million in 2024 to increase IV catheter output by more than 40 million units annually.

Rising Use in Diagnostic Applications and Point-of-Care Devices

Growth in diagnostic testing, especially in infectious disease control, supports higher usage of sampling and fluid handling systems. Medical tubing enables precise control and transfer of biological samples in diagnostic devices and lab automation setups. Point-of-care testing kits often use compact tubing systems to deliver reagents and handle microfluidic flows. It helps ensure contamination-free testing and quicker patient results. Rising investments in decentralized diagnostics increase the demand for tubing with tight dimensional tolerances and sterile performance. This trend reinforces tubing adoption in preventive and early detection programs.

Material Advancements and Regulatory Approvals Driving Product Innovation

Technological innovation in tubing materials improves biocompatibility, transparency, and flexibility. Thermoplastics, silicone, and fluoropolymers allow enhanced sterilization and longer shelf life. New product approvals from global regulatory bodies help accelerate market entry and clinical usage. The Medical Tubing market gains from innovations in extrusion technologies and multi-lumen tube designs. These developments enable complex applications in cardiovascular and neurovascular procedures. Medical device OEMs prefer high-performance materials that meet evolving clinical standards and support integration with digital health systems.

Market Trends

Adoption of Biodegradable and Sustainable Tubing Materials Across Medical Applications

The shift toward eco-friendly healthcare solutions is driving interest in biodegradable medical tubing. Manufacturers are developing plant-based and bioresorbable materials to reduce clinical waste and environmental impact. These materials degrade safely inside the body or during disposal, meeting new sustainability goals. Regulatory pressure to cut plastic use supports this trend across hospitals and surgical centers. The Medical Tubing market integrates such innovations into wound drainage, drug delivery, and catheters. It helps healthcare providers align with green procurement policies and environmental compliance standards.

- For instance, In 2022, Saint-Gobain’s overall Group sales exceeded €51 billion, with a significant portion of its Life Sciences activity focused on providing components for critical applications that demand tight tolerances and high-quality materials.

Integration of Smart Tubing with Embedded Sensors and Digital Connectivity

Digital healthcare systems now incorporate smart tubing that tracks fluid flow, pressure, and temperature in real time. Embedded sensors enhance performance monitoring in IV therapy, catheters, and respiratory circuits. These systems support early detection of flow blockages or leakage risks, improving patient safety. Demand rises for tubing compatible with wireless communication modules and connected care platforms. The Medical Tubing market supports these advancements in ICU setups and remote monitoring devices. It strengthens the role of tubing in data-driven clinical environments.

- For instance, Freudenberg Medical annually supplies over 80 million custom-molded thermoplastic and silicone parts for in-vitro diagnostics and more than 10 million metal components for minimally invasive devices.

Miniaturization of Tubing for Precision-Based and Microfluidic Applications

Modern procedures in cardiology, neurology, and diagnostics require micro-scale tubing with high accuracy and low internal volume. Micro-extrusion techniques allow manufacturers to produce ultra-thin walls and multi-lumen configurations. This trend supports less invasive procedures and faster sample processing in lab devices. The Medical Tubing market benefits from these developments, especially in pediatric, ophthalmic, and portable medical devices. It ensures compatibility with compact device footprints while maintaining fluid integrity and strength. Demand continues to rise for tubing that enables miniaturized therapeutic and diagnostic systems.

Customization of Tubing Solutions Based on Application-Specific Requirements

Healthcare OEMs are seeking tubing tailored to their exact needs, including color coding, chemical resistance, and bonding compatibility. Customization enables easier device integration, better workflow efficiency, and regulatory compliance. Manufacturers offer application-specific tubing for oncology, cardiology, and wound care segments. The Medical Tubing market supports this shift by providing co-extruded, braided, or lubricated designs. It allows end-users to differentiate their products and improve user experience. This trend creates added value and strengthens supplier relationships across the medical value chain.

Market Challenges Analysis

Strict Regulatory Compliance and Material Certification Hurdles

The medical industry enforces stringent regulations for materials that come into contact with human tissue or fluids. Medical tubing must meet global standards such as USP Class VI, ISO 10993, and FDA requirements. Achieving certification involves time-consuming and costly testing for biocompatibility, toxicity, and extractables. These hurdles limit the speed at which new materials or designs enter the market. The Medical Tubing market must address evolving regulations in different countries, adding complexity for global manufacturers. It creates operational delays and raises development costs for tubing suppliers and device OEMs.

Volatile Raw Material Prices and Supply Chain Instability

Fluctuations in raw material prices impact production budgets for tubing manufacturers, especially for polymers like silicone and thermoplastics. Disruptions in the global supply chain—from resin shortages to freight delays—limit timely product delivery. Lead time inconsistencies affect contract manufacturing and OEM planning cycles. The Medical Tubing market faces added pressure to maintain quality and delivery timelines during supply constraints. It forces companies to hold higher inventory levels or seek alternative sourcing strategies. These challenges increase operational risks and reduce profit margins across the value chain.

