| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Construction Aggregates Market Size 2024 |

USD 17,863.87 Million |

| Middle East Construction Aggregates Market, CAGR |

3.76% |

| Middle East Construction Aggregates Market Size 2032 |

USD 24,002.72 Million |

Market Overview

Middle East Construction Aggregates Market size was valued at USD 17,863.87 million in 2024 and is anticipated to reach USD 24,002.72 million by 2032, at a CAGR of 3.76% during the forecast period (2024-2032).

The Middle East construction aggregates market is driven by rapid urbanization, large-scale infrastructure projects, and increasing government investments in smart cities and sustainable development. The expansion of the construction sector, fueled by Vision 2030 initiatives in Saudi Arabia and the UAE’s infrastructure boom, significantly boosts demand. Additionally, the rise in commercial and residential construction, supported by population growth and tourism projects, contributes to market expansion. The adoption of advanced construction techniques and sustainable materials, such as recycled aggregates, aligns with environmental regulations and enhances market growth. Trends indicate a growing preference for high-performance aggregates to improve durability and efficiency in construction. Furthermore, technological advancements in aggregate processing and transportation are optimizing supply chains and reducing costs. The increasing focus on green building initiatives and circular economy principles is expected to shape future market dynamics, fostering long-term sustainability and efficiency in the Middle East construction aggregates industry.

The Middle East construction aggregates market is geographically diverse, with key growth areas including Saudi Arabia, the UAE, Turkey, Iran, and other developing regions. Rapid urbanization, government-led infrastructure projects, and increasing investments in commercial and residential developments are driving market expansion. Saudi Arabia and the UAE are leading due to large-scale smart city projects and extensive transportation networks, while Turkey and Iran are experiencing steady demand from industrial and infrastructure development. Key players in the market include CRH plc, Heidelberg Materials AG, Vulcan Materials Company, Martin Marietta Materials Inc., and Boral Limited, among others. These companies are investing in advanced aggregate processing technologies, sustainable material solutions, and strategic partnerships to strengthen their market position. Additionally, the shift toward eco-friendly aggregates and digitalized supply chain management is shaping future market dynamics. With increasing regional investments and innovations, the Middle East construction aggregates market is poised for steady long-term growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East construction aggregates market was valued at USD 17,863.87 million in 2024 and is projected to reach USD 24,002.72 million by 2032, growing at a CAGR of 3.76%.

- Rapid urbanization and large-scale infrastructure projects, including Saudi Arabia’s Vision 2030 and UAE’s smart city developments, are key drivers of market growth.

- The market is witnessing a shift towards sustainable and recycled aggregates, driven by environmental regulations and green construction initiatives.

- Major players such as CRH plc, Heidelberg Materials AG, and Vulcan Materials Company are investing in advanced processing technologies and regional expansion strategies.

- Stringent environmental regulations and resource depletion are key challenges, increasing the cost of production and limiting natural aggregate extraction.

- Saudi Arabia and the UAE dominate the market, while Turkey and Iran show steady demand due to industrial and infrastructure development.

- Increasing foreign investments, public-private partnerships (PPPs), and technological advancements are creating new opportunities for market expansion.

Report Scope

This report segments the Middle East Construction Aggregates Market as follows:

Market Drivers

Rapid Urbanization and Infrastructure Development

The Middle East is experiencing significant urban expansion, driven by increasing population growth and government-backed initiatives aimed at modernizing infrastructure. For instance, Saudi Arabia’s Vision 2030 program includes the development of NEOM City, a futuristic urban hub designed to integrate smart technologies and sustainable practices. Similarly, Dubai’s Expo 2020 legacy projects have led to the construction of metro networks and commercial hubs to support urban growth. Qatar’s infrastructure enhancements post-FIFA World Cup 2022, such as the expansion of road networks and public transportation systems, further fuel the demand for high-quality construction aggregates essential for roads, bridges, and building foundations.

Government Investments and Mega Projects

Governments across the Middle East are allocating substantial budgets for infrastructural advancements to diversify their economies beyond oil dependency. For instance, Saudi Arabia’s NEOM City project is a cornerstone of Vision 2030, requiring vast quantities of aggregates for its construction. The UAE’s Etihad Rail initiative aims to connect key cities and industrial zones, driving aggregate consumption for railway tracks and associated infrastructure. Kuwait’s Silk City project, designed to enhance regional connectivity and economic growth, also relies heavily on crushed stone, sand, and gravel. Additionally, public-private partnerships (PPPs) are playing a crucial role in financing these projects, with government regulations promoting local production and sustainable sourcing.

