Market Overview

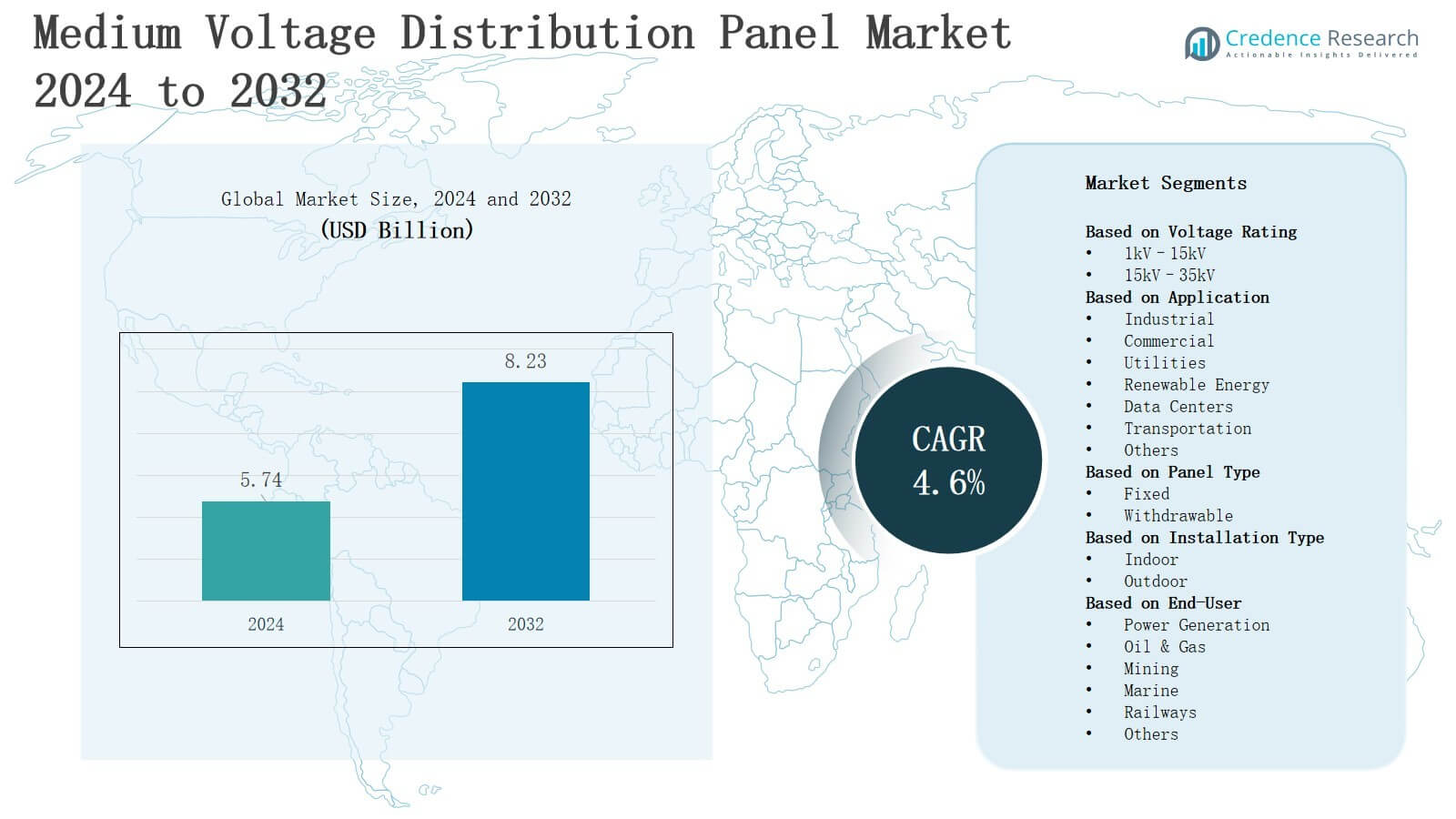

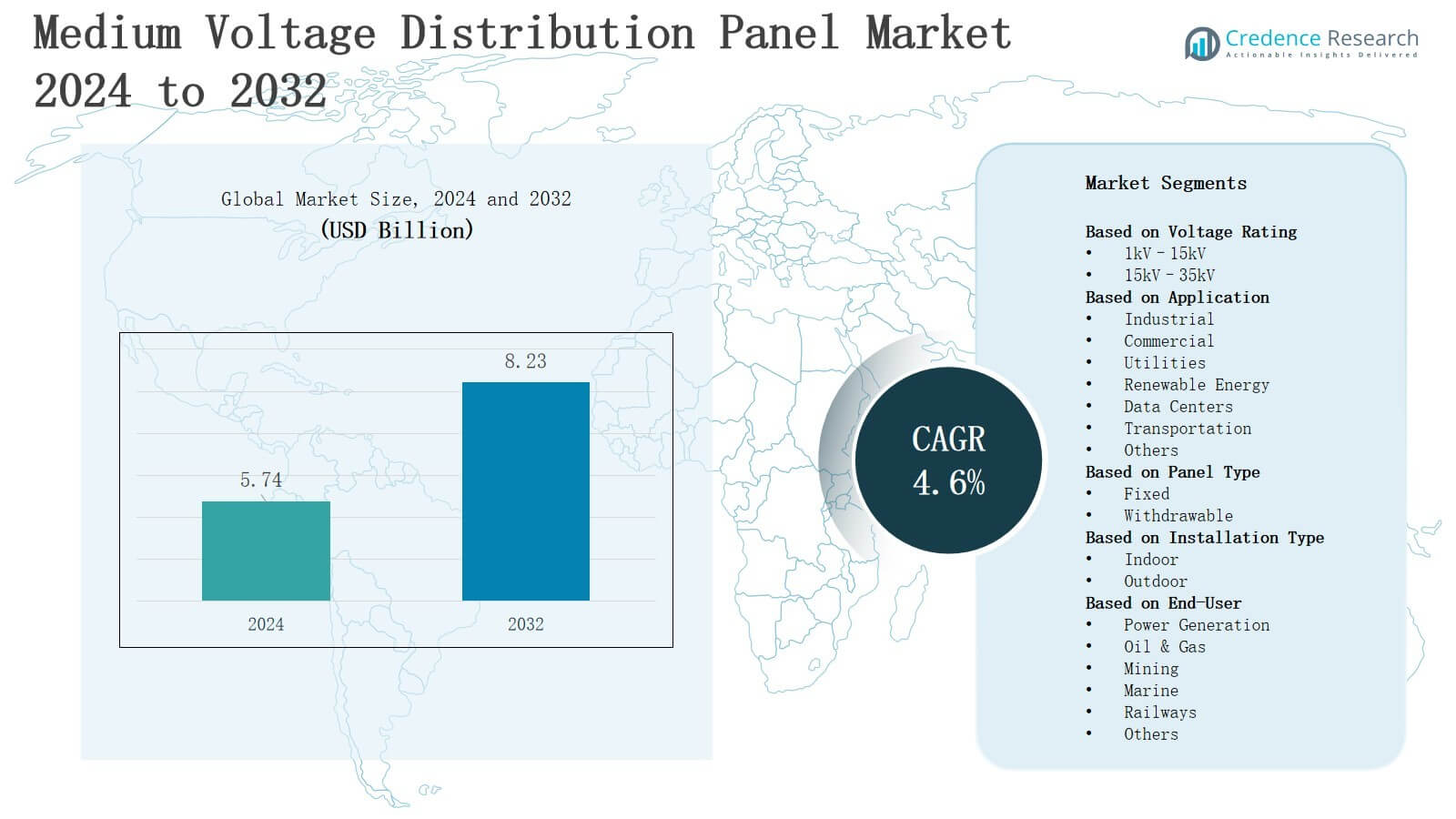

In the medium voltage distribution panel market, revenue is projected to grow from USD 5.74 billion in 2024 to USD 8.23 billion by 2032, registering a CAGR of 4.6%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Distribution Panel Market Size 2024 |

USD 5.74 billion |

| Medium Voltage Distribution Panel Market, CAGR |

4.6% |

| Medium Voltage Distribution Panel Market Size 2032 |

USD 8.23 billion |

The medium voltage distribution panel market is driven by the increasing demand for reliable and efficient power distribution across industrial, commercial, and utility sectors. Rapid urbanization, industrial expansion, and the growth of smart grids are fueling investments in advanced electrical infrastructure. Manufacturers are focusing on incorporating digital monitoring, IoT integration, and enhanced safety features to meet evolving regulatory standards and reduce downtime. Additionally, rising adoption of renewable energy sources and energy-efficient solutions is boosting the need for modern medium voltage panels. Technological innovations, coupled with stringent safety norms, continue to shape market trends, creating significant growth opportunities globally.

