Market Overview:

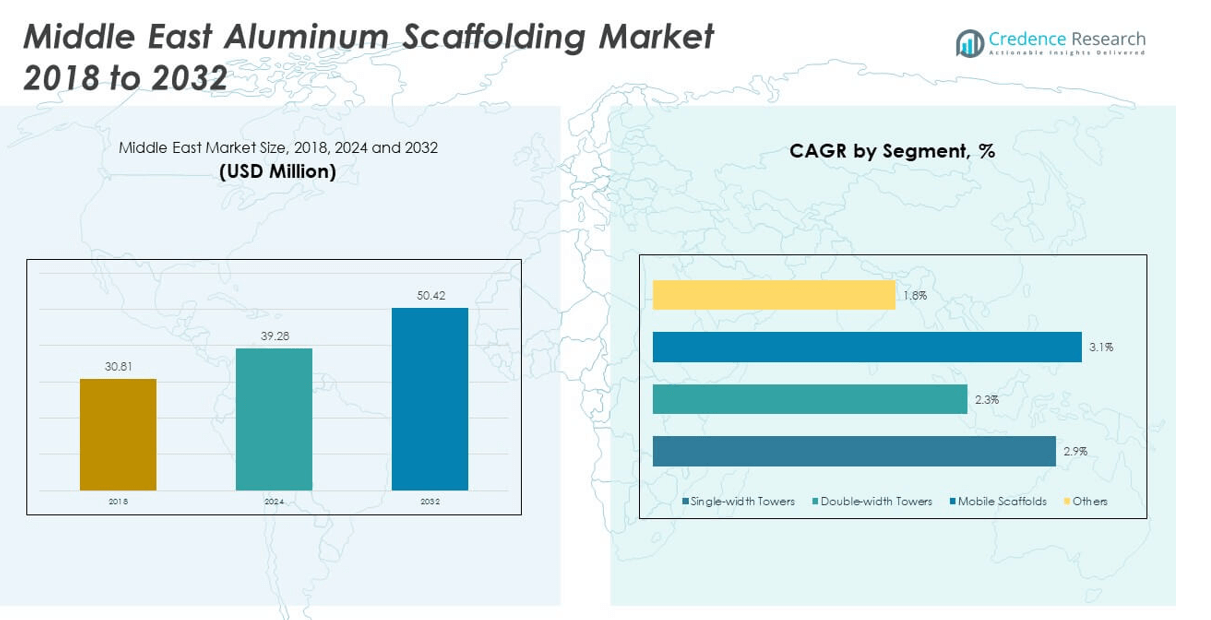

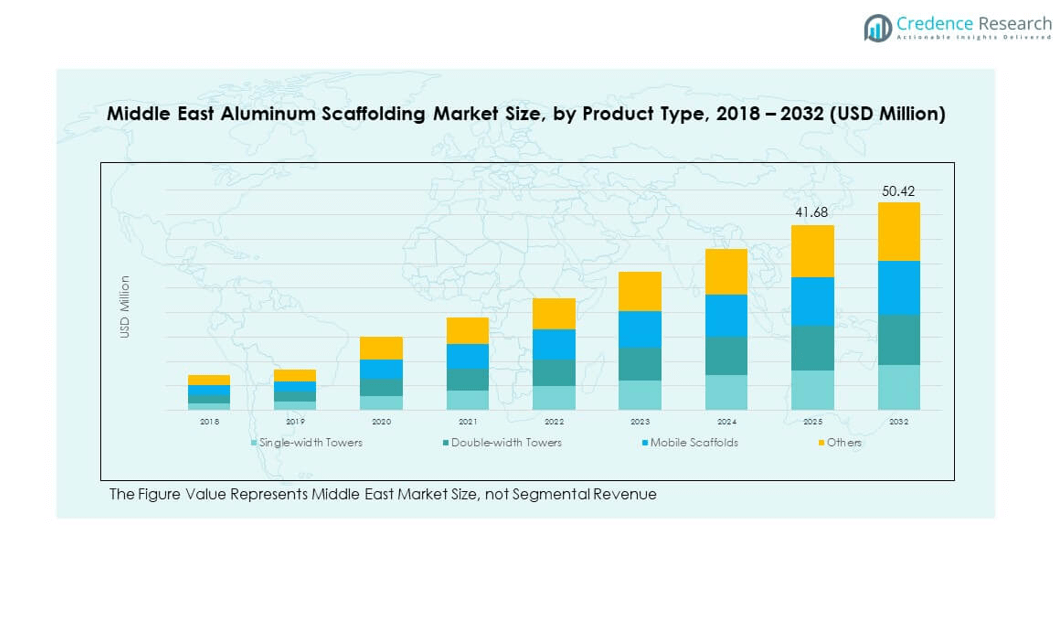

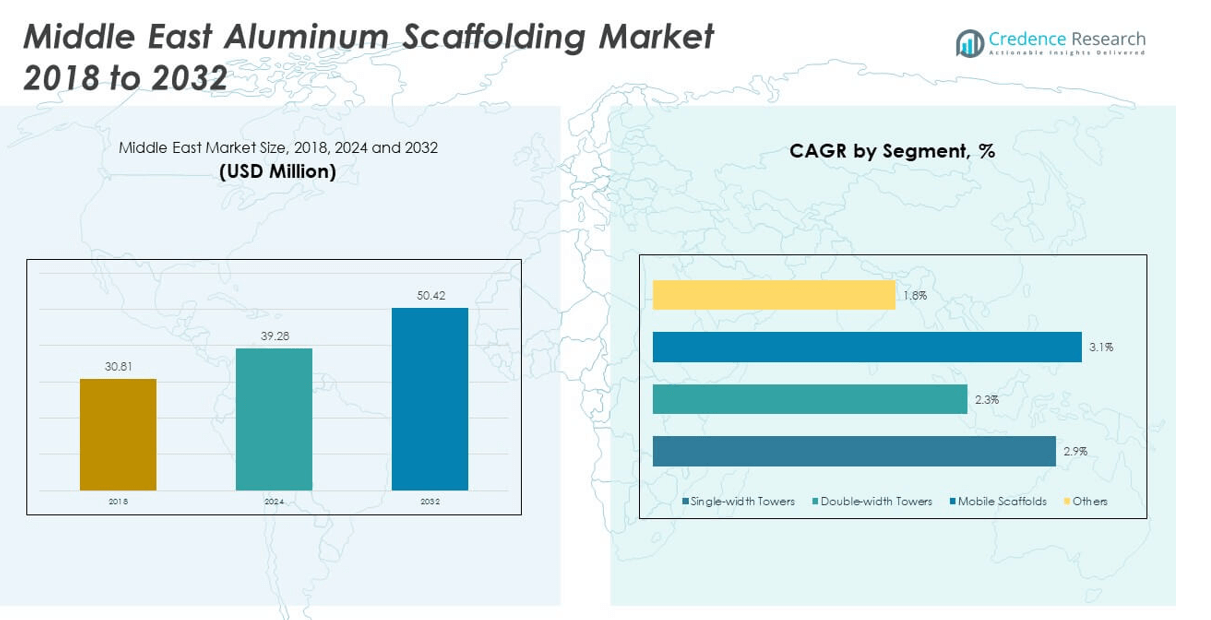

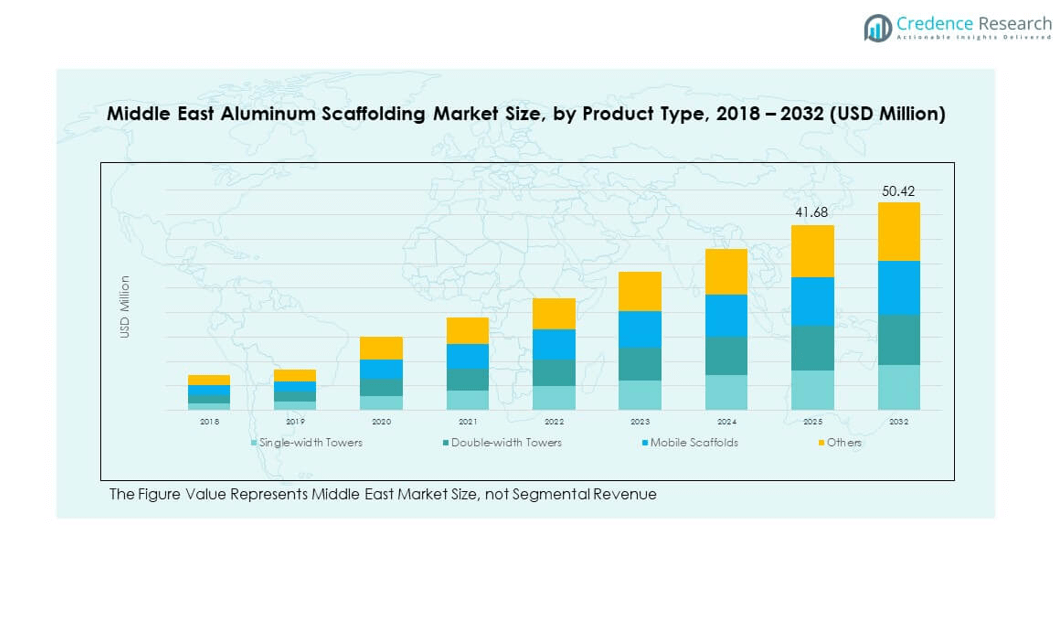

The Middle East Aluminum Scaffolding Market size was valued at USD 30.81 million in 2018 to USD 39.28 million in 2024 and is anticipated to reach USD 50.42 million by 2032, at a CAGR of 2.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Aluminum Scaffolding Market Size 2024 |

USD 39.28 million |

| Middle East Aluminum Scaffolding Market, CAGR |

2.80% |

| Middle East Aluminum Scaffolding Market Size 2032 |

USD 50.42 million |

The market is driven by a rising demand for lightweight, corrosion-resistant scaffolding solutions in high-temperature regions where traditional steel scaffolding may be less practical. Rapid urbanization, infrastructure development, and large-scale projects such as airports, stadiums, and high-rise buildings are increasing the adoption of aluminum scaffolding for its ease of installation, enhanced mobility, and safety features. Moreover, stricter occupational safety regulations across the region are further encouraging the use of modular and certified aluminum scaffolding systems.

