Market Overview

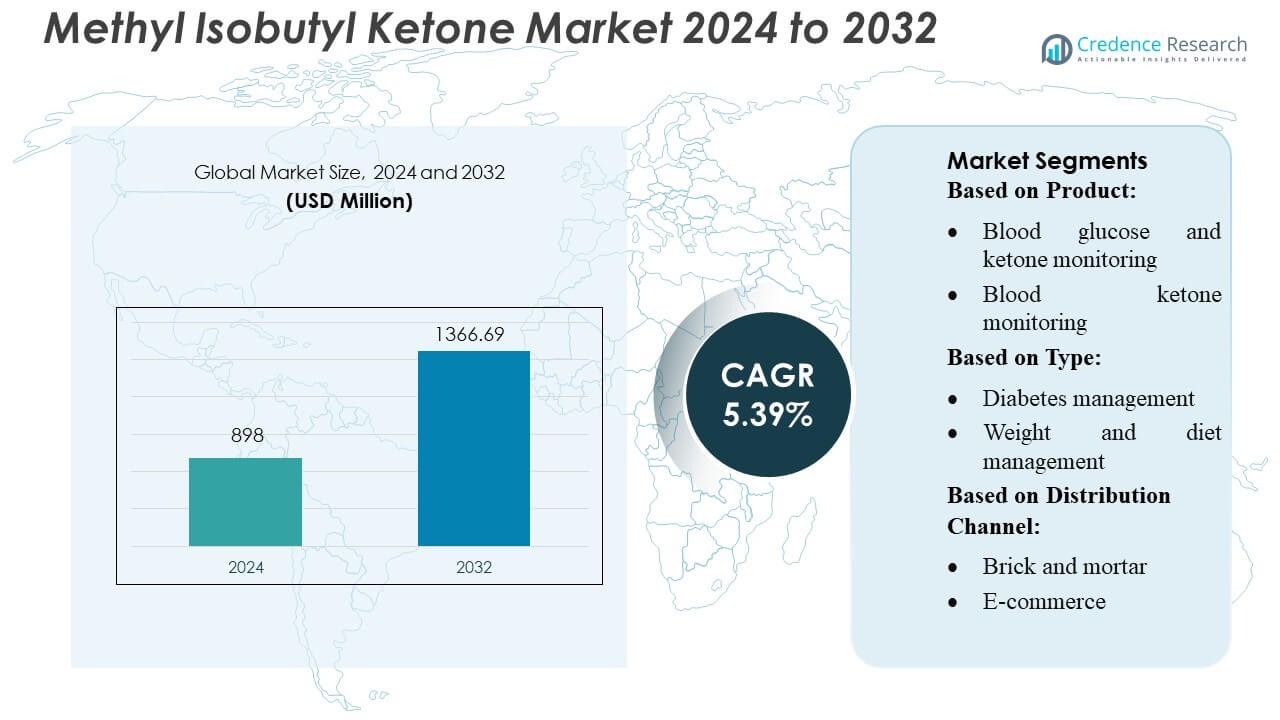

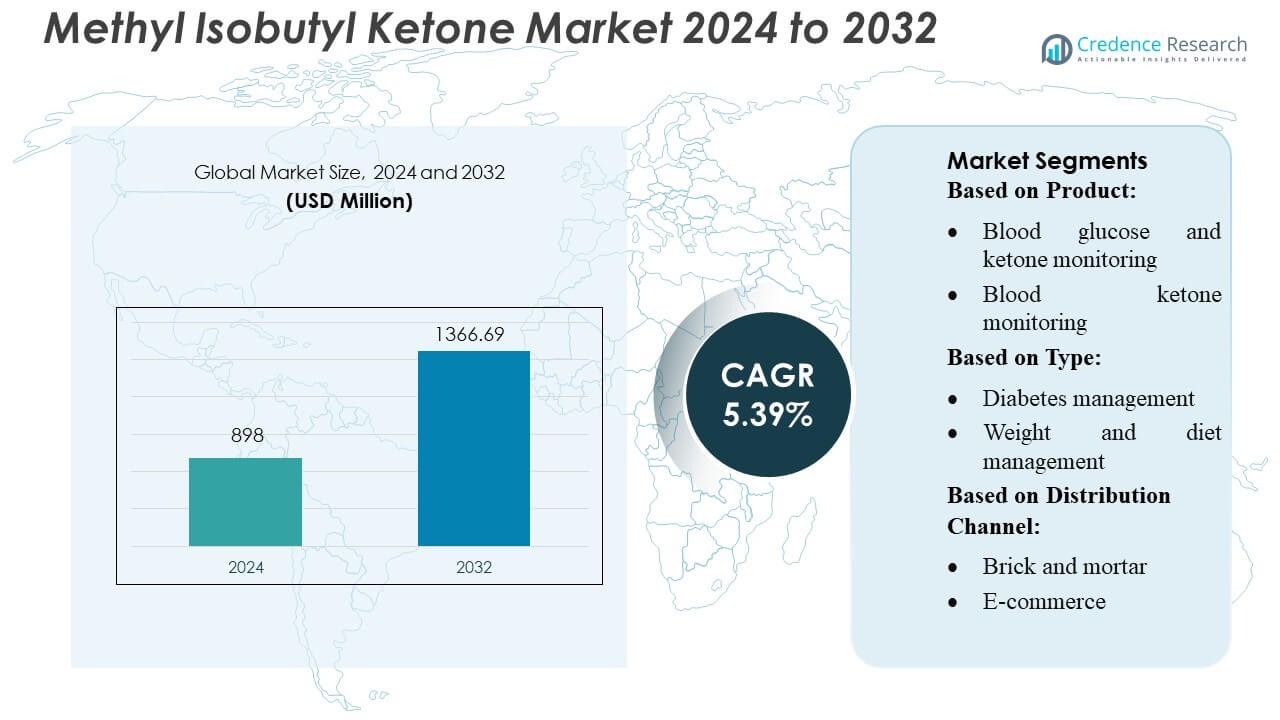

Methyl Isobutyl Ketone Market size was valued USD 898 million in 2024 and is anticipated to reach USD 1366.69 million by 2032, at a CAGR of 5.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Methyl Isobutyl Ketone Market Size 2024 |

USD 898 Million |

| Methyl Isobutyl Ketone Market, CAGR |

26.7% |

| Methyl Isobutyl Ketone Market Size 2032 |

USD 1366.69 Million |

The global methyl isobutyl ketone (MIBK) market include Shell Chemicals, Celanese Corporation, Kumho P&B Chemicals, Mitsui Chemicals, Sasol, and Dow Chemical. Shell leverages its integrated petrochemical network, while Celanese focuses on high-purity grades for specialty uses. Kumho and Mitsui dominate in the Asia-Pacific, and Sasol and Dow contribute significant capacity from their global operations. The Asia-Pacific region is the leading market, accounting for approximately 50 percent of global demand, driven largely by rapid industrialization and strong consumption in coatings, rubber, and chemicals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The methyl isobutyl ketone (MIBK) market reached USD 898 million in 2024 and will grow to USD 1366.69 million by 2032 at a 39% CAGR, supported by expanding industrial solvent applications.

- Rising demand from coatings, adhesives, and rubber processing industries drives steady consumption as manufacturers prioritize high-purity grades.

- Advancing process optimization and capacity expansions among Shell, Celanese, Kumho P&B, Mitsui, Sasol, and Dow strengthen competitive positioning across global supply networks.

- Regulatory pressure on VOC emissions and price volatility of petrochemical feedstocks restrict production efficiency and challenge smaller producers.

- Asia-Pacific maintains its leadership with about 50% regional share, supported by strong industrial growth, while coatings applications continue to hold the largest segment share due to widespread use in automotive, construction, and chemical processing.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

The blood glucose and ketone monitoring segment dominates the market with an estimated over 45% share, driven by rising adoption of integrated meters that deliver dual-parameter insights for metabolic management. Consumers increasingly prefer compact devices with improved sensor accuracy and shorter response times, enabling continuous data tracking for diabetes and nutritional monitoring. The consumables segment, including test strips and lancets, grows steadily due to recurring usage, while standalone blood ketone monitoring devices gain traction among athletes and ketogenic-diet users seeking real-time metabolic feedback.

