Market Overview:

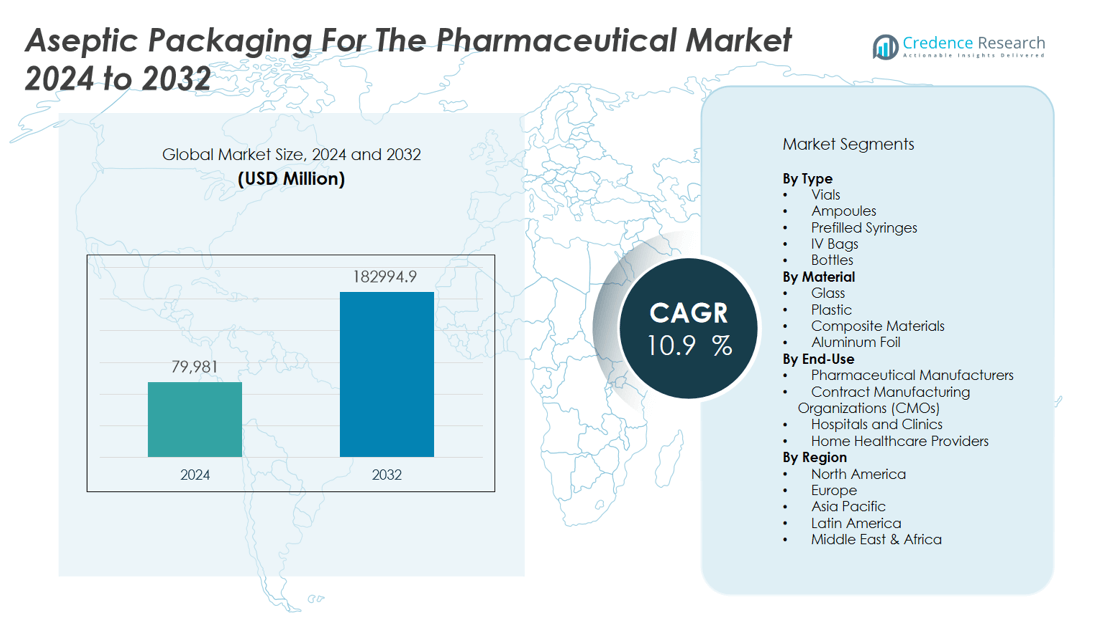

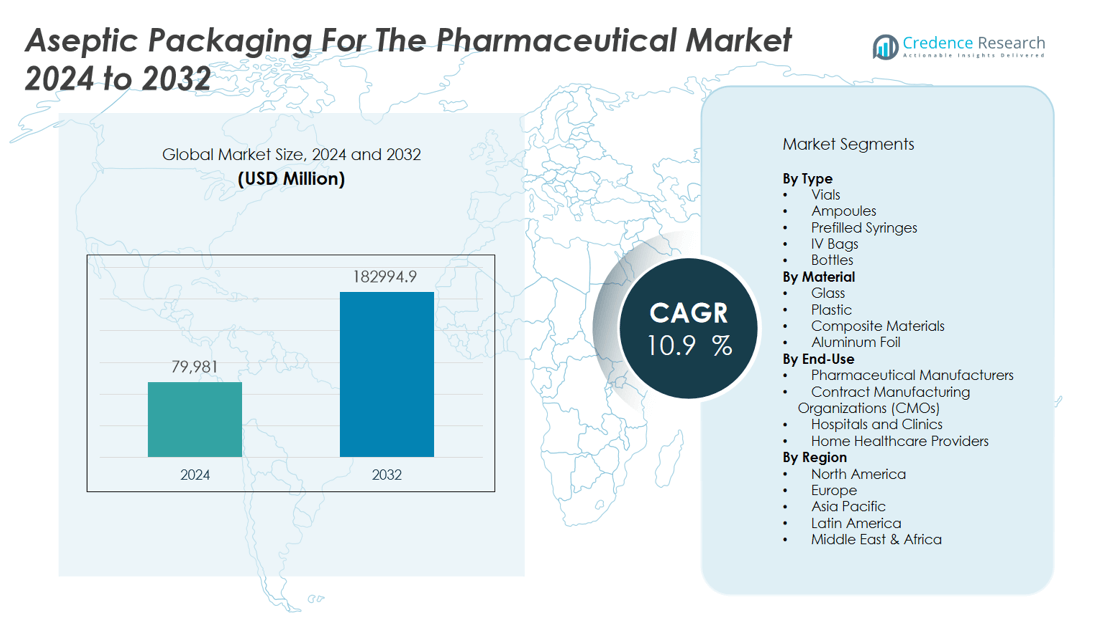

The aseptic packaging for the pharmaceutical market size was valued at USD 79,981 million in 2024 and is anticipated to reach USD 182994.9 million by 2032, at a CAGR of 10.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aseptic Packaging for the Pharmaceutical Market Size 2024 |

USD 79,981 million |

| Aseptic Packaging for the Pharmaceutical Market, CAGR |

10.9% |

| Aseptic Packaging for the Pharmaceutical Market Size 2032 |

USD 182994.9 million |

Key drivers propelling the aseptic packaging for the pharmaceutical market include the heightened emphasis on patient safety, the need to extend the shelf life of sensitive formulations, and the surge in demand for ready-to-administer drugs. Pharmaceutical companies are adopting advanced aseptic packaging formats such as vials, prefilled syringes, ampoules, and IV bags to minimize contamination risks and comply with stringent regulatory guidelines. The integration of automation and robotics in aseptic filling lines enhances efficiency, consistency, and product quality. In addition, rising healthcare expenditures, the prevalence of chronic diseases, and the shift toward biologics and personalized medicine are contributing to market growth.

Regionally, North America leads the aseptic packaging for the pharmaceutical market, supported by strong pharmaceutical manufacturing, robust regulatory frameworks, and high R&D investments, with key players such as Gerresheimer AG, AptarGroup Inc., and West Pharmaceutical Services Inc. Europe follows, driven by established pharmaceutical infrastructure, advanced packaging technologies, and the presence of MediSafe Technologies, Schott AG, and Sartorius AG. The Asia Pacific region is set for the fastest growth due to expanding pharmaceutical production in China and India and increasing demand for affordable medicines. Latin America and the Middle East & Africa are emerging as key markets, driven by better healthcare access and investments in local drug manufacturing.

Market Insights:

- The aseptic packaging for the pharmaceutical market reached USD 79,981 million in 2024 and will grow rapidly to USD 182,994.9 million by 2032.

- Heightened focus on patient safety and product sterility drives strong adoption of advanced aseptic packaging solutions.

- Demand for vials, prefilled syringes, ampoules, and IV bags rises to support injectable, biologic, and ready-to-administer drugs.

- Automation, robotics, and high-barrier materials improve production efficiency and reduce contamination risks.

- North America holds 37% market share, followed by Europe at 29% and Asia Pacific at 23%, reflecting regional leadership and growth dynamics.

- Complex production processes and high regulatory demands pose challenges for both large and small manufacturers.

- Expansion in emerging markets and growing biologics production create new opportunities for technology-driven packaging providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Emphasis on Product Sterility and Patient Safety:

The aseptic packaging for the pharmaceutical market is driven by growing concerns over product sterility and patient safety. Strict regulatory standards from authorities such as the FDA and EMA mandate sterile environments for packaging sensitive drug formulations. Pharmaceutical companies face significant risks from contamination, including product recalls and reputational damage. High-profile cases of contamination have increased industry vigilance, prompting investments in advanced aseptic packaging systems. The adoption of single-use technologies and barrier isolators helps maintain sterile conditions throughout the filling and sealing process. Ensuring product safety remains a top priority for pharmaceutical manufacturers.

- For Instances, PCI Pharma Services’ San Diego manufacturing facility uses fully automated, gloveless robotic isolator technology that can fill up to 1,200 vials per clinical batch with no operator intervention, significantly minimizing human contact and contamination risk during fill-finish operations.

Expanding Demand for Injectable and Biopharmaceutical Products:

Rapid expansion in the injectable drug and biopharmaceutical sectors is fueling demand for aseptic packaging solutions. Biologics, vaccines, and personalized medicines require contamination-free environments to preserve efficacy and stability. The growing pipeline of new biologic therapies has created opportunities for innovative packaging solutions such as prefilled syringes and IV bags. Aseptic packaging enables safe delivery of temperature-sensitive and high-value drugs, supporting both hospital and home-care settings. Pharmaceutical companies are also scaling up capacity to meet surges in vaccine and biosimilar production. This trend is accelerating the adoption of advanced aseptic packaging lines.

- For instance, Comecer’s automatic aseptic filling line now processes up to 2,300 IV bags per hour using advanced LAF isolation and in-line integrity testing to ensure sterile, error-free operations.

Advancements in Packaging Technology and Automation:

Technological advancements are transforming aseptic packaging processes in the pharmaceutical sector. Integration of robotics, automated filling lines, and real-time monitoring systems enhances operational efficiency and reduces human intervention. These innovations minimize the risk of contamination and ensure consistency in product quality. Companies are adopting blow-fill-seal and form-fill-seal technologies to streamline production and reduce packaging costs. Improved material science has also led to high-barrier containers that protect drug formulations from external contaminants. It continues to benefit from investments in smart packaging and track-and-trace solutions.

Stringent Regulatory Frameworks and Global Pharmaceutical Expansion:

Evolving regulatory frameworks across major regions drive compliance-focused investments in aseptic packaging. Guidelines from organizations such as the World Health Organization and local authorities specify packaging requirements for pharmaceuticals. Globalization of pharmaceutical supply chains has increased the need for secure, contamination-free transportation of drugs. Growing demand for medicines in emerging economies encourages companies to build local manufacturing facilities with advanced packaging capabilities. It faces continued scrutiny from regulators regarding packaging integrity and traceability. Ensuring alignment with global standards remains critical for market growth and competitiveness.

Market Trends:

Integration of Smart and Sustainable Packaging Solutions:

The aseptic packaging for the pharmaceutical market is witnessing a strong shift toward smart and sustainable packaging solutions. Companies are investing in packaging formats that enhance traceability, such as incorporating RFID tags and QR codes to support digital supply chain management. Smart features enable better tracking of product integrity, temperature, and movement throughout the logistics process. Sustainability is also shaping material choices, with an increasing focus on recyclable, lightweight, and bio-based polymers to minimize environmental impact. Manufacturers are designing packaging that meets both regulatory and eco-friendly standards. The drive toward smart and green packaging solutions is influencing procurement strategies and long-term industry direction.

- For instance, the Temptime LIMITMarker is a disposable temperature indicator integrated into pharmaceutical packaging, instantly signaling if medicine has exceeded pre-set temperature thresholds from 0°C to +38°C, thus safeguarding cold-chain pharmaceuticals during transit.

Customization, Convenience, and Advanced Material Adoption:

Demand for customization and user convenience continues to grow in the aseptic packaging for the pharmaceutical market. Prefilled syringes, single-dose vials, and auto-injectors are gaining popularity due to their ease of use and reduced risk of dosing errors. Pharmaceutical companies are working with packaging suppliers to create tamper-evident and child-resistant designs that meet evolving safety requirements. Advances in high-barrier films and multilayer containers improve protection against moisture, oxygen, and light. Packaging designs are becoming more patient-centric, supporting home care and self-administration trends. The emphasis on innovation and user-friendly packaging is shaping product differentiation strategies across the industry.

- For instance, Becton, Dickinson and Company (BD) supplies more than 2 billion prefilled syringes per year, which are used globally for a wide variety of medications, supporting precise and safe self-administration for millions of patients.

Market Challenges Analysis:

Complexity and High Costs of Aseptic Packaging Processes:

The aseptic packaging for the pharmaceutical market faces significant challenges from complex and costly production processes. Installing and maintaining aseptic filling lines require substantial capital investment and specialized technical expertise. Companies must comply with rigorous validation and monitoring standards to ensure sterility, which increases operational expenses. Any deviation or failure in aseptic processes can result in costly product recalls or reputational harm. Smaller manufacturers often struggle to adopt advanced aseptic technologies due to limited resources. The need for constant upgrades and training to keep pace with evolving regulatory and technological requirements creates ongoing financial pressure.

Stringent Regulatory Requirements and Supply Chain Risks:

Strict and evolving regulatory requirements present ongoing challenges in the aseptic packaging for the pharmaceutical market. Regulatory bodies in different regions impose varying standards on packaging integrity, traceability, and environmental safety, creating compliance hurdles for multinational manufacturers. Changes in global pharmaceutical supply chains introduce risks related to material shortages, transportation delays, and quality assurance. It must manage supplier quality and maintain robust logistics systems to ensure uninterrupted, contamination-free distribution. Any lapse in meeting compliance or supply chain disruptions can impact drug availability and patient safety. The complex regulatory landscape demands continuous investment in compliance management and supply chain resilience.

Market Opportunities:

Growth Potential in Emerging Markets and Local Pharmaceutical Manufacturing:

Expanding pharmaceutical production in emerging markets presents strong opportunities for aseptic packaging providers. Rising healthcare investments in Asia Pacific, Latin America, and Africa are driving demand for high-quality packaging solutions. Local manufacturing initiatives aim to reduce import dependency and ensure drug security, increasing the need for advanced aseptic technologies. Pharmaceutical companies entering these markets require robust packaging to meet international standards. It can leverage regional partnerships and technology transfer to establish a presence in fast-growing economies. The expansion of universal healthcare and government support for local production further strengthens long-term market prospects.

Innovation in Biologics, Personalized Medicine, and Delivery Formats:

Opportunities for aseptic packaging are rising with the shift toward biologics, gene therapies, and personalized medicine. These drugs require highly specialized, contamination-free packaging to preserve efficacy and extend shelf life. Growing adoption of prefilled syringes, self-injection devices, and advanced IV solutions drives demand for customized packaging formats. It can capture value by offering tailored solutions for new drug formulations and targeted therapies. Collaboration with pharmaceutical innovators to co-develop next-generation packaging designs will help strengthen competitive positioning. The evolving landscape of drug delivery methods continues to open new avenues for packaging providers.

Market Segmentation Analysis:

By Type:

The aseptic packaging for the pharmaceutical market includes vials, ampoules, prefilled syringes, IV bags, and bottles. Prefilled syringes and vials dominate due to their compatibility with injectable drugs and biologics. Ampoules remain widely used for liquid formulations requiring absolute sterility. Demand for IV bags rises with the growth of hospital and home infusion therapies. Bottles support oral and topical formulations where sterility and product protection are essential.

- For instance, BD’s Effivax™ Prefillable Vaccine Syringe has been adopted by approximately 70 of the top 100 biopharmaceutical companies, illustrating broad industry trust in its enhanced processability and contamination control.

By Material:

Glass and plastic are the primary materials in the aseptic packaging for the pharmaceutical market. Glass leads for vials and ampoules because it provides excellent barrier properties and chemical resistance. Plastic gains traction in prefilled syringes, IV bags, and bottles due to its lightweight, break resistance, and compatibility with automation. Advanced polymer blends and multilayer structures improve protection against moisture, oxygen, and light, aligning with the trend toward high-barrier materials.

- For instance, since 2018, Becton Dickinson (BD) has added 350 million units to its glass barrel pre-fillable syringe manufacturing capacity, ensuring robust global supply for vaccines and biologics.

By End-Use:

Pharmaceutical manufacturers represent the largest end-use segment, driving volume through extensive drug production and packaging needs. Contract manufacturing organizations (CMOs) rapidly expand their share as the outsourcing trend intensifies. Hospitals and clinics use aseptic packaging to ensure safe handling and storage of medications. Home healthcare providers increase demand for convenient, ready-to-administer formats, reflecting the shift toward patient-centric care and self-administration.

Segmentations:

By Type:

- Vials

- Ampoules

- Prefilled Syringes

- IV Bags

- Bottles

By Material:

- Glass

- Plastic

- Composite Materials

- Aluminum Foil

By End-Use:

- Pharmaceutical Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Hospitals and Clinics

- Home Healthcare Providers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds a 37% market share in the aseptic packaging for the pharmaceutical market, driven by strong pharmaceutical manufacturing and advanced research capabilities. The region benefits from established regulatory frameworks and consistent investments in product innovation. Leading companies are deploying state-of-the-art aseptic processing and packaging lines to meet stringent sterility requirements. Growth in biologics, injectable drugs, and home healthcare supports sustained demand for high-integrity packaging. The United States dominates the regional landscape, supported by robust R&D spending and rapid commercialization of new therapies. Canada follows with a focus on advanced drug delivery formats and regulatory compliance.

Europe:

Europe accounts for 29% market share in the aseptic packaging for the pharmaceutical market, supported by rigorous regulatory enforcement and a well-developed pharmaceutical sector. Companies in the region benefit from harmonized standards and a high emphasis on product safety and traceability. Germany, Switzerland, and France serve as major hubs for both manufacturing and exports of pharmaceutical products. Regional players are investing in automation and digitalization to enhance production efficiency and meet evolving packaging standards. The growing presence of contract manufacturing organizations (CMOs) further accelerates demand for aseptic packaging. Innovation in sustainable and eco-friendly packaging materials aligns with Europe’s broader environmental goals.

Asia Pacific:

Asia Pacific holds 23% market share in the aseptic packaging for the pharmaceutical market, with rapid growth fueled by expanding pharmaceutical production in China, India, and Southeast Asia. Governments across the region are prioritizing healthcare infrastructure and local drug manufacturing to improve medicine accessibility. Companies are investing in modern aseptic processing lines to meet global export standards and rising domestic demand. Collaborations between multinational firms and local manufacturers support technology transfer and skill development. The region’s competitive labor costs and large patient population create strong incentives for market expansion. It is positioned for further growth as global pharmaceutical supply chains diversify into Asia Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Gerresheimer AG

- AptarGroup Inc.

- West Pharmaceutical Services Inc.

- MediSafe Technologies

- Schott AG

- Sartorius AG

- Becton

- Nipro Corporation

- Dickinson and Company

- Stelmi S.p.A.

Competitive Analysis:

The aseptic packaging for the pharmaceutical market features strong competition among global leaders and specialized technology providers. Key players such as Gerresheimer AG, AptarGroup Inc., West Pharmaceutical Services Inc., MediSafe Technologies, Schott AG, and Sartorius AG shape the market landscape through advanced product portfolios and strategic partnerships. Companies focus on innovation in barrier materials, automation, and smart packaging to enhance sterility and compliance. It sees continuous investment in R&D, with firms expanding manufacturing capacity and pursuing collaborations with pharmaceutical manufacturers. Market participants differentiate by offering tailored solutions for biologics, injectables, and specialty drugs. The ability to meet regulatory demands and provide reliable, scalable packaging formats remains critical for maintaining competitive advantage.

Recent Developments:

- In June 2025, Gerresheimer AG introduced a digital product database solution to accelerate the market launch of new drugs by providing comprehensive, up-to-date documentation for solid, liquid, and ophthalmic packaging products.

- In February 2024, AptarGroup, through Aptar CSP Technologies, collaborated with ProAmpac to co-launch the Moisture Protect MP-1000, an advanced packaging solution for active microclimate management.

- January 2025, West Pharmaceutical Services Inc. launched Daikyo PLASCAP® Ready-to-Use Validated (RUV) closures in a new nested format, optimizing containment for advanced therapies in cell and gene treatments.

Market Concentration & Characteristics:

The aseptic packaging for the pharmaceutical market exhibits moderate concentration, with several global leaders and a mix of regional players shaping its landscape. Leading companies differentiate through advanced aseptic technologies, robust compliance capabilities, and strategic partnerships with pharmaceutical manufacturers. It features high entry barriers due to significant capital investment, regulatory demands, and the need for specialized expertise. Innovation in packaging materials, automation, and integrated track-and-trace systems drives competitive advantage. The market values scalability, operational reliability, and seamless integration with pharmaceutical production processes. Ongoing consolidation and alliances further intensify competition and support continuous product development.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Market participants will invest in AI-driven quality control systems to reduce human errors and reinforce sterility assurance.

- Leading firms will expand adoption of single-use systems to lower cross-contamination risks and simplify changeover.

- Packaging providers will integrate advanced serialization and blockchain-based traceability systems to enforce supply chain transparency.

- Manufacturers will explore bio-based and compostable polymers to align with global sustainability standards.

- The market will move toward modular, flexible filling lines that adapt to small-batch biologic and personalized medicine production.

- Cold-chain packaging will evolve to maintain stability of temperature-sensitive therapies during transit and storage.

- Equipment suppliers will embed real-time predictive maintenance sensors to optimize uptime and reduce unplanned downtime.

- Collaboration between CMOs and packaging technology vendors will accelerate co-development of customized delivery formats.

- Regulatory authorities will introduce harmonized global guidelines that standardize aseptic packaging validation and documentation.

- Emerging markets will adopt localized aseptic packaging capacity, supported by technology transfer agreements and public–private partnerships.