Market Overview:

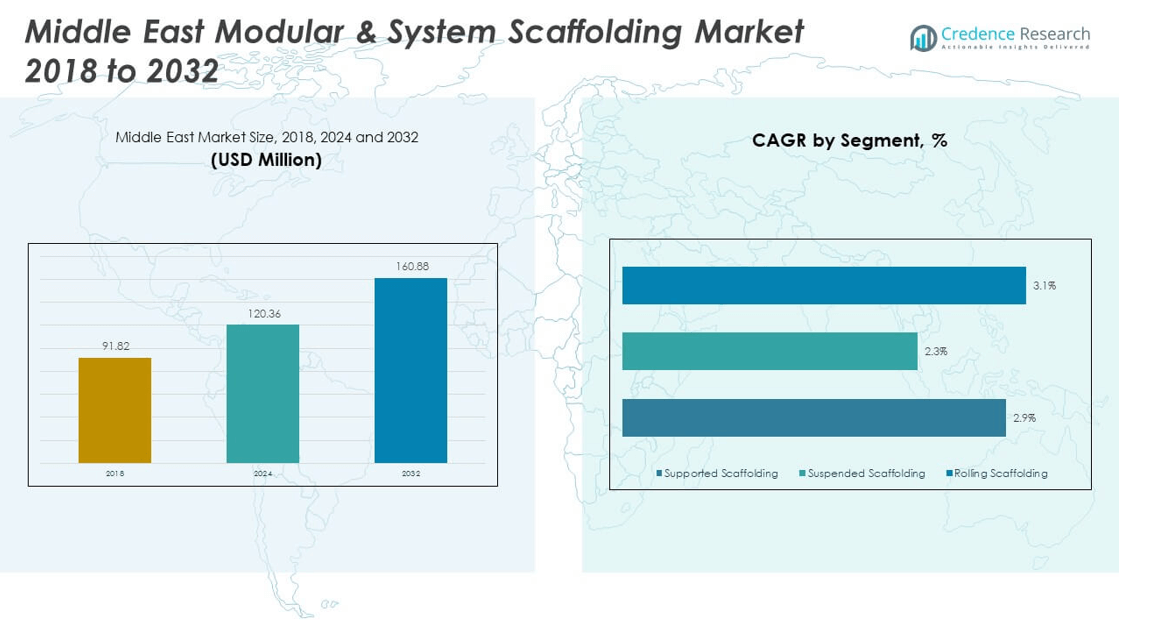

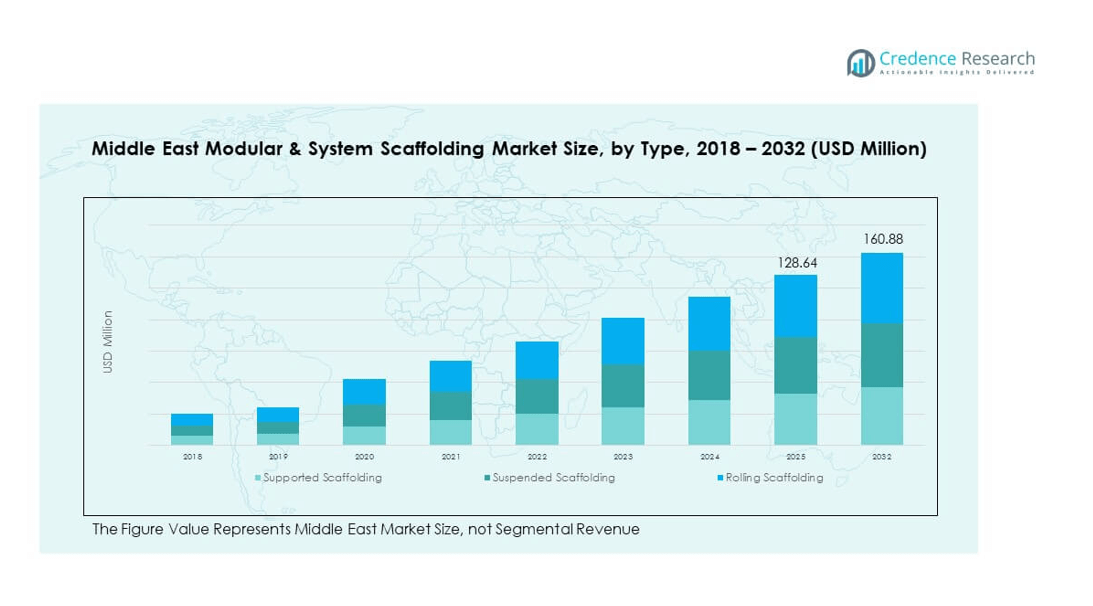

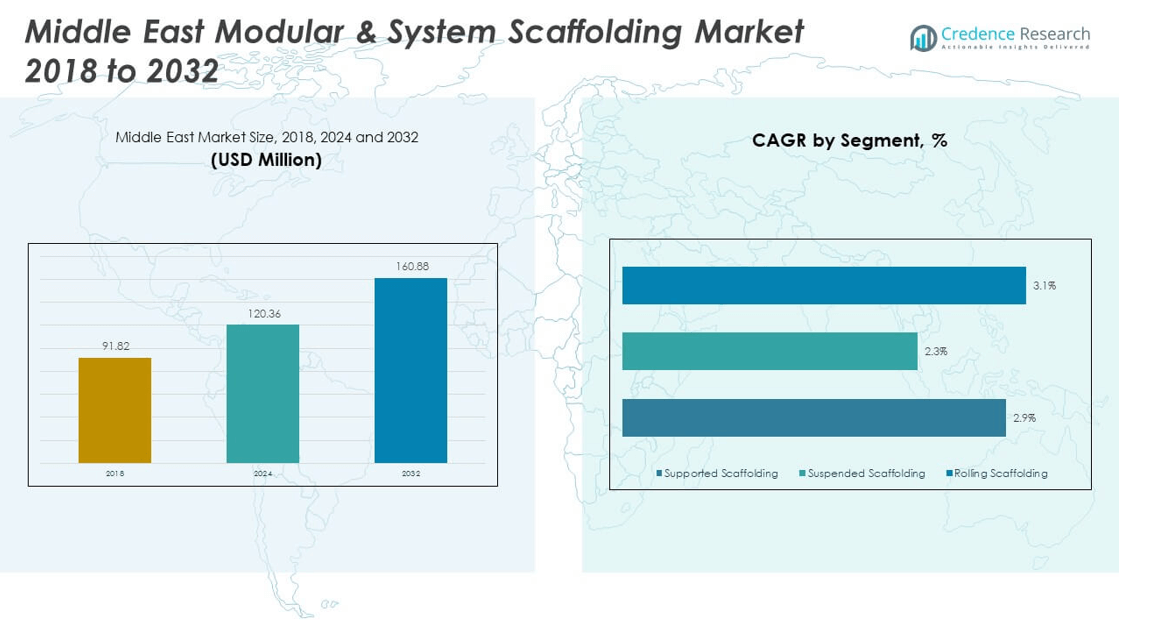

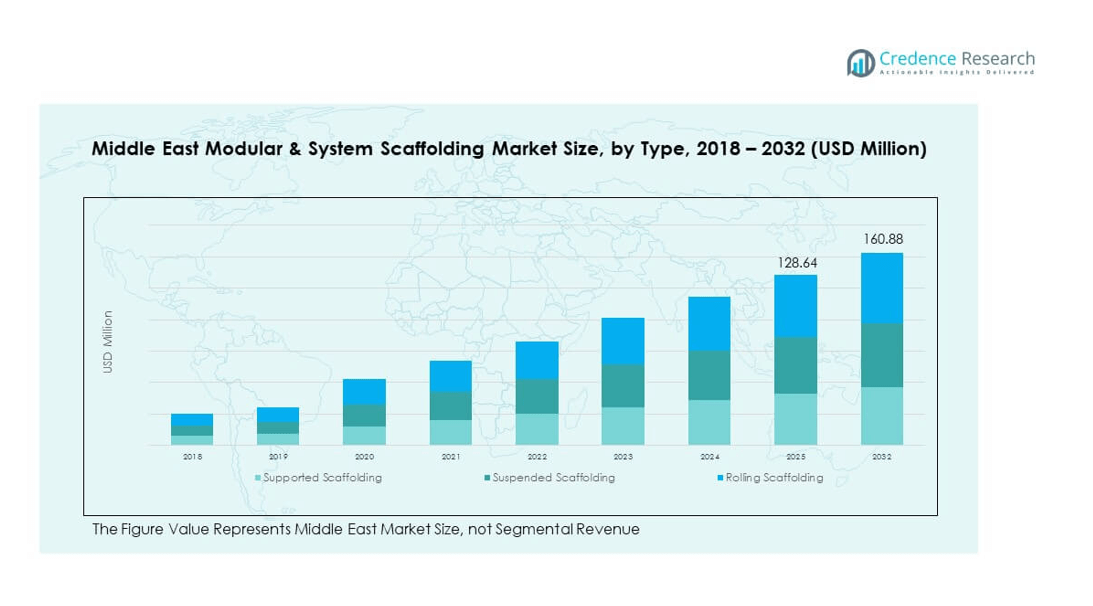

The Middle East Modular & System Scaffolding Market size was valued at USD 91.82 million in 2018 to USD 120.36 million in 2024 and is anticipated to reach USD 160.88 million by 2032, at a CAGR of 3.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Modular & System Scaffolding Market Size 2024 |

USD 120.36 million |

| Middle East Modular & System Scaffolding Market, CAGR |

3.20% |

| Middle East Modular & System Scaffolding Market Size 2032 |

USD 160.88 million |

The market growth is primarily driven by increased infrastructure development across the Middle East, particularly in commercial, industrial, and oil & gas sectors. Governments are heavily investing in smart city projects, airport expansions, and tourism-related infrastructure, which significantly boosts the demand for modular and system scaffolding solutions. Moreover, the rising preference for modular scaffolding over traditional systems due to its safety, efficiency, and adaptability in complex construction environments is further fueling adoption across the region.