The market witnesses’ strong growth across the Gulf Cooperation Council (GCC) countries, with the UAE and Saudi Arabia leading due to their continuous investments in infrastructure and commercial real estate. The UAE’s focus on smart cities and event-driven construction, such as Expo-related developments, has supported widespread scaffolding use. Saudi Arabia is emerging rapidly, fueled by Vision 2030 initiatives, including NEOM and other megaprojects. Meanwhile, countries like Qatar and Oman are gradually adopting aluminum scaffolding as they expand their construction activities, supported by diversified economic strategies.

Market Insights:

- The Middle East Aluminum Scaffolding Market was valued at USD 39.28 million in 2024 and is projected to reach USD 50.42 million by 2032, growing at a CAGR of 2.80%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Rising infrastructure development and high-rise construction across the GCC are accelerating demand for lightweight, modular scaffolding systems.

- Strict safety regulations and growing awareness of workplace compliance are pushing adoption of certified aluminum scaffold products.

- Limited availability of skilled labor and training gaps in safe scaffold assembly hinder market expansion in emerging Middle Eastern economies.

- The GCC region accounted for nearly 75% of the Middle East Aluminum Scaffolding Market in 2024, led by large-scale projects in the UAE and Saudi Arabia.

- Price fluctuations in imported aluminum and logistical delays present challenges for regional suppliers and rental operators.

- Industrial maintenance and energy sector projects continue to offer recurring demand for corrosion-resistant and portable scaffolding solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Construction Activity Backed by Infrastructure Expansion and Urban Development Initiatives

The Middle East Aluminum Scaffolding Market is driven by large-scale construction projects across key urban centers. Governments are allocating significant budgets toward infrastructure, including airports, metros, commercial complexes, and high-rise residential buildings. This has created sustained demand for scaffolding systems that enable faster, safer, and modular site setups. Aluminum scaffolding meets these criteria by offering enhanced flexibility and corrosion resistance. Major urban hubs like Dubai, Riyadh, and Doha are witnessing dense vertical growth, which boosts the need for access equipment. Contractors in the region prefer aluminum systems due to their reusability and compatibility with rapid project timelines. New smart city initiatives, including NEOM and Lusail, rely on modern construction equipment to maintain efficiency. These dynamics reinforce a stable growth trajectory across core application sectors.

