Market Overview

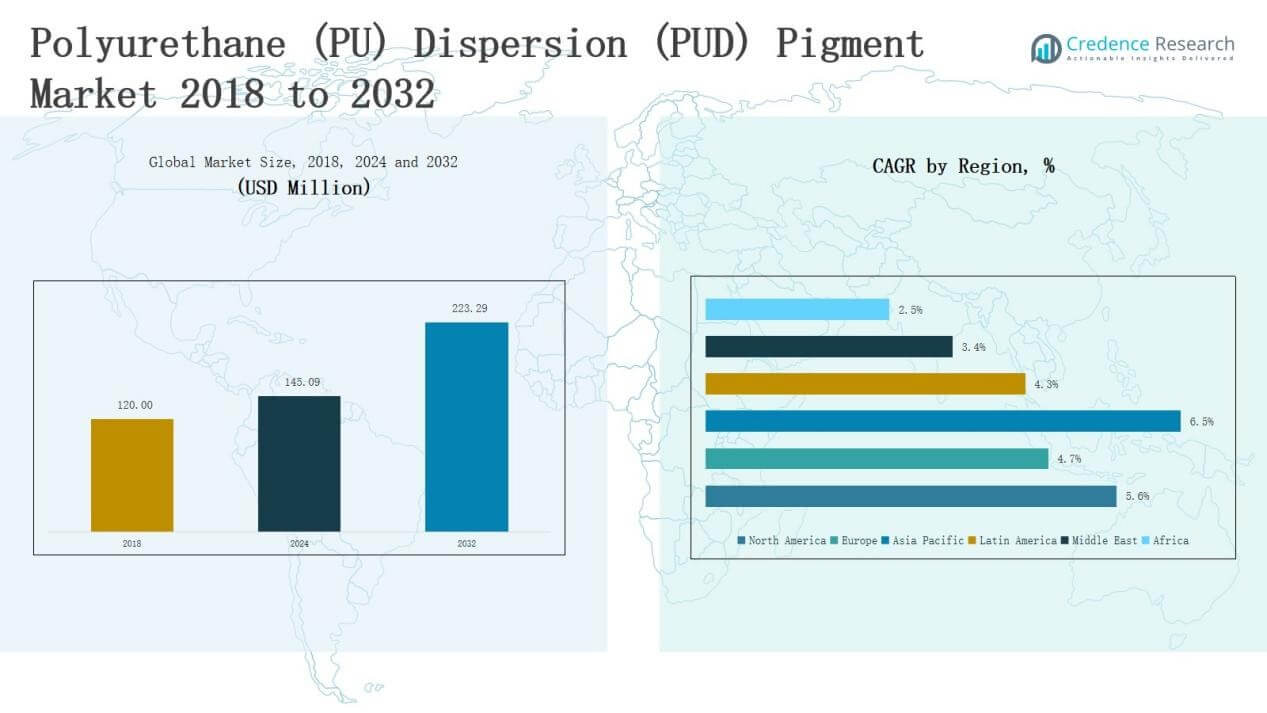

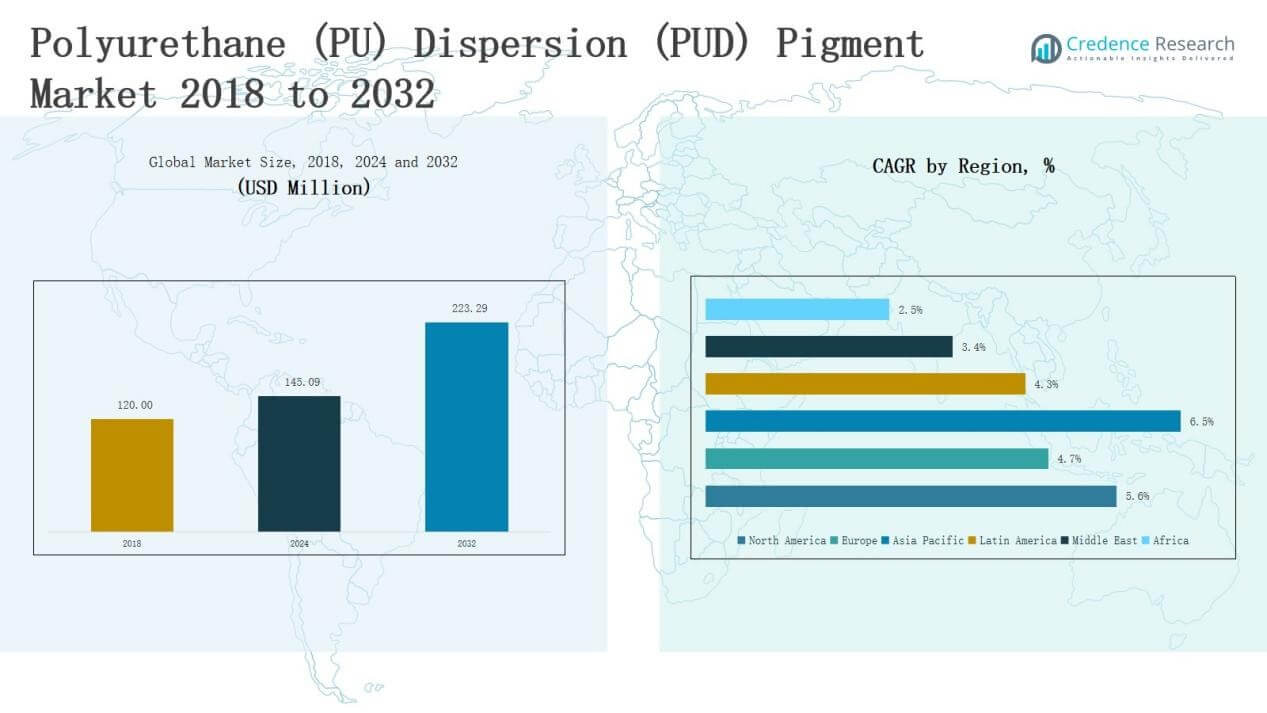

Polyurethane (PU) Dispersion (PUD) Pigment Market size was valued at USD 120.00 million in 2018 to USD 145.09 million in 2024 and is anticipated to reach USD 223.29 million by 2032, at a CAGR of 5.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyurethane (PU) Dispersion (PUD) Pigment Market Size 2024 |

USD 145.09 Million |

| Polyurethane (PU) Dispersion (PUD) Pigment Market, CAGR |

5.58% |

| Polyurethane (PU) Dispersion (PUD) Pigment Market Size 2032 |

USD 223.29 Million |

The Polyurethane (PU) Dispersion (PUD) Pigment Market is shaped by leading players such as BASF, Covestro, Huntsman, Lanxess, Mitsui, DSM, SABIC, Solvay, Dow, Alberdingk Boley, and Wanhua, who compete through product innovation, sustainability initiatives, and regional expansion strategies. These companies focus on water-based and bio-based dispersions to align with tightening environmental regulations and evolving customer demands. Asia Pacific emerged as the leading region in 2024, commanding a 55.40% share, driven by rapid industrialization, expanding construction, automotive demand, and robust textile and leather finishing industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyurethane (PU) Dispersion (PUD) Pigment Market grew from USD 120.00 million in 2018 to USD 145.09 million in 2024, and is projected at USD 223.29 million by 2032, expanding at a 58% CAGR.

- Asia Pacific dominated with a 40% share in 2024, fueled by strong industrialization, urbanization, and expansion in automotive, construction, textile, and leather finishing sectors across China, India, and Southeast Asia.

- By type, water-based PU dispersions held 63% share in 2024, supported by eco-friendly demand and VOC regulations, while solvent-based variants accounted for 37% due to niche industrial durability needs.

- By application, paints & coatings led with 41% share in 2024, followed by adhesives & sealants at 27%, leather and textile finishing at 22%, and other specialty uses at 10%.

- Single-component (1K) systems led by 49% share in 2024, while two-component (2K) accounted for 34% and urethane-modified variants 17%, reflecting diverse industrial performance requirements.

Market Segment Insights

Market Segment Insights

By Type

Water-based PU dispersion pigments dominated the market with 63% share in 2024, reflecting the industry’s shift toward eco-friendly and low-VOC coatings. Growing environmental regulations and consumer demand for sustainable products further reinforced adoption across paints, adhesives, and textiles. Solvent-based pigments, holding 37%, maintained relevance in industrial sectors requiring superior chemical resistance and durability, though their growth outlook remains limited due to rising regulatory restrictions and substitution by water-based alternatives.