Geographically, countries such as the United Arab Emirates and Saudi Arabia dominate the market due to their large-scale construction projects and strong urban development initiatives. Qatar and Oman are emerging as high-potential markets owing to increasing industrial investments and infrastructure modernization. These nations are actively pursuing economic diversification plans, which in turn spur construction activity and enhance demand for modular scaffolding systems. The market remains highly responsive to national development goals and urbanization trends across the region.

Market Insights:

- The Middle East Modular & System Scaffolding Market was valued at USD 120.36 million in 2024 and is expected to reach USD 160.88 million by 2032, growing at a CAGR of 3.20%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Strong infrastructure investment across UAE and Saudi Arabia drives market expansion, especially in transport, real estate, and industrial zones.

- Modular scaffolding gains traction due to its adaptability, safety compliance, and reduced installation time in high-rise and complex projects.

- Price fluctuations in raw materials like steel and aluminum pose a challenge to cost stability for scaffolding manufacturers and suppliers.

- The UAE leads the regional market with 34% share, followed by Saudi Arabia with 30%, supported by government-backed mega projects.

- Smaller markets such as Qatar, Oman, and Kuwait show rising adoption of modular systems driven by new industrial and logistics investments.

- Uneven labor training standards and workforce dependency in certain regions restrict consistent quality in scaffolding installation and safety compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government-led infrastructure expansion is accelerating scaffolding system demand across the Middle East

Governments across the Middle East are heavily investing in infrastructure modernization to diversify their economies. Large-scale projects such as new airports, metros, bridges, and stadiums demand advanced scaffolding solutions for timely and safe completion. The Middle East Modular & System Scaffolding Market benefits from this strong pipeline of civil construction. It gains momentum from government-backed urban transformation plans like Saudi Vision 2030 and UAE’s smart city initiatives. Contractors prefer modular systems for their flexibility and speed on complex projects. The rise in residential and commercial high-rises reinforces the demand for high-performance scaffolding solutions. It creates a stable foundation for sustained growth in the construction equipment industry.

- For instance, PERI UP Flex is a BIM-planned modular scaffold system featuring a 25 cm/50 cm uniform grid, gravity-lock ledger nodes, and self-locking deck components enhancements documented to support rapid assembly, high load capacity, and improved safety in complex industrial installations.

Industrial diversification is fueling adoption of modular scaffolding in oil, gas, and manufacturing

With regional economies diversifying beyond oil, new industrial facilities are expanding across key Middle Eastern countries. Modular scaffolding is vital for plant construction, routine maintenance, and shutdown operations. It supports safety and compliance in energy-intensive industries. The Middle East Modular & System Scaffolding Market finds increased relevance in petrochemical, manufacturing, and power generation sectors. It meets the stringent safety standards required in these environments. Companies prefer modular scaffolding to reduce downtime during inspections and repair works. Industrial megaprojects such as refineries and desalination plants consistently generate recurring demand. These factors collectively enhance the market’s position across the industrial segment.

Rising adoption of modern construction practices promotes modular system integration

Construction firms across the region are shifting toward modern practices like prefabrication and modular construction. These methods require scaffolding systems that can integrate seamlessly into accelerated workflows. The Middle East Modular & System Scaffolding Market aligns with this shift by offering faster assembly, modularity, and reduced labor requirements. It gains traction among international contractors with time-bound project deliverables. Construction firms reduce dependence on traditional tube-and-coupler systems due to inefficiency and higher risk. Modern scaffolding ensures better worker safety, efficiency, and adaptability to irregular structures. It becomes a core element of streamlined site management practices.

- For instance, Altrad RMD Kwikform’s Kwikstage (also branded as QuickStage) modular scaffolding system uses captive wedge connections and standardized components to enable efficient, safe erection and removal.

Stringent safety regulations are reinforcing the need for engineered scaffolding systems

Regulatory authorities across the Middle East have tightened worker safety norms on construction sites. Non-compliance penalties and mandatory certifications drive contractors toward high-quality scaffolding. The Middle East Modular & System Scaffolding Market responds with engineered systems that adhere to international safety standards. It minimizes on-site accidents and promotes safe access for workers at height. Developers prioritize certified scaffolding to comply with occupational safety frameworks. The trend is particularly strong in high-rise projects, industrial plants, and infrastructure works. Modular systems also enable easier inspection and documentation for regulatory audits. Safety compliance, once a liability, is now a strategic priority for developers.

Market Trends:

Rental model adoption is reshaping procurement strategies in scaffolding services

Construction firms are increasingly shifting toward renting modular scaffolding rather than owning it. The cost advantages and operational flexibility make rentals a preferred choice for short-term or phased projects. Rental companies provide trained labor, compliance assurance, and maintenance support. The Middle East Modular & System Scaffolding Market sees a growing presence of rental-focused players meeting localized demand. It reflects a change in capital expenditure strategies by both public and private builders. Equipment rental reduces the burden of asset management and depreciation. Market stakeholders respond by expanding rental fleets with newer modular systems. The trend enhances market competitiveness and efficiency.

Digital site management tools are influencing scaffolding deployment and monitoring

Digital transformation in construction is extending to scaffolding planning and monitoring. Software tools now support digital modeling, erection planning, and structural analysis. The Middle East Modular & System Scaffolding Market aligns with this shift by offering compatibility with Building Information Modeling (BIM). It helps project managers visualize scaffold positions and improve safety compliance. Digital monitoring improves inspection traceability and project scheduling. The adoption of smart tags and sensors enhances real-time status tracking. Digital integration leads to reduced errors and better site coordination. The scaffolding market gradually adopts tech-enabled workflows for large-scale operations.