Advancements in Construction Technology and Sustainable Practices

The adoption of advanced construction technologies, such as prefabrication, 3D printing, and modular construction, is shaping aggregate demand in the Middle East. Developers are increasingly incorporating high-performance aggregates to enhance the durability and strength of structures. Furthermore, sustainability concerns are driving the use of recycled and eco-friendly aggregates, aligning with global environmental goals. The growing emphasis on green building materials and circular economy practices is expected to reshape the construction aggregates market, encouraging innovations in processing and material utilization.

Rising Demand from Commercial and Residential Sectors

The expansion of commercial real estate, hospitality, and residential housing sectors significantly influences aggregate demand. Increased foreign direct investment (FDI) in tourism and real estate development—particularly in Dubai, Riyadh, and Doha—has led to the construction of luxury hotels, resorts, and residential communities. Additionally, increasing housing demand, fueled by population growth and expatriate influx, continues to drive aggregate consumption. As governments introduce housing initiatives and real estate development incentives, the market for construction aggregates is set to expand further in the coming years.

Market Trends

Growing Demand for Sustainable and Recycled Aggregates

Sustainability is becoming a key focus in the Middle East construction aggregates market as governments and developers prioritize eco-friendly building materials. For instance, the UAE’s Ministry of Climate Change and Environment has introduced regulations promoting the use of recycled aggregates in public infrastructure projects, while Saudi Arabia’s National Center for Waste Management is actively supporting initiatives to convert demolition waste into reusable materials. Manufacturers are also investing in advanced recycling technologies, such as AI-driven sorting systems, to meet growing demand while aligning with global sustainability goals.

Technological Advancements in Aggregate Processing

The integration of advanced machinery and automation in aggregate processing is enhancing efficiency and quality in the Middle East market. For instance, Saudi Arabia’s Ministry of Industry and Mineral Resources has implemented AI-driven quality control systems to optimize aggregate production, while the UAE’s Geological Survey is utilizing IoT-based tracking systems to streamline logistics and ensure efficient transportation. These advancements allow for the production of high-performance aggregates that improve the durability and strength of construction materials. Additionally, digitalization and IoT-based tracking systems are streamlining logistics, ensuring efficient transportation and distribution of aggregates to construction sites.

Expansion of Infrastructure and Smart City Projects

Mega infrastructure and smart city projects across the Middle East are driving long-term growth in the construction aggregates market. Developments such as Saudi Arabia’s NEOM, the UAE’s Dubai 2040 Urban Master Plan, and Qatar’s Lusail City are increasing demand for aggregates used in roads, bridges, commercial buildings, and public utilities. These projects emphasize modern urban planning, sustainable architecture, and high-quality construction materials, creating a continuous demand for superior aggregates. As governments push for urban expansion, the market is expected to witness steady growth in the coming years.

Increasing Foreign Investments and Public-Private Partnerships (PPPs)

The Middle East’s construction sector is attracting significant foreign direct investments (FDIs), particularly in commercial real estate, tourism, and industrial projects. Public-private partnerships (PPPs) are playing a crucial role in funding large-scale infrastructure developments, leading to increased aggregate consumption. Investors are particularly drawn to high-growth markets like the UAE and Saudi Arabia, where strategic economic diversification efforts are driving construction activities. With continued investment in transport networks, residential developments, and hospitality projects, the demand for construction aggregates is set to rise, further strengthening market growth.

Market Challenges Analysis

Environmental Regulations and Resource Depletion

The Middle East construction aggregates market faces increasing challenges due to stringent environmental regulations and the depletion of natural resources. For instance, the UAE’s Ministry of Climate Change and Environment has introduced policies requiring environmental impact assessments for quarrying activities, while Saudi Arabia’s National Center for Environmental Compliance enforces strict guidelines on sustainable mining practices. These regulations often lead to higher operational costs for aggregate producers, as they must invest in sustainable extraction methods and pollution control measures. Additionally, the over-extraction of natural aggregates, particularly in regions with limited natural stone and sand deposits, is creating long-term sustainability concerns. This challenge is pushing the industry towards alternative materials, such as recycled aggregates, but widespread adoption remains slow due to cost and infrastructure limitations.

