Market Overview

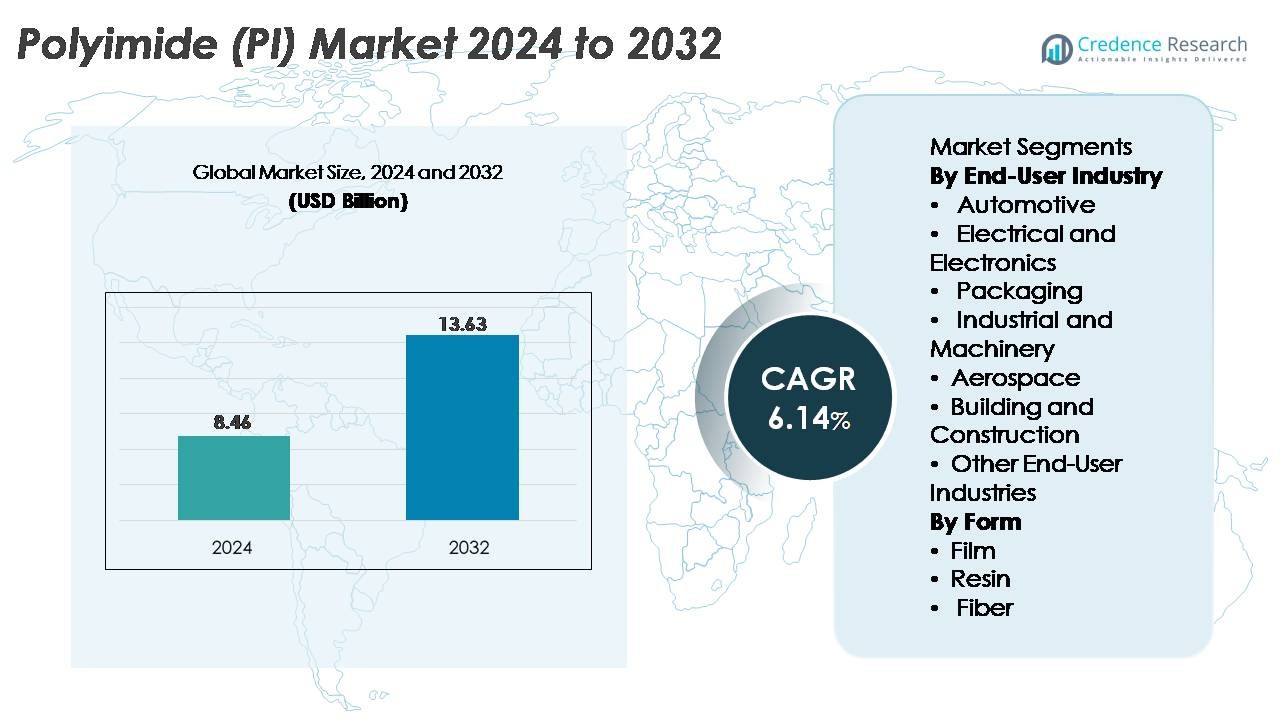

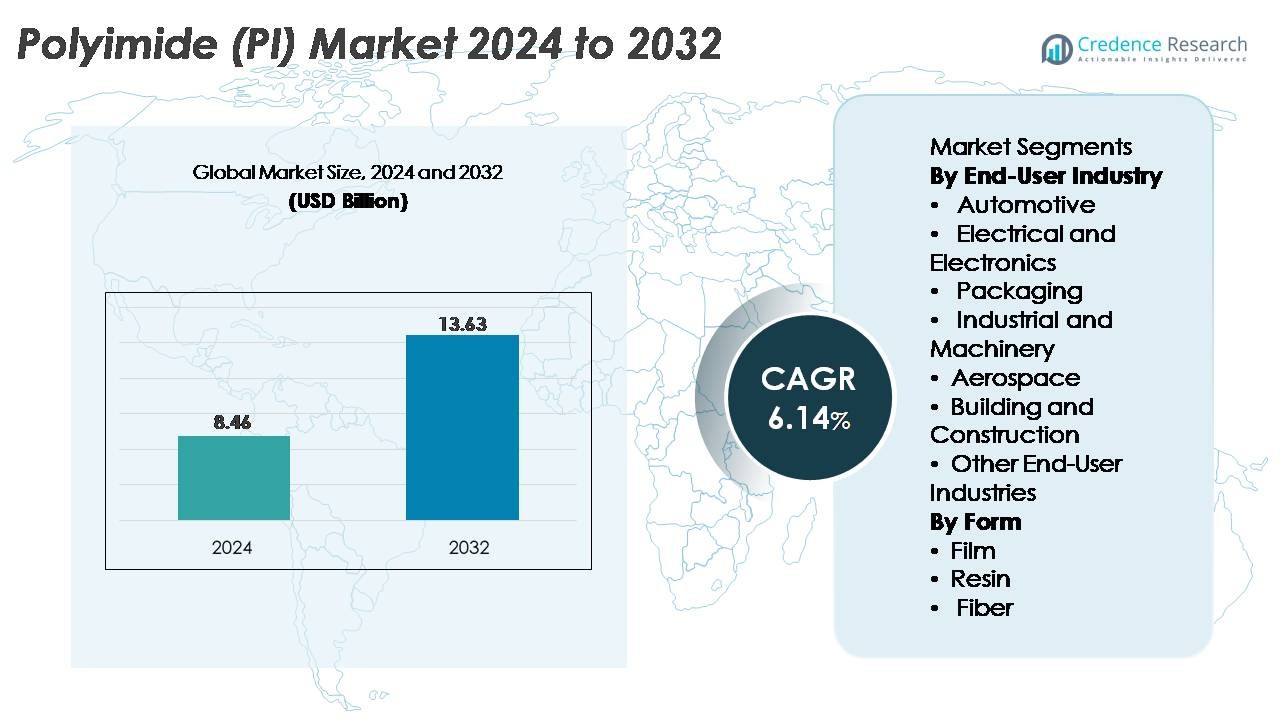

The Polyimide (PI) market was valued at USD 8.46 billion in 2024 and is projected to reach USD 13.63 billion by 2032, registering a CAGR of 6.14% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyimide (PI) Market Size 2024 |

USD 8.46 Billion |

| Polyimide (PI) Market, CAGR |

6.14% |

| Polyimide (PI) Market Size 2032 |

USD 13.63 Billion |

The Polyimide (PI) market is shaped by a strong group of global leaders, including PI Advanced Materials Co., Ltd., Toray Industries Inc., DuPont, UBE Corporation, and Kaneka Corporation, each competing through advanced material development, high-temperature polymer technologies, and strong integration with electronics and aerospace value chains. These companies dominate high-performance PI films, resins, and composites used in semiconductor packaging, flexible circuits, EV components, and aerospace insulation systems. Asia-Pacific remains the leading regional hub, holding over 45% of the global market share, supported by extensive electronics manufacturing in South Korea, Japan, China, and Taiwan. The region’s robust semiconductor capacity and rapid expansion of flexible display production further reinforce its leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyimide (PI) market was valued at USD 8.46 billion in 2024 and is projected to reach USD 13.63 billion by 2032, registering a 6.14% CAGR during the forecast period.

- Strong demand for high-temperature materials in electronics, aerospace, and EV systems drives market expansion, with the electrical and electronics segment holding the largest share at over 40% due to extensive use in flexible PCBs, insulation films, and semiconductor packaging.

