Market Overview

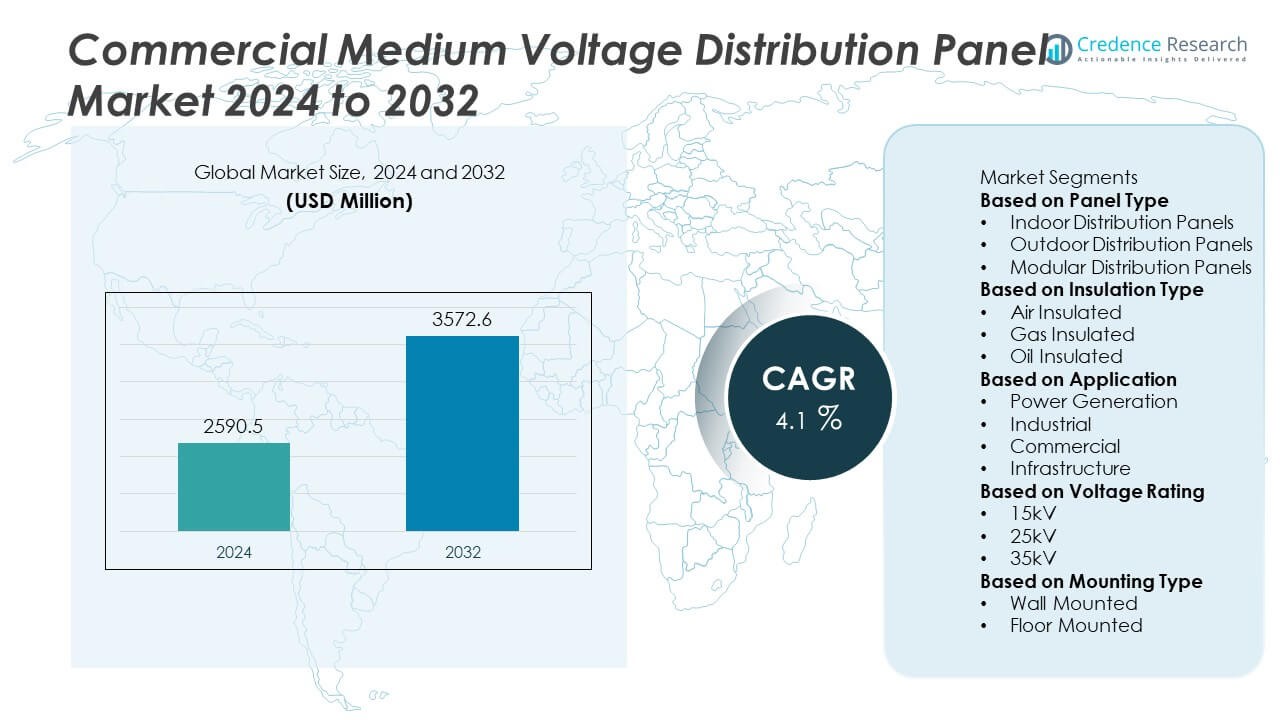

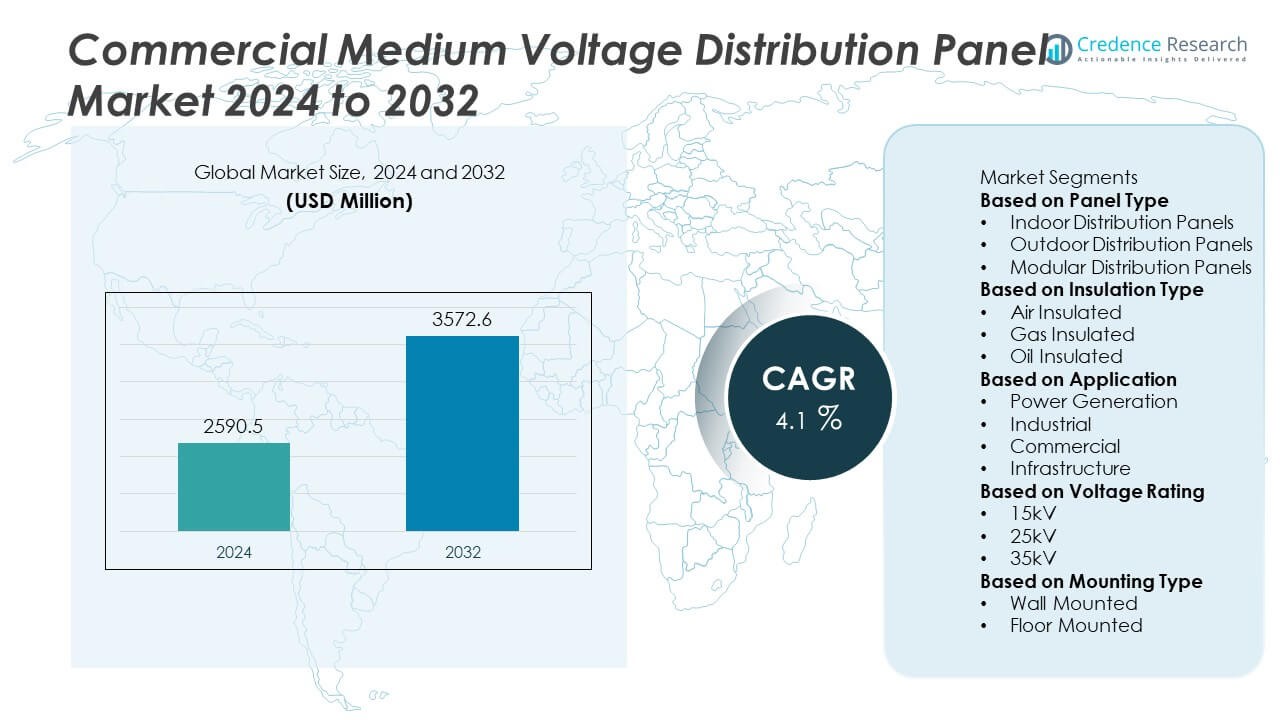

The Commercial Medium Voltage Distribution Panel Market was valued at USD 2,590.5 million in 2024 and is projected to reach USD 3,572.6 million by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Medium Voltage Distribution Panel Market Size 2024 |

USD 2,590.5 Million |

| Commercial Medium Voltage Distribution Panel Market, CAGR |

4.1% |

| Commercial Medium Voltage Distribution Panel Market Size 2032 |

USD 3,572.6 Million |

The Commercial Medium Voltage Distribution Panel Market grows steadily, driven by rising demand for energy-efficient electrical infrastructure, expansion of smart building projects, and strict safety regulations. It benefits from increased investments in modern commercial facilities, industrial expansions, and infrastructure upgrades in emerging economies. Key trends include adoption of IoT-enabled panels for real-time monitoring, integration with renewable energy systems, and preference for modular, scalable designs that offer flexibility and cost efficiency.

The Commercial Medium Voltage Distribution Panel Market has a strong global presence, with significant demand across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America and Europe focus on modernization of aging electrical infrastructure and adoption of smart, energy-efficient systems. Asia-Pacific leads growth through rapid urbanization, industrial expansion, and large-scale commercial projects, while Latin America and the Middle East & Africa see rising investments in infrastructure and high-capacity power systems. Key players shaping the market include Siemens, Schneider Electric, and ABB, recognized for their advanced product portfolios, technological innovations, and strong distribution networks supporting diverse commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Medium Voltage Distribution Panel Market was valued at USD 2,590.5 million in 2024 and is projected to reach USD 3,572.6 million by 2032 at a CAGR of 4.1% during the forecast period.

- Growing demand for energy-efficient power distribution systems in commercial facilities, coupled with stringent electrical safety regulations, drives steady market expansion.

- Increasing adoption of IoT-enabled panels, renewable energy integration, and modular, scalable designs highlights the industry’s shift toward advanced and flexible solutions.

- The competitive landscape features major players such as Siemens, ABB, Schneider Electric, and Eaton, focusing on innovation, strategic partnerships, and expansion into emerging markets.

- High initial investment costs and shortage of skilled installation professionals remain key restraints, particularly in cost-sensitive regions and complex retrofit projects.

