Market Overview:

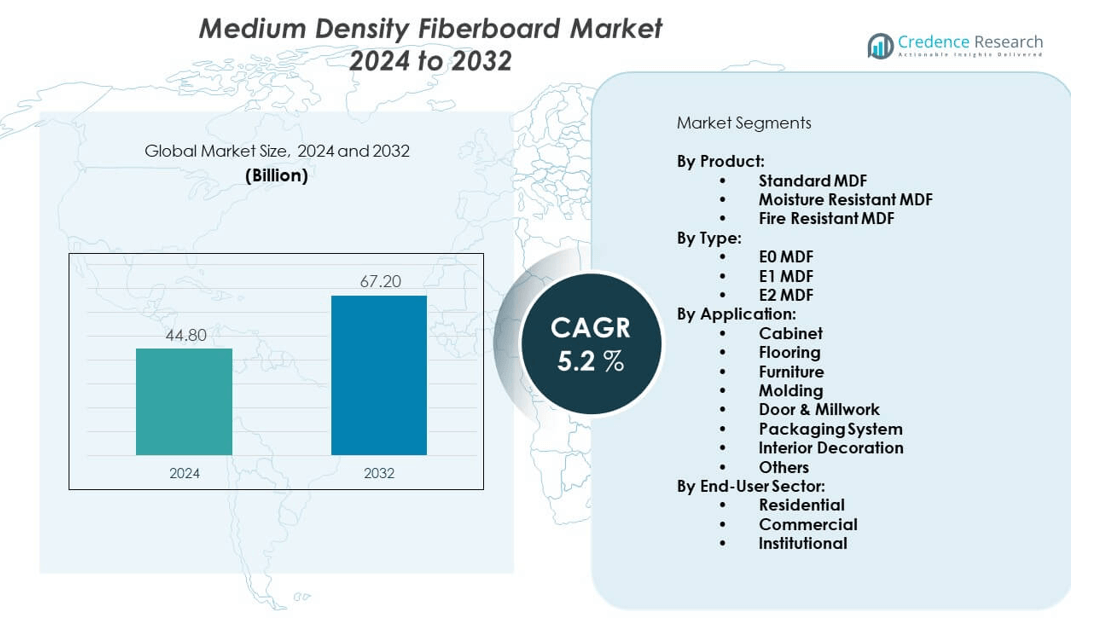

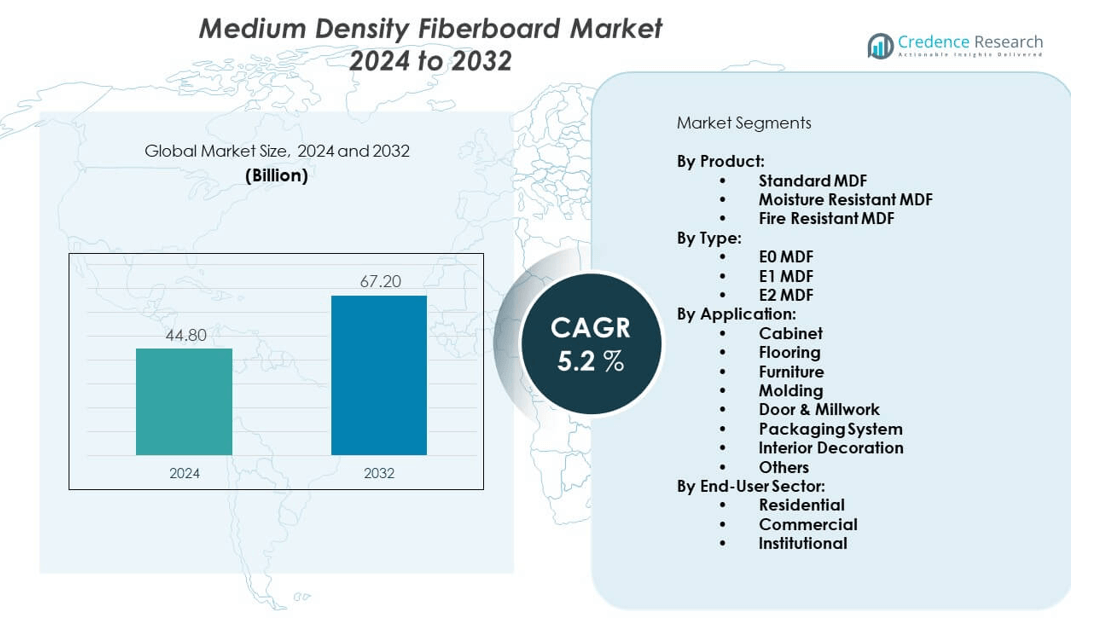

The Medium density fiberboard (MDF) market is projected to grow from USD 44.8 billion in 2024 to an estimated USD 67.2 billion by 2032, registering a compound annual growth rate (CAGR) of 5.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Density Fiberboard Market Size 2024 |

