Market Overview

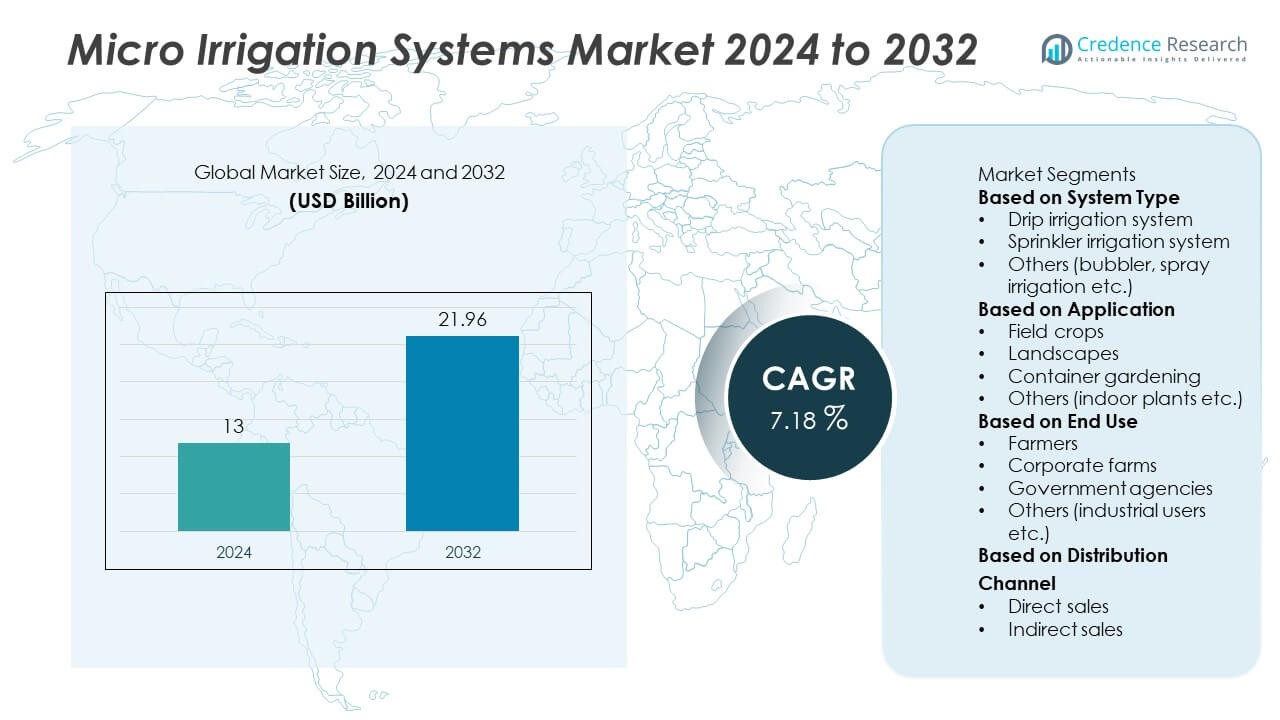

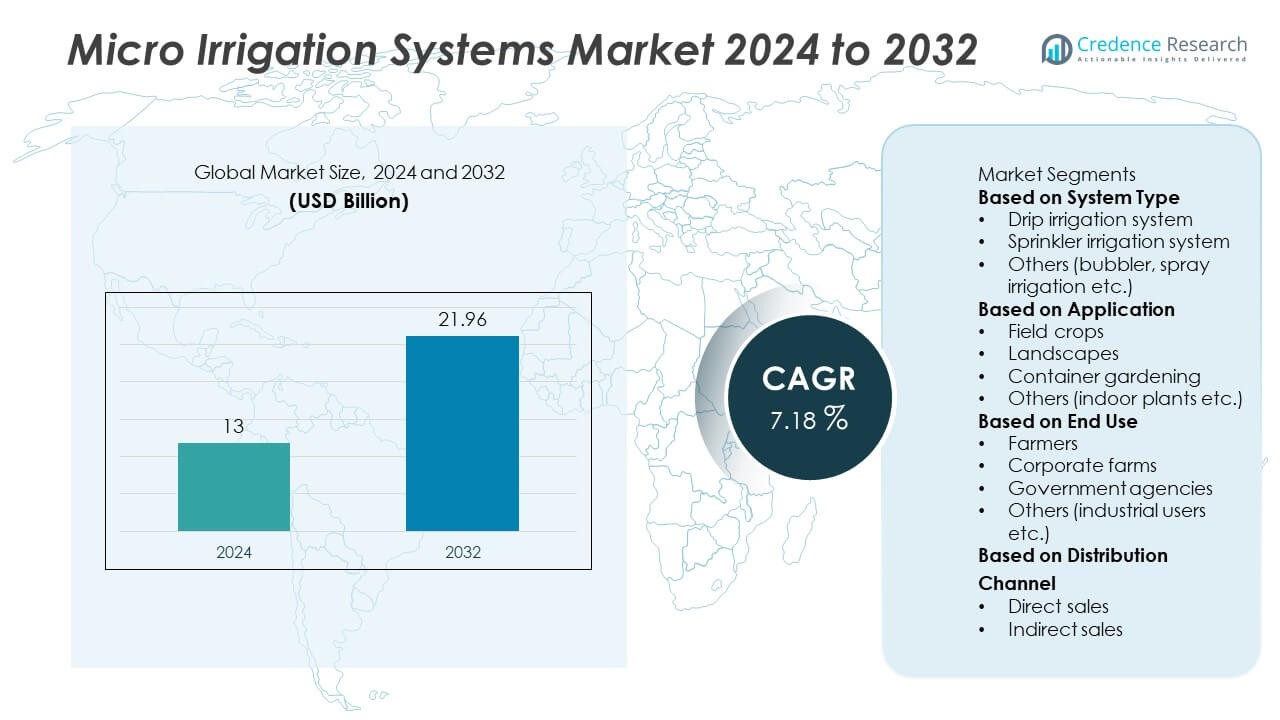

The Micro Irrigation Systems market was valued at USD 13 billion in 2024 and is projected to reach USD 21.96 billion by 2032, growing at a CAGR of 7.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro Irrigation Systems Market Size 2024 |

USD 13 Billion |

| Micro Irrigation Systems Market, CAGR |

7.18% |

| Micro Irrigation Systems Market Size 2032 |

USD 21.96 Billion |

The top players in the micro irrigation systems market-Netafim Ltd., Jain Irrigation Systems Ltd., Lindsay Corporation, Captain Polyplast Ltd., and Ecoflo India Ltd.-drive industry growth through advanced product portfolios and global networks. Netafim leads the global market with a roughly 30% share, supported by its strong presence in over 100 countries. Meanwhile, Asia Pacific emerges as the leading region, capturing 39.13% of global market share in 2019 and maintaining dominance through high adoption in India and China. North America and Europe follow with significant penetration in precision irrigation for high‑value crops and regulatory‑driven demand. These companies leverage technological innovation, economies of scale and regional insights to capture value and expand reach across key geographies, reinforcing their leadership positions in this growing market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global micro irrigation systems market was valued at USD 13.25 billion in 2024 and is projected to grow at a CAGR of 7.84% during the forecast period.

- The market is driven by increasing water scarcity, particularly in arid regions, prompting a shift toward water-efficient irrigation solutions that can reduce water usage by up to 70%.

- Drip irrigation systems hold the largest market share, accounting for 43% in 2024, with the farmer end-use segment also dominating at 48% market share the same year.

- Competitive pressure is high, with major players expanding through technological innovations and global reach, while high initial investment costs and the need for technical expertise act as market restraints.

- Asia Pacific holds the largest regional share, contributing 38% of the market in 2024, driven by strong government incentives and extensive agricultural activity in countries like India and China.

Market Segmentation Analysis:

By System Type

The Drip Irrigation System dominates the Micro Irrigation Systems market, holding the largest share due to its water efficiency and precision in targeting plant roots. Drip systems account for approximately 55% of the market share, making it the preferred choice for field crops and high-value horticulture. The Sprinkler Irrigation System follows with a 30% share, offering broader coverage and versatility, especially in landscapes and container gardening. The Others segment, which includes bubbler and spray irrigation, holds the remaining 15%. This segment is growing as alternative irrigation methods are explored for specific applications, including indoor and vertical farming. The drivers for drip systems include water conservation, government subsidies, and increasing adoption in regions facing water scarcity.