- North America and Europe emphasize infrastructure modernization and smart building adoption, while Asia-Pacific leads growth through rapid urbanization, industrial expansion, and smart city initiatives.

- Latin America and the Middle East & Africa present emerging opportunities, driven by commercial real estate development, infrastructure upgrades, and increasing demand for reliable medium voltage power solutions.

Market Drivers

Rising Demand for Energy-Efficient Electrical Infrastructure in Commercial Facilities

The Commercial Medium Voltage Distribution Panel Market benefits from the growing emphasis on energy-efficient solutions in commercial buildings. Businesses prioritize systems that minimize energy losses and optimize load management. Governments implement regulations that encourage the adoption of efficient distribution technologies. It helps reduce operational costs for facility owners and improves sustainability metrics. Urban development projects integrate advanced panels to meet modern energy codes. The market gains momentum from industries seeking greener and more cost-effective power distribution methods.

- For instance, Siemens commissioned the world’s first 8DAB 24 blue GIS using Clean Air insulation to serve a substation that secures power for up to 40,000 residents, showcasing a practical SF₆-free medium-voltage alternative.

Expansion of Smart Building Projects and Digital Control Integration

Smart building initiatives increase demand for medium voltage distribution panels with advanced monitoring and automation capabilities. The market sees strong uptake from facilities aiming to centralize control and improve fault detection. It enables predictive maintenance, reducing downtime and extending equipment life. Digital integration supports real-time energy management, enhancing operational efficiency. Commercial complexes, data centers, and large institutions invest in panels with IoT-enabled features. The integration of intelligent controls positions these panels as critical components in modern infrastructure.

- For instance, ABB introduced its IoT Dashboard that cuts maintenance costs by enabling preventative maintenance, which is three to nine times cheaper than reactive approaches.

Stringent Safety Regulations and Compliance Requirements

The Commercial Medium Voltage Distribution Panel Market experiences steady growth due to strict electrical safety regulations. Authorities mandate adherence to updated safety codes, driving replacement and modernization of outdated systems. It supports improved protection against electrical hazards and system failures. Compliance boosts end-user confidence and reduces risks in high-load commercial environments. Manufacturers focus on designs that meet international standards and enhance system reliability. Regulatory enforcement accelerates the shift toward advanced panel solutions in multiple regions.

Industrial Growth and Rising Power Demand in Emerging Economies

Industrial expansion in developing markets fuels higher demand for robust distribution systems. The market responds to increasing investments in manufacturing, commercial real estate, and large-scale infrastructure. It addresses the need for stable power distribution in facilities with heavy electrical loads. Rapid urbanization and economic growth drive construction of high-rise buildings, malls, and industrial parks. Manufacturers see opportunities in supplying panels that ensure uninterrupted power supply. Rising power consumption trends in these economies sustain long-term market potential.

Market Trends

Adoption of IoT and Smart Monitoring Capabilities in Distribution Panels

The Commercial Medium Voltage Distribution Panel Market witnesses a clear shift toward IoT-enabled and smart monitoring systems. Facility managers prefer panels that provide real-time performance data and fault detection. It allows quicker decision-making and reduces downtime in critical operations. Integration with building management systems supports energy optimization and load balancing. Remote access features enhance control for geographically distributed facilities. The trend drives demand for panels with embedded sensors and advanced communication protocols.

- For instance, Siemens has introduced its Sentron portfolio’s 5SL6 miniature circuit breakers and 5SV6 arc-fault detection devices, which offer real-time measurement of current, voltage, temperature, and switching states for each circuit and relay data through the 7KN Powercenter 1000 gateway for immediate analytics.

Integration of Renewable Energy Sources into Commercial Power Systems

The market aligns with the growing incorporation of renewable energy into commercial infrastructure. Panels are designed to handle power from solar, wind, and hybrid systems efficiently. It ensures stable distribution despite fluctuations in generation from these sources. Manufacturers develop solutions with better grid synchronization and power quality management. Commercial buildings adopt such panels to meet sustainability targets and reduce dependency on conventional energy. The demand for renewable-compatible panels continues to rise across multiple regions.