- For instance, Abbott’s FreeStyle Libre 3 system achieves a mean absolute relative difference (MARD) of 7.8 %, and reports glucose readings every minute along with a 10-meter Bluetooth range for reliable connectivity.

By Type

The diabetes management segment accounts for the largest market share at approximately 50%, supported by the expanding global diabetic population and the clinical requirement for precise ketone assessment to prevent diabetic ketoacidosis (DKA). Weight and diet management continues to rise as ketogenic and low-carb regimens gain popularity, while sports monitoring accelerates due to performance-optimization use cases. Epilepsy treatment represents a niche but fast-growing application area, benefiting from increased clinical adoption of ketogenic therapies requiring tight ketone-level control.

- For instance, Maruzen Petrochemical expanded its MEK plant capacity from 13,000 to 170,000 tonnes per year and maintains an ethylene unit with a production capacity of 525,000 metric tons per year, while its Keiyo Ethylene joint venture lists a production capacity of 768,000 tons per year.

By Distribution Channel

Brick-and-mortar channels remain dominant with about 60% share, driven by strong consumer trust, pharmacist guidance, and easy accessibility of test strips and monitoring devices. Pharmacies and specialty stores continue to play a critical role in repeat purchases of consumables. However, e-commerce is expanding rapidly as competitive pricing, subscription models for consumables, and wide product availability encourage online adoption. Digital platforms also benefit from rising awareness of metabolic health tools and the convenience of doorstep delivery, making them the fastest-growing distribution channel.

Key Growth Drivers

- Rising Demand from Rubber Antioxidants and Adhesives

Demand for MIBK strengthens as rubber antioxidants—especially 6PPD and 7PPD—require high-purity solvents to ensure stability and performance in automotive tires and industrial rubber applications. Expanding global vehicle production and aftermarket tire replacement activity intensify solvent consumption. Adhesive manufacturers also adopt MIBK for its superior solubility and fast evaporation rate, supporting high-strength bonding formulations. The shift toward durable, high-performance rubber compounds across automotive, construction, and electronics sustains consistent demand, positioning MIBK as a critical industrial solvent.

- For instance, Shell Plc’s Singapore chemical facilities (across the integrated Pulau Bukom and Jurong Island sites) operate an isopropyl alcohol (IPA) production unit with a rated capacity of approximately 75,000 tonnes per year, supporting downstream manufacturing of various chemical products through integrated refining pathways.

- Growth in Paints, Coatings, and Specialty Chemicals

The paints and coatings industry remains a major growth driver due to MIBK’s excellent solvency, medium evaporation rate, and compatibility with acrylic, epoxy, and nitrocellulose systems. Rising construction activities, infrastructure upgrades, and automotive refinishing boost consumption. Specialty chemical manufacturers rely on MIBK for producing surface coatings, corrosion-resistant formulations, and protective finishes. Increasing adoption of high-solid and fast-drying coatings in industrial sectors amplifies demand, as MIBK enables improved film formation, viscosity control, and superior product performance across multiple end-use industries.

- For instance, Nova Molecular Technologies achieves purity levels of up to 99.9% (or higher for specific niche applications or product lines) for some of its high-purity solvents, such as Nova THF (Tetrahydrofuran) 99.9%.

- Expanding Use in Extraction Processes and Agrochemicals

MIBK gains traction in extraction applications such as rare-metal purification, pharmaceutical intermediates, and chemical processing due to its selective solvency profile. Agrochemical producers increasingly use MIBK as a carrier solvent in pesticide and formulation development, benefiting from its stability and controlled volatility. Growing agricultural modernization and the rising demand for high-efficiency crop protection solutions reinforce its role. The chemical’s ability to enhance formulation uniformity and improve active ingredient dispersion positions it as a valuable solvent across high-growth industrial and agricultural sectors.

Key Trends & Opportunities

- Shift Toward High-Purity and Low-Emission Solvent Grades

A major trend involves rising demand for high-purity, low-VOC MIBK grades as manufacturers align with sustainability and regulatory requirements. Coating and adhesive formulators increasingly adopt eco-efficient solvents to reduce emissions while maintaining performance. Opportunities arise in developing ultra-pure MIBK grades for pharmaceuticals, advanced coatings, and electronic chemical applications. Producers focusing on process optimization and energy-efficient purification technologies gain competitive advantages, particularly as downstream industries demand solvents that meet both stringent environmental standards and high-performance criteria.