- For instance, Rain Bird’s XeriSpray nozzle system, designed for landscaping applications in non-turf areas, uses low-volume micro-spray technology to provide precise, targeted watering in areas like ground cover, flower beds, and containers, which significantly reduces water waste and runoff compared to less efficient methods.

By Application

In the Micro Irrigation Systems market, Field Crops represent the dominant application, capturing nearly 50% of the market share. This segment benefits from the growing need to increase agricultural productivity while conserving water. Landscapes and Container Gardening follow with shares of 25% and 15%, respectively. These applications benefit from the flexibility and efficiency of micro irrigation, especially in urban and residential settings. The Others segment, including indoor plants, holds a 10% share and is seeing increased interest with the rise of home gardening and vertical farming. Drivers for field crops include the need for sustainable agricultural practices and water efficiency in arid regions.

- For instance, Hunter Industries’ landscape irrigation systems are employed in urban parks and golf courses, effectively conserving water by adjusting water distribution based on real-time weather data, improving irrigation efficiency in municipal landscapes.

By End Use

Farmers hold the largest market share in the Micro Irrigation Systems market, contributing to nearly 60% of the total market. This dominance is driven by the increased adoption of water-efficient technologies to improve crop yields. Corporate Farms follow with a 25% share, focusing on large-scale, efficient operations to reduce water and labor costs. Government Agencies account for 10% of the market, supporting the implementation of micro irrigation in public agricultural projects and water management schemes. The Others segment, which includes industrial users, holds the remaining 5%. Drivers for the farmer segment include government incentives, the rising need for food production, and the growing awareness of environmental sustainability in agriculture.

Key Growth Drivers

Water Conservation and Efficiency

One of the primary growth drivers for the Micro Irrigation Systems market is the growing emphasis on water conservation. With global water resources becoming increasingly scarce, farmers are turning to micro irrigation systems to optimize water usage. Drip irrigation, in particular, delivers water directly to the roots, reducing evaporation and runoff. This precision minimizes water wastage, making it especially beneficial in arid and semi-arid regions. The need to address water scarcity and enhance agricultural productivity drives the market forward. Governments and international organizations also promote these systems through incentives, further accelerating adoption across various agricultural sectors.

- For instance, the University of Arizona has collaborated with local farmers to implement micro irrigation systems, saving approximately 40% of water usage in desert farming regions. The need to address water scarcity and enhance agricultural productivity drives the market forward.

Technological Advancements

Technological advancements in micro irrigation systems are significantly contributing to market growth. Innovations such as smart irrigation systems that incorporate sensors, automation, and real-time monitoring are enhancing efficiency. These systems adjust water flow based on weather conditions, soil moisture, and crop requirements, leading to improved resource management. Additionally, the development of more durable, cost-effective materials for irrigation components is making micro irrigation systems more accessible to smallholder farmers. Technological improvements have made these systems more efficient, scalable, and affordable, allowing them to gain popularity in both developing and developed markets.

- For instance, Hunter Industries Hydrawise technology allows users to monitor landscape irrigation systems remotely, automatically adjusting watering schedules based on real-time and forecasted weather conditions, which can save up to 50% of water used for landscape irrigation.

Government Support and Subsidies

Governments worldwide are playing a crucial role in the adoption of micro irrigation systems. In many regions, agricultural policies support the transition to more sustainable irrigation methods through subsidies, grants, and tax incentives. These initiatives are designed to encourage farmers to adopt water-efficient technologies, reduce dependence on traditional irrigation methods, and improve food security. Programs such as the National Mission on Micro Irrigation in India and similar initiatives in other countries aim to promote micro irrigation in large-scale agriculture. This support is driving increased penetration of these systems, especially in areas where water scarcity is a critical issue.

