Market Overview

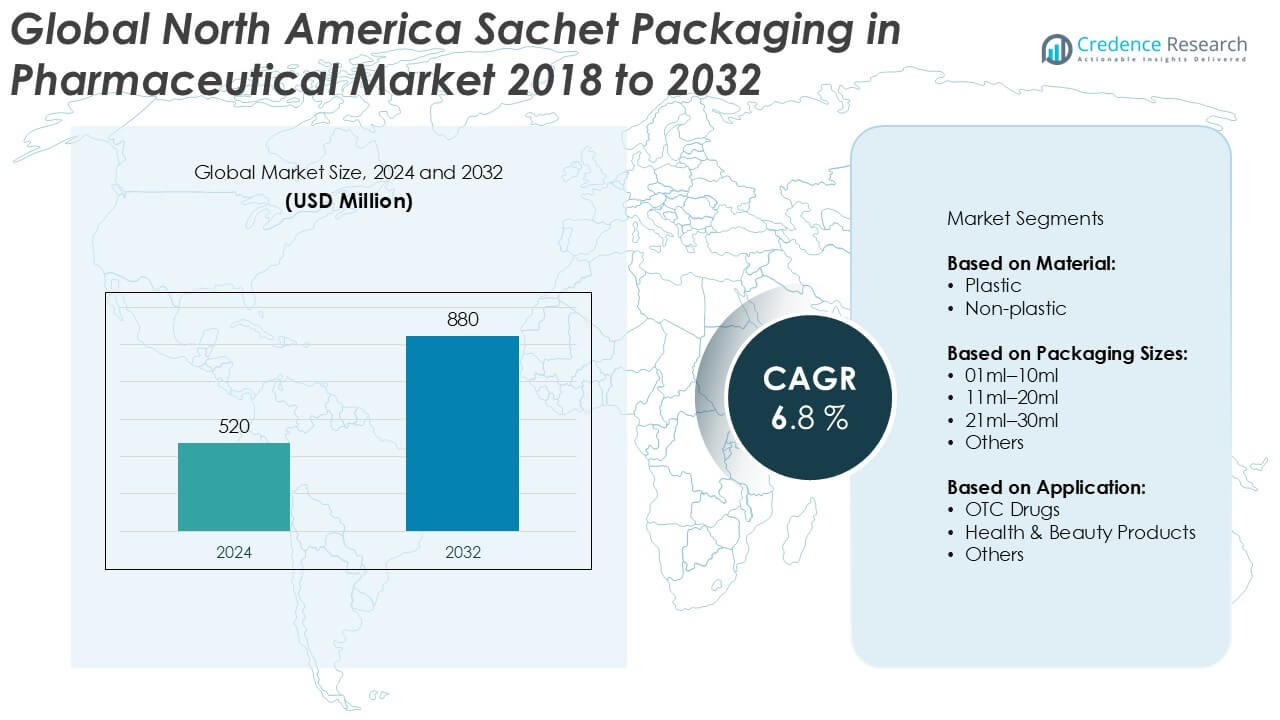

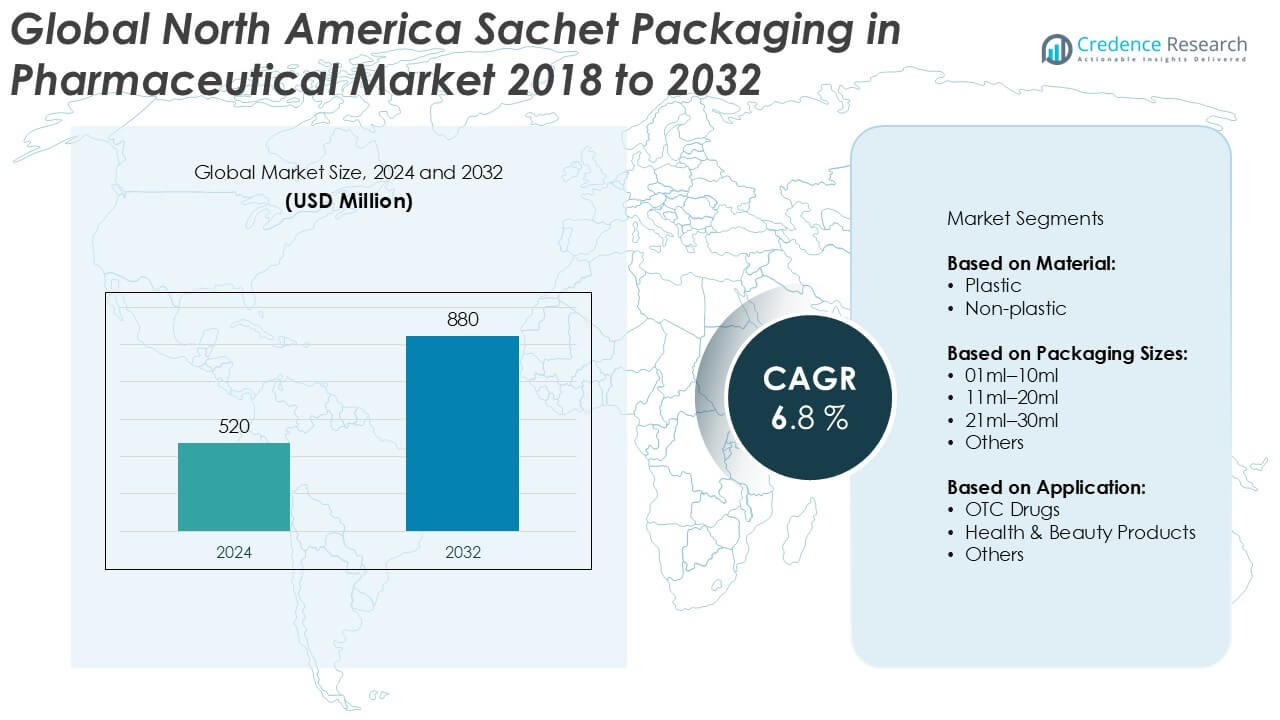

North America Sachet Packaging in Pharmaceutical market size was valued at USD 520 million in 2024 and is anticipated to reach USD 880 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Sachet Packaging in Pharmaceutical market Size 2024 |

USD 520 Million |

| North America Sachet Packaging in Pharmaceutical market , CAGR |

6.8% |

| North America Sachet Packaging in Pharmaceutical market Size 2032 |

USD 880 Million |

The North America sachet packaging in pharmaceutical market is led by prominent players such as Amcor plc, Constantia Flexibles, Ahlstrom-Munksjö, Sharp, Glenroy Inc., and Ropack, Inc. These companies dominate through advanced material technologies, regulatory compliance, and strong supply chain capabilities. Amcor and Constantia Flexibles lead in high-barrier laminate solutions, while Sharp and Ropack specialize in contract packaging services tailored to pharmaceutical applications. Regionally, the United States holds the largest share, accounting for approximately 68% of the total North American market in 2024, driven by strong consumer demand for OTC drugs and a mature pharmaceutical infrastructure. Canada and Mexico follow, contributing 20% and 12%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America sachet packaging in pharmaceutical market was valued at USD 520 million in 2024 and is projected to reach USD 880 million by 2032, growing at a CAGR of 6.8% during the forecast period.

- Increasing demand for single-dose, travel-friendly packaging and rising self-medication trends are key drivers propelling market growth across over-the-counter drugs and health supplements.

- Market trends highlight a shift toward sustainable and recyclable materials, with companies adopting eco-friendly sachet formats to align with regulatory and consumer expectations.

- The market is moderately consolidated, with top players like Amcor plc, Constantia Flexibles, and Sharp leading through innovation and scalable contract packaging solutions; the plastic segment holds over 65% market share due to its durability and cost-efficiency.

- Regionally, the United States accounts for 68%, followed by Canada at 20% and Mexico at 12%, with the 01ml–10ml segment dominating in size-based segmentation due to its popularity in unit-dose drug applications.

Market Segmentation Analysis:

By Material

In the North America sachet packaging in pharmaceutical market, the plastic segment holds the dominant share, accounting for over 65% of the total market in 2024. Plastic sachets offer superior barrier properties, cost-effectiveness, and design flexibility, making them ideal for moisture-sensitive pharmaceutical products. Their lightweight nature and ease of sealing also contribute to enhanced portability and extended shelf life, driving widespread adoption. While non-plastic alternatives are gaining traction due to sustainability trends, their limited compatibility with certain drug formulations currently restricts broader market penetration, keeping plastic as the material of choice for sachet packaging.

- For instance, Amcor plc operates over 200 production facilities globally, and its North American sites have integrated high-barrier co-extrusion and solvent-less lamination lines capable of producing more than 1.2 billion plastic sachets annually, ensuring consistency in pharmaceutical-grade barrier performance.

By Packaging Sizes:

The 01ml–10ml segment leads the market, capturing approximately 48% of the total share in 2024. This dominance is attributed to the high demand for single-use doses, particularly in over-the-counter (OTC) medications and health supplements. These small-volume sachets enhance dosage accuracy, reduce wastage, and improve patient compliance, especially in fast-moving consumer drug applications. Compact packaging sizes also support better storage, lower shipping costs, and ease of use, making them highly preferred by both consumers and manufacturers. Larger sachets (11ml–30ml) are gradually expanding, particularly for health and beauty applications, but remain secondary in market volume.

- For instance, Glenroy Inc. has dedicated production lines that specialize in sachets ranging from 1ml to 10ml and reports output exceeding 750 million units annually across its Wisconsin-based facility alone, primarily serving pharmaceutical and personal care clients.

By Application:

OTC drugs dominate the application segment, representing over 55% of the North American market in 2024. This is driven by increased consumer preference for convenient, pre-measured dosages that support self-medication and travel-friendly use. Sachet packaging is widely used for analgesics, cold remedies, and dietary supplements, aligning with growing health awareness and demand for accessible treatment options. Health and beauty products also contribute significantly, leveraging sachets for sample distributions and single-use formats. However, their market share remains comparatively lower due to different regulatory requirements and less stringent packaging needs than pharmaceutical products.

Key Growth Drivers

Rising Demand for Single-Dose Packaging

The growing preference for single-dose packaging is a major driver in the North America sachet packaging in pharmaceutical market. Consumers increasingly favor unit-dose sachets for their convenience, portability, and accurate dosing, particularly in over-the-counter (OTC) medications and dietary supplements. This packaging format reduces wastage and contamination risks, improving medication adherence and product safety. Pharmaceutical manufacturers also benefit from easier distribution and longer shelf life of sachets, making them an ideal solution for modern lifestyles and self-care habits, thereby fueling market growth.

- For instance, Sharp, a U.S.-based contract packaging company, expanded its single-dose sachet operations in Pennsylvania by adding three new automated lines with a combined packaging speed of 450 sachets per minute, boosting capacity to over 600 million sachets per year.

Expansion of OTC Drug Consumption

The steady rise in OTC drug consumption across North America significantly supports the sachet packaging market. As consumers become more health-conscious and proactive about self-medication, the demand for easy-to-use, pre-measured drug packaging has grown substantially. Sachets are increasingly used for analgesics, allergy medications, and vitamins, aligning well with the retail pharmacy and e-commerce distribution models. The convenience of sachets in travel, trial packs, and daily regimens further promotes their usage, encouraging pharmaceutical companies to expand sachet-based product portfolios.

- For instance, Ropack, Inc. supports major OTC brands in the U.S. and Canada with its sachet filling capabilities, handling over 400 product SKUs annually, and packaging more than 300 million sachets each year across two GMP-certified facilities.

Technological Advancements in Packaging

Technological improvements in packaging machinery and materials have enhanced the appeal and feasibility of sachet packaging in the pharmaceutical sector. Innovations such as high-speed filling equipment, multi-layer barrier films, and tamper-evident designs contribute to improved safety, product integrity, and regulatory compliance. These advancements allow pharmaceutical companies to deliver high-quality sachet formats with precise dosing and extended shelf life. The development of sustainable, recyclable plastics and eco-friendly non-plastic alternatives also addresses environmental concerns, opening new opportunities for adoption in line with corporate sustainability goals.

Key Trends & Opportunities

Sustainability and Eco-Friendly Packaging Solutions

Sustainability is emerging as a key trend in the North America sachet packaging market, driving innovation in biodegradable and recyclable packaging materials. As regulatory pressure and consumer demand for environmentally responsible solutions intensify, pharmaceutical companies are exploring non-plastic materials and mono-material sachets that reduce environmental impact. This trend presents an opportunity for manufacturers to align with green initiatives and gain competitive advantage. Investing in sustainable packaging not only enhances brand perception but also supports long-term market compliance with evolving environmental standards.

- For instance, Constantia Flexibles has developed its recyclable mono-material sachet solution, EcoLam, which has already replaced over 1,500 metric tons of conventional multi-layer packaging annually across its North American pharmaceutical client base.

Growth in E-commerce and Direct-to-Consumer Channels

The rise of e-commerce and direct-to-consumer healthcare delivery models has created new growth avenues for sachet packaging. With consumers increasingly purchasing OTC medications, supplements, and health products online, pharmaceutical companies are adopting sachets for their lightweight, compact, and shippable qualities. These attributes reduce shipping costs and improve the unboxing experience. Additionally, sachets serve as ideal formats for sample packs or bundled offerings, enhancing customer engagement and brand loyalty through personalized and convenient delivery formats.

- For instance, Multi-Pack Solutions LLC reported that over 35% of its sachet packaging volume in 2023 was tied directly to e-commerce product formats, prompting the company to add two new digital-ready filling lines capable of serving direct-to-consumer campaigns with same-week turnaround.

Key Challenges

Regulatory Compliance and Material Restrictions

Maintaining compliance with stringent pharmaceutical packaging regulations remains a critical challenge. Sachet packaging must meet rigorous standards for safety, labeling, barrier protection, and dosage accuracy, which can complicate the design and material selection process. Non-compliance may lead to product recalls, delays in market approvals, and reputational risks. Additionally, the introduction of new materials, particularly non-plastic alternatives, must undergo comprehensive testing and approval, posing time and cost barriers to innovation in the segment.

Environmental Concerns with Plastic Usage

Despite the dominance of plastic sachets, their environmental impact has become a growing concern. Single-use plastic sachets contribute significantly to non-biodegradable waste, drawing criticism from environmental groups and regulatory bodies. As a result, manufacturers face increasing pressure to transition to sustainable packaging formats. However, developing viable non-plastic alternatives that maintain the necessary barrier properties and pharmaceutical compliance can be costly and technically challenging, slowing the pace of eco-friendly innovation.

High Initial Investment in Automation and Equipment

Adopting advanced sachet packaging solutions often requires substantial investment in high-speed machinery and automation systems. Small and mid-sized pharmaceutical companies may find it financially burdensome to integrate new technologies, particularly when transitioning from traditional bulk or blister packaging formats. The need for specialized equipment, maintenance, and skilled labor adds to operational costs. These financial barriers can limit market entry or expansion for smaller players, creating a challenge in scaling sachet production effectively across the industry.

Regional Analysis

United States:

The United States dominates the North America sachet packaging in pharmaceutical market, accounting for approximately 68% of the regional market share in 2024. This stronghold is driven by high demand for over-the-counter drugs, dietary supplements, and growing consumer preference for single-use, travel-friendly dosage forms. The presence of established pharmaceutical companies, advanced packaging technologies, and a well-regulated healthcare system further supports the growth of sachet packaging. Additionally, the rise in e-commerce and direct-to-consumer health channels has amplified the need for compact, lightweight packaging. The country’s ongoing shift toward self-medication and preventive healthcare continues to boost market expansion.

Canada:

Canada holds around 20% of the North American sachet packaging in pharmaceutical market as of 2024. The market is supported by increasing demand for health supplements and self-care products, coupled with strong regulatory frameworks that encourage high-quality packaging solutions. Canadian consumers increasingly seek convenient and accurate dosage formats, especially for OTC medications and wellness products. Furthermore, the push for sustainable packaging materials is influencing manufacturers to innovate sachet formats using eco-friendly alternatives. With an expanding elderly population and growing awareness about preventive health, Canada presents a stable and growing market for sachet packaging in the pharmaceutical sector.

Mexico:

Mexico contributes approximately 12% to the North America sachet packaging in pharmaceutical market in 2024. The market is gradually expanding due to rising healthcare access, increased consumption of OTC medications, and growing awareness of health and hygiene. Sachet packaging is gaining popularity for its affordability, convenience, and suitability for single-use medications in urban and rural areas alike. Local pharmaceutical companies are adopting sachet formats to enhance market reach and reduce packaging costs. While the market is still developing compared to the U.S. and Canada, government initiatives to improve healthcare infrastructure and packaging standards are expected to drive future growth.

Market Segmentations:

By Material:

By Packaging Sizes:

- 01ml–10ml

- 11ml–20ml

- 21ml–30ml

- Others

By Application:

- OTC Drugs

- Health & Beauty Products

- Others

By Geography

Competitive Landscape

The North America sachet packaging in pharmaceutical market features a moderately consolidated competitive landscape, with several key players vying for market share through innovation, strategic partnerships, and capacity expansion. Leading companies such as Amcor plc, Constantia Flexibles, Ahlstrom-Munksjö, and Sharp dominate the market by leveraging advanced packaging technologies, robust distribution networks, and compliance with stringent pharmaceutical regulations. These firms focus on producing high-barrier, tamper-evident sachets that ensure product integrity and extend shelf life. Mid-sized players like Glenroy Inc., Ropack, Inc., and Synchpack contribute to market diversity by offering custom solutions tailored to OTC and health supplement brands. Additionally, companies are increasingly investing in sustainable materials and digital printing capabilities to align with eco-conscious trends and enhance branding. The competitive intensity is further amplified by the growing demand for single-dose, travel-friendly packaging and the expansion of e-commerce pharmaceutical sales. Innovation in packaging design, scalability, and regulatory adherence remain critical factors for maintaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Synchpack

- Ahlstrom‑Munksjö

- Tripak Pharmaceuticals

- Constantia Flexibles

- Sharp

- Ropack, Inc.

- American Flexpack

- Glenroy Inc.

- Multi‑Pack Solutions LLC

- Amcor plc

Recent Developments

- In January 2025, Arcade Beauty launched the 80.0% Paper Packette, a recycle-ready, mono-dose sample sachet designed as an alternative to plastic or foil sachets. The new paper packette is made with 80% paper material and is designed for skincare, haircare, and color cosmetics sampling.

- In October 2023, Elemis partnered with Xampla to launch biodegradable, plastic-free sachets for the cosmetic sector. This innovation seeks to replace commonly used multilayer plastic sachets.

- In June 2023, Amcor added new heat-sealable sachets for food and beverage use, including instant coffee and spices, to their AmFiber Performance Paper range. The sachets are recyclable and reduce plastic use.

Market Concentration & Characteristics

The North America Sachet Packaging in Pharmaceutical Market demonstrates a moderate level of market concentration, with a mix of global packaging giants and regional players competing for share. A few major companies, including Amcor plc, Constantia Flexibles, and Sharp, hold significant influence through their advanced technologies, strong distribution networks, and regulatory expertise. It features a blend of contract packaging service providers and material suppliers catering to pharmaceutical manufacturers, particularly in the OTC segment. The market reflects characteristics such as high demand for single-dose formats, strong regulatory compliance, and growing interest in sustainable packaging materials. Companies invest in automation and innovation to meet pharmaceutical standards and differentiate their offerings. The dominance of plastic sachets persists due to their cost-effectiveness and performance, though non-plastic alternatives are entering the landscape. Consumer demand for convenience, accurate dosing, and portability continues to shape product development strategies. E-commerce expansion and self-medication trends contribute to the evolving structure of this market.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Sizes, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing demand for single-dose and travel-friendly pharmaceutical packaging.

- OTC drug manufacturers will continue adopting sachet formats to enhance consumer convenience and improve dosage accuracy.

- Sustainable and recyclable materials will gain traction as companies respond to regulatory pressures and consumer preferences.

- Technological advancements in filling and sealing machinery will improve production efficiency and packaging quality.

- Plastic sachets will remain dominant, but non-plastic alternatives will gradually expand their market presence.

- E-commerce growth in pharmaceuticals will support higher demand for lightweight, tamper-evident sachet packaging.

- Contract packaging organizations will play a larger role in offering customized sachet solutions to pharmaceutical brands.

- The United States will retain its leadership in the regional market, driven by its advanced healthcare infrastructure and high OTC consumption.

- Small and mid-sized players will focus on niche segments and sustainable innovations to compete with larger firms.

- Regulatory compliance and safety standards will continue to influence packaging design and material selection.