Market Overview

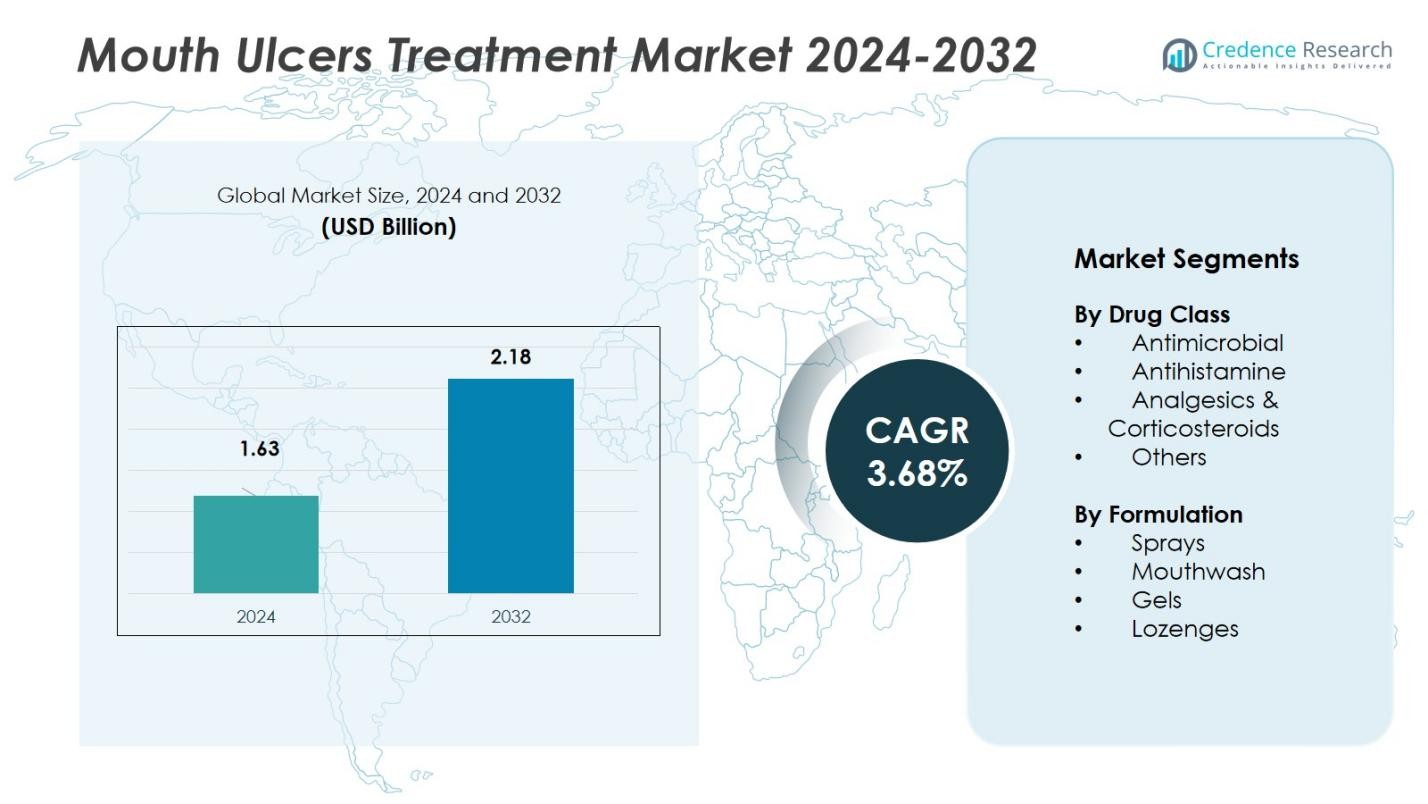

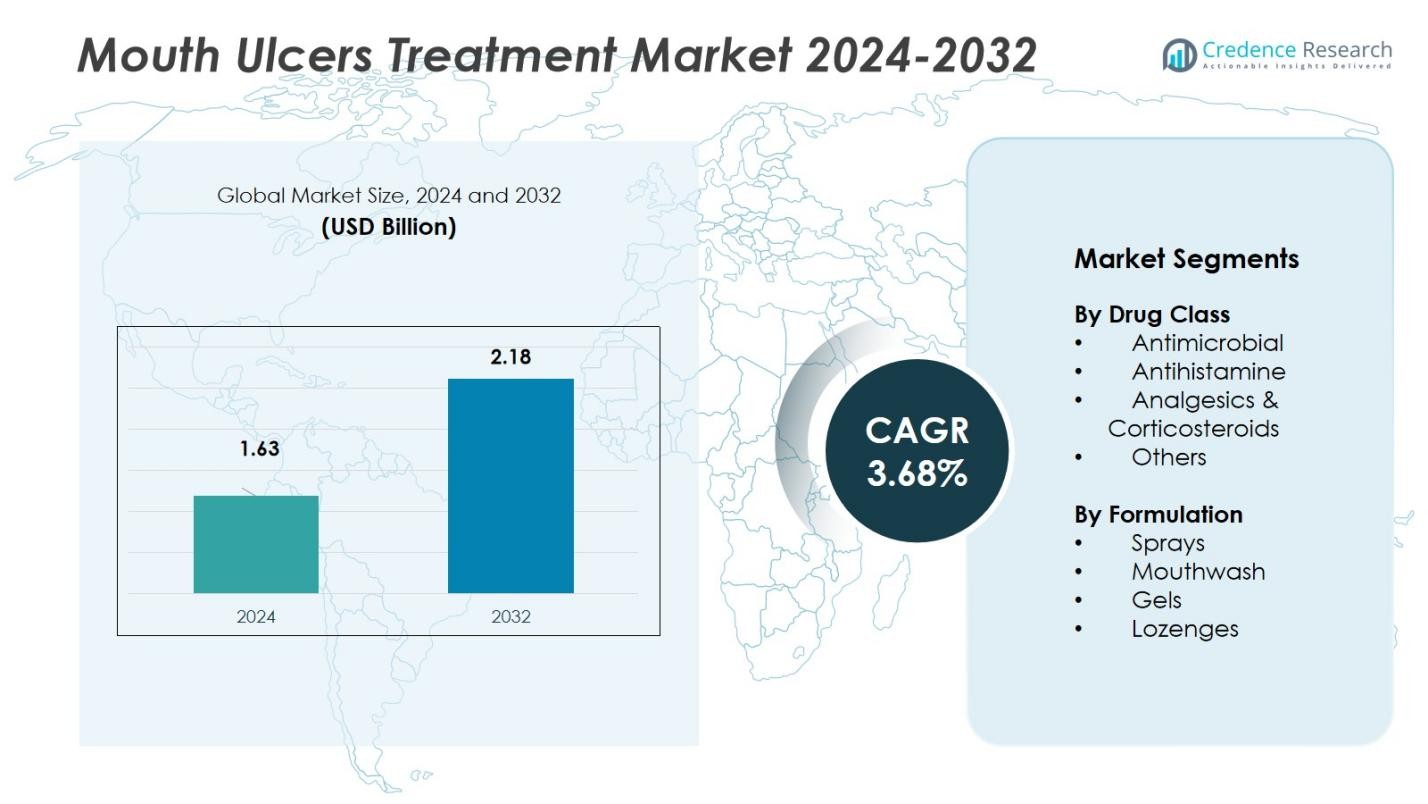

The Mouth Ulcers Treatment Market was valued at USD 1.63 billion in 2024 and is projected to reach USD 2.18 billion by 2032, growing at a CAGR of 3.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mouth Ulcers Treatment Market Size 2024 |

USD 1.63 Billion |

| Mouth Ulcers Treatment Market, CAGR |

3.68% |

| Mouth Ulcers Treatment Market Size 2032 |

USD 2.18 Billion |

The Mouth Ulcers Treatment Market features strong competition among global and regional pharmaceutical manufacturers. Major players such as Dr. Reddy’s Laboratories Ltd, Pfizer Inc., GSK plc, Colgate-Palmolive Company, Blistex Inc., Church & Dwight Co. Inc., 3M Company, Bristol Myers Squibb Company, Patterson Dental Supply Inc., and Prince Care Pharma Private Limited dominate the landscape through extensive product portfolios, continuous R&D, and global distribution. These companies focus on developing advanced formulations like bioadhesive gels and herbal-based products to enhance healing and reduce recurrence. Strategic partnerships and digital marketing initiatives further strengthen brand positioning. Regionally, North America leads the market with 36% share, driven by high healthcare spending and OTC product availability. Europe follows with 28% share, supported by strong pharmaceutical infrastructure, while Asia-Pacific accounts for 24% share, emerging as the fastest-growing region due to rising oral health awareness and expanding access to affordable, locally produced ulcer treatments.