- For instance, ABB’s automation solutions have reached over 10 GW of capacity across India’s solar, wind, and battery energy storage facilities via IoT-based PLC-SCADA systems, enabling operators to monitor and optimize key parameters seamlessly.

Shift Toward Modular and Scalable Panel Designs for Flexibility

Businesses increasingly prefer modular medium voltage distribution panels for their scalability and ease of installation. The Commercial Medium Voltage Distribution Panel Market responds with designs that can be expanded without major system overhauls. It offers flexibility for facilities expecting growth in power needs over time. Modular setups reduce installation time and simplify maintenance. This approach supports cost control and operational efficiency for end users. The trend gains traction among data centers, industrial plants, and commercial complexes.

Emphasis on High-Safety and Arc-Resistant Panel Technologies

Safety-focused innovations dominate recent product developments in the market. Arc-resistant designs help protect personnel and equipment from electrical faults. It addresses growing regulatory emphasis on workplace safety in high-voltage environments. Manufacturers invest in materials and configurations that limit fault propagation. Enhanced insulation, improved grounding, and intelligent trip mechanisms define new panel models. The trend reflects the rising importance of operational safety in high-load commercial settings.

Market Challenges Analysis

High Initial Investment and Cost-Sensitive Procurement Decisions

The Commercial Medium Voltage Distribution Panel Market faces a challenge from the high upfront costs associated with advanced panel installations. Many commercial facility owners hesitate to invest in premium solutions despite long-term efficiency benefits. It creates procurement delays, especially in cost-sensitive markets where budgets are tightly managed. Price competition from low-cost manufacturers further complicates the adoption of high-specification panels. Some end users opt for basic models that meet minimum standards, limiting demand for innovative features. Fluctuations in raw material prices also impact final costs, adding uncertainty to project planning.

Complex Installation Requirements and Skilled Workforce Shortages

The market encounters operational hurdles due to the complexity of installing and commissioning medium voltage panels. It demands a skilled workforce capable of handling safety, compliance, and performance requirements. Shortages of qualified technicians in certain regions delay project timelines and increase operational risks. Compliance with strict installation standards requires precise execution, which not all contractors can ensure. Retrofitting panels into existing infrastructure adds further complications, especially in older commercial buildings. The combination of technical complexity and labor gaps continues to hinder seamless deployment in several markets.

Market Opportunities

Growing Infrastructure Development and Smart Commercial Projects

The Commercial Medium Voltage Distribution Panel Market stands to benefit from the surge in infrastructure development across urban and semi-urban regions. Smart commercial projects, including high-rise buildings, shopping complexes, and data centers, require reliable and efficient power distribution systems. It creates demand for panels with advanced safety, monitoring, and automation features. Governments and private investors continue to fund large-scale commercial developments, expanding market scope. Adoption of smart grid technologies further boosts the need for intelligent distribution solutions. The opportunity is significant in regions undergoing rapid urban transformation and industrial growth.

Rising Demand for Renewable Energy Integration and Sustainable Solutions

The market gains opportunities from the global shift toward renewable energy adoption in commercial infrastructure. Panels capable of integrating solar, wind, and hybrid power sources attract increasing interest. It enables businesses to meet sustainability goals while ensuring stable and efficient energy distribution. Manufacturers that design panels optimized for renewable compatibility position themselves strongly for future demand. Energy efficiency regulations and corporate environmental commitments support this trend. The combination of clean energy adoption and advanced distribution technology opens profitable avenues for industry players.

Market Segmentation Analysis:

By Panel Type

The Commercial Medium Voltage Distribution Panel Market segments by panel type into fixed type, withdrawable type, and others. Fixed type panels dominate due to their lower cost, straightforward design, and ease of installation in standard commercial environments. Withdrawable type panels gain traction in facilities requiring frequent maintenance and higher operational flexibility. It allows safe removal and replacement of components without complete system shutdown. Demand for specialized configurations grows in critical infrastructure such as data centers and large industrial complexes. The choice of panel type depends on operational requirements, safety priorities, and budget considerations.