Key Trends & Opportunities

Rise in Vertical and Urban Farming

A significant trend in the Micro Irrigation Systems market is the rise of vertical farming and urban agriculture. As cities expand and available arable land decreases, urban farming has gained momentum, requiring efficient irrigation systems. Micro irrigation systems, particularly drip and sprinkler systems, are well-suited for vertical and container gardening due to their compact size and water efficiency. This trend presents opportunities for suppliers to develop specialized solutions for urban growers, including rooftop gardens and hydroponics. As more people become interested in local food production, the demand for efficient irrigation in urban settings will continue to grow.

- For instance, Netafim, which develops micro-irrigation systems, collaborates with various partners in community projects and digital farming solutions, like the “Better Life Farming” alliance with Bayer and the International Finance Corporation (IFC) to provide holistic solutions for small farmers.

Increasing Adoption of Smart Irrigation Solutions

The growing adoption of smart irrigation solutions is another key opportunity in the Micro Irrigation Systems market. Smart irrigation systems, which use IoT-enabled sensors and automation, are gaining traction among farmers due to their ability to optimize water usage and reduce labor costs. These systems can monitor soil moisture levels, weather conditions, and plant requirements, automatically adjusting the irrigation schedule. The integration of artificial intelligence (AI) further enhances the precision of these systems. With the global push toward sustainable agriculture and precision farming, smart irrigation solutions are expected to see increased investment and adoption, creating opportunities for both hardware and software providers.

- For instance, CropX’s smart soil sensors provide precise measurements of soil moisture, temperature, and electrical conductivity, allowing farmers to automate irrigation in real-time and increase water efficiency across fields.

Key Challenges

High Initial Investment Costs

One of the primary challenges in the Micro Irrigation Systems market is the high initial cost of installation. While micro irrigation systems offer long-term benefits such as water and cost savings, the upfront investment required for purchasing and installing the systems can be significant. This cost barrier is particularly challenging for smallholder farmers, especially in developing countries, where financial constraints limit their ability to invest in modern irrigation technologies. Despite government subsidies in some regions, the capital-intensive nature of these systems remains a key challenge to widespread adoption, particularly in low-income farming communities.

Lack of Technical Knowledge and Training

Another challenge faced by the Micro Irrigation Systems market is the lack of technical knowledge and training among farmers. Implementing and maintaining micro irrigation systems requires a certain level of expertise, which may not be readily available in rural or underdeveloped areas. Without proper training, farmers may struggle to optimize system performance, resulting in inefficiency or system failure. To overcome this challenge, companies and governments must invest in educational programs and training initiatives to ensure that farmers can fully understand and utilize the potential of micro irrigation systems.

Regional Analysis

Asia Pacific

In the Asia Pacific region, the micro irrigation systems market commands a 38.3% share of global revenue. Governments in India, China and Southeast Asia promote drip and sprinkler systems through subsidies and training. Farmers face increasing water scarcity and adopt micro irrigation to boost yields and conserve resources. Rapid modernization of agriculture and large areas under cultivation further drive growth in this region. As a result, Asia Pacific leads the market with robust demand across field crops, horticulture and government‑initiated irrigation schemes.

North America

The North America region holds approximately a 22% share of the global micro irrigation systems market. The U.S. and Canada see strong adoption of precision irrigation technologies in high‑value crops and greenhouse operations. Federal and state agencies support water‑efficient systems via incentives and research collaboration. Large‑scale farms and agribusinesses drive demand due to pressure on resources and labor costs. North America’s mature infrastructure and technology readiness help maintain its sizable market share and steady growth.

Europe

Europe accounts for about 18% of the micro irrigation systems market globally. The region benefits from strict water‑use regulations in agriculture, pushing growers toward drip and micro‑sprinkler solutions. Countries like Spain, Italy and France lead adoption in orchards, vineyards and protected cultivation. Government frameworks and subsidies make micro irrigation systems an appealing choice for European farmers. Despite moderate growth rates compared to developing regions, Europe maintains its share due to focus on regulatory compliance and sustainable farms.

Middle East & Africa

The Middle East & Africa region represents nearly 9% of the global micro irrigation systems market share. Arid climates and pressing water scarcity drive the uptake of efficient irrigation methods in countries like Saudi Arabia, UAE and South Africa. Government agencies and large agribusinesses invest in micro irrigation to enable desert‑farming and export‑oriented cultivation. While financial and infrastructure constraints exist in some markets, the high need for water‑smart technologies enhances demand. Growth prospects remain strong as agriculture shifts toward sustainability.

Latin America

Latin America holds a share of around 7% in the global micro irrigation systems market. Brazil, Argentina and Chile lead adoption of drip and sprinkler systems in both field crops and horticulture. Livestock‑farm irrigation and export‑oriented fruit cultivation fuel demand for efficient systems. Subsidies and financing schemes in some countries support farmers’ transition from traditional methods. While infrastructure variability and investment levels vary, the region presents tangible potential for expansion of micro irrigation technologies.

Market Segmentations:

By System Type

- Drip irrigation system

- Sprinkler irrigation system

- Others (bubbler, spray irrigation etc.)

By Application

- Field crops

- Landscapes

- Container gardening

- Others (indoor plants etc.)

By End Use

- Farmers

- Corporate farms

- Government agencies

- Others (industrial users etc.)

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Micro Irrigation Systems market is dominated by key players such as Netafim Ltd., Jain Irrigation Systems Ltd., and Lindsay Corporation, who collectively hold a significant share of the global market. These companies lead through extensive product portfolios, cutting-edge technology, and strong distribution networks. Netafim, for instance, has a robust presence in drip irrigation, while Jain Irrigation is recognized for its comprehensive irrigation solutions spanning various agricultural applications. Lindsay Corporation, known for its Zimmatic pivot irrigation systems, continues to expand its reach in both established and emerging markets. Smaller regional players, including N-Drip and Captain Polyplast, compete by focusing on localized solutions and cost-effective systems. Innovation is a key competitive factor, with companies investing in smart irrigation technologies that incorporate sensors, IoT, and automation to improve water efficiency. Additionally, strategic partnerships, acquisitions, and joint ventures are common in the market, enabling players to strengthen their regional presence and expand product offerings. Companies are also actively involved in expanding their operations in developing regions, particularly Asia Pacific, where demand for efficient irrigation solutions is increasing rapidly. The competition remains fierce, driven by technological advancements, a shift toward sustainability, and growing adoption of water-efficient farming practices across the globe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jain Irrigation Systems

- Ecoflo India

- N-Drip

- Novagric

- Netafim

- Lindsay

- Captain Polyplast

- Hunter

- Adritec Europe

- Automat Industries

Recent Developments

- In September 2025, Jain Irrigation received the National Award at the 56th Engineering Export Promotion Council India Export Excellence Awards, recognizing its engineering and export achievements.

- In August 2025, Jain Irrigation Systems Ltd. secured a work order for 5,438 solar‑water pumps under the “Magel Tyala Saur Krushi Pump Yojana” Phase II scheme.

- In July 2025, Netafim India (part of Orbia Precision Agriculture) celebrated its 60‑year milestone by launching an outreach initiative targeting over 100,000 farmers across ten Indian states.

Report Coverage

The research report offers an in-depth analysis based on System Type, Application, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IoT‑enabled sensors will expand in micro irrigation systems, driving smarter operations.

- Integration of AI‑based analytics will optimize water delivery and reduce resource wastage across farms.

- Growing urban agriculture and indoor container farming will create demand for compact, efficient micro irrigation solutions.

- Expanding government subsidy programmes in water‑scarce regions will accelerate micro irrigation system uptake among smallholder farmers.

- Collaborative models between ag‑tech firms and traditional irrigation manufacturers will bring innovative systems to market faster.

- Modular and retrofit‑friendly micro irrigation systems will gain traction as farmers seek upgrades instead of full replacements.

- Leasing and irrigation‑as‑a‑service models will lower entry barriers and broaden access among cost‑sensitive users.

- Developing markets in Asia Pacific, Latin America and Middle East will offer strong growth opportunities as irrigation penetration increases.

- Manufacturers will focus on eco‑friendly materials and recyclable components to address sustainability demands.

- Training and extension services will scale to bridge technical skill gaps and enhance adoption of advanced micro irrigation technologies.