Supply Chain Disruptions and Rising Material Costs

Fluctuations in raw material prices, supply chain disruptions, and logistical challenges significantly impact the Middle East construction aggregates market. Geopolitical tensions, trade restrictions, and transportation bottlenecks often cause delays in aggregate supply, affecting construction timelines and increasing project costs. Additionally, inflation and rising fuel prices contribute to higher transportation expenses, making aggregates more expensive for end-users. The reliance on imported aggregates in certain regions further complicates supply chain stability. To mitigate these issues, industry players are exploring local sourcing, advanced logistics solutions, and digital supply chain management, but challenges persist in maintaining a steady and cost-effective supply of aggregates.

Market Opportunities

The Middle East construction aggregates market presents significant growth opportunities driven by increasing infrastructure investments and rapid urban development. Government-led initiatives, such as Saudi Arabia’s Vision 2030, the UAE’s urban expansion plans, and Qatar’s post-World Cup infrastructure projects, are creating sustained demand for high-quality aggregates. The development of smart cities, transportation networks, and large-scale residential and commercial complexes is fueling aggregate consumption. Additionally, public-private partnerships (PPPs) and foreign direct investments (FDIs) are accelerating infrastructure projects, offering new avenues for aggregate suppliers to expand their market presence. The demand for durable and high-performance aggregates in highways, bridges, and high-rise buildings further strengthens growth prospects in the region.

Another key opportunity lies in the shift towards sustainable and recycled aggregates, driven by environmental regulations and green building initiatives. Governments are promoting the use of alternative materials to reduce reliance on natural resources, opening doors for companies specializing in recycled aggregates and eco-friendly production technologies. The adoption of advanced aggregate processing equipment and digitalized supply chain management is enhancing efficiency and cost-effectiveness, making local production more viable. Furthermore, technological innovations in extraction and processing methods are enabling the production of high-strength aggregates that cater to evolving construction standards. As sustainability and smart infrastructure development gain momentum, companies that invest in innovation, sustainability, and strategic partnerships will be well-positioned to capitalize on the region’s growing demand for construction aggregates.