The medium voltage distribution panel market demonstrates strong regional diversity, with Asia-Pacific leading at 30%, followed by North America at 28%, Europe at 26%, Middle East & Africa at 9%, and Latin America at 7%. It experiences high demand from industrial, commercial, utility, and renewable energy sectors across these regions. Key players, including ABB, Schneider Electric, Siemens, Eaton, General Electric (GE), Mitsubishi Electric, Rockwell Automation, Legrand, Larsen & Toubro (L&T), Fuji Electric, Toshiba, Hitachi Energy, and NHP Electrical Engineering Products, compete to provide advanced, reliable, and energy-efficient solutions tailored to regional needs.

Market Insights

- The medium voltage distribution panel market is projected to grow from USD 5.74 billion in 2024 to USD 8.23 billion by 2032, registering a CAGR of 4.6% due to rising industrial and utility demand.

- The 1kV–15kV segment leads with a 62% share, offering reliable distribution for small- to medium-scale systems, while the 15kV–35kV segment holds 38%, supporting large facilities and renewable energy integration.

- Industrial applications dominate with a 40% share, driven by manufacturing and process industries, followed by utilities at 25%, commercial at 15%, renewable energy at 10%, and other sectors collectively at 10%.

- Fixed panels capture 55% of the market due to durability and low maintenance, while withdrawable panels hold 45%, favored for flexibility, modular expansion, and quick maintenance in large-scale installations.

- Regionally, Asia-Pacific leads with 30%, North America holds 28%, Europe 26%, Middle East & Africa 9%, and Latin America 7%, supported by industrialization, renewable energy adoption, smart grids, and infrastructure modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rapid Industrialization and Urban Infrastructure Expansion

The growing need for reliable electricity supply in industrial and urban areas significantly drives the medium voltage distribution panel market. Industries require consistent power for manufacturing, processing, and operational efficiency, while urban centers demand uninterrupted energy for commercial and residential use. It supports load management and reduces the risk of outages. Investments in modern infrastructure, industrial parks, and smart city projects create continuous demand. Governments encourage upgrades to resilient electrical systems, boosting panel adoption globally. It ensures safety, efficiency, and compliance with electrical standards.

- For instance, Eaton’s innovative distribution panels are widely used in urban infrastructure upgrades to improve safety and efficiency, conforming with stringent regulations globally.

Integration with Renewable Energy Systems

Renewable energy adoption accelerates the demand for medium voltage distribution panels. Solar, wind, and hybrid energy systems require reliable distribution solutions to manage variable power input and maintain grid stability. It connects renewable installations with conventional grids, ensuring seamless power flow. Energy storage systems also rely on advanced panels for safety and operational efficiency. Rising environmental regulations and commitments to sustainable energy increase deployment. It enables efficient monitoring, fault detection, and energy management. Investments in green energy infrastructure drive the market forward.

- For instance, Adani Green Energy’s 30 GW solar and hybrid projects leverage medium voltage systems to efficiently integrate large-scale renewable power into the grid while maintaining operational resilience and safety.

Technological Advancements and Smart Grid Development

Innovations in digital monitoring, IoT-enabled control, and automation propel the medium voltage distribution panel market. It allows operators to monitor load, detect faults, and optimize power distribution in real time. Smart grids demand advanced panels capable of integrating with intelligent systems to enhance reliability and efficiency. Manufacturers focus on compact designs, modularity, and enhanced safety features to meet evolving standards. It reduces maintenance requirements and operational costs. The integration of predictive maintenance and analytics strengthens infrastructure resilience. Continuous technological progress creates opportunities for high-performance solutions globally.

Stringent Safety Standards and Regulatory Compliance

Regulatory frameworks and safety standards drive market demand for medium voltage distribution panels. It ensures electrical installations meet operational, environmental, and safety requirements, reducing risks of accidents and equipment damage. Industrial, commercial, and utility sectors prioritize compliance with IEC, ANSI, and local standards, prompting upgrades to advanced panels. It incorporates protective devices, circuit breakers, and monitoring systems to enhance reliability. Governments promote modern, safe, and energy-efficient infrastructure. Compliance pressure motivates continuous innovation and adoption of high-quality panels worldwide. This focus strengthens market growth and adoption across sectors.

