Market Overview:

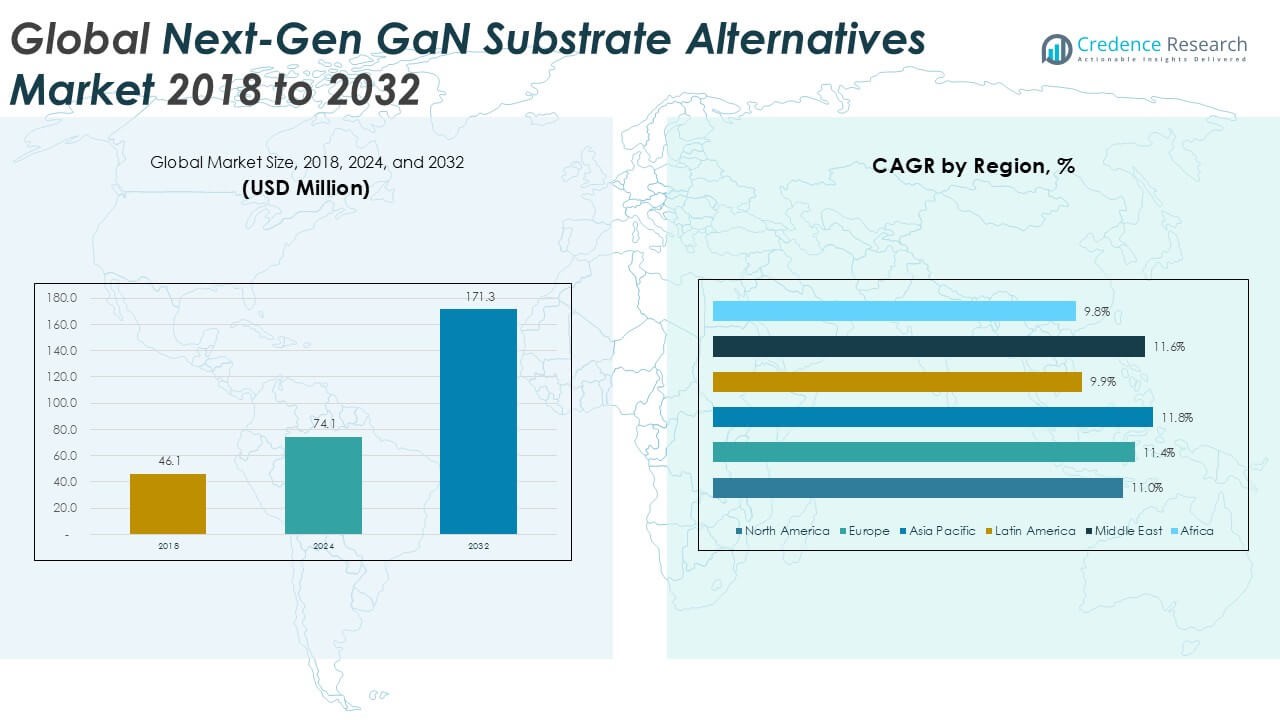

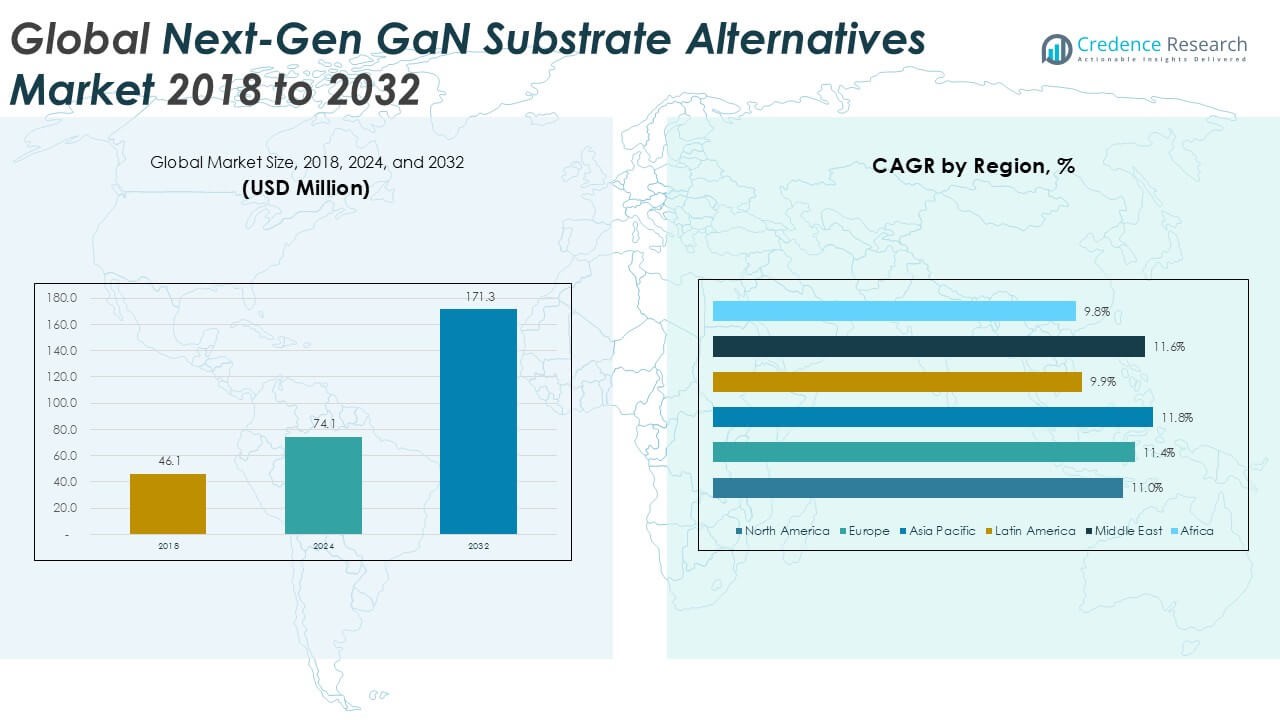

The Global Next-Gen GaN Substrate Alternatives Market size was valued at USD 46.1 million in 2018 to USD 74.1 million in 2024 and is anticipated to reach USD 171.3 million by 2032, at a CAGR of 11.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Next-Gen GaN Substrate Alternatives Market Size 2024 |

USD 74.1 Million |

| Next-Gen GaN Substrate Alternatives Market , CAGR |

11.28% |

| Next-Gen GaN Substrate Alternatives Market Size 2032 |

USD 171.3 Million |

Key drivers of market growth include the superior performance characteristics of GaN substrate alternatives, such as high electron mobility, low switching losses, and better thermal stability compared to conventional materials. These advantages make GaN substrates essential for the development of energy-efficient power devices and miniaturized electronics. Furthermore, the ongoing transition towards electric vehicles (EVs), 5G networks, and renewable energy solutions is accelerating the adoption of GaN-based technologies.

Regionally, Asia Pacific holds a dominant position in the market, driven by the presence of major semiconductor manufacturers and a rapidly expanding industrial base. The region benefits from a growing electronics sector, cost-effective manufacturing capabilities, and increasing investments in GaN technology. North America and Europe also contribute significantly to the market, supported by strong research ecosystems, advanced manufacturing capabilities, and government initiatives promoting clean energy and energy-efficient technologies. These regions are expected to witness steady growth in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Next-Gen GaN Substrate Alternatives Market was valued at USD 46.1 million in 2018 and is projected to reach USD 171.3 million by 2032, growing at a CAGR of 11.28% during the forecast period.

- GaN substrates offer high electron mobility, low switching losses, and better thermal stability, making them essential for energy-efficient power devices and miniaturized electronics.

- Energy efficiency is a key driver, with GaN substrates increasingly used in EVs, renewable energy systems, and power electronics for their low energy loss and high efficiency.

- The rise of electric vehicles and 5G networks drives GaN substrate adoption, improving performance in power electronics and enabling faster data transmission.

- Government policies promoting clean energy and energy-efficient technologies accelerate GaN substrate adoption, supported by regulatory incentives and research funding.

- High production costs and complex manufacturing processes challenge market growth, limiting scalability and increasing the cost of GaN-based products.

- Limited availability of high-quality GaN substrates due to production complexities could slow their adoption, especially in high-demand sectors like EVs and telecommunications.

Market Drivers:

Superior Performance Characteristics

The Global Next-Gen GaN Substrate Alternatives Market benefits significantly from the superior properties of GaN-based materials, including high electron mobility, low switching losses, and improved thermal stability. These attributes enable GaN substrates to outperform traditional silicon-based materials, particularly in high-power and high-frequency applications. GaN’s ability to handle higher power densities in compact devices makes it indispensable in industries such as automotive, telecommunications, and renewable energy. This performance is essential for energy-efficient, high-performance electronics, further boosting its adoption across a wide range of applications.

Increasing Demand for Energy Efficiency

Energy efficiency is a critical driver for the Global Next-Gen GaN Substrate Alternatives Market. With global efforts focused on sustainability, there is mounting pressure to minimize energy consumption across various sectors. GaN substrates, known for their low energy loss and high efficiency, are being increasingly adopted in energy-critical applications like electric vehicles (EVs), renewable energy systems, and power electronics. Their ability to enhance system efficiency while reducing power loss makes them key to achieving energy conservation targets, propelling further demand for GaN substrates.

- For instance, Dell incorporated a Texas Instruments GaN power stage in its 1.8kW server power-supply unit, which achieves a system-level efficiency above 96 while enabling a compact form factor.

Advancements in Electric Vehicles and 5G Networks

The rise of electric vehicles (EVs) and the deployment of 5G networks are pivotal to driving GaN substrate adoption. GaN substrates enable improved performance in EV power electronics, such as charging systems and battery management, enhancing energy efficiency and driving range. Similarly, in 5G applications, GaN materials are crucial for high-frequency, high-performance devices needed to support faster data speeds and reduced latency. The rapid growth of these sectors ensures continued demand for GaN substrates in next-generation technologies.

- For instance, Canoo utilizes Infineon’s automotive-qualified GaN power semiconductors in a 7.2kW onboard charger that achieves 98.7% power factor correction (PFC) efficiency, enabling higher system efficiency and compact design in EVs.

Supportive Government Policies and Research Initiatives

Government policies promoting clean energy and energy-efficient technologies are accelerating the adoption of GaN substrates. Regulatory incentives and research funding are supporting the commercialization of GaN-based solutions. Collaborative efforts between industry leaders, research institutions, and governments are further fostering innovation, enhancing the development of GaN substrate technologies and their integration into high-demand applications.

Market Trends:

Increased Adoption in Electric Vehicles and Power Electronics

A key trend in the Global Next-Gen GaN Substrate Alternatives Market is the rising adoption of GaN substrates in electric vehicles (EVs) and power electronics. As the demand for EVs grows, manufacturers are seeking high-performance, energy-efficient materials to improve battery management systems, power conversion units, and charging stations. GaN substrates, with their ability to operate at higher efficiencies and handle more power, are becoming integral to EV infrastructure. This shift is driven by GaN’s ability to reduce energy loss, enhance power density, and enable compact, lightweight designs, critical for the advancement of EVs. These benefits align with the growing trend towards sustainable transportation and renewable energy solutions, further boosting GaN adoption in these sectors.

- For instance, a laboratory prototype GaN-based battery charger developed by Virginia Tech for plug-in hybrid electric vehicles achieved an efficiency of 92.4% at 1.8kW and a power density of 125W/in³, showcasing significant improvements over traditional silicon-based designs.

Expansion in Telecommunications and 5G Infrastructure

The demand for GaN substrates is also being driven by the rapid expansion of 5G networks and telecommunications infrastructure. GaN materials offer superior performance in high-frequency, high-power applications, essential for the deployment of 5G technology. They enable more efficient power amplifiers, improving signal strength and reducing energy consumption in base stations and devices. The Global Next-Gen GaN Substrate Alternatives Market is experiencing increased demand from telecom companies investing heavily in 5G rollout. As the global 5G infrastructure expands, the demand for GaN-based solutions in telecommunications will continue to rise, driven by the need for high-speed, low-latency, and energy-efficient communication systems.

- For instance, Mitsubishi Electric developed a GaN power amplifier module for 5G base stations with a compact 6mm-by-10mm footprint and power efficiency above 43, achieving a world-first in performance verification for the 3.4–3.8GHz 5G frequency range.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

A significant challenge facing the Global Next-Gen GaN Substrate Alternatives Market is the high production costs and complex manufacturing processes associated with GaN substrates. The materials require specialized equipment and advanced techniques, such as high-temperature growth processes, to produce high-quality substrates. These factors contribute to the higher cost of GaN-based products compared to traditional silicon alternatives. As a result, many companies face difficulties in scaling production to meet increasing demand while maintaining cost competitiveness. The high initial investment required for manufacturing also limits market penetration, particularly in cost-sensitive applications.

Limited Availability of High-Quality Substrates

Another challenge hindering the growth of the Global Next-Gen GaN Substrate Alternatives Market is the limited availability of high-quality GaN substrates. While GaN-based materials offer superior performance, sourcing consistently high-quality substrates has proven difficult due to the complexities in their production. The lack of advanced manufacturing capabilities and qualified suppliers makes it challenging for companies to meet the increasing demand for GaN substrates in various industries. This issue is particularly pressing in the rapidly growing sectors of electric vehicles and telecommunications, where demand for GaN substrates is expected to rise significantly. The scarcity of quality substrates may slow the adoption of GaN-based technologies across these high-demand industries.

Market Opportunities:

Expansion in Electric Vehicle and Renewable Energy Applications

The Global Next-Gen GaN Substrate Alternatives Market holds significant opportunities in the rapidly expanding electric vehicle (EV) and renewable energy sectors. With the growing demand for EVs, there is an increasing need for efficient power electronics to enhance battery management and power conversion systems. GaN substrates, known for their superior performance, are ideal for improving the efficiency and energy density of EV power systems. The shift toward renewable energy solutions also presents an opportunity for GaN substrates to play a pivotal role in power electronics for solar and wind energy systems. As both sectors continue to grow, the adoption of GaN substrates will increase, providing substantial market opportunities.

Advancements in 5G and Telecommunications Infrastructure

Another key opportunity lies in the growing demand for GaN substrates in 5G and telecommunications infrastructure. As global telecommunications providers expand 5G networks, GaN-based solutions are critical for achieving high-frequency, high-power performance in power amplifiers and base stations. GaN substrates enable faster data transmission, lower energy consumption, and improved signal integrity, making them essential for the development of efficient 5G technologies. The continued global rollout of 5G networks presents a robust opportunity for the Global Next-Gen GaN Substrate Alternatives Market, driven by the increasing need for high-performance, energy-efficient materials in telecom applications.

Market Segmentation Analysis:

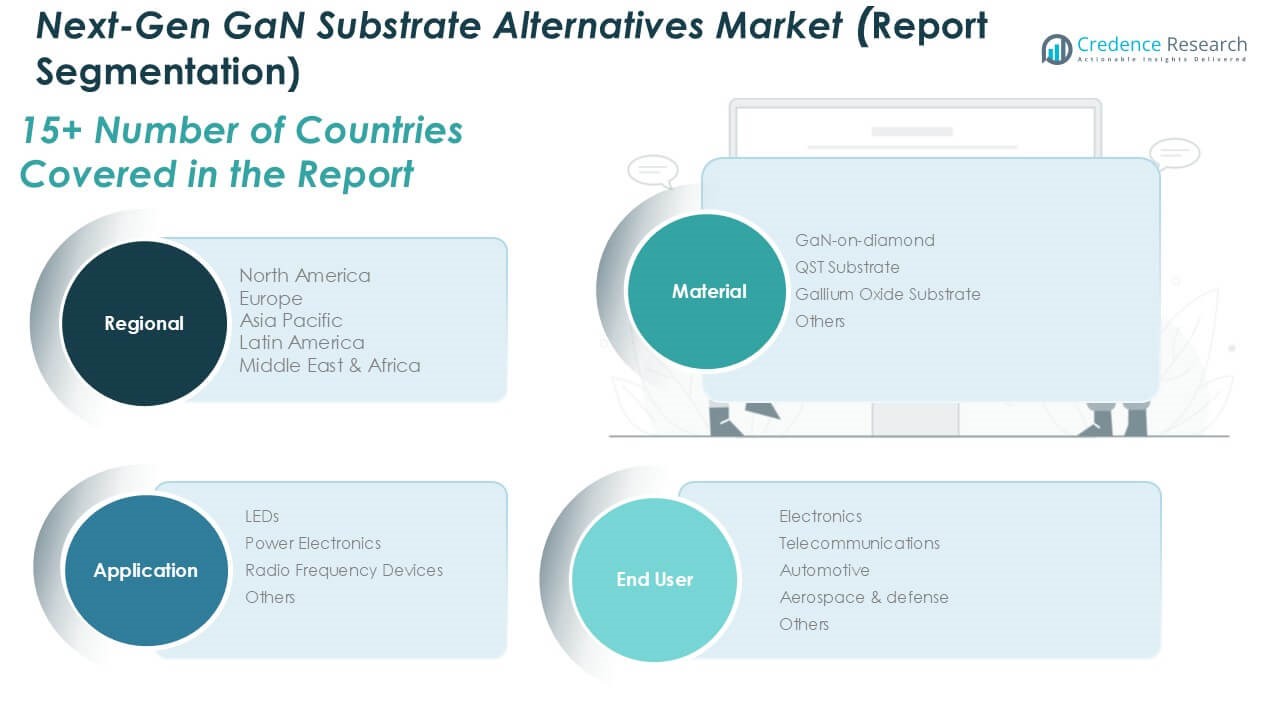

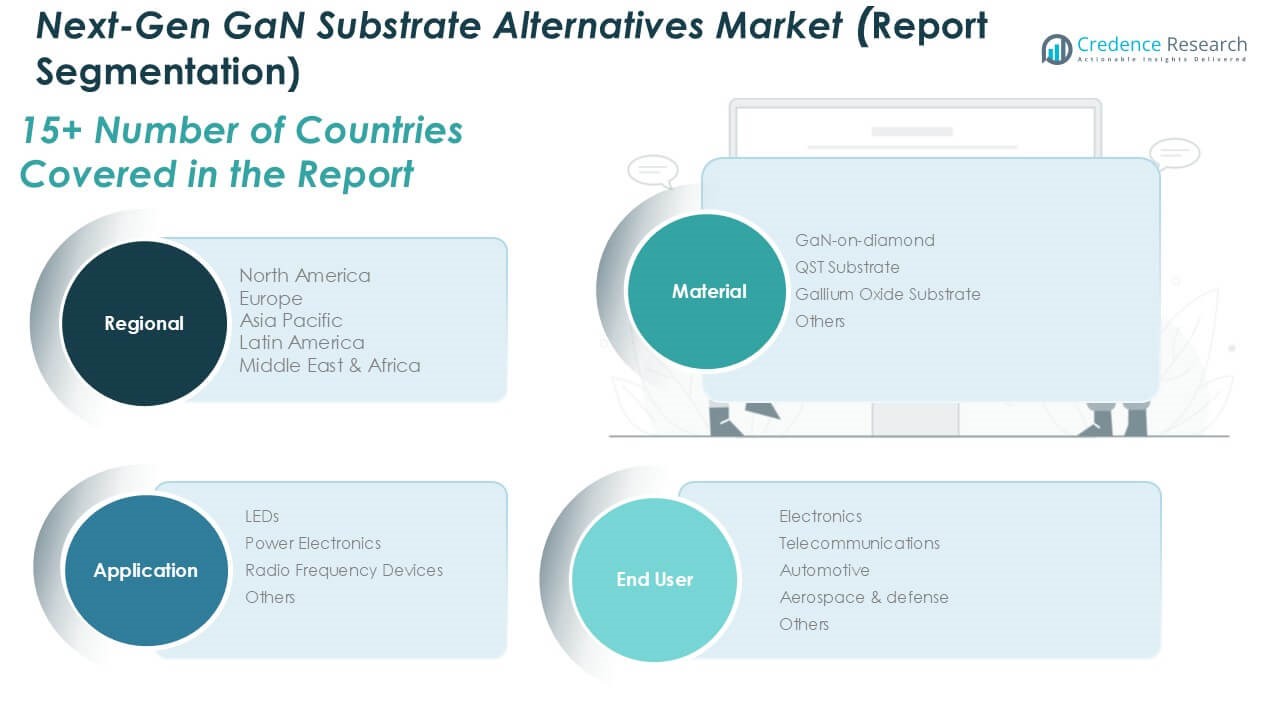

By Material Type

The Global Next-Gen GaN Substrate Alternatives Market is primarily driven by the GaN-on-diamond substrate segment. This material type offers superior thermal conductivity, making it ideal for high-power applications. Other notable materials include gallium oxide and QST substrates, which provide enhanced electrical properties, low switching losses, and better thermal stability compared to conventional materials. These advancements enable the development of highly efficient power devices and contribute to the growing adoption of GaN substrates across industries.

- For instance, β-gallium oxide (β-Ga2O3) offers an ultra-wide bandgap of 4.8eV, more than four times that of silicon, which allows it to withstand much higher electric fields—making it highly suitable for high-power transistors in electric vehicle charging and renewable energy systems.

By Application

In terms of application, power electronics lead the market due to GaN’s ability to operate at high voltages with minimal energy loss, making it suitable for power conversion systems. The LED segment also plays a significant role, driven by the demand for energy-efficient lighting solutions. Furthermore, RF applications, particularly in 5G networks, increasingly utilize GaN substrates due to their high efficiency and compact form factors, which are essential for meeting the performance requirements of modern communication systems.

- For instance, a GaN low-noise amplifier MMIC designed for 28GHz 5G base stations achieved a gain of up to 15.8dB and a noise figure as low as 1.6dB, supporting advanced, high-performance wireless infrastructure.

By End-User

The electronics sector is the largest end-user of GaN substrates, owing to their widespread application in consumer electronics, telecommunications, and industrial devices. The automotive sector, particularly with the rise of electric vehicles (EVs), is a growing contributor, as GaN substrates enable more efficient power conversion in EV charging systems and electric drivetrains. The aerospace and defense sectors also drive demand for GaN due to its use in radar, communication systems, and satellite technology, where high performance is critical.

Segmentations:

By Material Type

- GaN-on-diamond

- QST Substrate

- Gallium Oxide Substrate

- Others

By Application

- LEDs

- Power Electronics

- Radio Frequency Devices

- Others

By End User

- Electronics

- Telecommunications

- Automotive

- Aerospace & Defense

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The Global Next-Gen GaN Substrate Alternatives Market in North America was valued at USD 12.72 million in 2018 and is projected to reach USD 45.79 million by 2032, growing at a CAGR of 11.0%. The region benefits from the presence of key semiconductor companies and strong government support for clean energy and 5G infrastructure. As industries such as electric vehicles (EVs) and telecommunications demand more power-efficient solutions, North America is expected to continue experiencing substantial growth in GaN technology adoption.

Europe

In Europe, the market size is expected to grow from USD 10.92 million in 2018 to USD 40.94 million by 2032, at a CAGR of 11.4%. The region’s commitment to sustainability, alongside stringent environmental regulations, drives the adoption of GaN-based solutions in electric vehicles, renewable energy, and telecommunications. Leading countries like Germany, France, and the U.K. are advancing GaN technologies, positioning Europe as a key player in the global GaN substrate market.

Asia Pacific

In Asia Pacific dominates the market with a projected growth from USD 14.51 million in 2018 to USD 57.83 million by 2032, at a CAGR of 11.8%. The region is home to major semiconductor manufacturers, benefiting from cost-effective production capabilities and substantial investments in GaN technology development. With rising demand for electric vehicles, smart grids, and 5G networks, Asia Pacific is expected to maintain its leadership in GaN substrate adoption, driving the global market forward.

Latin America

In Latin America, the market is expected to grow from USD 4.71 million in 2018 to USD 14.85 million by 2032, at a CAGR of 9.9%. The region shows steady growth potential, particularly in Brazil and Mexico, where increasing investments in renewable energy and electric vehicle infrastructure are key drivers. GaN substrates are set to play a crucial role in supporting these sectors, as demand for energy-efficient technologies continues to rise.

Middle East

The Middle East market is projected to reach USD 8.57 million by 2032, growing at a CAGR of 11.6%. Demand for clean energy solutions and smart grid technologies drives market expansion. Countries like Saudi Arabia and the UAE are heavily investing in renewable energy, where GaN substrates can significantly enhance energy efficiency. The region’s focus on deploying 5G networks further accelerates the demand for GaN-based technologies.

Africa

In Africa, the market is expected to grow from USD 1.08 million in 2018 to USD 3.32 million by 2032, at a CAGR of 9.8%. The market remains in its early stages but holds significant growth potential, particularly in telecommunications and renewable energy. Countries like South Africa and Nigeria are adopting clean energy solutions, creating opportunities for GaN substrate applications in power devices. The demand for energy-efficient solutions will drive the adoption of GaN technology in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hexagem

- Shin-Etsu Chemical Co., Ltd.

- CoorsTek

- Mitsubishi Chemical Corporation

- Soitec

Competitive Analysis:

The Global Next-Gen GaN Substrate Alternatives Market is highly competitive, with several key players focusing on innovation, strategic partnerships, and regional expansion to maintain their market positions. Leading companies in the market are investing heavily in R&D to develop advanced materials such as GaN-on-diamond, QST substrates, and gallium oxide substrates, which offer superior thermal and electrical properties. These advancements are crucial in meeting the growing demand for more efficient power devices across applications such as LEDs, power electronics, and radio frequency devices. Companies are also targeting high-growth regions, including North America and Asia Pacific, to capitalize on expanding electronics and telecommunications sectors. Competitive dynamics are shaped by continuous product innovation, mergers, and acquisitions, with companies aiming to increase their production capabilities and broaden their product portfolios. The market remains highly dynamic, with companies focusing on achieving scalability and cost-efficiency to sustain long-term growth.

Recent Developments:

- In June 2025, Hexagon launched Luciad 2025.0, a major update to its situational awareness platform, introducing enhanced real-time visualization and new capabilities for defense and intelligence agencies.

- In April 2025, Hexagon announced the global launch of its Digital Factory as-a-service solution.

- In May 2025, Shin-Etsu Chemical Co., Ltd. launched innovative silicone products, including KF-6070W and KF-6080W, aimed at improving the texture and functionality in personal care and cosmetic applications.

Market Concentration & Characteristics:

The Global Next-Gen GaN Substrate Alternatives Market is moderately concentrated, with a few dominant players driving significant market share. The competitive landscape is shaped by large multinational companies and specialized players focusing on advanced materials like GaN-on-diamond, QST substrates, and gallium oxide substrates. Key market characteristics include continuous technological advancements, strategic partnerships, and heavy investments in R&D. Companies are expanding their product portfolios and enhancing manufacturing capacities to cater to the growing demand for efficient power devices. The market also benefits from strong collaboration between technology providers, research institutions, and end-users in industries such as telecommunications, automotive, and aerospace. Despite the concentration, the market remains dynamic with opportunities for smaller, innovative players to gain traction by offering specialized solutions in niche applications.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to experience significant growth due to increasing demand for high-efficiency power devices.

- Advancements in GaN-on-diamond, QST, and gallium oxide substrates are anticipated to enhance device performance and reliability.

- The transition from silicon-based substrates to GaN alternatives is projected to accelerate across various applications.

- Strategic investments in R&D by leading companies are expected to drive innovation and cost reductions in GaN substrate production.

- The automotive industry’s shift towards electric vehicles is anticipated to increase the demand for GaN-based power electronics.

- The expansion of 5G infrastructure is expected to create new opportunities for GaN substrates in RF applications.

- Government initiatives promoting energy efficiency and sustainability are likely to bolster the adoption of GaN technologies.

- Collaborations between material suppliers and device manufacturers are expected to streamline the development and commercialization of GaN substrates.

- The emergence of new markets in Asia-Pacific and Latin America is projected to contribute to global market expansion.

- Ongoing advancements in wafer scaling and defect reduction are expected to improve the economic viability of GaN substrates.