Market Overview

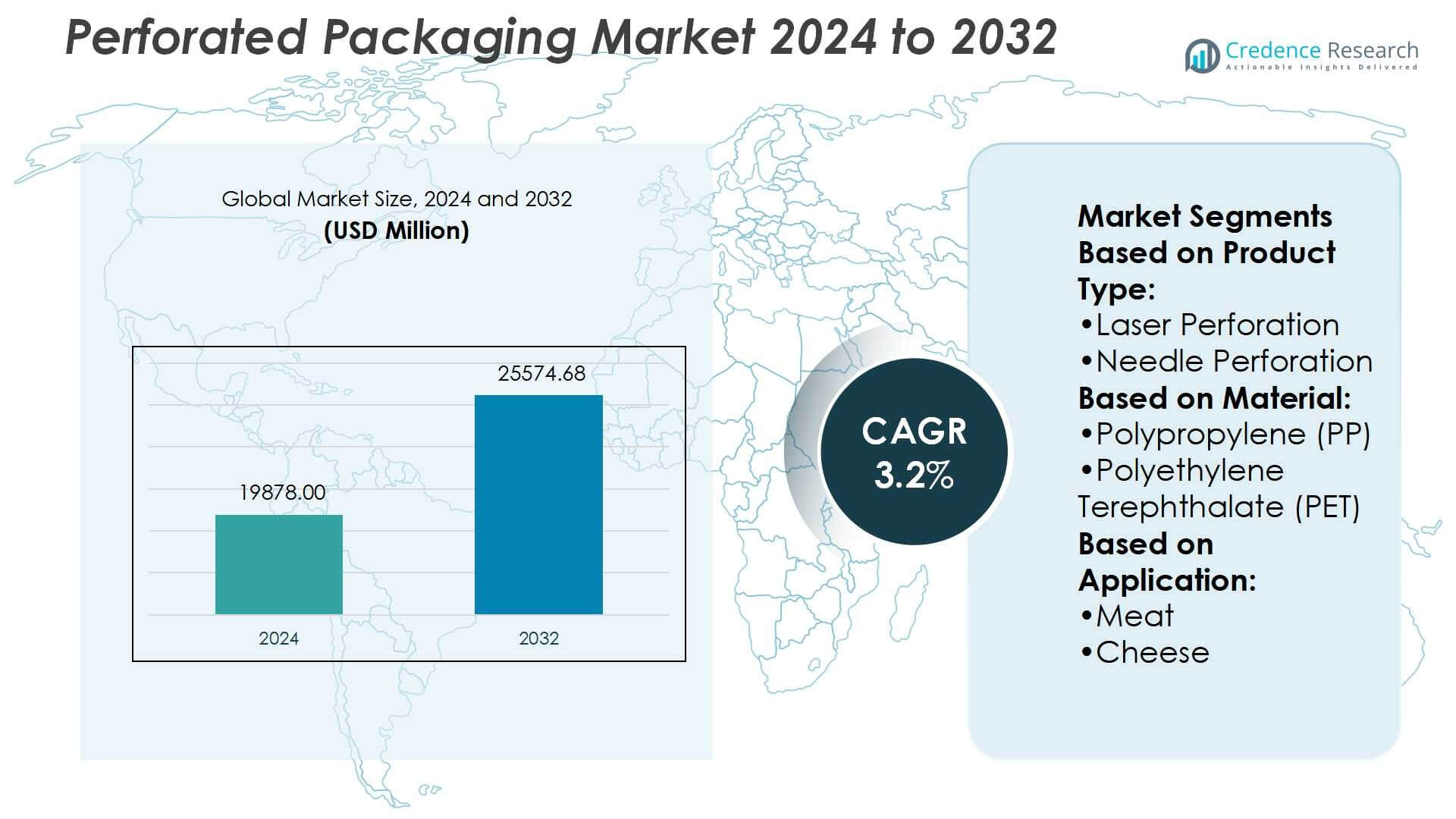

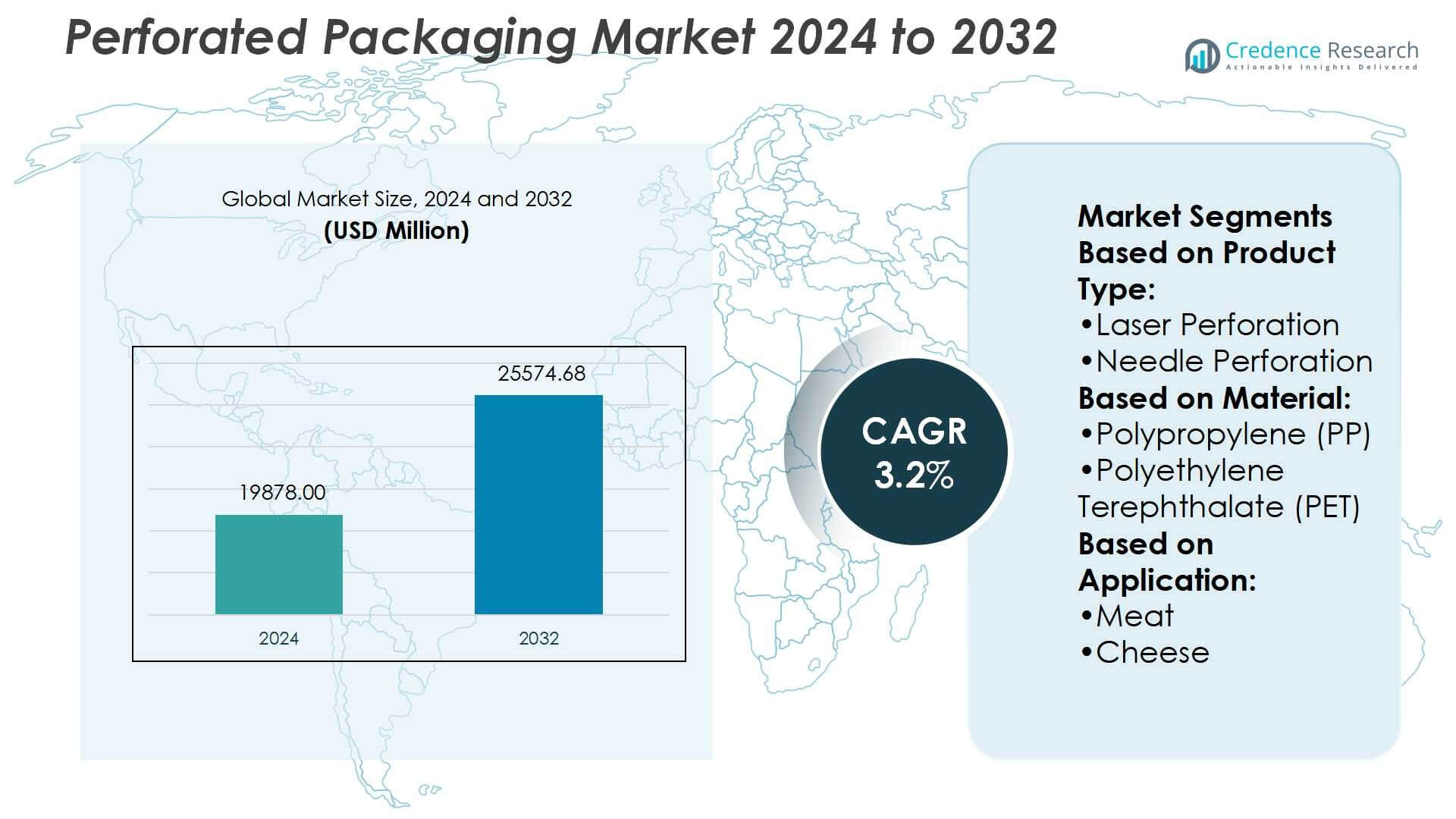

Perforated Packaging Market size was valued USD 19878.00 million in 2024 and is anticipated to reach USD 25574.68 million by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Perforated Packaging Market Size 2024 |

USD 19878.00 Million |

| Perforated Packaging Market, CAGR |

3.2% |

| Perforated Packaging Market Size 2032 |

USD 25574.68 Million |

The perforated packaging market features strong competition from leading players such as Amcor plc, Mondi plc, Constantia Flexibles Group GmbH, Coveris Holdings S.A., DuPont de Nemours, Inc., Futamura Chemical Co., Ltd., Polyplex Corporation Limited, Innovia Films, Bemis Company, Inc., and Exxon Mobil Corporation. These companies focus on technological advancements in laser perforation, sustainable material development, and global expansion strategies to strengthen their market positions. Among regions, Asia-Pacific leads the market with a 34% share, driven by rising consumption of packaged fresh produce, growth in convenience foods, and rapid expansion of e-commerce grocery sales across China, India, and Japan.