For instance, BASF launched a new water-based polyurethane dispersion under its Joncryl® line designed for low-VOC applications in packaging and industrial coatings.

By Application

Paints & coatings emerged as the largest application, accounting for 41% share in 2024, driven by their wide use in automotive, construction, and industrial surfaces demanding high durability and finish. Adhesives & sealants followed with 27%, fueled by packaging and footwear applications. Leather and textile finishing combined contributed 22%, supported by demand for superior aesthetics and flexibility. Other applications, including specialty coatings, represented 10%, showing moderate but steady adoption across niche end-use industries.

For instance, AkzoNobel expanded its Interpon powder coatings portfolio with low-cure technology targeting automotive and architectural surfaces, offering improved durability with reduced energy consumption.

By Component Types

Single-component (1K) systems led the segment with 49% share in 2024, valued for their cost-efficiency, easy handling, and application across consumer goods and construction. Two-component (2K) systems captured 34%, catering to high-performance areas like automotive and aerospace where enhanced mechanical properties and chemical resistance are critical. Urethane-modified variants, holding 17%, showed gradual uptake due to their customization benefits, particularly in protective coatings and advanced adhesives, positioning them as emerging solutions for specialized end uses.

Key Growth Drivers

Rising Demand for Eco-Friendly Solutions

Water-based PU dispersion pigments are gaining rapid traction as industries align with strict environmental regulations. With increasing restrictions on volatile organic compounds (VOCs), manufacturers prefer water-based formulations for paints, coatings, and adhesives. Their low toxicity, recyclability, and compliance with sustainability standards make them the preferred choice across developed and emerging economies. Growing awareness of green building standards and sustainable manufacturing further accelerates the transition, driving strong demand for PU dispersion pigments that deliver high performance while meeting regulatory and consumer expectations.

For instance, Chase Corporation developed waterborne polyurethane products with significantly reduced VOC content, addressing industrial hygiene concerns and meeting environmental standards without sacrificing performance.

Expanding Applications in Construction and Automotive

The construction and automotive industries significantly contribute to the PU dispersion pigment market’s expansion. In construction, PU-based coatings enhance durability, gloss, and resistance to weathering, supporting infrastructure growth and refurbishment projects. In the automotive sector, rising demand for lightweight, durable, and high-performance coatings fuels adoption. Adhesives and sealants using PU dispersion pigments are also increasingly applied in automotive interiors and exteriors. This dual demand from construction and automotive ensures sustained market growth, supported by urbanization trends, rising vehicle production, and infrastructure modernization worldwide.

For instance, Covestro introduced a waterborne PU dispersion solution for automotive coatings, improving scratch resistance and flexibility for lightweight vehicle components.

Technological Advancements in Formulations

Continuous R&D investments have led to innovations in PU dispersion pigment formulations with improved performance. Manufacturers are developing advanced water-based systems that rival solvent-based alternatives in adhesion, flexibility, and resistance. Enhanced formulations enable usage across diverse substrates, including textiles, leather, and plastics, broadening market potential. Nanotechnology and hybrid polymer systems further improve pigment stability, dispersion, and color strength. These innovations allow end-users to achieve higher efficiency and product performance, creating strong growth momentum for companies investing in next-generation PU dispersion technologies.

Key Trends & Opportunities

Shift Toward Bio-Based Polyurethanes

A growing trend is the adoption of bio-based raw materials in PU dispersion pigments. Derived from renewable sources such as vegetable oils and biomass, bio-based variants align with sustainability goals while reducing reliance on petrochemicals. This shift opens new opportunities in eco-conscious industries like packaging, textiles, and automotive interiors. Companies investing in bio-based R&D are well-positioned to capture demand from global brands prioritizing circular economy practices. The integration of renewable feedstock enhances brand reputation and creates significant long-term opportunities for PU pigment producers.

For instance, NIPSEA Group developed a high solid content waterborne bio-based polyurethane resin derived from renewable sources, enabling superior flexibility and hydrolysis resistance for automotive coatings, reducing solvent emissions and reliance on petrochemicals.