USD 44.8 billion |

| Medium Density Fiberboard Market, CAGR |

5.2% |

| Medium Density Fiberboard Market Size 2032 |

USD 67.2 billion |

The market expansion is driven by strong demand for sustainable, engineered wood products that offer durability and ease of customization. Manufacturers emphasize eco-friendly production methods, using recycled wood fibers to appeal to green building trends. Rising urbanization and housing demand boost MDF consumption in flooring, cabinetry, and paneling. Its consistent texture supports modern designs in both commercial and residential spaces. Technological innovations in manufacturing processes enhance product quality, making MDF more competitive against plywood and particleboard in global markets.

Asia Pacific leads the medium density fiberboard market due to rapid construction growth, rising disposable incomes, and furniture exports from China, India, and Southeast Asia. North America shows strong adoption driven by renovation activities and a shift toward engineered wood solutions in sustainable housing projects. Europe maintains a steady share supported by strict environmental standards and demand for eco-certified materials. Emerging markets in Latin America and the Middle East show potential as infrastructure projects and urbanization accelerate, fueling MDF consumption in residential and commercial sectors.

Market Insights:

- The medium density fiberboard market is projected to grow from USD 44.8 billion in 2024 to USD 67.2 billion by 2032, at a CAGR of 5.2%.

- Growing demand from the construction and furniture industries fuels adoption due to MDF’s cost-effectiveness, smooth surface, and versatility.

- Rising sustainability focus drives adoption, with MDF favored for its recycled wood fiber content and eco-friendly production processes.

- High raw material costs and regulatory requirements on emissions and adhesives act as restraints, impacting smaller manufacturers more heavily.

- Asia Pacific leads the market, supported by large-scale construction, rising middle-class populations, and strong furniture exports.

- North America shows steady growth, driven by home renovations and sustainable building preferences, while Europe benefits from strict eco-certifications.

- Emerging economies in Latin America and the Middle East present strong opportunities due to rapid urbanization, housing initiatives, and retail expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Construction and Furniture Industries Strengthening Growth Potential:

The medium density fiberboard market benefits strongly from the global construction and furniture industries, which consistently demand cost-effective, versatile, and durable materials. MDF offers smooth finishing surfaces, making it a preferred option for cabinetry, paneling, and flooring. Growth in urban housing projects fuels consumption, supported by rising disposable incomes and improved living standards. Large-scale commercial spaces also create steady requirements for modular furniture and partitions. Consumers favor MDF for its affordability when compared with solid wood and plywood. Increasing focus on home renovation trends boosts its applications in interior design. The construction industry in emerging economies, especially in Asia, strengthens consumption patterns. The market remains aligned with expansion in both residential and commercial developments.

- For instance, ARAUCO’s new Zitácuaro MDF production line in Mexico adds 300,000 cubic meters of annual capacity, including a significant share of melamine-coated MDF designed for furniture and cabinetry, reinforcing supply for construction and commercial interior markets.

Sustainability and Environmental Preferences Influencing Material Adoption:

Sustainability-focused policies and consumer awareness fuel adoption across the medium density fiberboard market. MDF uses recycled wood fibers and minimizes wastage, making it appealing in green building projects. Governments promote eco-friendly construction standards, which strengthens industry opportunities. Buyers increasingly demand materials with reduced carbon footprints and certified supply chains. Furniture brands adopt MDF to align with environmental targets and certification programs. It delivers an alternative to traditional hardwood, which faces sustainability concerns and rising costs. Large retailers highlight MDF’s eco-friendly properties in marketing strategies, influencing consumer choices. The long-term focus on reducing deforestation risks drives adoption of engineered wood over natural wood.

- For instance, Sonae Arauco has increased its use of recycled wood to 33%, reusing approximately 809,000 tons of recycled wood annually. Moreover, its new dry fiberboard recycling line, launched in early 2025, enhances circular production by converting old MDF into raw materials—demonstrating a strong commitment to eco-friendly manufacturing. Large retailers highlight MDF’s eco-friendly properties in marketing strategies, influencing consumer choices.

Technological Innovation and Product Improvement Enhancing Market Expansion:

Advancements in production methods create stronger opportunities for the medium density fiberboard market. New resin technologies improve strength and moisture resistance, widening application in kitchens and bathrooms. Enhanced machining and finishing capabilities allow precision in cutting, routing, and shaping. Manufacturers innovate with fire-retardant and low-VOC panels, appealing to health-conscious buyers. Rising investment in advanced machinery enhances efficiency and reduces production costs. Research into lightweight MDF panels broadens use in transport and portable furniture. Companies invest in automation and quality control to meet international standards. Innovations in digital design also promote custom solutions in furniture and interior projects.

Rising Global Urbanization and Lifestyle Transformation Shaping Market Demand:

Urbanization accelerates housing demand, driving MDF adoption in large volumes. Rapid city development in Asia Pacific fuels growth opportunities, with rising middle-class populations demanding affordable solutions. The medium density fiberboard market aligns with lifestyle trends that emphasize modular, customizable, and stylish interiors. Growing preference for compact, multifunctional furniture boosts MDF consumption. Shifts toward apartment living create higher needs for space-efficient cabinetry and partitions. Global demand for ready-to-assemble furniture supports wider adoption of MDF products. Retail expansion and online platforms enhance consumer accessibility to affordable MDF-based products. Rising exposure to global design influences strengthens its role in interior projects.

Market Trends:

Growing Influence of Online Retail and E-Commerce Platforms on Market Expansion:

Digital platforms reshape distribution patterns, allowing consumers to access MDF-based furniture and décor with ease. E-commerce companies expand offerings, creating direct-to-consumer channels for modular and ready-to-assemble products. This trend supports small manufacturers by providing access to international customers. Market players adopt online customization tools to support buyers in design planning. The medium density fiberboard market aligns with this trend, as lightweight and cost-effective products ship easily across regions. Large retailers invest in online visibility and logistics networks. Social media marketing further amplifies consumer awareness of MDF furniture. Digital retail channels become essential for market competitiveness.

- For instance, ARAUCO Grayling plant in Michigan, USA, integrates smart logistics and inventory management that helps streamline distribution for North American markets; the facility is known for high product availability and efficient supply chain responsiveness.

Integration of Smart Manufacturing and Automation in MDF Production Processes:

Automation and smart manufacturing technologies play a vital role in modern MDF production facilities. Industry 4.0 practices help reduce energy consumption, improve accuracy, and minimize waste. Robotic systems enable efficient cutting, pressing, and finishing. The medium density fiberboard market gains from these improvements through cost efficiency and higher productivity. Smart sensors allow manufacturers to monitor quality during continuous production. Investments in advanced plant technology lower operational risks while enhancing consistency. Companies integrate predictive maintenance to avoid breakdowns and reduce downtime. Global competitiveness increases as producers adopt automation-driven efficiency.

- For instance, EGGER Group invested over $42 million in automating their Lexington, USA production facility with new lamination and impregnation lines, enabling integration of smart sensors throughout the production to monitor and ensure board quality in real-time. The automation has led to consistent production output exceeding one million square meters of thermally fused laminate monthly, reflecting enhanced throughput and waste reduction.

Increasing Preference for Premium and Decorative MDF in Interior Applications:

Interior designers and architects increasingly adopt premium MDF for aesthetic flexibility. High-gloss, textured, and laminated variants replace traditional wood in modern projects. The medium density fiberboard market benefits from demand for decorative finishes that meet global style preferences. Consumers seek MDF products with added durability and scratch resistance. Manufacturers expand portfolios with high-quality decorative panels. Decorative MDF aligns with rising expectations for luxury interiors in residential and commercial spaces. Demand for contemporary styles strengthens its presence in high-end applications. Investments in design innovation reinforce MDF’s position as a versatile decorative solution.

Expanding Use of MDF in Industrial and Specialized Applications Beyond Furniture:

MDF adoption expands beyond traditional furniture and interiors into broader industrial applications. Its stability and machinability support usage in packaging, automotive interiors, and soundproofing. The medium density fiberboard market adapts as new industries recognize its performance advantages. MDF provides acoustic insulation, appealing to theater and recording studios. It also supports cost-effective solutions in transportation and construction packaging. Industrial designers favor MDF for prototyping due to its uniform texture. Increased recognition of these diverse benefits broadens future opportunities. MDF steadily grows from a household material into an industrially significant product.

