Market Overview:

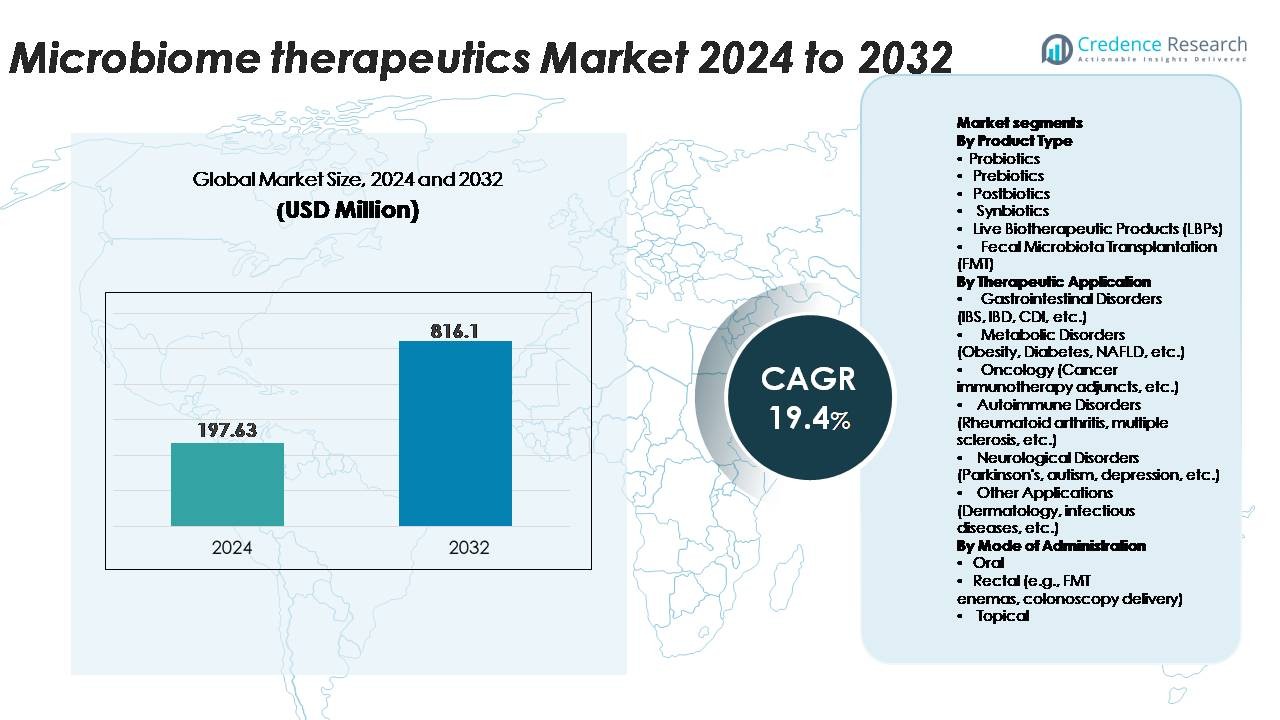

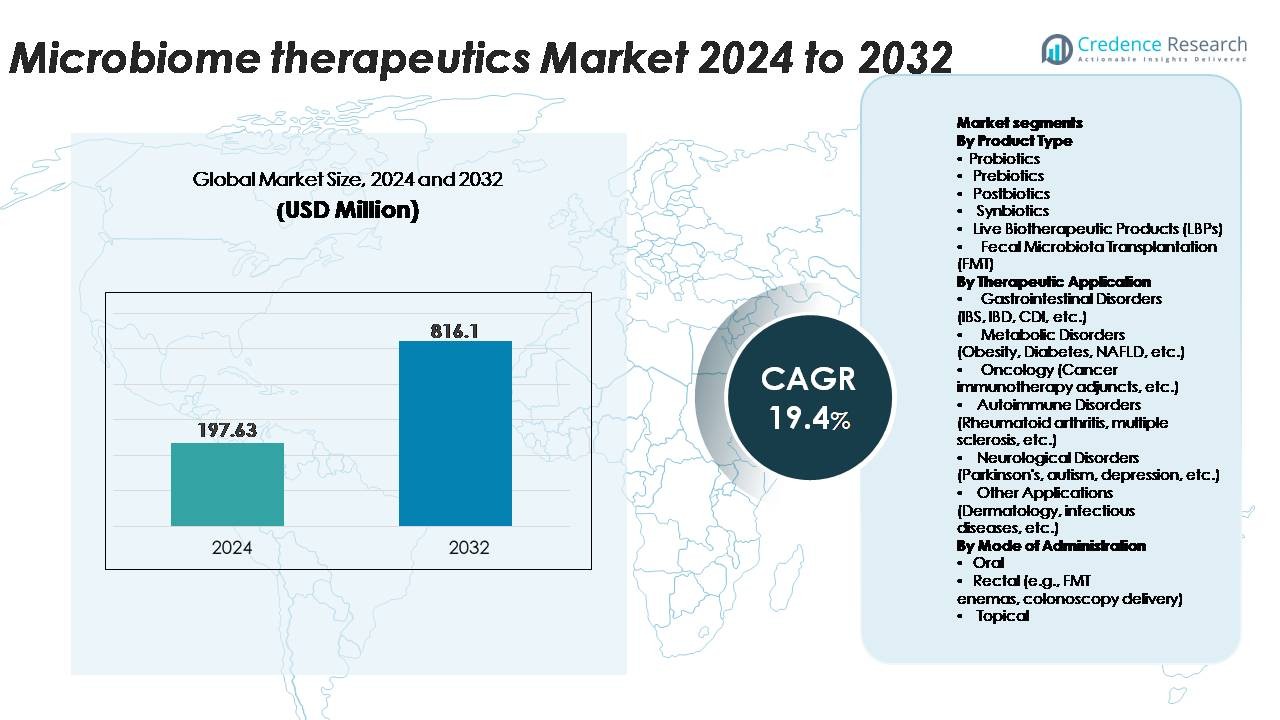

The Microbiome Therapeutics Market was valued at USD 197.63 million in 2024 and is projected to reach USD 816.1 million by 2032, expanding at a CAGR of 19.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microbiome Therapeutics Market Size 2024 |

USD 197.63 Million |

| Microbiome Therapeutics Market, CAGR |

19.4% |

| Microbiome Therapeutics Market Size 2032 |

USD 816.1 Million |

The microbiome therapeutics market features a dynamic competitive landscape led by innovators such as Evelo Biosciences, AOBiome Therapeutics, Microbiotica, 4D Pharma, Axial Therapeutics, Enterome, Novome Biotechnologies, MaaT Pharma, Finch Therapeutics, and Quorum Innovations. These companies advance Live Biotherapeutic Products, engineered microbial consortia, and precision-microbiome platforms targeting gastrointestinal, metabolic, autoimmune, and neurological disorders. Strategic collaborations, late-stage clinical trials, and investments in GMP microbial manufacturing strengthen their market positions. North America leads the global market with approximately 38% share, driven by strong regulatory frameworks and high clinical trial activity, followed by Europe with around 30%, supported by robust academic–industry partnerships and growing adoption of microbiome-based interventions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The microbiome therapeutics market was valued at USD 197.63 million in 2024 and is projected to reach USD 816.10 million by 2032, registering a CAGR of 19.4% over the forecast period.

- Growing clinical validation of Live Biotherapeutic Products (LBPs) and strong adoption of Fecal Microbiota Transplantation (FMT) for recurrent C. difficile infections drive market expansion, with gastrointestinal disorders holding the largest application share at ~45%.

- Next-generation trends such as engineered microbial consortia, precision-microbiome profiling, and digital health integration accelerate innovation, supported by rising investments and late-stage clinical pipelines.

- Competitive activity intensifies as companies expand GMP manufacturing and pursue strategic collaborations, while challenges persist around regulatory variability, production complexity, and limited long-term safety datasets.

- Regionally, North America leads with ~38%, followed by Europe at ~30% and Asia-Pacific at ~22%, while probiotics remain the dominant product-type sub-segment at ~32% due to widespread clinical and consumer adoption.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Probiotics represent the dominant product type, holding the largest market share due to widespread OTC availability, high consumer acceptance, and extensive clinical evidence supporting gut health improvement. Prebiotics and postbiotics gain traction as next-generation formulations offering enhanced stability and targeted metabolic effects. Synbiotics continue to expand with the introduction of synergistic blends that improve colonization efficiency. Live Biotherapeutic Products (LBPs) remain the fastest-advancing regulated class, driven by FDA-tracked clinical programs. Fecal Microbiota Transplantation (FMT) retains strong adoption for recurrent C. difficile infections, supported by high therapeutic response rates.

- For instance, Chr. Hansen documented that its Lactobacillus rhamnosus GG strain maintains viability above 10⁹ CFU per capsule through 24-month stability testing, demonstrating high-performance probiotic formulation standards.

By Therapeutic Application

Gastrointestinal disorders dominate the therapeutic landscape, accounting for the highest share due to the strong clinical success of microbiome-based interventions in IBS, IBD, and CDI. Metabolic disorders gain momentum as companies explore microbial pathways influencing obesity and insulin resistance. Oncology applications grow through increasing integration of microbiome modulators with immunotherapies to improve treatment response. Autoimmune and neurological segments advance steadily as evidence links microbial dysbiosis with systemic inflammation and neurobehavioral pathways. Emerging opportunities in dermatology and infectious diseases further diversify the application base for therapeutic development.

- For instance, Finch Therapeutics’ CP101 achieved a 74.5% sustained clinical cure rate for recurrent C. difficile through week 8 in its PRISM3 data readout, demonstrating high therapeutic impact in GI applications.

By Mode of Administration

Oral administration holds the dominant share due to ease of use, high patient compliance, and its suitability for probiotics, prebiotics, synbiotics, postbiotics, and many LBPs. Rectal delivery, primarily used for FMT through enemas or colonoscopic instillation, remains critical for severe or recurrent CDI, where direct colonic engraftment provides rapid clinical response. Topical administration gains relevance in dermatology-focused microbiome products targeting acne, eczema, and wound healing. Other routes, including injectable and nasal delivery, are at early development stages but show potential for systemic immune modulation and neurological applications.

KEY GROWTH DRIVERS

Expanding Clinical Evidence and Regulatory Advancements

The microbiome therapeutics market benefits significantly from growing clinical validation and clearer regulatory frameworks, which collectively accelerate product development and commercialization. As more Phase II and Phase III trials demonstrate efficacy for conditions such as recurrent C. difficile infection, ulcerative colitis, and metabolic dysfunction, regulatory agencies increasingly formalize pathways for Live Biotherapeutic Products (LBPs). Recent approvals and breakthrough designations strengthen confidence among investors and pharmaceutical partners. Standardized guidelines for manufacturing, safety profiling, and microbial consortia characterization further reduce regulatory uncertainty, enabling faster progression from discovery to market. This evolution encourages biopharma companies to expand pipelines and invest in scalable microbial fermentation technologies. The growing acceptance of microbiome modulation as a legitimate therapeutic modality positions the field for sustained momentum across gastrointestinal, metabolic, and immunomodulatory applications.

- For instance, Seres Therapeutics’ FDA-approved LBP SER-109 demonstrated a 12-week recurrence rate reduction to 12% in its pivotal ECOSPOR III trial (compared to 40% in the placebo group), establishing one of the strongest clinical evidence bases for microbiome modulation.

Rising Incidence of Chronic Diseases Linked to Dysbiosis

The growing global prevalence of chronic conditions such as inflammatory bowel disease (IBD), obesity, diabetes, colorectal cancer, autoimmune disorders, and neurodevelopmental challenges increases demand for microbiome-based therapeutics. Scientific evidence linking microbial dysbiosis with immune dysregulation, metabolic imbalance, and neurological signaling has strengthened the rationale for targeted interventions. As conventional treatments often provide limited long-term relief or come with significant side effects, microbiome therapeutics offer a novel modality that acts on upstream biological mechanisms. This drives patient and clinician adoption of probiotics, synbiotics, LBPs, and FMT for disease modification rather than symptomatic control. Chronic disease burdens in aging populations further reinforce the market’s growth trajectory. Additionally, personalized microbiome profiling supports precision-medicine approaches, enabling tailored interventions based on microbial composition, metabolic signatures, and functional activity, thereby expanding therapeutic relevance across diverse patient groups.

- For instance, Axial Therapeutics reported quantitative reductions of 24% in gut-derived aromatic amino acid metabolites in its Phase 1b trial for autism spectrum disorder using AX-A-102, demonstrating how microbiome modulation can directly influence neurological pathways.

Growing Investments, Collaborations, and Commercialization Pipelines

The strong surge in private funding, strategic partnerships, and pharmaceutical collaborations plays a central role in scaling the microbiome therapeutics market. Leading biotech firms attract substantial venture capital to advance LBP platforms, while large pharmaceutical companies pursue co-development agreements to expand their immunology and metabolic disease portfolios. Investments in GMP-compliant microbial manufacturing, automated culturing systems, and high-throughput sequencing tools enhance development capacity and reduce production costs. At the same time, global research initiatives accelerate discovery of novel microbial strains and engineered consortia. As multiple firms move toward late-stage clinical trials, commercial readiness improves through expanded distribution alliances, physician-education programs, and payer-engagement strategies. This ecosystem of financial and scientific collaboration establishes a robust foundation for market expansion across multiple therapeutic areas.

KEY TRENDS & OPPORTUNITIES

Emergence of Next-Generation LBPs and Engineered Microbial Consortia

A pivotal trend reshaping the market is the rapid development of next-generation LBPs and engineered microbial consortia designed to deliver targeted therapeutic functions. Advances in synthetic biology enable the engineering of bacterial strains capable of producing bioactive metabolites, modulating immune pathways, or degrading toxic compounds in situ. Companies are increasingly designing multi-strain consortia with defined compositions that outperform traditional probiotics. These innovations open opportunities in oncology, metabolic regulation, and autoimmune disease management. Precision-engineered LBPs also support more predictable, reproducible clinical outcomes compared to donor-derived formulations. As engineering and computational biology converge, platforms integrating AI-driven strain selection and digital twins accelerate discovery, paving the way for microbiome therapeutics to evolve into a high-precision, programmable treatment category.

- For instance, Synlogic engineered its strain SYNB1934 to be more potent than its predecessor (SYNB1618), demonstrating the potential for engineered microbes to treat phenylketonuria.

Expansion of Precision Microbiome Profiling and Digital Health Integration

Precision microbiome analytics drive significant opportunity by enabling personalized therapeutic strategies based on microbial signatures and functional markers. High-resolution metagenomics, metabolomics, and machine-learning-based classifiers allow developers to segment patients, predict treatment response, and optimize formulations. Integration with digital health tools—such as microbiome-tracking apps, symptom-monitoring platforms, and connected at-home testing kits—enhances patient engagement and generates real-world data supporting long-term optimization. Health-tech partnerships enable remote monitoring and adaptive treatment plans, improving adherence and outcomes. As precision-medicine frameworks gain adoption, microbiome therapeutics benefit from increased clinical relevance and stronger payer value propositions. This trend also supports stratified clinical trials, improving regulatory acceptance and accelerating time-to-market.

- For instance, Microba Life Sciences has processed more than 20,000 high-resolution microbiome samples using its proprietary metagenomic platform, generating datasets that support AI-driven patient stratification for clinical microbiome therapeutics programs.”

Growing Applications Beyond Gut Health into Systemic and Neurological Disorders

Microbiome therapeutics are expanding rapidly into systemic diseases and neuroimmune pathways beyond traditional gastrointestinal disorders. Emerging evidence highlighting the gut–brain axis, gut–skin axis, and microbiome–immune interactions creates opportunities in neurodegeneration, mood disorders, dermatology, and autoimmune pathology. Developers are exploring bacterial metabolites, short-chain fatty acids, and microbial signatures that influence inflammation, neurotransmitter regulation, and barrier integrity. This expands the addressable market across conditions such as Parkinson’s disease, depression, eczema, and rheumatoid arthritis. As mechanisms become clearer and more clinical trials address non-GI indications, the market gains access to high-value therapeutic segments where unmet needs remain significant.

Key Challenges:

Manufacturing Complexity, Stability Issues, and Quality Control Limitations

Producing microbiome therapeutics poses significant challenges due to the biological complexity of live microbes, strict anaerobic culture requirements, and sensitivity to temperature, oxygen, and pH fluctuations. Ensuring consistent potency, viability, and functional stability across production batches is difficult compared to traditional pharmaceuticals. GMP-compliant facilities require specialized bioreactors, cold-chain logistics, and advanced freeze-drying technologies, increasing production costs. Multi-strain consortia amplify these challenges by introducing interspecies interactions that affect predictability. Limited global capacity for large-scale microbial manufacturing further restricts supply. These constraints hinder rapid commercialization and demand extensive investment in process optimization, automation, and validated quality-control frameworks.

Regulatory Uncertainty, Clinical Variability, and Limited Long-Term Data

Despite progress, regulatory ambiguity continues to challenge market expansion, especially for LBPs and engineered microbial consortia. Regional disparities in classification—ranging from biological drugs to supplements—complicate global commercialization. Variability in patient responses due to diet, genetics, environment, and baseline microbiome composition increases trial complexity and reduces reproducibility. Many therapies also lack long-term safety and durability data, raising concerns among clinicians and payers. Designing placebo-controlled trials is difficult when using multi-strain or donor-derived formulations. These hurdles slow pipeline advancement and necessitate more standardized trial designs, mechanistic studies, and regulatory harmonization to support broader clinical confidence.

Regional Analysis:

North America

North America holds the largest share of the microbiome therapeutics market at approximately 38%, supported by advanced research ecosystems, strong regulatory guidance for LBPs, and early commercialization of FMT-based therapies. The U.S. leads in clinical trial activity, with multiple Phase II/III programs targeting gastrointestinal, metabolic, and immunological disorders. Strategic collaborations between biotech innovators and major pharmaceutical companies accelerate product development. The region benefits from expanding reimbursement pathways and rising adoption of precision-microbiome diagnostics. High awareness among clinicians and robust venture-capital funding further reinforce North America’s continued dominance across both pipeline maturity and commercial deployment.

Europe

Europe accounts for roughly 30% of the global market, driven by strong regulatory oversight, progressive microbiome research frameworks, and increasing demand for FMT and LBPs across gastrointestinal and immunology applications. Countries such as Germany, France, the U.K., and the Netherlands lead clinical innovation, supported by extensive biobank networks and public–private research programs. The region’s emphasis on antimicrobial stewardship and non-antibiotic therapies accelerates the adoption of microbiome-based interventions. European regulatory agencies play an influential role in standardizing quality requirements for microbial therapies, which strengthens clinical confidence and supports rapid expansion into oncology and metabolic disorders.

Asia-Pacific

Asia-Pacific captures nearly 22% of the market, expanding rapidly due to increasing disease burden, rising healthcare expenditure, and a strong shift toward preventive and gut-health-focused therapies. China, Japan, South Korea, and Australia lead the region with growing investments in microbiome sequencing, personalized nutrition platforms, and clinical programs targeting IBD, obesity, and neurological disorders. Local biotech companies increasingly collaborate with global LBP developers to scale manufacturing capacity. Patient awareness of probiotic, synbiotic, and postbiotic products is rising, driving commercial adoption. Government-backed precision-medicine initiatives further support APAC’s emergence as a high-growth hub for microbiome therapeutics.

Latin America

Latin America holds approximately 6% of the global market, driven by growing adoption of probiotic and synbiotic therapies and rising interest in cost-effective microbiome solutions for gastrointestinal and infectious diseases. Brazil, Mexico, and Argentina lead clinical integration, supported by expanding microbiome research capabilities and partnerships with international institutions. Regulatory harmonization remains in early development, but increasing healthcare modernization accelerates acceptance of microbial therapies. Consumer-driven demand for functional gut-health products also supports market penetration. While limited in high-end LBP manufacturing, the region shows strong potential for future clinical expansion as infrastructure and regulatory capacity strengthen.

Middle East & Africa

The Middle East & Africa region represents around 4% of the market, supported by growing healthcare modernization, rising prevalence of chronic metabolic and gastrointestinal disorders, and increasing consumer interest in microbiome-supportive supplementation. The UAE, Saudi Arabia, and South Africa lead adoption, investing in precision-health and advanced diagnostics frameworks. Access to regulated LBPs and FMT remains limited, but regional healthcare providers gradually integrate microbiome-based interventions into GI and immune-health pathways. Demand for probiotics and synbiotics continues to expand through pharmacy and retail channels. Strengthening clinical infrastructure is expected to gradually increase regional participation in global microbiome research.

Market Segmentations:

By Product Type

- Probiotics

- Prebiotics

- Postbiotics

- Synbiotics

- Live Biotherapeutic Products (LBPs)

- Fecal Microbiota Transplantation (FMT)

By Therapeutic Application

- Gastrointestinal Disorders (IBS, IBD, CDI, etc.)

- Metabolic Disorders (Obesity, Diabetes, NAFLD, etc.)

- Oncology (Cancer immunotherapy adjuncts, etc.)

- Autoimmune Disorders (Rheumatoid arthritis, multiple sclerosis, etc.)

- Neurological Disorders (Parkinson’s, autism, depression, etc.)

- Other Applications (Dermatology, infectious diseases, etc.)

By Mode of Administration

- Oral

- Rectal (g., FMT enemas, colonoscopy delivery)

- Topical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the microbiome therapeutics market is characterized by a mix of specialized biotech innovators, academic spin-offs, and large pharmaceutical companies accelerating investment in microbiome-based drug development. Key players focus on Live Biotherapeutic Products (LBPs), engineered microbial consortia, and precision-microbiome diagnostics, with several firms advancing late-stage clinical programs for recurrent C. difficile infection, ulcerative colitis, metabolic dysfunction, and oncology support. Companies leverage synthetic biology, strain engineering, and high-throughput sequencing to differentiate their platforms, while strategic partnerships strengthen commercialization pathways. Recent regulatory approvals and breakthrough designations have intensified competition, prompting firms to expand GMP manufacturing capacity, automate microbial culturing, and adopt standardized quality-control frameworks. Mergers, licensing agreements, and co-development partnerships between startups and major pharmaceutical groups continue to shape the competitive environment, enabling broader therapeutic pipelines and enhanced global market reach. As clinical validation improves, competition increasingly revolves around safety, strain specificity, dosing predictability, and scalability.

Key Player Analysis:

- Microbiotica Ltd.

- Evelo Biosciences, Inc.

- Quorum Innovations

- 4D Pharma plc

- Novome Biotechnologies

- MaaT Pharma

- AOBiome Therapeutics

- Enterome SA

- Axial Therapeutics, Inc.

- Finch Therapeutics Group, Inc.

Recent Developments:

- In May 2025, the company reported final data from a Phase 1b trial of MaaT033 in patients with Amyotrophic Lateral Sclerosis (ALS): the therapy was well tolerated, successfully engrafted gut microbiota within the first month, and the ALS Functional Rating Scale-Revised (ALSFRS-R) slope improved from a median –0.7 to –0.3 points/month over the 84-day treatment window.

- In 2025, industry overview, Evelo remains listed among the top companies working on gut-microbiome therapies, signaling continued investment and pipeline activity in live-microbiome based therapeutics.

- In 2024, Enterome presented new clinical and preclinical data for its lead cancer immunotherapy program (peptide-based, commensal-derived) in multiple conferences (e.g., ESMO IO, ASH), highlighting evidence of CD8+ T-cell activation in patients with indolent non-Hodgkin lymphoma treated with its candidate EO2463, as well as ongoing trials in metastatic colorectal cancer and glioblastoma.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product type, Therapeutics Application, Mode of administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market advances rapidly as more late-stage clinical trials validate microbiome-based interventions across multiple therapeutic areas.

- Developers expand pipelines of precision-engineered LBPs and consortia designed for targeted immune and metabolic modulation.

- Regulatory frameworks mature globally, improving approval pathways for next-generation microbial therapies.

- Investment strengthens manufacturing capacity for anaerobic culturing, formulation stability, and large-scale microbial production.

- Partnerships between biotech innovators and major pharmaceutical companies accelerate technology transfer and commercialization.

- Precision microbiome profiling integrates with AI tools to support personalized treatment strategies and patient stratification.

- Clinical adoption broadens into metabolic, neurological, autoimmune, and oncology indications beyond GI disorders.

- Real-world evidence platforms enhance long-term safety tracking and support payer reimbursement decisions.

- Consumer awareness of microbiome-health links increases demand for clinically validated formulations.

- Emerging markets improve research infrastructure and gradually expand participation in global microbiome therapy development.

Market Segmentation Analysis:

Market Segmentation Analysis: