Market Overview

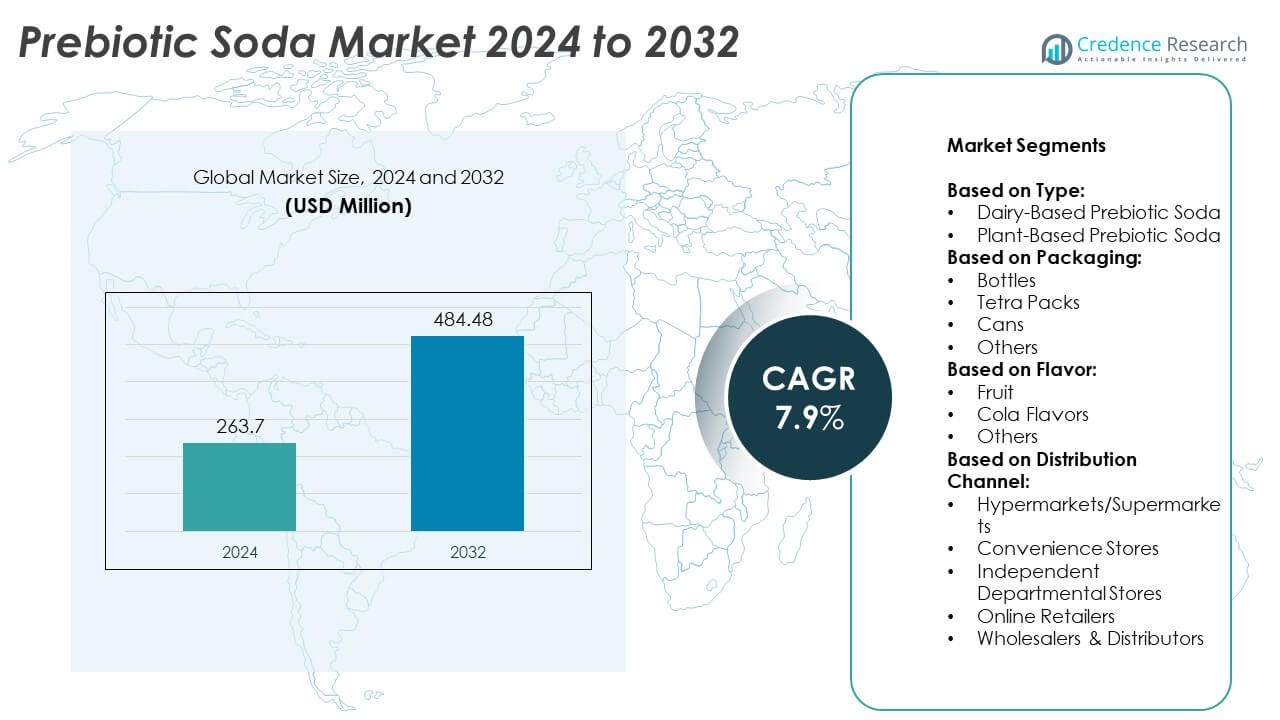

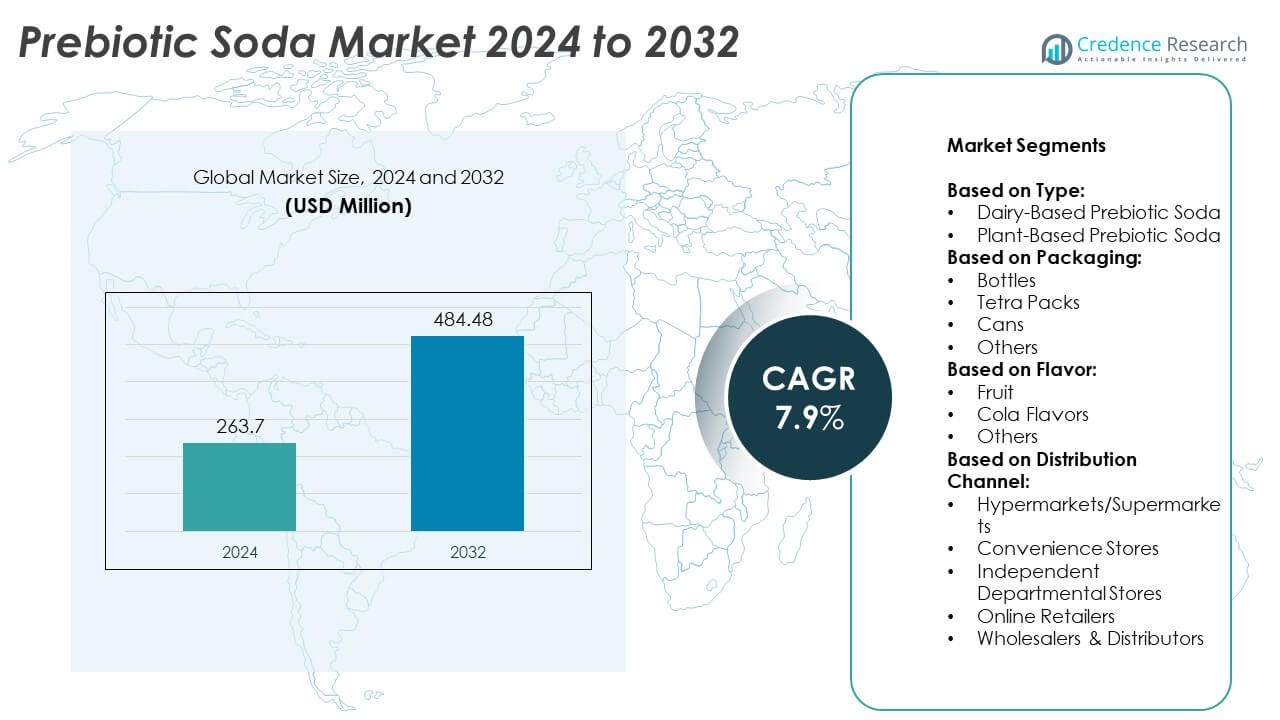

Prebiotic Soda Market size was valued at USD 263.7 million in 2024 and is anticipated to reach USD 484.48 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prebiotic Soda Market Size 2024 |

USD 263.7 Million |

| Prebiotic Soda Market, CAGR |

7.9% |

| Prebiotic Soda Market Size 2032 |

USD 484.48 Million |

The Prebiotic Soda market grows on the strength of rising health awareness, increased focus on gut microbiome balance, and consumer demand for clean-label, low-sugar beverages. It benefits from regulatory support for functional ingredients and shifting preferences toward plant-based formulations. Brands invest in flavor innovation, natural fiber sources, and shelf-stable packaging to enhance product appeal. Social media engagement and influencer marketing further boost visibility across younger demographics.

The Prebiotic Soda market shows strong presence across North America, Europe, and Asia-Pacific, with increasing adoption in Latin America and the Middle East & Africa. North America leads due to advanced health awareness and a well-established functional beverage sector. Europe follows with demand driven by clean-label and gut-friendly trends, while Asia-Pacific exhibits rapid growth supported by urbanization and shifting dietary habits. Latin America and the Middle East show rising interest through urban wellness segments. Key players shaping the global landscape include Humm Kombucha, GT’s Living Foods, Health-Ade Kombucha, and Brew Dr. Kombucha, each focusing on innovation, flavor diversity, and targeted marketing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Prebiotic Soda market was valued at USD 263.7 million in 2024 and is projected to reach USD 484.48 million by 2032, growing at a CAGR of 7.9%.

- Rising consumer awareness of gut health and demand for low-sugar, functional beverages are driving market expansion across health-conscious demographics.

- The market reflects strong trends in multifunctional formulations, clean-label ingredients, and flavor innovation tailored to diverse lifestyle needs.

- Leading players such as GT’s Living Foods, Humm Kombucha, Health-Ade Kombucha, and Brew Dr. Kombucha focus on direct-to-consumer models, product differentiation, and influencer-driven brand visibility.

- Limited consumer understanding of prebiotic functionality and high production costs present key challenges to market penetration and scalability.

- North America leads in adoption, followed by Europe and Asia-Pacific, with growing interest seen in Latin America and the Middle East & Africa through urban wellness channels.

- Strategic investments in sustainable packaging, science-backed claims, and regional flavor profiles will shape future growth opportunities.