Market Insights

Market Insights

- The perforated packaging market size was valued at USD 19,878.00 million in 2024 and is projected to reach USD 25,574.68 million by 2032, growing at a CAGR of 3.2% during the forecast period.

- Rising demand for fresh produce and convenience foods is a key driver, supported by the adoption of laser perforation technology that improves shelf life and product safety.

- Sustainable material innovation is a major trend, with companies developing recyclable and biodegradable perforated films to meet environmental regulations and consumer preferences.

- Competitive intensity is high, with top players including Amcor plc, Mondi plc, Constantia Flexibles, Coveris Holdings, DuPont, and Exxon Mobil focusing on global expansion, while high production costs of advanced technologies remain a restraint.

- Asia-Pacific leads with a 34% regional share, while polypropylene dominates material usage at 39%, highlighting strong growth potential in emerging markets and continued demand across fresh produce, ready meals, and pet food applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Laser perforation dominates the perforated packaging market with a share of 46%. Its precision, consistency, and ability to control airflow make it the preferred choice for food and fresh produce packaging. Brands adopt laser perforation to extend shelf life and improve product visibility without compromising quality. Needle perforation holds a significant share in cost-sensitive applications, while other technologies remain niche. The growth of laser perforation is driven by rising demand for modified atmosphere packaging, increasing focus on food safety, and the adoption of automated high-speed packaging lines across industries.

- For instance, Polyplex commissioned a brownfield BOPP film line in Indonesia that became operational. The line has an output capacity of 60,000 metric tons per year and helped the company diversify its product offerings in the region.

By Material

Polypropylene (PP) leads the market with 39% share due to its strength, flexibility, and cost-effectiveness. Its compatibility with laser perforation and recyclability further enhance its adoption across food and consumer packaging. Polyethylene (PE) is also widely used for lightweight applications, while PET finds demand in premium packaging formats. PVDC and PS remain limited to specialized applications due to cost and environmental concerns. The dominance of PP is supported by expanding use in fresh produce, ready meals, and frozen food, driven by growing retail packaging volumes and the push for sustainable yet durable materials.

- For instance, in FY2024 Amcor purchased over 224,000 metric tons of recycled plastic materials for its packaging, including PP grades, and achieved offering recycle-ready solutions in 94% of its flexible packaging portfolio by area.

By Application

Fruits and vegetables represent the largest application segment, accounting for 41% of the market. Perforated packaging enables better ventilation and moisture control, reducing spoilage during storage and transit. Ready meals also show strong demand, supported by rising convenience food consumption. Meat, cheese, and pet food use perforated formats for extended freshness and product safety. Growth in the fruits and vegetable segment is driven by the expansion of supermarket chains, consumer preference for fresh produce, and the increasing adoption of modified atmosphere packaging that enhances shelf life and reduces waste.

Key Growth Drivers

Rising Demand for Fresh Produce Packaging

The perforated packaging market is experiencing strong growth due to rising global demand for fresh fruits and vegetables. Perforated films help regulate moisture and oxygen levels, extending shelf life and minimizing spoilage. Supermarket chains and e-commerce grocery platforms rely heavily on these solutions to ensure freshness during distribution. This trend is further reinforced by consumer preference for healthier diets, which has increased fruit and vegetable consumption. Consequently, perforated packaging has become essential in reducing food waste and supporting the expansion of the fresh produce supply chain.

- For instance, Mondi recently launched its “FunctionalBarrier Paper Ultimate” at its Solec (Poland) plant, exhibiting an oxygen transmission rate (OTR) below 0.5 cm³/m²·day and a water vapour transmission rate (WVTR) below 0.5 g/m²·day.

Advancements in Laser Perforation Technology

Laser perforation has emerged as the dominant technology in perforated packaging, offering high precision and consistency. Unlike needle perforation, laser technology allows controlled airflow, enhancing packaging performance for sensitive products. Its adoption is fueled by food manufacturers’ focus on modified atmosphere packaging, which prolongs shelf life and improves product safety. Increasing automation in packaging lines also supports laser perforation’s scalability. Continuous innovation in laser equipment, with faster speeds and greater accuracy, further boosts its use, making it a critical driver for market expansion across multiple food categories.

- For instance, Constantia invested 6.5 million at its Pirk site to commission a 5-layer blown film line with inline machine-direction orientation (MDO) from Hosokawa Alpine. This line uses twelve rollers instead of ten to improve film homogeneity and physical properties.

Growing Popularity of Ready Meals and Convenience Foods

Changing lifestyles and urbanization have significantly increased demand for ready meals and convenience foods. Perforated packaging supports these products by maintaining texture, reducing condensation, and improving microwave performance. Food manufacturers use perforated films to enhance consumer experience while meeting safety standards. Rising disposable incomes and the growth of single-person households in urban regions amplify this demand. As busy consumers prefer ready-to-eat options, perforated packaging ensures quality and longer shelf stability, positioning it as a key enabler of the growing convenience food industry worldwide.

Key Trends & Opportunities

Shift Toward Sustainable Packaging Materials

Sustainability has become a central focus, creating opportunities for eco-friendly perforated packaging solutions. Manufacturers are introducing recyclable and biodegradable films made from materials like polypropylene and bio-based polymers. Retailers and brands are adopting these solutions to align with regulatory requirements and consumer demand for green packaging. This shift supports corporate sustainability goals and strengthens brand positioning in competitive markets. Investment in renewable and compostable packaging materials provides a major growth pathway for companies, especially in regions with strict environmental standards such as Europe and North America.

- For instance, Exxtend™ advanced recycling technology, produced at an advanced recycling facility in Baytown, Texas. The facility’s capacity has since been expanded, with its first unit capable of processing 40,000 metric tons of plastic waste per year.

Expansion in E-Commerce and Online Grocery Sales

The rapid rise of e-commerce and online grocery platforms is boosting demand for perforated packaging. These solutions ensure product freshness and durability during extended transportation and last-mile delivery. Packaged fruits, vegetables, and ready meals require controlled ventilation to maintain quality, making perforated films highly relevant. As digital retail adoption accelerates, packaging solutions that balance product protection and convenience gain priority. This opportunity is particularly significant in emerging markets where e-commerce penetration is rapidly expanding, creating new revenue streams for perforated packaging manufacturers.

- For instance, Amcor’s AmLite Standard Recyclable packaging doubled the shelf-life of Popcorn Shed’s premium popcorn, enhancing its export and e-commerce reach. Global exports accounted for 25% of Popcorn Shed’s turnover under that solution.

Key Challenges

High Production Costs of Advanced Perforation Technologies

While laser perforation offers superior precision, its high setup and operating costs pose challenges. Small and medium packaging firms often struggle to adopt advanced equipment due to the capital investment required. Maintenance and energy costs further add to expenses, limiting widespread penetration in price-sensitive markets. This cost barrier creates reliance on traditional needle perforation methods, which may not deliver the same quality standards. Addressing affordability and improving scalability of advanced perforation technologies remains a critical hurdle for ensuring broader market adoption.

Environmental Concerns Regarding Plastic Use

Despite innovations in recyclable films, perforated packaging often relies on plastics like polypropylene and polyethylene. Rising regulatory pressures and consumer concerns about plastic waste challenge market growth. Countries with strict single-use plastic bans are pushing manufacturers to accelerate the shift toward biodegradable and compostable options. However, alternatives are often costlier and less scalable, making transition difficult for many companies. Balancing performance, sustainability, and cost remains a major obstacle. Overcoming this challenge will require collaboration across the value chain, investment in R&D, and wider adoption of circular economy models.

Regional Analysis

North America

North America holds a 32% share of the perforated packaging market, driven by strong demand from the fresh produce and ready meals segments. The region’s well-established retail and e-commerce grocery networks favor packaging that extends shelf life and maintains product quality. U.S. food manufacturers increasingly adopt laser perforation technologies for precision and efficiency. Sustainability initiatives, such as the shift toward recyclable and biodegradable films, further shape market dynamics. Regulatory support for eco-friendly packaging solutions and rising consumer preference for convenience foods ensure continued growth, making North America a leading market for perforated packaging solutions.

Europe

Europe accounts for 28% of the perforated packaging market, supported by stringent regulations on food safety and sustainability. Countries like Germany, France, and the U.K. drive adoption of recyclable and biodegradable perforated films. Laser perforation dominates due to its alignment with advanced food packaging requirements and regulatory compliance. The region’s strong retail sector and demand for fresh fruits, vegetables, and bakery items reinforce growth. High consumer awareness of eco-friendly packaging adds momentum. With the EU’s strict environmental directives and retailers prioritizing sustainable supply chains, Europe remains a hub for innovation and premium perforated packaging solutions.

Asia-Pacific

Asia-Pacific leads with a 34% share, reflecting its dominance in the perforated packaging market. The region benefits from expanding urbanization, rising disposable incomes, and growing consumption of packaged fresh produce and ready meals. Countries like China, India, and Japan show strong adoption of laser and needle perforation technologies. Rapid growth in e-commerce grocery sales and the demand for affordable packaging fuel expansion. Flexible films like polypropylene and polyethylene remain highly preferred. Government initiatives promoting sustainable packaging also encourage the use of recyclable materials, positioning Asia-Pacific as both the largest and fastest-growing market for perforated packaging globally.

Latin America

Latin America contributes 4% of the perforated packaging market, with growth driven by rising demand for packaged fruits, vegetables, and dairy products. Brazil and Mexico are the largest contributors, supported by expanding supermarket chains and changing consumer lifestyles. The adoption of perforated films in fresh produce packaging helps reduce post-harvest losses, a critical issue in the region. However, limited technological adoption and cost constraints hinder faster growth. Increasing investments in food processing and packaging industries, combined with growing interest in sustainable packaging, are expected to strengthen Latin America’s role in the global perforated packaging landscape.

Middle East & Africa

The Middle East & Africa region holds a 2% share of the perforated packaging market, reflecting its early-stage adoption. Rising urban populations and growing modern retail formats drive demand for packaged fruits, vegetables, and ready meals. Countries such as South Africa, the UAE, and Saudi Arabia show notable growth potential. Limited infrastructure and cost pressures slow the adoption of advanced technologies like laser perforation. However, increasing awareness of food safety, coupled with government focus on reducing food waste, supports gradual market expansion. Long-term growth opportunities lie in investments in sustainable materials and cold chain packaging solutions.

Market Segmentations:

By Product Type:

- Laser Perforation

- Needle Perforation

By Material:

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

By Application:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The perforated packaging market is highly competitive, with key players including Futamura Chemical Co., Ltd., Polyplex Corporation Limited, Amcor plc, Mondi plc, Innovia Films, DuPont de Nemours, Inc., Coveris Holdings S.A., Bemis Company, Inc., Constantia Flexibles Group GmbH, and Exxon Mobil Corporation. The perforated packaging market is characterized by intense competition, with companies focusing on innovation, sustainability, and cost efficiency to strengthen their positions. Market participants are investing in advanced laser perforation technologies to improve precision, extend product shelf life, and meet rising demand in fresh produce and ready meals. Growing emphasis on recyclable and biodegradable films highlights the importance of aligning with global sustainability regulations. Firms are also expanding their regional presence through strategic partnerships and acquisitions to capture emerging opportunities in Asia-Pacific and Latin America. Continuous product development, integration of automation in packaging lines, and diversification into eco-friendly materials remain central strategies driving competitive differentiation across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Kapag’s innovative Changemaker concept uses Sappi’s premium materials to create exceptional barrier packaging. This groundbreaking solution, developed by Kapag, combines Sappi’s premium Algro Design paperboard or Fusion Topliner with AvantGuard functional barrier paper to deliver a 100% paper-based, mono-material, recyclable solution for food products that eliminates the need for plastic-based alternatives.

- In May 2025, Metsä Group and Amcor, a global leader in developing and producing responsible packaging solutions, announced a strategic collaboration to develop three-dimensional moulded fibre packaging solutions with lidding and liner for a variety of food applications.

- In April 2025, Packaging film supplier SÜDPACK, food service company Werz, and BASF Gastronomie collaborate to utilize BASF polyamide Ultramid Cycled material for meat and sausage packaging in the hotel, restaurant, and catering sector.

- In April 2025, Amcor, a globally leading developer and producer of responsible packaging solutions, collaborated with Riverside Natural Foods, a major certified organic snack producer for launching MadeGood Trail Mix bars.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for fresh produce and ready meal packaging.

- Laser perforation technology will gain wider adoption due to precision and efficiency.

- Sustainability initiatives will drive innovation in recyclable and biodegradable perforated films.

- E-commerce growth will increase demand for durable and breathable packaging solutions.

- Emerging markets will witness stronger adoption with expanding retail and food processing industries.

- Consumer preference for convenience foods will boost the need for advanced perforated formats.

- Automation in packaging lines will enhance production speed and consistency.

- Regulatory pressure on plastics will accelerate investment in eco-friendly materials.

- Partnerships and acquisitions will shape market consolidation and global expansion.

- Smart packaging integration may emerge, combining perforation with traceability features.

Market Insights

Market Insights