Sustainability priorities are driving interest in recyclable and reusable scaffold materials

Construction companies face pressure to reduce waste and embrace sustainable practices. Modular scaffolding systems support these efforts through reuse and recyclability. The Middle East Modular & System Scaffolding Market experiences growing demand for eco-efficient scaffolds with longer lifecycle value. It responds with lightweight materials and modular frames that reduce environmental load. Sustainability metrics now influence procurement decisions for public and private projects. Aluminum and galvanized steel systems align with low-emission goals. Market participants promote green credentials as part of their value proposition. Environmental regulations and client expectations fuel this structural shift.

- For instance, Tilon Composites’ Supadek plastic scaffold boards are made from over 95% recycled polymer composites reinforced with glass fibre, fully compliant with BS 2482, TG20, and EN 12811 standards. The boards offer exceptional durability, resistance to corrosion and environmental degradation, and an estimated service life exceeding nine years.

Workforce shortages are accelerating demand for user-friendly scaffold systems

Skilled labor shortages across the construction sector are prompting companies to seek simplified systems. Modular scaffolding offers rapid installation and dismantling without requiring specialized skills. The Middle East Modular & System Scaffolding Market benefits from this shift toward user-centric designs. It enhances productivity while reducing worker fatigue and error. The modular approach improves speed, which is critical for tight project timelines. Safety is also easier to maintain when scaffold systems are less complex. Simplified systems attract smaller contractors who lack technical workforce capacity. The demand for user-friendly scaffolds will continue as labor gaps widen.

- For instance, Instant Upright’s Span 400 is a lightweight aluminum mobile tower system certified to EN 1004 for indoor use, with platform heights up to 6 m and quick-move assembly via Rib‑Grip connections and snap-lock braces.

Market Challenges Analysis:

High dependency on labor quality affects scaffold safety and installation consistency

Despite the growth in demand, labor-related issues continue to challenge consistent scaffold deployment. Improper installation practices due to unskilled labor increase site risks and reduce the reliability of scaffolding systems. The Middle East Modular & System Scaffolding Market often depends on a migrant workforce with variable training standards. It makes safety management more difficult for contractors operating on tight deadlines. Ensuring adherence to specifications and safety standards becomes harder when labor turnover is high. Regional disparities in training programs and licensing contribute to inconsistent results. These gaps can delay projects and increase the potential for accidents. A fragmented approach to workforce development impairs scaffold system performance.

Fluctuating raw material prices and supply chain constraints hinder cost predictability

Steel and aluminum prices remain volatile due to global supply disruptions and regional import dependency. These fluctuations directly impact the pricing of modular scaffolding systems. The Middle East Modular & System Scaffolding Market struggles to maintain cost predictability across projects with long execution cycles. Uncertainty around material availability adds risk for contractors and rental providers. Currency fluctuations and trade restrictions further compound procurement issues. Delays in delivery and cost escalations strain profit margins and contract compliance. Smaller players face more difficulty in absorbing these shocks. Price instability undermines long-term planning and affects supplier-client trust.

Market Opportunities:

Smart city projects and tourism-driven infrastructure unlock new scaffolding applications

Regional initiatives focused on smart cities and cultural tourism are driving novel construction activity. These projects create diverse use cases for modular scaffolding beyond conventional building sites. The Middle East Modular & System Scaffolding Market gains ground in transport hubs, entertainment zones, and heritage site restorations. It meets the flexible requirements of high-profile, design-intensive projects. Scaffolding systems designed for quick assembly and aesthetic integration find increased uptake. National development plans across Gulf countries sustain strong demand across verticals.

Private sector investments in logistics and warehousing create steady project volumes

Private developers are expanding logistics parks and warehouse networks across the Middle East. These projects involve repetitive yet large-scale structural work, ideal for modular scaffolding. The Middle East Modular & System Scaffolding Market benefits from growing activity in e-commerce, distribution, and retail sectors. It supports multi-phase development cycles with consistent scaffolding requirements. Rising demand for safe, modular access solutions in logistics facilities creates recurring business for equipment suppliers.