Market Trends

Adoption of Digital and IoT-Enabled Panels

The medium voltage distribution panel market increasingly shifts toward digital and IoT-enabled solutions. It allows real-time monitoring of load, fault detection, and remote control of electrical systems. Utilities and industries implement smart panels to enhance reliability, reduce downtime, and optimize energy distribution. Advanced communication protocols and data analytics enable predictive maintenance and operational efficiency. It supports integration with automation systems and smart grid infrastructure. Manufacturers focus on modular designs and scalable solutions. Continuous upgrades drive adoption globally.

Focus on Energy Efficiency and Sustainability

Energy efficiency and sustainability trends shape the medium voltage distribution panel market. It enables optimized power management and reduces transmission losses across industrial and commercial applications. Rising demand for renewable energy integration and eco-friendly electrical infrastructure encourages deployment of energy-efficient panels. It incorporates features such as low-loss components and advanced monitoring systems to minimize energy waste. Policies promoting green energy and carbon reduction reinforce adoption. It aligns with corporate sustainability goals and regulatory mandates.

- For instance, ABB has introduced environmentally friendly medium voltage switchgear that reduces lifecycle carbon footprints and integrates advanced digital diagnostics to support greener electrical infrastructure.

Expansion of Smart Grid Infrastructure

Smart grid implementation drives significant trends in the medium voltage distribution panel market. It supports two-way communication, advanced protection, and integration with distributed energy resources. Utilities and industrial facilities rely on intelligent panels to enhance grid reliability, manage peak loads, and prevent outages. It incorporates automation and remote diagnostics to improve operational performance. Demand for smart cities and modernized electrical networks reinforces market growth. Manufacturers innovate with modular, compact, and adaptive panel designs. Smart grid development continues to accelerate adoption worldwide.

- For instance, Blue Whale Energy in Southeast Asia partnered with UNIGRID, Inc. to deploy sodium-ion battery energy storage systems paired with rooftop solar panels, enhancing energy storage and grid flexibility in urban areas.

Emphasis on Safety, Compliance, and Reliability

Safety, regulatory compliance, and system reliability remain key trends in the medium voltage distribution panel market. It ensures protection against electrical faults, fire hazards, and equipment failures. Strict adherence to IEC, ANSI, and local standards drives modernization of legacy panels. Industries and utilities prioritize panels that provide robust insulation, circuit protection, and monitoring capabilities. It reduces maintenance costs and enhances operational efficiency. Continuous updates in safety regulations encourage manufacturers to innovate. Market growth reflects the importance of secure and reliable power distribution systems.

Market Challenges Analysis

High Initial Investment and Installation Costs

The medium voltage distribution panel market faces challenges due to high initial investment and installation costs. It requires significant capital expenditure for procurement, site preparation, and integration with existing electrical systems. Small and medium-sized enterprises may hesitate to adopt advanced panels due to budget constraints. Complex installation processes demand skilled labor and specialized tools, increasing project timelines and costs. It often involves retrofitting legacy systems, which adds technical complexity. Manufacturers must balance performance, quality, and affordability to attract diverse customers. Cost-related barriers can slow market penetration in price-sensitive regions.

Maintenance Complexity and Technological Adaptation

Maintenance complexity and rapid technological evolution present challenges in the medium voltage distribution panel market. It requires regular inspections, fault analysis, and component replacement to ensure reliable operation. Integration with smart grid technologies and IoT systems demands continuous technical expertise and software updates. Older panels may face compatibility issues with new digital solutions, limiting scalability. It increases operational expenditure for utilities and industries. Manufacturers and service providers must provide training, support, and upgrades to maintain performance. These challenges affect adoption rates and require strategic planning to mitigate risks and ensure long-term reliability.

Market Opportunities

Expansion in Emerging Economies

The medium voltage distribution panel market presents significant opportunities in emerging economies. It supports growing industrialization, urbanization, and infrastructure development in regions with rising energy demand. Governments invest in modernizing electrical grids, creating favorable conditions for panel deployment. It enables reliable power distribution for commercial, residential, and industrial applications. Manufacturers can capitalize on untapped markets by offering cost-effective and scalable solutions. Increasing foreign investments in energy infrastructure further strengthen growth potential. Strategic partnerships with local distributors can accelerate market penetration and adoption.

Integration with Renewable Energy and Smart Grids

Integration with renewable energy systems and smart grids creates substantial opportunities for the medium voltage distribution panel market. It ensures efficient management of distributed energy resources and supports stable grid operations. Rising adoption of solar, wind, and hybrid energy projects drives demand for advanced panels capable of handling variable power inputs. It enables energy monitoring, fault detection, and predictive maintenance for improved operational efficiency. Technological advancements and regulatory support for sustainable energy reinforce market potential. Manufacturers focusing on intelligent, IoT-enabled panels can benefit from long-term growth prospects globally.