Market Opportunities

Expanding Use of Medical Tubing in Wearable and Portable Healthcare Devices

The growing demand for wearable and portable health solutions creates strong opportunities for tubing suppliers. Devices for insulin delivery, pain management, and wound care rely on flexible, kink-resistant tubing. These devices require tubing that supports mobility without compromising fluid flow or safety. Miniaturized systems with integrated tubing appeal to patients managing chronic conditions at home. The Medical Tubing market supports this shift by offering lightweight, customizable, and durable solutions. It aligns with rising investments in home-based care and personalized treatment platforms.

Emerging Markets Driving Demand for Low-Cost, Scalable Tubing Solutions

Healthcare infrastructure in Asia-Pacific, Latin America, and parts of Africa is expanding rapidly. These regions require affordable, high-quality medical tubing for infusion systems, catheters, and respiratory care. Governments and private providers are scaling up public health services, creating demand for mass-produced tubing. Localized production and distribution can reduce costs and improve supply reliability. The Medical Tubing market can grow through partnerships with regional OEMs and healthcare agencies. It opens access to new patient bases and supports broader global health initiatives.

Market Segmentation Analysis:

By Structure:

Single-lumen tubing dominates the market due to its wide usage in intravenous lines, catheters, and feeding tubes. It offers straightforward design, consistent flow, and ease of sterilization, making it suitable for standard clinical use. Multi-lumen tubing supports advanced medical devices by enabling multiple fluid or electrical channels within a single tube. This segment finds increasing use in minimally invasive procedures and cardiovascular treatments. Co-extruded tubing offers advantages in combining material properties like chemical resistance and flexibility, suited for complex applications such as endoscopy. The “other structures” category includes braided and balloon tubing, supporting niche requirements in surgical and diagnostic settings. The Medical Tubing market continues to evolve with structural innovation to meet precision and safety standards.

- For instance, Spectrum Plastics Group, The company has extensive global manufacturing capabilities, including for single-lumen and multi-lumen tubing and complex co-extruded designs. Spectrum was acquired by DuPont in 2023 for $1.75 billion, at which point it had approximately $500 million in annual revenue.

By Material:

Polyvinyl chloride (PVC) leads the market due to cost-effectiveness and versatility across various medical applications. It provides chemical resistance, flexibility, and compatibility with sterilization methods. Silicone tubing holds strong demand in implantable and high-performance applications due to its biocompatibility and heat resistance. Polyolefins such as polyethylene and polypropylene serve as alternatives for those seeking latex-free and low-extractable materials. Polycarbonates offer strength and transparency, often used in connectors and high-pressure tubing segments. The “other materials” segment includes fluoropolymers and thermoplastic elastomers supporting specialty needs in diagnostics and surgical tools. It supports custom development across device platforms.

- For instance, Raumedic, a German manufacturer of polymer-based medical and pharmaceutical products, develops and produces a wide variety of medical-grade tubing, including PVC, silicone, and complex multi-lumen structures designed for applications in infusion, respiratory, and minimally invasive surgery. With over 70 years of experience, the company serves the international medical technology and pharmaceutical sectors.

By End-User:

Hospitals and clinics form the largest segment due to high patient volume and ongoing need for infusion and drainage systems. These settings require tubing for catheters, oxygen delivery, and fluid transfer. Ambulatory surgical centers prefer compact and reliable tubing for outpatient surgeries and day-care procedures. Diagnostic laboratories demand precision tubing in automated systems for sample handling and reagent delivery. The “other end use” segment includes home healthcare providers, specialty clinics, and research institutions. The Medical Tubing market supports all these segments through tailored solutions that meet sterilization, safety, and regulatory demands.

Segments:

Based on Structure:

- Single-lumen tubing

- Multi-lumen tubing

- Co-extruded tubing

- Other structures

Based on Material:

- Polyvinyl chloride (PVC)

- Silicone

- Polyolefins

- Polycarbonates

- Other materials

Based on End-User:

- Hospitals and clinics

- Ambulatory surgical centers

- Diagnostic laboratories

- Other end use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the Medical Tubing market, accounting for 38.2% in 2024. The region benefits from advanced healthcare infrastructure and high spending on medical technology. Strong demand for minimally invasive procedures drives the use of specialized tubing in cardiovascular, respiratory, and urology applications. Regulatory clarity from agencies such as the FDA supports innovation in medical device manufacturing. Major companies operate production facilities in the U.S., allowing fast turnaround for custom tubing requirements. The growing elderly population and rising outpatient care usage continue to support the need for IV lines, catheters, and drainage systems. It remains the leading region in both revenue and innovation output.

Europe

Europe accounted for 26.5% of the global Medical Tubing market in 2024. The region emphasizes product safety, eco-compliance, and sustainable material use in medical devices. Countries like Germany, France, and the UK lead in adopting advanced tubing in diagnostic and surgical tools. The demand for single-use medical devices rises with increased attention to infection control and patient safety. Regulatory standards such as MDR (Medical Device Regulation) guide material selection and performance testing. Hospitals and research centers invest in tubing that supports high-precision diagnostics and long-term treatments. It creates sustained demand for both standard and specialty tubing across public and private healthcare systems.

Asia Pacific

Asia Pacific captured 22.1% of the Medical Tubing market in 2024, driven by expanding healthcare infrastructure and growing demand in countries like China, India, and Japan. Government-led health schemes and rising medical tourism support equipment upgrades across public and private hospitals. Local manufacturing hubs supply cost-effective tubing solutions for domestic and export needs. The demand grows for dialysis tubing, respiratory lines, and drug delivery systems to support chronic disease management. Multinational companies are increasing investments in regional partnerships and localized R&D. It helps address unique patient needs and regulatory preferences across the Asia Pacific region.

Latin America

Latin America represented 7.8% of the global Medical Tubing market in 2024. Brazil and Mexico lead in terms of healthcare infrastructure development and medical imports. Rising awareness of non-communicable diseases fuels demand for infusion sets, catheters, and surgical tubing. Hospitals and clinics upgrade their systems to match international care standards. Public and private sector investments in ambulatory care and diagnostics increase the use of sterile tubing. Local suppliers work with global brands to meet supply requirements efficiently. It supports regional growth despite challenges related to reimbursement and import logistics.

Middle East & Africa

Middle East & Africa accounted for 5.4% of the Medical Tubing market in 2024. The region sees increased investment in modern hospitals and specialty clinics, especially in the UAE, Saudi Arabia, and South Africa. Rising demand for cardiac and respiratory treatments drives the need for durable and biocompatible tubing. The use of imported medical devices fuels demand for compatible and approved tubing systems. Donor-backed programs and government partnerships expand access to diagnostic tools and critical care equipment. Manufacturers find opportunities in distributing cost-effective tubing for low-resource settings. It strengthens regional healthcare capabilities while expanding global market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AngioDynamics

- SAINT-GOBAIN

- GORE

- FREUDENBERG

- POLYZEN

- SPECTRUM

- ZEUS

- Parker

- mdc

- TRELLEBORG

- AdvantaPURE

- Putnam Plastics

- AP Technologies

- Nordson

- raumedic

Competitive Analysis

Key players in the Medical Tubing market include AngioDynamics, SAINT-GOBAIN, GORE, FREUDENBERG, SPECTRUM, ZEUS, Parker, AdvantaPURE, Nordson, Putnam Plastics, POLYZEN, raumedic, AP Technologies, mdc, and TRELLEBORG. These companies compete through material innovation, extrusion technology, and application-specific tubing designs. Market leaders invest in R&D to improve biocompatibility, flexibility, and miniaturization of tubing used in drug delivery, surgical instruments, and diagnostic systems. Some players focus on custom manufacturing for OEMs, while others scale mass production for high-volume disposable medical devices. Strategic collaborations with healthcare device manufacturers allow faster prototyping and regulatory compliance. Global manufacturing presence and strong distribution channels help maintain supply chain resilience and meet regional demand. Players differentiate through proprietary polymer blends, cleanroom production facilities, and sterilization compatibility. The market favors companies that offer traceability, regulatory certification, and fast turnaround for complex configurations. Competitive advantage depends on quality control, material selection, and ability to adapt to evolving healthcare technologies. Strong branding and long-term supplier agreements further support position in hospital procurement chains. Players continue expanding in Asia Pacific and Latin America through local partnerships and production hubs.

Recent Developments

- In 2025, Freudenberg Medical reported continued expansion of global production facilities and investments in precision manufacturing to meet international demands for advanced silicone and thermoplastic tubing

- In 2024, Nordson Corporation held significant market share owing to a diversified product portfolio, large customer base, and geographical presence, with an emphasis on product introductions enhancing fluid transfer technology.

- In November 2024, The Lubrizol Corporation entered into an agreement with Polyhose to manufacture medical tubing and expand production capacity in Chennai, Tamil Nadu.

Report Coverage

The research report offers an in-depth analysis based on Structure, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for medical tubing will grow due to rising chronic diseases and aging populations.

- Wearable and portable medical devices will increase the need for flexible tubing solutions.

- Regulatory focus on biocompatibility will drive material innovation in tubing products.

- Home-based care expansion will support tubing use in drug delivery and oxygen therapy.

- Emerging economies will seek cost-effective, scalable tubing for public healthcare systems.

- Smart tubing with sensors will gain traction in critical care and diagnostic devices.

- Manufacturers will invest in sustainable and recyclable tubing materials to meet green goals.

- Custom extrusion technologies will allow personalized tubing designs for advanced applications.

- Rising demand for single-use devices will push the need for sterile and disposable tubing.

- Strategic collaborations with OEMs will help suppliers expand tubing portfolios and global reach.