Market Drivers

Rising Health Awareness and Gut Microbiome Education Among Consumers

The Prebiotic Soda market benefits from growing awareness of gut health and its connection to overall well-being. Consumers are actively seeking products that support digestive balance without compromising taste or convenience. The expansion of wellness-focused content across media channels has increased public understanding of prebiotics and their role in supporting a healthy microbiome. This growing knowledge has driven demand for beverages that deliver functional benefits beyond hydration. It reflects a shift toward prevention-oriented consumption, especially among younger demographics and health-conscious urban consumers. The Prebiotic Soda market aligns well with this trend by offering a clean-label alternative to traditional carbonated drinks.

- For instance, Humm Kombucha launched its Probiome line, featuring 10 billion CFUs of Bacillus subtilis DE111 and 2 grams of plant-based fiber per bottle to target both digestive and immune support.

Consumer Shift Toward Sugar Reduction and Clean Ingredient Formulations

Changing consumer preferences for lower-sugar, naturally formulated beverages significantly influence the Prebiotic Soda market. Individuals are actively avoiding synthetic sweeteners and excessive sugars, demanding products with transparent ingredient lists. It creates an opportunity for brands to differentiate using prebiotic fibers derived from chicory root, cassava, or other plant sources. Regulatory pressure on sugar content and warning labels in various regions further accelerates product reformulations. Clean-label prebiotic sodas meet both taste and nutritional requirements while complying with evolving guidelines. The market capitalizes on this alignment between public health priorities and ingredient innovation.

- For instance, Health-Ade Kombucha secured placement in over 5,200 U.S. retail locations and recorded a 42% increase in DTC subscription orders through its online platform in the 12‑month period ending, and is available in approximately 65,000 retail outlets across the U.S.

Expanding Availability Across Retail Channels and Direct-to-Consumer Platforms

The Prebiotic Soda market gains momentum from its growing retail penetration across mainstream grocery, natural food stores, and online platforms. Brands are securing shelf space alongside established functional beverages, supported by attractive packaging and targeted messaging. It benefits from direct-to-consumer strategies that enable rapid brand discovery and loyalty through subscription models and social commerce. Distribution in wellness cafés, gyms, and co-working spaces strengthens visibility among core health-conscious audiences. Strategic partnerships with retailers allow for better positioning and seasonal promotions. Wider availability supports recurring purchases and increases consumer trust in the product category.

Supportive Innovation in Fermentation, Fiber Technology, and Shelf Stability

Advances in food science and fermentation enable manufacturers to enhance the efficacy and sensory quality of prebiotic sodas. It helps overcome past limitations related to taste, clarity, and shelf life of fiber-enriched beverages. Novel prebiotic fibers improve solubility and allow for diverse flavor profiles without gritty texture. R&D investments support the development of temperature-stable formulations that retain efficacy during storage and transport. This innovation ensures consistent consumer experience and allows for longer distribution cycles. The Prebiotic Soda market benefits from these scientific improvements that drive both quality and scalability.

Market Trends

Emergence of Functional Beverage Hybrids Integrating Multiple Health Benefits

The Prebiotic Soda market is witnessing a shift toward multifunctional beverages that combine digestive support with immunity, hydration, and mood-enhancing properties. Brands are formulating sodas with added botanical extracts, adaptogens, and vitamins to meet evolving consumer expectations. It reflects a broader demand for convenience-driven wellness solutions in a single format. This trend attracts both new entrants and established players seeking to expand their product portfolios. The hybridization approach enhances market differentiation and addresses diverse lifestyle needs. Prebiotic sodas positioned with broader health benefits gain greater traction across health-conscious demographics.

- For instance, Wild Tonic Jun Kombucha introduced its new 12 oz slim can line, achieving a 32% weight reduction compared to its previous glass format and transitioning to soy-based inks and biodegradable adhesives across all printed labels.

Rising Popularity of Natural Fermentation and Plant-Based Fiber Sources

Consumer interest in natural fermentation and plant-derived ingredients is shaping product development in the Prebiotic Soda market. Brands are highlighting sources such as agave inulin, Jerusalem artichoke, and baobab for their functional and sustainable appeal. It reinforces clean-label positioning and improves transparency in sourcing. Minimal processing and traceable supply chains contribute to brand credibility and consumer trust. This trend supports differentiation in a competitive segment where formulation authenticity drives purchasing behavior. Consumers value sodas that reflect both wellness and environmental awareness.

- For instance, Poppi markets its prebiotic soda with 2 grams of agave inulin per can, a specification that has emerged at the center of a recent class-action lawsuit regarding the sufficiency of the prebiotic content.

