Market Overview

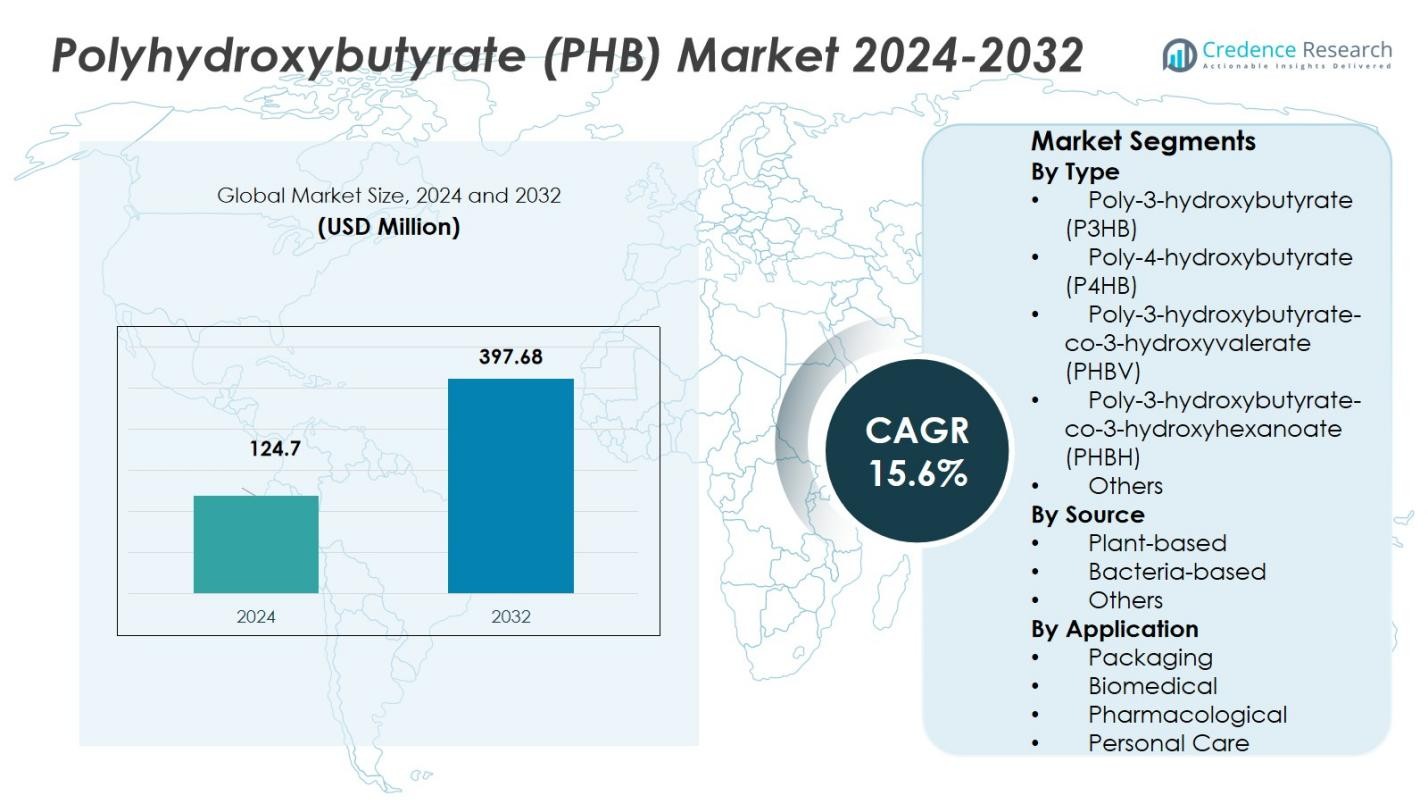

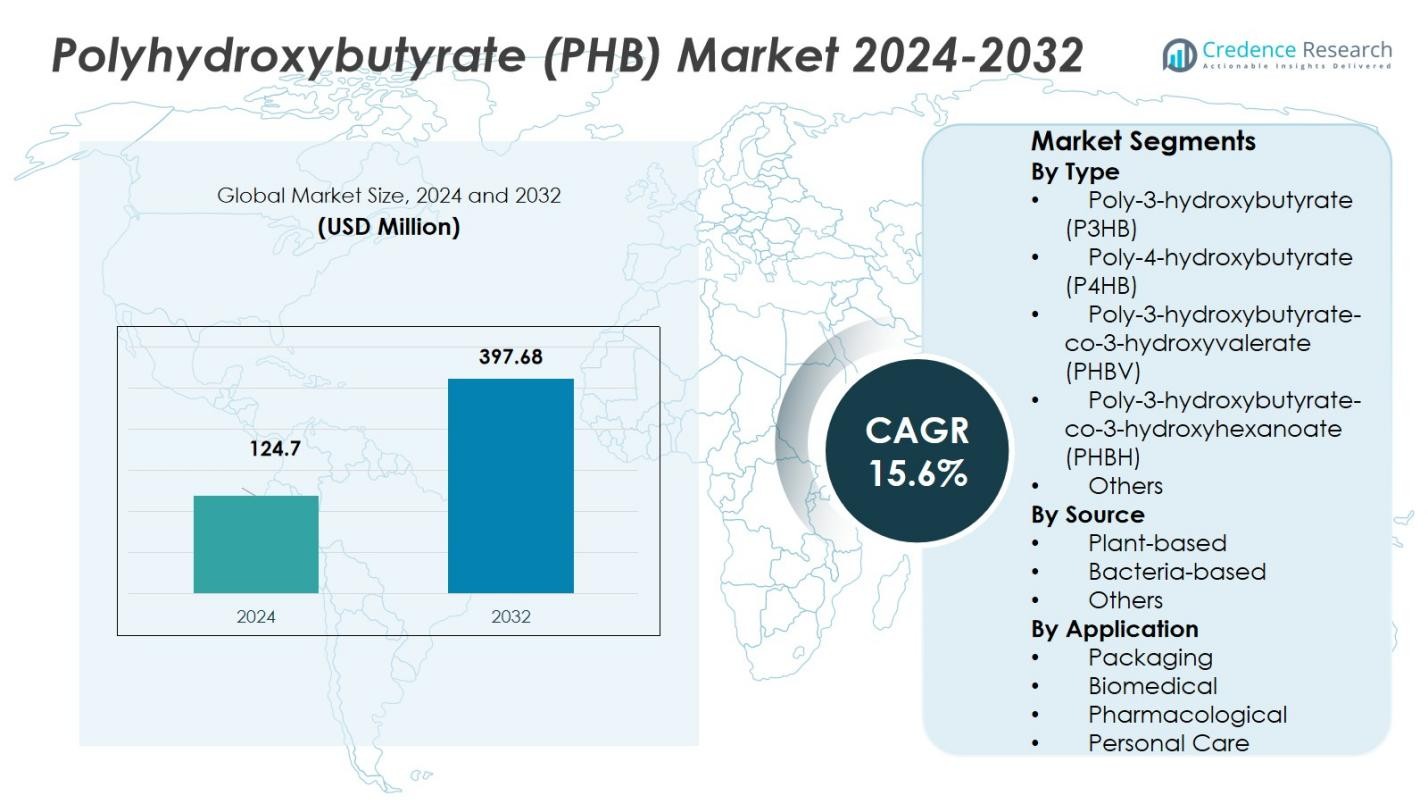

The Polyhydroxybutyrate (PHB) Market size was valued at USD 124.7 million in 2024 and is anticipated to reach USD 397.68 million by 2032, growing at a CAGR of 15.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyhydroxybutyrate (PHB) Market Size 2024 |

USD 124.7 Million |

| Polyhydroxybutyrate (PHB) Market, CAGR |

15.6% |

| Polyhydroxybutyrate (PHB) Market Size 2032 |

USD 397.68 Million |

The Polyhydroxybutyrate (PHB) market is driven by key players such as BASF SE, Biomer, TianAn Biologic Materials Co., Ltd., PHB Industrial S.A., BIO‑ON, TEPHA INC., and Telles, LLC, who are leading the way in biopolymer production through technological innovations and expanded manufacturing capabilities. The Asia-Pacific region holds the largest market share at 46.2%, largely due to increasing demand for biodegradable plastics and growing industrial applications in packaging and consumer goods. Europe follows closely, supported by stringent environmental regulations and a strong emphasis on sustainable practices. North America also shows significant growth, particularly in packaging, agriculture, and biomedical applications, driven by rising consumer demand for eco-friendly products and regulatory incentives aimed at reducing plastic waste.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyhydroxybutyrate (PHB) market was valued at USD 124.7 million in 2024 and is projected to reach USD 397.68 million by 2032, growing at a CAGR of 15.6% during the forecast period.

- Key drivers for market growth include increasing environmental concerns, a shift toward sustainable packaging, and the rising adoption of biodegradable plastics across multiple industries such as food packaging, agriculture, and biomedical applications.

- Major trends shaping the market include the development of more efficient production methods, particularly through bacterial fermentation, and the growing demand for eco-friendly alternatives to petroleum-based plastics.

- The market faces challenges such as high production costs and the need for significant investment in research and development to improve PHB’s commercial viability.

- Regionally, Asia-Pacific holds the largest market share at 46.2%, followed by Europe and North America, which are also witnessing steady growth due to regulatory pressures and demand for sustainable products.

Market Segmentation Analysis:

By Type:

The Polyhydroxybutyrate (PHB) market is segmented by type into Poly-3-hydroxybutyrate (P3HB), Poly-4-hydroxybutyrate (P4HB), Poly-3-hydroxybutyrate-co-3-hydroxyvalerate (PHBV), Poly-3-hydroxybutyrate-co-3-hydroxyhexanoate (PHBH), and others. Among these, Poly-3-hydroxybutyrate-co-3-hydroxyvalerate (PHBV) holds the dominant position, commanding a 45% market share due to its superior biodegradability and wide range of applications in packaging and biomedical sectors. The increasing demand for sustainable materials and the adoption of PHBV in environmentally friendly packaging solutions are key drivers for this segment’s growth. Furthermore, PHBV’s ability to be processed like conventional plastics contributes to its expanding usage in various industries.

- For instance, PHBV/PBSA blends (70 wt% PHBV) were successfully film-blown on a pilot scale with a 180 cm bubble height, achieving impact strength of 7.7 kJ/m² and heat-sealing capability for flexible food packaging.

By Source:

The PHB market is categorized by source into plant-based, bacteria-based, and others. The bacteria-based segment leads the market, holding a 60% share, due to the efficient production process and cost-effectiveness of bacterial fermentation in producing high-quality PHB. Bacteria-based PHB offers a sustainable alternative to traditional petroleum-based plastics, and its widespread use in packaging, biomedical, and agricultural applications is driving its growth. Moreover, the growing focus on reducing environmental impact and carbon footprint supports the continued dominance of bacteria-based PHB production.

- For instance, Kaneka has developed Kaneka PHBH™, a biodegradable polymer made from renewable plant oils, with large-scale production enabling its use in packaging, agriculture, and consumer goods.

By Application:

The Polyhydroxybutyrate (PHB) market is segmented into packaging, biomedical, pharmacological, and personal care applications. Packaging is the largest application segment, with a 50% market share, driven by the increasing demand for biodegradable and eco-friendly packaging materials. The shift towards sustainable packaging in response to growing environmental concerns, particularly in the food and beverage industry, fuels the adoption of PHB in packaging solutions. Additionally, advancements in processing techniques and government regulations favoring sustainable materials are boosting the market share of PHB in packaging.

Key Growth Drivers

Key Growth Drivers

Increasing Demand for Biodegradable Plastics

The rising global shift toward sustainability and eco-friendly products is a significant growth driver for the Polyhydroxybutyrate (PHB) market. As environmental concerns about plastic waste intensify, governments and industries are actively seeking alternatives to traditional plastics. PHB, being biodegradable and compostable, aligns with these sustainability goals. With increasing regulatory pressure to reduce plastic waste, PHB’s applications in packaging and consumer goods are expanding, particularly in industries such as food packaging, agriculture, and textiles, driving significant market growth.

- For instance, Xampla has developed biodegradable plastic feedstocks from plant proteins like pea and soy that form water-insoluble films comparable to conventional plastics, fully degrading in soil within 28 days, suitable for flexible films and coatings used in packaging.

Government Regulations and Environmental Policies

Government regulations promoting the use of biodegradable and sustainable materials are a crucial driver for the PHB market. In regions like Europe and North America, stricter regulations on plastic production and waste management are forcing industries to adopt bioplastics like PHB. These regulations, such as the EU’s Plastic Strategy and bans on single-use plastics, are encouraging investments in sustainable alternatives. The favorable policy environment not only boosts PHB adoption but also attracts companies to invest in research and development, fostering further innovation and expansion in the market.

- For instance, Kaneka Corporation completed the expansion of its PHBH biodegradable polymer production capacity to 5,000 tons annually at its Takasago site in Japan by December 2019. This expansion aimed to meet global demand and align with tightening plastic waste regulations.

Technological Advancements in Production Processes

Advancements in microbial fermentation technologies and other production methods are accelerating the growth of the PHB market. These technological improvements have made PHB production more cost-effective, efficient, and scalable. Researchers are optimizing production processes to reduce the high costs associated with PHB and increase yield, making it a more viable option for large-scale commercial use. As production technologies advance, PHB is becoming more competitive with traditional plastics, facilitating its broader application across various industries, including packaging, automotive, and healthcare.

Key Trends & Opportunities

Rising Popularity of Eco-Friendly Packaging Solutions

The increasing preference for sustainable and eco-friendly packaging solutions presents a significant opportunity for the PHB market. With consumer awareness about environmental issues on the rise, industries are prioritizing biodegradable materials for packaging. PHB’s ability to decompose naturally without harming the environment positions it as an ideal substitute for conventional plastic in packaging applications. The growth in e-commerce, coupled with stringent regulations on plastic waste, is creating strong demand for sustainable packaging, driving further adoption of PHB in the packaging industry.

- For instance, IKEA has adopted mycelium-based packaging made from mushroom roots, which is fully biodegradable and decomposes quickly in composting conditions.

Growth in Agricultural and Medical Applications

The adoption of PHB in agricultural and medical sectors is emerging as a key opportunity. In agriculture, PHB is used for biodegradable mulch films, offering farmers an eco-friendly alternative to plastic. The demand for such solutions is driven by the growing trend of sustainable farming practices and the need to reduce plastic pollution in the soil. In the medical sector, PHB’s biocompatibility makes it suitable for applications such as drug delivery systems and biodegradable implants. These expanding uses in agriculture and healthcare present untapped growth potential for the PHB market.

- For instance, in the medical sector, PHB’s biocompatibility has enabled its use in drug delivery systems and biodegradable implants, where companies like Danimer Scientific and Kaneka are innovating production methods to expand applications such as tissue engineering scaffolds and implantable devices.

Key Challenges

High Production Costs

Despite advancements in production technology, PHB remains expensive to manufacture compared to traditional plastics. The high costs associated with raw materials and production processes limit its competitiveness, especially in industries with tight margins. While microbial fermentation is the most common method of PHB production, it still requires substantial investment in biotechnological infrastructure and expertise. As a result, the high production costs present a significant barrier to widespread adoption, hindering the market’s growth potential, particularly in cost-sensitive sectors like packaging and textiles.

Limited Awareness and Adoption Across Industries

While PHB offers substantial environmental benefits, its adoption is still limited in certain industries due to a lack of awareness and understanding of its advantages. Many companies remain hesitant to switch from conventional plastics to bioplastics like PHB due to perceived risks related to performance, availability, and cost-effectiveness. The need for greater industry education and awareness about the long-term benefits of PHB, including its sustainability and biodegradability, is crucial for expanding its adoption. This limited adoption hinders the broader market growth and impacts the development of infrastructure for PHB production and application.

Regional Analysis

Asia‑Pacific

Asia‑Pacific holds a leading position in the Polyhydroxybutyrate (PHB) market, capturing a 46.2% share in 2024. Strong demand stems from rapid industrialization, expanding packaging, agriculture, and consumer‑goods manufacturing in major economies like China, India, and Japan. Environmental regulations and growing consumer awareness about sustainability further bolster PHB adoption. Additionally, lower labor and manufacturing costs combined with supportive governmental policies for biodegradable materials make the region especially attractive for both local producers and foreign investors seeking to scale PHB production and deployment.

North America

North America accounted for 25% of the global PHB market share in recent estimates. The region benefits from a robust R&D ecosystem and a strong regulatory and corporate push toward sustainability. Stringent environmental regulations and growing consumer demand for eco-friendly packaging and products drive PHB adoption. Well‑established biotechnology infrastructure and investments in advanced production processes enhance supply capabilities. As a result, North America remains a key market for PHB, especially in segments such as packaging, biomedical applications, and sustainable consumer goods.

Europe

Europe holds a 20% share of the global PHB market, supported by rigorous environmental legislation and a commitment to circular‑economy principles. Regulations targeting single‑use plastics and strong incentives for biodegradable alternatives have fostered the adoption of PHB across packaging, agriculture, and automotive segments. Countries such as Germany, France, and Italy lead in both production and consumption of bioplastics, leveraging established manufacturing capacity and favorable policy frameworks. European demand is especially strong in sustainable packaging and compostable consumer goods, aligning with consumer preferences and regulatory mandates.

Latin America

Latin America contributes around 7.4% to the global PHB market share. Growing environmental awareness and emerging regulatory pressure to curb plastic waste are gradually increasing the uptake of PHB in this region. Key growth is seen in packaging and agricultural applications, where biodegradable materials offer advantages for soil health and waste reduction. Although adoption remains nascent compared to other regions, Latin America is witnessing rising interest in sustainable polymers, driven by both governmental encouragement and increasing demand for eco-conscious consumer products.

Middle East & Africa

The Middle East & Africa (MEA) region holds about 5.6% share of the global PHB market. Market development is at an early stage, but growing awareness of environmental degradation and plastic pollution is encouraging initial adoption. Demand is emerging in sectors such as packaging and agriculture, where biodegradable alternatives align with sustainability goals. Limited manufacturing infrastructure and lower per‑capita consumption currently constrain growth, but increasing emphasis on environmental sustainability and potential government incentives suggest that MEA could gradually expand its share in the PHB market.

Market Segmentations:

By Type

- Poly-3-hydroxybutyrate (P3HB)

- Poly-4-hydroxybutyrate (P4HB)

- Poly-3-hydroxybutyrate-co-3-hydroxyvalerate (PHBV)

- Poly-3-hydroxybutyrate-co-3-hydroxyhexanoate (PHBH)

- Others

By Source

- Plant-based

- Bacteria-based

- Others

By Application

- Packaging

- Biomedical

- Pharmacological

- Personal Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polyhydroxybutyrate (PHB) market is marked by the presence of key players such as GreenBio Materials, Shenzhen Ecomann Technology, MHG, P&G Chemicals, Metabolix, Tianan Biopolymer, Kaneka, Biomer, Newlight Technologies, and PHB Industrial. These companies are at the forefront of developing and commercializing PHB, driven by the growing demand for sustainable and biodegradable materials across various industries, including packaging, agriculture, and healthcare. Key players are focused on expanding their production capabilities through technological innovations, such as advancements in microbial fermentation and optimizing production processes to reduce costs and increase yield. Additionally, collaborations and partnerships with other industry leaders, along with investments in research and development, are crucial strategies being employed to strengthen their market positions. As the market continues to evolve, the emphasis on scalability, regulatory compliance, and the ability to meet sustainability goals will remain vital for companies aiming to capture a larger share of the growing PHB market.

Key Player Analysis

- Tianan Biopolymer

- Metabolix

- Kaneka

- Shenzhen Ecomann Technology

- PHB Industrial

- GreenBio Materials

- Newlight Technologies

- MHG

- P&G Chemicals

- Biomer

Recent Developments

- In November 2025, Renaissance BioScience and Biome Bioplastics launched a US$1.06 million partnership to develop renewable plastics alternatives (targeting packaging and consumer‑goods).

- In October 2025, CJ Biomaterials won an “Innovation in Bioplastics” award for the development of a product named PHACT A1000P-signaling a new advancement in PHA/PHB‑related bioplastics.

- In 2023, a paper from Washington University in St. Louis (WashU) described a novel “leaf‑inspired” bioplastic design that introduces cellulose nanofibers into bioplastics -specifically improving strength and biodegradability of PHB (and PLA) blends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and biodegradable materials will continue to drive the growth of the PHB market across industries like packaging, agriculture, and healthcare.

- Technological advancements in production processes, such as improved microbial fermentation techniques, will lower costs and enhance scalability, making PHB more competitive with conventional plastics.

- Increasing government regulations and bans on single-use plastics will accelerate the adoption of PHB as an eco-friendly alternative in various sectors.

- Growing consumer awareness about environmental sustainability and the negative impact of plastic pollution will further boost the demand for biodegradable bioplastics like PHB.

- The expansion of PHB applications in the automotive sector, particularly for lightweight components and eco-friendly parts, will contribute to market growth.

- Key players will continue investing in research and development to innovate and improve the performance of PHB in diverse applications.

- The agricultural sector’s adoption of PHB for biodegradable films and soil protection will be a major growth driver, particularly in sustainable farming practices.

- Collaboration between industry players and government bodies will create favorable conditions for the widespread use of PHB, supported by regulatory incentives.

- As production technologies advance, the availability of raw materials for PHB will improve, leading to a more stable and efficient supply chain.

- Emerging markets in Latin America, Africa, and the Middle East will present new opportunities for PHB adoption, driven by environmental concerns and growing regulatory pressures.

Key Growth Drivers

Key Growth Drivers