Market Overview

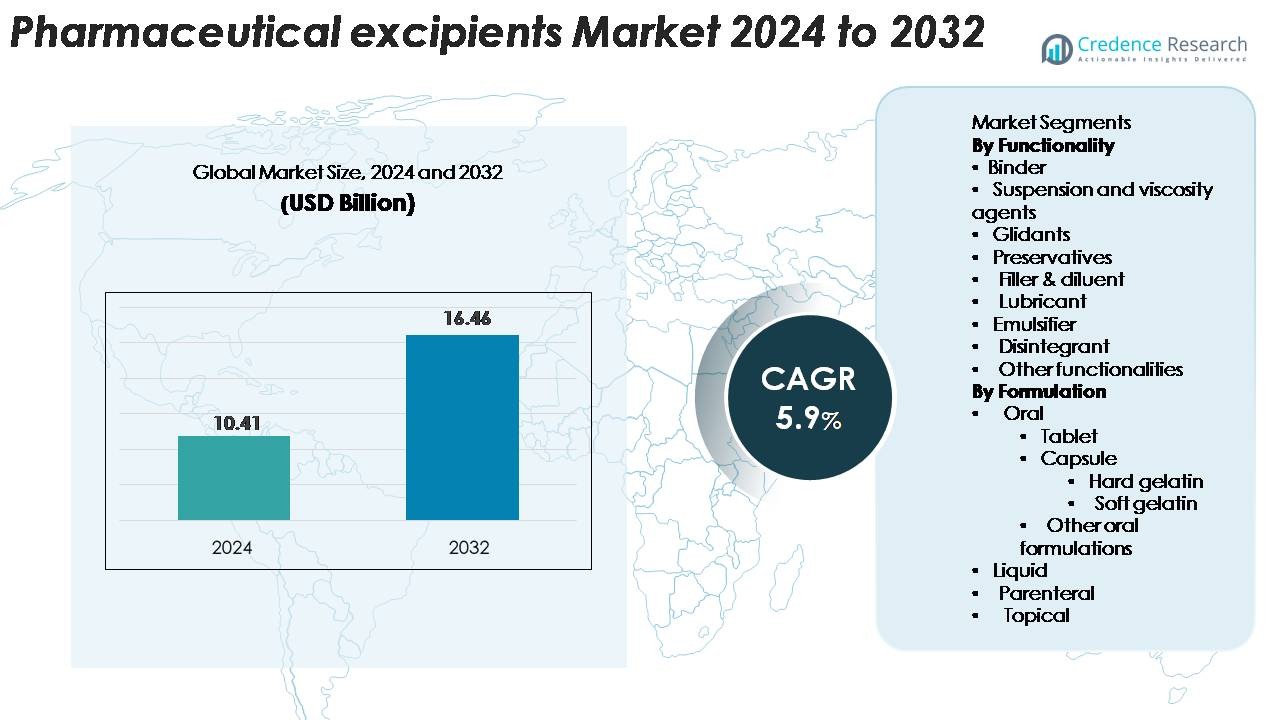

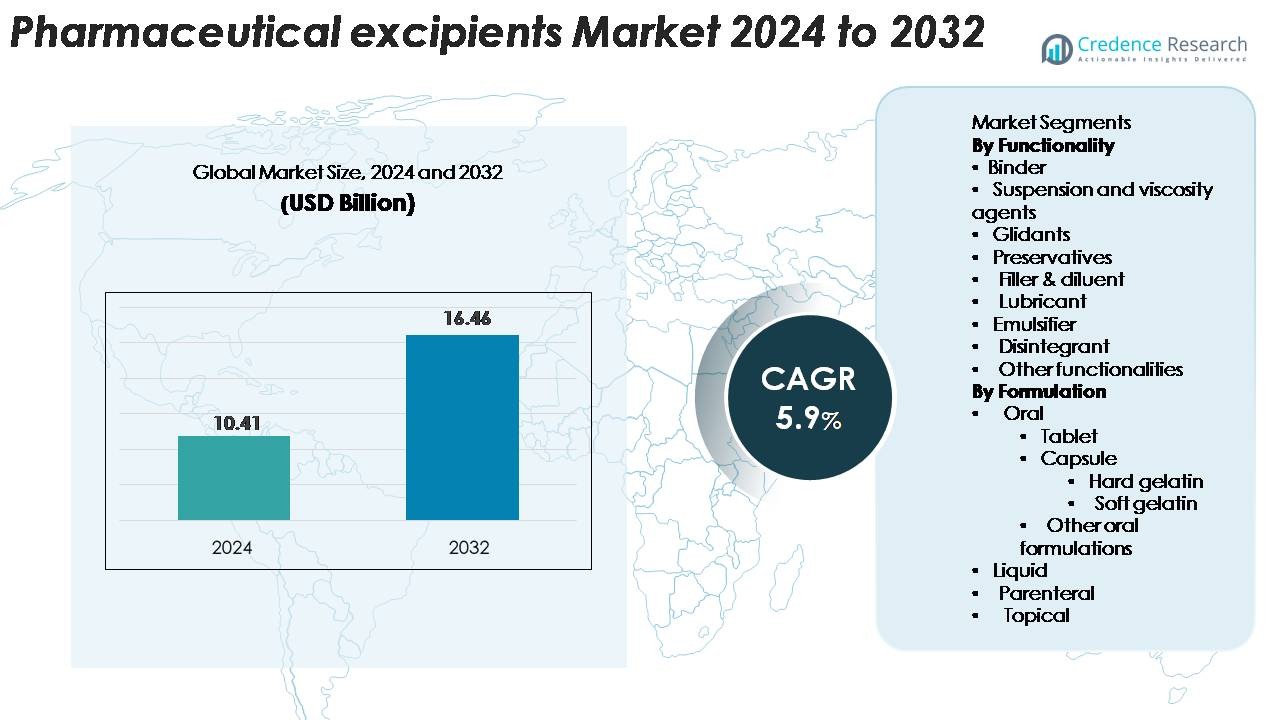

Pharmaceutical excipients market size was valued at USD 10.41 billion in 2024 and is anticipated to reach USD 16.46 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical excipients market Size 2024 |

USD 10.41 Billion |

| Pharmaceutical excipients market, CAGR |

5.9% |

| Pharmaceutical excipients market Size 2032 |

USD 16.46 Billion |

The pharmaceutical excipients market features leading players such as BASF SE, Ashland Inc., Evonik Industries AG, Kerry Group, Roquette Frères, Dow Chemical Company, Croda International, Lubrizol Corporation, Colorcon Inc., and Associated British Foods. These companies focus on high-purity polymers, binders, fillers, stabilizers, and multifunctional excipients that support complex oral, injectable, and topical formulations. North America leads the market with a 34% share due to strong drug manufacturing and regulatory compliance, followed by Europe at 29% with high adoption of clean-label and plant-based materials. Asia-Pacific holds 26% and remains the fastest-growing region, driven by expanding generics and contract manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The pharmaceutical excipients market was valued at USD 10.41 billion in 2024 and is projected to reach USD 16.46 billion by 2032, growing at a CAGR of 5.9%.

- Market growth is driven by rising production of generics, increased demand for advanced oral formulations, and rapid expansion of biologics requiring high-purity stabilizers and functional polymers.