- For instance, ENEOS Corporation’s electronic-grade solvent portfolio includes isopropyl alcohol with certified purity of 99.9% and a typical water content of 0.0046 mass% (46 ppm), supported by semiconductor-grade filtration systems.

- Capacity Expansions in Asia-Pacific and Diversification of Applications

Producers in Asia-Pacific—especially China and Southeast Asia—expand solvent production capacities to meet growing regional demand from automotive, construction, rubber, and chemical sectors. This provides opportunities for strategic partnerships and supply chain strengthening. Diversification into emerging applications such as lithium extraction, precision chemicals, and next-generation adhesives supports future growth. Companies exploring differentiated grades, tailored solvent blends, and industry-specific formulations can capture niche segments and maintain resilience amid evolving industrial requirements.

- For instance, Idemitsu Kosan Co., Ltd. operates the Chiba petrochemical complex, which includes an ethylene production capacity of 374,000 tonnes per year, supporting downstream manufacturing of high-purity solvents and chemical intermediates used across multiple industries.

Key Challenges

- Regulatory Pressure on Volatile Organic Compounds (VOCs)

Stringent VOC emission regulations in North America, Europe, and parts of Asia challenge MIBK adoption in paints, coatings, and adhesives. Compliance requirements push formulators toward water-based or bio-based alternatives, potentially reducing solvent demand. Manufacturers must invest in emission-controlled production technologies and innovate low-VOC solvent variants to remain competitive. Regulatory uncertainty and evolving environmental frameworks add complexity to long-term planning, forcing the industry to balance performance needs with stricter environmental expectations.

- Price Volatility and Raw Material Dependency

MIBK production depends heavily on petrochemical feedstocks such as acetone and hydrogen, making the market vulnerable to crude-oil price fluctuations and supply chain disruptions. Feedstock shortages, geopolitical instability, and refinery capacity shifts can elevate production costs and pressure profit margins. Market participants face challenges in maintaining stable pricing and securing reliable raw material supplies. To mitigate volatility, producers increasingly explore backward integration, long-term supply contracts, and operational efficiencies to optimize performance under unpredictable market conditions.

Regional Analysis

North America

North America holds an estimated 28–30% share of the Methyl Isobutyl Ketone market, supported by strong demand from the paints, coatings, and specialty chemicals industries. The U.S. leads regional consumption due to its large manufacturing base for automotive coatings, rubber chemicals, and industrial solvents. Growth is reinforced by rising investments in construction and infrastructure, which increase coating and adhesive requirements. Stringent environmental standards encourage producers to optimize production efficiency and develop lower-emission solvent grades. Although regulatory pressures pose limitations, the region benefits from stable feedstock availability and technologically advanced chemical processing capabilities.

Europe

Europe accounts for roughly 22–24% of the global market, driven by robust adoption in industrial coatings, rubber modification, and high-performance adhesives. Germany, the U.K., and France lead demand due to their well-developed automotive, aerospace, and chemicals sectors. Environmental regulations accelerate the shift toward high-purity and lower-VOC solvent formulations, prompting manufacturers to upgrade production technologies. Market growth benefits from increased investment in energy-efficient infrastructure and protective coating applications. However, strict compliance mandates add cost pressures, prompting European producers to focus on process innovation and specialty-grade MIBK to maintain competitiveness.

Asia-Pacific

Asia-Pacific dominates the global MIBK market with a commanding 43–45% share, fueled by rapid industrialization, expanding manufacturing bases, and strong demand from automotive, construction, and agrochemical sectors. China and India serve as major consumption hubs due to large coatings and rubber industries, while Southeast Asia contributes through growing chemical and adhesive production. Capacity expansions by regional manufacturers strengthen supply security and cost competitiveness. Increasing agricultural activities also support demand for MIBK-based pesticide formulations. The region’s favorable regulatory environment, combined with rising investments in chemical processing, positions Asia-Pacific as the fastest-growing market.