Market Challenges Analysis:

Volatile Raw Material Costs and Environmental Regulations Impacting Market Stability:

The medium density fiberboard market faces challenges from fluctuating raw material prices and strict environmental regulations. Prices of adhesives, resins, and wood fibers directly affect production costs. Regulatory compliance demands investments in eco-friendly processes, which raises operational expenses. Emission standards limit the use of formaldehyde-based adhesives, prompting costly technological shifts. Small manufacturers struggle to compete with larger players due to compliance costs. Global supply chain disruptions further intensify volatility in raw material supply. It becomes necessary for producers to balance profitability with adherence to stricter environmental standards. These issues create uncertainty for future investments in the industry.

Competition from Substitute Materials and Consumer Perceptions Creating Obstacles:

The medium density fiberboard market experiences stiff competition from plywood, particleboard, and alternative engineered woods. Consumers in certain regions still perceive MDF as less durable than traditional wood. Negative views on moisture resistance limit adoption in kitchens and bathrooms. Manufacturers face the challenge of continuous innovation to counter durability concerns. Branding and awareness campaigns are essential to improve perceptions. Price-sensitive buyers often shift to cheaper substitutes when MDF prices rise. Strong competition also comes from imported low-cost products in developing countries. Market growth requires constant differentiation to remain competitive against substitutes.

Market Opportunities:

Expanding Green Building Practices and Rising Demand for Sustainable Materials Globally:

The medium density fiberboard market holds strong opportunities due to expanding global demand for sustainable building materials. Green building certifications encourage wider adoption of MDF panels in eco-friendly projects. Growing awareness of environmental protection drives demand for recycled and renewable material use. Governments actively promote low-carbon construction solutions, favoring MDF’s environmental advantages. Builders and furniture producers find opportunities in promoting MDF as an eco-conscious alternative. Consumer demand for sustainable solutions adds momentum to this growth. This creates room for long-term strategic gains across regions.

Increasing Penetration into Emerging Markets Supported by Rapid Urbanization and Housing Demand:

Emerging economies create new opportunities for the medium density fiberboard market as urbanization and housing projects expand. Rising middle-class populations drive strong demand for cost-effective and customizable furniture. Local production capacities continue to grow in countries like India, Vietnam, and Brazil. Affordable housing initiatives encourage bulk adoption of MDF products in construction. Expanding retail and e-commerce platforms increase accessibility of MDF-based products. Investments by global manufacturers into local facilities enhance product availability. These factors create significant untapped growth potential across emerging regions.

Market Segmentation Analysis:

By Product

The medium density fiberboard market demonstrates strong diversity across product categories, with standard MDF holding a significant share due to its wide usage in furniture and cabinetry. Moisture-resistant MDF finds adoption in kitchens and bathrooms, while fire-resistant MDF gains traction in public buildings and institutional projects requiring safety compliance. Each product type addresses distinct performance needs, making the segment an essential driver of overall market demand.

- For instance, manufacturers like Kronospan have invested in specialized moisture-resistant MDF lines meeting strict standards that cater to wet environments in residential and commercial construction.

By Type

E1 MDF dominates the type segment due to its balance of cost and low formaldehyde emissions. E0 MDF is gaining preference in regions with strict environmental regulations, reflecting the market’s shift toward safer and eco-friendly solutions. E2 MDF continues to serve cost-sensitive markets where emission standards remain less stringent, sustaining demand in developing regions. The medium density fiberboard market shows resilience through varied compliance-driven adoption patterns.

- For instance, Sonae Arauco’s MDF product lines include a significant volume of E0 rated boards for markets with stringent emissions regulations, reinforcing their leadership in safe and eco-friendly MDF solutions.

By Application

Furniture and cabinetry drive the highest demand, supported by global housing and renovation activities. Flooring and interior decoration also contribute significantly, with molding and millwork expanding in both residential and commercial spaces. Packaging systems represent a niche but growing segment supported by lightweight and durable panel needs. Wide application diversity ensures stability in consumption across industries.

By End-User Sector

Residential use accounts for the majority share, driven by modular furniture and home interiors. Commercial projects support demand in offices, retail, and hospitality environments where MDF is used for partitions and decorative panels. Institutional adoption expands in schools, healthcare facilities, and government buildings, driven by safety and cost considerations. Broad adoption across end-user sectors strengthens long-term growth prospects for the industry.

Segmentation:

By Product:

- Standard MDF

- Moisture Resistant MDF

- Fire Resistant MDF

By Type:

By Application:

- Cabinet

- Flooring

- Furniture

- Molding

- Door & Millwork

- Packaging System

- Interior Decoration

- Others

By End-User Sector:

- Residential

- Commercial

- Institutional

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest share of the medium density fiberboard market, accounting for around 48% of global revenue. Strong growth in China, India, and Southeast Asia drives demand, supported by rapid urbanization and expanding residential construction. The region benefits from large-scale furniture manufacturing, which fuels exports to Europe and North America. Rising middle-class incomes increase demand for affordable and modular furniture. Government-backed housing projects also create opportunities for MDF consumption in flooring and interior decoration. It remains the most dynamic region, with expanding production capacities and strong cost advantages for manufacturers.

Europe

Europe contributes around 22% share in the medium density fiberboard market, led by Germany, France, and the U.K. The region focuses heavily on sustainability, with strict environmental standards supporting demand for low-emission MDF types such as E0 and E1 boards. Furniture and interior design industries use MDF widely due to its flexibility and consistency. Strong demand for decorative and high-quality MDF panels in commercial and residential interiors sustains growth. Renovation projects across Western and Eastern Europe further enhance consumption levels. It benefits from well-established manufacturing facilities and steady adoption of eco-friendly engineered wood products.

North America, Latin America, and Middle East & Africa

North America holds around 18% share in the medium density fiberboard market, driven by home renovation trends and steady demand in cabinetry and millwork. The U.S. leads the region with rising adoption of eco-certified panels for sustainable building projects. Latin America represents around 7% share, led by Brazil and Mexico, where rapid housing growth drives MDF demand in residential applications. The Middle East & Africa account for nearly 5%, with opportunities arising from infrastructure development and expanding retail furniture markets. Both regions show potential due to rising urban populations and growth in commercial spaces. It continues to attract investment in local production facilities to reduce reliance on imports and meet growing demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ARAUCO

- Daiken Corporation

- Duratex (Dexco)

- EGGER Group

- Kronospan Limited

- Kastamonu Entegre

- Swiss Krono Group

- Centuryply

- Georgia-Pacific

- Roseburg Forest Products

Competitive Analysis:

The medium density fiberboard market is highly competitive with strong global and regional players operating across multiple segments. Leading companies focus on capacity expansions, product innovation, and sustainability to secure their positions. It is marked by a mix of integrated manufacturers with wide distribution networks and regional firms serving localized demand. Global players such as EGGER Group, Kronospan, and ARAUCO emphasize high-quality, eco-friendly panels to meet regulatory requirements. Regional players like Centuryply and Kastamonu Entegre cater to growing housing and furniture needs in emerging economies. Partnerships with distributors, investment in digital retail, and advancements in production processes are key strategies shaping competition.

Recent Developments:

- In August 2025, Kastamonu Entegre was recognized as an industry leader in exports and introduced new eco-friendly MDF products focused on sustainability, utilizing 100% recycled materials in production, and developed innovative bio-glue MDF boards with zero formaldehyde emissions.

- Kastamonu Entegre was named an industry leader in exports in 2025, accounting for 7% of global laminate flooring production and ranking third among MDF producers worldwide. The company also introduced a new brand of Evosoft double-sided ultra-matte decorative panels featuring 14 unique pastel decors with scratch-resistant coatings to meet evolving customer needs.

- In January 2025, EGGER Group launched new decorative collections for MDF and flooring, enhancing sustainable furniture design options. Lexington plant supports high-quality, large-scale MDF production for the North American market.

Market Concentration & Characteristics:

The medium density fiberboard market reflects moderate concentration, with a few global players holding strong influence alongside several regional producers. It is characterized by intense competition, high capital requirements, and strong emphasis on compliance with emission and sustainability standards. Product differentiation largely occurs through moisture resistance, fire resistance, and decorative finishes. Competitive dynamics remain shaped by technological innovations, local production capacities, and long-term distributor partnerships. Price competition is notable in emerging markets, while developed economies emphasize quality, certification, and eco-friendly features.

Report Coverage:

The research report offers an in-depth analysis based on By Product, By Type, By Application, By End-User Sector, and By Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for eco-friendly MDF boards will expand with stricter emission regulations worldwide.

- Furniture and cabinetry applications will continue to dominate market consumption.

- Decorative MDF with advanced finishes will gain popularity in premium interior projects.

- Emerging economies will drive significant consumption through urban housing initiatives.

- Investments in automated and smart manufacturing will improve efficiency and margins.

- Strategic partnerships and acquisitions will strengthen global supply networks.

- Online retail and digital customization platforms will shape consumer access.

- Lightweight MDF products will expand applications in transportation and packaging.

- North America and Europe will focus on certified, low-emission MDF for sustainability.

- Regional players will gain strength by catering to localized design and cost needs.