Market Overview

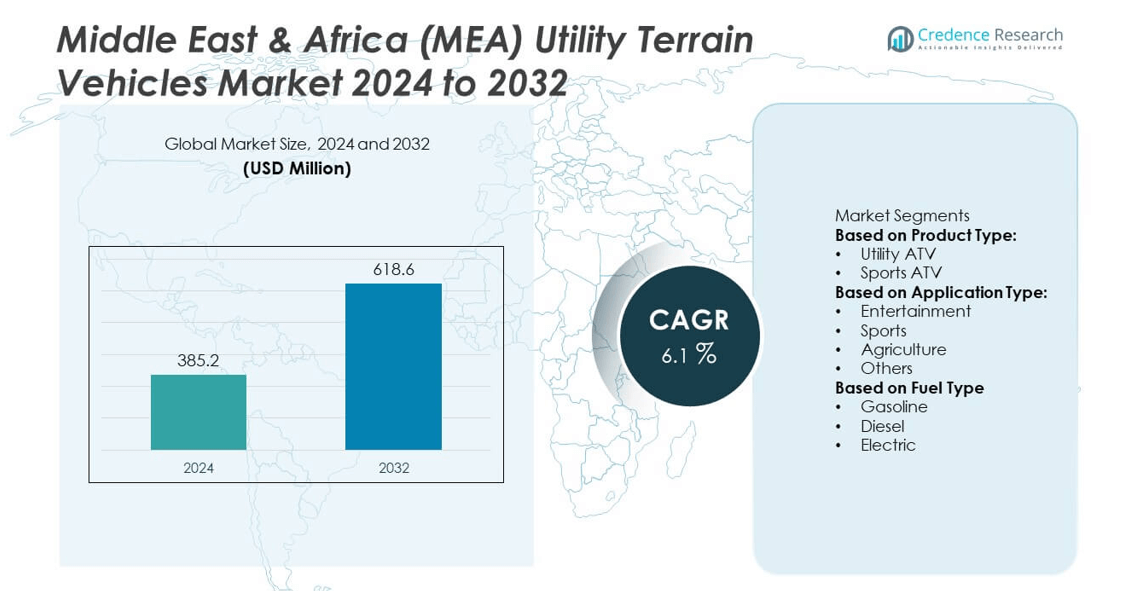

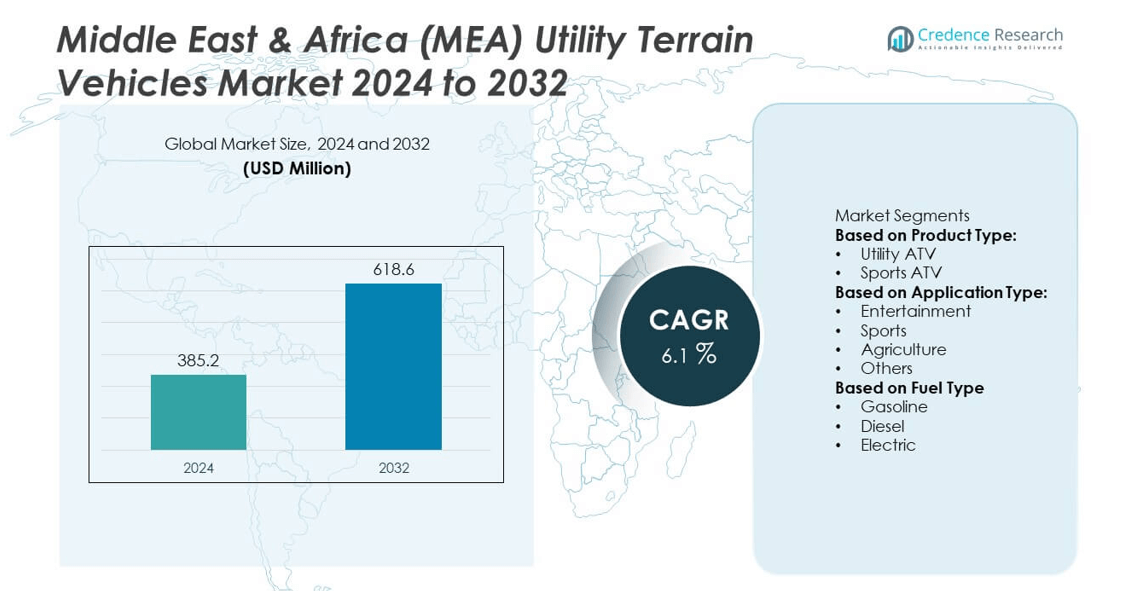

The Middle East & Africa (MEA) Utility Terrain Vehicles (UTV) Market was valued at USD 385.2 million in 2024 and is projected to reach USD 618.6 million by 2032, expanding at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East & Africa (MEA) Utility Terrain Vehicles Market Size 2024 |