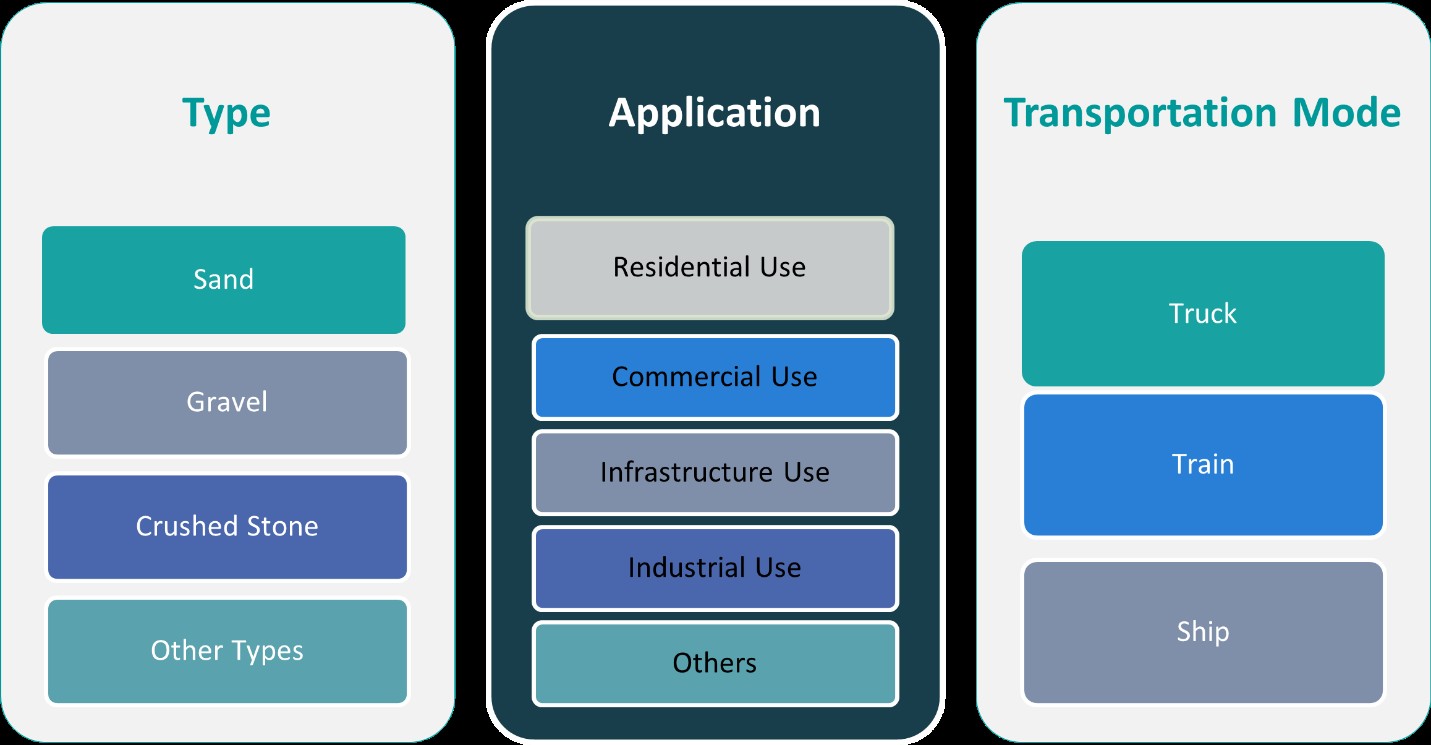

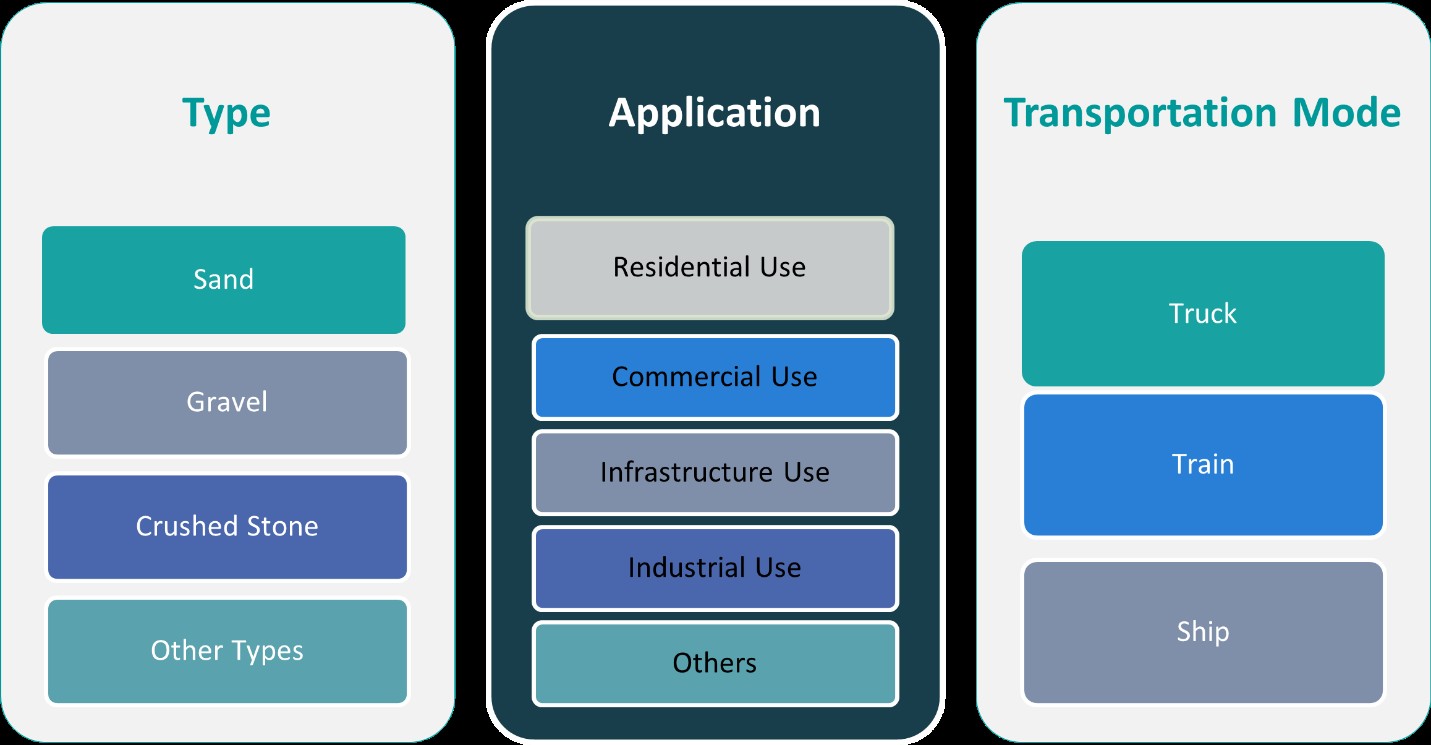

Market Segmentation Analysis:

By Type:

The Middle East construction aggregates market is segmented into sand, gravel, crushed stone, and other types, each serving distinct construction applications. Sand is a fundamental aggregate used extensively in concrete production, plastering, and road construction. The increasing demand for ready-mix concrete in commercial and residential projects is driving the consumption of high-quality sand, while regulatory restrictions on natural sand mining are pushing the adoption of manufactured and recycled sand. Gravel plays a crucial role in road base layers, drainage systems, and concrete mixes, with its demand rising due to expanding highway and transportation networks. Crushed stone is widely used in infrastructure and heavy construction, offering high durability and strength for projects such as bridges, railways, and airport runways. The other types category includes lightweight aggregates and specialty materials, often used in innovative construction techniques and green building solutions. As infrastructure projects and real estate developments accelerate across the region, demand for all aggregate types is expected to grow, prompting investments in sustainable extraction and processing technologies.

By Application:

By application, the construction aggregates market in the Middle East is categorized into residential, commercial, infrastructure, and industrial use. Residential construction is a major driver of aggregate demand, fueled by rapid urbanization, population growth, and government initiatives to develop affordable housing. Increasing real estate investments in high-rise apartments, gated communities, and villa projects are boosting aggregate consumption. Commercial construction, including shopping malls, hotels, and office buildings, also contributes significantly to demand, particularly in urban centers such as Dubai, Riyadh, and Doha. Infrastructure projects, including highways, rail networks, bridges, and ports, remain the dominant consumers of construction aggregates, driven by government investments in transportation and connectivity. Additionally, industrial applications, such as the construction of manufacturing plants, power stations, and logistics hubs, are supporting market growth. With continuous infrastructure expansion, rising foreign investments, and a push for smart city developments, the Middle East construction aggregates market is poised for sustained demand across all application segments.

Segments:

Based on Type:

- Sand

- Gravel

- Crushed Stone

- Other Types

Based on Application:

- Residential Use

- Commercial Use

- Infrastructure Use

- Industrial Use

Based on End- User:

Based on the Geography:

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

Regional Analysis

Saudi Arabia (KSA)

Saudi Arabia dominates the Middle East construction aggregates market, primarily due to its large-scale infrastructure projects under Vision 2030. The country’s push for economic diversification is driving investments in smart cities, industrial zones, and mega projects such as NEOM City, the Red Sea Project, and Qiddiya Entertainment City. The construction of new highways, airports, and commercial complexes is significantly increasing the demand for sand, gravel, and crushed stone. The government’s focus on localized production and sustainable aggregates further strengthens market growth, while public-private partnerships (PPPs) encourage foreign investment in the construction sector.

United Arab Emirates (UAE)

The UAE accounts for a substantial share of the construction aggregates market, fueled by rapid urbanization and real estate expansion. Dubai and Abu Dhabi are at the forefront, with major commercial, residential, and tourism-related construction projects boosting aggregate consumption. Developments such as Dubai 2040 Urban Master Plan, Etihad Rail, and Expo 2020 legacy projects are driving market demand. Additionally, the UAE is investing heavily in green building initiatives and sustainable aggregates, promoting recycled materials and alternative construction techniques. The reliance on imported aggregates is gradually decreasing due to increased local production, enhancing market stability.

Turkey

Turkey is a key player in the construction aggregates market, supported by extensive infrastructure projects and a strong domestic construction sector. The country is investing in high-speed rail projects, new highways, and the Istanbul Canal, which significantly boost aggregate demand. Turkey also has a strong aggregates export market, supplying materials to neighboring regions, including the Middle East and Europe. Government-led initiatives in affordable housing and urban transformation projects are driving long-term market expansion, while advancements in aggregate processing technologies are improving efficiency and product quality.

Iran

Iran holds a notable share in the Middle East construction aggregates market, primarily driven by domestic industrial and infrastructure developments. The country is investing in oil and gas infrastructure, residential housing projects, and transportation networks, leading to high aggregate consumption. Despite economic sanctions and trade restrictions limiting imports, Iran maintains a self-sufficient aggregates industry, relying on extensive natural reserves. However, outdated extraction techniques and environmental concerns pose challenges. The shift towards sustainable aggregates and government-backed industrial expansion plans offer long-term growth opportunities in the Iranian market.