Market Insights

- The Mouth Ulcers Treatment Market was valued at USD 1.63 billion in 2024 and is projected to reach USD 2.18 billion by 2032, growing at a CAGR of 3.68%.

- Increasing cases of oral mucosal disorders, stress-induced ulcers, and rising use of tobacco products drive consistent market demand across all demographics.

- Growing consumer preference for herbal and corticosteroid-free products is shaping market trends, with companies focusing on bioadhesive and nanotechnology-based formulations for improved healing.

- Market competition remains strong among global players such as Dr. Reddy’s, Pfizer, GSK, Colgate-Palmolive, and Blistex, who emphasize innovation and OTC product expansion.

- Regionally, North America dominates with 36% share, followed by Europe at 28% and Asia-Pacific at 24%; among segments, antimicrobial drugs hold 38% share, and gels lead formulation preference with 41%, reflecting patient demand for fast-acting and easily applicable treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Class

Antimicrobial drugs dominate the mouth ulcers treatment market, holding 38% share in 2024. Their leadership stems from broad effectiveness in controlling bacterial infections that aggravate oral lesions. Increased prescription of chlorhexidine and tetracycline-based formulations enhances patient recovery and lowers recurrence rates. Antihistamines account for 27% share, favored for relieving allergic or inflammation-induced ulcers. Analgesics and corticosteroids collectively hold 25% share, driven by demand for rapid pain relief and inflammation reduction. The remaining 10% belongs to other agents, including vitamins and herbal formulations supporting mucosal healing and immunity enhancement.

- For instance, Aphthasol (amlexanox 5% oral paste) was tested in four multicenter, double-blind trials with 1,335 subjects and applied four times daily; FDA labeling notes statistically significant acceleration of healing versus vehicle and no treatment.

By Formulation

Gels lead the market with 41% share due to their targeted application, quick absorption, and soothing effect on lesions. Their growing use in over-the-counter treatments reflects patient preference for direct relief and minimal side effects. Mouthwash formulations follow with 30% share, supported by antibacterial properties and preventive use in daily oral care. Lozenges hold 18% share, gaining adoption for convenience and slow-release medication delivery. Sprays represent 11% share, primarily used for severe or recurrent ulcer cases where precise dosing and instant action are required.

- For instance, benzydamine 0.15% mouth spray is dosed 4–8 sprays every 1.5–3 hours; UK patient information leaflets document these administration frequencies for oral pain, including mouth ulcers.

Key Growth Drivers

Rising Prevalence of Oral Disorders

The growing incidence of mouth ulcers caused by stress, nutritional deficiency, and viral infections drives market demand. Increasing consumption of spicy food and tobacco products has also elevated oral lesion cases globally. The elderly population and patients with autoimmune diseases experience higher ulcer recurrence, prompting continuous treatment use. Expanding dental awareness campaigns further encourage early diagnosis and therapy adoption, supporting steady sales of antiseptic gels and antimicrobial mouthwashes.

- For instance, Haleon plc’s Biotène® OralBalance Moisturizing Gel, used for dry mouth and related ulceration, demonstrated relief lasting up to 4 hours in a 28-day clinical study.

Growing Demand for Over-the-Counter (OTC) Products

Consumer preference for self-medication and convenient treatment options fuels the adoption of OTC mouth ulcer products. Gels, lozenges, and sprays are increasingly available in pharmacies and e-commerce stores without prescriptions. Pharmaceutical companies invest in attractive packaging and natural ingredient-based formulations to expand reach. Widening retail distribution networks in emerging economies strengthen accessibility and affordability, boosting product penetration across demographics.

- For instance, Biotène® gel by Haleon is marketed as a “#1 dentist, pharmacist, and hygienist recommended brand for Dry Mouth management” in the U.S.

Technological and Formulation Advancements

Innovation in drug delivery systems and bioadhesive gels enhances treatment efficacy and duration of action. Manufacturers integrate anti-inflammatory and antimicrobial properties into single formulations for faster healing. Nanotechnology-based formulations improve local drug absorption and reduce recurrence risk. The introduction of herbal and corticosteroid-free products addresses safety concerns and appeals to health-conscious consumers, driving sustained growth across global markets.

Key Trends & Opportunities

Rising Preference for Herbal and Natural Formulations

The growing shift toward natural ingredients such as aloe vera, honey, and curcumin opens new market opportunities. Consumers prefer herbal-based gels and mouthwashes for their minimal side effects and soothing properties. Companies invest in clinical trials and certifications to enhance credibility and global acceptance. Expansion of organic product portfolios aligns with increasing demand for safe, long-term oral ulcer management solutions.

- For instance, the Indian firm’s Smyle Mouth Ulcer Gelis an Ayurvedic, herbal product that advertises ‘instant’ or ‘quick’ pain relief and is marketed as being free from synthetic ingredients like Lidocaine and Choline Salicylate, found in other allopathic gels.

- Commerce Expansion and Digital Promotion Strategies

The growing influence of digital marketing and online pharmacies boosts product visibility and consumer access. Companies leverage e-commerce platforms to reach wider audiences, especially in developing countries. Subscription models and tele-dentistry consultations encourage regular product use and brand loyalty. Online awareness campaigns and influencer partnerships drive sales growth, making digital channels a major opportunity area for future expansion.

- For instance, PharmEasy, a leading e-pharmacy in India, operates a comprehensive online platform offering prescription medicines, lab tests, and healthcare products with home delivery services. The platform has simplified healthcare access, particularly in remote areas, enhancing customer convenience.

Key Challenges

Key Challenges

Limited Awareness in Developing Regions

Despite product availability, low awareness about oral health and self-treatment options restricts adoption in developing economies. Many consumers perceive ulcers as minor and avoid medical consultation. Poor dental infrastructure and lack of education campaigns further limit market reach. Manufacturers face challenges in expanding their footprint without adequate awareness programs or healthcare collaborations.

Side Effects and Product Safety Concerns

Frequent use of corticosteroid-based and antimicrobial treatments raises concerns about mucosal thinning and resistance development. Some topical drugs cause irritation or allergic reactions, reducing long-term compliance. The regulatory scrutiny for synthetic ingredients and preservatives also restricts product approval timelines. Manufacturers must balance efficacy with safety by developing mild yet effective alternatives to maintain consumer trust.

Regional Analysis

North America

North America holds 36% share of the mouth ulcers treatment market in 2024, driven by high healthcare awareness and widespread use of OTC oral care products. The U.S. dominates regional revenue due to strong pharmaceutical R&D and the availability of advanced corticosteroid gels and antimicrobial mouthwashes. Rising prevalence of aphthous ulcers linked to stress, smoking, and dietary habits boosts demand. Favorable reimbursement structures and the expansion of e-commerce platforms for oral treatments further support regional growth. Canada contributes steadily with increasing adoption of herbal and natural formulations for ulcer relief.

Europe

Europe accounts for 28% share, supported by robust dental healthcare infrastructure and growing patient preference for prescription and non-prescription formulations. The U.K., Germany, and France lead with high demand for topical corticosteroids and herbal gels targeting oral lesions. The region’s focus on product safety and regulatory compliance encourages innovation in bioactive and natural ingredients. Manufacturers benefit from strong retail pharmacy distribution and consumer trust in clinical-grade products. The rising geriatric population and government-backed oral health campaigns also play a key role in expanding the European market.

Asia-Pacific

Asia-Pacific captures 24% share of the market and remains the fastest-growing region during the forecast period. Countries such as China, India, and Japan exhibit rising incidence of oral mucosal diseases linked to poor hygiene, spicy diets, and stress. Expanding access to affordable OTC medicines and increased awareness about oral care drive market growth. The presence of regional manufacturers offering low-cost herbal and traditional remedies enhances availability. Rapid urbanization, digital retail expansion, and healthcare modernization across Southeast Asia are expected to strengthen the region’s contribution further.

Latin America

Latin America holds 7% share, driven by growing adoption of OTC mouth ulcer products and expanding retail pharmacy networks. Brazil and Mexico lead the regional market, supported by increasing oral health awareness and government programs promoting hygiene education. Economic recovery and improving healthcare access boost the demand for cost-effective gels and mouthwashes. International brands are entering the region through partnerships with local distributors, enhancing availability. The rising middle-class population and preference for affordable, multi-symptom relief formulations further stimulate product demand.

Middle East & Africa

The Middle East & Africa region accounts for 5% share, reflecting growing awareness of oral care and increased adoption of modern treatment solutions. The Gulf Cooperation Council (GCC) countries lead, supported by high healthcare expenditure and expanding pharmacy chains. South Africa shows rising demand due to urbanization and higher prevalence of oral ulcers caused by nutritional deficiencies. Limited access to specialized dental care in some areas restricts faster growth. However, the introduction of herbal-based and cost-effective mouth ulcer treatments presents promising opportunities for market expansion.

Market Segmentations:

By Drug Class

- Antimicrobial

- Antihistamine

- Analgesics & Corticosteroids

- Others

By Formulation

- Sprays

- Mouthwash

- Gels

- Lozenges

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mouth ulcers treatment market includes major players such as Dr. Reddy’s Laboratories Ltd, Pfizer Inc., Blistex Inc., Colgate-Palmolive Company, GSK plc, Bristol Myers Squibb Company, Church & Dwight Co. Inc., Patterson Dental Supply Inc., 3M Company, and Prince Care Pharma Private Limited. These companies compete through product innovation, brand reputation, and distribution strength. Market leaders emphasize expanding OTC product portfolios featuring fast-acting gels, herbal formulations, and pain-relief sprays to attract diverse consumer groups. Strategic collaborations, acquisitions, and regional partnerships enhance their market presence across developed and emerging economies. For instance, global pharmaceutical firms focus on bioadhesive technologies and anti-inflammatory compounds that improve healing efficacy and patient comfort. Continuous investment in R&D and digital marketing supports competitive differentiation, while local manufacturers strengthen their foothold through affordable, herbal-based treatments tailored to regional preferences.

Key Player Analysis

- Reddy’s Laboratories Ltd

- Pfizer Inc.

- Blistex Inc.

- Colgate-Palmolive Company

- GSK plc

- Bristol Myers Squibb Company

- Church & Dwight Co. Inc.

- Patterson Dental Supply Inc.

- 3M Company

- Prince Care Pharma Private Limited

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In October 2023, Mucocort AB received a European patent for its innovative intra-oral patch designed to treat aphthous mouth ulcers and expanded its collaboration with Aurena Laboratories AB to strengthen production and distribution capabilities.

- In 2024, Aston University (UK) and Quest Pharm announced a partnership to develop a tablet formulation for chemotherapy-induced mouth ulcers.

- In September 2022, Mucocort AB partnered with Aurena Laboratories AB to manufacture and commercialize a self-absorbing pain-relief patch aimed at managing recurrent mouth ulcers effectively.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Formulation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising awareness of oral hygiene will expand preventive and therapeutic product demand.

- Growth of herbal and natural formulations will attract health-conscious consumers globally.

- E-commerce channels will enhance accessibility and brand visibility in emerging regions.

- Continuous innovation in bioadhesive and nanotechnology-based gels will improve efficacy.

- OTC availability will boost consumer convenience and increase market penetration.

- Expanding geriatric population will drive demand for long-term mouth ulcer management.

- Strategic collaborations among pharma companies will accelerate new product development.

- Rising stress-related ulcer cases will sustain consistent demand across demographics.

- Regulatory focus on safety will encourage the development of mild, non-steroidal products.

- Emerging markets in Asia-Pacific and Latin America will offer major revenue growth opportunities.

Key Challenges

Key Challenges