Increasing Emphasis on Worker Safety and Regulatory Compliance in Scaffolding Deployment

Occupational health and safety standards are becoming more stringent across the Gulf construction landscape. Regulatory authorities are reinforcing protocols that mandate certified scaffolding systems at both public and private sites. The Middle East Aluminum Scaffolding Market gains from this trend due to aluminum’s superior structural integrity and non-corrosive nature. Companies are investing in compliant systems to reduce liabilities and meet audit requirements. This is driving suppliers to offer tested and modular products designed for risk-free vertical access. Safety-conscious end users are shifting from traditional bamboo or steel scaffoldings to advanced aluminum options. It helps reduce workplace accidents while ensuring compliance with local labor laws. This focus on safety encourages adoption across both urban and remote construction zones.

- For example, Scaxa manufactures its aluminum scaffolding systems using high-grade 6061 T6 and 6082 T6 aluminum alloys. The products are designed in accordance with the European Safety Standard BS EN 1004 and are certified by TÜV SÜD Middle East, as stated on the company’s official website.

Need for Lightweight and Portable Scaffolding Systems Across Dynamic Project Environments

Contractors seek materials that reduce transportation costs and installation time without compromising structural load-bearing. The Middle East Aluminum Scaffolding Market addresses this with portable, easy-to-assemble systems. These scaffolds are ideal for frequently shifting worksites and interior applications. In high-rise maintenance, such scaffolds can be disassembled and moved efficiently between levels. Industrial users in oil and gas plants prefer aluminum scaffolds for confined spaces and corrosion-prone environments. It reduces labor intensity while increasing turnaround time for scheduled maintenance or inspections. Their stackable design also allows for compact storage and redeployment across multiple job sites. This enhances operational flexibility, especially in multi-phase construction projects.

- For instance, Al Dereya Scaffolding’s aluminum mobile towers are designed to reach heights of up to 12 meters and support a maximum working load of 270 kg. These towers are engineered for mobility and are equipped with castor wheels, making them suitable for applications such as oil and gas maintenance and efficient use in confined or elevated work areas.

Growing Preference for Modular and Customized Access Solutions Across Diverse Industries

Developers and contractors increasingly demand scaffolding solutions tailored to unique project layouts. The Middle East Aluminum Scaffolding Market meets this requirement by offering modular designs that fit complex structures. Curtain wall installations, atrium glazing, and HVAC ducting in modern buildings often require non-standard access solutions. Aluminum scaffolds offer modularity and adjustable heights that adapt to such needs. It supports safe working conditions while conforming to evolving architectural styles. Manufacturers provide bespoke components for curved facades and multilevel access zones. Logistics hubs, industrial plants, and event management setups all benefit from custom scaffolding solutions. This customization trend fuels innovation among scaffold manufacturers operating in the region.

Market Trends

Adoption of Mobile Aluminum Towers for Maintenance, Fit-Out, and Renovation Projects

Mobile aluminum towers are gaining traction in the Middle East Aluminum Scaffolding Market due to rising maintenance needs in airports, shopping malls, and public infrastructure. Facility management companies use these towers for ceiling work, lighting repairs, and HVAC servicing. Their lightweight and wheel-based structure enables quick movement within indoor environments. Projects with height restrictions or limited access points favor compact tower configurations. Retail stores and exhibition centers use foldable units to avoid permanent scaffold erection. These towers meet EN 1004 safety standards and appeal to contractors prioritizing flexibility and speed. Local distributors now offer quick-delivery models to meet rising demand. Rental agencies also expand inventories to cater to this trend.

- For instance, Ace Aluminium Scaffolding in the UAE offers EN 1004-compliant aluminum mobile towers with working heights of up to 12 meters. The company routinely supplies scaffolding systems for maintenance activities at major facilities such as Dubai International Airport, supporting high-ceiling access requirements in busy operational environments.

Integration of Advanced Safety Features and Guardrail Systems in New Scaffolding Designs

Scaffolding suppliers are upgrading products with enhanced safety mechanisms in response to client requirements and evolving norms. The Middle East Aluminum Scaffolding Market is seeing increased availability of platforms with integrated guardrails, toe boards, and slip-resistant surfaces. Safety locks and stabilizers now come as standard in premium models. Clients value systems that reduce fall risks during erection, use, and dismantling. It strengthens their safety profile and minimizes site downtime due to incidents. Dual-locking castor wheels, self-closing gates, and reinforced joints are being adopted across industrial projects. Manufacturers compete by highlighting compliance with European or Gulf safety certifications. This emphasis supports safe operations in fast-paced construction settings.