Market Segmentation Analysis:

By Voltage Rating

In the medium voltage distribution panel market, the 1kV–15kV segment dominates with an estimated share of 62% due to its widespread adoption in industrial, commercial, and utility applications. It provides reliable distribution for small- to medium-scale power systems while maintaining cost efficiency. The 15kV–35kV segment holds a 38% share, driven by demand from large industrial facilities, renewable energy farms, and utility substations requiring higher transmission capacity.

- For instance, Siemens supplies 12kV gas-insulated switchgear under its 8DJH series, widely used in commercial complexes and light industrial facilities.

By Application

The industrial segment leads the medium voltage distribution panel market with a 40% share, propelled by manufacturing plants, process industries, and factories requiring stable and continuous power supply. Utilities follow with a 25% share, reflecting investments in grid modernization and smart grid deployment. Commercial applications capture 15%, supported by office complexes, malls, and hospitals. Renewable energy accounts for 10%, while data centers, transportation, and other applications collectively represent 10%.

- For instance, Schneider Electric partnered with Enel in Italy to deploy smart MV panels integrated with automation for advanced grid management.

By Panel Type

Fixed panels dominate the medium voltage distribution panel market with a 55% share, favored for their durability, lower maintenance needs, and suitability in standard installations. Withdrawable panels hold a 45% share, driven by demand for flexibility, quick replacement, and ease of maintenance in large-scale industrial, utility, and renewable energy applications. It supports modular expansion and reduces downtime during upgrades or fault rectification.

Segments:

Based on Voltage Rating

Based on Application

- Industrial

- Commercial

- Utilities

- Renewable Energy

- Data Centers

- Transportation

- Others

Based on Panel Type

Based on Installation Type

Based on End-User

- Power Generation

- Oil & Gas

- Mining

- Marine

- Railways

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 28% share in the medium voltage distribution panel market, driven by ongoing industrial expansion and modernization of electrical infrastructure. It experiences high demand from utilities, commercial establishments, and data centers requiring reliable power distribution. It supports the integration of renewable energy sources and smart grid projects. Manufacturers focus on advanced digital panels with IoT capabilities to enhance operational efficiency. Strong regulatory standards and safety compliance further fuel market adoption. Investments in urban infrastructure and industrial parks sustain consistent growth. The region remains a key market for technological innovation and high-performance panels.

Europe

Europe commands a 26% share of the medium voltage distribution panel market, led by rapid adoption of energy-efficient and sustainable power systems. It supports growing renewable energy installations, including wind and solar farms, requiring reliable medium voltage solutions. It benefits from stringent safety regulations and government incentives promoting smart grids and infrastructure upgrades. Industrial and utility sectors demand robust and digitally integrated panels. Manufacturers focus on innovation, modular designs, and compliance with IEC and regional standards. Expansion of smart cities and modernization projects strengthens market growth. It positions Europe as a competitive and technologically advanced market.

Asia-Pacific

Asia-Pacific dominates the market with a 30% share, fueled by rapid urbanization, industrialization, and energy infrastructure development in China, India, and Southeast Asia. It experiences high demand from industrial plants, commercial complexes, and utility grids undergoing modernization. Investments in renewable energy projects drive adoption of medium voltage distribution panels. Manufacturers provide cost-effective and scalable solutions to meet diverse regional needs. It integrates smart monitoring systems to improve operational efficiency and safety. Government initiatives promoting electrification and infrastructure expansion further enhance growth. The region remains a high-growth opportunity globally.

Middle East & Africa

Middle East & Africa hold a 9% share in the medium voltage distribution panel market, supported by investments in oil, gas, and industrial sectors requiring reliable power distribution. It focuses on upgrading legacy electrical systems and implementing modern panels in utilities and commercial facilities. Infrastructure development and renewable energy adoption drive market demand. Manufacturers offer customized solutions suited for harsh environmental conditions. It benefits from growing urbanization and industrial diversification projects. Technological integration and compliance with international standards enhance adoption. Regional energy expansion projects sustain steady market growth.