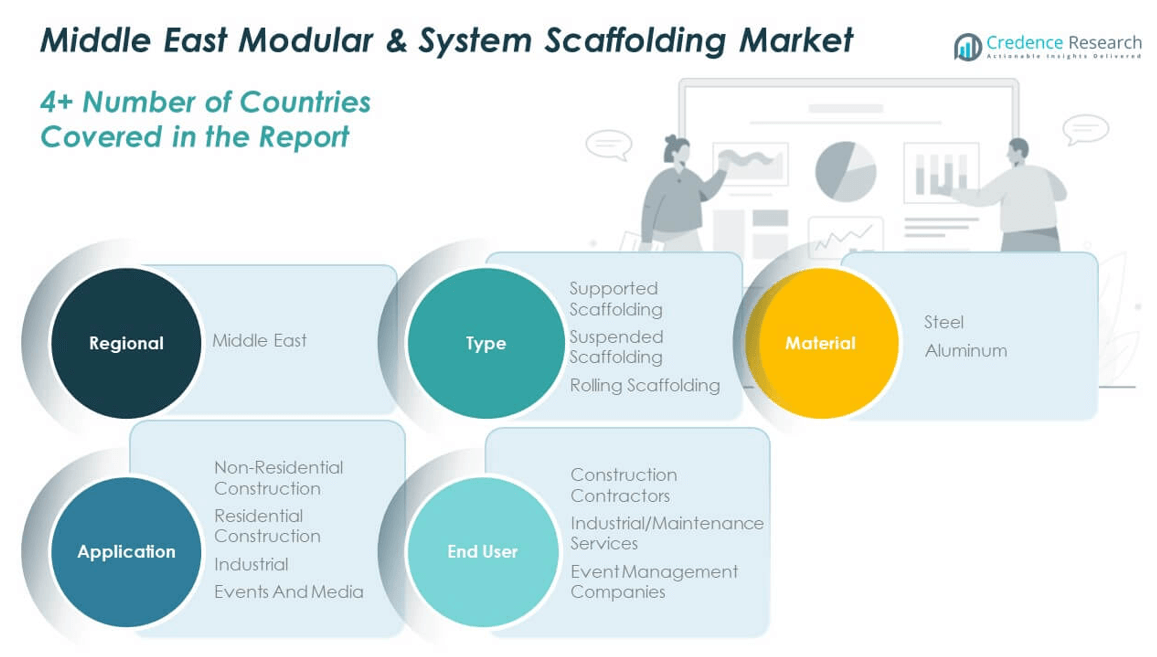

Market Segmentation Analysis:

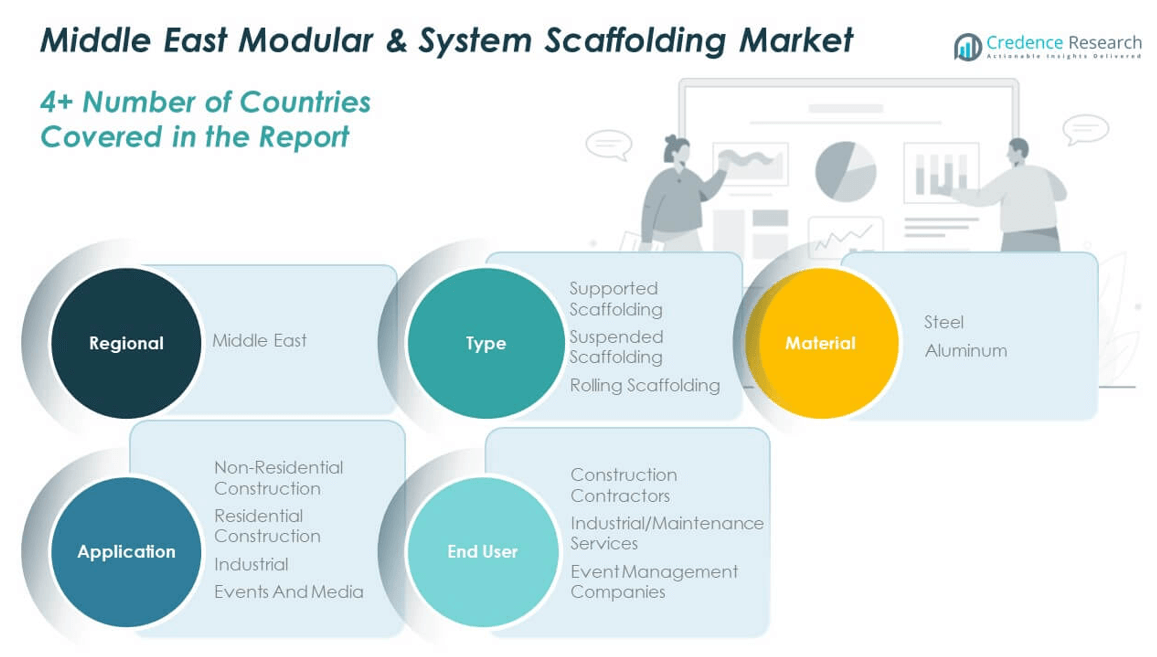

By type, supported scaffolding holds the largest share due to its wide applicability in large-scale infrastructure and commercial projects. Suspended scaffolding finds greater use in high-rise construction and maintenance of tall structures, particularly in urban centers. Rolling scaffolding caters to flexible, low-height projects and remains favored in event setups and indoor industrial work.

- For instance, the Burj Khalifa exterior is serviced via a façade access system designed by CoxGomyl in collaboration with Alimak’s façade access expertise. Alimak systems including mast climbers and transport platforms offer capacities up to about 2 000 kg and speeds of 12–24 m/min per unit.

By material, steel dominates the Middle East Modular & System Scaffolding Market due to its strength, load-bearing capacity, and suitability for harsh environments. Aluminum is gaining traction in projects that prioritize lightweight structures and quicker installation, particularly in confined or mobile workspaces.

- For instance, Cuplock is a modular steel scaffolding system with a patented cup-and-blade locking node that enables rapid, secure assembly and support for high vertical loads. It is widely used in petrochemical and oil & gas facilities due to its robust structural capacity and corrosion-resistant hot-dip galvanization.

By application, non-residential construction leads the market share due to the region’s ongoing development of airports, malls, stadiums, and hospitality infrastructure. Industrial applications follow, with high demand from oil and gas, power, and manufacturing sectors. Residential construction remains steady, supported by urban housing initiatives. Events and media segments use modular scaffolding for temporary structures, lighting setups, and stage assemblies.

By end user, construction contractors form the core customer base, driving volume demand through new builds and infrastructure upgrades. Industrial and maintenance service providers utilize scaffolding for operational safety and maintenance activities in factories, refineries, and plants. Event management companies contribute niche demand, emphasizing modularity and ease of assembly for temporary installations. Each segment contributes distinct requirements, shaping the competitive offerings in the region.

Segmentation:

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material

By Application

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region

- GCC

- Turkey

- Israel

- Rest of Middle East

Regional Analysis:

Regional Analysis – Middle East Modular & System Scaffolding Market

The United Arab Emirates holds the largest share of the Middle East Modular & System Scaffolding Market, accounting for 34% of the regional market. The country maintains this lead due to continuous investments in infrastructure, commercial high-rises, and tourism-related mega-projects. Dubai and Abu Dhabi continue to see strong activity in airport expansions, hospitality, and real estate, driving consistent demand for modular scaffolding solutions. It also benefits from high safety standards and adoption of advanced construction techniques, encouraging the use of modern scaffolding systems. The strong presence of global construction firms and favorable project financing further support market growth. The UAE’s construction pipeline remains resilient, driven by national diversification agendas.