- For example, Wellmade Scaffold in China manufactures Layher-compatible galvanized guardrail systems, designed for use with frame and modular scaffolding. These components are available in multiple sizes and are produced in compliance with international standards such as EN 12811 and ISO 9001. The company exports its scaffolding products to over 55 countries, including markets in the Middle East, where adherence to safety standards is a key requirement.

Rise in Rental Demand for Scaffolding Equipment Due to Cost and Lifecycle Considerations

Construction firms prefer leasing rather than owning aluminum scaffolding to reduce upfront capital costs. The Middle East Aluminum Scaffolding Market benefits from this rental model expansion across urban centers and industrial zones. Short-duration interior projects such as mall refurbishments or exhibition setups are driving rental uptake. Service providers offer flexible packages with delivery, setup, and dismantling support. It eliminates the burden of maintenance, storage, and certification. Contractors also rotate inventory more frequently by relying on third-party providers. Rental companies invest in modern scaffold models to ensure durability and client satisfaction. It sustains a recurring revenue cycle for scaffolding vendors operating in competitive markets.

Digitalization and Software-Based Planning for Scaffold Configuration and Load Assessment

Engineering firms are leveraging software tools to design scaffolding layouts that meet project-specific requirements. The Middle East Aluminum Scaffolding Market aligns with this trend by offering products that are compatible with scaffold design software. AutoCAD plug-ins and BIM integrations allow engineers to simulate scaffold positioning, load capacity, and anchor points. This digital shift reduces onsite errors and ensures regulatory compliance in advance. It also accelerates the approval cycle for complex commercial projects. Clients use digital models to plan installation sequences and optimize manpower deployment. Vendors increasingly provide data sheets and digital assembly guides to align with this practice. It fosters precision and cost control across large-scale infrastructure builds.

Market Challenges Analysis

Limited Skilled Workforce and Technical Training for Scaffold Assembly and Safety Compliance

The Middle East Aluminum Scaffolding Market faces challenges related to workforce preparedness and onsite training. Skilled labor for safe scaffold erection, inspection, and dismantling remains in short supply, especially in remote or fast-developing areas. Many workers lack formal certification or hands-on experience with modular aluminum systems. This increases the risk of misaligned components or unstable structures. Safety incidents delay projects and raise insurance costs. Construction firms must invest in repeated onboarding and supplier-led demonstrations. Language barriers and turnover rates also reduce training continuity. These gaps hinder the optimal use of advanced scaffold features. It delays full market adoption, particularly in lower-tier urban zones.

Import Reliance and Volatility in Aluminum Pricing Across Global Supply Chains

Most aluminum scaffolding components used in the region are imported from Europe or Asia, making the Middle East Aluminum Scaffolding Market vulnerable to currency fluctuations and freight costs. Any disruption in global shipping or raw material availability can affect product lead times. Rising aluminum prices due to global demand or trade restrictions increase procurement costs for regional contractors. It squeezes margins for rental companies and smaller distributors who operate on volume-based models. Price-sensitive buyers may delay purchases or opt for lower-grade alternatives. Import regulations and certification delays further strain the supply chain. These factors complicate inventory planning and pricing strategies for local players

Market Opportunities

Expansion of Event Infrastructure and Indoor Fit-Out Projects Across Commercial Sectors

The Middle East Aluminum Scaffolding Market presents growth potential in sectors beyond construction, including event management, retail, and hospitality. Frequent conferences, exhibitions, and entertainment events require safe, temporary access systems. Indoor venues prefer lightweight, non-marking scaffold systems to protect flooring and wall finishes. Aluminum towers meet these specifications while supporting rapid setup. Contractors engaged in hotel renovations and retail fit-outs are adopting compact scaffolds for ceiling and lighting work. This diversification creates new revenue streams for scaffold manufacturers and rental firms.

Growing Investment in Industrial Maintenance and Energy Sector Infrastructure

Large-scale industrial zones and oil and gas facilities across Saudi Arabia, the UAE, and Oman demand periodic maintenance and equipment upgrades. The Middle East Aluminum Scaffolding Market can serve this demand by supplying systems that enable safe access in high-risk environments. Aluminum’s non-sparking and corrosion-resistant properties make it ideal for refinery zones and power plants. Maintenance contractors seek easy-to-deploy units that minimize equipment downtime. Expanding energy infrastructure creates recurring demand for inspection platforms and temporary access solutions, driving sustained adoption in the industrial segment.