Latin America

Latin America accounts for a 7% share of the medium voltage distribution panel market, driven by industrial modernization and utility sector investments in Brazil, Mexico, and Argentina. It supports reliable energy distribution across commercial and industrial applications. Infrastructure upgrades, renewable energy projects, and smart grid initiatives increase demand for advanced panels. It enables efficient power management and reduces operational risks. Manufacturers focus on providing cost-effective and durable solutions tailored to regional requirements. Growing urbanization and industrialization contribute to moderate market expansion. The region presents emerging opportunities for long-term adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Energy

- Schneider Electric

- Toshiba

- Eaton

- Fuji Electric

- ABB

- Rockwell Automation

- Larsen & Toubro (L&T)

- Siemens

- Legrand

- Mitsubishi Electric

- General Electric (GE)

- NHP Electrical Engineering Products

Competitive Analysis

The medium voltage distribution panel market remains highly competitive, driven by continuous technological innovation, strategic partnerships, and regional expansion. It sees key players such as ABB, Schneider Electric, Siemens, Eaton, General Electric (GE), Mitsubishi Electric, Rockwell Automation, Legrand, Larsen & Toubro (L&T), Fuji Electric, Toshiba, Hitachi Energy, and NHP Electrical Engineering Products competing to enhance product offerings and market presence. It emphasizes advanced digital panels, IoT integration, and energy-efficient solutions to meet growing industrial, commercial, and utility demands. Companies invest in research and development to introduce modular, compact, and intelligent panels that improve reliability, reduce downtime, and support renewable energy integration. Strategic acquisitions, collaborations, and distribution network expansion help these players strengthen global footprints and address regional infrastructure projects. It drives innovation in safety features, regulatory compliance, and smart grid compatibility. Continuous product differentiation and customer-focused solutions define competitive positioning, while aggressive pricing strategies and service excellence further influence market share. The competitive landscape remains dynamic, with established manufacturers and emerging companies striving to capture opportunities in high-growth regions and technology-driven applications.

Recent Developments

- In September 2024, Siemens announced its agreement to acquire California-based Trayer Engineering Corporation, a leader in the design and manufacturing of medium voltage secondary distribution switchgear suitable for outdoor and below-ground applications.

- In August 2025, Hubbell Inc. announced its acquisition of DMC Power, a California-based provider of connectors and tooling for utility substations and transmission, for $825 million. The acquisition aims to strengthen Hubbell’s position in fast-growing markets such as data centers and utility infrastructure.

- In 2025, Schneider Electric launched a new series of surface-mounted medium voltage distribution panels designed to enhance energy efficiency and safety in commercial and industrial applications.

- In 2025, Mission Critical Group (MCG) acquired DVM Manufacturing, LLC (DVM Power + Control), a leading manufacturer of low- and medium-voltage electrical distribution equipment, to expand its capabilities in providing comprehensive electrical system solutions.

Market Concentration & Characteristics

The medium voltage distribution panel market exhibits a moderately concentrated structure, with a few global players holding significant market share while numerous regional manufacturers serve local demands. It is dominated by companies such as ABB, Schneider Electric, Siemens, Eaton, General Electric (GE), Mitsubishi Electric, Rockwell Automation, Legrand, Larsen & Toubro (L&T), Fuji Electric, Toshiba, Hitachi Energy, and NHP Electrical Engineering Products, which compete on technological innovation, product quality, and service reliability. It emphasizes digital monitoring, IoT integration, and energy-efficient solutions to meet evolving industrial, commercial, and utility requirements. Manufacturers focus on modular designs, smart grid compatibility, and enhanced safety features to differentiate their offerings. It experiences steady growth driven by infrastructure modernization, renewable energy integration, and regulatory compliance. The market encourages continuous innovation, operational excellence, and strategic partnerships to maintain competitiveness, while regional players provide cost-effective and customized solutions to address localized needs.

Report Coverage

The research report offers an in-depth analysis based on Voltage Rating, Application, Panel Type, Installation Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The medium voltage distribution panel market will witness increased adoption of digital and IoT-enabled panels.

- Renewable energy integration will drive demand for advanced and flexible distribution solutions.

- Smart grid development will encourage deployment of intelligent and automated panels.

- Industrial modernization and urban infrastructure expansion will sustain market growth.

- Manufacturers will focus on modular and compact designs for easier installation and maintenance.

- Energy efficiency and sustainability requirements will influence product development and adoption.

- Regulatory compliance and stringent safety standards will continue to shape market offerings.

- Emerging economies will present new growth opportunities for cost-effective and scalable panels.

- Strategic collaborations and technological partnerships will enhance competitive positioning.

- Continuous innovation in monitoring, protection, and control features will define future market trends.