Market Overview

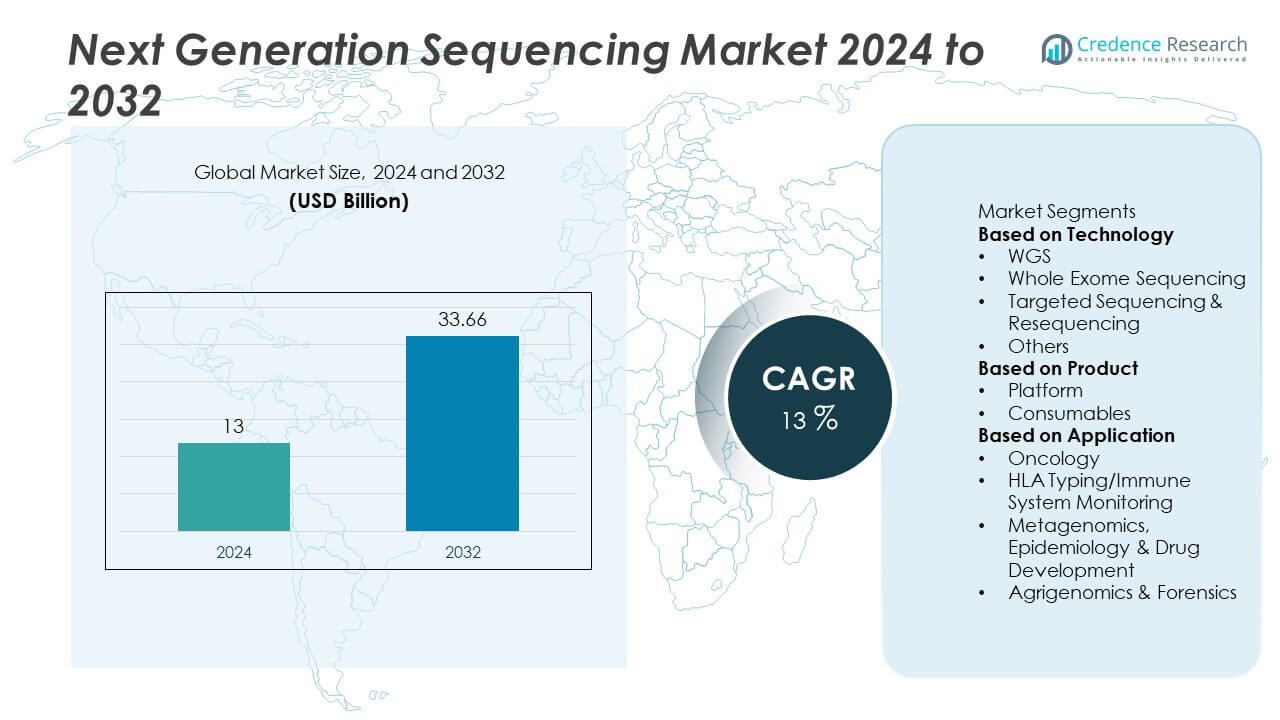

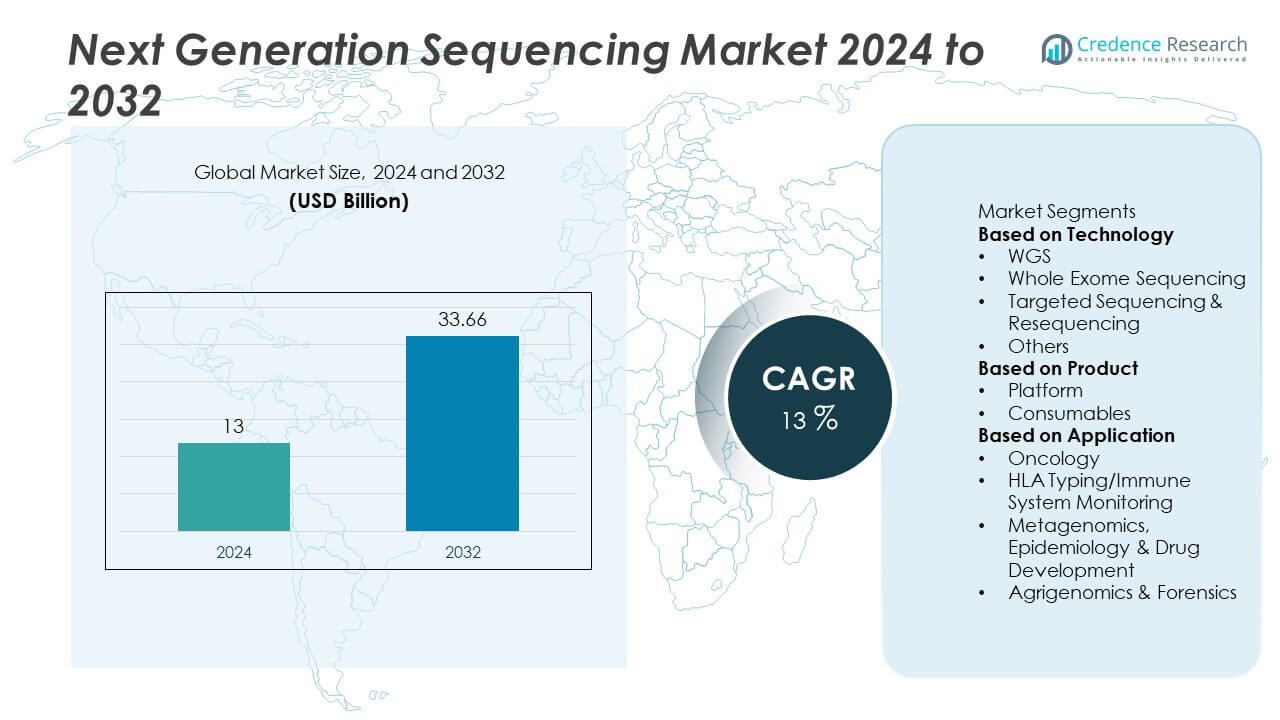

The Next Generation Sequencing market was valued at USD 13 billion in 2024 and is projected to reach USD 33.66 billion by 2032, growing at a compound annual growth rate (CAGR) of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Next Generation Sequencing Market Size 2024 |

USD 13 Billion |

| Next Generation Sequencing Market, CAGR |

13% |

| Next Generation Sequencing Market Size 2032 |

USD 33.66 Billion |

The Next Generation Sequencing (NGS) market is dominated by key players such as Illumina Inc., Thermo Fisher Scientific Inc., and F. Hoffmann-La Roche Ltd., which collectively drive the market with their broad product portfolios, global reach, and substantial investments in R&D. These companies, along with secondary competitors like QIAGEN N.V., Bio-Rad Laboratories, Inc., PacBio, and Oxford Nanopore Technologies, lead through innovation and strategic partnerships. In 2024, North America held the largest share at 44.7%, driven by strong research funding and widespread adoption of precision medicine. Europe and Asia Pacific follow, with significant growth observed in Asia due to rising healthcare investments and government genomics initiatives. North America’s advanced infrastructure and research ecosystem continue to maintain its leadership, while Asia Pacific is expected to be the fastest-growing region, surpassing other markets in terms of growth trajectory.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global NGS market stood at USD 13 billion in 2024, and it is forecast to reach USD 33.66 billion by 2032, growing at a CAGR of 13%.

- Precision medicine and genomic diagnostics drive growth, especially in oncology where over 35% market share is observed.

- Key trends include expanding applications in agrigenomics, forensics, metagenomics and the integration of AI‑driven analytics and point‑of‑care sequencing systems.

- Restraints consist of the complexity of managing large sequencing data sets and regulatory and reimbursement delays across regions.

- Regionally, North America leads with 44.7% market share in 2024, while Asia Pacific is the fastest‑growing region; technology segments such as whole genome sequencing hold around 45% share and consumables over 60% in product category.

Market Segmentation Analysis:

By Technology

In the Next Generation Sequencing (NGS) market, Whole Genome Sequencing (WGS) is the dominant technology, holding the largest market share of approximately 45%. WGS is widely used for comprehensive genomic analysis and is pivotal in areas such as genetic disorder detection, personalized medicine, and cancer research. The increasing demand for accurate, high-throughput sequencing methods for a range of applications, including rare disease identification and genetic research, drives the adoption of WGS. Other technologies like Whole Exome Sequencing and Targeted Sequencing also contribute to the market, but WGS remains the leading segment due to its broad application and higher accuracy.

- For instance, Illumina’s NovaSeq 6000 system, which supports WGS, has been used to sequence the genomes of more than 1 million individuals, helping advance cancer research and personalized treatments.

By Product

In the Next Generation Sequencing market, consumables hold the largest market share, accounting for over 60%. Consumables include reagents, kits, and other necessary components that facilitate the sequencing process. The growth of this segment is primarily driven by the increasing volume of sequencing studies in clinical diagnostics, research, and pharmaceutical applications. As the demand for NGS platforms grows, so does the need for consumables, ensuring their continued dominance. The platform segment, while significant, is smaller in comparison and focuses on providing the equipment and software needed for sequencing.

- For instance, QIAGEN’s QIAseq technology is part of the growing market for consumables and its solutions are used by over 500,000 customers worldwide across various therapeutic areas, including infectious disease diagnostics and oncology.

By Application

Oncology is the leading application in the NGS market, capturing more than 35% of the market share. The rising prevalence of cancer and the need for targeted therapies that require detailed genomic data contribute to the segment’s growth. NGS is extensively used for tumor profiling, identifying mutations, and assessing genetic predispositions in cancer patients. Additionally, applications in HLA typing and immune system monitoring, metagenomics, and agrigenomics are also significant, but oncology remains the dominant driver due to its high demand for precision medicine and targeted treatment strategies.

Key Growth

Rising Demand for Precision Medicine and Genomic Diagnostics

The growing demand for precision medicine is a key driver of the Next Generation Sequencing (NGS) market. Healthcare providers increasingly rely on genomic sequencing to detect genetic mutations, identify biomarkers, and personalize treatment plans. NGS allows for more accurate disease diagnosis and better-targeted therapies, especially in oncology, rare diseases, and genetic disorders. The ability to provide tailored treatments based on genetic profiles is a game-changer for improving patient outcomes. As precision medicine continues to gain traction, the need for robust sequencing technologies grows, making this a major growth driver. Additionally, the integration of NGS in clinical diagnostics is driving investments in healthcare infrastructure, contributing further to the market expansion.

- For instance, the Genomics England 100,000 Genomes Project used NGS to analyze the genomes of patients with rare diseases, enabling the identification of genetic variants, leading to a new diagnosis for 25% of participants with rare diseases.

Technological Advancements and Reduced Sequencing Costs

Technological advancements and the continuous reduction in sequencing costs are major factors propelling the Next Generation Sequencing market. The improvements in sequencing accuracy, throughput, and automation make NGS platforms more efficient and cost-effective. Over the past decade, the cost of sequencing has drastically decreased, making it accessible to a wider range of research and clinical applications. This cost reduction allows for broader adoption in clinical diagnostics, drug development, and population genomics. As sequencing costs continue to fall, the technology becomes more scalable and affordable for both large and small labs, driving increased demand across multiple industries, including healthcare, agriculture, and environmental science.

- For instance, PacBio’s Sequel II system improved sequencing accuracy and read length while also reducing costs, enabling large-scale genomic projects such as the Human Pangenome Project, which aims to map the diversity of human genomes across various populations.

Expanding Applications Across Multiple Industries

The expanding applications of Next Generation Sequencing across various industries is fueling its market growth. Beyond healthcare, NGS is increasingly used in fields like agrigenomics, forensic analysis, and metagenomics. In agriculture, it helps in crop improvement and livestock breeding through genomic analysis. In forensics, NGS is employed for DNA analysis, enabling faster and more accurate identification. The technology also plays a crucial role in epidemiology, drug development, and environmental studies. As the use cases for NGS continue to grow, demand increases in both research and practical applications, driving the market’s expansion across diverse sectors. The ability to integrate NGS into these fields is a significant growth factor.

Key Trend & Opportunity

AI-Driven Analytics and Predictive Genomics

One of the most significant trends in the Next Generation Sequencing market is the integration of Artificial Intelligence (AI) and machine learning with sequencing platforms. AI-driven analytics offer advanced capabilities, such as predictive genomics, which allow researchers and clinicians to forecast disease progression, identify potential genetic risk factors, and make more informed treatment decisions. By analyzing large datasets quickly and accurately, AI enhances the utility of NGS, improving diagnostic precision and therapeutic outcomes. This trend also enables the development of personalized medicine, where treatment plans are tailored to individual genetic profiles. As AI continues to advance, its integration with NGS technologies is expected to provide new insights and further drive adoption across the healthcare sector.

- For instance, IBM Watson for Genomics integrated AI with next-generation sequencing platforms to analyze large-scale genomic data. This system assisted in identifying potential biomarkers and providing treatment recommendations for cancer patients.

Point-of-Care and Portable Sequencing Systems

The development of portable and point-of-care sequencing platforms presents a significant opportunity for the Next Generation Sequencing market. These systems are designed to be more compact, cost-effective, and adaptable for use outside traditional laboratory settings, such as in hospitals, remote areas, and even fieldwork. Point-of-care sequencing allows for real-time results, enabling faster clinical decision-making, particularly in infectious disease monitoring and genetic diagnostics. As demand grows for decentralized healthcare solutions, portable NGS platforms offer a more accessible option for smaller clinics and healthcare providers. The convenience and flexibility of these systems are key drivers for their adoption in low-resource settings, offering a significant opportunity for market expansion.

- For instance, the Oxford Nanopore MinION, a portable sequencing device, has been used in over 50 countries for field-based research, including outbreak surveillance of Ebola and Zika viruses, due to its ability to perform rapid, real-time analysis of smaller genomes in a few hours outside a lab.

Key Challenge

Data Management and Analysis Complexity

A major challenge in the Next Generation Sequencing market is the complexity of managing and analyzing the vast amount of data generated. Sequencing technologies produce enormous volumes of genomic data, and effectively storing, processing, and interpreting this data is a significant hurdle. Researchers and clinicians need robust bioinformatics tools to analyze the data accurately, and the lack of skilled professionals in bioinformatics can limit the potential of NGS. Furthermore, issues with data integration, management, and scalability in healthcare environments can delay the adoption of NGS technologies. The ability to manage and derive meaningful insights from large genomic datasets remains a critical challenge.

Regulatory and Reimbursement Hurdles

Another challenge in the Next Generation Sequencing market is the regulatory uncertainty and slow reimbursement processes that hinder widespread adoption, particularly in clinical settings. Regulatory approval for NGS-based diagnostics varies by region and can be a lengthy and complex process, which delays market entry for new technologies. Additionally, many health insurance providers are slow to reimburse NGS-based tests, as they are still considered cutting-edge technology. These hurdles increase the cost and time required for clinical implementation, limiting the expansion of NGS solutions in some markets. Overcoming these regulatory and reimbursement challenges is essential for wider adoption of NGS technologies in healthcare.

Regional Analysis

North America

In 2024, North America held a dominant share of 44.7% in the next‑generation sequencing market. The region benefits from strong investment in genomic research, widespread use of precision medicine programs, and a large number of clinical laboratories offering sequencing services. Advanced healthcare infrastructure and significant funding from public and private sectors accelerate the adoption of NGS platforms. On‑going initiatives in cancer genomics and rare disease diagnostics further support regional growth. The established presence of major players and high utility in both research and clinical settings maintain North America’s lead position.

Europe

Europe accounted for a significant share of the next‑generation sequencing market in 2024, though exact percentage varies across sources. The region’s growth is supported by government programs for genomics, strong public‑private partnerships, and growing clinical adoption of NGS in oncology and infectious disease monitoring. Countries such as the UK, Germany and France are setting the pace with national genome projects and large‑scale research initiatives. The region’s regulatory frameworks, while complex, also bolster demand for high‑quality diagnostic sequencing. Europe’s mature research ecosystem and policy support ensure continued market expansion.

Asia‑Pacific

The Asia‑Pacific region stands out as the fastest‑growing market for next‑generation sequencing, with increasing enthusiasm from countries like China, India, Japan and Australia. Although precise market share figures vary, this region leverages rising healthcare expenditure, government initiatives in genomics, and growing awareness of precision medicine. Domestic biotech companies and collaborations drive adoption of sequencing platforms and services. Investments in infrastructure, expansion of clinical diagnostics and localization of technologies further accelerate growth. Asia‑Pacific’s growth trajectory is expected to outpace more mature regions as penetration deepens.

Latin America and Middle East & Africa

Together, Latin America and the Middle East & Africa regions represent a combined segment with emerging opportunity in the next‑generation sequencing market. These regions benefit from rising demand for modern healthcare infrastructure, increasing use of cloud‑based diagnostics and government‑backed genomics efforts. While current market share is smaller compared to North America or Europe, growth prospects are strong as sequencing technologies reach underserved areas. Focus on infectious disease monitoring, agrigenomics and regional research initiatives supports uptake. The evolving regulatory environment and improving access make these regions critical for vendors seeking new growth avenues.

Market Segmentations:

By Technology

- WGS

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- Others

By Product

By Application

- Oncology

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Competitive landscape analysis the global Next Generation Sequencing market features major players such as Illumina Inc., Thermo Fisher Scientific Inc., and F. Hoffmann‑La Roche Ltd., which lead through broad product portfolios, global reach and strong service capabilities. These companies invest heavily in R&D, strategic partnerships and geographic expansion to maintain leadership positions. Secondary competitors like QIAGEN N.V., Bio‑Rad Laboratories, Inc., PacBio (Bio Pacifica), Oxford Nanopore Technologies Plc., Revvity, Inc., Merck KGaA, and BGI Group focus on niche segments, innovative workflows and regional expansion. Firms differentiate through advanced analytics, lower‑cost workflows and automation, which raise competitive pressure on pricing and margins. Smaller entrants continue to challenge incumbents by offering specialised services and region‑specific offers, making product innovation and service excellence key success factors in the NGS market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QIAGEN

- Hoffman-La Roche Ltd.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina

- Oxford Nanopore Technologies

- BGI

- Revvity, Inc.

- PacBio

Recent Developments

- In July 2025, QIAGEN N.V. launched its “QIAseq xHYB Long Read Panels,” enabling long‑read enrichment workflows on platforms such as Pacific Biosciences (PacBio) for structural variant and HLA typing applications.

- In May 2025, Roche announced a strategic collaboration with Broad Clinical Labs to pilot applications using the SBX technology, targeting clinical genomics use‑cases in translational research.

- In February 2025, F. Hoffmann‑La Roche Ltd. unveiled its proprietary “Sequencing by Expansion (SBX)” technology, a new category of NGS combining novel chemistry and a CMOS sensor module for ultra‑rapid, scalable sequencing workflows.

Report Coverage

The research report offers an in-depth analysis based on Technology, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market participants will further invest in AI‑augmented genomic analytics to improve disease prediction and treatment decisions.

- Portable and point‑of‑care sequencing systems will expand access in remote and low‑resource settings.

- Whole genome sequencing will gain share as its cost continues to fall and accuracy improves.

- Consumables (reagents, kits) will remain the largest product category as sequencing volume grows.

- Clinical adoption of sequencing for oncology, rare diseases, and infectious disease will accelerate globally.

- Bioinformatics and data management services will surge to handle increasing volumes of genomic data.

- Asia Pacific will register strong growth due to rising healthcare spend and national genomics initiatives.

- Regulatory harmonisation and reimbursement frameworks will improve, enabling broader clinical implementation.

- Sequencing technologies will extend into agriculture, forensics, and environmental genomics, opening new markets.

- Skilled workforce development and training in bioinformatics and genomics will become critical for market expansion.