Increasing Influence of Influencer-Led Marketing and Social Engagement

Marketing strategies in the Prebiotic Soda market now focus heavily on influencer partnerships, user-generated content, and community engagement. Brands are using social media platforms to educate consumers and create lifestyle-driven narratives. It accelerates awareness and loyalty, especially among younger consumers in digital-first environments. Limited edition drops and brand collaborations generate excitement and foster exclusivity. Visual branding and storytelling across digital platforms drive differentiation in a cluttered beverage space. Social engagement strategies are shaping perception and adoption of prebiotic soda products.

Adoption of Eco-Friendly Packaging and Circular Design Models

Sustainability trends continue to influence packaging choices across the Prebiotic Soda market. Brands are investing in recyclable aluminum cans, compostable labels, and lightweight shipping formats. It reduces environmental impact and aligns with the values of environmentally conscious buyers. Circular economy principles are gaining traction, encouraging refill programs and closed-loop material sourcing. Brands that implement sustainable packaging strategies enhance their appeal and meet growing regulatory expectations. Eco-conscious design is becoming integral to competitive positioning and long-term brand value.

Market Challenges Analysis

Limited Consumer Understanding of Prebiotic Functionality and Label Interpretation

The Prebiotic Soda market faces a persistent challenge in educating consumers about the specific benefits of prebiotic ingredients. Many shoppers struggle to differentiate between prebiotics and probiotics, which creates confusion and limits confidence in purchase decisions. It affects brand communication strategies and slows product trial in broader demographics. Functional claims must meet regulatory scrutiny while remaining clear and accessible to non-specialist consumers. Misinterpretation of fiber content or health claims can weaken brand trust and hinder long-term adoption. Companies must invest in precise messaging that simplifies health science without compromising accuracy.

High Production Costs and Complex Formulation Requirements Impact Scalability

Cost-intensive ingredient sourcing and complex formulation processes present barriers to scalability in the Prebiotic Soda market. Ensuring taste, shelf stability, and fiber efficacy without synthetic additives raises manufacturing expenses. It restricts smaller brands from competing on price while maintaining product integrity. Balancing functional benefits with palatable flavor profiles also requires specialized R&D capabilities. Scaling production while preserving clean-label standards and consistent quality remains a critical hurdle. This cost-pressure environment makes it difficult to reach mass-market consumers without compromising brand values.

Market Opportunities

Expansion Into Emerging Wellness Markets and Non-Traditional Retail Channels

The Prebiotic Soda market holds strong potential in emerging economies where demand for functional wellness beverages is increasing. Rising urban incomes and greater access to health education create fertile ground for premium, gut-friendly products. It opens avenues for brands to enter convenience-focused retail formats such as pharmacy chains, boutique fitness centers, and health-focused cafés. Alternative retail channels support brand exposure beyond traditional grocery environments. Brands can tailor regional flavors and fiber sources to local preferences, creating stronger cultural alignment. These entry points allow companies to diversify distribution and capture underserved demographics.

Product Line Diversification Across Occasion-Based and Age-Specific Needs

Opportunities exist for brands to create prebiotic soda variants targeted at specific consumption occasions and age groups. Children’s formulations with lower carbonation and tailored flavors can support digestive health at earlier life stages. It enables companies to address new demand segments such as school snacks and family health beverages. Similarly, adult-focused formulations with added nootropics or relaxation compounds can serve workplace or evening routines. Seasonal limited editions, functional blends, and pack-size variations further enhance consumer appeal. The Prebiotic Soda market can strengthen growth by aligning offerings with diverse lifestyle needs.

Market Segmentation Analysis:

By Type:

The Prebiotic Soda market divides into dairy-based and plant-based variants. Plant-based prebiotic sodas lead the segment due to broader consumer acceptance across vegan, lactose-intolerant, and clean-label preferences. Brands favor plant-based formulations using inulin, chicory root, or cassava fiber, which align with sustainable sourcing goals. Dairy-based offerings remain niche and cater to specific health-focused consumers seeking protein-rich or probiotic-compatible options. It reflects a rising demand for non-dairy innovation in the functional beverage category. The plant-based segment supports greater product flexibility in flavor and shelf stability.

- For instance, Olipop features 9 grams of prebiotic fiber per can, derived from its OLISMART blend of cassava root, chicory root inulin, and Jerusalem artichoke inulin, as verified on its nutrition label.