USD 385.2 million |

| Middle East & Africa (MEA) Utility Terrain Vehicles Market, CAGR |

6.1% |

| Middle East & Africa (MEA) Utility Terrain Vehicles Market Size 2032 |

USD 618.6 million |

The Middle East & Africa (MEA) Utility Terrain Vehicles Market grows steadily with strong drivers linked to agriculture, mining, construction, and defense sectors where UTVs enhance productivity and mobility across challenging terrains. Rising demand for recreational activities, including desert safaris and off-road tourism, further strengthens adoption in Gulf countries.

The Middle East & Africa (MEA) Utility Terrain Vehicles Market demonstrates strong geographical diversity, with South Africa leading in mining and agriculture applications, supported by UTVs that handle rugged terrains and enhance productivity in large-scale operations. Saudi Arabia and the United Arab Emirates showcase growing demand driven by construction projects, defense mobility needs, and thriving recreational tourism sectors such as desert safaris and off-road racing. Turkey adds balance with agriculture, defense, and construction contributing to steady growth. The market is shaped by leading players such as Polaris, Inc., Yamaha Motor Co., Ltd., Honda Motor Co. Ltd., and Kawasaki Heavy Industries, Ltd., each focusing on product innovation, regional distribution networks, and hybrid or electric UTV introductions. Their strategies combine advanced engineering, fuel efficiency, and durability to meet industrial and leisure demands.

Market Insights

- The Middle East & Africa (MEA) Utility Terrain Vehicles Market was valued at USD 385.2 million in 2024 and is projected to reach USD 618.6 million by 2032, expanding at a CAGR of 6.1% during the forecast period.

- Growing demand from agriculture, mining, and construction sectors drives adoption, as UTVs improve operational efficiency, haul loads, and support mobility across uneven and rugged terrains.

- Key market trends include rising recreational use in desert tourism and off-road sports, along with an increasing shift toward electric and hybrid UTVs that align with sustainability goals.

- Competitive dynamics are shaped by leading manufacturers such as Polaris, Yamaha, Honda, and Kawasaki, which focus on durable designs, advanced safety features, and region-specific models to strengthen presence.

- Market restraints include high equipment costs, limited access to financing options, and challenges related to availability of spare parts and after-sales services in remote areas.

- Regional dynamics highlight South Africa’s strong demand in mining and agriculture, Saudi Arabia and UAE’s growth driven by defense and tourism, and Turkey’s balanced contributions from farming and construction sectors.

- The market continues to expand through government-backed infrastructure projects, increasing recreational investments, and partnerships between global manufacturers and local distributors to ensure accessibility across the MEA region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Agriculture and Farming Activities

The Middle East & Africa (MEA) Utility Terrain Vehicles Market grows steadily with rising demand from agriculture and farming. UTVs serve as efficient alternatives to traditional tractors for transporting equipment, feed, and workers across large farmlands. It offers flexibility, speed, and durability, which supports daily farm operations. In countries such as South Africa and Nigeria, commercial farms integrate UTVs to improve productivity in crop management and livestock handling. Farmers adopt them for their ability to navigate uneven terrains and withstand long working hours. This expanding use in agriculture strengthens the foundation of UTV adoption across the region.

- For instance, John Deere introduced its Gator XUV835M model with a 907 kg towing capacity and 454 kg cargo box load rating, which has been deployed in African farms to streamline irrigation and livestock transport operations. This expanding use in agriculture strengthens the foundation of UTV adoption across the region.

Expansion in Mining and Natural Resource Projects

The Middle East & Africa (MEA) Utility Terrain Vehicles Market benefits from large-scale mining and resource exploration projects. Mining hubs in South Africa, Botswana, and Zambia require reliable vehicles for transportation in rugged and hazardous terrains. UTVs are favored for their load-bearing capacity and maneuverability in narrow passages. It enables safe and efficient movement of workers, tools, and materials within mine sites. Mining companies prioritize UTVs for their adaptability to challenging conditions and relatively low maintenance costs. The consistent expansion of mining operations creates a stable demand base for UTVs in MEA.