Saudi Arabia follows with a 30% market share, supported by its large-scale urban transformation under Vision 2030. Major projects such as NEOM, Qiddiya, and The Red Sea Project require extensive scaffolding deployment across infrastructure, entertainment, and industrial zones. The Middle East Modular & System Scaffolding Market in Saudi Arabia benefits from the high volume of publicly funded developments and the scale of operations involved. It gains traction due to strict regulatory frameworks and increased emphasis on site safety and productivity. The influx of international contractors and technology providers accelerates system standardization. The kingdom continues to dominate long-term project pipelines in the region.

Qatar, Kuwait, and Oman collectively account for 23% of the regional market, while Bahrain and others contribute the remaining 13%. Qatar’s infrastructure upgrades ahead of global events and its expanding energy sector support consistent scaffolding requirements. In Kuwait, oil and gas developments and healthcare infrastructure fuel the need for modular systems. Oman’s steady growth in logistics and utilities also contributes to regional demand. The Middle East Modular & System Scaffolding Market finds new opportunities in emerging cities, industrial parks, and cross-border projects. It remains responsive to public-private partnerships and export-oriented infrastructure schemes. Regional collaboration and investment in training standards improve scaffolding system usage across these smaller but active markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arabian Spar

- Finomax Scaffolding

- ABN Scaffolding

- Arab Contractors

- Aljalama Contracting

- Spar Steel

- Al Jonoub Scaffolding

- Dubai Scaffolding Company

- Al Bader Scaffolding

- Al Rajhi Scaffolding

Competitive Analysis:

The Middle East Modular & System Scaffolding Market features a competitive landscape with both international and regional players. Key companies include PERI Group, Layher, Altrad Group, and ULMA Construction, each offering advanced modular systems tailored for complex project demands. It reflects high competition based on system quality, safety compliance, rental services, and customization. Leading firms invest in expanding rental fleets, enhancing digital integration, and improving on-site technical support. Regional firms compete by offering cost-effective solutions and localized services. Strategic collaborations and long-term contracts with large construction firms help major players maintain market presence. The market sees consistent innovations in lightweight materials, reusable components, and safety mechanisms.

Recent Developments:

- In May 2025, Arabian Spar expanded its presence with the opening of a new flagship SPAR Express store at KAFD Metro Station in Riyadh, Saudi Arabia, focusing on modern food convenience solutions for commuters and urban travelers. This opening reflects the company’s broader strategy of targeting high-traffic urban locations with innovative retail experiences.

- In April 2025, Arab Contractors entered into a significant strategic alliance with China State Construction Engineering Corporation (CSCEC) to collaborate on landmark project developments across Africa. This partnership aims to leverage both firms’ expertise for high-profile infrastructure works in Egypt’s industrial zones and other regions of the continent.

Market Concentration & Characteristics:

The Middle East Modular & System Scaffolding Market is moderately consolidated, with a few dominant players controlling a significant share. It exhibits high demand from infrastructure, industrial, and commercial construction sectors, creating steady growth opportunities. The market favors companies that provide integrated solutions, including design, installation, maintenance, and rental. It demands high safety standards and product certifications, especially in industrial and high-rise applications. International players leverage strong brand equity, while regional firms benefit from pricing flexibility and local compliance. The market values durability, modularity, and efficiency over traditional scaffolding approaches. Rapid urbanization and regulatory enforcement shape product adoption patterns.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness steady demand growth due to continued infrastructure development across Gulf countries.

- Smart city initiatives and large-scale tourism projects will expand opportunities for modular scaffolding providers.

- Industrial megaprojects in oil, gas, and manufacturing sectors will generate recurring need for advanced scaffolding systems.

- Integration with digital tools like BIM and scaffold design software will become more widespread among top contractors.

- The rental model will gain further traction, especially among mid-sized construction firms seeking cost control.

- Stricter safety regulations will accelerate the shift from traditional to engineered modular systems.

- Sustainable scaffolding materials and reusable designs will see increased preference in public and private tenders.

- Demand for user-friendly systems will grow amid regional labor shortages and productivity goals.

- Emerging markets like Oman, Kuwait, and Bahrain will experience stronger adoption due to expanding infrastructure.

- Long-term supplier partnerships and localization strategies will define competitive advantage in the region.