Market Overview

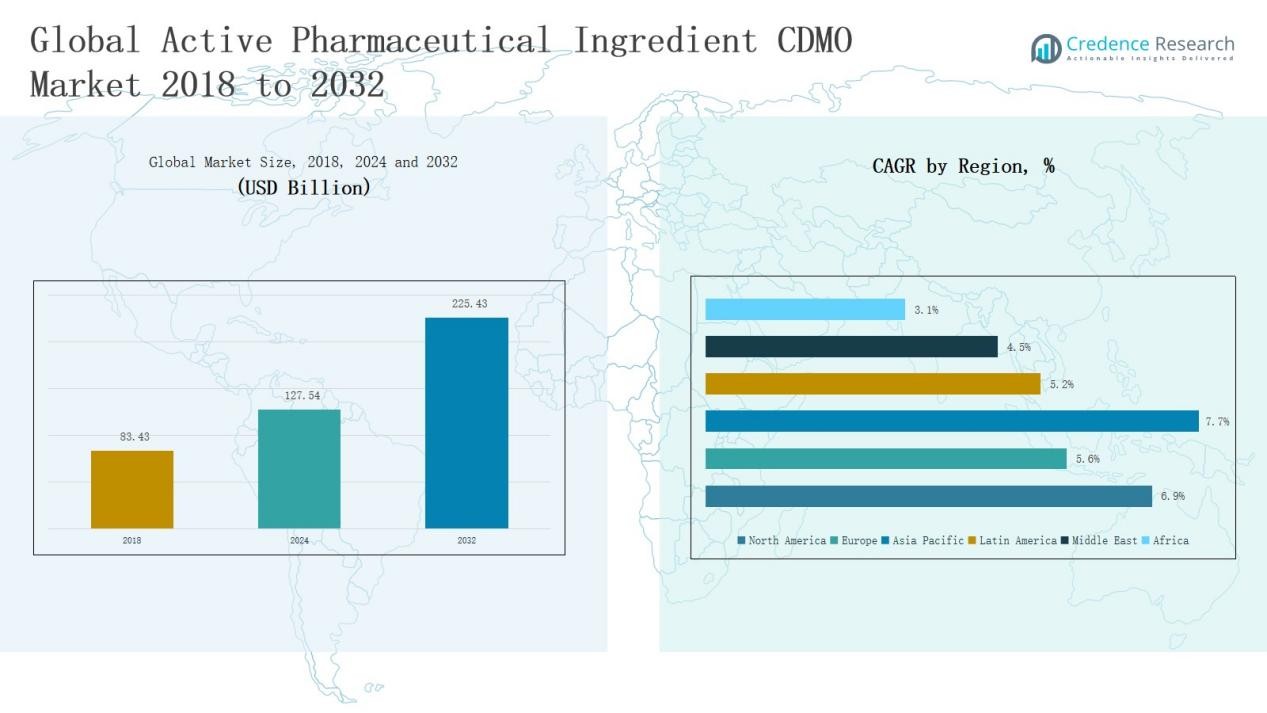

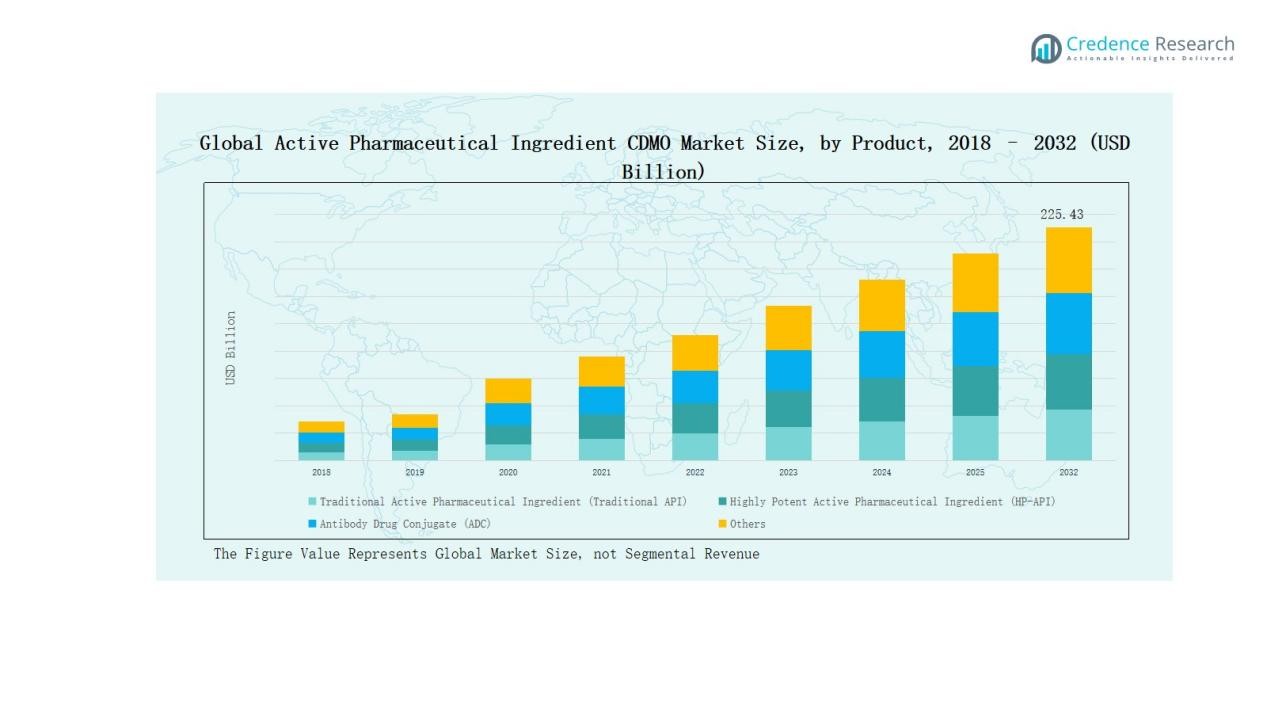

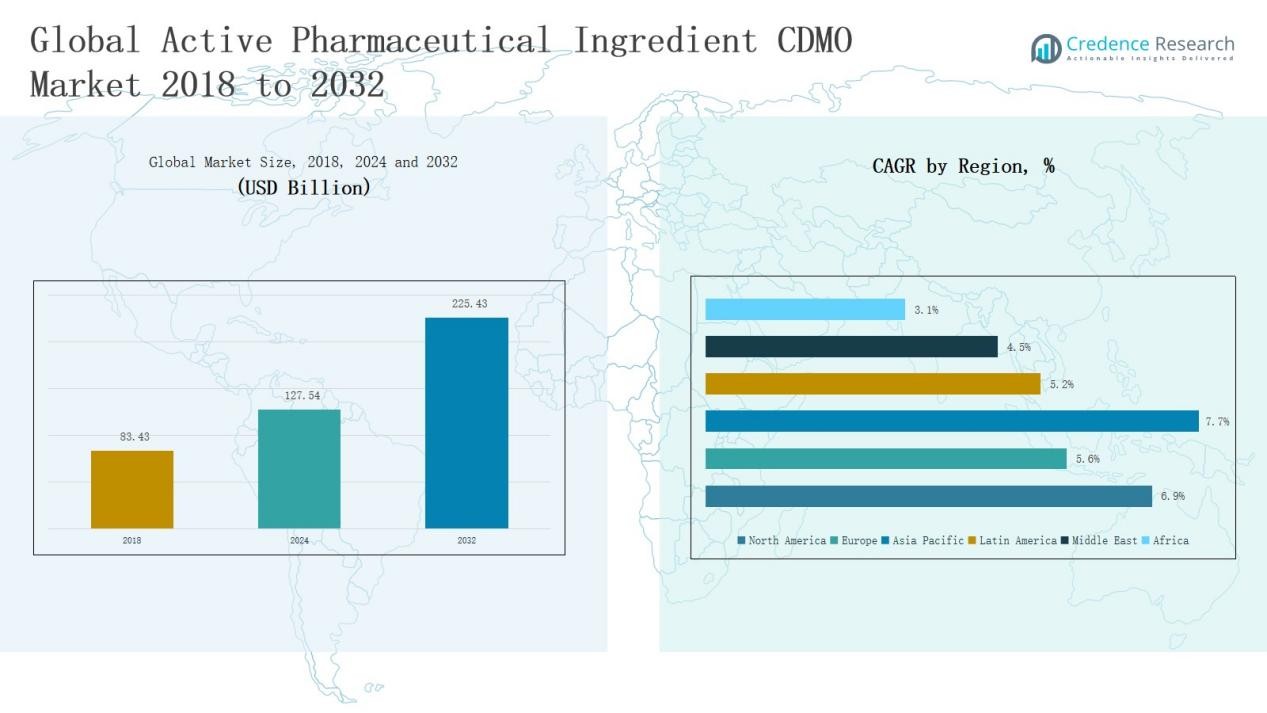

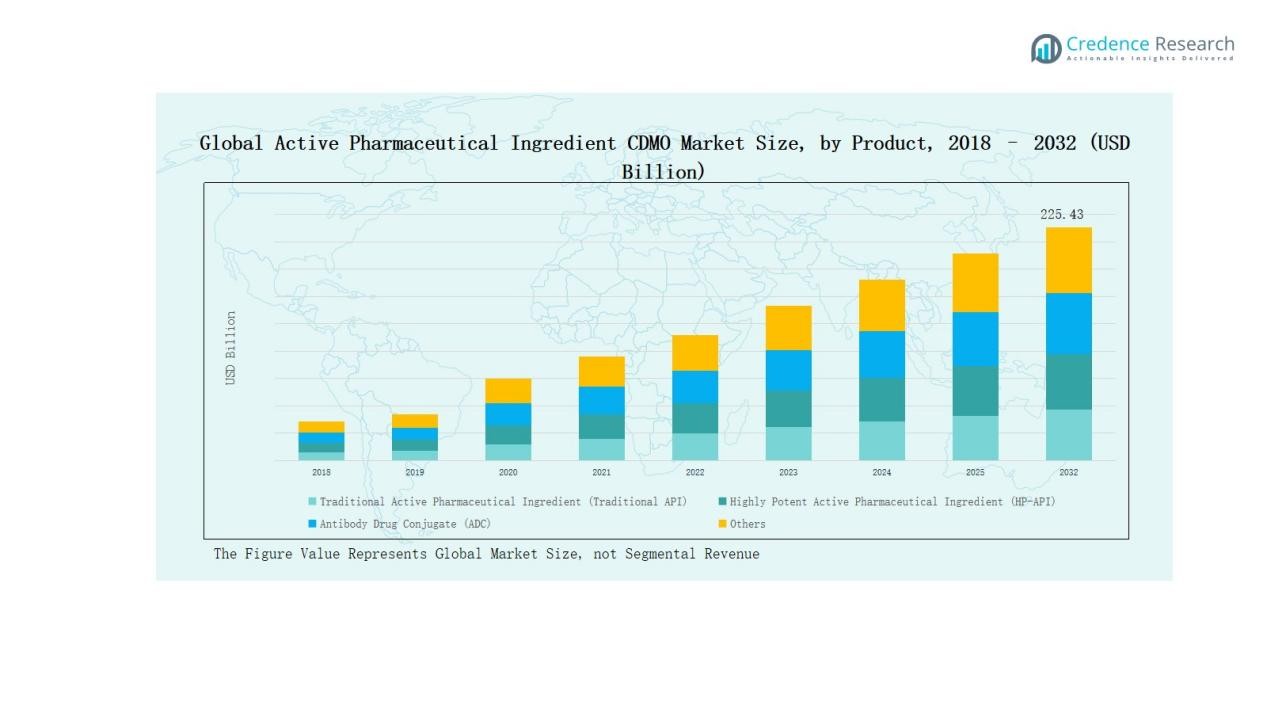

Active Pharmaceutical Ingredient CDMO Market size was valued at USD 83.43 Billion in 2018 to USD 127.54 Billion in 2024 and is anticipated to reach USD 225.43 Billion by 2032, at a CAGR of 6.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Active Pharmaceutical Ingredient CDMO Market Size 2024 |

USD 127.54 Billion |

| Active Pharmaceutical Ingredient CDMO Market, CAGR |

6.87% |

| Active Pharmaceutical Ingredient CDMO Market Size 2032 |

USD 225.43 Billion |

The Active Pharmaceutical Ingredient (API) CDMO Market is shaped by global leaders such as Thermo Fisher Scientific, Lonza, Catalent, Samsung Biologics, CordenPharma, Cambrex, Recipharm, Siegfried, WuXi AppTec, and Piramal Pharma Solutions. These companies dominate through extensive manufacturing capacity, advanced R&D capabilities, and expertise in highly potent and complex molecules, including biologics, peptides, and antibody drug conjugates. Strategic mergers, global partnerships, and investments in specialized facilities further strengthen their competitive positions. Regionally, Asia Pacific led the market in 2024 with a 37% share, driven by cost-efficient production, strong government support in India and China, and rapid expansion of biomanufacturing hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Active Pharmaceutical Ingredient CDMO Market grew from USD 83.43 Billion in 2018 to USD 127.54 Billion in 2024, projected to reach USD 225.43 Billion by 2032.

- Traditional APIs led with 47% share in 2024, supported by generics demand, cost efficiency, and established large-scale synthesis methods, while HP-APIs and ADCs are expanding rapidly.

- Contract Development held 55% share in 2024, with process development leading at 22%, while Commercial-Scale API Production dominated Contract Manufacturing at 45% market contribution.

- Synthetic APIs dominated with 62% share in 2024, driven by cost-effective production, while Biotech APIs (38%) grew quickly with biologics approvals and rising demand for advanced therapies.

- Asia Pacific led with 37% share in 2024, followed by North America at 32% and Europe at 20%, while Latin America, Middle East, and Africa accounted for smaller contributions.

Market Segment Insights

By Product

Traditional Active Pharmaceutical Workflow (Traditional API) dominated the market with a 47% share in 2024, driven by strong demand for generic medicines and established synthesis methods. Cost efficiency, wide therapeutic applicability, and large-scale production capabilities reinforce its leadership. HP-APIs are growing steadily, supported by rising oncology and hormonal therapies. Antibody Drug Conjugates (ADCs) are expanding quickly, fueled by targeted cancer treatment demand and high investment in bioconjugation technologies. The “Others” category, though smaller, includes niche and emerging molecules, supported by growing pipeline diversification.

For instance, Teva’s operations, the company recently announced plans to divest its Teva API (TAPI) unit, its small-molecule active pharmaceutical ingredient business, to better focus on its core portfolio of over 3,500 generic and specialty medicines.

By Service Type

Contract Development led the market with a 55% share in 2024, supported by pharmaceutical firms outsourcing early-stage development for cost and speed advantages. Within this, Process Development accounted for the largest portion at 22%, driven by the need for scalable and regulatory-compliant workflows. Custom synthesis also holds strong adoption, enabling companies to secure unique APIs with IP protection. Analytical services are increasingly critical, supported by stringent regulatory guidelines. Contract Manufacturing, though slightly smaller at 45%, remains vital, with Commercial-Scale API Production dominating due to consistent demand for large-volume supply.

For instance, Catalent introduced advanced analytical platforms in 2024 for biologics characterization, aligning with FDA and EMA expectations for more comprehensive product release testing.

By API Type

Synthetic APIs remained the dominant segment with a 62% share in 2024, reflecting strong reliance on chemical synthesis for both generic and branded drugs. Their cost-effectiveness, established manufacturing protocols, and scalability drive continued leadership. Biotech APIs, including biologics, peptides, and oligonucleotides, held a 38% share, expanding rapidly due to rising biologics approvals, growth in precision medicine, and increasing demand for advanced therapies. The biotech segment is expected to close the gap, supported by ongoing innovation in complex molecules and investments in biomanufacturing facilities.

Key Growth Drivers

Rising Outsourcing of API Production

Pharmaceutical companies increasingly outsource API production to CDMOs, enabling them to focus on drug discovery and commercialization. CDMOs provide cost savings, flexible manufacturing, and regulatory compliance, making outsourcing a strategic choice. The growing complexity of drug molecules also drives reliance on specialized expertise. This trend is particularly strong among mid-sized pharma firms that lack large-scale manufacturing capacity, reinforcing CDMOs’ role as key partners in meeting rising global API demand across therapeutic areas.

For instance, Axplora, a CDMO that ensures API quality and supply chain security by auditing its ingredient suppliers rigorously and embedding quality into every operational aspect to meet pharma companies’ demands for reliability and regulatory compliance.

Growing Demand for Highly Potent APIs (HP-APIs)

The surge in oncology and hormonal therapies boosts demand for HP-APIs, which require advanced containment and specialized facilities. CDMOs investing in high-containment infrastructure are gaining significant contracts from both large and small pharma companies. With rising cancer incidence and the shift toward targeted therapies, HP-APIs are projected to record strong double-digit growth. This demand not only drives revenue but also pushes CDMOs to expand capabilities in cytotoxic handling, high-potency formulation, and compliance with stringent global safety standards.

For instance, in 2022, Catalent expanded its nasal drug development and manufacturing capabilities at its Morrisville, North Carolina facility. Separately, it completed a $10 Billion expansion of its highly potent micronization capabilities at its facilities in Malvern, Pennsylvania, and Dartford, U.K.

Expansion of Biotech and Complex Molecules

The increasing adoption of biologics, peptides, and oligonucleotides is fueling growth in biotech APIs. CDMOs are investing in advanced biomanufacturing and analytical platforms to cater to this demand. Regulatory approvals for biologics are rising, further accelerating CDMO engagement in biotech projects. As precision medicine and RNA-based therapies expand, CDMOs with expertise in complex molecules are positioned to capture higher-value contracts. This shift toward innovation-driven molecules provides long-term growth opportunities and diversifies revenue streams for the API CDMO industry.

Key Trends & Opportunities

Growth of Antibody Drug Conjugates (ADCs)

ADCs are gaining momentum as a promising class of targeted therapies, particularly in oncology. CDMOs specializing in conjugation chemistry and biomanufacturing are securing major contracts from global pharma firms. Rising investment in ADC R&D, coupled with expanding pipelines, creates strong outsourcing opportunities. CDMOs with dual expertise in biologics and cytotoxic payloads are positioned at the forefront of this trend. This focus on targeted therapies provides significant growth opportunities while also diversifying the service portfolio beyond traditional APIs.

FOr instance, Thermo Fisher Scientific, which offers integrated end-to-end development and manufacturing services, accelerating ADC clinical and commercial supply.

Regional Expansion and Emerging Markets

Emerging markets such as Asia-Pacific and Latin America are becoming attractive for API outsourcing due to cost advantages and expanding healthcare infrastructure. CDMOs are investing in regional manufacturing hubs to tap into growing local demand. Governments in countries like India and China are also promoting domestic production through favorable policies. This regional expansion not only reduces supply chain risks for pharma companies but also positions CDMOs closer to high-growth therapeutic markets, improving competitiveness in global supply networks.

For instance, Lonza opened a new API manufacturing suite in Guangzhou, China in 2022, strengthening its footprint in the Asia-Pacific region to better serve multinational drug developers working on small molecules.

Key Challenges

Stringent Regulatory Compliance

API CDMOs must comply with rigorous regulatory requirements from authorities such as the FDA, EMA, and PMDA. Meeting global quality standards across multiple markets requires significant investment in documentation, audits, and validation processes. Non-compliance risks costly delays, fines, and loss of client trust. Smaller CDMOs often face higher pressure due to limited resources. Maintaining continuous compliance while scaling operations remains a major challenge that can slow expansion and increase operational costs in a competitive market.

Pricing Pressure and Margin Constraints

CDMOs face constant pricing pressure from pharmaceutical companies seeking to reduce development and manufacturing costs. While outsourcing demand is strong, the competition among CDMOs keeps margins thin. Large CDMOs with economies of scale often dominate contracts, making it difficult for smaller players to compete on pricing. Furthermore, the high cost of infrastructure upgrades, technology adoption, and compliance intensifies financial strain. Sustaining profitability while offering competitive pricing remains a key challenge for the industry.

Supply Chain Disruptions and Dependency Risks

Global supply chains for raw materials and intermediates are increasingly vulnerable to disruptions, as highlighted during the COVID-19 pandemic. Heavy reliance on specific regions, such as China and India, for critical inputs exposes CDMOs to risk. Geopolitical tensions, logistics delays, or raw material shortages can disrupt production timelines and impact client deliveries. Ensuring resilient supply chains through diversification and strategic partnerships is critical, yet it remains a significant challenge for maintaining consistent API output.

Regional Analysis

North America

North America held a 32% share of the global API CDMO market in 2024. The region generated USD 23.81 billion in 2018, USD 35.81 billion in 2024, and is projected to reach USD 63.57 billion by 2032, growing at a CAGR of 6.9%. The United States leads due to strong biologics approvals, rising oncology drug demand, and FDA-certified manufacturing sites. Strong investments in high-potency and biotech APIs keep North America dominant in innovation-led outsourcing.

Europe

reach USD 36.32 billion by 2032 at a CAGR of 5.6%. Strong regulations, leading CDMO hubs in Germany, Switzerland, and the UK, and advancements in biologics support regional demand. Outsourcing continues as firms seek cost efficiency under EMA compliance, though Asia-Pacific pricing competition affects margins.

Asia Pacific

Asia Pacific held a 37% share in 2024, the largest globally. Regional revenue rose from USD 36.81 billion in 2018 to USD 58.33 billion in 2024 and is forecast to reach USD 109.34 billion by 2032 at a CAGR of 7.7%. Low-cost production, supportive policies in India and China, and rising biotech capacity fuel leadership. Japan and South Korea expand peptide and biologic API capabilities, reinforcing the region as the fastest-growing outsourcing hub.

Latin America

Latin America held a 4% share in 2024. The market grew from USD 3.86 billion in 2018 to USD 5.82 billion in 2024 and is expected to reach USD 9.08 billion by 2032 at a CAGR of 5.2%. Brazil and Mexico drive activity through growing pharma investments and generics demand. Limited infrastructure and import dependence remain challenges, yet partnerships with global pharma firms offer expansion potential.

Middle East

The Middle East contributed a 3% share in 2024. Revenue increased from USD 2.28 billion in 2018 to USD 3.18 billion in 2024 and is projected to reach USD 4.72 billion by 2032 at a CAGR of 4.5%. Healthcare investment, expanding manufacturing, and import-substitution policies strengthen the market. Saudi Arabia and the UAE lead regional development, creating niche CDMO opportunities despite smaller scale.

Africa

Africa accounted for 2% of the market in 2024. Revenue rose from USD 1.04 billion in 2018 to USD 1.80 billion in 2024 and is forecast to reach USD 2.40 billion by 2032 at a CAGR of 3.1%. South Africa and Egypt anchor the market through government support for local drug production. Infrastructure gaps and import reliance slow growth, though generic-focused programs and global partnerships offer long-term prospects.

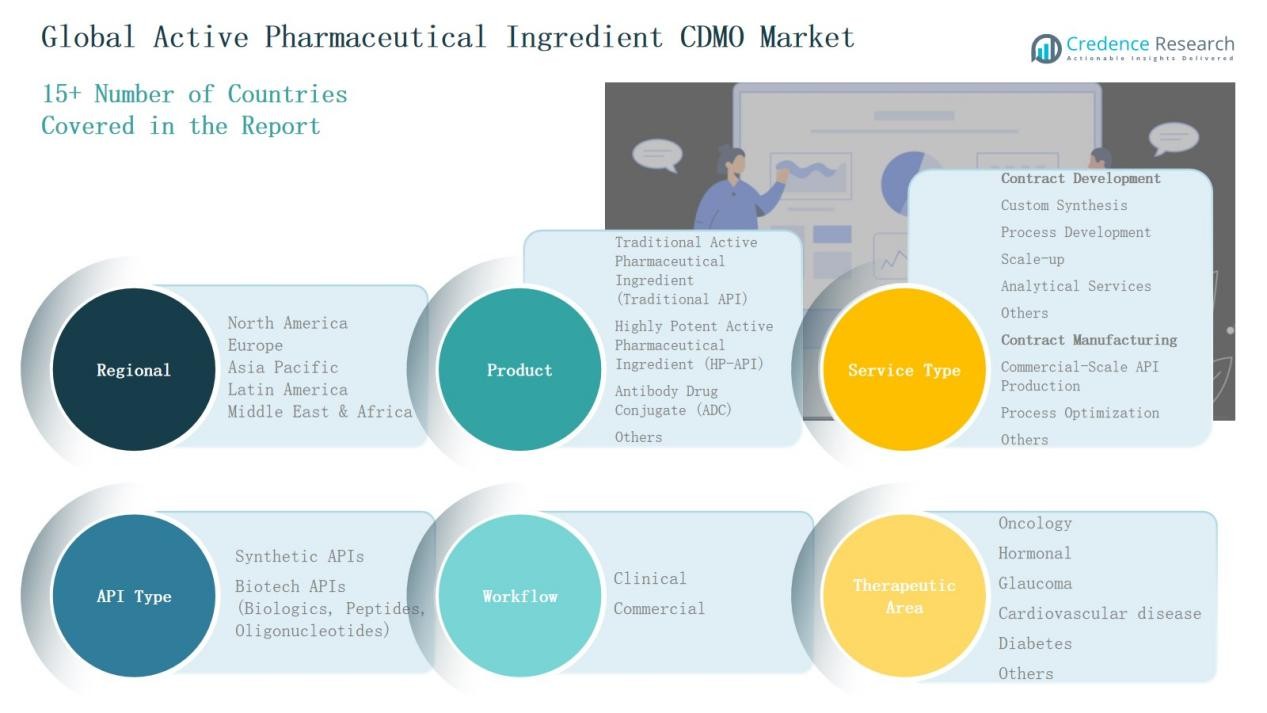

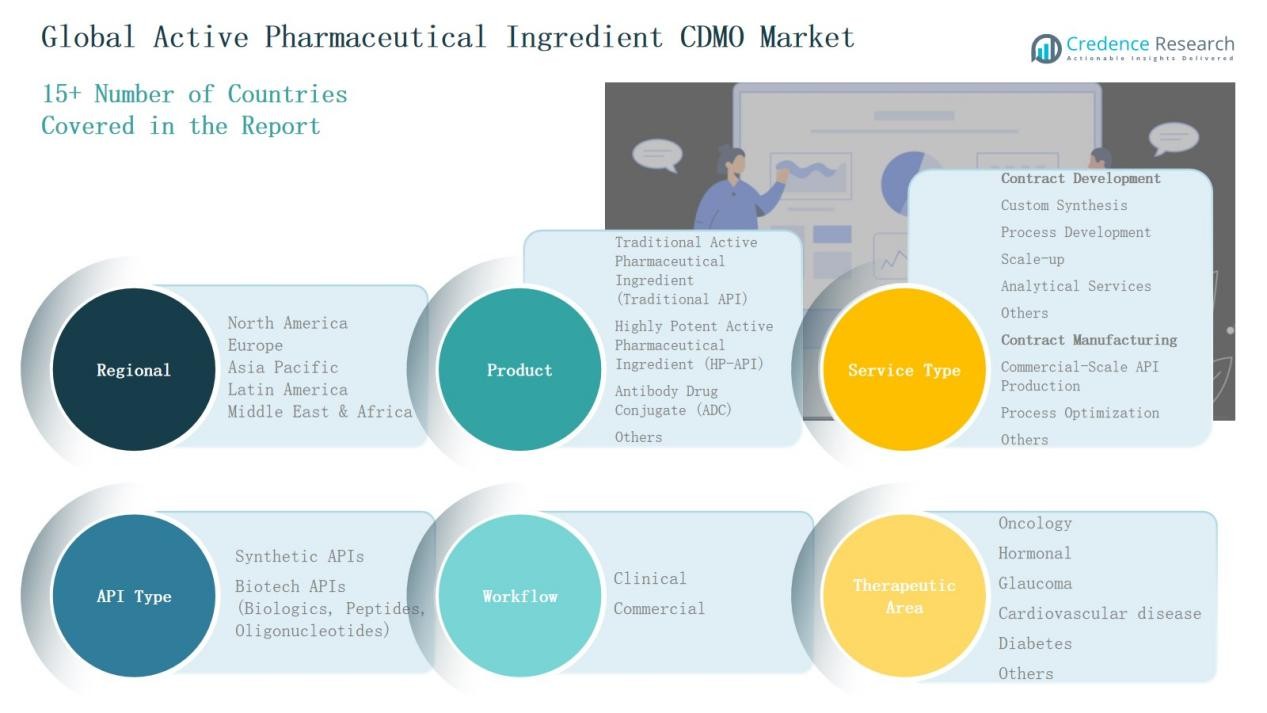

Market Segmentations:

By Product

- Traditional Active Pharmaceutical Workflow (Traditional API)

- Highly Potent Active Pharmaceutical Workflow (HP-API)

- Antibody Drug Conjugate (ADC)

- Others

By Service Type

Contract Development

- Custom Synthesis

- Process Development

- Scale-up

- Analytical Services

- Others

Contract Manufacturing

- Commercial-Scale API Production

- Process Optimization

- Others

By API Type

- Synthetic APIs

- Biotech APIs (Biologics, Peptides, Oligonucleotides)

By Workflow

By Therapeutic Area

- Oncology

- Hormonal

- Glaucoma

- Cardiovascular Disease

- Diabetes

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Active Pharmaceutical Ingredient (API) CDMO market is highly competitive, shaped by global leaders and specialized regional firms. Major players such as Thermo Fisher Scientific, Lonza, Catalent, Samsung Biologics, and CordenPharma dominate with extensive manufacturing networks, advanced R&D capabilities, and regulatory expertise across multiple geographies. These companies focus on expanding high-potency and biologics capacities, while strengthening partnerships with large pharmaceutical and biotech firms. Mid-sized CDMOs, including Cambrex, Recipharm, Siegfried, Piramal Pharma Solutions, and WuXi AppTec, are gaining traction through niche expertise, flexible operations, and cost-efficient offerings. The market is witnessing consolidation, with mergers and acquisitions enhancing scale, service integration, and global reach. Competition is driven by technological innovation, compliance with stringent quality standards, and the ability to manage complex molecules such as HP-APIs, peptides, and antibody drug conjugates. Pricing pressure, supply chain resilience, and differentiated service portfolios remain key factors influencing market positioning and long-term competitiveness.

Key Players

Recent Developments

- In May 2025, HAS Healthcare Advanced Synthesis SA completed the acquisition of Cerbios-Pharma SA, forming a top-tier global CDMO with expanded API, HP-API, and ADC capabilities.

- In 2025, Zydus Lifesciences acquired Agenus Inc.’s biologics manufacturing facilities in California, marking its entry into the global biologics API CDMO sector.

- In July 2025, Thermo Fisher Scientific expanded its partnership with Sanofi by acquiring Sanofi’s sterile manufacturing site in Ridgefield, New Jersey, to boost U.S. drug product capacity.

- In July–August 2025, ESTEVE CDMO acquired Regis Technologies (US), expanding its API CDMO presence and capabilities across the drug development lifecycle.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Service Type, API Type, Workflow, Therapeutic Area and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for outsourcing will continue to rise as pharma companies focus on core R&D.

- CDMOs will expand high-potency API capacity to meet growing oncology drug demand.

- Biologics, peptides, and oligonucleotides will gain higher share in outsourced projects.

- Investment in advanced containment and automation technologies will enhance production efficiency.

- Strategic mergers and acquisitions will accelerate to strengthen service portfolios and scale.

- Regional manufacturing hubs in Asia-Pacific will attract more global outsourcing contracts.

- Supply chain diversification will become a priority to reduce raw material dependency.

- Regulatory compliance and quality certifications will remain critical for winning global contracts.

- Growth in antibody drug conjugates will create new opportunities for specialized CDMOs.

- Digital technologies and data-driven process optimization will drive competitiveness in API production.