- For instance, Polaris deployed its RANGER XP 1000 models, each with a payload capacity of 680 kg and ground clearance of 33 cm, in South African mining operations to enhance mobility and reduce downtime in underground and open-pit sites. The consistent expansion of mining operations creates a stable demand base for UTVs in MEA.

Rising Infrastructure Development and Construction Activities

The Middle East & Africa (MEA) Utility Terrain Vehicles Market gains momentum from growing infrastructure and construction projects. Governments across the Gulf countries and Africa invest heavily in urban development, transportation networks, and renewable energy projects. UTVs play an important role on construction sites by facilitating movement of personnel, supplies, and equipment across uneven landscapes. It offers a cost-effective solution for managing site operations quickly and efficiently. Contractors adopt UTVs for their ability to reduce downtime and support demanding workloads. This driver links directly to rising construction spending and infrastructure modernization across the region.

Increasing Popularity in Recreational and Tourism Activities

The Middle East & Africa (MEA) Utility Terrain Vehicles Market also expands through rising recreational and tourism use. Adventure tourism destinations in the UAE, Saudi Arabia, and South Africa promote UTV rides for desert safaris, wildlife tours, and off-road experiences. It enhances the visitor experience with safe yet thrilling mobility in challenging environments. Resorts and travel operators invest in UTV fleets to attract tourists seeking adventure-based activities. This recreational adoption creates new opportunities for UTV manufacturers to diversify offerings. The growth of outdoor and leisure industries in MEA strengthens the long-term prospects for UTV demand.

Market Trends

Shift Toward Electrification and Sustainable Mobility

The Middle East & Africa (MEA) Utility Terrain Vehicles Market reflects a growing trend toward electric and hybrid UTV models. Manufacturers introduce battery-powered options to reduce emissions and fuel costs while supporting sustainability goals in Gulf nations. It appeals to industries such as tourism and agriculture, where quiet operation and efficiency are valued. Governments encourage adoption of low-emission vehicles through clean energy initiatives. Improved battery technologies extend range and durability, making electric UTVs more viable for daily operations. This transition toward electrification strengthens the market’s long-term sustainability outlook.

- For instance, Polaris launched the RANGER XP Kinetic with a 110-horsepower electric motor and a towing capacity of 1,134 kg, delivering up to 130 km of range per charge, a model already deployed in eco-tourism reserves in UAE. This transition toward electrification strengthens the market’s long-term sustainability outlook.

Adoption of Smart Features and Connectivity Solutions

The Middle East & Africa (MEA) Utility Terrain Vehicles Market evolves with the integration of advanced digital features. GPS tracking, telematics, and IoT-enabled dashboards are being added to enhance safety and fleet management. It allows operators in mining, defense, and agriculture to monitor vehicle usage and optimize performance. Connectivity solutions provide real-time data on fuel consumption, terrain navigation, and vehicle health. Smart technologies also support predictive maintenance and improved operational planning. The adoption of these features positions UTVs as intelligent mobility tools beyond traditional off-road applications.

- For instance, Yamaha’s Wolverine RMAX2 1000 integrates the Adventure Pro GPS system, which provides terrain mapping and fleet diagnostics with 7-inch touchscreen navigation, already applied in Middle Eastern safari fleet operations handling 15+ UTVs simultaneously.

Customization to Meet Industry-Specific Demands

The Middle East & Africa (MEA) Utility Terrain Vehicles Market shows an increasing trend of customization across end-user segments. Farmers require attachments such as sprayers, cargo carriers, and seed spreaders, while defense agencies demand armored and tactical designs. It extends to recreational users who prefer models equipped with safety kits, luxury seating, and performance enhancements. Industrial buyers seek high-payload UTVs tailored for construction and logistics. Manufacturers respond by offering modular designs that adapt to sector-specific requirements. This trend ensures broader adoption by meeting the diverse needs of regional industries.

Rising Recreational Adoption and Off-Road Tourism

The Middle East & Africa (MEA) Utility Terrain Vehicles Market grows with rising interest in recreational and off-road tourism. Desert safaris in the UAE, dune racing in Saudi Arabia, and wildlife tours in South Africa feature UTVs as central attractions. It creates strong opportunities for manufacturers to supply high-performance and durable recreational models. Resorts and tour operators invest in UTV fleets to meet the growing adventure tourism demand. Organized motorsport events and off-road rallies further highlight UTV capabilities in competitive settings. This rising adoption strengthens the role of UTVs as lifestyle and leisure vehicles in the MEA region.

Market Challenges Analysis

High Costs and Affordability Barriers Across Emerging Economies

The Middle East & Africa (MEA) Utility Terrain Vehicles Market faces challenges from high upfront costs and limited affordability in many regional economies. Premium pricing of advanced models restricts access for small-scale farmers, contractors, and recreational buyers. Import duties and logistics expenses increase overall vehicle costs, making them less attractive compared to traditional alternatives. It creates reliance on refurbished or second-hand UTVs in lower-income markets, limiting new sales growth. Limited availability of financing options further narrows accessibility for rural and small business users. This affordability gap slows the pace of large-scale adoption across the region.

Infrastructure Gaps and Service Limitations in Remote Areas

The Middle East & Africa (MEA) Utility Terrain Vehicles Market also struggles with infrastructure and after-sales service limitations. Remote areas lack sufficient dealership networks, spare parts availability, and skilled technicians to maintain UTV fleets. It increases operational downtime for industries such as mining, defense, and agriculture where reliability is critical. Harsh desert and off-road conditions add wear and tear, raising maintenance needs and repair costs. Limited fuel stations and absence of charging infrastructure in rural regions further challenge the adoption of conventional and electric UTVs. These operational barriers reduce buyer confidence and constrain long-term market expansion.

Market Opportunities

Growth Potential in Agriculture, Mining, and Construction Projects

The Middle East & Africa (MEA) Utility Terrain Vehicles Market holds strong opportunities from expanding use in agriculture, mining, and construction. Farmers adopt UTVs for crop management, irrigation support, and transport of tools across large farmlands, improving operational efficiency. Mining operations in South Africa, Zambia, and Botswana create sustained demand for durable UTVs capable of navigating rugged conditions. It also gains traction in large-scale construction projects across Gulf nations, where UTVs are valued for their role in logistics and on-site mobility. Growing investments in industrial projects across MEA ensure long-term adoption opportunities. Manufacturers focusing on durable and sector-specific designs can strengthen their position in these expanding sectors.

Rising Adoption of Electric Models and Adventure Tourism Applications

The Middle East & Africa (MEA) Utility Terrain Vehicles Market benefits from opportunities tied to the adoption of electric UTVs and growth in tourism. Governments across the UAE, Saudi Arabia, and South Africa promote sustainable mobility solutions, supporting demand for electric UTVs in farms, resorts, and wildlife reserves. It creates avenues for manufacturers to introduce low-maintenance and eco-friendly models suited for local conditions. Adventure tourism also drives demand, with desert safaris, dune racing, and wildlife expeditions showcasing UTVs as part of premium experiences. Resorts and tour operators expand fleets to cater to a growing base of adventure-seeking tourists. This dual opportunity in eco-friendly mobility and leisure markets enhances the long-term outlook for UTV adoption across MEA.

Market Segmentation Analysis:

By Product Type

The Middle East & Africa (MEA) Utility Terrain Vehicles Market divides into sport, work, and multi-purpose UTVs. Sport models record growing demand in tourism and recreational sectors, particularly in Gulf countries where desert safaris, dune bashing, and off-road racing attract domestic and international visitors. Work UTVs dominate usage in agriculture, construction, and mining, with their payload capacity and rugged design making them essential for daily operations. Multi-purpose models combine versatility with adaptability, catering to buyers who require vehicles for both functional and leisure activities. It shows steady growth across all categories, with work UTVs holding a leading share due to their direct role in industrial efficiency and mobility. Manufacturers expand offerings by targeting both productivity-focused buyers and lifestyle-driven consumers.

- For instance, John Deere’s Gator XUV835M offers a cargo box capacity of 454 kg and towing capacity of 907 kg, features that have been adopted in South African citrus farms covering over 20,000 hectares. Manufacturers expand offerings by targeting both productivity-focused buyers and lifestyle-driven consumers.

By Application Type

The Middle East & Africa (MEA) Utility Terrain Vehicles Market demonstrates diverse applications across agriculture, construction, mining, defense, and recreation. Agriculture represents a major contributor, with UTVs streamlining crop management, logistics, and irrigation tasks across large farms. Construction firms in countries like the UAE and Saudi Arabia integrate UTVs for workforce mobility and material handling on complex projects. Mining operations in South Africa and Botswana depend on UTVs for navigating harsh terrains and transporting personnel in confined environments. Defense agencies deploy specialized models for patrols, tactical missions, and logistics support. Recreational activities expand rapidly, as tour operators and resorts adopt UTV fleets to enhance off-road tourism experiences. It reflects strong demand across both industrial and leisure sectors, reinforcing UTVs as versatile mobility assets.