By Packaging:

The Prebiotic Soda market segments into bottles, tetra packs, cans, and others. Cans dominate shelf presence due to their portability, recyclability, and cost efficiency in large-scale distribution. They support vibrant visual branding and extended shelf life, making them suitable for retail and vending channels. Bottles, often used for premium or cold-chain offerings, provide a resealable option for on-the-go consumption. Tetra packs appeal to eco-conscious consumers and facilitate lightweight logistics in e-commerce shipments. It showcases growing demand for sustainable and functional packaging combinations across formats.

- For instance, Coca‑Cola’s Simply Pop prebiotic soda—introduced—is packaged in 12‑ounce cans that each deliver 6 grams of soluble fiber, plus added vitamin C and zinc, with no added sugar.

By Flavor:

The Prebiotic Soda market includes fruit, cola, and others. Fruit-flavored prebiotic sodas hold the largest share, driven by consumer preference for familiar and naturally sweet profiles. Popular variants include citrus, berry, and tropical flavors that blend well with fiber sources without masking functional benefits. Cola-flavored prebiotic sodas cater to consumers seeking healthier alternatives to traditional soft drinks. The “others” category features botanical, herbal, and exotic blends targeting niche wellness preferences. It reflects rising experimentation in flavor innovation to increase product appeal and retention.

Segments:

Based on Type:

- Dairy-Based Prebiotic Soda

- Plant-Based Prebiotic Soda

Based on Packaging:

- Bottles

- Tetra Packs

- Cans

- Others

Based on Flavor:

- Fruit

- Cola Flavors

- Others

Based on Distribution Channel:

- Hypermarkets/Supermarkets

- Convenience Stores

- Independent Departmental Stores

- Online Retailers

- Wholesalers & Distributors

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share in the Prebiotic Soda market, accounting for 38% of the global volume. The region demonstrates a strong alignment between consumer health awareness and demand for functional beverages. A mature wellness culture supports high adoption rates of digestive health products, especially among millennials and Gen Z consumers. It benefits from an established natural food retail infrastructure and early entry of key market players. Brands such as OLIPOP and Poppi have built strong distribution across Whole Foods, Sprouts, and national retailers. Regulatory clarity around functional claims and fiber labeling allows consistent product positioning. North America also shows strong performance in online sales, supported by influencer marketing and direct-to-consumer channels.

Europe

Europe represents 26% of the Prebiotic Soda market, supported by a well-regulated food and beverage industry and growing attention to gut health. Consumers in countries such as Germany, the UK, and the Netherlands prioritize natural ingredients and transparent sourcing. It benefits from the region’s established interest in prebiotics and fermented foods, including kefir and kombucha. European manufacturers are increasingly incorporating chicory-derived inulin and acacia fiber into beverage formulations. The region maintains strong demand in both the retail and foodservice sectors, particularly among urban populations and older consumers focused on digestive wellness. Shelf-stable, eco-packaged products perform well in sustainability-driven retail environments across the continent.

Asia-Pacific

Asia-Pacific holds 19% of the Prebiotic Soda market, driven by rising middle-class incomes and expanding health-conscious demographics. Countries such as Japan, South Korea, and Australia have led early adoption, while China and India show rapid growth potential. Functional beverages are gaining traction in urban centers, supported by the popularity of traditional digestive aids and increasing probiotic familiarity. It benefits from shifting dietary habits and demand for lower-sugar beverage alternatives. Domestic and international brands are investing in market entry strategies with localized flavors and culturally relevant product positioning. E-commerce and mobile-based wellness platforms are also fueling brand visibility and consumer engagement across Asia-Pacific markets.

Latin America

Latin America contributes 10% to the global Prebiotic Soda market. The region sees growing awareness of gut health and rising interest in healthier beverage alternatives, particularly in Brazil, Mexico, and Chile. Urban consumers are responding to functional drinks that offer digestive support without added sugars or artificial ingredients. It faces pricing challenges in middle-income segments but benefits from expanding modern retail infrastructure. Brands are partnering with health food stores, fitness centers, and pharmacy retailers to build product availability. Regional flavor preferences, such as passionfruit and guava, influence formulation strategies tailored to local tastes. The market remains in its early stages but shows solid opportunity with strategic pricing and education campaigns.