- For instance, Siemens NXPLUS C fixed-mounted GIS supports voltage up to 36 kV, fault current withstands up to 25 kA, and continuous currents up to 1,250 A. It also withstands internal arc faults for selectable durations of 0.1 or 1 second, enabling safer fixed-panel installations.

By Insulation Type

By insulation type, the market divides into air-insulated switchgear (AIS) and gas-insulated switchgear (GIS). Air-insulated panels hold a strong position due to cost-effectiveness and ease of maintenance. Gas-insulated panels gain momentum in space-constrained commercial environments where compact design is essential. It offers higher reliability, lower maintenance, and better performance under harsh environmental conditions. GIS adoption increases in urban commercial projects, high-rise buildings, and premium-grade facilities where safety and space optimization are critical. Both types maintain relevance, with selection influenced by project specifications and installation site conditions.

- For instance, Hitachi Energy’s GIS portfolio lists standard ratings that include operation at 72.5 kV, rated currents up to 2,500 A, and breaking capacities up to 40 kA, enabling compact installations with high short-circuit performance for constrained commercial sites.

By Application

The market by application covers commercial buildings, industrial facilities, infrastructure projects, and others. Commercial buildings represent a significant share, driven by rising construction of office spaces, malls, and institutional complexes. Industrial facilities require high-capacity panels for stable distribution in manufacturing, processing, and large-scale production units. It plays a vital role in infrastructure projects such as airports, hospitals, and transportation hubs where continuous power supply is essential. Growth in smart building developments fuels demand for intelligent panels with real-time monitoring capabilities. The application scope continues to expand with the global push toward reliable and efficient power distribution in diverse commercial settings.

Segments:

Based on Panel Type

- Indoor Distribution Panels

- Outdoor Distribution Panels

- Modular Distribution Panels

Based on Insulation Type

- Air Insulated

- Gas Insulated

- Oil Insulated

Based on Application

- Power Generation

- Industrial

- Commercial

- Infrastructure

Based on Voltage Rating

Based on Mounting Type

- Wall Mounted

- Floor Mounted

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a substantial share of the Commercial Medium Voltage Distribution Panel Market, accounting for approximately 28% of the global revenue. The region benefits from advanced commercial infrastructure, high adoption of smart building technologies, and strong enforcement of electrical safety regulations. It supports demand for high-specification panels with IoT integration, arc-resistant designs, and energy efficiency features. The United States leads the market with extensive modernization of commercial power systems, while Canada shows steady growth through investments in sustainable building projects. Replacement of outdated electrical infrastructure in older facilities adds consistent demand. The market in North America is characterized by strong presence of established manufacturers and a focus on compliance with international safety and energy standards.

Europe

Europe commands nearly 25% of the market share, driven by strict regulatory requirements for energy efficiency and workplace safety. Countries such as Germany, France, and the United Kingdom invest heavily in upgrading commercial distribution systems to meet EU directives. It reflects a strong shift toward panels compatible with renewable energy sources and smart grid integration. The region shows high adoption of gas-insulated switchgear in urban centers where space optimization is a priority. Growth in retrofitting projects across older commercial buildings fuels steady demand. The European market also benefits from innovation-focused manufacturers developing compact, high-performance panel solutions.

Asia-Pacific

Asia-Pacific dominates the global market with the largest share, approximately 34%, supported by rapid urbanization, infrastructure expansion, and industrial growth. China, India, and Japan lead demand through large-scale commercial developments, industrial parks, and high-rise construction projects. It gains further momentum from government-led smart city initiatives and renewable energy integration targets. The adoption of modular and scalable panels is high in rapidly expanding metropolitan areas. Local manufacturing capabilities help meet growing demand at competitive prices. Asia-Pacific is projected to remain the fastest-growing regional market due to ongoing infrastructure investments and rising electricity consumption.

Latin America

Latin America accounts for about 7% of the Commercial Medium Voltage Distribution Panel Market, with Brazil and Mexico representing the key contributors. The region’s growth is driven by expansion in commercial real estate, retail complexes, and public infrastructure projects. It faces challenges from budget constraints in some markets, which slow the adoption of premium solutions. However, demand for energy-efficient and reliable panels grows in urbanized areas. Local governments increasingly promote compliance with updated electrical safety standards. The trend toward modernization of outdated systems creates long-term opportunities for suppliers.