- For instance, Polaris Ranger Crew XP 1000 provides seating for six and offers a payload capacity of 726 kg, while its towing capacity reaches 1,134 kg—attributes that make it a popular choice for UAE safari operators deploying fleet vehicles for tourist groups.

By Fuel Type

The Middle East & Africa (MEA) Utility Terrain Vehicles Market segments into gasoline, diesel, and electric models. Gasoline UTVs remain the most widely used, favored for their affordability, availability, and ease of maintenance across both urban and rural regions. Diesel UTVs gain traction in heavy-duty applications such as mining, construction, and large-scale agriculture, where durability and torque are critical. Electric UTVs represent a growing segment, driven by sustainability initiatives in the UAE, Saudi Arabia, and South Africa, where quieter and low-emission vehicles are preferred in tourism, farming, and conservation projects. It shows potential growth in electrification as governments promote eco-friendly mobility and charging infrastructure begins to expand. Manufacturers invest in hybrid and electric options to address both regulatory compliance and rising demand for sustainable off-road solutions.

Segments:

Based on Product Type:

Based on Application Type:

- Entertainment

- Sports

- Agriculture

- Others

Based on Fuel Type

Based on the Geography:

- South Africa

- Saudi Arabia

- United Arab Emirates

- Turkey

Regional Analysis

South Africa

South Africa accounts for around 30% of the Middle East & Africa (MEA) Utility Terrain Vehicles Market, supported by strong industrial applications and recreational use. The country’s well-established mining industry creates consistent demand for UTVs designed to operate in hazardous and rugged environments. Agriculture also contributes significantly, with farmers using UTVs to transport equipment, manage crops, and streamline logistics across expansive farmlands. Tourism supports additional demand, particularly in wildlife reserves and game parks where UTVs are deployed for safaris and conservation activities. It benefits from an established distribution network, offering access to both new and refurbished models. Strong adoption across multiple industries positions South Africa as the single largest market in the region for UTVs.

Saudi Arabia

Saudi Arabia holds nearly 28% of the Middle East & Africa (MEA) Utility Terrain Vehicles Market, fueled by large-scale infrastructure development and the rapid growth of adventure tourism. Expanding construction projects under Vision 2030 drive strong demand for UTVs in logistics and site mobility, while agriculture in rural regions adds further adoption. Recreational demand is also rising, with desert tourism and off-road sports becoming popular leisure activities that rely on sport-oriented UTV models. Defense agencies in the country deploy tactical UTVs for patrol and mobility in remote desert areas, reinforcing institutional demand. It shows strong potential for electric and hybrid UTV adoption as Saudi Arabia emphasizes sustainability in transportation. The market continues to expand, driven by government investment and private sector involvement.

United Arab Emirates

The United Arab Emirates represents about 25% of the Middle East & Africa (MEA) Utility Terrain Vehicles Market, led by strong recreational and tourism-driven demand. The country’s desert safaris, off-road racing events, and luxury adventure tourism position UTVs as an essential part of leisure activities. Construction and real estate sectors also support adoption, as UTVs improve efficiency on large-scale development sites. Defense and security agencies contribute by integrating tactical models for mobility in border and desert operations. The UAE stands out as an early adopter of electric UTVs, supported by government programs encouraging sustainable mobility and eco-friendly tourism. It maintains a competitive edge with established dealerships and after-sales services that ensure reliability. This combination of leisure, industrial, and government demand sustains its strong position in the regional market.

Turkey

Turkey contributes roughly 17% of the Middle East & Africa (MEA) Utility Terrain Vehicles Market, supported by a balanced mix of agriculture, construction, and defense applications. The country’s extensive farmlands create steady demand for UTVs in crop management, irrigation, and rural logistics. Expanding urban development projects also drive adoption in the construction sector. Defense applications remain a key driver, with UTVs deployed in border patrol, tactical missions, and mobility support for military units. Recreational activities, though smaller in comparison, are gaining traction in rural and mountainous areas where UTVs enhance tourism and leisure. It benefits from a growing domestic distribution network and partnerships with international manufacturers, ensuring access to modern UTV models. Turkey’s steady adoption across industrial and institutional sectors ensures its long-term contribution to regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yamaha Motor Co., Ltd.

- Deere & Company

- Polaris, Inc.

- Suzuki Motor Corporation

- Kawasaki Heavy Industries, Ltd.

- Textron, Inc.

- Zhejiang CFMoto Power Co., Ltd.