Rising Demand in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa present significant opportunities for PU dispersion pigments. Rapid industrialization, expanding construction activities, and growing automotive production fuel demand in these regions. Rising disposable incomes and urbanization drive consumption of finished goods such as textiles, footwear, and decorative coatings, further boosting market uptake. Local governments promoting industrial modernization and sustainable manufacturing add to growth momentum. Companies expanding production capacity and distribution networks in these high-growth economies are positioned to secure long-term competitive advantages.

For instance, BASF opened a new polyurethane (PU) technical development center in Mumbai, India, to support regional customers in construction, automotive, footwear, appliances, and furniture.

Key Challenges

High Production Costs

PU dispersion pigments involve complex manufacturing processes and raw materials, leading to higher costs compared to traditional pigments. Water-based formulations require advanced technologies to ensure stability, performance, and compliance with environmental standards, further increasing expenses. These costs often translate to premium pricing, limiting adoption in price-sensitive markets. Small-scale manufacturers and end-users in developing economies may hesitate to switch from conventional pigments, posing a barrier to wider penetration. Overcoming this challenge requires cost optimization strategies and scaling efficiencies.

Raw Material Supply Volatility

The availability and cost of raw materials, such as isocyanates and polyols, directly impact PU dispersion pigment production. Fluctuations in crude oil prices, trade disruptions, and geopolitical uncertainties often create volatility in raw material supply chains. Such unpredictability leads to unstable production costs and supply delays, affecting market consistency. Manufacturers are increasingly exploring alternative raw materials and local sourcing strategies, but dependence on global supply chains continues to pose a significant challenge for stable pricing and uninterrupted production.

Competition from Alternative Technologies

The PU dispersion pigment market faces rising competition from alternative coatings and pigment technologies. Epoxy, acrylic, and powder coating systems often provide comparable durability and performance at lower costs. In some applications, solvent-free alternatives offer faster curing times and higher efficiency, attracting end-users. The presence of well-established substitutes restricts PU pigment adoption, particularly in mature markets where industries already rely on cost-effective alternatives. Overcoming this challenge requires differentiation through superior performance, sustainability features, and innovation in application-specific solutions.

Regional Analysis

North America

The North America PU dispersion pigment market was valued at USD 16.20 billion in 2018, reaching USD 20.50 billion in 2024, and is projected to attain USD 28.19 billion by 2032, registering a CAGR of 5.6%. Growth is supported by strict environmental regulations driving adoption of water-based formulations. The U.S. leads demand through advanced automotive and construction industries, while Canada and Mexico contribute steadily with rising industrial applications. Increasing focus on sustainable infrastructure, coupled with expansion in adhesives and coatings, further reinforces regional market expansion during the forecast period.

Europe

Europe accounted for USD 25.68 billion in 2018, expanding to USD 29.57 billion in 2024, and is projected to reach USD 42.37 billion by 2032, at a CAGR of 4.7%. The region’s growth is shaped by stringent VOC regulations, advanced industrial bases, and high adoption of green coatings in automotive, textile, and leather industries. Germany, France, and the UK remain dominant contributors. Continuous R&D in bio-based formulations and alignment with circular economy principles support long-term growth, although expansion is comparatively moderate due to saturation across mature industries.

Asia Pacific

The Asia Pacific market stood at USD 44.52 billion in 2018, rising to USD 55.40 billion in 2024, and is expected to achieve USD 91.17 billion by 2032, growing at the highest CAGR of 6.5%. Strong industrialization, rapid urbanization, and expanding automotive and construction sectors in China, India, and Southeast Asia underpin this dominance. The region’s vast textile and leather finishing industries also drive demand. Government initiatives supporting sustainable practices and increasing production capacities consolidate Asia Pacific’s position as the global growth hub for PU dispersion pigments.

Latin America

Latin America’s PU dispersion pigment market was valued at USD 6.00 billion in 2018, increasing to USD 7.17 billion in 2024, and is forecast to reach USD 10.02 billion by 2032, at a CAGR of 4.3%. Brazil and Argentina dominate demand, driven by construction, footwear, and packaging sectors. The transition toward sustainable coatings creates additional opportunities, although market expansion is constrained by slower infrastructure growth and economic volatility. Local adoption of advanced dispersion technologies, coupled with export potential for specialty applications, is expected to sustain long-term growth across the region.