Middle East & Africa

The Middle East & Africa region holds 7% of the Prebiotic Soda market. Market development is slower due to lower awareness of prebiotic ingredients and limited retail exposure. However, urban centers in the UAE, Saudi Arabia, and South Africa are showing rising demand for wellness beverages. It benefits from growing expat populations and premium health product imports in metropolitan areas. Distribution remains concentrated in specialty stores and e-commerce platforms serving affluent consumers. Regional players are beginning to explore fiber-enriched formulations aligned with halal and natural ingredient standards. Long-term growth will depend on broader health education and expansion of functional drink assortments in mainstream channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clearly Kombucha

- The Bu Kombucha

- Better Booch

- Lifeway Kefir

- GT’s Living Foods

- Wild Tonic Jun Kombucha

- Suja Juice

- GoodBelly

- Remedy Kombucha

- Farmhouse Culture

- Revive Kombucha

- Health-Ade Kombucha

- Brew Dr. Kombucha

- Kevita

- Humm Kombucha

Competitive Analysis

The leading players in the Prebiotic Soda market include Humm Kombucha, Better Booch, Clearly Kombucha, Remedy Kombucha, Kevita, GT’s Living Foods, Brew Dr. Kombucha, Suja Juice, Farmhouse Culture, Revive Kombucha, Health-Ade Kombucha, Wild Tonic Jun Kombucha, Lifeway Kefir, GoodBelly, and The Bu Kombucha.These companies compete through formulation innovation, brand positioning, and expanding retail access. They emphasize clean-label ingredients, prebiotic fiber content, and low-sugar profiles to meet evolving health-conscious demand. Market leaders invest in flavor variety, shelf-stable packaging, and functional claims to strengthen product differentiation. Several brands pursue strategic partnerships with wellness influencers, fitness centers, and e-commerce platforms to increase visibility. Larger players leverage their distribution scale to gain premium shelf space in natural food chains and mainstream retailers. Emerging brands focus on niche flavor development, limited-edition releases, and regional expansion strategies. The competitive environment favors companies that maintain scientific transparency, secure regulatory compliance, and align their products with lifestyle-based wellness trends.

Recent Developments

- In January 2025, Humm Kombucha highlighted a report Humm expansion into the prebiotic beverage segment following its earlier focus on probiotics.

- In February 2024, GT’s launched AURA Collagen Tea, blending bovine collagen (15 g protein) with only 2 g sugar. The release debuted during New York Fashion Week in collaboration with fashion brand Eckhaus Latta, marking GT’s first presence at the event.

- In April 2023, Brew Dr. Kombucha unveiled a revamped brand identity featuring a modern logo and refreshed packaging. The launch included two new flavors: Strawberry Fields and Pineapple Paradise.

Market Concentration & Characteristics

The Prebiotic Soda market exhibits moderate concentration, with a mix of established functional beverage brands and emerging startups driving category development. It features a dynamic landscape where innovation, flavor diversity, and wellness positioning shape competitive advantage. Leading companies operate in niche subsegments and focus on plant-based ingredients, clean-label certifications, and low-sugar formulations. The market remains fragmented in distribution, with players targeting direct-to-consumer models, specialty retail, and national grocery chains. It benefits from growing consumer demand for gut health solutions but faces challenges in regulatory clarity and consumer education. Rapid product turnover and evolving health trends create opportunities for differentiation through ingredient sourcing, sustainability efforts, and value-added functions. Brands that invest in research-backed claims and packaging innovation gain traction among informed and health-oriented consumers.

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging, Flavor, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased demand for low-sugar, functional beverages that support digestive health.

- Brands will expand their portfolios with multifunctional formulations that combine prebiotics with vitamins or adaptogens.

- Direct-to-consumer and e-commerce channels will play a larger role in brand growth and consumer engagement.

- Flavor innovation using regional fruits and botanical blends will help attract diverse consumer groups.

- Companies will invest in clinical research to support health claims and strengthen consumer trust.

- Retail partnerships with wellness-focused outlets and mainstream grocery chains will increase product accessibility.

- Packaging innovation focused on sustainability and convenience will influence brand differentiation.

- Consumer education campaigns will improve awareness of prebiotic benefits and boost adoption.

- Market players will explore personalized nutrition platforms to deliver targeted prebiotic soda options.

- Strategic collaborations and product co-creation will help brands connect with health-conscious communities.