- Honda Motor Co. Ltd.

- Bombardier Recreational Products, Inc.

- Kwang Yang Motor Company Ltd.

Competitive Analysis

The competitive landscape of the Middle East & Africa (MEA) Utility Terrain Vehicles Market is defined by global manufacturers leveraging innovation, regional distribution, and product adaptability to meet diverse industrial and recreational demands. Leading players include Polaris, Inc., Yamaha Motor Co., Ltd., Honda Motor Co. Ltd., Kawasaki Heavy Industries, Ltd., Suzuki Motor Corporation, Deere & Company, Bombardier Recreational Products, Inc., Textron, Inc., Kwang Yang Motor Company Ltd. (KYMCO), and Zhejiang CFMoto Power Co., Ltd. Polaris strengthens its position with rugged, high-performance models widely used in agriculture and mining, while Yamaha and Honda focus on versatile, fuel-efficient designs suited for farming and recreational use. Kawasaki and Suzuki emphasize durability and strong dealer networks across Gulf markets, and Deere & Company integrates UTVs into agricultural solutions tailored for large-scale operations. BRP and Textron target premium recreational and defense applications with advanced safety and performance features. KYMCO and CFMoto expand regional access through cost-effective models and partnerships with local distributors. Together, these companies compete by offering a balance of durability, efficiency, and innovation while expanding aftermarket services, hybrid offerings, and tailored solutions to strengthen adoption across industrial, defense, and leisure sectors in the MEA region.

Recent Developments

- In January 2025, Polaris, Inc. achieved a high-profile victory when the Sébastien Loeb Racing – RZR Factory Racing Team defended their SSV (Side‑by‑Side Vehicle) Dakar Rally title in Saudi Arabia using Polaris RZR Pro R vehicles.

- In August 2024, Polaris, Inc. reinforced its regional presence with enhancements across its RANGER lineup, including new trim options, refreshed styling, and extended warranties in the MEA region

- In April 2024, Polaris, Inc. expanded its MEA-specific lineup by introducing the 2025 Sportsman 570 2-up models, featuring upgraded trims like the Touring, X2, and six‑wheel 6×6 variants, designed for enhanced comfort and performance.

- In March 2023, Polaris, Inc. expanded product availability across the EMEA region with the introduction of the next-generation RZR XP at dealerships, emphasizing improved chassis strength and off-road durability for challenging terrains.

Market Concentration & Characteristics

The Middle East & Africa (MEA) Utility Terrain Vehicles Market demonstrates a moderately consolidated structure, where global manufacturers dominate through innovation, distribution reach, and brand strength while regional distributors support adoption across varied terrains. Leading companies such as Polaris, Yamaha, Honda, Kawasaki, and CFMoto hold significant influence by offering durable, high-performance UTVs tailored for agriculture, mining, defense, and recreational activities. It reflects characteristics of a demand-driven market shaped by industrial expansion, outdoor tourism, and government-led infrastructure projects. Premium brands focus on advanced safety systems, hybrid options, and rugged engineering, while cost-efficient models from Asian manufacturers attract small-scale farmers and adventure operators. Long product lifecycles and high maintenance costs highlight its premium positioning, supported by aftersales services and specialized dealer networks. The Middle East & Africa (MEA) Utility Terrain Vehicles Market continues to balance between niche luxury demand in Gulf economies and utility-focused applications in regions such as South Africa and Turkey, positioning it as both a functional and aspirational mobility segment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application Type, Fuel Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Middle East & Africa (MEA) Utility Terrain Vehicles Market will expand steadily with growing adoption in agriculture, mining, and construction.

- Demand for recreational and adventure tourism activities will strengthen the use of UTVs in Gulf countries and South Africa.

- Defense and security agencies will increase procurement of UTVs for patrol, logistics, and mobility across desert and border regions.

- Electric and hybrid UTVs will gain traction as sustainability and emission reduction policies advance in major economies.

- Premium global manufacturers will continue to dominate through advanced technology, safety integration, and customization for local terrains.

- Local distributors and dealer networks will play a critical role in improving accessibility and aftersales services.

- Rising consumer interest in motorsports and off-road leisure events will create new revenue opportunities.

- Infrastructure development projects will fuel utility-based adoption of UTVs across construction and industrial operations.

- South Africa, Saudi Arabia, UAE, and Turkey will remain the most influential regional hubs driving consistent growth.

- Long-term market stability will depend on balancing high upfront costs with financing options, leasing models, and service reliability.