- Growing adoption of flexible displays, 5G infrastructure, and miniaturized devices fuels trends toward advanced PI films, including colorless polyimide (CPI) for foldable screens and next-generation optical applications.

- The competitive landscape is dominated by PI Advanced Materials, Toray Industries, DuPont, UBE Corporation, and Kaneka Corporation, all investing in high-performance resin technologies, CPI films, and expanded production capacity across major electronics hubs.

- Asia-Pacific leads the global market with over 45% regional share, followed by North America (~25%) and Europe (~20%), supported by strong semiconductor ecosystems, EV growth, and aerospace manufacturing demand.

Market Segmentation Analysis:

By End-User Industry

The electrical and electronics industry represents the dominant end-user segment in the polyimide (PI) market, holding the largest share due to PI’s exceptional thermal stability, dielectric strength, and chemical resistance. Its widespread use in flexible printed circuits, high-density semiconductor packaging, and insulation films continues to strengthen demand. The surge in miniaturized components, 5G infrastructure, and advanced semiconductor manufacturing further reinforces this segment’s leadership. Automotive, aerospace, and industrial machinery applications show steady expansion, driven by lightweighting initiatives, high-temperature tolerance requirements, and the adoption of PI-based components in EV batteries, wiring insulation, and precision mechanical systems.

- For instance, DuPont’s Kapton® polyimide films are engineered to withstand continuous operating temperatures up to 400 °C and deliver dielectric strengths exceeding 250 kV/mm, enabling reliable insulation in advanced microelectronics.

By Form

Polyimide films account for the largest share within the form-based segmentation, driven by their critical role in flexible electronics, insulation tapes, high-temperature labels, and display technologies. Their adaptability in foldable devices, photovoltaic modules, and high-frequency communication components reinforces their dominance. Demand for PI resins grows in molded components, adhesives, and composite matrices used across automotive and aerospace applications, while PI fibers gain traction in specialty filtration, protective clothing, and industrial reinforcement applications. Increasing innovation in high-performance flexible substrates and optoelectronic materials continues to position PI films as the market’s most influential growth driver.

- For instance, PI Advanced Materials supplies PIQ® polyimide films used in OLED panels, flexible printed circuits, and semiconductor packaging. The company reports that PIQ® films deliver high heat resistance and dimensional stability suited for advanced display and electronics manufacturing. PI Advanced Materials is also a key supplier of PI substrates for flexible OLED displays used by global device makers.

Key Growth Drivers

Rising Demand for High-Temperature and High-Performance Materials

The growing need for advanced materials capable of withstanding extreme temperatures, mechanical stress, and chemical exposure significantly drives polyimide demand. PI’s outstanding thermal stability above 400°C, inherent flame resistance, and low outgassing make it indispensable across semiconductor packaging, aerospace insulations, and automotive electrification systems. As industries prioritize materials that deliver reliability in harsh environments, PI emerges as a preferred solution for flexible PCBs, high-temperature wiring, and sensor substrates. Increasing investments in electric vehicles, satellite systems, and power electronics further amplify PI consumption, as these applications require components that maintain mechanical integrity under thermal cycling. Additionally, the expansion of renewable energy especially photovoltaic modules and inverter technologies reinforces the need for robust insulating films. This shift toward high-performance engineering materials places polyimides at the core of next-generation industrial and electronic design, cementing its role as a long-term growth catalyst.

· For instance, Kaneka’s Apical® polyimide films demonstrate water absorption below 1% and tensile strengths exceeding 240 MPa, based on Kaneka’s verified technical data. These characteristics support reliable performance in high-temperature electrical insulation and automotive electronics exposed to thermal cycling.

Expansion of Flexible Electronics, 5G Infrastructure, and Miniaturized Devices

Polyimide demand accelerates as the electronics industry transitions toward thinner, lighter, and more complex devices. PI’s unmatched flexibility, dielectric strength, and dimensional stability enable the manufacturing of flexible printed circuits, foldable displays, wearable sensors, and antenna substrates. The rise of 5G networks significantly boosts consumption because high-frequency circuits require thermally stable, low-loss materials conditions that PI films readily meet. Miniaturized semiconductors and high-density chip architectures depend on PI layers for stress buffering, insulation, and thermal management, especially in advanced packaging technologies such as FO-WLP and chip-stacking. Growing production of smartphones, IoT modules, and AR/VR headsets further expands application scope. As OEMs increasingly adopt flexible and hybrid circuit designs, PI remains essential for achieving mechanical reliability and long operating lifecycles. This alignment with next-generation electronics ensures sustained, multi-industry growth for PI materials.

· For instance, Ube’s Upilex®-S polyimide film delivers tensile strength around 500 MPa and a CTE of 3 ppm/°C (100–200 °C range), according to the company’s technical literature. This stability supports precision circuits and advanced sensor modules.

Strong Adoption Across Aerospace, Defense, and Automotive Electrification

Polyimides play a critical role in high-reliability sectors where safety, performance, and durability are non-negotiable. Aerospace applications including lightweight composites, insulation blankets, wire coatings, thrust-resistant components, and antenna films continue to boost PI consumption due to its ability to perform under extreme temperatures, vibration, and irradiation. In defense systems, PI is used in missile electronics, radars, avionics, and protective structures requiring thermal and mechanical resilience. The rapid electrification of vehicles adds another growth vector, as EV batteries, motors, and inverters rely heavily on PI films for thermal insulation, slot liners, and high-voltage protection. Advanced driver-assistance systems (ADAS), battery management units, and powertrain electronics also incorporate PI-based substrates to ensure signal stability and heat dissipation. As global OEMs accelerate lightweighting, high-temperature safety standards, and electric mobility strategies, polyimide’s adoption across these sectors continues to rise.

Key Trends & Opportunities

Advancements in Polyimide Films for Flexible Displays and Optoelectronics

A major market opportunity arises from the rapid development of polyimide films engineered for high-clarity, high-flexibility display applications. Colorless PI (CPI) films have become foundational in foldable smartphones, OLED displays, flexible touch sensors, and transparent protective layers traditionally dominated by glass. Their superior optical transmission, impact resistance, and bending durability create unprecedented opportunities for device innovation. Manufacturers are investing in next-generation CPI films with improved haze reduction, UV stability, and scratch resistance, enabling wider adoption in tablets, laptops, e-readers, AR/VR optics, and next-gen wearables. Growing investments in micro-LED displays and flexible lighting solutions further accelerate demand. As global consumer electronics shift toward thinner form factors and adaptive display technologies, PI films position themselves as a cornerstone material, offering long-term growth and premium pricing advantages. This trend also supports cross-industry adoption in medical imaging screens and automotive infotainment systems.

· For instance, LG Chem reports that its colorless polyimide (CPI) films offer optical transmittance above 90% and high flexibility suitable for foldable OLED applications. The company highlights that these CPI materials provide strong heat resistance and durability required for next-generation flexible displays.

Increasing Use of Polyimide in Clean Energy, Batteries, and High-Voltage Applications

The transition to renewable energy and electrification introduces new opportunities for polyimide materials. PI films serve as critical insulation components in high-efficiency solar modules, wind turbine electronics, and power inverters, where thermal endurance and electrical stability are paramount. In energy storage, PI is increasingly used in battery separators, thermal barriers, and module-level insulation for EVs and grid systems. As battery designs move toward higher energy density and faster charging, PI’s thermal runaway resistance becomes essential for safety. Additionally, high-voltage equipment including traction motors, HVDC converters, and power transmission systems continues to integrate PI components to enhance dielectric strength and moisture resistance. With governments expanding investments in renewable energy infrastructure and EV adoption rising globally, PI manufacturers gain strong positioning in energy-centric value chains. This alignment creates sustained opportunities in coatings, films, molded parts, and electrical insulation solutions.

· For instance, Panasonic reports that its lithium-ion battery packs use polyimide-based insulating sheets to help prevent internal short-circuit propagation and improve module-level safety. The company highlights that these insulation layers offer strong heat resistance and electrical stability needed for high-energy EV battery systems.

Key Challenges

High Material Cost and Manufacturing Complexity

Polyimides face a significant challenge due to their high production cost, complex synthesis routes, and stringent processing requirements. Manufacturing PI involves costly monomers, multi-stage imidization processes, and specialized equipment capable of handling high-temperature polymerization. These factors limit adoption in cost-sensitive applications such as commodity electronics, mass-market automotive parts, and general packaging. In addition, scaling CPI film production requires advanced coating, curing, and polishing technologies, which restrict participation to a small group of technologically advanced manufacturers. The lack of economically viable alternatives for high-performance applications further reinforces pricing pressure. For end users evaluating material choices, the cost-performance trade-off can slow replacement rates and delay broader penetration. Although demand remains strong in premium sectors, high manufacturing costs continue to hinder the expansion of PI into mainstream industrial applications.

Performance Limitations Compared to Emerging High-Performance Polymers

Despite their robust performance profile, polyimides face competition from emerging high-performance polymers such as PEEK, PEI, PPS, and liquid-crystal polymers (LCPs), which offer advantages in specific environments. In certain high-frequency electronic applications, LCPs provide lower dielectric loss, challenging PI’s dominance in advanced antenna and RF structures. Some applications require improved chemical resistance or moisture absorption characteristics, areas where alternative polymers may outperform PI. Additionally, the electronics industry increasingly seeks materials compatible with ultra-low-temperature processing and extreme miniaturization criteria that can limit PI usage in specific next-generation devices. As new polymer chemistries emerge, customers reassess material selection to optimize cost, manufacturability, and performance. These evolving material preferences introduce competitive pressure and necessitate continuous innovation in next-generation polyimide grades.

Regional Analysis

Asia-Pacific

Asia-Pacific dominates the global polyimide market with over 45% market share, driven by its strong electronics manufacturing ecosystem and expanding semiconductor production in China, South Korea, Japan and Taiwan. High demand for flexible PCBs, display films and insulation materials reinforces the region’s leadership. Rapid growth in electric vehicles, 5G infrastructure and aerospace manufacturing further boosts consumption of high-performance PI films and molded components. Continuous investments in advanced materials, alongside government incentives supporting domestic chip production, strengthen Asia-Pacific’s long-term role as the primary growth engine of the global PI industry.

North America

North America accounts for approximately 25% of the global market, supported by strong technological innovation in aerospace, defense electronics, medical devices and electric vehicle platforms. The U.S. leads regional demand due to its high adoption of PI in high-temperature wiring, advanced packaging, radar systems and next-generation communication hardware. Growth in semiconductor fabrication expansions and electric mobility accelerates PI consumption across insulation, substrates and thermal management materials. Strict quality standards and the region’s focus on high-reliability components ensure steady demand, especially in NASA programs, EV battery systems and defense-grade electronic assemblies.

Europe

Europe holds nearly 20% market share, driven by its advanced aerospace industry, automotive electrification efforts and strong presence of specialty material manufacturers. Germany, France and the U.K. lead adoption in high-performance insulation, lightweight composites, EV powertrain components and industrial machinery applications. Increased emphasis on sustainability and energy-efficient systems supports PI use in wind turbines, high-voltage equipment and insulation films for renewable energy installations. Europe’s strong R&D environment fosters the development of novel PI chemistries and high-temperature-resistant materials, reinforcing its stable demand profile across industrial, mobility and defense applications.

Latin America

Latin America captures around 6% of the global polyimide market, driven primarily by growing investments in automotive assembly, industrial automation and electronics component manufacturing. Brazil and Mexico support steady demand for PI films used in wiring harnesses, sensors, industrial insulation and printed circuitry. As regional industries modernize production lines and expand into advanced electronics and EV components, PI adoption increases due to its durability, heat resistance and electrical performance. Although market size remains smaller compared to major regions, rising industrial upgrades and infrastructure development provide a gradual pathway for long-term PI growth.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for about 4% of global market share, supported by expanding industrial equipment manufacturing, aerospace partnerships and high-temperature insulation requirements in energy and petrochemical operations. Demand grows steadily in electrical systems, turbine insulation, oilfield electronics and high-performance coatings. The UAE and Saudi Arabia accelerate adoption through technology investment programs and diversification strategies aimed at developing domestic electronics and aerospace capabilities. Although still emerging, MEA’s increasing focus on advanced materials and industrial modernization is expected to gradually strengthen regional demand for polyimide products.

Market Segmentations:

By End-User Industry

- Automotive

- Electrical and Electronics

- Packaging

- Industrial and Machinery

- Aerospace

- Building and Construction

- Other End-User Industries

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the polyimide (PI) market is characterized by a mix of global chemical producers, specialty material manufacturers, and electronics-focused polymer suppliers, each competing through product innovation, manufacturing capability, and application-specific expertise. Leading companies emphasize developing high-performance PI films, resins, and fibers tailored for electronics, aerospace, automotive, and industrial applications. Firms invest heavily in advanced polymerization technologies, colorless PI (CPI) film development, and high-thermal-stability grades to meet demands from semiconductor packaging, 5G infrastructure, and EV components. Strategic partnerships with electronics OEMs, aerospace agencies, and EV manufacturers strengthen supply chain integration and secure long-term contracts. Companies also expand production capacities across Asia-Pacific and North America to address growing demand for flexible substrates, insulation films, and high-temperature composites. Competitive differentiation increasingly centers on quality consistency, dielectric performance, and the ability to support miniaturized electronics and lightweight mobility systems. As global innovation accelerates, the market sees continuous product upgrades and technology-driven competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Toray Industries unveiled STF-2000, a photosensitive polyimide enabling 30 µm high-aspect-ratio patterning in films up to 200 µm thick.

Report Coverage

The research report offers an in-depth analysis based on End-User industry, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Polyimide demand will rise steadily as electronics continue shifting toward flexible, miniaturized, and thermally demanding architectures.

- Advancements in 5G, 6G, and high-frequency communication systems will expand PI use in antenna substrates and insulation layers.

- Growth in electric vehicles will accelerate adoption of PI films for battery insulation, high-voltage components, and thermal management systems.

- Aerospace and defense programs will increasingly integrate PI composites for lightweight, heat-resistant structural and electronic components.

- Colorless polyimide (CPI) films will gain momentum as foldable displays, AR/VR devices, and flexible sensors scale globally.

- Semiconductor packaging will drive stronger consumption of PI coatings, stress-buffer layers, and high-density circuit substrates.

- Renewable energy systems, especially solar inverters and wind power electronics, will boost demand for high-durability PI insulation materials.

- Manufacturers will expand production capacity in Asia-Pacific to meet surging electronics and EV requirements.

- Innovation in ultra-high-temperature and chemically resistant PI grades will unlock new industrial applications.

- Sustainability initiatives will drive research into recyclable PI formulations and energy-efficient processing technologies.