Key Player Analysis

- CRH plc

- Heidelberg Materials AG

- Vulcan Materials Company

- Martin Marietta Materials Inc.

- Adbri Limited

- Eagle Materials Inc.

- SRC Group

- Tarmac

- Sika AG

- Boral Limited

Competitive Analysis

The Middle East construction aggregates market is highly competitive, with leading players such as CRH plc, Heidelberg Materials AG, Vulcan Materials Company, Martin Marietta Materials Inc., Boral Limited, Adbri Limited, Eagle Materials Inc., SRC Group, Tarmac, and Sika AG driving industry growth. These companies focus on expanding their regional presence, investing in advanced processing technologies, and enhancing sustainable aggregate production to meet evolving regulatory and environmental standards. Leading firms focus on enhancing production efficiency, investing in sustainable and recycled aggregates, and improving supply chain logistics to meet the rising demand driven by infrastructure projects and urbanization. Market players are adopting strategies such as mergers and acquisitions to strengthen their foothold in the region, expand their product portfolios, and gain access to new markets. The growing emphasis on environmental regulations has led to increased investment in eco-friendly aggregate solutions, with companies prioritizing innovations in extraction and processing technologies. Additionally, competition is intensifying due to the rising demand for high-performance aggregates in commercial, residential, and industrial applications. As infrastructure development continues to grow across Saudi Arabia, the UAE, and other key regions, the market is expected to witness further consolidation and technological advancements among competitors.

Recent Developments

- In September 2024, Holcim started the Holcim Sustainable Construction Academy. This is a free online training program that teaches about eco-friendly building methods. It helps people who work in construction learn new skills. The program offers both online classes and face-to-face training.

- In October 2024, CRH Ventures launched the Sustainable Building Materials accelerator to scale up creative climate and build technology firms that specialize in CO2-mineralized materials and sustainable binder solutions.

- In July 2024, Heidelberg Materials launched a recycling plant in Katowice, Poland, using a patented ReConcrete process to recycle demolition concrete and replace virgin material.

- In July 2024, Cemex USA formed a joint venture with Couch Aggregates and Premier Holdings for the production and distribution of aggregates in the Mid-South region. Cemex USA already had a strategic partnership with Couch Aggregates. The company stated that this vertical integration, combined with Premier Holdings’ Gulf Coast marine terminals, would accelerate its regional growth.

- In April 2024, Rogers Group joined The Road Forward initiative to advance sustainable asphalt production and paving practices.

- In January 2024, Heidelberg Materials launched Evo Build, its new global brand for low-carbon and circular products. This initiative aims to provide sustainable solutions for the construction industry, focusing on reducing carbon emissions and promoting circular economy principles.

Market Concentration & Characteristics

The Middle East construction aggregates market exhibits a moderate to high market concentration, with a mix of global industry leaders and regional suppliers competing for market share. Established multinational companies dominate due to their extensive production capabilities, advanced processing technologies, and strong distribution networks. However, local and regional suppliers play a crucial role in catering to country-specific demands and government-backed infrastructure projects. The market is characterized by high demand for sustainable and high-performance aggregates, driven by large-scale urbanization and transportation projects. Stringent environmental regulations and resource depletion concerns are influencing industry players to adopt eco-friendly materials and recycling initiatives. Additionally, price volatility in raw materials and transportation costs impacts market dynamics, making cost optimization a key competitive factor. With public-private partnerships (PPPs) and foreign investments accelerating infrastructure growth, the market continues to evolve, encouraging innovation, sustainable practices, and technological advancements to meet the rising construction demands across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Middle East construction aggregates market is expected to experience steady growth, driven by ongoing infrastructure development and urban expansion.

- Government initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s smart city projects will continue to boost demand for high-quality aggregates.

- Sustainable and recycled aggregates will gain prominence as environmental regulations become stricter across the region.

- Technological advancements in aggregate processing and supply chain management will enhance efficiency and reduce production costs.

- Increasing foreign direct investment (FDI) and public-private partnerships (PPPs) will support the expansion of large-scale construction projects.

- The demand for high-performance aggregates in transportation, commercial, and residential projects will continue to rise.

- Fluctuations in raw material prices and transportation costs will remain key challenges for market players.

- Localized production and sourcing strategies will gain traction to reduce dependence on imported aggregates.

- Digitalization and automation in the construction sector will drive innovation in aggregate usage and distribution.

- The market will witness consolidation, with mergers and acquisitions strengthening the position of leading players in the industry.