Latin America

Latin America captures approximately 5–6% of the global market, driven by increasing use of MIBK in industrial coatings, automotive refinishing, and agrochemical formulations. Brazil and Mexico lead regional demand due to their expanding manufacturing and agricultural sectors. Infrastructure development and construction activities support steady growth in coating applications. However, market expansion remains moderate due to currency fluctuations, limited production facilities, and reliance on imported feedstocks. Opportunities emerge as regional industries adopt more advanced solvent-based processes, encouraging investment in localized chemical manufacturing to reduce supply chain vulnerabilities.

Middle East & Africa (MEA)

The MEA region accounts for nearly 3–4% of the global market, supported by rising industrial activities, especially in construction, petrochemicals, and automotive maintenance. GCC countries, particularly the UAE and Saudi Arabia, generate significant demand for MIBK in protective coatings used in large-scale infrastructure and energy projects. Africa experiences gradual growth as urbanization boosts demand for adhesives and coatings. However, limited local production capacity and dependence on imports restrict faster expansion. Despite these challenges, increasing industrial diversification efforts and rising chemical processing investments create growth opportunities for MIBK suppliers.

Market Segmentations:

By Product:

- Blood glucose and ketone monitoring

- Blood ketone monitoring

By Type:

- Diabetes management

- Weight and diet management

By Distribution Channel:

- Brick and mortar

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Methyl Isobutyl Ketone market features leading players such as Nouryon, Maruzen Petrochemical Co., Ltd., Shell Plc, Nova Molecular Technologies, ENEOS Corporation, Idemitsu Kosan Co., Ltd., Arkema S.A., Sasol Limited, ExxonMobil Corporation, and INEOS Group. The Methyl Isobutyl Ketone (MIBK) market reflects a blend of capacity expansion, technology-driven production upgrades, and strategic integration across petrochemical value chains. Manufacturers prioritize high-purity MIBK output through advanced hydrogenation and purification systems to meet rising demand from coatings, adhesives, rubber chemicals, and agrochemical sectors. Competitive strategies increasingly focus on enhancing operational efficiency, reducing energy consumption, and developing low-VOC solvent grades aligned with global environmental regulations. Companies strengthen regional supply chains by expanding production facilities and forming partnerships with downstream formulators. Additionally, long-term feedstock contracts, digital process monitoring, and portfolio diversification help mitigate price volatility and support sustainable market positioning.

Key Player Analysis

- Nouryon

- Maruzen Petrochemical Co., Ltd.

- Shell Plc

- Nova Molecular Technologies

- ENEOS Corporation

- Idemitsu Kosan Co., Ltd.

- Arkema S.A.

- Sasol Limited

- ExxonMobil Corporation

- INEOS Group

Recent Developments

- In March 2025, Sumitomo Chemical began selling its chemically recycled polymethyl methacrylate (PMMA), which is made from recycled methyl methacrylate (MMA) monomer. The company plans to supply this sustainable material to LG Display for use in LCD backlight units and to Nissan Motor for headlight lenses.

- In September 2024, Bostik, part of the Arkema Group’s adhesive solutions division, has announced a significant advancement in Arkema’s Net Zero goals with the introduction of its new Kizen LIME range of packaging adhesives. This launch represents a key milestone in Bostik’s dedication to minimizing carbon footprints and enhancing the sustainability of packaging solutions.

- In January 2023, Tecton launched the first ketone hydration beverage, a drink formulated with ketone esters that are believed to have potential anti-inflammatory and antioxidant benefits. The company’s product aims to provide metabolic and recovery support, and it is created using a proprietary, natural enzymatic process.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth as industries expand solvent applications.

- Manufacturers will adopt cleaner production technologies to reduce emissions and energy consumption.

- Growing emphasis on high-purity grades will encourage investments in advanced refining capabilities.

- Expanding coatings and adhesives sectors will continue to strengthen consumption across emerging regions.

- Regulatory pressure will accelerate the shift toward safer handling and sustainable formulation practices.

- Industries will increasingly integrate MIBK into specialty chemical processes requiring high chemical stability.

- Capacity expansions in Asia will enhance supply security and reduce dependency on imports.

- Market players will focus on cost optimization through process automation and waste-minimization strategies.

- R&D initiatives will target alternative feedstocks to improve overall production efficiency and sustainability.

- Strategic partnerships will rise as companies aim to enhance distribution networks and product availability.

Market Segmentation Analysis:

Market Segmentation Analysis: