Market Overview

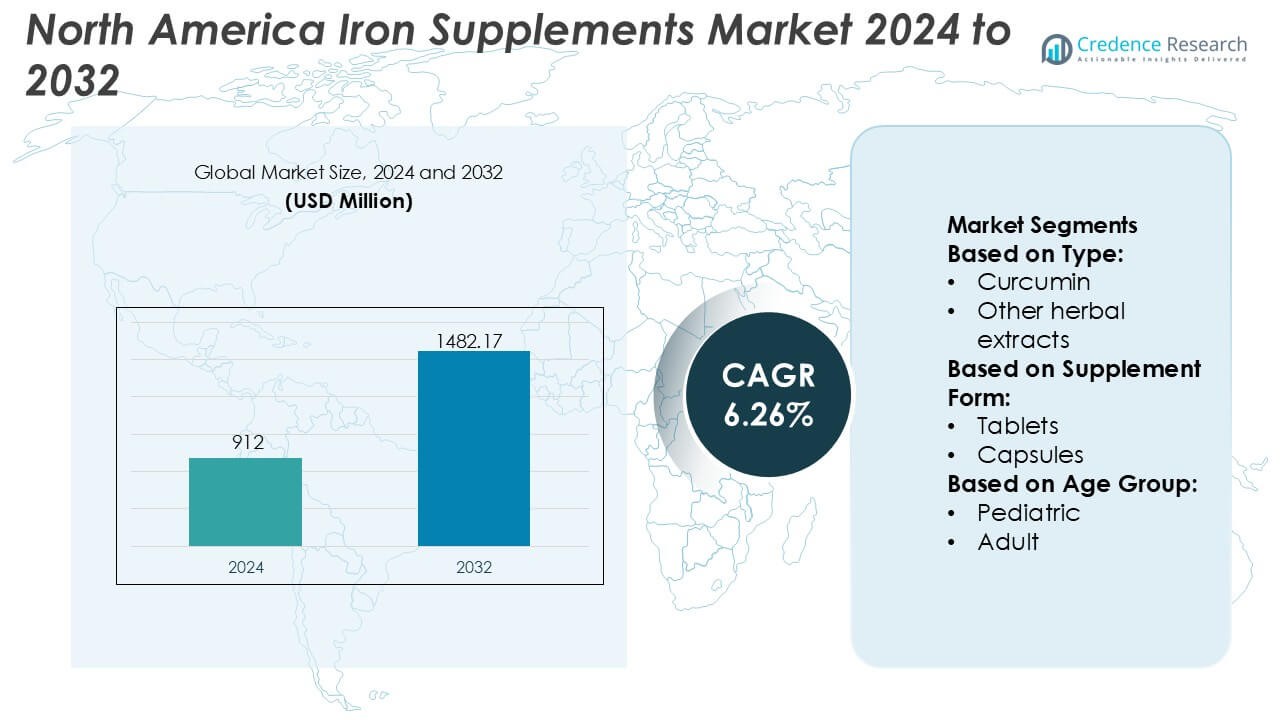

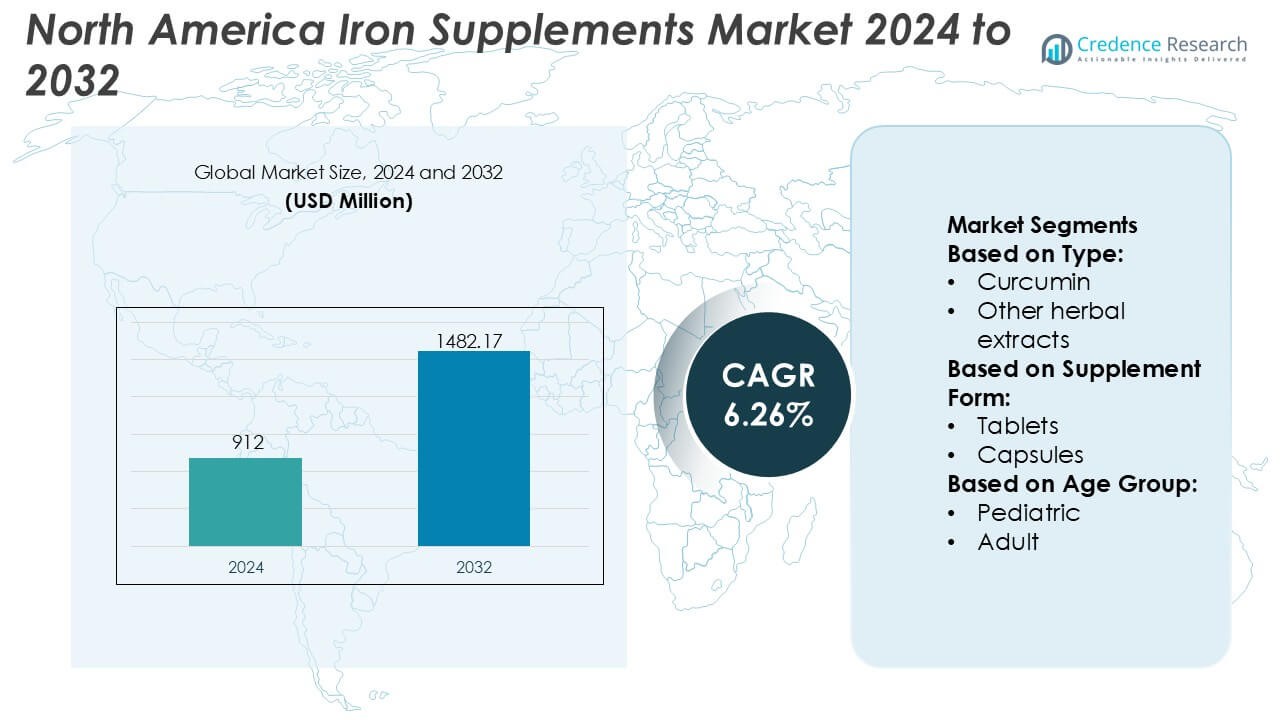

North America Iron Supplements Market size was valued USD 912 million in 2024 and is anticipated to reach USD 1482.17 million by 2032, at a CAGR of 6.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Iron Supplements Market Size 2024 |

USD 912 Million |

| North America Iron Supplements Market, CAGR |

6.26% |

| North America Iron Supplements Market Size 2032 |

USD 1482.17 Million |

The North America iron supplements market is led by established pharmaceutical manufacturers and global nutrition companies with strong capabilities in clinical formulation, regulatory compliance, and large-scale distribution. These players maintain competitive positioning through diversified product portfolios spanning prescription-grade iron therapies, over-the-counter supplements, and preventive nutrition products. Continuous investment in bioavailability enhancement, combination formulations, and tolerance-focused dosing supports brand differentiation and physician acceptance. Strong presence across retail pharmacies, mass merchandisers, and direct-to-consumer platforms further strengthens market reach. Regionally, the United States dominates the North America iron supplements market with an exact 82% market share, driven by high anemia prevalence, advanced healthcare access, robust dietary supplement consumption, and strong awareness of preventive nutrition. Canada and Mexico contribute smaller shares, supported by expanding wellness trends and improving access to fortified nutrition products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America iron supplements market was valued at USD 912 million in 2024 and is projected to reach USD 1,482.17 million by 2032, expanding at a CAGR of 6.26% driven by sustained nutritional demand.

- Rising prevalence of iron deficiency anemia among women, pediatric, and geriatric populations continues to drive consistent consumption across preventive and therapeutic supplementation.

- Product innovation trends emphasize high-absorption formulations, reduced gastrointestinal side effects, and combination products, with tablet formulations holding a dominant share of nearly 58% due to dosing convenience and cost efficiency.

- Competitive dynamics remain strong, supported by diversified portfolios, clinical validation, and wide distribution across pharmacies, mass retail, and direct-to-consumer channels.

- Regionally, the United States leads with an exact 82% market share, supported by high supplement penetration, advanced healthcare access, and strong preventive nutrition awareness, while Canada and Mexico show steady growth momentum.

Market Segmentation Analysis:

By Type

The North America iron supplements market by type reflects a diversified formulation landscape combining natural molecules, herbal extracts, and vitamins & minerals. Vitamins & minerals represent the dominant sub-segment, accounting for approximately 46% market share, driven by strong clinical validation, physician recommendation, and widespread use of iron combined with vitamin C or B-complex to enhance absorption and hematinic efficacy. Natural molecules follow, supported by rising interest in gut-friendly formulations and pre/pro/postbiotics that improve iron bioavailability. Herbal extracts hold a smaller share but gain traction among consumers seeking plant-based, clean-label, and holistic nutritional solutions.

- For instance, Glanbia specializes in custom premixes, 18 mg is the Recommended Dietary Allowance (RDA) for adult women, making it a standard target dosage for their iron-focused formulations.

By Supplement Form

By supplement form, tablets dominate the North America iron supplements market with nearly 52% share, supported by cost efficiency, long shelf life, and high-dose formulation capability suited for anemia management. Tablets remain the preferred format in clinical and OTC settings due to standardized dosing and familiarity among healthcare providers. Capsules hold a significant secondary share, driven by improved gastrointestinal tolerability and encapsulation technologies that reduce metallic taste and irritation. Other supplement forms, including liquids and powders, cater mainly to niche populations requiring flexible dosing or enhanced absorption, particularly in pediatric and geriatric care.

- For instance, Nature’s Sunshine Products, Inc. formulates Iron-Chelated tablets providing 25 mg of elemental iron per serving, designed for optimal absorption and gastrointestinal comfort. These are manufactured under pharmaceutical-grade cGMP standards at its 200,000-square-foot, solar-powered facility in Spanish Fork, Utah.

By Age Group

By age group, the adult segment leads with an estimated 58% market share, driven by high prevalence of iron-deficiency anemia among women of reproductive age, working professionals, and patients with chronic conditions. Increased health screening, prenatal supplementation, and physician-led interventions sustain strong adult demand. The pediatric segment follows, supported by fortified formulations addressing nutritional gaps in early development. The geriatric segment shows steady growth, driven by age-related absorption decline and chronic disease burden, with demand favoring low-dose, well-tolerated formulations tailored for long-term compliance.

Key Growth Drivers

Rising Prevalence of Iron Deficiency and Anemia

The North America iron supplements market continues to expand due to the high prevalence of iron deficiency and anemia across diverse demographic groups. Women of reproductive age, pregnant women, older adults, and individuals with chronic conditions represent key at-risk populations. Sedentary lifestyles, dietary insufficiencies, and malabsorption disorders further elevate demand for preventive and therapeutic supplementation. Healthcare providers increasingly recommend iron supplements as first-line interventions, while routine screening programs improve early diagnosis. This sustained clinical need directly supports consistent product uptake across retail and prescription channels.

- For instance, Abbott incorporates clinically defined iron levels into its medical nutrition portfolio, such as Similac infant formulas delivering approximately 1.8 mg of iron per 100 kcal to support early-life hematologic development, validated through controlled pediatric nutrition studies.

Growing Health Awareness and Preventive Nutrition Adoption

Increasing consumer awareness regarding micronutrient deficiencies significantly drives market growth. North American consumers actively adopt preventive healthcare practices, supported by higher health literacy and widespread access to nutritional information. Iron supplements are gaining acceptance as part of daily wellness regimens aimed at improving energy levels, cognitive function, and immune health. The expansion of fitness culture and personalized nutrition further reinforces demand. Additionally, employer wellness programs and public health initiatives promote dietary supplementation, creating a favorable environment for long-term market expansion.

- For instance, Herbalife’s Formula 2 Vitamin & Mineral Complex tablets contain defined nutrient quantities such as 21 essential vitamins and minerals, including iron (as ferrous fumarate) in gender-specific formulas for a consistent daily intake.

Strong Distribution Networks and Product Accessibility

Well-established retail and e-commerce infrastructure across North America enhances iron supplement availability and market penetration. Pharmacies, supermarkets, health stores, and online platforms provide extensive product visibility and convenient purchasing options. Direct-to-consumer digital channels allow manufacturers to reach targeted consumer segments efficiently. Regulatory clarity around dietary supplements in the region also supports consistent product launches. These robust distribution systems reduce entry barriers, strengthen brand competition, and ensure steady sales growth across both urban and semi-urban markets.

Key Trends & Opportunities

Shift Toward Advanced and Gentle Formulations

Consumers increasingly prefer iron supplements with improved bioavailability and reduced gastrointestinal side effects. This trend drives innovation in formulations such as chelated iron, slow-release capsules, and liquid iron supplements. Manufacturers focus on combining iron with complementary nutrients like vitamin C and folic acid to enhance absorption. These advanced products appeal to sensitive populations, including pregnant women and elderly consumers. The shift toward patient-friendly formulations creates opportunities for premium pricing and brand differentiation.

- For instance, Archer Daniels Midland (ADM) develops chelated mineral systems under its Novare™ nutrition portfolio, where iron is bound to amino acid complexes to enhance stability and reduce free-iron reactivity. Typical formulations deliver precisely controlled elemental iron doses, such as 18 mg per serving, which is the Recommended Dietary Allowance (RDA) benchmark for women.

Expansion of Plant-Based and Clean-Label Supplements

The growing demand for plant-based and clean-label nutrition presents significant opportunities in the North America iron supplements market. Consumers increasingly seek products free from artificial additives, allergens, and animal-derived ingredients. Vegan and organic iron supplements align well with rising sustainability and ethical consumption trends. Transparent labeling and non-GMO certifications further influence purchasing decisions. Companies investing in natural sourcing and sustainable packaging can capture a rapidly expanding segment of health-conscious consumers.

- For instance, Haleon’s Centrum multivitamin formulations incorporate iron at clearly defined levels, such as 18 mg per daily serving in the women’s variant, to support specific nutritional needs.

Growth of Online Sales and Personalized Nutrition Platforms

Digital health platforms and online retail channels are reshaping supplement purchasing behavior. Consumers leverage e-commerce for product comparisons, subscription models, and personalized dosage recommendations. Integration of AI-driven nutrition assessments enables tailored iron supplementation plans based on individual health data. This digital transformation improves consumer engagement and brand loyalty. Companies that invest in data-driven personalization and omnichannel strategies gain a competitive advantage in reaching tech-savvy consumers.

Key Challenges

Gastrointestinal Side Effects and Consumer Compliance Issues

Despite strong demand, gastrointestinal side effects such as nausea, constipation, and abdominal discomfort limit consumer compliance with iron supplementation. These adverse effects often lead to inconsistent usage or early discontinuation, particularly among first-time users. Negative experiences can reduce repeat purchases and harm brand perception. Manufacturers must invest in formulation improvements and consumer education to address tolerance concerns. Failure to mitigate these issues may restrain sustained market growth.

Regulatory Scrutiny and Market Saturation Risks

The North America iron supplements market faces increasing regulatory scrutiny related to labeling accuracy, dosage limits, and health claims. Compliance requirements raise development and operational costs for manufacturers. Additionally, market saturation with numerous brands intensifies competition and pricing pressure. Differentiation becomes challenging, especially for smaller players with limited marketing budgets. Navigating evolving regulations while maintaining profitability remains a key challenge for industry participants.

Regional Analysis

North America

North America represents the largest regional market in the global industrial gases industry, accounting for approximately 30–32% market share. Strong demand originates from a well-established manufacturing base, advanced healthcare infrastructure, and large-scale oil and gas operations. The region shows high consumption of oxygen, nitrogen, hydrogen, and specialty gases across chemicals, electronics, food processing, and metal fabrication industries. Continuous investments in clean energy, semiconductor manufacturing, and healthcare modernization further support demand growth. Technological advancements, strict safety standards, and the presence of leading industrial gas suppliers reinforce North America’s dominant market position.

Europe

Europe holds an estimated 22–24% market share, supported by its mature industrial landscape and strong focus on sustainability. The region demonstrates steady demand from chemicals, automotive manufacturing, healthcare, and food and beverage industries. Growing adoption of hydrogen for decarbonization initiatives and renewable energy integration significantly boosts industrial gas consumption. Stringent environmental regulations encourage the use of industrial gases in emission control and energy-efficient processes. Advanced healthcare systems and pharmaceutical production also sustain medical gas demand, positioning Europe as a stable and innovation-driven regional market.

Asia-Pacific

Asia-Pacific accounts for approximately 34–36% market share, making it the fastest-growing and most dominant regional market. Rapid industrialization, urbanization, and expanding manufacturing activities across China, India, Japan, and Southeast Asia drive strong demand for industrial gases. Key applications include steel production, electronics, chemicals, healthcare, and energy. Rising investments in infrastructure, semiconductor manufacturing, and healthcare expansion further accelerate consumption. Additionally, government support for clean energy and hydrogen projects enhances long-term growth potential, positioning Asia-Pacific as the primary engine of global market expansion.

Latin America

Latin America holds around 6–8% market share, supported by growth in mining, metals, food processing, and healthcare sectors. Brazil and Mexico remain the key contributors due to their industrial bases and expanding healthcare infrastructure. Industrial gases are widely used in mineral processing, steel manufacturing, and food preservation applications. Although economic volatility poses challenges, ongoing investments in industrial modernization and healthcare access support gradual market growth. Increasing foreign investments and infrastructure development projects create long-term opportunities for industrial gas suppliers in the region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6–7% market share, driven primarily by oil and gas, petrochemicals, and metal fabrication industries. High demand for nitrogen, oxygen, and hydrogen supports refining, enhanced oil recovery, and petrochemical production. Expanding healthcare infrastructure and industrial diversification initiatives in Gulf countries further contribute to market growth. In Africa, mining and construction activities drive localized demand. While infrastructure gaps persist, long-term investments in energy, healthcare, and industrial development support steady regional market expansion.

Market Segmentations:

By Type:

- Curcumin

- Other herbal extracts

By Supplement Form:

By Age Group:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the North America iron supplements market players such as Glanbia plc, Nature’s Sunshine Products, Inc., Abbott, Herbalife Nutrition Ltd., Archer Daniels Midland, Pfizer Inc., NU SKIN, Bayer AG, Amway Corp., GlaxoSmithKline plc. the North America iron supplements market is characterized by the presence of well-established pharmaceutical manufacturers, global nutrition companies, and specialized dietary supplement brands competing across prescription, over-the-counter, and direct-to-consumer channels. Market participants focus on product differentiation through improved iron bioavailability, reduced gastrointestinal side effects, and combination formulations with vitamins and minerals that support absorption. Strong brand recognition, extensive retail and pharmacy networks, and compliance with stringent regulatory and quality standards support sustained market positioning. Companies increasingly invest in clinical validation, clean-label claims, and targeted products for pediatric, women’s health, and geriatric populations. Strategic initiatives such as portfolio expansion, partnerships with healthcare providers, and enhanced digital marketing strengthen customer reach. Competition remains moderate to high, driven by price sensitivity, growing consumer awareness, and continuous innovation in formulation and delivery formats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, DKSH (Business Unit Healthcare) and Hong Kong-based INFItech Limited (a consumer health company) formed a strategic partnership to distribute INFItech’s clinically-backed brain health supplements in Hong Kong and Macau, leveraging DKSH’s network for sales, distribution, and marketing through modern trade and e-commerce.

- In February 2025, GetHealthy and Vitaboom partner to offer practitioners daily-dosed supplement packs, enhancing client convenience, compliance, and branding. By combining Vitaboom’s expertise in nutritional supplements with GetHealthy’s advanced digital health platform, the collaboration aims to deliver customized supplement recommendations and wellness plans to consumers.

- In October 2024, Vantage Nutrition introduced a new line of high-concentration VitaCholine in transparent liquid capsules, offering a distinctive dosage format. Vantage Nutrition launched higher concentration VitaCholine in transparent liquid capsules, offering a unique and visually appealing dosage that delivers between 275mg to 550mg of free choline per capsule.

Report Coverage

The research report offers an in-depth analysis based on Type, Supplement Form, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will continue to rise due to sustained prevalence of iron deficiency anemia among women, children, and aging populations.

- Preventive healthcare adoption will support steady consumption of iron supplements across routine wellness and clinical use.

- Formulation innovation will prioritize higher bioavailability and reduced gastrointestinal side effects to improve patient adherence.

- Combination products with vitamins and minerals will gain traction to enhance absorption and overall nutritional benefits.

- Clean-label, plant-based, and allergen-free formulations will attract health-conscious and label-aware consumers.

- Personalized nutrition and targeted supplementation will expand through data-driven wellness programs and digital platforms.

- Pediatric and geriatric-focused products will record faster uptake due to age-specific nutritional requirements.

- E-commerce and direct-to-consumer channels will strengthen market accessibility and brand engagement.

- Regulatory scrutiny will encourage higher quality standards, clinical validation, and transparent labeling practices.

- Competitive intensity will remain strong, driving continuous product innovation and marketing differentiation.