Market Segmentation Analysis:

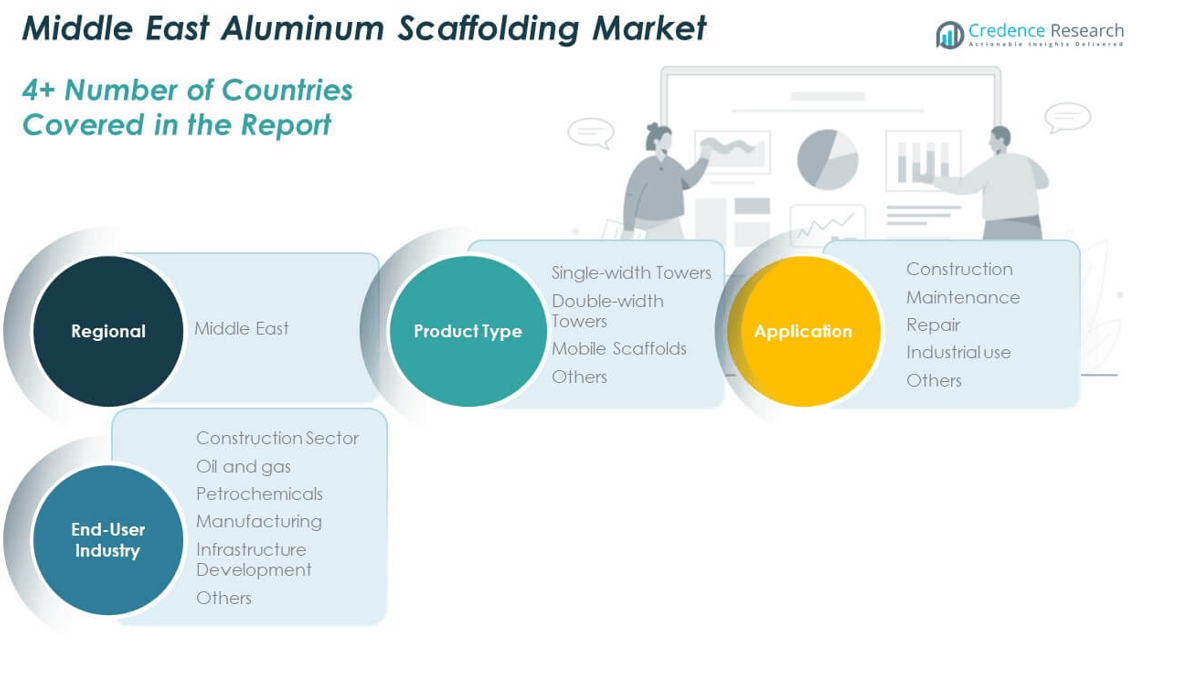

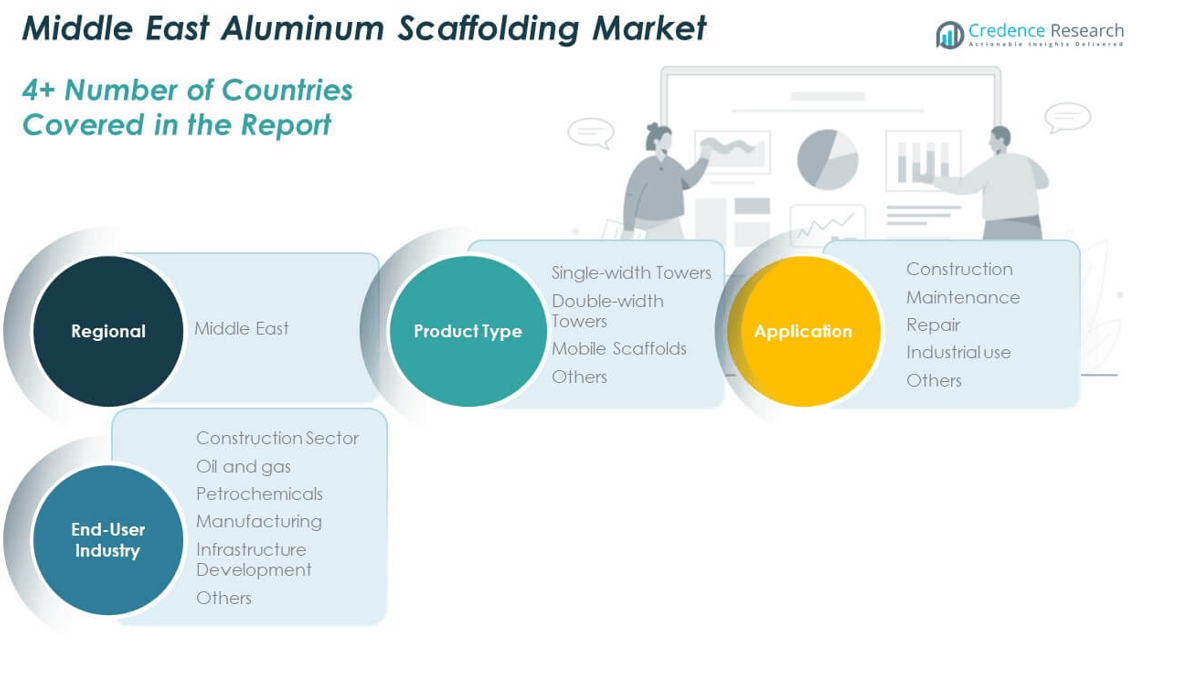

The Middle East Aluminum Scaffolding Market is segmented by product type, application, and end-user industry, each contributing distinct value to regional demand.

By product type, mobile scaffolds dominate due to their ease of transport, quick assembly, and suitability for both indoor and outdoor projects. Double-width towers follow, preferred for high-rise construction and heavy-duty use. Single-width towers serve compact or interior spaces efficiently, while the “others” category includes custom or hybrid scaffolding systems tailored for niche requirements.

- For example, a high-rise construction project in Riyadh employed mobile scaffolds up to the regulatory maximum height of 12 meters, incorporating safety nets, guardrails, and regular inspections. These measures aligned with Saudi Arabia’s scaffolding safety standards to ensure worker protection and structural stability.

By application, construction leads the market, supported by large-scale real estate, infrastructure, and commercial development. Maintenance holds a strong position, driven by demand from malls, airports, and public buildings requiring periodic access solutions. Repair activities and industrial use also present stable demand, especially in oil, gas, and utility sectors. Other applications include events, exhibitions, and short-term installations.

- For example, Mobile tower scaffolds are routinely deployed at King Abdulaziz International Airport (Jeddah, KAIA) for maintenance tasks such as ceiling, lighting, and infrastructure access. These systems enable maintenance teams to safely reach elevated zones and move efficiently between work areas, offering a reliable solution for servicing large airport facilities.

By end-user industry, the construction sector holds the largest share, given the region’s ambitious development programs. Oil and gas and petrochemicals sectors require corrosion-resistant systems for routine inspections and maintenance. Manufacturing and infrastructure development are emerging as important contributors to demand. It supports varied operational needs across energy plants, industrial zones, and transport hubs. The Middle East Aluminum Scaffolding Market aligns with evolving sectoral priorities by offering versatile, modular systems tailored to safety, mobility, and structural efficiency.

Segmentation:

By Product Type

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

Regional Analysis:

The Gulf Cooperation Council (GCC) dominates the Middle East Aluminum Scaffolding Market, accounting for nearly 75% of the regional revenue share. The United Arab Emirates and Saudi Arabia lead the market due to their ongoing megaprojects and aggressive infrastructure investments. The UAE benefits from a mature construction ecosystem and consistent demand from commercial, residential, and industrial sectors. Dubai and Abu Dhabi, in particular, support high volumes of scaffolding rentals and purchases tied to high-rise developments and facility upgrades. Saudi Arabia’s Vision 2030 continues to boost large-scale projects such as NEOM, the Red Sea Project, and industrial zones. These initiatives sustain strong demand for modular and durable aluminum scaffolding solutions.