Middle East & Africa

The Middle East & Africa region holds around 6% of the market share, supported by large-scale infrastructure and commercial projects, especially in the Gulf Cooperation Council (GCC) countries. The UAE and Saudi Arabia lead demand through investments in airports, shopping malls, and hospitality complexes. It benefits from high-specification panel installations that meet both safety and performance requirements in harsh climatic conditions. African markets are at an early stage but show potential through urban development and industrialization initiatives. The focus on sustainable, high-capacity power distribution systems strengthens growth prospects in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Commercial Medium Voltage Distribution Panel Market is defined by the presence of global and regional leaders including Siemens, ABB, Schneider Electric, Eaton, Legrand, General Electric, Larsen & Toubro Limited, NHP, Industrial Electric MFG, and ESL Power Systems, Inc. These companies compete on technological innovation, product quality, and global distribution capabilities. Siemens and ABB lead in offering advanced smart panels with IoT integration and arc-resistant designs, catering to high-demand commercial and industrial applications. Schneider Electric emphasizes sustainable and energy-efficient solutions with strong digital monitoring features, while Eaton focuses on modular designs and high-safety configurations. Legrand and General Electric maintain strong market positions through broad product portfolios and long-standing client relationships. Larsen & Toubro Limited leverages its engineering expertise to serve infrastructure and industrial segments in high-growth regions. NHP, Industrial Electric MFG, and ESL Power Systems, Inc. target niche applications with specialized panel designs, emphasizing reliability and compliance with safety standards. The market remains competitive, with companies investing in R&D, regional expansion, and strategic partnerships to capture emerging opportunities.

Recent Developments

- In July 2025, Legrand published insights on essential electrical equipment used in data centers, including transformers and switchgear that align with medium-voltage distribution needs.

- In June 2025, Eaton introduced a new series of low- to medium-voltage switchgear tailored for solar and wind applications and unveiled the 9395 XR UPS system at ELECRAMA, targeting renewable energy and mission-critical infrastructures.

- In September 2024, L&T secured mega orders in the Middle East for high-voltage grid expansion, including HVDC transmission lines and GIS packages.

Market Concentration & Characteristics

The Commercial Medium Voltage Distribution Panel Market exhibits a moderately consolidated structure, with a mix of global leaders and strong regional players competing for market share. It is characterized by high entry barriers due to the need for advanced engineering capabilities, compliance with strict safety regulations, and significant capital investment. Leading companies such as Siemens, ABB, Schneider Electric, Eaton, and Larsen & Toubro dominate through extensive product portfolios, global distribution networks, and ongoing innovation in smart, modular, and energy-efficient panel solutions. Regional manufacturers strengthen competition by offering cost-effective and application-specific products tailored to local market needs. The market emphasizes reliability, safety, and compatibility with modern energy systems, including renewable integration and IoT-based monitoring. Demand patterns are influenced by large-scale infrastructure development, smart city projects, and regulatory pushes for energy efficiency. Product differentiation often depends on technological advancements, customization options, and after-sales service capabilities, making innovation and customer-centric design critical competitive factors.

Report Coverage

The research report offers an in-depth analysis based on Panel Type, Insulation Type, Voltage Rating, Mounting Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by urbanization and expansion of commercial infrastructure.

- Demand for IoT-enabled and smart monitoring panels will increase in modern facilities.

- Renewable energy integration will become a key feature in new panel designs.

- Modular and scalable configurations will gain preference for flexible installations.

- Safety-focused innovations such as arc-resistant designs will see higher adoption.

- Emerging economies will present strong opportunities through infrastructure investments.

- Replacement of aging electrical infrastructure will drive consistent demand in developed regions.

- Manufacturers will focus on compact designs to meet space constraints in urban projects.

- Regulatory pressure for energy efficiency will influence product development strategies.

- Strategic partnerships and regional expansions will strengthen competitive positioning.