- Key trends include the adoption of multifunctional and co-processed excipients, clean-label plant-derived materials, and wider use of direct-compression grades supporting continuous manufacturing.

- Competitive activity remains strong, with BASF SE, Ashland, Evonik, Dow, Roquette, and Colorcon focusing on high-purity grades, global supply reliability, and innovation in oral and injectable excipients.

- North America leads with a 34% share, followed by Europe at 29% and Asia-Pacific at 26%, while binders hold the dominant segment share at 28% within functionality due to their essential role in tablet and capsule production.

Market Segmentation Analysis:

By Functionality

Binders dominate this segment with a 28% share, driven by strong use in tablet and capsule manufacturing. These agents improve mechanical strength and support uniform tablet formation, which boosts demand across high-volume solid dosage production. Growing preference for controlled-release and fast-disintegration formats increases the need for advanced polymer-based binders. Suspension and viscosity agents grow due to rising liquid and semisolid formulations. Glidants support high-speed tablet lines, while preservatives remain essential for shelf-stability in liquid and topical drugs. Fillers, lubricants, emulsifiers, and disintegrants maintain steady use as companies expand generic and OTC portfolios.

- For instance, BASF’s Kollidon® VA 64 is used in more than 1,000 registered solid-oral formulations worldwide as a binder and solubility-enhancing excipient, demonstrating its broad technical adoption.

By Formulation

Oral formulations lead the market with a 63% share, supported by strong adoption of tablets and capsules in prescription and OTC therapies. Tablets account for the largest portion due to mass-production capability, patient convenience, and stable dosing profiles. Capsule demand rises through both hard gelatin and soft gelatin forms, especially in nutraceuticals and modified-release drugs. Liquid formulations gain traction in pediatric and geriatric care, while parenteral products grow with biologics and sterile injectables. Topical drugs show stable growth as companies expand dermatology and pain-relief categories.

- For instance, Lonza’s Capsugel® division has a global production capacity of approximately 260 billion hard capsules annually across multiple global facilities, providing large-scale supply for both pharmaceutical and nutraceutical oral formulations.

Key Growth Drivers

Growing Demand for Advanced Drug Delivery Systems

The rising focus on controlled-release, taste-masked, and targeted-delivery drugs drives strong demand for high-performance excipients. Pharmaceutical companies use functional polymers, co-processed blends, and solubility-enhancing agents to improve bioavailability and extend drug-release profiles. This trend grows as more APIs exhibit poor water solubility and need advanced carriers to reach therapeutic performance. Excipients such as microcrystalline cellulose, HPMC, and modified starch support consistent drug release and tablet integrity under high-speed manufacturing. Pediatric and geriatric drug development also accelerates the use of excipients for palatability, swallowability, and stability. With increasing preference for patient-centric formulations, excipient innovation becomes central to dosage optimization. The expanding biologics and biosimilars market adds new demand for stabilizers, cryoprotectants, and emulsifiers, further strengthening this driver.

- For instance, Evonik’s EUDRAGIT® polymer platform is used in more than 200 commercial oral drug products worldwide to achieve controlled-release and enteric-release performance with validated regulatory acceptance.

Expansion of Generic and Over-the-Counter Drug Manufacturing

Global generic and OTC production continues to rise due to patent expiries and the need for affordable medication. These products rely heavily on excipients such as binders, fillers, lubricants, and glidants to ensure uniformity, stability, and quick manufacturing turnaround. As developing regions increase their pharmaceutical manufacturing capacity, excipient suppliers benefit from higher volume demand. Regulatory acceptance of co-processed excipients enables faster tablet development and reduces formulation failures, supporting cost-efficient generic production. Companies diversify their excipient portfolios to meet the needs of high-output compression lines and automated capsule-filling systems. Growing consumer demand for vitamins, dietary supplements, and herbal formulations also expands excipient use in both solid and liquid forms. This driver gains momentum as global healthcare systems encourage low-cost therapeutic solutions.

- For instance, Teva Pharmaceutical Industries has a total portfolio of more than 3,500 medicines globally, which includes generics, specialty, and over-the-counter (OTC) products. The large scale of its overall production, encompassing approximately 76 to 85 billion tablets and capsules a year, drives demand for high-performance excipients used in mass-volume tablet and capsule production.

Rising Adoption of Biologics and Injectable Therapies

Biologics, vaccines, and parenteral drugs require excipients that maintain stability, prevent aggregation, and protect sensitive APIs during storage and handling. This shift boosts consumption of stabilizers, surfactants, buffers, and cryoprotectants within sterile formulations. Growth in chronic disease treatment—such as oncology, autoimmune disorders, and metabolic conditions—accelerates biologic drug development and increases excipient usage per formulation. Advanced injectable formats like prefilled syringes, auto-injectors, and depot injections rely on excipients for viscosity control and long-term stability. Cold-chain logistics expansion further encourages the use of high-purity excipients designed for extreme temperature resilience. As pharmaceutical pipelines increasingly favor large-molecule drugs with complex stability needs, demand for specialized injectable-grade excipients expands at a rapid pace.

Key Trends & Opportunities

Shift Toward Co-Processed and Multifunctional Excipients

Manufacturers increasingly adopt multifunctional excipients that combine binder, filler, and disintegrant properties in a single material. Co-processed blends reduce processing steps, improve flowability, and enhance compressibility, which makes them valuable for high-speed tablet manufacturing. They also minimize formulation variability and support continuous manufacturing technologies. This trend accelerates as companies aim to shorten development cycles and improve operational efficiency. Multifunctional excipients offer better API compatibility and performance consistency, especially for low-dose or moisture-sensitive drugs. As the pharmaceutical sector moves toward automation and quality-by-design frameworks, demand for robust, ready-to-use excipients presents a major opportunity for suppliers to differentiate portfolios and expand into premium segments.

- For instance, BASF’s Ludiflash®, a multifunctional excipient used in fast-disintegrating tablets, is engineered with a median particle size of two hundred micrometres, enabling uniform flow and direct-compression performance in rapid-dissolve oral formulations.

Growing Focus on Clean-Label, High-Purity, and Plant-Derived Excipients

Regulatory and consumer emphasis on clean-label formulations pushes companies to adopt plant-based, non-GMO, and allergen-free excipients. High-purity grades of cellulose, starch, and glycerin gain traction due to their superior safety and compatibility profiles. This trend strengthens in nutraceuticals, pediatric medicines, and sensitive patient groups where minimal additive exposure is preferred. Manufacturers invest in new extraction and processing technologies to achieve higher purity levels and reduce contaminants such as heavy metals and residual solvents. The rise of sustainability initiatives creates opportunities for renewable, biodegradable excipients sourced from plant fibers, marine materials, and fermentation processes. As transparency and traceability become key purchasing criteria, companies offering clean, environmentally responsible excipients gain competitive advantage.

- For instance, Ashland’s plant-derived Benecel™ HPMC range includes viscosity grades from 3 mPa·s to 100,000 mPa·s, allowing formulators to select precise polymer performance while maintaining clean-label compliance.

Adoption of Continuous Manufacturing and Advanced Processing Technologies

Pharmaceutical manufacturers shift toward continuous manufacturing to improve efficiency, reduce batch failures, and achieve consistent product quality. This transition creates opportunities for excipients with superior flow, compressibility, and lubrication performance, enabling stable operation in continuous lines. Novel excipients designed for direct compression gain strong market interest due to their ability to simplify workflow. Advanced processing technologies, including hot-melt extrusion, 3D printing, and spray drying, rely on excipients that withstand high temperatures and support uniform dispersion. These innovations open new formulation possibilities for complex APIs and personalized medicines. Companies that invest in excipient engineering tailored to advanced production systems stand to benefit from long-term growth momentum.

Key Challenges

Stringent Regulatory Requirements and Quality Compliance

Pharmaceutical excipients face strict global regulations related to purity, safety, and manufacturing controls. Compliance with USP-NF, EP, and other pharmacopeial standards increases production costs and limits the introduction of new excipient molecules. Regulatory bodies increasingly demand full documentation, traceability, and risk assessments, which creates challenges for suppliers with diverse global operations. Any inconsistency in raw material sourcing or manufacturing conditions can lead to rejections or delays in drug approval. Smaller manufacturers struggle to meet these expectations, while larger firms must invest heavily in testing and quality systems. As oversight intensifies, companies face rising pressure to maintain consistent quality while managing cost efficiency.

Supply Chain Volatility and Raw Material Dependence

The excipients industry depends heavily on raw materials sourced from petrochemicals, plant extracts, minerals, and animal products. Fluctuating availability, geopolitical disruptions, and changing import regulations disrupt supply stability and increase costs for manufacturers. Demand spikes in related industries—such as food, cosmetics, and industrial chemicals—also strain excipient supply chains. Challenges intensify when producing high-purity excipients that require specialized processing and dedicated facilities. Logistics disruptions, such as port delays and transport shortages, further impact timely delivery to pharmaceutical manufacturers. These uncertainties force companies to diversify sourcing strategies and adopt stronger risk-management frameworks to maintain production continuity.

Regional Analysis

North America

North America leads the pharmaceutical excipients market with a 34% share, supported by strong drug manufacturing capacity, heavy adoption of advanced formulation technologies, and the presence of major generic and innovator companies. The region benefits from strict regulatory frameworks that encourage the use of high-purity and multifunctional excipients in tablets, injectables, and topical drugs. Growth in biologics and sterile injectables further increases demand for stabilizers, buffers, and viscosity-modifying agents. The United States remains the primary contributor due to continuous investments in R&D, expanding production of controlled-release systems, and strong demand for OTC and prescription medicines.

Europe

Europe holds a 29% share of the pharmaceutical excipients market, driven by a well-established pharmaceutical industry, strong GMP compliance, and rising adoption of clean-label and plant-derived excipients. Countries such as Germany, France, and the UK maintain high consumption of binders, fillers, and cellulose-based materials due to strong generic drug production. The region also benefits from a growing focus on sustainability, encouraging the use of bio-based and renewable excipient sources. Increasing investment in biologics and injectable drug development boosts demand for specialized stabilizers and high-purity grades designed for stringent regulatory environments.

Asia-Pacific

Asia-Pacific commands a 26% market share and remains the fastest-growing region due to expanding pharmaceutical manufacturing in China, India, and Southeast Asia. Strong growth in generics, nutraceuticals, and OTC medicines drives heavy use of binders, diluents, and disintegrants across high-volume production lines. Government incentives for domestic drug production and rising exports support large-scale demand for excipients across oral, parenteral, and topical formulations. Increasing investments in biologics and contract manufacturing strengthen the need for injectable-grade stabilizers and solubility-enhancing materials. Rapid population growth and rising healthcare spending further accelerate consumption across all formulation types.

Latin America

Latin America accounts for a 7% share of the pharmaceutical excipients market, supported by expanding generic drug production and growing investment in domestic manufacturing in Brazil and Mexico. Rising healthcare access and increased consumption of oral solid dosage forms strengthen regional demand for binders, fillers, and lubricants. The OTC and nutraceutical sectors also contribute as companies introduce new tablets, syrups, and topical products. Regulatory improvements and partnerships with global drug manufacturers increase excipient import volumes. However, reliance on foreign suppliers and fluctuating economic conditions influence adoption patterns, keeping market growth steady but moderate.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the pharmaceutical excipients market, influenced by growing investment in healthcare infrastructure and rising reliance on imported finished drugs and excipients. Countries such as the UAE, Saudi Arabia, and South Africa lead demand due to expanding local packaging and formulation activities. The market sees higher consumption of fillers, lubricants, and preservatives used in oral and topical products. As regional governments encourage domestic drug manufacturing, demand for high-purity and multifunctional excipients is expected to increase. Limited production capacity and regulatory variability keep market expansion gradual.

Market Segmentations:

By Functionality

- Binder

- Suspension and viscosity agents

- Glidants

- Preservatives

- Filler & diluent

- Lubricant

- Emulsifier

- Disintegrant

- Other functionalities

By Formulation

- Oral

- Tablet

- Capsule

- Hard gelatin

- Soft gelatin

- Other oral formulations

- Liquid

- Parenteral

- Topical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pharmaceutical excipients market features a strong presence of global manufacturers that focus on high-purity ingredients, multifunctional materials, and regulatory-compliant production capabilities. Leading companies such as BASF SE, Evonik Industries, Ashland, Roquette, Kerry, Lubrizol, Dow, and Colorcon compete by expanding portfolios that support complex oral, parenteral, and topical formulations. These players invest in advanced polymer technologies, co-processed excipients, and bio-based materials to meet rising demand for controlled-release, solubility-enhanced, and patient-centric dosage forms. Strategic partnerships with pharmaceutical firms and CDMOs strengthen supply reliability, while capacity expansions ensure consistent availability of injectable-grade stabilizers and binders. Companies also enhance competitiveness through tighter quality systems, global distribution networks, and compliance with USP-NF, EP, and IPEC standards. As drug development shifts toward biologics, high-potency APIs, and continuous manufacturing, suppliers differentiate themselves by offering excipients with superior functionality, traceability, and performance consistency across high-speed production environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, ADM highlighted the launch of ADM Purified Glycerin LA in its pharma solutions portfolio, presenting a versatile excipient for pharmaceutical formulations.

- In October 2025, Ashland introduced high-purity sucrose excipients for injectables and low-nitrite grades for oral dosage forms as part of its high-purity excipient strategy.

- In 2024, Evonik also announced the launch of EUDRACAP® colon, a functional capsule platform for sensitive APIs, further expanding its oral delivery excipient portfolio.

Report Coverage

The research report offers an in-depth analysis based on Functionality, Formulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for multifunctional and co-processed excipients that support faster formulation development.

- Adoption of plant-based, clean-label, and allergen-free excipients will increase across oral and nutraceutical products.

- Continuous manufacturing will boost the use of direct-compression and high-flow excipients.

- Growth in biologics and injectables will expand demand for high-purity stabilizers and surfactants.

- Personalized medicine and 3D-printed formulations will create opportunities for specialized polymers.

- More pharmaceutical companies will prefer excipients with strong traceability and regulatory documentation.

- Innovation in solubility-enhancing materials will support development of poorly soluble APIs.

- Sustainable sourcing and green chemistry will become key selection criteria for global buyers.

- Contract manufacturing expansion in Asia will increase regional excipient production and consumption.

- Digital quality systems and advanced analytics will strengthen excipient process control and compliance.