Qatar and Oman collectively contribute around 15% of the Middle East Aluminum Scaffolding Market. Both countries are gradually expanding their construction portfolios through transport, hospitality, and mixed-use projects. Qatar maintains consistent demand, driven by post-World Cup urban upgrades and ongoing infrastructure modernization. It supports aluminum scaffolding applications in both public works and private developments. Oman focuses on industrial expansion in SEZs and port infrastructure, where lightweight scaffolding enables safe access for installation and maintenance. Contractors in these markets show preference for certified scaffolding systems that align with global safety and durability standards. Rental companies are expanding their presence in these regions to meet rising short-term project requirements.

The remaining 10% market share is distributed across Bahrain, Kuwait, and other parts of the Levant. Bahrain experiences steady demand tied to mixed-use developments, tourism-related construction, and maintenance of heritage structures. Kuwait’s market remains conservative but shows gradual uptake in aluminum scaffolding, especially within oilfield maintenance and civil construction. Lebanon and Jordan have limited activity due to political instability and funding challenges, but select commercial projects still rely on imported aluminum scaffolding. The Middle East Aluminum Scaffolding Market reflects strong regional imbalance, where growth remains concentrated in high-spending GCC economies while emerging markets move forward at a slower, investment-dependent pace. It offers manufacturers clear direction for regional distribution strategies and product positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arabian Spar

- Spar Steel

- Finomax Scaffolding

- Arab Contractors

- Capital Scaffolding Co. LLC

- Fitwell Scaffolding LLC

- Forever Scaffolding and Contracting

- Al Bawadi Metals

- Al Jonoub Scaffolding

- Dubai Scaffolding Company

- Al Bader Scaffolding

Competitive Analysis:

The Middle East Aluminum Scaffolding Market features a moderately fragmented landscape with a mix of global manufacturers, regional suppliers, and specialized rental providers. Key players such as Altrex, Instant UpRight, WernerCo, and Layher dominate through wide product portfolios and safety-certified systems. Regional companies, including Arabian Spar and Al Mateen Scaffolding, cater to localized demand with cost-effective offerings and faster service capabilities. Competitive advantage often depends on product durability, ease of assembly, and compliance with international safety standards. Rental services play a key role, with companies offering turnkey solutions and flexible pricing. Innovation in design and emphasis on user safety continue to shape competitive positioning. The market encourages partnerships between contractors and scaffolding providers to support high-volume, time-sensitive projects. It rewards vendors that align with regulatory changes and offer modular, lightweight systems tailored to regional construction needs.

Recent Developments:

- In September 2024, SPAR Saudi Arabia forged a strategic partnership with Yango Tech and Al Sadhan, introducing innovative digital retail solutions aimed at enhancing personalization, boosting operational efficiency, and accelerating the adoption of seamless e-commerce capabilities. This collaboration is expected to help transform the shopping landscape and digital engagement for scaffolding and aluminum products across the Middle East market.

Market Concentration & Characteristics:

The Middle East Aluminum Scaffolding Market is moderately concentrated, with leading players holding strong positions in high-demand urban regions. It is characterized by a growing shift toward certified, modular systems that support both large-scale and interior construction projects. The market favors suppliers who provide rental and after-sales services along with rapid on-site delivery. Product customization and compliance with EN and OSHA standards remain key differentiators. Demand is steady across high-rise construction, maintenance, and industrial sectors. It reflects a mature structure in the GCC and a developing profile in emerging economies like Oman and Jordan. Market growth depends heavily on infrastructure budgets and contractor adoption of safety-led solutions. Strategic partnerships and regional distribution networks are becoming critical for long-term market competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for aluminum scaffolding will grow with the region’s ongoing push for large-scale infrastructure and urban development.

- GCC countries are expected to remain the primary growth drivers, supported by national transformation plans and mega construction projects.

- Manufacturers will prioritize modular and lightweight designs to meet the evolving needs of urban and interior applications.

- Rental services will expand as contractors seek cost-efficient and flexible access solutions for short-term projects.

- Safety regulations will become more stringent, prompting increased adoption of certified and compliant scaffolding systems.

- Growth in industrial maintenance and energy projects will generate consistent demand for corrosion-resistant scaffolds.

- Technological integration, including digital planning and load simulation tools, will enhance product adoption in complex builds.

- Local players will strengthen market presence through tailored offerings and faster delivery in underserved regions.

- International vendors will invest in regional partnerships to scale operations and address country-specific requirements.

- Sustainable and recyclable scaffolding solutions will gain traction amid rising environmental awareness and green building practices.