Middle East

The Middle East market was valued at USD 2.94 billion in 2018, rising to USD 3.21 billion in 2024, and projected at USD 4.15 billion by 2032, with a CAGR of 3.4%. Growth is primarily concentrated in GCC countries and Turkey, supported by strong construction and infrastructure investments. Demand in automotive refinishing and industrial coatings also contributes. While import reliance remains high, initiatives to boost local manufacturing and government-led sustainability programs provide growth avenues, albeit from a smaller base compared to other global regions.

Africa

Africa recorded USD 1.86 billion in 2018, reaching USD 3.24 billion in 2024, and is forecast to achieve USD 4.10 billion by 2032, at a CAGR of 2.5%. South Africa and Egypt lead demand, particularly in construction, leather finishing, and textile industries. Market expansion is limited by low industrial capacity and reliance on imports. However, rising urbanization, modernization of manufacturing processes, and distribution expansions by global players are expected to gradually enhance adoption of water-based PU dispersion pigments, positioning Africa as a long-term but modest growth contributor.

Market Segmentations:

By Type

- Water-based

- Solvent-based

By Application

- Paints & Coatings

- Adhesives & Sealants

- Leather Finishing

- Textile Finishing

- Others

By Component Types

- Single-component (1K)

- Two-component (2K)

- Urethane-modified variants

By Region

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global Polyurethane (PU) Dispersion (PUD) Pigment Market is moderately consolidated, with key multinational players holding a significant share through diversified product portfolios and strong global reach. Leading companies such as BASF, Covestro, Huntsman, Lanxess, Mitsui, DSM, SABIC, Solvay, Dow, Alberdingk Boley, and Wanhua drive competition by emphasizing sustainable innovations, water-based technologies, and bio-based PU dispersions to meet tightening environmental regulations. Strategic alliances, mergers, and regional expansions strengthen their positioning, while continuous R&D enhances performance characteristics like durability, flexibility, and chemical resistance. European and North American players dominate in terms of advanced technology adoption, while Asia-Pacific firms focus on expanding capacity and cost-efficient manufacturing to serve high-growth markets. Mid-tier and regional players also compete by targeting niche applications in textiles, leather finishing, and adhesives. Overall, the market’s competitive intensity is shaped by innovation, compliance with global sustainability standards, and the ability to address emerging opportunities in eco-friendly and specialty applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- BASF

- Covestro

- Huntsman

- Lanxess

- Mitsui

- DSM

- SABIC

- Solvay

- Dow

- Alberdingk Boley

- Wanhua

Recent Developments

- In July 2025, Lubrizol launched Sancure™ 942, a new polyurethane dispersion (PUD) technology designed for wood floor finishes and OEM wood coatings.

- In October 2024, Stahl opened a new PUD production facility in Singapore, focused on delivering high-performance dispersions for global markets.

- In July 2025, Nature Coatings introduced BioBlack Blends, a bio-based pigment and dispersion line, expanding sustainable options in waterborne dispersions.

- In April 2025, Lamberti USA acquired Covestro’s East Providence, Rhode Island site. It now specializes in producing polyurethane dispersions (including matte & ultra-matte polymers) for coatings, synthetic leather, CASE, etc.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Component Types and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for water-based PU dispersions will continue to rise due to stricter emission norms.

- Bio-based raw materials will gain adoption as industries shift toward sustainable alternatives.

- Asia-Pacific will strengthen its dominance with expanding construction, textile, and automotive sectors.

- Technological innovations will enhance performance in adhesion, flexibility, and durability.

- Growing use in packaging and footwear industries will support long-term market expansion.

- Strategic collaborations will increase as players invest in eco-friendly pigment solutions.

- Europe will focus on green coatings adoption aligned with circular economy principles.

- Automotive refinishing and industrial coatings will remain critical demand drivers worldwide.

- Local production facilities in emerging regions will help reduce import dependence.

- Specialty applications in protective coatings and adhesives will unlock new growth opportunities.

Market Segment Insights

Market Segment Insights