Market Overview:

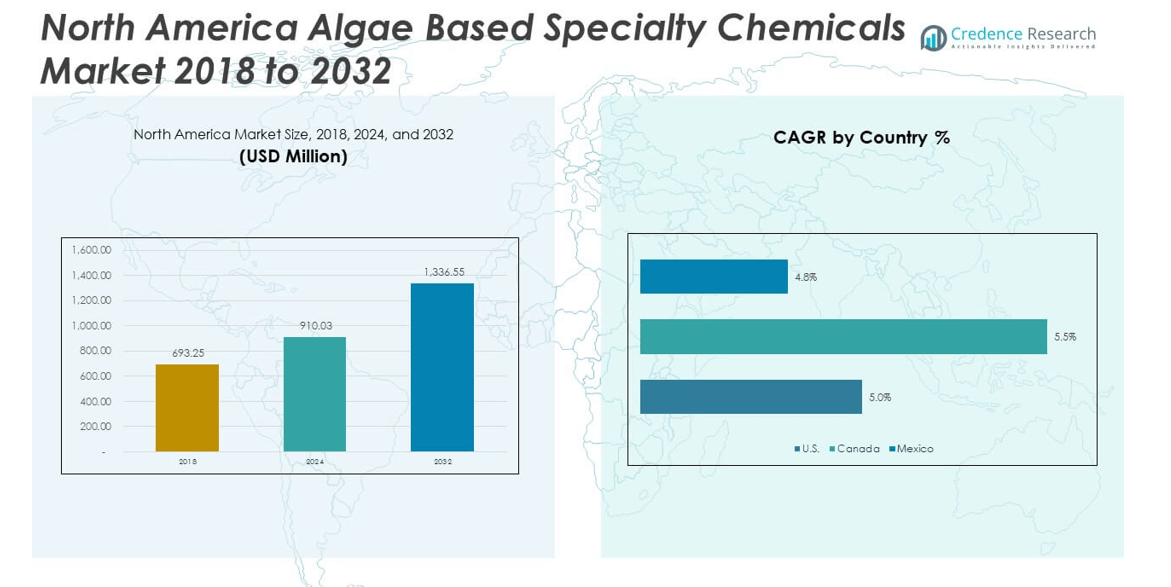

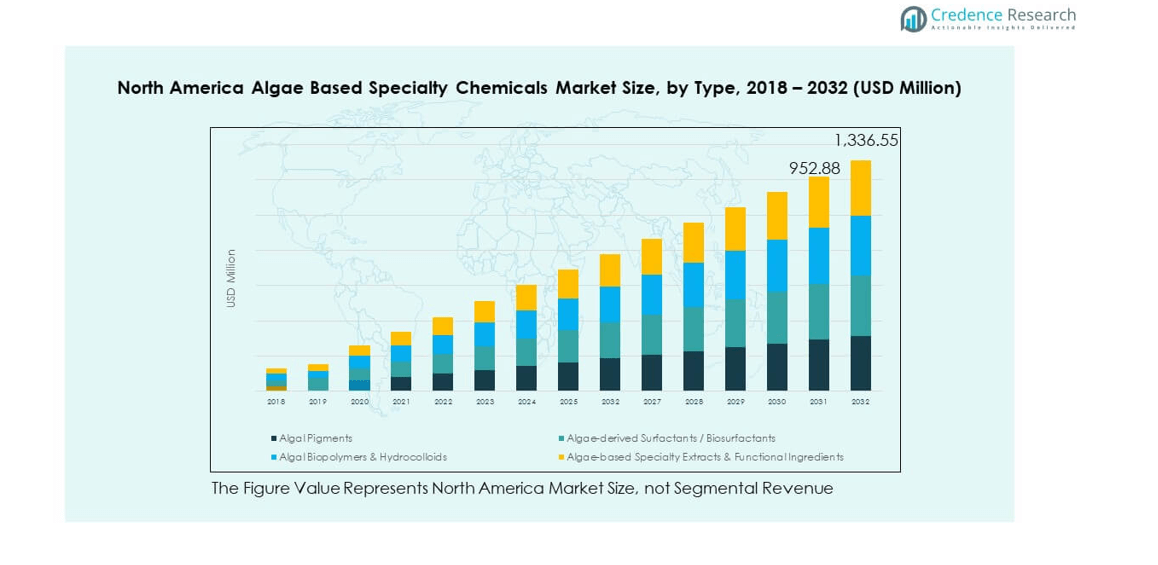

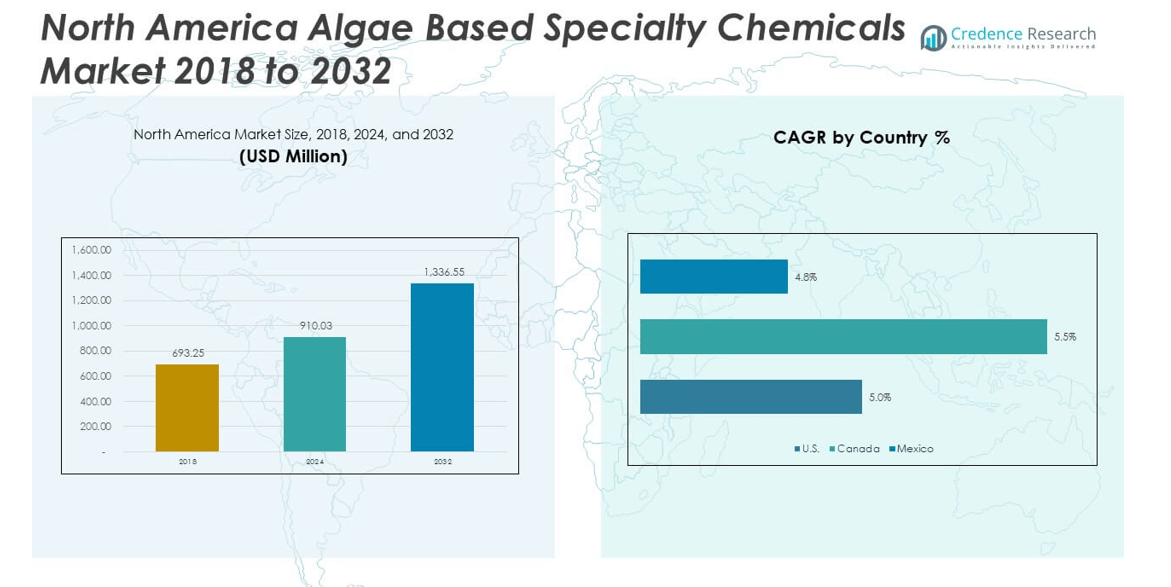

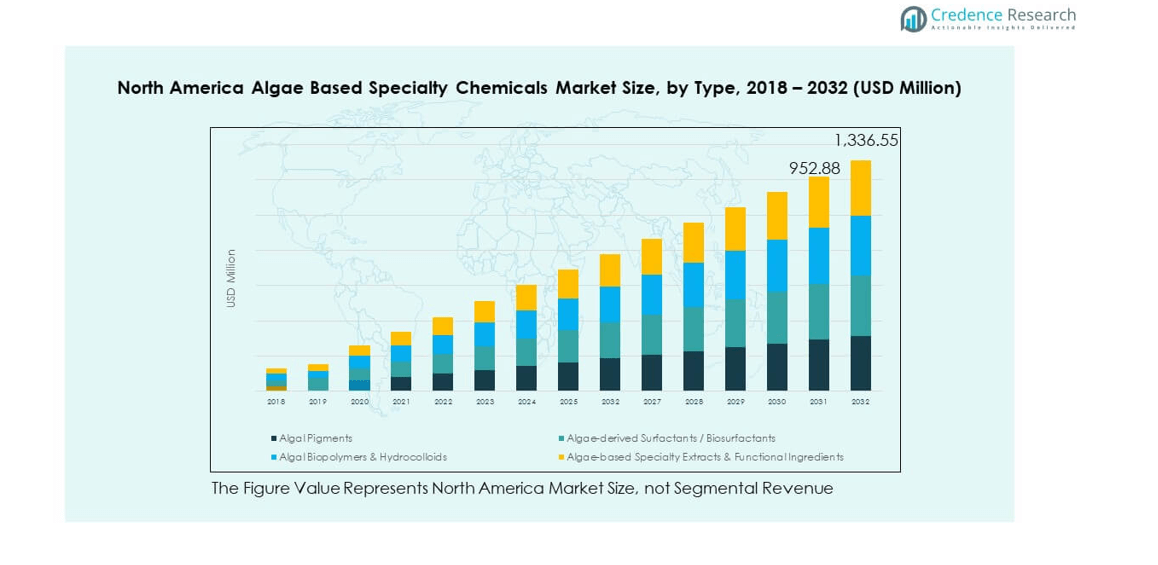

The North America Algae Based Specialty Chemicals Market size was valued at USD 693.25 million in 2018 to USD 910.03 million in 2024 and is anticipated to reach USD 1,336.55 million by 2032, at a CAGR of 4.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Algae Based Specialty Chemicals Market Size 2024 |

USD 910.03 million |

| North America Algae Based Specialty Chemicals Market, CAGR |

4.87% |

| North America Algae Based Specialty Chemicals Market Size 2032 |

USD 1,336.55 million |

Growing consumer demand for eco-friendly products fuels adoption of algae-based specialty chemicals across end-use industries. Rising awareness of natural ingredients in cosmetics and personal care strengthens this demand. Nutraceutical and food manufacturers adopt algae-derived pigments, hydrocolloids, and proteins due to clean-label preferences. Pharmaceutical firms invest in algae-based bioactive compounds for advanced drug formulations. Supportive government policies on renewable resources accelerate production and innovation. Industry collaborations also encourage technology transfer and commercialization, creating a strong environment for market expansion.

Geographically, the United States leads due to strong research infrastructure, advanced biotechnology firms, and higher consumer awareness of natural products. Canada shows growing traction with supportive government incentives and investments in sustainable industries. Mexico emerges as a developing hub, fueled by its expanding food, agriculture, and aquaculture industries. The regional market growth reflects diverse demand patterns, with mature economies driving innovation and emerging economies building cost-effective production bases. This creates a balanced ecosystem supporting broad adoption across multiple applications.

Market Insights:

- The North America Algae Based Specialty Chemicals Market was valued at USD 693.25 million in 2018, reached USD 910.03 million in 2024, and is projected to hit USD 1,336.55 million by 2032, growing at a CAGR of 4.87%.

- The United States led the market with 68% share in 2024, supported by advanced biotechnology, consumer awareness, and strong adoption in food, cosmetics, and pharmaceuticals.

- Canada accounted for 20% share, driven by sustainability-focused policies and investments, while Mexico held 12% share, supported by agriculture and aquaculture applications.

- Mexico is the fastest-growing country in the region, benefiting from expanding demand in biofertilizers, aquaculture feed, and clean-label food ingredients.

- From the type segmentation, Algal Biopolymers & Hydrocolloids held the largest share at 35.7%, while Algae-based Specialty Extracts & Functional Ingredients accounted for 28.6% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable and Natural Ingredients Across Consumer Industries:

The North America Algae Based Specialty Chemicals Market benefits from the increasing preference for eco-friendly and bio-based solutions. Consumers prioritize clean-label products across food, cosmetics, and nutraceuticals. It gains momentum as regulations encourage industries to reduce dependence on synthetic chemicals. Food and beverage manufacturers integrate algae-derived hydrocolloids and pigments to enhance nutritional and visual value. Cosmetics companies invest in algae extracts due to their functional properties and appeal to environmentally conscious buyers. Nutraceutical firms develop supplements using algae-based compounds for health benefits. Pharmaceutical applications add another growth avenue through algae-derived bioactives. It creates a strong push across industries seeking renewable inputs.

- For instance, CP Kelco U.S., Inc., a leading provider of algae-based hydrocolloids such as carrageenan and alginate, supplies to large food and beverage companies, supporting formulations with up to 98% purity and demonstrating scalability with their production volumes exceeding thousands of metric tons annually. Cosmetics companies invest in algae extracts due to their functional properties and appeal to environmentally conscious buyers. Cyanotech Corporation produces astaxanthin-rich microalgae extracts, offering purity levels above 95%, utilized in anti-aging skincare products.

Expanding Applications in Pharmaceuticals, Nutraceuticals, and Bioplastics Manufacturing:

The North America Algae Based Specialty Chemicals Market grows as algae-based ingredients gain relevance in health-focused applications. Nutraceutical companies use algae compounds rich in antioxidants, proteins, and vitamins. Pharmaceuticals leverage algae-derived molecules for biomarker development and novel therapies. It also gains traction in bioplastics manufacturing, where algae-based polymers provide biodegradable solutions. Packaging firms explore algae biopolymers to meet sustainability goals. Agriculture and aquaculture sectors benefit from algae surfactants enhancing soil and feed performance. Industrial cleaning product makers adopt biosurfactants for safer and greener formulations. This multi-industry adoption ensures long-term demand and investment.

- For instance, Notpla, a leader in algae-based bioplastics, produces edible packaging materials that are 100% home-compostable and fully biodegradable in 4–6 weeks. While its annual revenue is not publicly confirmed, various industry estimates place it between $10 million and $50 million. Packaging firms increasingly explore algae biopolymers to meet sustainability goals, and the agriculture and aquaculture sectors benefit from algae-derived products enhancing soil and feed performance.

Strong Policy Support and Research Investments Accelerating Market Expansion:

The North America Algae Based Specialty Chemicals Market experiences growth through robust government support and policy frameworks. Subsidies, grants, and research funding drive algae cultivation and downstream processing. It gains strength from universities and biotech firms actively investing in algae-based innovation. Renewable energy policies indirectly support algae production as part of the circular bioeconomy. Companies receive encouragement to replace fossil-derived chemicals with algae-based alternatives. Growing awareness of climate change boosts interest in low-carbon industrial solutions. Collaborative projects between public and private entities accelerate commercialization. This framework encourages industrial adoption across North America.

Technological Advancements and Industrial Collaborations Driving Innovation:

The North America Algae Based Specialty Chemicals Market advances with significant improvements in cultivation, harvesting, and processing technologies. It benefits from innovations in photobioreactors, genetic engineering, and efficient extraction methods. These advancements enhance yield and reduce production costs, making algae-based products more competitive. Industrial collaborations between chemical producers, biotech startups, and research labs fuel technology transfer. Food and pharmaceutical players co-develop specialized ingredients with algae producers. Strategic mergers and partnerships expand production capacity and market reach. Growing private equity and venture funding further accelerates technological adoption. These innovations help the market overcome traditional cost barriers and scale efficiently.

Market Trends:

Growing Popularity of Functional Algae-Based Ingredients in Premium Consumer Products:

The North America Algae Based Specialty Chemicals Market trends toward premium consumer goods integrating algae ingredients. Cosmetics brands highlight algae extracts for anti-aging and moisturizing properties. Functional beverages include algae proteins and pigments for added health appeal. Nutraceuticals emphasize algae-based omega-3s as alternatives to fish-derived sources. It gains visibility as consumers seek natural and sustainable labels. Luxury skincare products integrate microalgae due to bioactive content. Premium food categories adopt algae pigments for clean-label formulations. Retailers market algae-based products as eco-luxury choices. These trends reflect increasing consumer sophistication and demand for differentiated, natural products.

Integration of Algae-Based Polymers in Circular Economy Packaging Solutions:

The North America Algae Based Specialty Chemicals Market follows the shift toward sustainable packaging. Algae-derived polymers and hydrocolloids present viable options for bioplastics. Companies adopt these solutions to comply with circular economy principles. It supports reduction of single-use plastics through biodegradable alternatives. Packaging firms collaborate with algae producers to scale innovative materials. Food brands test algae biopolymers in containers, films, and coatings. Consumer preference for recyclable packaging strengthens adoption. Research initiatives focus on improving mechanical and thermal properties of algae plastics. This trend aligns with regulatory mandates and corporate sustainability goals.

- For instance, Packaging firms collaborate with algae producers to scale innovative materials. Food brands test algae biopolymers in containers, films, and coatings with moisture and oxygen barrier properties experimentally validated to extend product shelf life by up to 15%. Consumer preference for recyclable packaging strengthens adoption.

Increasing Collaborations Between Algae Startups and Established Industrial Players:

The North America Algae Based Specialty Chemicals Market demonstrates a trend toward partnerships and joint ventures. Startups focus on cultivating high-value strains and improving production efficiency. Established players leverage these innovations to diversify product portfolios. It encourages rapid commercialization of novel algae-based solutions. Pharmaceutical companies engage startups to develop biomolecules for drug discovery. Cosmetics giants partner with algae firms to co-create natural formulations. Industrial chemical producers expand biosurfactant applications through collaborations. Government-backed projects further encourage such alliances. This collaboration trend drives faster innovation cycles and broader market penetration.

Expansion of Algae-Based Specialty Chemicals into Agriculture and Aquaculture:

The North America Algae Based Specialty Chemicals Market expands its footprint into agriculture and aquaculture applications. Algae-derived surfactants improve soil quality and crop performance. Aquaculture feed incorporates algae ingredients for better nutrition and sustainability. It reduces reliance on synthetic chemicals in farming practices. Companies highlight algae inputs as eco-friendly enhancers for productivity. Research institutions explore algae-based fertilizers with reduced environmental impact. Farmers adopt algae formulations to comply with sustainability certifications. The aquaculture industry benefits from algae proteins replacing fishmeal. These applications support regional sustainability targets while opening new revenue channels.

Market Challenges Analysis:

High Production Costs and Scalability Issues in Algae-Based Manufacturing:

The North America Algae Based Specialty Chemicals Market faces challenges linked to production economics. Algae cultivation requires advanced infrastructure, including photobioreactors and controlled facilities. Energy and operational costs remain higher compared to synthetic alternatives. It creates barriers for small and mid-scale companies seeking to compete. Limited scalability restricts the transition from pilot to commercial-scale production. High costs discourage price-sensitive industries from adoption. Addressing these constraints requires breakthroughs in low-cost cultivation and extraction technologies. Companies invest in automation and optimized harvesting to reduce expenses. Without cost efficiency, mass adoption remains a challenge.

Regulatory Complexity and Market Awareness Constraints Affecting Wider Adoption:

The North America Algae Based Specialty Chemicals Market struggles with regulatory hurdles and awareness gaps. Stringent approval processes for algae-based compounds slow commercialization. Food, pharmaceutical, and cosmetic applications require extensive testing and compliance. It creates delays in bringing innovative algae-based products to market. Limited awareness among industrial users reduces demand momentum. Some industries remain cautious about replacing traditional inputs. Complex intellectual property rights around algae strains pose additional challenges. Companies face difficulty navigating diverse regulatory frameworks across countries. Educating stakeholders and simplifying compliance can help address these issues effectively.

Market Opportunities:

Expanding Use of Algae-Based Extracts in High-Growth Consumer Sectors:

The North America Algae Based Specialty Chemicals Market offers strong opportunities through expanding use in consumer-facing industries. Nutraceuticals integrate algae extracts for wellness-focused products. Cosmetics highlight bioactive properties of algae for skincare solutions. Food manufacturers use pigments and hydrocolloids in natural formulations. Pharmaceuticals continue exploring bio-compounds for innovative therapies. It gains momentum with growing consumer interest in natural and renewable products. Partnerships with consumer brands enhance commercialization. Companies investing in algae-based innovations position themselves for significant long-term gains.

Growth Potential in Bio-based Materials and Industrial Applications:

The North America Algae Based Specialty Chemicals Market presents opportunities in industrial applications and sustainable materials. Bioplastics derived from algae polymers attract attention in packaging. Agriculture firms use algae surfactants for soil and crop health. Aquaculture formulators develop algae-based feed ingredients. Industrial cleaning products incorporate biosurfactants for eco-friendly alternatives. It creates growth paths across sectors aligned with sustainability agendas. Investment in production facilities enhances competitiveness. Companies adopting algae innovations meet both regulatory compliance and market expectations.

Market Segmentation Analysis:

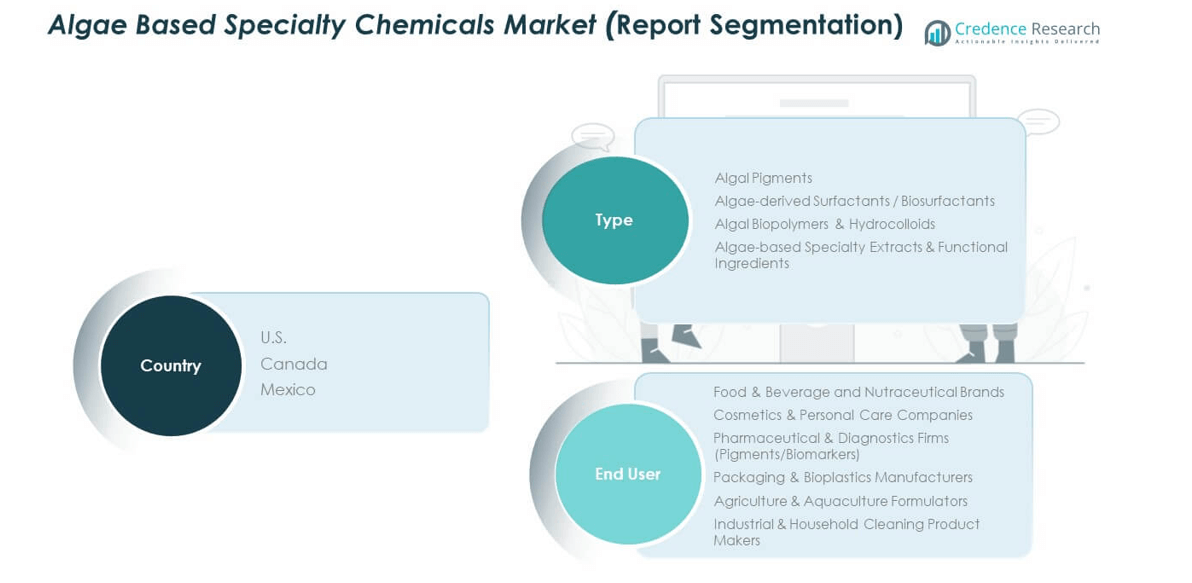

Type-Based Segmentation

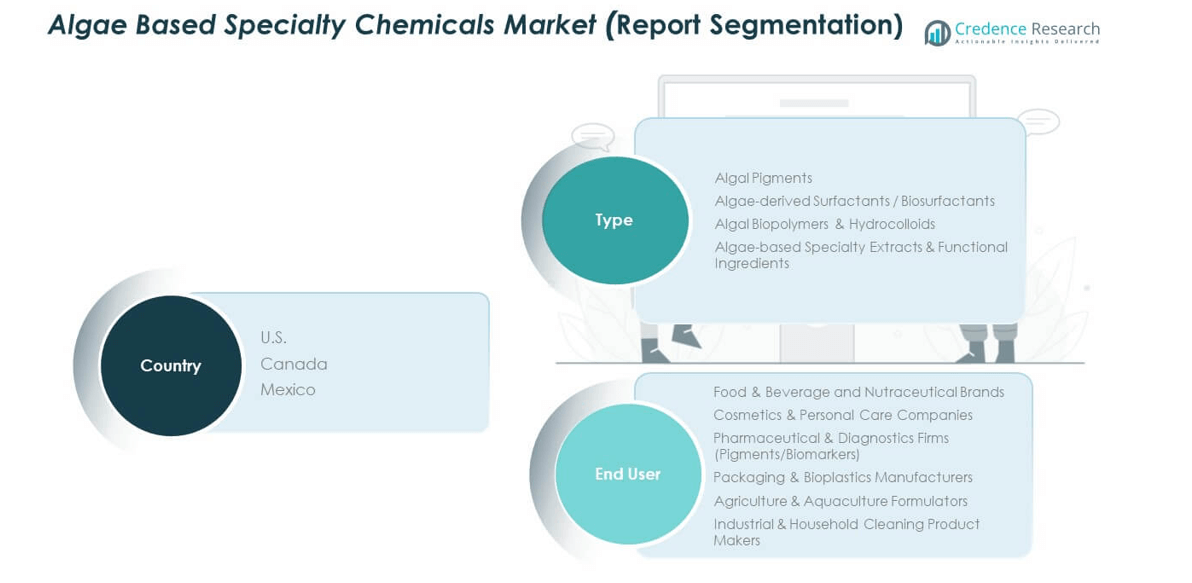

The North America Algae Based Specialty Chemicals Market demonstrates strong demand across diverse product categories. Algal pigments gain traction in food and cosmetics due to natural coloring properties and clean-label appeal. Biosurfactants from algae are integrated into industrial cleaning products and personal care formulations, offering eco-friendly alternatives to synthetic surfactants. Biopolymers and hydrocolloids derived from algae serve as essential inputs for bioplastics and packaging industries. Specialty extracts and functional ingredients provide value-added solutions in nutraceuticals and pharmaceuticals, driving innovation in health-focused markets. Each type segment contributes to broader adoption across consumer and industrial applications.

- For instance, algal pigments such as phycocyanin are commercially available for use as a natural food colorant. For example, biosurfactants produced by microorganisms, including some algae, are integrated into industrial cleaning products and personal care formulations, offering biodegradable alternatives to synthetic surfactants.

End-User Segmentation

The North America Algae Based Specialty Chemicals Market caters to multiple industries with unique needs. Food and nutraceutical companies dominate adoption, leveraging algae-based compounds for natural and functional product development. Cosmetics and personal care firms focus on algae extracts for premium formulations targeting sustainability-conscious consumers. Pharmaceuticals and diagnostic companies explore pigments and biomarkers from algae for innovative therapies. Packaging and bioplastics manufacturers adopt algae polymers to address the growing demand for biodegradable solutions. Agriculture and aquaculture industries integrate algae products for soil enhancement and feed improvement. Industrial and household cleaning product makers benefit from biosurfactants that support safer and greener formulations.

- For instance, Arthrospira platensis-based protein powders with 65% protein content are widely used by manufacturers in health supplements. Cosmetics and personal care firms focus on algae extracts for premium formulations targeting sustainability-conscious consumers, using extracts with antioxidant activity measured by high ORAC values (oxygen radical absorbance capacity).

Segmentation:

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

By Country (North America)

Regional Analysis:

United States

The North America Algae Based Specialty Chemicals Market is dominated by the United States, holding nearly 68% share in 2024. Strong research facilities, biotechnology firms, and high consumer awareness of sustainable products support its leadership. Nutraceutical and cosmetic industries actively integrate algae-derived compounds to address health and wellness trends. Pharmaceutical players expand applications through algae-based bioactive compounds and biomarkers. The country also benefits from supportive regulations and private investments in renewable industries. It sets regional and global benchmarks in algae innovation and commercialization.

Canada

Canada represented about 20% of the regional share in 2024, driven by strong sustainability policies and innovation-focused initiatives. Cosmetics and personal care companies lead demand for algae-derived extracts due to consumer preference for natural formulations. Nutraceutical and pharmaceutical firms invest in algae-based pigments and compounds to meet rising wellness demand. Universities collaborate with chemical companies to develop scalable production methods. The country also advances algae-derived bioplastics and packaging solutions aligned with circular economy targets. It is building a reputation as a competitive hub for algae-based innovation in North America.

Mexico

Mexico accounted for nearly 12% share in 2024, and it shows growing momentum across multiple industries. Agriculture and aquaculture sectors drive adoption, using algae-based surfactants, fertilizers, and feed formulations. Food and beverage companies explore algae pigments and hydrocolloids to support clean-label requirements. Industrial cleaning and packaging applications remain in early stages but hold strong potential. Mexico benefits from integrated trade networks and knowledge transfer from U.S. and Canadian firms. Investments in new production facilities strengthen local supply capacity. It emerges as a cost-effective growth hub supporting regional expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CABB Chemicals

- BASF SE

- E.I.D. Parry (Parry Nutraceuticals)

- Cyanotech Corporation

- Earthrise Nutritionals

- Algatechnologies (Algatech)

- CP Kelco

- Cargill

- AlgaEnergy

- Other Key Players

Competitive Analysis:

The North America Algae Based Specialty Chemicals Market is characterized by strong competition among global and regional players. Key companies such as BASF SE, CABB Chemicals, and Cyanotech Corporation invest heavily in product development and strategic expansion. It benefits from active participation of nutraceutical, pharmaceutical, and cosmetic-focused firms like Earthrise Nutritionals and Algatech. CP Kelco and Cargill expand algae-based biopolymer and biosurfactant portfolios. Emerging firms and startups add competition by focusing on niche formulations. Partnerships and acquisitions strengthen market presence and accelerate commercialization. Companies compete on innovation, cost-efficiency, and regulatory compliance. The competitive landscape emphasizes sustainability, differentiation, and scaling capacity.

Recent Developments:

- In July 2025, CABB Group partnered with Finnish green chemicals company Origin by Ocean to launch the world’s first algae biorefinery in Kokkola, Finland. This facility will utilize patented technology to convert invasive sargassum brown seaweed into valuable ingredients like alginate and fucoidan, with plans to begin operations by 2028.

- In December 2024, BASF signed an agreement to sell its Food and Health Performance Ingredients business, including the North American production site in Illertissen, Germany, to focus on more value-added products and growth in downstream markets.

- Algatechnologies opened a U.S. subsidiary in New York to strengthen its presence in the North American algae market, focusing on the distribution and development of microalgae ingredient brands like AstaPure®. The company also collaborates with distributors and partners to introduce new algal products like organic oleoresin and fucoxanthin.

- CP Kelco continued to provide nature-based ingredient solutions across industries, focusing on natural and sustainable hydrocolloid products that improve performance and safety in cosmetics and other applications.

Report Coverage:

The research report offers an in-depth analysis based on type and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for algae-based inputs will rise across food, nutraceutical, and cosmetic industries.

- Expansion of bioplastic adoption will strengthen packaging applications.

- Research funding in North America will accelerate commercialization of algae compounds.

- Partnerships between startups and major players will boost innovation cycles.

- Nutraceutical firms will prioritize algae-based omega-3 and bioactive formulations.

- Pharmaceuticals will explore algae compounds for biomarker and therapeutic use.

- Sustainable agriculture solutions will drive algae-based surfactant adoption.

- Investments in cultivation technology will reduce production costs.

- Consumer awareness of eco-friendly products will expand market penetration.

- Regulatory support will continue to promote algae-based product adoption.